East West Bancorp, Inc. (Nasdaq: EWBC), parent company of East

West Bank, one of the nation’s premier community banks, today

reported financial results for the fourth quarter and full year

2009.

“East West reported a return to profitability with net earnings

for full year 2009 of $76.6 million. The return to profitability

for 2009 follows a single loss year for 2008 – the only loss year

for East West in nearly 30 years,” stated Dominic Ng, Chairman and

Chief Executive Officer of East West. “Previous to 2008, East West

achieved record earnings every year for over a decade, with net

income of $161.2 million in 2007 and $143.4 million in 2006. Our

core business remains strong and we are back on track to deliver

solid profitability and create long-term value for our shareholders

in 2010 and beyond.”

For the fourth quarter 2009, net income was $259.7 million, an

increase of $328.3 million over a loss reported in third quarter.

For the full year 2009, net income was $76.6 million, an increase

of $126.3 million over a loss reported in 2008. Our fourth quarter

earnings include a pre-tax gain of $471.0 million from the

FDIC-assisted acquisition of United Commercial Bank (UCB), offset

by a $140.0 million provision for loan losses and a $45.8 million

impairment loss on investment securities.

Ng stated, “Throughout 2009 and from the onset of the economic

downturn, East West successfully executed on all strategic actions.

We believe that for East West, the credit cycle peaked in the third

quarter of 2009 and that as we enter the new year, the worst is

behind us. Since January 1, 2008, we actively reduced our exposure

to land and construction loans by over $2.2 billion. Our capital

position is strong and continues to grow – during 2009 we raised a

total of $607.8 million in new capital and generated $76.6 million

additional capital from net income.”

“Further, our swift and decisive actions during this challenging

operating environment to improve our balance sheet have allowed us

to take the exceptional opportunity to acquire the assets and

deposit franchise of UCB, nearly doubling our size to $20.6

billion. The acquisition of UCB has expedited our return to

profitability and serves as an immediate catalyst to further our

growth and profitability in 2010,” concluded Ng.

FDIC-Assisted Acquisition of UCB

On November 6, 2009, East West acquired substantially all of the

assets and assumed substantially all of the liabilities of UCB from

the Federal Deposit Insurance Corporation (FDIC) in an

FDIC-assisted transaction.

As the market leader in the Asian-American banking sector, East

West has positive brand recognition. UCB customers and the

Asian-American community have responded positively to our

acquisition of the banking operations of UCB. As widely reported in

the Asian-American media, our acquisition of UCB served to

stabilize deposits and strengthen customer confidence in the entire

Asian-American banking sector. Additionally, East West’s proven

asset resolution process, coupled with our expertise in the market

niche of UCB will result in a higher recovery and lower potential

losses to the FDIC insurance fund. Further, because East West has

an existing presence and expertise in Hong Kong and Greater China,

we are better able to assist the FDIC in managing the overseas

operations of UCB, also reducing any potential exposure to the FDIC

insurance fund.

The integration of United Commercial Bank is progressing

smoothly and we are on target for full integration of all systems

in April 2010.

East West entered into loss sharing agreements with the FDIC

that covers future losses incurred on nearly all the UCB legacy

loans and all real estate owned assets that existed at November 6,

2009. Under the terms of the agreement, the FDIC will absorb 80

percent of losses and share in 80 percent of recoveries on the

first $2.05 billion and absorb 95 percent of losses and share in 95

percent of recoveries exceeding $2.05 billion. The term for the

loss share agreement is ten years for single family loans. For all

other loans, the term is five years for losses and eight years for

recoveries.

East West recorded a FDIC indemnification asset as of November

6, 2009 of $1.1 billion, which represents the present value of the

estimated losses on covered loans to be reimbursed to East West by

the FDIC. East West also recorded a $174.0 million receivable from

the FDIC.

The UCB legacy loans guaranteed under loss sharing agreements

with the FDIC will be defined as “covered loans” and the UCB legacy

loans and real estate owned assets guaranteed under loss sharing

agreements with the FDIC will be defined as “covered assets”

throughout this press release. Further, any references to

nonaccrual loans and nonperforming assets will consist of East West

legacy loans and assets only as all covered assets are subject to

loss share agreements with the FDIC.

In accordance with U.S. GAAP, all the UCB legacy loans were

accounted for at fair value and recorded at a discount to book

value. Accordingly, any share of losses East West expects to incur

have already been written off and factored into the fair value as

of November 6, 2009.

A summary of the net assets received from the FDIC is as

follows:

November 6, 2009 (In

thousands) Assets Cash and cash equivalents

$

599,036

FDIC receivable

173,995 Investment securities 1,561,446

Loans covered by FDIC loss

sharing, (gross balance $7,299,303 and shown net of discount of

$1,638,871)

5,660,432

Loans not covered by FDIC loss

sharing, (gross balance $306,477 and shown net of discount of

$69,973)

236,504 FDIC indemnification asset 1,143,989 Other assets

486,555 Total assets acquired

$

9,861,957

Liabilities Deposits

$

6,529,864

Federal Home Loan Bank advances 1,837,593 Securities sold under

repurchase agreements 858,244 Other liabilities 344,788

Total liabilities 9,570,489 Net assets acquired

$

291,468

Further information on the acquisition of UCB can be found in

the Form 8-K, filed by East West with the SEC on January 22,

2010.

East West recorded an after tax gain of $291.5 million from the

acquisition of UCB on November 6, 2009. Further, the Company

recorded additional net revenue of $51.1 million during the period

from November 6, 2009 to December 31, 2009 as a result of early

prepayments on covered loans during the quarter. This additional

net revenue is comprised of $74.4 million discount accretion on

early payoffs on covered loans as a yield adjustment offset by a

corresponding $23.3 million net reduction in the FDIC

indemnification asset and FDIC receivable as noninterest income

(loss).

Preliminary Forecast

The Company is providing a forecast for the first quarter of

2010. Management currently estimates that fully diluted earnings

per share for the first quarter of 2010 will range from $0.04 to

$0.08. This EPS guidance is based on the following assumptions:

- Net interest margin between

3.80% and 3.90%

- Provision for loan losses of

approximately $70.0 to $80.0 million for the quarter

- Noninterest expense flat from

the fourth quarter of 2009

Full Year 2009 Highlights

- Increase in Balance Sheet

– Total asset increased to a record $20.6 billion at year-end, an

increase of $8.2 billion or 66% year over year. Total deposits

increased to $15.0 billion, an increase of $6.8 billion or 84% year

over year. Year-to-date, East West grew deposits organically by

$744.1 million or 9%, excluding the impact of the UCB acquisition.

Total gross loans receivable increased to $14.1 billion, an

increase of $5.9 billion or 71% year over year. These increases in

the balance sheet are primarily due to the acquisition of UCB.

- Capital Strengthened –

During the full year 2009, we raised a total of $607.8 million in

capital. We issued $107.8 million of common stock in July 2009 and

$165.0 million of common stock and $335.0 million of mandatory

convertible preferred stock in November 2009. As of December 31,

2009, East West’s Tier 1 risk-based and total risk-based capital

ratios were 17.9% and 19.9%, respectively, significantly higher

than the well capitalized requirement of 6% and 10%,

respectively.

- Loan to Deposit Ratio -

Throughout 2009, East West continued to further strengthen the

balance sheet and decrease the loan to deposit ratio. As of

December 31, 2009, the loan to deposit ratio was 94.3%, compared to

101.3% as of December 31, 2008.

- Allowance for Loan Losses

Strengthened – The allowance for loan loss was increased to

$238.8 million or a 34% increase year over year. The allowance for

loan losses to gross non-covered loans was 2.80% at December 31,

2009 compared to 2.16% as of December 31, 2008. The allowance to

nonaccrual loans ratio improved to 137.9% as of December 31, 2009,

compared to 83.0% as of December 31, 2008.

- Reduced Exposures to Problem

Credits –Total land loans decreased $206.2 million or 36% and

total commitments on construction loans decreased $1.0 billion or

63% year to date. As of December 31, 2009, outstanding balances on

land and construction loans totaled only 5.9% of total gross loans

receivable.

Fourth Quarter Summary

- Credit Quality Improved –

Total nonperforming assets have improved to $187.0 million, a

decrease of $43.2 million or 19% from prior quarter. Total

nonperforming assets to total assets improved to 0.91% as of

December 31, 2009, from 1.84% as of September 30, 2009. The

decrease in nonperforming assets from the prior quarter is largely

a result of a reduction in nonaccrual residential construction

loans.

- Net Interest Margin

Improved – Net interest income for the fourth quarter

increased to $219.5 million, a $123.6 million increase over third

quarter of 2009. The net interest margin for the fourth quarter

increased to 5.46%, compared to 3.20% in the prior quarter.

Excluding the impact of the yield adjustment to covered loans of

$74.4 million, net interest income increased to $145.1 million and

the net interest margin increased to 3.61% for the fourth quarter.

See reconciliation of the GAAP financial measure to this non-GAAP

financial measure in the tables attached.

- Deposits Increased –

Total deposits increased to a record $15.0 billion at year-end

2009. In fourth quarter of 2009, deposits increased $6.3 billion or

73% over prior quarter due primarily to the UCB acquisition. East

West grew deposits organically by $217.5 million for the quarter,

excluding the impact of the UCB acquisition.

Capital Strength

(Dollars in millions)

December 31, 2009

Well

CapitalizedRegulatoryRequirement

Total Excess AboveWell

CapitalizedRequirement

Tier 1 leverage capital ratio 11.7 % 5.00 % $ 1,150.2 Tier 1

risk-based capital ratio 17.9 % 6.00 %

$

1,337.9 Total risk-based capital ratio 19.9 % 10.00 %

$

1,106.1

Proforma tangible common equity to

risk weighted assets ratio

13.2 % 4.00 %

$

1,028.2 * The tangible common equity to risk weighted

asset ratio is a non-GAAP disclosure. The Mandatory Convertible

Cumulative Non-Voting Perpetual Preferred Stock, Series, C issued

in November 2009 has been included as a proforma tangible common

equity ratio. The Series C shares will automatically convert to

common shares if an affirmative shareholder vote is obtained. See

reconciliation of the GAAP financial measure to this non-GAAP

financial measure in the tables attached. As there is no stated

regulatory guideline for this ratio, the Supervisory Capital

Assessment Program (SCAP) guideline of 4.00% has been used.

East West has always been committed to maintaining strong

capital levels and has been well capitalized throughout this

economic cycle. As of the end of the fourth quarter, our Tier 1

leverage capital ratio increased to 11.7%, Tier 1 risk-based

capital ratio increased to 17.9% and total risk-based capital ratio

increased to 19.9%. East West exceeds well capitalized requirements

for all regulatory guidelines by over $1 billion. Furthermore, East

West’s proforma tangible common equity to risk weighted assets

ratio totaled 13.2% as of December 31, 2009.

During the fourth quarter, we issued $165 million in common

stock and $335 million in Mandatory Convertible Cumulative

Non-Voting Perpetual Preferred Stock, Series C (Series C preferred

stock). The newly issued capital, along with the net income for the

quarter resulted in an increase to total shareholders’ equity to

$2.3 billion at December 31, 2009. The special shareholders’

meeting to vote to approve the conversion of the Series C preferred

stock to common stock has been set for March 18, 2010. The Series C

preferred stock converts to common stock automatically three days

after the receipt of an affirmative shareholder vote. No Series C

dividend has been declared by the Board of Directors. Under the

terms of the Series C preferred stock, the May 1 dividend payment

or any portion thereof will not be earned or paid should an

affirmative shareholder vote to convert be obtained on the March

18, 2010 meeting date. Since management fully expects that the

Series C preferred dividend will not be earned or paid, income

available to common shareholders has not been adjusted for purposes

of computing basic and diluted per share amounts.

Further, during the fourth quarter, we received a 50% reduction

in the warrant we issued to the U.S. Treasury in conjunction with

the TARP capital we received in December 2008. As of December 31,

2009, the new share count of the warrant is 1,517,555. This

adjustment to the warrant was due to the fact that within one year

of issuance, we raised new capital in excess of the TARP capital

issued in December 2008. Management intends to repay the $306.5

million TARP capital in full later this year.

Credit Management

Total nonperforming assets as of December 31, 2009 totaled

$187.0 million or 0.91% of total assets, compared to $230.2 million

or 1.84% of total assets at September 30, 2009. Nonperforming

assets as of December 31, 2009 included nonaccrual loans totaling

$173.2 million and REO assets totaling $13.8 million.

The legacy UCB covered loans that were nonaccrual as of December

31, 2009 totaled $675.6 million, net of a $466.3 million discount.

All loans acquired from UCB were recorded at estimated fair value

as of the acquisition date.

Throughout this challenging economic cycle, we have taken strong

measures to reduce our exposure to problem credits – largely

comprised of our construction and land portfolios. The outstanding

balances for the land and construction portfolios totaled $828.7

million as of December 31, 2009, or 5.9% of total gross loans

receivable.

Further, with the addition of $5.6 billion in covered loans from

the UCB acquisition, concentrations within our loan portfolio have

been reduced. Total exposure to commercial real estate loans is 26%

of total loans as of December 31, 2009, down from 43% as of

September 30, 2009.

As previously discussed by management, both the provision for

loan losses and the net chargeoffs peaked in the third quarter of

2009. Given the trends we are seeing in the loan portfolio, it is

expected that provision for loan losses and net chargeoffs will

continue to decrease throughout 2010. Provision for loan losses was

$140.0 million for the fourth quarter of 2009, a decrease 12% from

$159.2 million in the third quarter.

For the fourth quarter of 2009, net charge-offs were $130.7

million, a decrease of 14% or $20.6 million compared to $151.2

million during the third quarter of 2009. The net chargeoffs for

the quarter were largely related to construction and land

loans.

At December 31, 2009, the allowance for loan losses increased to

$238.8 million or 2.80% of non-covered loans receivable, compared

to $230.7 million or 2.74% of outstanding loans at September 30,

2009. Based on management's evaluation and analysis of portfolio

credit quality and prevailing economic conditions, we believe the

allowance for loan losses is adequate for losses inherent in the

loan portfolio as of December 31, 2009.

Fourth Quarter 2009 Operating Results

Net interest income for the fourth quarter increased to $219.5

million, a $123.6 million or 129% increase over third quarter of

2009. The net interest margin for the fourth quarter increased to

5.46%, up 226 basis points from 3.20% in the prior quarter.

Excluding the impact of the yield adjustment to covered loans of

$74.4 million, net interest income increased to $145.1 million and

the net interest margin increased to 3.61% for the fourth quarter.

During the quarter, East West paid down $200 million in FHLB

advances at an average cost of 4.43%. Additionally, East West sold

approximately $1.3 billion in lower yielding investment securities

obtained from UCB, shortly after the acquisition. These actions

improved the net interest margin for the fourth quarter and will

continue to do so in coming quarters.

Currently, we estimate that the net interest margin, without

yield adjustments to covered loans, will be approximately 3.80% to

3.90% for the first quarter of 2010.

Excluding the impact of the gain on the acquisition of UCB, the

decrease in the FDIC indemnification asset, impairment charges on

investment securities and gains on sales of investment securities,

noninterest income for the fourth quarter totaled $14.4 million,

compared to $10.2 million in the third quarter of 2009. The

increase was primarily due to increased fee and other income from

the acquisition of UCB. See reconciliation of the GAAP financial

measure to this non-GAAP financial measure in the tables

attached.

Noninterest expense for the fourth quarter totaled $91.1

million, compared to $46.1 million in the third quarter of 2009.

The increase in the noninterest expense quarter over quarter was

due to additional expenditures from the acquisition of UCB on

November 6, 2009. We anticipate that noninterest expense will

decrease starting the second quarter of 2010, after the systems

integration of UCB is completed.

Investment Securities

During the fourth quarter, we recorded other than temporary

impairment on investment securities of $45.8 million related

primarily to pooled trust preferred securities. Year to date, total

impairment on the pooled trust preferred securities totaled $106.6

million and the remaining book balance of these securities has

decreased to $18.1 million. These securities are available for sale

and recorded on the balance sheet at fair value and any difference

in the book balance and the fair value is reflected in the other

comprehensive income section of stockholders’ equity. As of

December 31, 2009, the fair value of these securities was written

down to $2.9 million.

Deposit Summary

Total deposits as of December 31, 2009 increased to $15.0

billion, up $6.3 billion or 72.9% from $8.7 billion at September

30, 2009. Quarter over quarter, core deposits increased $2.7

billion or 60.1% and time deposits increased $3.7 billion or 86.3%.

The average cost of deposits for the fourth quarter of 2009

decreased to 1.11%, a 13 basis point decrease from the third

quarter of 2009. East West grew deposits organically by $217.5

million for the quarter, excluding the impact of the UCB

acquisition.

Dividend Payout

East West Bank’s Board of Directors has declared first quarter

dividends on the common stock and Series A Preferred Stock. The

common stock cash dividend of $0.01 is payable on or about February

24, 2010 to shareholders of record on February 10, 2010. The

dividend on the Series A Preferred Stock of $20.00 per share is

payable on February 1, 2010 to shareholders of record on January

15, 2010.

About East West

East West Bancorp is a publicly owned company with $20.6 billion

in assets and is traded on the Nasdaq Global Select Market under

the symbol “EWBC”. The Company’s wholly owned subsidiary, East West

Bank, is the third largest independent commercial bank

headquartered in California with 135 branches worldwide; including

111 branches in California, eight branches in New York, five

branches in Georgia, three branches in Massachusetts, two branches

in Texas, and two branches in Washington. In Greater China, East

West's presence includes four full-service branches, including two

in Hong Kong, one in Shanghai, and one in Shantou. The Bank also

has representative offices in Beijing, Guangzhou, Shanghai and

Shenzhen, China, and Taipei, Taiwan. For more information on East

West Bancorp, visit the Company’s website at

www.eastwestbank.com.

Forward-Looking Statements

This release may contain forward-looking statements, which are

included in accordance with the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995 and accordingly,

the cautionary statements contained in East West Bancorp’s Annual

Report on Form 10-K for the year ended Dec. 31, 2008 (See Item I --

Business, and Item 7 -- Management’s Discussion and Analysis of

Consolidated Financial Condition and Results of Operations), and

other filings with the Securities and Exchange Commission are

incorporated herein by reference. These factors include, but are

not limited to: the effect of interest rate and currency exchange

fluctuations; competition in the financial services market for both

deposits and loans; EWBC’s ability to efficiently incorporate

acquisitions into its operations; the ability of borrowers to

perform as required under the terms of their loans; effect of

additional provisions for loan losses; effect of any goodwill

impairment, the ability of EWBC and its subsidiaries to increase

its customer base; the effect of regulatory and legislative action,

including California tax legislation and an announcement by the

state’s Franchise Tax Board regarding the taxation of Registered

Investment Companies; and regional and general economic conditions.

Actual results and performance in future periods may be materially

different from any future results or performance suggested by the

forward-looking statements in this release. Such forward-looking

statements speak only as of the date of this release. East West

expressly disclaims any obligation to update or revise any

forward-looking statements found herein to reflect any changes in

the Bank’s expectations of results or any change in event.

EAST WEST BANCORP, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (In thousands, except per share

amounts) (unaudited) December 31, 2009

September 30, 2009 December 31, 2008 Assets Cash and

due from banks $ 585,024 $ 132,569 $ 144,486 Short-term investments

262,329 460,665 734,367 Interest-bearing deposits in other banks

498,565 320,860 228,441 Securities purchased under resale

agreements 227,444 75,000 50,000 Investment securities 2,564,081

2,238,354 2,162,511

Loans receivable, excluding

covered loans (net of allowance for loan losses of $238,833,

$230,650, and $178,027)

8,246,685 8,156,838 8,069,377 Covered loans 5,598,155

- - Total loans receivable, net

13,844,840 8,156,838 8,069,377 Federal Home Loan Bank and Federal

Reserve stock 217,002 123,514 114,317 FDIC indemnification asset

1,091,814 - - Other real estate owned, net 13,832 24,185 38,302

Other real estate owned covered, net 44,273 - - Premiums on

deposits acquired, net 89,735 17,904 21,190 Goodwill 337,438

337,438 337,438 Other assets 806,533 598,603

522,387 Total assets $ 20,582,910 $

12,485,930 $ 12,422,816 Liabilities and

Stockholders' Equity Deposits $ 14,987,613 8,668,557 $ 8,141,959

Federal Home Loan Bank advances 1,805,387 923,216 1,353,307

Securities sold under repurchase agreements 1,026,870 1,019,450

998,430 Subordinated debt and trust preferred securities 235,570

235,570 235,570 Other borrowings 67,040 3,022 28,022 Accrued

expenses and other liabilities 175,771 114,333

114,762 Total liabilities 18,298,251

10,964,148 10,872,050 Stockholders' equity 2,284,659

1,521,782 1,550,766 Total liabilities

and stockholders' equity $ 20,582,910 12,485,930

$ 12,422,816 Book value per common share $ 14.37 $

12.58 $ 16.92 Number of common shares at period end 109,963 91,694

63,746

Ending Balances December 31, 2009

September 30, 2009 December 31, 2008 Loans receivable

Real estate - single family $ 930,840 $ 912,391 $ 491,315 Real

estate - multifamily 1,025,849 1,036,932 677,989 Real estate -

commercial 3,606,179 3,624,469 3,472,000 Real estate - land 370,394

415,228 576,564 Real estate - construction 458,292 654,115

1,260,724 Commercial 1,512,709 1,343,496 1,554,219 Consumer

624,784 432,844 216,642 Total

loans receivable, excluding covered loans 8,529,047 8,419,475

8,249,453 Unearned fees, premiums and discounts (43,529 ) (31,987 )

(2,049 ) Allowance for loan losses (238,833 )

(230,650 ) (178,027 ) Net loans receivable, excluding

covered loans 8,246,685 8,156,838

8,069,377 Covered loans 5,598,155

- - Net loans receivable $ 13,844,840 $

8,156,838 $ 8,069,377 Deposits Noninterest-bearing demand $

2,291,259 $ 1,397,217 $ 1,292,997 Interest-bearing checking 667,177

347,745 363,285 Money market 3,138,866 2,263,319 1,323,402 Savings

991,520 420,365 420,133

Total core deposits 7,088,822 4,428,646 3,399,817 Time deposits

less than $100,000 3,240,094 1,062,575 1,521,988 Time deposits

$100,000 or greater 4,658,697 3,177,336

3,220,154 Total time deposits 7,898,791

4,239,911 4,742,142 Total deposits $

14,987,613 $ 8,668,557 $ 8,141,959

EAST WEST BANCORP, INC. CONDENSED CONSOLIDATED STATEMENTS

OF INCOME (In thousands, except per share amounts)

(unaudited) Quarter Ended December

31, 2009 September 30, 2009 December 31, 2008

Interest and dividend income $ 283,646 $ 147,924 $ 149,907

Interest expense (64,147 ) (52,044 ) (73,053 )

Net interest income before provision for loan losses 219,499 95,880

76,854 Provision for loan losses (140,000 ) (159,244

) (43,000 ) Net interest income (loss) after provision for

loan losses 79,499 (63,364 )

33,854 Noninterest income (loss) 420,820 (11,880 ) (863 )

Noninterest expense (91,085 ) (46,064 )

(44,199 ) Income (loss) before provision (benefit) for income taxes

409,234 (121,308 ) (11,208 ) Provision (benefit) for income taxes

149,504 (52,777 ) (13,574 ) Net income

(loss) $ 259,730 $ (68,531 ) $ 2,366

Preferred stock dividend,

inducement, and amortization of preferred stock discount (1)

(6,129 ) (10,620 ) (5,385 ) Net income (loss)

available to common stockholders (1) $ 253,601 $ (79,151 ) $ (3,019

) Net income (loss) per share, basic $ 2.49 $ (0.91 ) $ (0.05 ) Net

income (loss) per share, diluted $ 1.96 $ (0.91 ) $ (0.05 ) Shares

used to compute per share net income (loss): - Basic 101,924 $

86,538 62,932 - Diluted 130,346 $ 86,538 62,932

Quarter Ended December 31, 2009 September 30,

2009 December 31, 2008 Noninterest income (loss): Gain

on acquisition of UCB $ 471,009 $ - $ - Impairment loss on

investment securities (45,775 ) (24,249 ) (9,653 )

Decrease in FDIC indemnification

asset and FDIC receivable

(23,338 ) - - Branch fees 7,846 4,679 4,247 Net gain on sale of

investment securities 4,545 2,177 1,238 Letters of credit fees and

commissions 2,570 1,984 2,267 Ancillary loan fees 1,474 1,227 738

Other operating income 2,489 2,302

300 Total noninterest income (loss) $ 420,820 $

(11,880 ) $ (863 ) Noninterest expense: Compensation and

employee benefits $ 29,983 $ 15,875 $ 15,658 Occupancy and

equipment expense 10,268 6,262 6,627 Deposit insurance premiums and

regulatory assessments 9,123 6,057 2,032 Consulting expense 6,256

759 610 Legal expense 3,168 1,323 1,687 Other real estate owned

expense 2,624 767 2,493 Amortization and impairment loss of

premiums on deposits acquired 2,609 1,069 1,125 Amortization of

investments in affordable housing partnerships 2,329 1,709 1,751

Data processing 2,279 1,079 1,108 Other operating expense

22,446 11,164 11,108 Total

noninterest expense $ 91,085 $ 46,064 $ 44,199 (1)

The special shareholders' meeting to vote to approve the conversion

of the Mandatory Convertible Cumulative Preferred Stock, Series C

(Series C preferred stock) to common stock has been set for March

18, 2010. The Series C preferred stock converts to common stock

automatically three days after the receipt of an affirmative

shareholder vote. No Series C dividend has been declared by the

Board of Directors. Under the terms of the Series C preferred

stock, the May 1 dividend payment or any portion thereof will not

be earned or paid should an affirmative shareholder vote to convert

be obtained on the March 18, 2010 meeting date. Since management

fully expects that the Series C preferred dividend will not be

earned or paid, income available to common shareholders has not

been adjusted for purposes of computing basis and diluted per share

amounts.

EAST WEST BANCORP, INC.

CONDENSED CONSOLIDATED STATEMENTS OF INCOME (In

thousands, except per share amounts) (unaudited)

Year Ended December 31, 2009 December 31, 2008

% Change Interest and dividend income $ 722,826 $

664,858 9 Interest expense (239,506 ) (309,694 ) (23

) Net interest income before provision for loan losses 483,320

355,164 36 Provision for loan losses (528,666 )

(226,000 ) 134 Net interest (loss) income after provision for loan

losses (45,346 ) 129,164 (135 ) Noninterest income (loss) 396,535

(25,062 ) 1,682 Noninterest expense (246,467 )

(201,270 ) 22 Income (loss) before provision (benefit) for income

taxes 104,722 (97,168 ) 208 Provision (benefit) for income taxes

22,714 (47,485 ) (148 ) Net income (loss)

before extraordinary items $ 82,008 $ (49,683 ) 265 Extraordinary

item, net of tax $ (5,366 ) $ - NA Net income (loss) after

extraordinary item $ 76,642 $ (49,683 ) 254

Preferred stock dividend,

inducement, and amortization of preferred stock discount (1)

(49,115 ) (9,474 ) 418 Net income (loss) available to

common stockholders (1) $ 27,527 $ (59,157 ) 147 Net income (loss)

per share, basic $ 0.35 $ (0.94 ) 137 Net income (loss) per share,

diluted $ 0.33 $ (0.94 ) 135 Shares used to compute per share net

loss: - Basic 78,770 62,673 26 - Diluted 84,553 62,673 35

Year Ended December 31, 2009 December 31,

2008 % Change Noninterest income (loss): Gain on

acquisition of UCB $ 471,009 $ - NA Impairment loss on investment

securities (107,671 ) (73,165 ) 47

Decrease in FDIC indemnification

asset and FDIC receivable

(23,338 ) - NA Branch fees 22,309 16,972 31 Net gain on sale of

investment securities 11,923 9,005 32 Letters of credit fees and

commissions 8,338 9,739 (14 ) Ancillary loan fees 6,286 4,646 35

Other operating income 7,679 7,741 (1 )

Total noninterest income (loss) $ 396,535 $ (25,062 ) 1,682

Noninterest expense: Compensation and employee benefits $ 79,475 $

82,236 (3 ) Occupancy and equipment expense 30,218 26,991 12

Deposit insurance premiums and regulatory assessments 28,073 7,223

289 Other real estate owned expense 19,104 6,013 218 Consulting

expense 8,135 4,398 85 Legal expense 8,024 5,577 44 Amortization of

investments in affordable housing partnerships 7,450 7,272 2

Amortization and impairment loss of premiums on deposits acquired

5,895 7,270 (19 ) Data processing 5,641 4,494 26 Other operating

expense 54,452 49,796 9 Total

noninterest expense $ 246,467 $ 201,270 22 (1) The

special shareholders' meeting to vote to approve the conversion of

the Mandatory Convertible Cumulative Preferred Stock, Series C

(Series C preferred stock) to common stock has been set for March

18, 2010. The Series C preferred stock converts to common stock

automatically three days after the receipt of an affirmative

shareholder vote. No Series C dividend has been declared by the

Board of Directors. Under the terms of the Series C preferred

stock, the May 1 dividend payment or any portion thereof will not

be earned or paid should an affirmative shareholder vote to convert

be obtained on the March 18, 2010 meeting date. Since management

fully expects that the Series C preferred dividend will not be

earned or paid, income available to common shareholders has not

been adjusted for purposes of computing basis and diluted per share

amounts.

EAST WEST BANCORP, INC.

QUARTERLY ALLOWANCE FOR LOAN LOSSES RECAP (In

thousands) (unaudited) Quarter Ended

12/31/2009 9/30/2009

6/30/2009 3/31/2009

12/31/2008 LOANS Allowance balance, beginning of

period $ 230,650 $ 223,700 $ 195,450 $ 178,027 $ 177,155 Allowance

for unfunded loan commitments and letters of credit (1,161 ) (1,051

) 1,442 (1,008 ) (625 ) Provision for loan losses 140,000 159,244

151,422 78,000 43,000 Impact of desecuritization - - 9,262 - -

Net Charge-offs: Real estate - single family 7,083 8,034

14,058 3,832 1,756 Real estate - multifamily 8,425 7,231 2,256

1,624 524 Real estate - commercial 13,305 23,105 12,472 2,790 750

Real estate - land 20,390 39,988 33,183 12,523 9,039 Real estate -

residential construction 48,919 32,535 30,634 16,347 17,127 Real

estate - commercial construction 21,355 23,051 28,602 1,977 -

Commercial 5,789 14,956 11,577 18,146 8,054 Trade finance 2,569

2,256 774 1,032 4,026 Consumer 2,821

87 320

1,298 227 Total net

charge-offs 130,656 151,243

133,876

59,569 41,503 Allowance balance,

end of period $ 238,833 $ 230,650

$ 223,700 $ 195,450

$ 178,027

UNFUNDED LOAN COMMITMENTS

AND LETTERS OF CREDIT: Allowance balance, beginning of period $

6,958 $ 5,907 $ 7,349 $ 6,341 $ 5,716 Provision for unfunded loan

commitments and letters of credit 1,161

1,051 (1,442 )

1,008 625 Allowance

balance, end of period $ 8,119 $ 6,958

$ 5,907 $ 7,349

$ 6,341 GRAND TOTAL, END OF PERIOD $ 246,952

$ 237,608 $ 229,607

$ 202,799 $ 184,368

Nonperforming assets to total assets 0.91 % 1.84 % 1.49 %

2.28 % 2.04 % Allowance for loan losses to total gross non-covered

loans at end of period 2.80 % 2.74 % 2.62 % 2.42 % 2.16 % Allowance

for loan losses and unfunded loan commitments to total gross

non-covered loans at end of period 2.90 % 2.82 % 2.69 % 2.51 % 2.23

% Allowance to non-covered nonaccrual loans at end of period 137.91

% 112.82 % 137.94 % 78.81 % 82.95 % Nonaccrual loans to total loans

1.23 % 2.43 % 1.90 % 3.08 % 2.60 %

EAST WEST BANCORP, INC TOTAL

NON-COVERED NON-PERFORMING ASSETS (in thousands)

(unaudited) AS OF DECEMBER 31, 2009 Total

Nonaccrual Loans

90+

DaysDelinquent

Under

90+DaysDelinquent

TotalNonaccrualLoans

90+ DaysDelinquent

NotOn Nonaccrual

TotalNon-performingLoans

REOAssets

TotalNon-PerformingAssets

Loan Type Real estate - single family $ 3,262 $ - $ 3,262 $

- $ 3,262 $ 264 $ 3,526 Real estate - multifamily 10,631 - 10,631 -

10,631 2,118 12,749 Real estate - commercial 11,654 18,450 30,104 -

30,104 5,687 35,791 Real estate - land 27,179 42,666 69,845 -

69,845 4,393 74,238 Real estate - residential construction 17,179 -

17,179 - 17,179 540 17,719 Real estate - commercial construction -

17,132 17,132 - 17,132 830 17,962 Commercial 8,002 16,765 24,767 -

24,767 - 24,767 Trade Finance - - - - - - - Consumer 114

146 260 - 260 -

260

Total $ 78,021 $ 95,159

$ 173,180 $ - $ 173,180

$ 13,832 $ 187,012 AS OF

SEPTEMBER 30, 2009 Total Nonaccrual Loans

90+

DaysDelinquent

Under

90+DaysDelinquent

TotalNonaccrualLoans

90+ DaysDelinquent

NotOn Nonaccrual

TotalNon-performingLoans

REOAssets

TotalNon-PerformingAssets

Loan Type Real estate - single family $ 6,189 $ - $ 6,189 $

- $ 6,189 $ 648 $ 6,837 Real estate - multifamily 11,211 652 11,863

- 11,863 1,147 13,010 Real estate - commercial 17,381 16,040 33,421

- 33,421 2,330 35,751 Real estate - land 23,568 33,610 57,178 -

57,178 4,020 61,198 Real estate - residential construction 55,130 -

55,130 - 55,130 12,238 67,368 Real estate - commercial construction

10,784 - 10,784 - 10,784 3,680 14,464 Commercial 11,783 13,227

25,010 - 25,010 122 25,132 Trade Finance 2,110 1,785 3,895 1,556

5,451 - 5,451 Consumer 293 676 969 -

969 - 969

Total $

138,449 $ 65,990 $ 204,439

$ 1,556 $ 205,995 $

24,185 $ 230,180 AS OF JUNE 30,

2009 Total Nonaccrual Loans

90+

DaysDelinquent

Under

90+DaysDelinquent

TotalNonaccrualLoans

90+ DaysDelinquent

NotOn Nonaccrual

TotalNon-performingLoans

REOAssets

TotalNon-PerformingAssets

Loan Type Real estate - single family $ 5,181 $ - $ 5,181 $

- $ 5,181 $ 4,921 $ 10,102 Real estate - multifamily 7,938 - 7,938

- 7,938 281 8,219 Real estate - commercial 19,786 4,590 24,376 -

24,376 2,887 27,263 Real estate - land 35,660 1,656 37,316 - 37,316

13,307 50,623 Real estate - residential construction 46,176 -

46,176 - 46,176 4,154 50,330 Real estate - commercial construction

20,629 - 20,629 - 20,629 - 20,629 Commercial 8,034 8,067 16,101 -

16,101 626 16,727 Trade Finance 3,706 - 3,706 - 3,706 211 3,917

Consumer 339 412 751 - 751

801 1,552

Total $ 147,449

$ 14,725 $ 162,174 $ -

$ 162,174 $ 27,188 $

189,362 AS OF MARCH 31, 2009 Total

Nonaccrual Loans

90+

DaysDelinquent

Under

90+DaysDelinquent

TotalNonaccrualLoans

90+ DaysDelinquent

NotOn Nonaccrual

TotalNon-performingLoans

REOAssets

TotalNon-PerformingAssets

Loan Type Real estate - single family $ 18,515 $ 634 $

19,149 $ - $ 19,149 $ 671 $ 19,820 Real estate - multifamily 9,863

- 9,863 - 9,863 887 10,750 Real estate - commercial 12,465 42,724

55,189 - 55,189 4,240 59,429 Real estate - land 63,052 6,233 69,285

- 69,285 17,934 87,219 Real estate - residential construction

28,433 14,196 42,629 - 42,629 13,278 55,907 Real estate -

commercial construction 28,604 - 28,604 - 28,604 - 28,604

Commercial 16,798 5,000 21,798 - 21,798 1,236 23,034 Trade Finance

177 - 177 - 177 270 447 Consumer 839 482 1,321

- 1,321 118 1,439

Total $

178,746 $ 69,269 $ 248,015

$ - $ 248,015 $ 38,634

$ 286,649 AS OF DECEMBER 31, 2008

Total Nonaccrual Loans

90+

DaysDelinquent

Under

90+DaysDelinquent

TotalNonaccrualLoans

90+ DaysDelinquent

NotOn Nonaccrual

TotalNon-performingLoans

REOAssets

TotalNon-PerformingAssets

Loan Type Real estate - single family $ 13,519 $ - $ 13,519

$ - $ 13,519 $ 419 $ 13,938 Real estate - multifamily 11,845 -

11,845 - 11,845 1,136 12,981 Real estate - commercial 24,680 -

24,680 - 24,680 4,882 29,562 Real estate - land 66,185 12,892

79,077 - 79,077 10,307 89,384 Real estate - residential

construction 27,052 8,766 35,818 - 35,818 21,146 56,964 Real estate

- commercial construction 30,581 - 30,581 - 30,581 - 30,581

Commercial 6,570 10,604 17,174 - 17,174 142 17,316 Trade Finance 65

- 65 - 65 270 335 Consumer 1,654 194 1,848

- 1,848 - 1,848

Total $

182,151 $ 32,456 $ 214,607

$ - $ 214,607 $ 38,302

$ 252,909

EAST WEST BANCORP, INC. QUARTER TO DATE AVERAGE

BALANCES, YIELDS AND RATES PAID (In thousands) (unaudited)

Quarter Ended December 31, 2009

September 30, 2009 Average Average

Volume Interest Yield

(1) Volume

Interest Yield (1)

ASSETS

Interest-earning assets: Short-term investments and interest

bearing deposits in other banks $ 978,967 $ 1,635 0.66 % $ 897,527

$ 1,856 0.82 % Securities purchased under resale agreements 165,839

3,290 7.76 % 91,033 2,153 9.25 % Investment securities Taxable

2,616,485 27,966 4.24 % 2,304,619 28,311 4.87 % Tax-exempt (2)

22,458 316 5.63 % 22,727 256 4.51 % Loans receivable 8,504,833

116,278 5.42 % 8,471,766 114,512 5.36 % Loans receivable - covered

(3) 3,479,519 133,966 15.27 % - - - Federal Home Loan Bank and

Federal Reserve Bank stocks 180,420

368 0.82 % 123,514

918 2.97 % Total

interest-earning assets 15,948,521

283,819 7.06 %

11,911,186 148,006 4.93 %

Noninterest-earning assets: Cash and due from banks

266,287 124,708 Allowance for loan losses (236,858 ) (244,542 )

Other assets 1,585,379 843,925 Total

assets $ 17,563,329 $ 12,635,277

LIABILITIES AND STOCKHOLDERS'

EQUITY

Interest-bearing liabilities: Checking accounts 523,519 504

0.38 % 342,922 286 0.33 % Money market accounts 2,671,917 6,919

1.03 % 2,160,722 6,830 1.25 % Savings deposits 775,834 1,353 0.69 %

421,844 608 0.57 % Time deposits less than $100,000 2,403,331 9,936

1.64 % 1,090,647 5,572 2.03 % Time deposits $100,000 or greater

3,972,588 15,761 1.57 % 3,308,057 13,674 1.64 % Federal funds

purchased 1,158 1 0.34 % 1,385 2 0.57 % Federal Home Loan Bank

advances 1,731,525 14,119 3.24 % 1,046,056 11,172 4.24 % Securities

sold under repurchase agreements 1,086,279 13,709 4.94 % 1,018,321

12,140 4.66 % Subordinated debt and trust preferred securities

235,570 1,605 2.67 % 235,570 1,760 2.92 % Other borrowings

48,842 240 1.97 %

- -

- Total interest-bearing liabilities 13,450,563

64,147 1.89 %

9,625,524 52,044

2.15 %

Noninterest-bearing liabilities:

Demand deposits 1,953,781 1,335,131 Other liabilities 237,394

130,800 Stockholders' equity 1,921,591

1,543,822 Total liabilities and stockholders' equity $

17,563,329 $ 12,635,277 Interest rate spread

5.17 % 2.78 % Net interest income and net interest margin

(3) $ 219,672 5.46 % $ 95,962 3.20 %

Net interest income and net

interest margin, excluding purchase accounting discount accretion

(3)

$ 145,233 3.61 %

(1)

Annualized

(2)

Amounts calculated on a fully

taxable basis using the current statutory federal tax rate.

(3)

Amounts include yield adjustment

of $74,439 from discount accretion on early prepayments.

EAST WEST

BANCORP, INC. YEAR TO DATE AVERAGE BALANCES, YIELDS AND

RATES PAID (In thousands) (unaudited)

Year To Date

December 31, 2009 2008

Average Average Volume

Interest Yield

Volume Interest

Yield

ASSETS

Interest-earning assets: Short-term investments and interest

bearing deposits in other banks $ 881,282 $ 8,976 1.02 % $ 286,650

$ 7,029 2.45 % Securities purchased under resale agreements 89,883

7,985 8.76 % 70,246 6,811 9.67 % Investment securities Taxable

2,542,124 115,531 4.54 % 2,001,089 98,217 4.89 % Tax-exempt (1)

27,668 1,223 4.42 % 44,708 3,256 7.28 % Loans receivable 8,355,825

453,275 5.42 % 8,601,825 545,260 6.32 % Loans receivable - covered

(2) 877,029 133,966 15.27 % - - - Federal Home Loan Bank and

Federal Reserve Bank stocks 137,001

2,337 1.71 %

115,370 5,175 4.47 %

Total interest-earning assets 12,910,812

723,293 5.60 %

11,119,888 665,748

5.97 %

Noninterest-earning assets: Cash and due from

banks 147,694 137,730 Allowance for loan losses (216,775 ) (144,154

) Other assets 997,214 689,323 Total

assets $ 13,838,945 $ 11,802,787

LIABILITIES AND STOCKHOLDERS'

EQUITY

Interest-bearing liabilities: Checking accounts 398,619

1,507 0.38 % 404,404 3,226 0.80 % Money market accounts 2,035,821

25,583 1.26 % 1,099,576 25,805 2.34 % Savings deposits 506,706

3,322 0.66 % 452,259 4,148 0.91 % Time deposits less than $100,000

1,499,076 32,073 2.14 % 1,164,622 35,061 3.00 % Time deposits

$100,000 or greater 3,538,046 66,921 1.89 % 3,018,876 109,820 3.63

% Federal funds purchased 2,379 9 0.37 % 89,309 2,217 2.48 %

Federal Home Loan Bank advances 1,333,846 52,310 3.92 % 1,592,125

70,661 4.43 % Securities sold under repurchase agreements 1,027,665

49,725 4.77 % 1,000,332 46,062 4.59 % Subordinated debt and trust

preferred securities 235,570 7,816 3.27 % 235,570 12,694 5.37 %

Other borrowings 12,311 240

1.95 % -

- - Total interest-bearing

liabilities 10,590,039 239,506

2.26 % 9,057,073

309,694 3.41 %

Noninterest-bearing liabilities: Demand deposits 1,459,871

1,362,617 Other liabilities 154,138 137,320 Stockholders' equity

1,634,897 1,245,777 Total liabilities

and stockholders' equity $ 13,838,945 $ 11,802,787

Interest rate spread 3.34 % 2.56 % Net interest

income and net interest margin (2) $ 483,787 3.75 % $ 356,054 3.19

%

Net interest income and net

interest margin, excluding purchase accounting discount accretion

(2)

$ 409,348 3.17 %

(1)

Amounts calculated on a fully

taxable equivalent basis using the current statutory federal tax

rate.

(2)

Amounts include yield adjustment

of $74,439 from discount accretion on early prepayments.

EAST WEST BANCORP, INC. SELECTED FINANCIAL

INFORMATION (In thousands) (unaudited)

Average Balances Quarter Ended December 31,

2009 September 30, 2009 December 31, 2008 Loans

receivable Real estate - single family $ 908,095 $ 888,106 $

493,415 Real estate - multifamily 1,037,460 1,036,080 682,455 Real

estate - commercial 3,610,640 3,552,897 3,407,697 Real estate -

land 398,109 460,256 579,335 Real estate - construction 586,883

855,446 1,311,622 Commercial 1,446,695 1,360,223 1,548,231 Consumer

516,951 318,758 210,448

Total loans receivable, excluding covered loans 8,504,833 8,471,766

8,233,203 Covered loans 3,479,519 -

- Total loans receivable 11,984,352 8,471,766

8,233,203 Investment securities 2,638,943 2,327,346 2,223,842

Earning assets 15,948,521 11,911,186 11,219,272 Total assets

17,563,329 12,635,277 11,949,168 Deposits

Noninterest-bearing demand $ 1,953,781 $ 1,335,131 $ 1,311,283

Interest-bearing checking 523,519 342,922 367,792 Money market

2,671,917 2,160,722 1,153,171 Savings 775,834

421,844 419,757 Total core deposits 5,925,051

4,260,619 3,252,003 Time deposits less than $100,000 2,403,331

1,090,647 1,599,486 Time deposits $100,000 or greater

3,972,588 3,308,057 2,855,376

Total time deposits 6,375,919 4,398,704

4,454,862 Total deposits 12,300,970 8,659,323

7,706,865 Interest-bearing liabilities 13,450,563 9,625,524

9,143,800 Stockholders' equity 1,921,591 1,543,822 1,363,161

Selected Ratios Quarter Ended December 31,

2009 September 30, 2009 December 31, 2008 For The

Period Return on average assets 5.92 % -2.17 % 0.08 % Return on

average common equity 75.27 % -27.12 % -1.12 % Interest rate spread

(2) 5.17 % 2.78 % 2.13 % Net interest margin (2) 5.46 % 3.20 % 2.72

% Yield on earning assets (2) 7.06 % 4.93 % 5.30 % Cost of deposits

1.11 % 1.24 % 2.14 % Cost of funds 1.65 % 1.88 % 2.77 % Noninterest

expense/average assets (1) 1.96 % 1.37 % 1.38 % Efficiency ratio

(3) 52.53 % 39.99 % 47.52 %

(1)

Excludes the amortization of

intangibles, amortization and impairment loss of premiums on

deposits acquired, impairment loss on goodwill, and amortization of

investments in affordable housing partnerships.

(2)

Yields on certain securities have

been adjusted upward to a "fully taxable equivalent" basis in order

to reflect the effect of income which is exempt from federal income

taxation at the current statutory tax rate.

(3)

Represents noninterest expense,

excluding the amortization of intangibles, amortization and

impairment loss of premiums on deposits acquired, impairment loss

on goodwill, and investments in affordable housing partnerships,

divided by the aggregate of net interest income excluding the yield

adjustment, before provision for loan losses and noninterest

income, excluding impairment loss on investment securities, gain on

acquisition and the decrease in FDIC indemnification asset.

EAST WEST BANCORP, INC. SELECTED FINANCIAL

INFORMATION (In thousands) (unaudited)

Average Balances Year To Date December 31, %

2009 2008 Change Loans receivable Real estate

- single family $ 748,713 $ 467,739 60 Real estate - multifamily

898,927 707,621 27 Real estate - commercial 3,536,846 3,483,258 2

Real estate - land 490,546 631,951 (22 ) Real estate - construction

934,729 1,481,248 (37 ) Commercial 1,420,453 1,628,732 (13 )

Consumer 325,611 201,276 62 Total loans

receivable, excluding covered loans 8,355,825 8,601,825 (3 )

Covered loans 877,029 - NA Total loans

receivable 9,232,854 8,601,825 7 Investment securities 2,569,792

2,045,797 26 Earning assets 12,910,812 11,119,888 16 Total assets

13,838,945 11,802,787 17 Deposits Noninterest-bearing demand

$ 1,459,871 $ 1,362,617 7 Interest-bearing checking 398,619 404,404

(1 ) Money market 2,035,821 1,099,576 85 Savings 506,706

452,259 12 Total core deposits 4,401,017

3,318,856 33 Time deposits less than $100,000 1,499,076 1,164,622

29 Time deposits $100,000 or greater 3,538,046

3,018,876 17 Total time deposits 5,037,122

4,183,498 20 Total deposits 9,438,139 7,502,354 26

Interest-bearing liabilities 10,590,039 9,057,073 17 Stockholders'

equity 1,634,897 1,245,777 31

Selected Ratios

Year To Date December 31, % 2009 2008

Change For The Period Return on average assets 0.55 % -0.42

% (231 ) Return on average common equity 2.37 % -5.41 % (144 )

Interest rate spread (2) 3.34 % 2.56 % 30 Net interest margin (2)

3.75 % 3.19 % 17 Yield on earning assets (2) 5.60 % 5.97 % (6 )

Cost of deposits 1.37 % 2.37 % (42 ) Cost of funds 1.99 % 2.96 %

(33 ) Noninterest expense/average assets (1) 1.68 % 1.57 % 7

Efficiency ratio (3) 50.09 % 45.94 % 9 Period End Tier 1

risk-based capital ratio 17.9 % 13.9 % 29 Total risk-based capital

ratio 19.9 % 15.8 % 26 Tier 1 leverage capital ratio 11.7 % 12.4 %

(5 )

(1)

Excludes the amortization of

intangibles, amortization and impairment loss of premiums on

deposits acquired, impairment loss on goodwill, and amortization of

investments in affordable housing partnerships.

(2)

Yields on certain securities have

been adjusted upward to a "fully taxable equivalent" basis in order

to reflect the effect of income which is exempt from federal income

taxation at the current statutory tax rate.

(3)

Represents noninterest expense,

excluding the amortization of intangibles, amortization and

impairment loss of premiums on deposits acquired, impairment loss

on goodwill, and investments in affordable housing partnerships,

divided by the aggregate of net interest income excluding the yield

adjustment, before provision for loan losses and noninterest

income, excluding impairment loss on investment securities, gain on

acquisition and the decrease in FDIC indemnification asset.

EAST WEST BANCORP, INC.

GAAP TO NON-GAAP RECONCILIATION (In thousands)

(Unaudited) The tangible common equity to risk

weighted asset ratio is a non-GAAP disclosure. The Company uses

certain non-GAAP financial measures to provide supplemental

information regarding the Company's performance to provide

additional disclosure. As the use of tangible common equity is more

prevalent in the banking industry and with banking regulators and

analysts, we have included the tangible common equity to

risk-weighted assets ratio.

As of December 31,

2009 Stockholders' Equity $ 2,284,659 Less: Preferred equity

excluding the Mandatory Convertible Preferred Stock (379,129 ) *

Goodwill and other intangible assets (428,524 ) Tangible

common equity $ 1,477,006 Risk-weighted assets $

11,218,644 Tangible Common Equity to risk-weighted assets

13.2 % * The Mandatory Convertible Cumulative

Non-Voting Perpetual Preferred Stock, Series, C issued in November

2009 has been included as a proforma tangible common equity ratio.

The Series C shares will automatically convert to common shares

after the shareholder vote on March 18, 2010.

Operating noninterest income is a non-GAAP disclosure. The Company

uses certain non-GAAP financial measures to provide supplemental

information regarding the Company's performance to provide

additional disclosure. There are noninterest income line items that

are non-core in nature. Operating noninterest income excludes such

non-core noninterest income line items. The Company believes that

presenting the operating noninterest income provides more clarity

to the users of financial statements regarding the core noninterest

income amounts.

Quarter Ended December 31,

2009 Noninterest income (loss) $ 420,820 Add: Impairment loss

on investment securities 45,775 Net gain on sale of investment

securities (4,545 ) Gain on acquisition of UCB (471,009 )

Decrease in FDIC indemnification

asset and FDIC receivable

23,338 Operating noninterest income (non-GAAP) $

14,379

EAST WEST BANCORP, INC. GAAP TO NON-GAAP

RECONCILIATION (In thousands) (Unaudited)

The Company uses certain non-GAAP

financial measures to provide supplemental information regarding

the Company's performance to provide additional disclosure. The

fourth quarter of 2009 and the 2009 year to date net interest

income and net interest margin include a yield adjustment of

$74,439 from discount accretion on covered loans. Although there

may be additional yield adjustments in future quarters, this amount

is nonrecurring in nature. As such, the Company believes that

presenting the net interest income and net interest margin

excluding the yield adjustment provides additional clarity to the

users of financial statements regarding the core net interest

income and net interest margin.

Quarter to Date December 31, 2009 Average Volume

Interest Yield Total interest-earning

assets

$

15,948,521

$

283,819

7.06 % Net interest income and net interest margin

$

219,499

5.46 % Less: Yield adjustment to interest income from discount

accretion 74,439

Net interest income and net

interest margin, excluding yield adjustment

$

145,060

3.61 %

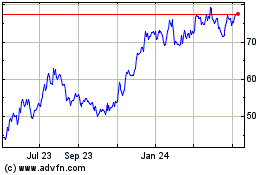

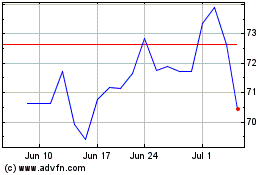

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From May 2024 to Jun 2024

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jun 2023 to Jun 2024