Eagle Bancorp, Inc. Announces Dividend and Share Repurchase Program Extension and Expansion

December 18 2019 - 10:30AM

Eagle Bancorp, Inc. (Nasdaq – EGBN) (the “Company”) announced today

that its Board of Directors declared a cash dividend. The Board of

Directors announced a cash dividend for the fourth quarter of 2020,

in the amount of $0.22 per share. The cash dividend will be payable

on January 31, 2020 to shareholders of record on January 15, 2020.

Additionally, the Board of Directors extended

its share repurchase program that was initiated earlier this year,

and increased the number of shares subject to repurchase. Under the

revised repurchase program, 1,641,000 shares of common stock, or

approximately 5% of its outstanding shares of common stock at

September 30, 2019 are subject to repurchase through the expiration

of the program on December 31, 2020, subject to earlier termination

of the program by the Board of Directors. As of December 16, 2019,

the Company had approximately 33,242,482 shares outstanding.

Repurchases may be made in open market

purchases, block trades or in privately negotiated transactions.

Repurchases, if any, under the program will be made at the

discretion of management, and will depend upon market pricing and

conditions, business, legal, accounting and other considerations.

Open market purchases will be conducted in accordance with the

limitation of Rule 10b-18 of the Securities and Exchange Commission

(the “SEC”). Repurchases may be made pursuant to any trading plan

that may be adopted in accordance with SEC Rule 10b5-1, which would

permit common stock to be repurchased when the Company might

otherwise be precluded from doing so under insider trading laws.

Under applicable law, repurchased shares will be cancelled and

revert to the status of authorized but unissued shares.

The repurchase program may be modified,

suspended or terminated at any time without notice, in the

Company’s discretion, based upon a number of factors, including

market conditions, the cost of repurchasing shares, the

availability of alternative investment opportunities, liquidity,

the need for capital in the Company’s operations and other factors

deemed appropriate. These factors may also affect the timing and

amount of share repurchases. The repurchase program does not

obligate the Company to repurchase any shares.

“We are pleased to announce the continuation of

a quarterly cash dividend payment to shareholders along with the

share repurchase program extension,” noted Susan G. Riel, President

and Chief Executive Officer of Eagle Bancorp, Inc. Ms. Riel

continued, “We expect that our sustained profitability will enable

us to provide shareholders with a tangible return in the form of

quarterly cash dividends, and believe that such action is prudent,

given the rate of continued capital accumulation at the Company.

Additionally, the share repurchase program provides the Company

with the continued ability to concentrate value for existing

shareholders through the judicious repurchase of shares when the

market provides opportunities at attractive prices.”

Ms. Riel added, “The Company’s capital planning

and policies are extensive and receive much attention by the

Company’s Board of Directors. The decision to continue with a

quarterly cash dividend and share repurchase program are consistent

with those policies.”

About Eagle Bancorp: The

Company is the holding company for EagleBank, which commenced

operations in 1998. The Bank is headquartered in Bethesda,

Maryland, and operates through twenty branch offices, located in

Suburban Maryland, Washington, D.C. and Northern Virginia. The

Company focuses on building relationships with businesses,

professionals and individuals in its marketplace.

Forward-looking

Statements: This press release contains

forward-looking statements within the meaning of the Securities and

Exchange Act of 1934, as amended, including statements of goals,

intentions, and expectations as to future trends, plans, events or

results of Company operations and policies and regarding general

economic conditions. In some cases, forward-looking statements can

be identified by use of words such as “may,” “will,” “anticipates,”

“believes,” “expects,” “plans,” “estimates,” “potential,”

“continue,” “should,” and similar words or phrases. These

statements are based upon current and anticipated economic

conditions, nationally and in the Company’s market, interest rates

and interest rate policy, competitive factors, and other conditions

which by their nature, are not susceptible to accurate forecast and

are subject to significant uncertainty. Because of these

uncertainties and the assumptions on which this discussion and the

forward-looking statements are based, actual future operations and

results in the future may differ materially from those indicated

herein. For details on factors that could affect these

expectations, see the risk factors and other cautionary language

included in the Company’s Annual Report on Form 10-K for the year

ended December 31, 2018 and in other periodic and current reports

filed with the SEC. Readers are cautioned against placing undue

reliance on any such forward-looking statements. The Company’s past

results are not necessarily indicative of future performance.

EAGLE BANCORP,

INC.CONTACT:Charles D. Levingston(301) 986 1800

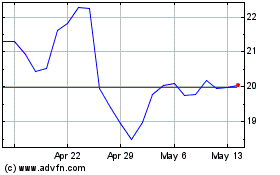

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Oct 2024 to Nov 2024

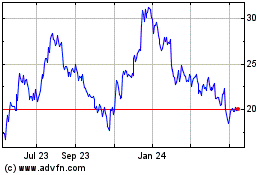

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Nov 2023 to Nov 2024