0001050441☐00010504412023-12-182023-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 18, 2023

EAGLE BANCORP, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Maryland | 0-25923 | 52-2061461 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

7830 Old Georgetown Road, Third Floor

Bethesda, Maryland 20814

(Address of Principal Executive Offices) (Zip Code)

(301) 986-1800

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

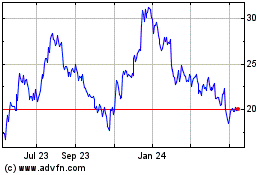

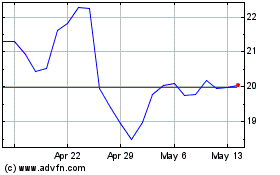

| Common Stock, $0.01 par value | EGBN | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Agreements with the President and Chief Executive Officer

On December 18, 2023, Eagle Bancorp, Inc. (the "Company") and EagleBank (the "Bank"), the wholly owned subsidiary of the Company, entered into an amended and restated employment agreement (the "Amended Employment Agreement") and amended and restated non-compete agreement (the "Amended Non-Compete") with Susan G. Riel, which superseded and replaced her prior agreements.

The Amended Employment Agreement has an initial term through December 31, 2026. Commencing on January 1, 2024, and on each January 1 thereafter (each, a "renewal date"), the term of the agreement automatically extends for an additional year so that the term will be three years from the immediately preceding renewal date, unless the Bank or Ms. Riel gives written notice of non-renewal at least 30 days prior to the renewal date. Under the Amended Employment Agreement, Ms. Riel is entitled to an annual base salary of $907,360, which can be increased but not decreased, other than a decrease that is applicable to all senior management. In addition, Ms. Riel is eligible to participate in health, welfare, benefit, stock, option and bonus plans generally available to all officers and employees of the Bank or the Company. The Amended Employment Agreement also includes a car allowance of $1,500 per month and a life insurance benefit of $750,000.

The Amended Employment Agreement eliminates the guaranteed retirement benefit included in Ms. Riel's prior employment agreement, and instead includes that in the event that Ms. Riel's employment is terminated by the Bank without cause (as defined in the agreement) or Ms. Riel resigns for good reason (as defined in the agreement), Ms. Riel would be entitled to a cash severance payment under the Amended Non-Compete (described below). In addition, under the Amended Employment Agreement, Ms. Riel would be entitled to a cash lump sum payment equal to the health insurance premiums under the Consolidated Omnibus Budget Reconciliation Act of 1985 for 12 months, payable within 60 days following her termination of employment.

In the event that Ms. Riel's employment is terminated by the Bank without cause within 120 days immediately prior to and in conjunction with a change in control (as defined in the agreement) or within 12 months following the consummation of a change in control, or if Ms. Riel terminates her employment for good reason within 12 months following the consummation of a change in control, the Amended Employment Agreement provides that Ms. Riel would be entitled to a lump sum cash payment equal to 1.99 times the sum of (i) her annual salary at the highest rate in effect during the 12-month period immediately preceding her termination date, plus (ii) the greater of (a) average cash bonuses earned in the prior three calendar years, or (b) the cash incentive that would be paid or payable to Ms. Riel at the target level for the Bank's fiscal year in which her termination date occurs (or for the prior fiscal year if the incentive opportunity has not yet been determined) assuming Ms. Riel and the Bank were to satisfy all applicable performance-related conditions, plus (iii) 36 times her full total monthly premium (i.e., her portion and the Bank's portion) of her health, dental and vision insurance premiums. The payment will be made 45 days following the later of Ms. Riel's date of termination of employment or the effective date of the change in control, subject to Ms. Riel executing and not revoking a general release of claims. The payment will be reduced by an amount necessary to avoid any excise tax or penalties under Sections 280G and 4999 of the Internal Revenue Code of 1986, as amended (the "Code"), only if such reduction results in a greater after-tax benefit to Ms. Riel.

The Amended Employment Agreement contains non-competition and non-solicitation restrictions that apply during the term and for one year following Ms. Riel's termination of employment. The Amended Employment Agreement also contains standard confidentiality, cooperation, and non-disparagement provisions.

The Amended Non-Compete requires that for one year after termination of employment, Ms. Riel will not, directly or indirectly, in any capacity (whether as a proprietor, owner, agent, officer, director, shareholder, organizer, partner, principal, manager, member, employee, contractor, consultant or otherwise) engage in employment or provide services to any financial services enterprise (including but not limited to a savings and loan association, bank, credit union or insurance company) engaged in the business of offering retail customer and commercial deposit accounts and/or loan products. The Amended Non-Compete provides that in the event the Bank terminates Ms. Riel's employment without cause or Ms. Riel terminates her employment with the Bank for good reason, the Bank will pay Ms. Riel the sum of (i) her salary at the rate in effect as of the termination date, plus (ii) the greater of (a) average cash bonuses earned in the prior three calendar years, or (b) the cash incentive that would be paid or payable to Ms. Riel at the target level for the Bank's fiscal year in which her termination date occurs (or for the prior fiscal year if the incentive opportunity has not yet been determined) assuming Ms. Riel and the Bank were to satisfy all applicable performance-related conditions, payable in equal monthly installments for one year following the date on which the general release of claims is executed and delivered to the Bank subject to her continued compliance with the provisions of the Amended Non-Compete.

The foregoing description of the Amended Employment Agreement and the Amended Non-Compete with Ms. Riel is not complete and is qualified in its entirety to reference each of the agreements attached hereto as Exhibits 10.1 and 10.2, respectively, and incorporated by reference herein.

Agreements with Executive Chairman

On December 18, 2023, the Company, the Bank and Norman R. Pozez entered into an amended and restated chairman compensation agreement (the "Amended Chairman Agreement") and an amended and restated non-compete agreement (the "Amended Chairman Non-Compete"), which superseded and replaced his prior agreements.

Under the Amended Chairman Agreement, Mr. Pozez will continue to serve as the Executive Chairman of the Bank and the Company. The Amended Chairman Agreement has an initial term through December 31, 2024. Commencing on January 1, 2025, and on each January 1 thereafter (each, a "renewal date"), the term will automatically renew for an additional year, unless either the Company or Mr. Pozez gives written notice of non-renewal at least 30 days prior to the renewal date. Under the Amended Chairman Agreement, Mr. Pozez is entitled to an annual retainer of $1.32 million, which may be increased and not decreased, except in connection with an overall reduction applicable to and in the same proportion as all senior executives; provided, that such reduction shall not exceed 5% of Mr. Pozez's then-current annual retainer and may not occur more than once during the term. The Amended Chairman Agreement eliminates the automatic annual 5% increases to the annual retainer included in his prior agreement. Mr. Pozez will be eligible for equity grants in the discretion of the Compensation Committee.

Under the Amended Chairman Agreement, in the event that, within 12 months following a change in control (as defined in the agreement), (i) Mr. Pozez's service is terminated by the Bank or the Company without cause (as defined in the agreement) (ii) Mr. Pozez terminates his service for good reason (as defined in the agreement), then Mr. Pozez would be entitled to receive a lump sum cash payment equal to 1.99 times the sum of (i) Mr. Pozez's then-current annual retainer and (ii) $1,148,653, payable within 45 days of Mr. Pozez's termination. The payment is contingent on Mr. Pozez executing and not revoking a general release of claims. The payment will be reduced by an amount necessary to avoid any excise tax or penalties under Code Sections 280G and 4999 only if such reduction results in a greater after-tax benefit to Pozez.

The Amended Chairman Agreement contains non-competition and non-solicitation restrictions that apply during the term and for one year following Mr. Pozez's termination of service. The Amended Chairman Agreement also contains standard confidentiality, cooperation, and non-disparagement provisions.

Under the Amended Chairman Non-Compete, in the event that (i) Mr. Pozez's service is terminated by the Bank or the Company without cause (ii) Mr. Pozez terminates his service for good reason, or (iii) within 12 months following a change in control, Mr. Pozez's service is terminated without cause or for good reason, or Mr. Pozez is not elected or appointed Executive Chairman of the surviving institution, then the Company and Bank will pay Mr. Pozez a non-compete fee equal to the sum of the annual retainer, plus at $1,148,653, payable in 12 equal monthly installments. For clarity, Mr. Pozez will not be entitled the payment in the event that he is not reelected as a director by the Company's shareholders.

Under the Amended Chairman Non-Compete, Mr. Pozez agrees that for a period of one year following his termination of service as a director, he will not, directly or indirectly, in any capacity (whether as a proprietor, owner, agent, officer, director, shareholder, organizer, partner, principal, manager, member, employee, contractor, consultant or otherwise) engage in employment or provide services to any financial services enterprise engaged in the business of offering retail customer and commercial deposit accounts and/or loan products.

The foregoing description of the Amended Chairman Agreement and the Amended Chairman Non-Compete with Mr. Pozez is not complete and is qualified in its entirety to reference each of the agreements attached hereto as Exhibits 10.3 and 10.4, respectively, and incorporated by reference herein.

Senior Executive Incentive Plan and Long-Term Incentive Plan

On December 18, 2023, the Compensation Committee (the "Committee") of Board of Directors of the Company approved the Company's Senior Executive Incentive Plan (the "2024 SEIP") for 2024 performance, and the Company's 2024-2026 Long-Term Incentive Plan (the "LTIP").

Senior Executive Incentive Plan

The 2024 SEIP is a short-term non-equity incentive compensation plan for senior officers pursuant to which participating officers may earn cash incentive awards (at multiples of the officers then current annual base salary) if certain pre-determined targets are met. Awards under the 2024 SEIP may also be paid in stock, through awards under the Company's stock plan, in the discretion of the Committee.

The 2024 SEIP is substantially similar to the Company's Senior Executive Incentive Plan for 2020, except that the 2024 SEIP provides that the actual award payouts will be calculated by interpolating scorecard results against the threshold, target, and maximum payout amounts. Further, the Company revised the threshold and maximum payout as follows:

a.Threshold payout will be 85% of target expectations with the exception of the efficiency ratio, which will be 105% of target expectations, and

b.Maximum payout will be 115% of target expectations with the exception of the efficiency ratio, which will be 95% of target expectations.

No award will be given for any performance objective below threshold. Further, the adjusted net income threshold level must be met for there to be any payment made under the scorecard result calculations. If the Company does not meet threshold for adjusted net income, any payout would be discretionary based upon Committee direction.

The Committee may also review other relevant performance factors including, but not limited, to credit quality, capitalization, liquidity and other risk factors and may modify or withhold calculated amounts to ensure incentives appropriately balance risk and reward.

The foregoing summary is qualified in its entirety by the full text of the 2024 SEIP, a copy of which the Company intends to file as an exhibit to its Annual Report on Form 10-K.

Long-Term Incentive Plan

The LTIP is an equity-based plan for senior officers designed to reward long-term performance over the plan period. Awards under the LTIP are paid through the Company's 2021 Equity Incentive Plan, or other current equity plan. For 2024, the proportion of performance-based awards to time-vested awards is 60% performance-based and 40% time-vested. If a participant ceases to be employed by the Company or the Bank due to death, disability or retirement, the participant's time-vested awards will immediately vest, and the performance-based awards will vest based on the greater of (i) actual performance measured on the most recent completed fiscal quarter, without proration or (ii) an assumed "at target" performance for the performance period, prorated for the period between date of grant and termination of employment.

Upon a change in control, (a) a participant's time-vested shares will fully vest, and (b) the performance-based awards will vest based on the greater of (i) actual performance measured on the most recent completed fiscal quarter, without proration or (ii) assumed "at target" performance for the performance period, prorated for the period between date of grant and the date that the change in control occurs.

The table below establishes the performance goals and payment ranges for the 2024-2026 performance period:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Measures | | Weight | | Threshold | | Target | | Stretch/Maximum |

Return on Average Assets (KRX Index) | | 50 | % | | Median | | 62.5% Percentile | | 75% Percentile |

Total Shareholder Return (KRX Index) | | 50 | % | | Median | | 62.5% Percentile | | 75% Percentile |

Payout Range (% of Target) | | 100 | % | | 50 | % | | 100 | % | | 150 | % |

The foregoing summary is qualified in its entirety by the full text of the LTIP, a copy of which the Company intends to file as an exhibit to its Annual Report on Form 10-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| | Amended and Restated Employment Agreement, by and among the Bank, the Company, and Susan G. Riel, dated as of December 18, 2023 |

| | Amended and Restated Non-Compete Agreement, by and among the Bank, the Company, and Susan G. Riel, dated as of December 18, 2023 |

| | Amended and Restated Chairman Compensation Agreement, by and among the Bank, the Company, and Norman R. Pozez, dated as of December 18, 2023 |

| | Amended and Restated Non-Compete Agreement, by and among the Bank, the Company, and Norman R. Pozez, dated as of December 18, 2023 |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | EAGLE BANCORP, INC. |

| | | |

| | | |

Date: December 21, 2023 | By: | /s/ Eric R. Newell |

| | | Eric R. Newell |

| | | Executive Vice President, Chief Financial Officer |

AMENDED AND RESTATED EMPLOYMENT AGREEMENT

THIS AMENDED AND RESTATED EMPLOYMENT AGREEMENT (“Agreement”) is made and entered into as of December 18, 2023 (the “Effective Date”) by and between EagleBank, a Maryland chartered commercial bank (the “Bank”), and Susan G. Riel (“Executive”).

RECITALS:

WHEREAS, Executive is currently employed by Bancorp and the Bank as its President and Chief Executive Officer and is a party to an amended and restated employment agreement with Bank dated as of December 31, 2019 (the “Prior Agreement”); and

WHEREAS, Bancorp and the Bank desire to continue Executive’s employment with Bancorp and the Bank as its President and Chief Executive Officer, and Executive agrees to accept such continued employment, in accordance with the terms and conditions set forth in this Agreement; and

WHEREAS, this Agreement shall supersede and replace the Prior Agreement as of the Effective Date.

NOW, THEREFORE, in consideration of the premises and the mutual covenants and agreements set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, the parties hereto agree as follows:

1. Employment. Bancorp and the Bank agree to continue to employ Executive, and Executive agrees to continue to be employed as, President and Chief Executive Officer of the Bank and Bancorp, subject to the terms and provisions of this Agreement.

2. Certain Definitions. As used in this Agreement, the following terms have the meanings set forth below:

2.1. “Affiliate” means, with respect to any Person, (i) any Person directly or indirectly controlling, controlled by or under common control with such Person, (ii) any Person owning or controlling fifty percent (50%) or more of the outstanding voting interests of such Person, (iii) any officer, director, general partner, managing member, or trustee of, or Person serving in a similar capacity with respect to, such Person, or (iv) any Person who is an officer, director, general partner, member, trustee, or holder of fifty percent (50%) or more of the voting interests of any Person described in clauses (i), (ii), or (iii) of this sentence. For purposes of this definition, the terms “controlling,” “controlled by,” or “under common control with” shall mean the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

2.2. “Bancorp” means Eagle Bancorp, Inc., a Maryland corporation, publicly traded as a bank holding company.

2.3. “Bank” is defined in the Recitals. If the Bank is merged into any other Entity, or transfers substantially all of its business operations or assets to another Entity, the term “Bank” shall be deemed to include such successor Entity for purposes of applying Article 8 of this Agreement.

2.4. “Bank Entities” means and includes any of the Bank, Bancorp and their Affiliates.

2.5. “Board” means the Board of Directors of the Bank.

2.6. “Code” means the Internal Revenue Code of 1986, as amended.

2.7. “Competitive Business” means the banking and financial services business, which includes, without limitation, consumer savings, commercial banking, the insurance and trust business, the savings and loan business and mortgage lending, or any other business in which any of the Bank Entities is engaged or has invested significant resources within the prior six (6) month period in preparation for becoming actively engaged; provided that after the Termination Date, such period shall be deemed to end on the Termination Date.

2.8. “Competitive Products or Services” means, as of any time during the Term, those products or services of the type that any of the Bank Entities is providing, or is actively preparing to provide, to its customers.

2.9. “Disability” means a mental or physical condition which, in the good faith opinion of the Board, renders Executive, with or without reasonable accommodation, unable or incompetent to carry out the essential functions of the position or the material job responsibilities which Executive held or the material duties to which Executive was assigned at the time the disability was incurred, which has existed for at least three (3) months and which in the opinion of a physician mutually agreed upon by the Bank and Executive (provided that neither party shall unreasonably withhold such agreement) is expected to be permanent or to last for an indefinite duration or a duration in excess of nine (9) months.

2.10. “Entity” means any partnership, corporation, limited liability company, trust, joint venture, unincorporated association, or other entity or association.

2.11. “Good Reason” means, other than as consented to by Executive, a:

(i) material diminution in Executive’s title, duties and/or position,

(ii) reduction of 5% in Executive’s annual Salary and/or incentive opportunity (except for any reduction that is part of a one-time reduction in pay by the Bancorp or Bank as part of a good faith, overall reduction and in the same proportion to all senior

executives; if Bancorp or the Bank has previously made a reduction of 5% within the preceding three (3) years, such a reduction shall constitute Good Reason); or

(iii) relocation of Executive’s primary worksite to a new location that is more than twenty-five (25) miles of Executive’s primary worksite,

provided that within thirty (30) days after the Bank or Bancorp notifies the Executive of such event, Executive notifies the Bank that she is terminating her employment due to Good Reason, unless the Bank and Bancorp cure the change within thirty (30) days of Executive’s notice. If Executive’s employment is terminated for Good Reason, Executive’s last day of employment shall be mutually agreed to by Executive and the Bank, but shall be not more than sixty (60) days after such notice is given by Executive.

2.12. “Person” means any individual or Entity.

2.13. “Section 409A” means Section 409A of the Code and the regulations and administrative guidance promulgated thereunder.

2.14. “Term” means the period commencing on the Effective Date and continuing through December 31, 2026 (the “Term”). Commencing on January 1, 2025, and continuing on each January 1st thereafter (each, a “Renewal Date”), the Term shall automatically renew and extend for one additional year such that the remaining Term shall be three (3) years from the immediately preceding Renewal Date; unless either the Board or the Executive by written notice to the other given at least thirty (30) days prior to such Renewal Date notifies the other of its intent to not renew the Term (the “Notice of Non-Renewal”). In the event that a Notice of Non-Renewal is given by either the Board or the Executive, this Agreement will terminate as of the last day of the then current Term. For avoidance of doubt, any extension to the Term will become the “Term” for purposes of this Agreement. Notwithstanding the foregoing, in the event that the Bancorp or the Bank has entered into an agreement to effect a transaction which would be considered a Change in Control, then the term of this Agreement shall be extended and shall terminate thirty-six (36) months following the date on which the Change in Control occurs.

2.15. “Termination Date” means the date upon which Executive ceases to provide services to the Bank and Bancorp hereunder.

Other terms are defined throughout this Agreement and have the meanings so given them.

3. Position.

3.1. Position. The Bank and Bancorp shall continue to employ Executive to serve as President and Chief Executive Officer of the Bank and Bancorp during the Term.

3.2. No Restrictions. Executive represents and warrants to the Bank that Executive is not subject to any legal obligations or restrictions that would prevent or limit Executive’s entering into this Agreement and performing Executive’s responsibilities hereunder.

4. Duties of Executive.

4.1. Nature and Substance. Executive shall provide such services and perform such duties, functions and assignments as are normally incident to the position of President and Chief Executive Officer, and such additional functions and services as the Board may from time to time direct. Executive shall report directly to and shall be under the direction of the Chairman of the Board.

4.2. Compliance with Law. Executive shall comply with all laws, statutes, ordinances, rules and regulations relating to Executive’s employment and duties.

5. Compensation; Benefits. As full compensation for all services rendered pursuant to this Agreement and the covenants contained herein, the Bank shall pay to Executive the following:

5.1. Salary. During the Term, Executive shall be paid a salary (“Salary”) of Nine Hundred Seven Thousand Three Hundred Sixty Dollars ($907,360) on an annualized basis. The Bank shall pay Executive’s Salary in equal installments in accordance with the Bank’s regular payroll periods as may be set by the Bank from time to time. Executive’s Salary may be further increased from time to time, at the discretion of the Compensation Committee, but not decreased except for a decrease that is generally applicable to all senior management. Executive may also be entitled to certain incentive bonus payments as determined by Board approved incentive plans.

5.2. Vacation and Leave. Executive shall be entitled to such vacation and leave as may be provided for under the current and future leave and vacation policies of the Bank for executive officers.

5.3. Office Space. The Bank will provide customary office space and office support to Executive.

5.4. Parking. Paid parking at Executive’s regular worksite will be provided by the Bank at its expense.

5.5. Other Expense Reimbursement. The Bank will pay Executive a monthly car allowance in the amount of One Thousand Five Hundred Dollars ($1,500).

5.6. Non-Life Insurance. During the Term, Executive will be eligible to participate in group health, disability and other insurance as the Bank may maintain for its employees from time to time.

5.7. Life Insurance.

5.7.1. Executive may obtain a term life insurance policy (the “Policy”) on Executive in the amount of Seven Hundred Fifty Thousand Dollars ($750,000), the particular product and carrier to be chosen by Executive in Executive’s discretion. Executive shall have the right to designate the beneficiary of the Policy. If the Policy is obtained, Executive shall provide the Bank with a copy of the Policy, and the Bank will reimburse Executive, during the Term of this Agreement, the premiums for the Policy upon submission by Executive to the Bank of the invoices therefor, provided that such reimbursement shall be made before the end of the calendar year following the year in which such expense was incurred by Executive. In the event Executive is rated and the premium exceeds the standard rate for a Seven Hundred Fifty Thousand Dollar ($750,000) policy, the Policy amount shall be lowered to the maximum amount that can be purchased at the standard rate for a Seven Hundred Fifty Thousand Dollar ($750,000) policy. For example, if Executive is rated and the standard rate for a Seven Hundred Fifty Thousand Dollar ($750,000) policy would acquire a Five Hundred Thousand Dollar ($500,000) policy, the Bank would only be required to pay the premium for a Five Hundred Thousand Dollar ($500,000) policy. If a Policy is obtained and it is cancelled or terminated, Executive shall immediately notify the Bank of such cancellation or termination.

5.7.2. The Bank may, at its cost, obtain and maintain “key-man” life insurance and/or Bank-owned life insurance on Executive in such amount as determined by the Board from time to time. Executive agrees to cooperate fully and to take all actions reasonably required by the Bank in connection with such insurance.

5.8. Expenses. The Bank shall, promptly upon presentation of proper expense reports therefor, pay or reimburse Executive, in accordance with the policies and procedures established from time to time by the Bank for its officers, for all reasonable and customary travel (other than local use of an automobile for which Executive is being provided the car allowance) and other out-of-pocket expenses incurred by Executive in the performance of Executive’s duties and responsibilities under this Agreement and promoting the business of the Bank, including approved membership fees, dues and the cost of attending business related seminars, meetings and conventions.

5.9. Retirement Plans. Executive shall be entitled to participate in any and all qualified pension or other retirement plans of the Bank which may be applicable to personnel of the Bank.

5.10. Other Benefits. While this Agreement is in effect, Executive shall be entitled to all other benefits that the Bank provides from time to time to its officers and such other benefits as the Board may from time to time approve for Executive, subject to applicable eligibility requirements.

5.11. Eligibility. Participation in any health, life, accident, disability, medical expense or similar insurance plan or any qualified pension or other retirement plan shall be subject to the terms and conditions contained in such plan as amended from time to time in the

Bank’s sole discretion. All matters of eligibility for benefits under any insurance plans shall be determined in accordance with the provisions of the applicable insurance policy issued by the applicable insurance company.

5.12. Equity Compensation. Executive shall be eligible to receive awards of options, SARs and /or Restricted Stock under the Eagle Bancorp, Inc. 2021 Equity Incentive Plan (or any successor plan), from time to time, at the discretion of the Compensation Committee of the Board of Directors of Bancorp or such other committee as is then administering such plan.

6. Regulatory Requirement. Notwithstanding anything herein contained to the contrary, any payments to Executive by the Bank or the Bancorp, whether pursuant to this Agreement or otherwise, are subject to and conditioned upon their compliance with Section 18(k) of the Federal Deposit Insurance Act, 12 U.S.C. Section 1828(k), and the regulations promulgated thereunder in 12 C.F.R. Part 359.

7. Effect of Termination. The Executive’s employment under this Agreement may be terminated as provided below in this Article 7.

7.1. Definition of Cause. For purposes of this Agreement, “Cause” means:

(a) any act of theft, fraud, intentional misrepresentation of a material matter, personal dishonesty or breach of fiduciary duty or similar conduct by Executive with respect to any of the Bank Entities or the services to be rendered by her under this Agreement;

(b) Executive is prohibited from employment with an FDIC-insured institution under applicable federal law or order of any bank-regulatory agency;

(c) indictment of Executive for, or Executive’s conviction of or plea of nolo contendere at the trial court level to, a felony, or any crime of moral turpitude, or involving dishonesty, deception or breach of trust;

(d) any of the following conduct on the part of Executive that has not been corrected or cured by Executive within thirty (30) days after having received written notice from the Bank describing such conduct (provided, however, that the Bank shall not be required to provide Executive with notice and opportunity to cure more than two (2) times in any twelve (12) month period):

(i) habitual absenteeism, or the failure by or the inability of Executive to devote full time and attention to the performance of Executive’s duties pursuant to this Agreement (other than by reason of Executive’s death or Disability);

(ii) intentional material failure by Executive to carry out the stated lawful and reasonable directions, instructions, policies, rules, regulations or decisions of the Board which are consistent with Executive’s position;

(iii) any action (including any failure to act) or conduct by Executive in violation of a material provision of this Agreement (including but not limited to the provisions of Article 8 hereof, which shall be deemed to be material);

(e) the use of drugs, alcohol or other substances by Executive to an extent which materially interferes with or prevents Executive from performing Executive’s duties under this Agreement;

(f) Executive’s commission of unethical business practices, acts of moral turpitude, financial impropriety, fraud or dishonesty in any material matter which the Board in good faith determines could adversely affect the reputation, standing or financial prospects of the Bank or its Affiliates; or

(g) willful or intentional misconduct on the part of Executive that results, or that the Board in good faith determines may result, in substantial injury to the Bank or any of its Affiliates, that has not been corrected or cured by Executive within thirty (30) days after having received written notice from the Bank describing such conduct (provided, however, that the Bank shall not be required to provide Executive with notice and opportunity to cure more than two (2) times in any twelve (12) month period).

Notwithstanding the foregoing, Cause shall not be deemed to exist unless there shall have been delivered to the Executive a copy of a resolution duly adopted by the affirmative vote of not less than a majority of the entire membership of the independent members of the Board at a meeting of the Board called and held for the purpose (after reasonable notice to the Executive and an opportunity for the Executive to be heard before the Board), finding that in the good faith opinion of the Board the Executive was guilty of conduct described above and specifying the particulars thereof. Executive shall have a period of not less than 10 days from delivery of such resolution to cure the conduct alleged to constitute Cause. Upon the expiration of that 10-day period, and prior to holding a meeting at which the Board is to make a final determination whether Cause exists, if the Board determines in good faith at a meeting of the Board, by not less than a majority of its entire membership, that (i) there is probable cause for it to find that the Executive was guilty of conduct constituting Cause as described above, and (ii) Executive has not cured such conduct, the Board may suspend the Executive from her duties hereunder for a reasonable period of time not to exceed fourteen (14) days pending a further meeting at which the Executive shall be given the opportunity to be heard before the Board. Upon a finding of Cause, the Board shall deliver to the Executive a notice of termination.

7.2. Termination by the Bank for Cause. After the occurrence of any of the conditions specified in Section 7.1, the Bank shall have the right to terminate the Executive’s employment for Cause on written notice to Executive, effective immediately.

7.3. Termination by the Bank without Cause. The Bank shall have the right to terminate the Executive’s employment at any time on 30 days’ written notice without Cause, for

any or no reason, such termination to be effective on the date on which the Bank gives such notice to Executive or such later date as may be specified in such notice.

7.4. Termination for Death or Disability. The Executive’s employment shall automatically terminate upon the death of Executive or upon the Board’s determination that Executive is suffering from a Disability.

7.5. Termination by Executive.

7.5.1. Executive shall have the right to terminate the Executive’s employment without Good Reason at any time, such termination to be effective on the date thirty (30) days after the date on which Executive gives such notice to the Bank unless Executive and the Bank agree in writing to a different date on which such termination is to be effective (the “Notice Period”).

7.5.2. After receiving notice of termination, the Bank may require Executive to devote Executive’s good faith energies to transitioning Executive’s duties to Executive’s successor and to otherwise helping to minimize the adverse impact of Executive’s resignation upon the operations of the Bank Entities. If Executive fails or refuses to fully cooperate with such transition, the Bank may immediately terminate Executive and such termination shall not be treated as a termination by the Company without Cause. At any time during the Notice Period, the Bank may elect to relieve Executive of some or all of Executive’s duties, responsibilities, privileges and positions for the remainder of the Notice Period, in its sole discretion.

7.6. Accrued Obligations. Without regard to the reason for, or the timing of, the termination of the Executive’s employment: (a) the Bank shall pay Executive any unpaid Salary due for the period prior to the Termination Date; and (b) following submission of proper expense reports by Executive, the Bank shall reimburse Executive for all expenses incurred prior to the Termination Date and subject to reimbursement pursuant to Section 5.8 hereof. These payments shall be made promptly upon termination and within the period of time mandated by law.

7.7. Termination by the Bank without Cause Before Change in Control or Termination by the Executive for Good Reason. If the Executive’s employment is terminated by the Bank without Cause or by the Executive for Good Reason, Executive shall be entitled to a lump sum cash payment within sixty (60) days after the Termination Date equal to twelve (12) times the Executive’s full total monthly premium (i.e., Executive’s portion and the Bank’s portion) of the Executive’s health, dental and vision insurance premiums, provided that Executive signs and delivers to the Bank no later than twenty-one (21) days (forty-five (45) days if deemed a “group termination” under the Older Workers Benefit Protection Act) after the Termination Date a General Release and Waiver substantially in the form attached as Exhibit A hereto, and that such release becomes irrevocable in accordance with its terms (the “Release Requirement”). In the event Executive breaches any provision of Article 8 of this Agreement or if she becomes entitled to payments pursuant to Section 9.3 in connection with a Change in

Control, Executive’s entitlement to any benefits payable pursuant to this Section 7.7 shall thereupon immediately cease and terminate.

7.8. Termination After Change in Control. Section 9.2 sets out provisions applicable to certain circumstances in which the Executive’s employment may be terminated in connection with a Change in Control.

7.9 Effect on Status as a Director. In the event of Executive’s termination of employment under this Agreement for any reason, unless otherwise agreed to by the mutual consent of Executive and the Board, the termination will also constitute Executive’s resignation as a director of the Bank and/or the Bancorp, as well as a director of any subsidiary or affiliate thereof, to the extent Executive is acting as a director of any of the aforementioned entities.

8. Confidentiality; Non-Competition; Non-Interference.

8.1. Confidential Information. Executive, during employment, will have, and has had, access to and become familiar with various confidential and proprietary information of the Bank Entities and/or relating to the business of the Bank Entities (“Confidential Information”), including, but not limited to: business plans; operating results; financial statements and financial information; contracts; mailing lists; purchasing information; customer data (including lists, names and requirements); feasibility studies; personnel related information (including compensation, compensation plans, and staffing plans); internal working documents and communications; and other materials related to the businesses or activities of the Bank Entities which is made available only to employees with a need to know or which is not generally made available to the public. Failure to mark any Confidential Information as confidential, proprietary or protected information shall not affect its status as part of the Confidential Information subject to the terms of this Agreement.

8.2. Nondisclosure. Executive hereby covenants and agrees that she shall not, directly or indirectly, disclose or use, or authorize any Person to disclose or use, any Confidential Information (whether or not any of the Confidential Information is novel or known by any other Person); provided however, that this restriction shall not apply to the use or disclosure of Confidential Information (i) to any governmental entity to the extent required by law, (ii) which is or becomes publicly known and available through no wrongful act of Executive or any Affiliate of Executive or (iii) in connection with the performance of Executive’s duties under this Agreement. No provision of this Agreement, including but not limited to this Section 8.2, shall be interpreted, construed, asserted or enforced by the Bank Entities to (i) prohibit Executive from reporting possible violations of federal law or regulation to any governmental agency or entity, including but not limited to the Department of Justice, the Commission, the Congress, and any agency Inspector General, or making other disclosures that are protected under the whistleblower provisions of federal law or regulation, or (ii) require notification or prior approval by the Bank or Bancorp of any such report; provided that, Executive is not authorized to disclose communications with counsel that were made for the purpose of receiving legal advice or that contain legal advice or that are protected by the attorney work product or similar privilege. Further, nothing contained in this Agreement, or any release and waiver delivered in accordance

with this Agreement, shall be interpreted, construed, asserted or enforced by the Bank or Bancorp to prohibit or disqualify Executive from being awarded, receiving and/or enjoying the benefit of, any award, reward, emolument or payment, or other relief of any kind whatsoever, from any agency, which is provided based upon Executive’s provision of information to any such agency as a whistleblower under applicable law or regulation. The Bank and Bancorp hereby waive any right to assert or enforce the provisions of this Agreement in a manner which would impede any whistleblower activity in accordance with applicable law or regulation. Furthermore, Executive shall not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that is made (i) in confidence to a federal, state or local government official, either directly or indirectly, or to an attorney, in each case, solely for the purpose of reporting or investigating a suspected violation of law or (ii) in a complaint or other document filed in a lawsuit or proceeding, if such filings are made under seal.

8.3. Documents. All files, papers, records, documents, compilations, summaries, lists, reports, notes, databases, tapes, sketches, drawings, memoranda, and similar items (collectively, “Documents”), whether prepared by Executive, or otherwise provided to or coming into the possession of Executive, that contain any Confidential or proprietary information about or pertaining or relating to the Bank Entities (the “Bank Information”) shall at all times remain the exclusive property of the Bank Entities. Promptly after a request by the Bank or automatically upon the Termination Date, Executive shall take reasonable efforts to (i) return to the Bank all Documents in any tangible form (whether originals, copies or reproductions) and all computer disks or other media containing or embodying any Document or Bank Information and (ii) purge and destroy all Documents and Bank Information in any intangible form (including computerized, digital or other electronic format), and Executive shall not retain in any form any such Document or any summary, compilation, synopsis or abstract of any Document or Bank Information.

8.4. Non-Competition. Executive hereby acknowledges and agrees that, during the course of employment, in addition to Executive’s access to Confidential Information, Executive has become, and will become, familiar with and involved in all aspects of the business and operations of the Bank Entities. Executive hereby covenants and agrees that during the Term until one (1) year after the Termination Date (the “Restricted Period”), Executive will not at any time (except for the Bank Entities), directly or indirectly, in any capacity (whether as a proprietor, owner, agent, officer, director, shareholder, organizer, partner, principal, manager, member, employee, contractor, consultant or otherwise):

(a) provide any advice, assistance or services of the kind or nature which she provided to any of the Bank Entities or relating to business activities of the type engaged in by any of the Bank Entities within the preceding two years, to any Person who owns or operates a Competitive Business or to any Person that is attempting to initiate or acquire a Competitive Business (in either case, a “Competitor”) if (i) such Competitor operates, or is planning to operate, any office, branch or other facility (in any case, a “Branch”) that is (or is proposed to be) located within a fifty (50) mile radius of the Bank’s headquarters or any Branch of the Bank Entities and (ii) such Branch competes or will compete with the products or services offered or planned to be offered by the Bank Entities during the Restricted Period; or

(b) sell or solicit sales of Competitive Products or Services to Persons within such 50 mile radius, or assist any Competitor in such sales activities.

Notwithstanding any provision hereof to the contrary, this Section 8.4 does not restrict Executive’s right to (i) own securities of any Entity that files periodic reports with the Securities and Exchange Commission under Section 13 or 15(d) of the Securities Exchange Act of 1934, as amended; provided that Executive’s total ownership constitutes less than two percent (2%) of the outstanding securities of such company and that such ownership does not does not violate: (A) the Code of Conduct or any other policy of the Bank, including any policy related to inside information; (B) any applicable securities law; or (C) any applicable standstill or other similar contractual obligation of the Bank. The parties acknowledge that they have entered into and agree to be bound by the terms of that certain Amended and Restated Non-Compete Agreement as of December _, 2023, as may be amended from time to time, which is in addition to and not in lieu of any of the restrictions hereunder (the “Non-Compete Agreement”).

8.5. Non-Interference. Executive hereby covenants and agrees that during the Restricted Period, she will not, directly or indirectly, for herself or any other Person (whether as a proprietor, owner, agent, officer, director, shareholder, organizer, partner, principal, member, manager, employee, contractor, consultant or any other capacity):

(a) induce or attempt to induce any customer, supplier, officer, director, employee, contractor, consultant, agent or representative of, or any other Person that has a business relationship with, any Bank Entity, to discontinue, terminate or reduce the extent of its or her relationship with any Bank Entity or to take any action that would disrupt or otherwise damage any such relationship;

(b) solicit any customer of any of the Bank Entities for the purpose of providing any Competitive Products or Services to such customer (other than any solicitation to the general public that is not disproportionately directed at customers of any Bank Entity); or

(c) solicit any employee of any of the Bank Entities to commence employment with, become a consultant or independent contractor to or otherwise provide services for the benefit of any other Competitive Business.

In applying this Section 8.5:

(i) the term “customer” shall be deemed to include, at any time, any Person to which any of the Bank Entities had, during the six (6) month period immediately prior to such time, (A) sold any products or provided any services or (B) submitted, or been in the process of submitting or negotiating, a proposal for the sale of any product or the provision of any services;

(ii) the term “supplier” shall be deemed to include, at any time, any Person which, during the six (6) month period immediately prior to such time, (A) had sold any products or services to any of the Bank Entities or (B) had submitted to any of the Bank Entities a proposal for the sale of any products or services;

(iii) for purposes of clause (c), the term “employee” shall be deemed to include, at any time, any Person who was employed by any of the Bank Entities within the prior six (6) month period (thereby prohibiting Executive from soliciting any Person who had been employed by any of the Bank Entities until six (6) months after the date on which such Person ceased to be so employed); and

(iv) If during the Restricted Period any employee of any of the Bank Entities accepts employment with or is otherwise retained by any Competitive Business of which Executive is an owner, director, officer, manager, member, employee, partner or employee, or to which Executive provides material services, it shall be presumed that such employee was hired in violation of the restriction set forth in clause (c) of this Section 8.5, with such presumption to be overcome only upon Executive’s showing by a preponderance of the evidence that she was not directly or indirectly involved in the hiring, soliciting or encouraging such employee to leave employment with the Bank Entities.

8.6. Injunction. In the event of any breach or threatened or attempted breach of any provision of this Article 8 by Executive, the Bank shall, in addition to and not to the exclusion of any other rights and remedies at law or in equity, be entitled to seek and receive from any court of competent jurisdiction (i) full temporary and permanent injunctive relief enjoining and restraining Executive and each and every other Person concerned therein from the continuation of such violative acts and (ii) a decree for specific performance of the applicable provisions of this Agreement, without being required to furnish any bond or other security.

8.7. Reasonableness.

8.7.1. Executive has carefully read and considered the provisions of this Article 8 and, having done so, acknowledges that she fully understands them, that she has had an opportunity to consult with counsel of Executive’s own choosing regarding the meaning and effect of such provisions, at Executive’s election, and she agrees that the restrictions and agreements set forth in this Article 8 are fair and reasonable and are reasonably required for the protection of the interests of the Bank Entities and their respective businesses, shareholders, directors, officers and employees. Executive agrees that the restrictions set forth in this Agreement will not impair or unreasonably restrain Executive’s ability to earn a livelihood. Executive further acknowledges that Executive’s services have been and shall continue to be of special, unique and extraordinary value to the Bank Entities.

8.7.2. If any court of competent jurisdiction should determine that the duration, geographical area or scope of any provision or restriction set forth in this Article 8 exceeds the maximum duration, geographic area or scope that is reasonable and enforceable under applicable law, the parties agree that said provision shall automatically be modified and

shall be deemed to extend only over the maximum duration, geographical area and/or scope as to which such provision or restriction said court determines to be valid and enforceable under applicable law, which determination the parties direct the court to make, and the parties agree to be bound by, such modified provision or restriction.

8.8. Additional Obligations.

8.8.1. Non-disparagement. Executive shall not during or after Executive’s employment disparage any officers, directors, employees, business, products, or services of the Bank Entities, except when compelled to do so in connection with a government investigation or judicial proceeding, or as otherwise may be required or protected by law.

8.8.2. Cooperation. During and after Executive’s employment, Executive shall fully cooperate with the reasonable requests of the Bank Entities, including providing information, with regard to any matter that Executive has knowledge of as a result of Executive’s employment or prior employment with the Bank Entities. Executive further agrees to comply with any reasonable request by the Bank Entities to assist in relation to any investigation into any actual or potential irregularities, including without limitation assisting with any threatened or actual litigation concerning the Bank Entities, giving statements/affidavits, meeting with legal and/or other professional advisors, and attending any legal hearing and giving evidence; provided that the Bank Entities shall reimburse Executive for any reasonable out-of-pocket expenses, including reasonable attorney’s fees, properly incurred by Executive in giving such assistance. Executive agrees to notify the Bank immediately if Executive is contacted by any third parties for information or assistance with any matter concerning the Bank Entities and agrees to co-operate with the Bank Entities with regard to responding to such requests.

9. Change in Control.

9.1. Definition. “Change in Control” means and shall be deemed to have occurred if:

(a) there shall be consummated (i) any consolidation, merger, share exchange, or similar transaction relating to Bancorp, or pursuant to which shares of Bancorp’s capital stock are converted into cash, securities of another Entity and/or other property, other than a transaction in which the holders of Bancorp’s voting stock immediately before such transaction shall, upon consummation of such transaction, own at least fifty percent (50%) of the voting power of the surviving Entity, or (ii) any sale of all or substantially all of the assets of Bancorp, other than a transfer of assets to a related Person which is not treated as a change in control event under §1.409A-3(i)(5)(vii)(B) of the U.S. Treasury Regulations;

(b) any person, entity or group (each within the meaning of Sections 13(d) and 14(d)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”)) shall become the beneficial owner (within the meaning of Rules 13d-3 and 13d-5 under the Exchange Act), directly or indirectly, of securities of Bancorp representing more than fifty percent (50%) of the voting power of all outstanding securities of Bancorp entitled to

vote generally in the election of directors of Bancorp (including, without limitation, any securities of Bancorp that any such Person has the right to acquire pursuant to any agreement, or upon exercise of conversion rights, warrants or options, or otherwise, which shall be deemed beneficially owned by such Person); or

(c) over a twelve (12) month period, a majority of the members of the Board of Directors of Bancorp are replaced by directors whose appointment or election was not endorsed by a majority of the members of the Board of Directors of Bancorp in office prior to such appointment or election.

Notwithstanding the foregoing, if the event purportedly constituting a Change in Control under Section 9.1(a), Section 9.1(b), or Section 9.1(c) does not also constitute a “change in ownership” of Bancorp, a “change in effective control” of Bancorp or a “change in the ownership of a substantial portion of the assets” of Bancorp within the meaning of Section 409A, then such event shall not constitute a “Change in Control” hereunder.

9.2. Change in Control Termination. For purposes of this Agreement, a “Change in Control Termination” means that while this Agreement is in effect:

(a) Executive’s employment with the Bank is terminated without Cause (i) within one hundred twenty (120) days immediately prior to and in conjunction with a Change in Control or (ii) within twelve (12) months following consummation of a Change in Control; or

(b) Within twelve (12) months following consummation of a Change in Control, Executive terminates employment for Good Reason:

9.3. Change in Control Payment. If there is a Change in Control Termination pursuant to Section 9.2, Executive shall be paid a lump-sum cash payment (the “Change Payment”) equal to: (a) 1.99 times (the “Multiplier”) the sum of (i) Executive’s Salary at the highest rate in effect during the twelve (12) month period immediately preceding Executive’s Termination Date, and (ii) the greater of the (a) average cash bonuses (incentive plan and discretionary) earned in the prior three (3) calendar years, or (b) the cash incentive (incentive plan and discretionary) that would be paid or payable to the Executive receiving the annual incentive at target for the Bank’s fiscal year in which the Change in Control Termination occurs (or for the prior fiscal year if the incentive opportunity has not yet been determined), as if the Executive and the Bank were to satisfy all applicable performance-related conditions, plus (b) thirty-six (36) times Executive’s full total monthly premium (i.e., Executive’s portion and the Bank’s portion) of Executive’s health, dental and vision insurance premiums, with such Change Payment to be made to Executive on the date forty-five (45) days after the later of (i) the Termination Date or (ii) the date of the Change in Control; provided, however, that the Bank shall be relieved of its obligation to pay the Change Payment if Executive fails to fulfill the Release Requirement. Notwithstanding anything to the contrary in this Section 9.3, (x) any payment pursuant to this Section 9.3 shall be subject to (i) any delay in payment required by Section 10.2 hereof and (ii) any reduction required pursuant to Section 10.1 hereof, as applicable,

(y) shall not include any equity awards pursuant to Section 5.12 above or otherwise, and (z) any amounts payable pursuant to this Section 9.3 shall be reduced by any amount paid or payable as the result of a termination without Cause under Section 7.7, if that termination without Cause under Section 7.7 becomes a Change in Control Termination (i.e., because the Change in Control occurs within one hundred twenty (120) days after the termination without Cause).

10. Compliance with Certain Restrictions.

10.1. Tax Matters.

(a) Notwithstanding anything in this Agreement to the contrary, if Executive’s employment is terminated following a Change in Control, the non-competition and non-solicitation restrictions set forth in Section 8.4(a) and 8.4(b) of this Agreement shall apply for the period of time mutually agreed to by the parties, and in no event shall the time period be less than six months or exceed two years. The Bank and the Executive hereby recognize that: (i) the non-solicitation restriction and non-competition restriction under Sections 8.4(a) and 8(b) have value, and (ii) the value shall be recognized in any calculations the Bank and Executive perform with respect to determining the affect, if any, of the parachute payment provisions of Section 280G of the Code (“Section 280G”), by allocating a portion of any payments, benefits or distributions in the nature of compensation (within the meaning of Section 280G(b)(2)), including the payments under Section 9.3 of this Agreement, to the fair value of the non-solicitation and non-competition restriction under Sections 8.4(a) and 8.4(b) of this Agreement (the “Appraised Value”). The Bank, at the Bank’s expense, shall obtain an independent appraisal to determine the Appraised Value no later than forty-five (45) days after entering into an agreement, that if completed, would constitute a Change in Control as defined in Section 5(a). The Appraised Value will be considered reasonable compensation for post change in control services within the meaning of Q&A-40 of the regulations under Section 280G; and accordingly, any aggregate parachute payments, as defined in Section 280G, will be reduced by the Appraised Value.

(b) After taking into account the Appraised Value, in the event the receipt of all payments, benefits or distributions in the nature of compensation (within the meaning of Section 280G(b)(2)), whether paid or payable pursuant to this Agreement or otherwise (the “Change in Control Benefits”) would subject Executive to an excise tax imposed by Code Sections 280G and 4999, then the payments and/or benefits payable under this Agreement (the “Payments”) shall be reduced by the minimum amount necessary so that no portion of the Payments under this Agreement are non-deductible to the Bank pursuant to Code Section 280G and subject to the excise tax imposed under Code Section 4999 (the “Reduced Amount”). Notwithstanding the foregoing, the Payments will not be reduced if it is determined that without such reduction, the Change in Control Benefits received by the Executive on a net after-tax basis (including without limitation, any excise taxes payable under Code Section 4999) is greater than the Change in Control Benefits that Executive would receive, on a net after-tax benefit, if the Executive is paid the Reduced Amount under the Agreement.

(c) Unless otherwise agreed in writing by the parties, all calculations with respect to Sections 280G and 4999 of the Code required under this Section 10.1 shall be determined by a nationally recognized firm with appropriate expertise mutually agreeable to the Bank and Executive (the “Firm”) whose determination will be conclusive and binding on all parties. The Bank shall pay all fees charged by the Firm for this purpose. The Bank and Executive shall provide the Firm with all information or documents it reasonably requests, and the Firm will be entitled to rely on such information and on reasonable estimates and assumptions and interpretations of the provisions of Sections 280G and 4999 of the Code. If it is determined that the Payments should be reduced as a result of the Section 280G calculations performed by the Firm, the Bank shall promptly give (or cause the Firm to give) Executive notice to that effect (and a copy of the detailed calculations thereof) and, to the extent consistent with Section 409A of the Code, Executive may determine which benefits are to be reduced. All determinations made under this Section 10.1 shall be made as soon as reasonably practicable and in no event later than ten (10) days prior to the date of Executive’s termination of employment.

10.2. Section 409A.

10.2.1. It is the intention of the parties hereto that this Agreement and the payments provided for hereunder shall not be subject to, or shall be in accordance with, Section 409A, and thus avoid the imposition of any tax and interest on Executive pursuant to Section 409A(a)(1)(B) of the Code, and this Agreement shall be interpreted and construed consistent with this intent. Executive acknowledges and agrees that she shall be solely responsible for the payment of any tax or penalty which may be imposed or to which she may become subject as a result of the payment of any amounts under this Agreement.

10.2.2. Notwithstanding any provision of this Agreement to the contrary, if Executive is a “specified employee” at the time of Executive’s “separation from service”, any payment of “nonqualified deferred compensation” (in each case as determined pursuant to Section 409A) that is otherwise to be paid to Executive within six (6) months following Executive’s separation from service, then to the extent that such payment would otherwise be subject to interest and additional tax under Section 409A(a)(1)(B) of the Code, such payment shall be delayed and shall be paid on the first business day of the seventh calendar month following Executive’s separation from service, or, if earlier, upon Executive’s death. Any deferral of payments pursuant to the foregoing sentence shall have no effect on any payments that are scheduled to be paid more than six (6) months after the date of separation from service. For purposes of this Agreement, “termination of employment” and similar terms shall be interpreted to mean a “separation from service” under Code Section 409A. “Separation from service” shall have occurred if the Bank and Executive reasonably anticipate that either no further services will be performed by the Executive after the date of Separation (whether as an employee or as an independent contractor) or the level of further services performed will not exceed 49% of the average level of bona fide services in the 12 months immediately preceding the date of Separation. For all purposes hereunder, the definition of Separation from Service shall be interpreted consistent with Treasury Regulation Section 1.409A-1(h)(ii ).

10.2.3. If any of the payments hereunder are subject to the Release Requirement, and the period in which Executive may consider executing the release begins in one calendar year and ends in the following calendar year, the date on which such payments will be made shall be no earlier than the first day of the second calendar year within such period.

10.2.4. All reimbursements and in-kind benefits provided under this Agreement shall be made or provided in accordance with the requirements of Section 409A to the extent that such reimbursements or in-kind benefits are subject to Section 409A, including, where applicable, the requirements that (i) any reimbursement is for expenses incurred during Executive’s lifetime (or during a shorter period of time specified in this Agreement), (ii) the amount of expenses eligible for reimbursement during a calendar year may not affect the expenses eligible for reimbursement in any other calendar year, (iii) the reimbursement of an eligible expense will be made on or before the last day of the calendar year following the year in which the expense is incurred and (iv) the right to reimbursement is not subject to set off or liquidation or exchange for any other benefit.

10.3. Withholding. The Company may withhold from any amounts payable under this Agreement such federal, state, local or foreign income taxes it determines may be appropriate.

11. Assignability. Executive shall have no right to assign this Agreement or any of Executive’s rights or obligations hereunder to another party or parties. The Bank may assign this Agreement to any of its Affiliates or to any Person that acquires a substantial portion of the operating assets of the Bank. Upon any such assignment by the Bank, references in this Agreement to the Bank shall automatically be deemed to refer to such assignee instead of, or in addition to, the Bank, as appropriate in the context.

12. Governing Law; Venue. This Agreement shall be governed by and construed in accordance with the laws of the State of Maryland applicable to contracts executed and to be performed therein, without giving effect to the choice of law rules thereof. Any action to enforce any provision of this Agreement may be brought only in a court of the State of Maryland within Montgomery County or in the United States District Court for the District of Maryland. Accordingly, each party (a) agrees to submit to the jurisdiction of such courts and to accept service of process at its address for notices and in the manner provided in Section 13 for the giving of notices in any such action or proceeding brought in any such court and (b) irrevocably waives any objection to the laying of venue of any such proceeding brought in such a court and any claim that any such proceeding brought in such a court has been brought in an inconvenient or inappropriate forum.

13. Notices. All notices, requests, demands and other communications required to be given or permitted to be given under this Agreement shall be in writing and shall be conclusively deemed to have been given as follows: (a) when hand delivered to the other party; (b) when received by facsimile at the facsimile number set forth below, provided, however, that any notice given by facsimile shall not be effective unless either (i) a duplicate copy of such facsimile notice is promptly given by depositing the same in a United States post office first-class postage

prepaid and addressed to the applicable party as set forth below or (ii) the receiving party delivers a signed, written confirmation of receipt for such notice either by facsimile or by any other method permitted under this Section; or (c) when deposited in a United States post office with first-class certified mail, return receipt requested, postage prepaid and addressed to the applicable party as set forth below; or (d) when deposited with a national overnight delivery service reasonably approved by the parties (Federal Express and DHL WorldWide Express being deemed approved by the parties), postage prepaid, addressed to the applicable party as set forth below with next-business-day delivery guaranteed; provided that the sending party receives a confirmation of delivery from the delivery service provider. Any notice given by facsimile shall be deemed received on the date on which notice is received except that if such notice is received after 5:00 p.m. (recipient’s time) or on a non-business day, notice shall be deemed given the next business day). Any notice sent by United States mail shall be deemed given three (3) business days after the same has been deposited in the United States mail. Any notice given by national overnight delivery service shall be deemed given on the first business day following deposit with such delivery service. For purposes of this Agreement, the term “business day” shall mean any day other than a Saturday, Sunday or day that is a legal holiday in Montgomery County, Maryland. The address of a party set forth below may be changed by that party by written notice to the other from time to time pursuant to this Article.

| | | | | | | | |

| To: | | Executive as set forth by Executive’s signature below |

| | |

| To: | | Norman Pozez, Chairman |

| | EagleBank |

| | 7830 Old Georgetown Road |

| | Bethesda, MD 20814 |

| | Fax No.: 301-337-3373 |

| | |

| cc: | | Eric Newell, EVP and CFO |

| | Eagle Bancorp, Inc. |

| | 7830 Old Georgetown Road |

| | Bethesda, MD 20814 |

| | Fax: 301-337-3373 |

| | |

| | Copy to: Paul Saltzman, EVP and Chief Legal Officer |

| | 7830 Old Georgetown Road |

| | Bethesda, MD 20814 |

| | Fax: 301-337-3373 |

14. Entire Agreement. This Agreement constitutes the entire agreement between the parties pertaining to its subject matter and supersedes all prior and contemporaneous agreements, including the Prior Agreement, understandings, negotiations, prior draft agreements, and discussions of the parties, whether oral or written. Nothing in this provision, however, shall be construed as modifying or superseding other agreements or discussions between the parties on subjects not addressed in this Agreement.

15. Headings. The Article and Section headings contained in this Agreement are for reference purposes only and shall not in any way affect the meaning or interpretation of this Agreement.

16. Severability. Should any part of this Agreement for any reason be declared or held illegal, invalid or unenforceable, such provision or portion of such provision shall be deemed severed here from and such determination shall not affect the legality, validity or enforceability of any remaining portion or provision of this Agreement, which remaining portions and provisions shall remain in force and effect as if this Agreement has been executed with the illegal, invalid or unenforceable portion thereof eliminated.

17. Amendment; Waiver. Neither this Agreement nor any provision hereof may be amended, modified, changed, waived, discharged or terminated except by an instrument in writing signed by the party against which enforcement of the amendment, modification, change, waiver, discharge or termination is sought. The failure of either party at any time or times to require performance of any provision hereof shall not in any manner affect the right at a later time to enforce the same. No waiver by either party of the breach of any term, provision or covenant contained in this Agreement, whether by conduct or otherwise, in any one or more instances, shall be deemed to be, or construed as, a further or continuing waiver of any such breach, or a waiver of the breach of any other term, provision or covenant contained in this Agreement.

18. Gender and Number. As used in this Agreement, the masculine, feminine and neuter gender, and the singular or plural number, shall each be deemed to include the other or others whenever the context so indicates.

19. Binding Effect. This Agreement is and shall be binding upon, and inures to the benefit of, the Bank, its successors and assigns, and Executive and Executive’s heirs, executors, administrators, and personal and legal representatives.

[signatures on following page]

IN WITNESS WHEREOF, the parties have executed this Employment Agreement as of the date first written above.

| | | | | |

| EAGLEBANK |

| |

| |

| By: | /s/ Norman Pozez |

| Name: Norman Pozez |

| Title: Chairman of the Board |

| |

| |

| EXECUTIVE |

| |

| |

| /s/ Susan G. Riel |

| Susan G. Riel, President and Chief |

| Executive Officer |

Exhibit A

Form of General Release and Waiver of All Claims

Susan G. Riel (“you”) executes this General Release And Waiver of All Claims (the “Release”) as a condition of receiving certain payments and other benefits in accordance with the terms of Section [ ] of your Employment Agreement dated . All capitalized terms used but not otherwise defined herein shall have the same meaning as in your Employment Agreement.

1. RELEASE.

You hereby release and forever discharge EagleBank and Eagle Bancorp, Inc. (each, a “Company”) and each and every one of their former or current subsidiaries, parents, affiliates, directors, officers, employees, agents, parents, affiliates, successors, predecessors, subsidiaries, assigns and attorneys (the “Released Parties”) from any and all charges, claims, damages, injury and actions, in law or equity, which you or your heirs, successors, executors, or other representatives ever had, now have, or may in the future have by reason of any act, omission, matter, cause or thing through the date of your execution of this Release. You understand that this Release is a general release of all claims you may have against the Released Parties based on any act, omission, matter, case or thing through the date of your execution of this Release.

2. WAIVER.

You realize there are many laws and regulations governing the employment relationship. These include, but are not limited to, Title VII of the Civil Rights Acts of 1964 and 1991; the Age Discrimination in Employment Act of 1967; the Americans with Disabilities Act; the National Labor Relations Act; 42 U.S.C. § 1981; the Family and Medical Leave Act; the Employee Retirement Income Security Act of 1974 (other than any accrued benefit(s) to which you have a non-forfeitable right under any pension benefit plan); the Older Workers Benefit Protection Act; the Equal Pay Act; the Family and Medical Leave Act; the Maryland Civil Rights Act, the Maryland Wage Payment and Collection Law, Maryland Occupational Safety and Health Act, the Maryland Collective Bargaining Law, and any other state, local and federal employment laws; and any amendments to any of the foregoing. You also understand there may be other statutes and laws of contract and tort that also relate to your employment. By signing this Release, you waive and release any rights you may have against the Released Parties under these and any other laws, except those as to which a waiver and release is not permitted as a matter of law, based on any act, omission, matter, cause or thing through the date of your execution of this Release; provided however, that this Release does not release or discharge the Released Parties from any Company’s obligations to you under or pursuant to (a) [Sections 7.7, 7.8 and 9.3] OR [Section 7.9] of the Agreement, (b) [Section 3.1 of the Non-Compete Agreement], (c) vested benefits under the Company’s employee welfare benefit plans and employee pension benefit plans (excluding any severance benefits), subject to the terms and

conditions of those plans, (d) any securities of the Company that you own or (e) claims for indemnification under the Company’s by-laws or policies of insurance.