false000117764800011776482023-11-202023-11-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 20, 2023 |

ENANTA PHARMACEUTICALS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-35839 |

04-3205099 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

500 Arsenal Street |

|

Watertown, Massachusetts |

|

02472 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 607-0800 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.01 per share |

|

ENTA |

|

Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 20, 2023, Enanta Pharmaceuticals, Inc. announced via press release its results for the fiscal quarter and year ended September 30, 2023. A copy of Enanta's press release is hereby furnished to the Commission and incorporated by reference herein as Exhibit 99.1.

Item 9.01 Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

ENANTA PHARMACEUTICALS, INC. |

|

|

|

|

Date: |

November 20, 2023 |

By: |

/s/ Paul J. Mellett |

|

|

|

Paul J. Mellett

Senior Vice President, Finance and Administration and Chief Financial Officer |

Exhibit 99.1

Enanta Pharmaceuticals Reports Financial Results for its Fiscal Fourth Quarter and Year Ended September 30, 2023, with Webcast and Conference Call Today at 4:30 p.m. ET

•Initiated a Phase 2a Challenge Study of EDP-323,an L-Protein Inhibitor, in Development as an Oral, Once-Daily Treatment for Respiratory Syncytial Virus (RSV); Expect to Report Data in Q3 2024

•Streamlined Business and Significantly Lowered 2024 R&D and G&A Spending Guidance to Support Ongoing Operations

•Cash and Marketable Securities Totaled $370 Million at September 30, 2023

WATERTOWN, Mass., Nov. 20, 2023 – Enanta Pharmaceuticals, Inc. (NASDAQ:ENTA), a clinical-stage biotechnology company dedicated to creating small molecule drugs with an emphasis on treatments for viral infections, today reported financial results for its fiscal fourth quarter and year ended September 30, 2023.

“Throughout fiscal 2023, Enanta remained focused on advancing our two RSV clinical stage programs of best-in-class antivirals with different mechanisms of action. We are pleased to announce the initiation of our Phase 2a challenge study of EDP-323, an L-protein inhibitor, in development as an oral, once-daily treatment for RSV, and look forward to reporting data in the third quarter of 2024,” said Jay R. Luly Ph.D., President and Chief Executive Officer of Enanta Pharmaceuticals. “Further, we are advancing RSVPEDs and RSVHR, our ongoing Phase 2 trials of EDP-938, our N-protein inhibitor, with a data readout from at least one of these studies in the third quarter of 2024, assuming this winter is a normal Northern Hemisphere RSV season. We have also made important adjustments to significantly reduce our 2024 spending and extend our cash runway through fiscal 2027. As a result, we are well positioned financially as we look forward to readouts across our RSV pipeline in 2024 and advancements in new non-virology programs.”

Fiscal Fourth Quarter and Year Ended September 30, 2023 Financial Results

Total revenue was $18.9 million for the three months ended September 30, 2023, which consisted of royalty revenue derived from worldwide net sales of AbbVie’s hepatitis C virus (HCV) regimen MAVYRET®/MAVIRET®, compared to royalty revenue of $20.3 million for the three months ended September 30, 2022. For the twelve months ended September 30, 2023, total revenue was $79.2 million compared to $86.2 million for the same period in 2022. The decrease in the quarter and in year-over-year revenue is due to a decline in AbbVie’s sales of MAVYRET®/MAVIRET®.

Beginning with the quarter ended September 30, 2023, 54.5% of Enanta’s ongoing royalties from AbbVie’s net sales of MAVYRET®/MAVIRET® are being paid to OMERS, one of Canada’s largest defined benefit pension plans, pursuant to a royalty sale transaction in April 2023. For financial reporting purposes, the transaction was treated as debt, with the upfront purchase payment of $200.0 million recorded as a liability. Enanta will continue to record 100% of the royalty earned as revenue and will then amortize the debt liability proportionally as 54.5% of the cash royalty payments are paid to OMERS, until a cap of 1.42 times the purchase payment is met, after which point 100% of the cash royalty payments will be retained by Enanta. Non-cash interest expense was $3.2 million for the three months ended September 30, 2023 and $5.1 million for the twelve months ended September 30, 2023.

Research and development expenses were $36.2 million for the three months ended September 30, 2023, compared to $34.8 million for the three months ended September 30, 2022. The increase was due to the timing of clinical trial costs, offset by a decrease in preclinical and manufacturing costs. For the twelve months ended

September 30, 2023, research and development expenses were $163.5 million compared to $164.5 million in 2022.

General and administrative expenses totaled $13.8 million for the three months ended September 30, 2023, compared to $12.6 million for the three months ended September 30, 2022. For the twelve months ended September 30, 2023, general and administrative expenses were $52.9 million compared to $45.5 million in 2022. The increases in both periods were primarily due to an increase in legal fees related to the company's patent infringement suit against Pfizer.

Other income, net, totaled $4.7 million for the three months ended September 30, 2023, compared to $0.7 million for the three months ended September 30, 2022. For the twelve months ended September 30, 2023, other income, net, totaled $11.4 million compared to $1.7 million in 2022. The increases in both periods were primarily due to an increase in investment income due to an increase in Enanta’s average invested cash balance from the receipt in April 2023 of $200 million from the sale of the company’s MAVYRET®/MAVIRET® royalty, as well as increases in interest rates year over year.

Enanta recorded an income tax benefit of $1.4 million for the three months ended September 30, 2023, compared to income tax expense of less than $0.1 million for the three months ended September 30, 2022. Enanta recorded income tax expense of $2.8 million for the twelve months ended September 30, 2023, compared to an income tax benefit of $0.4 million for the three months ended September 30, 2022. Despite recording a loss before taxes during the twelve months ended September 30, 2023, Enanta recorded tax expense driven by the receipt of the $200.0 million from the royalty sale agreement, which is treated as income for Federal and State income tax purposes. This taxable income and its related income tax expense was substantially offset by net operating loss carryforwards, research and development tax credit carryforwards and a deduction for foreign derived intangible income.

Net loss for the three months ended September 30, 2023, was $28.1 million, or a loss of $1.33 per diluted common share, compared to a net loss of $26.3 million, or a loss of $1.27 per diluted common share, for the corresponding period in 2022. For the twelve months ended September 30, 2023, net loss was $133.8 million, or a loss of $6.38 per diluted common share, compared to a net loss of $121.8 million, or loss of $5.91 per diluted common share for the corresponding period in 2022.

Enanta’s cash, cash equivalents and marketable securities totaled $370.0 million at September 30, 2023. Enanta expects that its current cash, cash equivalents and short-term marketable securities, as well as its continuing retained portion of royalty revenue, will continue to be sufficient to meet the anticipated cash requirements of its existing business and development programs through fiscal 2027.

Financial Guidance for Fiscal Year 2024

•Research and Development Expense: $100 million to $120 million (reduced from $163.5 million of actual expense in 2023)

•General and Administrative Expense: $45 million to $50 million (reduced from $52 million of actual expense in 2023; guidance includes an increase in legal fees associated with the company’s patent infringement lawsuit)

Pipeline Update and Business Review

Virology

RSV

•Enanta is progressing multiple clinical programs aimed at treating populations at high-risk for serious outcomes from RSV infection, and is evaluating EDP-938, an N-protein inhibitor, with two ongoing Phase 2 clinical trials, RSVPEDS and RSVHR.

oRSVPEDs is a Phase 2 randomized, double-blind, placebo-controlled study in hospitalized and non-hospitalized pediatric RSV patients. The study, which will enroll approximately 90 patients aged 28 days to 36 months, is being conducted in two parts. Because this is the first time the drug is being dosed in pediatrics, the objective of the first part of the study is to evaluate the safety and pharmacokinetics of EDP-938 in multiple ascending doses to select the optimal dose for each age group. The second part of the study will evaluate the antiviral activity of EDP-938 at the selected dose, and symptom scores will be assessed throughout the treatment duration. This part is designed as a small cohort to show a trend toward improved virology metrics for EDP-938 compared to placebo and to give confidence to move forward efficiently into registrational studies.

oRSVHR is a Phase 2b randomized, double-blind, placebo-controlled study in approximately 180 adults with RSV infection who are at high risk of complications, including the elderly and those with congestive heart failure, chronic obstructive pulmonary disease or asthma. The primary endpoint of RSVHR is time to resolution of RSV lower respiratory tract disease symptoms as assessed by the Respiratory Infection Intensity and Impact Questionnaire (RiiQ™) symptom scale. Secondary endpoints include additional clinical efficacy measures and antiviral activity compared to placebo, pharmacokinetics, and safety of EDP-938.

oRSVTx, a Phase 2b, randomized, double-blind, placebo-controlled study in adult hematopoietic cell transplant recipients with RSV infection and symptoms of upper respiratory tract infection, was discontinued in September and resources were reallocated to the enrollment and completion of the other ongoing Phase 2 RSV trials.

oEnanta expects to complete enrollment in one or both of its ongoing Phase 2 studies of EDP-938 and to report data in the third quarter of 2024, assuming this winter is a normal pre-pandemic RSV season in the Northern Hemisphere. Enanta has expanded its global footprint and has over 75 sites across 15 countries for RSVPEDs and over 130 sites across 16 countries for RSVHR.

oIn October, Enanta presented data at IDWeekTM 2023 highlighting EDP-938’s high barrier to the development of clinical resistance as demonstrated in the human challenge study. This is in contrast to the lower barrier to resistance that has been observed for other mechanisms, thereby supporting further development of this first-in-class N-protein inhibitor.

•Enanta today announced the initiation of a Phase 2a human challenge study of EDP-323, an oral, L-protein inhibitor in development for the treatment of RSV. The advancement of EDP-323 into a challenge study is supported by positive Phase 1 data which demonstrated favorable safety, tolerability, and pharmacokinetics (PK) supportive of once-daily dosing, with good exposure multiples. In this randomized, double-blind, placebo-controlled, human challenge study, up to 114 healthy adult subjects will be infected with RSV-A Memphis 37b virus. Primary and secondary outcome measures include safety, changes in viral load measurements and changes in baseline symptoms. Enanta plans to report data from this Phase 2a study in the third quarter of 2024.

oIn September, Enanta presented data for EDP-323 at the 9th European Scientific Working Group on Influenza (ESWI) Conference. These data detailed the positive results observed in the Phase 1 study of healthy subjects.

•Enanta hosted an RSV Key Opinion Leader event in October which highlighted the ongoing need for RSV treatments despite the availability of new vaccines and prophylactic monoclonal antibodies. Guest speakers included Jaime Fergie, MD, FAAP, FIDSA, FSHEA, Medical Director of the Global Institute for Hispanic Health, Professor of Pediatrics at Texas A&M University, and Director of Infectious Diseases at Driscoll Children’s Hospital in Texas; and Tom Wilkinson, MA (Cantab), MBBS, PhD, FRCP, FERS, Professor of Respiratory Medicine and Associate Dean at the University of Southampton and a member of the Faculty of Medicine at Southampton General Hospital, United Kingdom. To view the webcast, visit here.

COVID-19 (SARS-CoV-2)

•Enanta plans to pursue any future COVID-19 efforts in the context of a collaboration, including the development of EDP-235, an oral, once-daily, Phase 3 ready 3CL protease inhibitor which has been granted Fast Track designation by the FDA.

Human Metapneumovirus (hMPV)/RSV

•Enanta paused development of its research program targeting both hMPV and RSV with a single agent. Despite promising preclinical data, the company does not plan to move a third RSV candidate into the clinic as long as EDP-938 and EDP-323 continue to progress.

Hepatitis B Virus (HBV)

•Enanta continues to seek an additional mechanism for development in a combination regimen with a nucleoside reverse transcriptase inhibitor and EDP-514, its potent core inhibitor which has Fast Track designation from the FDA, as a functional cure for HBV.

Non-Virology

•Enanta is advancing discovery programs focused on non-virology indications that have a high unmet need and leverage the company’s expertise in preclinical small molecule drug discovery and development. The company will announce new therapeutic programs beginning in early 2024.

Upcoming Events and Presentations

•Evercore Healthcare Conference, November 29, 2023

•42nd Annual JP Morgan Healthcare Conference, January 10, 2024

•Enanta plans to issue its fiscal 2024 first quarter press release, and hold a conference call regarding those results, on February 7, 2024.

Conference Call and Webcast Information

Enanta will host a conference call and webcast today at 4:30 p.m. ET. The live webcast can be accessed under "Events & Presentations" in the investors section of Enanta’s website. To join by phone, participants can register for the call here. It is recommended that participants register a minimum of 15 minutes before the call. Once registered, participants will receive an email with the dial-in information. The archived webcast will be available on Enanta’s website for approximately 30 days following the event.

About Enanta Pharmaceuticals, Inc.

Enanta is using its robust, chemistry-driven approach and drug discovery capabilities to become a leader in the discovery and development of small molecule drugs with an emphasis on treatments for viral infections. Enanta’s research and development programs include clinical candidates for the following disease targets: respiratory syncytial virus (RSV), SARS-CoV-2 (COVID-19) and hepatitis B virus (HBV).

Glecaprevir, a protease inhibitor discovered by Enanta, is part of one of the leading treatment regimens for curing chronic hepatitis c virus infection and is sold by AbbVie in numerous countries under the tradenames MAVYRET® (U.S.) and MAVIRET® (ex-U.S.) (glecaprevir/pibrentasvir). Please visit www.enanta.com for more information.

Forward Looking Statements

This press release contains forward-looking statements, including statements with respect to the prospects for advancement of Enanta’s clinical programs in RSV, SARS-CoV-2 and HBV and its preclinical dual-inhibitor program in hMPV/RSV. Statements that are not historical facts are based on management’s current expectations, estimates, forecasts and projections about Enanta’s business and the industry in which it operates and management’s beliefs and assumptions. The statements contained in this release are not guarantees of future performance and involve

certain risks, uncertainties and assumptions, which are difficult to predict. Therefore, actual outcomes and results may differ materially from what is expressed in such forward-looking statements. Important factors and risks that may affect actual results include: the impact of development, regulatory and marketing efforts of others with respect to competitive treatments for RSV, SARS-CoV-2 and HBV; the discovery and development risks of Enanta’s programs in RSV, SARS-CoV-2, HBV and hMPV; the competitive impact of development, regulatory and marketing efforts of others in those disease areas; Enanta’s lack of clinical development experience; Enanta’s need to attract and retain senior management and key research and development personnel; Enanta’s need to obtain and maintain patent protection for its product candidates and avoid potential infringement of the intellectual property rights of others; and other risk factors described or referred to in “Risk Factors” in Enanta’s Form 10-K for the fiscal year ended September 30, 2022, and any other periodic reports filed more recently with the Securities and Exchange Commission. Enanta cautions investors not to place undue reliance on the forward-looking statements contained in this release. These statements speak only as of the date of this release, and Enanta undertakes no obligation to update or revise these statements, except as may be required by law.

Media and Investors Contact:

Jennifer Viera

617-744-3848

jviera@enanta.com

#

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENANTA PHARMACEUTICALS, INC. |

|

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|

UNAUDITED |

|

(in thousands, except per share amounts) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Twelve Months Ended |

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

18,932 |

|

|

$ |

20,317 |

|

|

$ |

79,204 |

|

|

$ |

86,160 |

|

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

36,167 |

|

|

|

34,796 |

|

|

|

163,524 |

|

|

|

164,522 |

|

General and administrative |

|

13,795 |

|

|

|

12,569 |

|

|

|

52,887 |

|

|

|

45,482 |

|

Total operating expenses |

|

49,962 |

|

|

|

47,365 |

|

|

|

216,411 |

|

|

|

210,004 |

|

Loss from operations |

|

(31,030 |

) |

|

|

(27,048 |

) |

|

|

(137,207 |

) |

|

|

(123,844 |

) |

Interest expense |

|

|

|

(3,151 |

) |

|

|

— |

|

|

|

(5,148 |

) |

|

|

— |

|

Other income, net |

|

4,664 |

|

|

|

714 |

|

|

|

11,360 |

|

|

|

1,656 |

|

Loss before income taxes |

|

(29,517 |

) |

|

|

(26,334 |

) |

|

|

(130,995 |

) |

|

|

(122,188 |

) |

Income tax benefit (expense) |

|

1,410 |

|

|

|

(14 |

) |

|

|

(2,821 |

) |

|

|

433 |

|

Net loss |

$ |

(28,107 |

) |

|

$ |

(26,348 |

) |

|

$ |

(133,816 |

) |

|

$ |

(121,755 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

$ |

(1.33 |

) |

|

$ |

(1.27 |

) |

|

$ |

(6.38 |

) |

|

$ |

(5.91 |

) |

|

Diluted |

$ |

(1.33 |

) |

|

$ |

(1.27 |

) |

|

$ |

(6.38 |

) |

|

$ |

(5.91 |

) |

Weighted average common shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

21,057 |

|

|

|

20,755 |

|

|

|

20,969 |

|

|

|

20,603 |

|

|

Diluted |

|

21,057 |

|

|

|

20,755 |

|

|

|

20,969 |

|

|

|

20,603 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ENANTA PHARMACEUTICALS, INC. |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

UNAUDITED |

|

(in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

|

2023 |

|

|

2022 |

|

Assets |

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

85,388 |

|

|

$ |

43,994 |

|

|

Short-term marketable securities |

|

284,522 |

|

|

|

205,238 |

|

|

Accounts receivable |

|

8,614 |

|

|

|

20,318 |

|

|

Prepaid expenses and other current assets |

|

13,263 |

|

|

|

13,445 |

|

|

Income tax receivable |

|

31,004 |

|

|

|

28,718 |

|

|

|

Total current assets |

|

422,791 |

|

|

|

311,713 |

|

Long-term marketable securities |

|

— |

|

|

|

29,285 |

|

Property and equipment, net |

|

11,919 |

|

|

|

6,173 |

|

Operating lease, right-of-use assets |

|

22,794 |

|

|

|

23,575 |

|

Restricted cash |

|

3,968 |

|

|

|

3,968 |

|

Other long-term assets |

|

803 |

|

|

|

696 |

|

|

|

Total assets |

$ |

462,275 |

|

|

$ |

375,410 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

$ |

4,097 |

|

|

$ |

6,000 |

|

|

Accrued expenses and other current liabilities |

|

18,339 |

|

|

|

20,936 |

|

|

Liability related to the sale of future royalties |

|

35,076 |

|

|

|

— |

|

|

Operating lease liabilities |

|

5,275 |

|

|

|

2,891 |

|

|

|

Total current liabilities |

|

62,787 |

|

|

|

29,827 |

|

Liability related to the sale of future royalties, net of current portion |

|

159,429 |

|

|

|

— |

|

Operating lease liabilities, net of current portion |

|

21,238 |

|

|

|

22,372 |

|

Series 1 nonconvertible preferred stock |

|

1,423 |

|

|

|

1,423 |

|

Other long-term liabilities |

|

663 |

|

|

|

454 |

|

|

|

Total liabilities |

|

245,540 |

|

|

|

54,076 |

|

Total stockholders' equity |

|

216,735 |

|

|

|

321,334 |

|

|

|

Total liabilities and stockholders' equity |

$ |

462,275 |

|

|

$ |

375,410 |

|

|

|

|

|

|

|

|

|

|

v3.23.3

Document And Entity Information

|

Nov. 20, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 20, 2023

|

| Entity Registrant Name |

ENANTA PHARMACEUTICALS, INC.

|

| Entity Central Index Key |

0001177648

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-35839

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

04-3205099

|

| Entity Address, Address Line One |

500 Arsenal Street

|

| Entity Address, City or Town |

Watertown

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02472

|

| City Area Code |

(617)

|

| Local Phone Number |

607-0800

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

ENTA

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

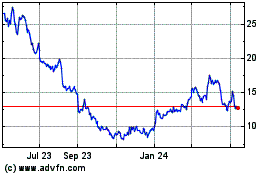

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Oct 2024 to Nov 2024

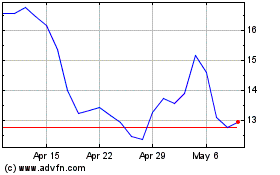

Enanta Pharmaceuticals (NASDAQ:ENTA)

Historical Stock Chart

From Nov 2023 to Nov 2024