East West Bancorp, Inc. Appoints Julia S. Gouw President and Chief Operating Officer of East West Bank

December 01 2009 - 4:15PM

Business Wire

East West Bancorp, Inc. (Nasdaq: EWBC), parent company of East

West Bank, today announced the appointment of Julia S. Gouw as

President and Chief Operating Officer of East West Bank reporting

to Dominic Ng, Chairman and Chief Executive Officer. Gouw will be

responsible for East West Bank’s key administrative operations

including finance, treasury, investor relations, enterprise risk

management, credit administration, deposit and loan operations,

technology and human resources. Gouw will also oversee the

integration of the banking operations of United Commercial Bank,

acquired by East West on November 6, 2009.

“With the UCB acquisition, East West Bank has nearly doubled in

size and is now the second largest independent bank headquartered

in California,” said Ng. “We are fortunate to have Julia

rejoin the bank as President and COO at this key milestone in the

bank’s history to lead the UCB integration, manage the bank’s

day-to-day operations and once again partner with me to continue to

grow East West Bank’s value to our customers and shareholders,” Ng

continued.

Gouw, most recently Vice Chairman of East West, came out of

retirement to assist the bank in its acquisition of United

Commercial Bank. Gouw originally joined East West Bank from KPMG

LLP in 1989 as Controller and quickly rose through the ranks to

Executive Vice President and Chief Financial Officer, the position

she held from 1994 to 2008. Under Gouw’s leadership, East West

achieved 11 consecutive years of record earnings – a stellar track

record widely recognized throughout the banking and investment

communities. U.S. Banker magazine four times ranked Gouw among the

“25 Most Powerful Women in Banking” and Institutional Investor

magazine twice named her among the “Best CFO’s in America.”

“This is clearly a wonderful and opportune time to rejoin East

West,” said Gouw. “The acquisition of United Commercial Bank is a

transformational event for East West Bank – strengthening its

presence in key markets throughout the U.S. and Asia and

positioning the bank for unprecedented growth and expansion. I am

pleased to rejoin my colleagues at East West and look forward to

working with my new colleagues from United Commercial Bank,”

continued Gouw.

Gouw will continue to serve on the Board of Directors of East

West Bancorp and East West Bank. She is a CPA and graduated with a

B.S. from the University of Illinois, Urbana-Champaign.

About East West

East West Bancorp (Nasdaq: EWBC) is a publicly owned company

with over $19 billion in assets. The Company’s wholly owned

subsidiary, FDIC-insured East West Bank, is the second largest bank

headquartered in California and the largest bank in the nation

focused on serving the Asian American community. East West Bank has

137 branches, including 112 branches in California, nine branches

in New York, five branches in metropolitan Atlanta, three branches

in Massachusetts, two branches in Houston, and two branches in

Seattle. East West Bank has four full-service branches in Greater

China, including two branches in Hong Kong, one branch in Shanghai,

and one branch in Shantou. The Bank also has representative offices

in Beijing, Guangzhou, Shanghai and Shenzhen, China, and Taipei,

Taiwan. For more information on East West Bancorp and East West

Bank, visit the Company's website at www.eastwestbank.com.

Forward-Looking Statements

This release may contain forward-looking statements, which are

included in accordance with the “safe harbor” provisions of the

Private Securities Litigation Reform Act of 1995 and accordingly,

the cautionary statements contained in East West Bancorp’s Annual

Report on Form 10-K for the year ended Dec. 31, 2008 (See Item I --

Business, and Item 7 -- Management’s Discussion and Analysis of

Consolidated Financial Condition and Results of Operations), and

other filings with the Securities and Exchange Commission are

incorporated herein by reference. These factors include, but are

not limited to: the effect of interest rate and currency exchange

fluctuations; competition in the financial services market for both

deposits and loans; EWBC’s ability to efficiently incorporate

acquisitions into its operations; the ability of borrowers to

perform as required under the terms of their loans; effect of

additional provisions for loan losses; effect of any goodwill

impairment, the ability of EWBC and its subsidiaries to increase

its customer base; the effect of regulatory and legislative action,

including California tax legislation and an announcement by the

state’s Franchise Tax Board regarding the taxation of Registered

Investment Companies; risks inherent in possible acquisitions and

FDIC-assisted transactions; and regional and general economic

conditions. Actual results and performance in future periods may be

materially different from any future results or performance

suggested by the forward-looking statements in this release. Such

forward-looking statements speak only as of the date of this

release. East West expressly disclaims any obligation to update or

revise any forward-looking statements found herein to reflect any

changes in the Bank’s expectations of results or any change in

event.

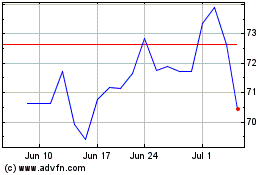

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jul 2024 to Jul 2024

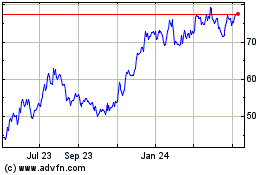

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jul 2023 to Jul 2024