UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 28, 2023 (December 21, 2023)

EDUCATIONAL DEVELOPMENT CORPORATION

(Exact name of registrant as specified in its charter)

| Delaware | 000-04957 | 73-0750007 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S Employer Identification No.) |

5402 S 122nd E Avenue, Tulsa, Oklahoma 74146

(Address of principal executive offices and Zip Code)

(918) 622-4522

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Common Stock, $.20 par value | EDUC | NASDAQ |

| (Title of class) | (Trading symbol) | (Name of each exchange on which registered) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT

On December 21, 2023, Educational Development Corporation (the “Company”) executed the Fourth Amendment to the Existing Credit Agreement (“Amendment”) with BOKF, NA (the “Lender”). The Amendment, effective December 1, 2023, increases the Revolving Loan commitment to $8,000,000 and extends the maturity date to May 31, 2024. The amendment also allows the Company to execute additional purchase orders, subject to the lenders approval, not to exceed $2,100,000 between December 1, 2023 and March 31, 2024.

Other terms in the Amendment include the Company’s previously announced plans to sell the Company’s headquarters and distribution warehouse located at 5400-5402 South 122nd East Avenue, Tulsa, Oklahoma 74146 (the “Hilti Complex”). The Hilti Complex consists of multiple buildings totaling 402,255 square feet of rentable office and warehouse space on 34-acres. In addition, the amendment includes the requirement, should an offer on the Hilti Complex not be received by March 31, 2023, or a later date at the Lender’s option, to sell the excess land adjacent to the Hilti Complex, consisting of approximately 17 acres.

The foregoing description of the Amendment is not complete and is qualified in all respects subject to the actual provisions of the Amendment, a copy of which have been filed as Exhibits 10.01, and is incorporated by reference herein.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) EXHIBITS

SIGNATURE

Pursuant to the requirements of the Exchange Act, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Educational Development Corporation

By: /s/ Craig M. White

Craig M. White

President and Chief Executive Officer

Date: December 28, 2023

false

0000031667

0000031667

2023-12-21

2023-12-21

Exhibit 10.01

FOURTH AMENDMENT TO CREDIT AGREEMENT

This FOURTH AMENDMENT TO CREDIT AGREEMENT (this “Amendment”), dated as of December 1, 2023, is by and between Educational DEVELOPMENT CORPORATION, a Delaware corporation (the “Borrower”) and BOKF, NA DBA BANK OF OKLAHOMA (the “Lender”).

RECITALS:

A. The Borrower and the Lender have previously entered into that certain Credit Agreement dated as of August 9, 2022, as amended by (i) that certain First Amendment to Credit Agreement dated as of December 22, 2022, (ii) that certain Second Amendment to Credit Agreement dated as of May 10, 2023, and (iii) that certain Third Amendment to Credit Agreement dated as of August 9, 2023 (as so amended, the “Existing Credit Agreement”; the Existing Credit Agreement, as amended by this Amendment, is referred to herein as the “Credit Agreement”).

B. The Borrower has requested, and the Lender has agreed, subject to the terms and conditions of this Amendment, to amend the Existing Credit Agreement as herein provided.

NOW, THEREFORE, in consideration of the premises herein contained and other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows:

ARTICLE I

Definitions

Section 1.1 Definitions. All terms used herein which are defined in the Credit Agreement shall have the same meanings when used herein, unless the context hereof otherwise requires or provides. In addition, all references in the Loan Documents to the “Agreement” and the “Credit Agreement” shall mean the Credit Agreement, as amended by this Amendment, as the same shall hereafter be amended from time to time.

ARTICLE II

Amendments to Existing Credit Agreement

Section 2.1 Section 1.01 of the Existing Credit Agreement is hereby amended to add the definition of Fourth Amendment Effective Date as follows:

“Fourth Amendment Effective Date” means December 1, 2023.

Section 2.2 Section 1.01 of the Existing Credit Agreement is hereby amended by amending and restating the definition of Revolving Commitment as follows:

“Revolving Commitment” means the commitment of the Lender to make Revolving Loans hereunder up to $8,000,000.

Section 2.3 Section 1.01 of the Existing Credit Agreement is hereby amended by amending and restating the definition of Revolving Loan Maturity Date as follows:

“Revolving Loan Maturity Date” means May 31, 2024, or any earlier date on which the Revolving Commitment is reduced to zero or otherwise terminated pursuant to the terms hereof.

Section 2.4 Section 5.21(c) is hereby added to the Existing Credit Agreement as follows:

FOURTH AMENDMENT TO CREDIT AGREEMENT – PAGE 1

(c) On or before the date that is 30 days from the Fourth Amendment Effective Date, the Borrower shall list its headquarters located at 5402 South 122nd East Avenue, Tulsa, Oklahoma, 74146 (“Headquarters”) for sale with a licensed commercial real estate broker satisfactory to the Lender. The sale of the Headquarters shall be on terms and conditions satisfactory to the Lender and subject to the Lender’s approval of the final settlement statement for such sale. If the Borrower has not entered into a letter of intent for the sale of the Headquarters on terms and conditions satisfactory to the Lender on or before March 31, 2024, the Borrower shall:

(1) immediately list the excess undeveloped land associated with the Headquarters for sale with a licensed commercial real estate broker satisfactory to the Lender; or

(2) on or before March 31, 2024, deliver to the Lender a copy of a bona fide commitment letter from a financial institution, in form and substance satisfactory to the Lender, to refinance or otherwise pay in full all unpaid principal of and accrued and unpaid interest and fees on the Revolving Loans on or before April 30, 2024 (or such later date as the Lender may agree in its sole discretion).

Notwithstanding anything herein to the contrary, the sale of the excess undeveloped land associated with the Headquarters shall be on terms and conditions satisfactory to the Lender and subject to the Lender’s approval of the final settlement statement for such sale.

Section 2.5 Section 6.13 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

SECTION 6.13. Inventory Purchases. Notwithstanding anything to the contrary herein or in any other Loan Document, from and after the Fourth Amendment Effective Date, the Borrower shall not enter into any new purchase orders or other agreements, contracts or transactions pursuant to which the Borrower agrees to purchase Inventory (“Inventory Purchase Orders”), except:

(a) the Borrower may enter into Inventory Purchase Orders in an aggregate amount not to exceed $300,000 to fulfill the Borrower’s existing orders of its SmartLab Toys and Learning Wrap-Ups product lines; and

(b) from and after January 1, 2024, until March 31, 2024, the Borrower may enter into Inventory Purchase Orders in an aggregate amount not to exceed $1,800,000;

in each case subject to the Lender’s receipt of a copy of such Inventory Purchase Order, in form and substance satisfactory to the Lender, and such other documentation as the Lender may reasonably request in connection with such Inventory Purchase Order, at least five (5) days prior to the Borrower’s execution thereof.

Section 2.6 Article VII of the Existing Credit Agreement is hereby amended to delete the following paragraph at the end of such Article:

From and after the Third Amendment Effective Date, upon the occurrence of an Event of Default, the Borrower shall, promptly and in any event within 15 days of the occurrence of such Event of Default, list its real property located at 5402 South 122nd East Ave., Tulsa, Oklahoma, 74146 for sale with a licensed commercial real estate broker satisfactory to the Lender. The sale of such property shall be on terms and conditions satisfactory to the Lender and subject to the Lender’s approval of the final settlement statement for such sale. In exchange for such listing, the Lender will forbear from exercising any of its available rights and remedies under the Loan Documents with respect to such Event of Default through the Revolving Loan Maturity Date (the “Forbearance Period”), provided that (i) no new Event of Default or event which, with the passage of time or the giving of notice or both, would constitute an Event of Default shall occur during the Forbearance Period, and (ii) such forbearance shall not be deemed a waiver or release of any claim, right, or remedy of the Lender under the Loan Documents.

FOURTH AMENDMENT TO CREDIT AGREEMENT – PAGE 2

ARTICLE III

Ratifications

Section 3.1 Ratifications by Borrower.

(a) The terms and provisions set forth in this Amendment shall modify and supersede all inconsistent terms and provisions set forth in the Existing Credit Agreement and the other Loan Documents, and except as expressly modified and superseded by this Amendment, the terms and provisions of the Existing Credit Agreement and the other Loan Documents are ratified and confirmed and shall continue in full force and effect.

(b) The Borrower and the Lender agree that each of the Credit Agreement, as amended hereby, and the other Loan Documents to which each is a party shall continue to be legal, valid, binding and enforceable in accordance with its respective terms. This Amendment is a “Loan Document” as referred to in the Credit Agreement and the provisions relating to Loan Documents in the Credit Agreement are incorporated herein by reference, the same as if set forth verbatim in this Amendment.

Section 3.2 Representations and Warranties of the Borrower. Borrower hereby represents and warrants to the Lender that (a) the execution, delivery and performance of this Amendment and any and all other Loan Documents executed and/or delivered by Borrower in connection herewith have been authorized by all requisite action on the part of Borrower and will not violate any organizational document of Borrower, (b) the representations and warranties contained in the Loan Documents, as amended hereby, are true and correct in all material respects on and as of the date hereof as though made on and as of the date hereof, except to the extent such representations and warranties speak to a specific date, and (c) no Default or Event of Default exists.

ARTICLE IV

Conditions Precedent

Section 4.1 Conditions Precedent. The effectiveness of this Amendment is subject to the satisfaction of the following conditions precedent:

(a) Amendment and Other Documents. Lender shall have received:

(i) this Amendment duly executed by the Borrower; and

(ii) such other documents, instruments and agreements as Lender may require.

(b) No Default. No Default or Event of Default shall exist.

(c) Representations and Warranties. All of the representations and warranties contained in the Credit Agreement, as amended hereby, shall be true and correct in all material respects on and as of the date of this Amendment with the same force and effect as if such representations and warranties had been made on and as of such date, except to the extent such representations and warranties speak to a specific date.

(d) Other Fees and Expenses. The Lender shall have received payment of all reasonable and documented out‑of‑pocket fees and expenses (including reasonable attorneys’ fees and expenses) incurred by Lender in connection with the preparation, negotiation and execution of this Amendment and the other Loan Documents.

FOURTH AMENDMENT TO CREDIT AGREEMENT – PAGE 3

ARTICLE V

Miscellaneous

Section 5.1 Survival of Representations and Warranties. All representations and warranties made in this Amendment or any other document executed in connection herewith shall survive the execution and delivery of this Amendment, and no investigation by the Lender or any closing shall affect the representations and warranties or the right of the Lender to rely upon them.

Section 5.2 Reference to Agreement. Each of the Credit Agreement, the other Loan Documents and any and all other agreements, documents, or instruments now or hereafter executed and delivered pursuant to the terms hereof or pursuant to the terms of the Credit Agreement, as amended hereby, and the other Loan Documents are hereby amended so that any reference in such documents to the Credit Agreement shall mean a reference to the Credit Agreement as amended hereby.

Section 5.3 Expenses of Lender. As provided in the Credit Agreement, Borrower agrees to pay on demand all reasonable costs and expenses incurred by Lender in connection with the preparation, negotiation, and execution of this Amendment and any other documents executed pursuant hereto and any and all amendments, modifications, and supplements thereto, including without limitation the costs and reasonable fees of Lender’s legal counsel, and all costs and expenses incurred by Lender in connection with the enforcement or preservation of any rights under the Credit Agreement, as amended hereby, or any other document executed in connection therewith, including without limitation the costs and reasonable fees of Lender’s legal counsel.

Section 5.4 Severability. Any provision of this Amendment held by a court of competent jurisdiction to be invalid or unenforceable shall not impair or invalidate the remainder of this Amendment and the effect thereof shall be confined to the provision so held to be invalid or unenforceable.

Section 5.5 Applicable Law. This Amendment and all other documents executed pursuant hereto shall be governed by and construed in accordance with the laws of the State of Oklahoma.

Section 5.6 Successors and Assigns. This Amendment is binding upon and shall inure to the benefit of the Lender, Borrower and their respective successors and assigns, except Borrower may not assign or transfer any of its rights or obligations hereunder without the prior written consent of the Lender.

Section 5.7 Counterparts. This Amendment may be executed in any number of counterparts and by different parties on separate counterparts, each of which shall be an original and all of which taken together shall constitute one and the same agreement. Delivery of an executed counterpart of a signature page to this Amendment by facsimile or as an attachment to an electronic mail message in .pdf, .jpeg, .TIFF or similar electronic format shall be effective as delivery of a manually executed counterpart of this Amendment for all purposes. The words “execution,” “signed,” “signature,” “delivery,” and words of like import in or relating to this Amendment and any other Loan Document to be signed in connection with this Amendment, the other Loan Documents and the transactions contemplated hereby and thereby shall be deemed to include Electronic Signatures, deliveries or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act; provided that nothing herein shall require the Lender to accept electronic signatures in any form or format without its prior written consent. For the purposes hereof, “Electronic Signatures” means an electronic sound, symbol, or process attached to, or associated with, a contract or other record and adopted by a Person with the intent to sign, authenticate or accept such contract or record. Each of the parties hereto represents and warrants to the other parties hereto that it has the corporate capacity and authority to execute the Amendment through electronic means and there are no restrictions for doing so in that party’s constitutive documents. Without limiting the generality of the foregoing, Borrower hereby (i) agrees that, for all purposes, including without limitation, in connection with any workout, restructuring, enforcement of remedies, bankruptcy proceedings or litigation among the Lender and Borrower, electronic images of this Amendment or any other Loan Document (in each case, including

FOURTH AMENDMENT TO CREDIT AGREEMENT – PAGE 4

with respect to any signature pages thereto) shall have the same legal effect, validity and enforceability as any paper original, and (ii) waives any argument, defense or right to contest the validity or enforceability of any Loan Document based solely on the lack of paper original copies of such Loan Document, including with respect to any signature pages thereto. Any party sending an executed counterpart of a signature page to this Amendment by facsimile, pdf, tiff, Electronic Signature or any other electronic means shall also send the original thereof to Lender within five (5) days following Lender’s request therefor, but failure to do so shall not affect the validity, enforceability, or binding effect of this Amendment.

Section 5.8 Headings. The headings, captions, and arrangements used in this Amendment are for convenience only and shall not affect the interpretation of this Amendment.

Section 5.9 ENTIRE AGREEMENT. THIS AMENDMENT AND THE OTHER LOAN DOCUMENTS EXECUTED AND DELIVERED IN CONNECTION WITH THIS AMENDMENT AND THE OTHER LOAN DOCUMENTS REPRESENT THE FINAL AGREEMENT AMONG THE PARTIES HERETO AND MAY NOT BE CONTRADICTED OR VARIED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR SUBSEQUENT ORAL AGREEMENTS OR DISCUSSIONS OF THE PARTIES HERETO. THERE ARE NO UNWRITTEN ORAL AGREEMENTS AMONG THE PARTIES HERETO.

[Signature Pages Follow]

FOURTH AMENDMENT TO CREDIT AGREEMENT – PAGE 5

Executed as of the date first written above.

|

BORROWER:

|

|

EDUCATIONAL DEVELOPMENT CORPORATION,

a Delaware corporation

|

| |

|

By:

|

|

Name: Craig White

|

|

Title: President & Chief Executive Officer

|

|

LENDER:

|

|

BOKF, NA DBA BANK OF OKLAHOMA,

a Delaware corporation

|

| |

| By: |

|

Name: Julie H. Chase

Title: Senior Vice President

|

Exhibit 99.1

PRESS RELEASE

EDUCATIONAL DEVELOPMENT CORPORATION ANNOUNCES

EXECUTED FOURTH AMENDMENT TO CREDIT AGREEMENT

On December 28, 2023, Educational Development Corporation announced, via press release, the executed the Fourth Amendment to its existing credit agreement with its bank. The Amendment, effective December 1, 2023, increases the Revolving Loan commitment to $8.0 million and extends the maturity date to May 31, 2024. The amendment also allows the Company to execute additional purchase orders, subject to lender approval, not to exceed $2.1 million between December 1, 2023 and March 31, 2024.

Other terms in the Amendment include the previously announced listing for sale of the Company’s headquarters and distribution warehouse located at 5400-5402 South 122nd East Avenue, Tulsa, Oklahoma 74146 (the “Hilti Complex”). The Hilti Complex consists of multiple buildings totaling 402,255 square feet of rentable office and warehouse space on 34acres. In addition, the amendment includes the requirement, should an offer on the Hilti Complex not be received by March 31, 2024, to list for sale the excess land adjacent to the Hilti Complex, consisting of approximately 17 acres.

The Company expects to enter into a sale leaseback arrangement with the building sale including a lease term of seven to fifteen years to maximize the sale price. Proceeds from the sale are expected to pay the Company’s borrowings with its bank and provide liquidity for ongoing operations.

Per Craig White, President and Chief Executive Officer, “We are pleased with the execution of this amendment as it provides additional borrowing capacity on our line of credit with our bank as well as allows us to add new products to our current offering and order product replenishment. The period of the extension of the Revolving Loan through May 31st, 2024 is aligned with the expected timeframe for selling the Hilti Complex. This amendment reflects the banks continued support during this challenging period as we focus on sales growth and returning to profitability.”

Mr. White continued, “Amidst the challenges of today's economic landscape, we remain laser focused on our commitment to our retailers, our Brand Partners, our customers, our employees and our shareholders. As we continue to navigate these unprecedented times together, our dedication to delivering exceptional value remains unchanged. Our products have incredible value and we strive to ensure that they remain widely accessible even through these challenging economic times.”

About Educational Development Corporation (EDC)

EDC began as a publishing company specializing in books for children. EDC is the owner and exclusive publisher of Kane Miller Books (“Kane Miller”); Learning Wrap-Ups, maker of educational manipulatives; and SmartLab Toys, maker of STEAM-based toys and games. EDC is also the exclusive United States MLM distributor of Usborne Publishing Limited (“Usborne”) children’s books. EDC-owned products are sold via 4,000 retail outlets and EDC and Usborne products are offered by independent brand partners who hold book showings through social media, book fairs with schools and public libraries, in individual homes, as well as other in-person events and internet sales.

Contact:

Educational Development Corporation

Craig White, (918) 622-4522

Investor Relations:

Three Part Advisors, LLC

Steven Hooser, (214) 872-2710

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

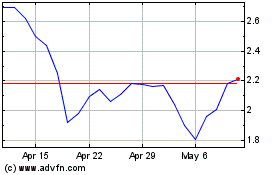

Educational Development (NASDAQ:EDUC)

Historical Stock Chart

From Mar 2024 to Apr 2024

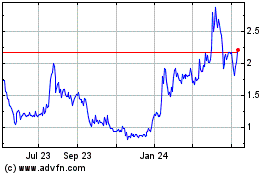

Educational Development (NASDAQ:EDUC)

Historical Stock Chart

From Apr 2023 to Apr 2024