East West Bancorp Announces Additional $50 Million Common Stock Repurchase Program

March 21 2007 - 6:00PM

PR Newswire (US)

PASADENA, Calif., March 21 /PRNewswire-FirstCall/ -- East West

Bancorp, Inc. (NASDAQ:EWBC), parent company of East West Bank, one

of the nation's premier community banks, today announced that its

board of directors authorized an increase in the stock repurchase

program to buy back an additional $50.0 million of the Company's

common stock in 2007. This new authorization is in addition to the

$30.0 million stock repurchase authorized and completed during the

first quarter of 2007. "We are pleased to announce that the Board

of Directors authorized a $50.0 million increase in the stock

repurchase program," stated Dominic Ng, Chairman, President and

Chief Executive Officer of East West. "We are focused on providing

long-term shareholder value. Our strong financial condition and

healthy growth allow us to continue our strategy of returning

capital to shareholders," concluded Ng. About East West East West

Bancorp is a publicly owned company, with $10.8 billion in assets,

whose stock is traded on the Nasdaq Global Select Market under the

symbol "EWBC". The company's wholly owned subsidiary, East West

Bank, is the second largest independent commercial bank

headquartered in Los Angeles with 61 branch locations. East West

Bank serves the community with 59 branch locations across Southern

and Northern California and a branch location in Houston, Texas.

East West Bank has two international locations in Greater China,

including a full-service branch in Hong Kong and a Beijing

Representative Office in China. For more information on East West

Bancorp, visit the company's website at

http://www.eastwestbank.com/. Forward-Looking Statements This

release may contain forward-looking statements, which are included

in accordance with the "safe harbor" provisions of the Private

Securities Litigation Reform Act of 1995 and accordingly, the

cautionary statements contained in East West Bancorp's Annual

Report on Form 10-K for the year ended Dec. 31, 2006 (See Item I --

Business, and Item 7 -- Management's Discussion and Analysis of

Consolidated Financial Condition and Results of Operations), and

other filings with the Securities and Exchange Commission are

incorporated herein by reference. These factors include, but are

not limited to: the effect of interest rate and currency exchange

fluctuations; competition in the financial services market for both

deposits and loans; EWBC's ability to efficiently incorporate

acquisitions into its operations; the ability of EWBC and its

subsidiaries to increase its customer base; the effect of

regulatory and legislative action, including California tax

legislation and an announcement by the state's Franchise Tax Board

regarding the taxation of Registered Investment Companies; and

regional and general economic conditions. Actual results and

performance in future periods may be materially different from any

future results or performance suggested by the forward-looking

statements in this release. Such forward-looking statements speak

only as of the date of this release. East West expressly disclaims

any obligation to update or revise any forward-looking statements

found herein to reflect any changes in the Bank's expectations of

results or any change in event. FOR FURTHER INFORMATION AT THE

COMPANY: Julia Gouw Chief Financial Officer (626) 768-6898

DATASOURCE: East West Bancorp, Inc. CONTACT: Julia Gouw, Chief

Financial Officer of East West Bancorp, Inc., +1-626-768-6898 Web

site: http://www.eastwestbank.com/

Copyright

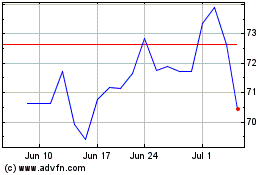

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From May 2024 to Jun 2024

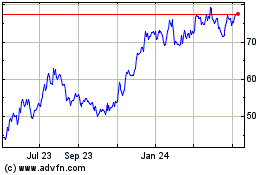

East West Bancorp (NASDAQ:EWBC)

Historical Stock Chart

From Jun 2023 to Jun 2024