Eagle Bancorp, Inc. (the “Company”) (NASDAQ:EGBN), the parent

company of EagleBank, today announced record quarterly net income

of $35.7 million for the three months ended March 31, 2018 (basic

and diluted earnings per common share of $1.04), a 32% increase

over the $27.0 million net income (basic and diluted earnings per

common share of $0.79) for the three months ended March 31, 2017.

“We are very pleased to report another quarter

of favorable earnings, which continued to exhibit positive trends

of balance sheet growth, revenue growth, solid asset quality and

favorable operating leverage,” noted Ronald D. Paul, Chairman and

Chief Executive Officer of Eagle Bancorp, Inc. Mr. Paul continued,

“The Company’s assets ended the quarter at $7.7 billion,

representing 9% growth over the first quarter of 2017. First

quarter 2018 earnings resulted in a return on average assets of

1.91% and a return on average common equity (“ROACE”) of 14.99%.”

Mr. Paul added, “We believe our financial results in the first

quarter continue to exhibit balanced and consistent performance

across all financial measures.”

The Company’s performance in the first quarter

of 2018 as compared to the first quarter of 2017 was highlighted by

growth in average total loans of 13%, growth in average total

deposits of 9%, by an increase in the net interest margin to 4.17%

from 4.14% and by 11% growth in total revenue to $81.1 million. Mr.

Paul noted that the Company focuses more on growth of average

balances year over year since that measure relates more directly to

income statement results. For the first quarter of 2018, the

annualized net charge-off ratio to average loans was 0.06%; the

level of nonperforming assets to total assets remained low at 0.19%

and the Company’s operating leverage remained very strong with an

efficiency ratio of 38.38%. Mr. Paul added, “In the first quarter

of 2018, total loans grew 3.0% over December 31, 2017, and total

deposits increased 4.6% over December 31, 2017. The pipeline of

loan commitments and new relationship opportunities remains strong.

The Company continues to emphasize strategies and focus on

achieving core deposit growth. Importantly, the mix of noninterest

deposits to total deposits averaged 33.5% in the first quarter of

2018, as compared to 32.3% for the first quarter of 2017.”

The net interest margin was 4.17% for the first

quarter of 2018, up four basis points from the fourth quarter of

2017 and three basis points higher than the first quarter in 2017

due substantially to a higher percentage of loans in the asset mix,

coupled with higher loan yields. Mr. Paul noted, “While we are

seeing a higher cost of funds, we are also experiencing improved

loan yields, in part due to rate adjustments on our predominately

variable and adjustable rate loan portfolio.” The Company’s net

interest income increased 13% in the first quarter of 2018 over

2017 as the Company continues to see good lending opportunities and

has continued its emphasis on disciplined pricing for both new

loans and funding sources. The Company believes that it has a

superior net interest margin compared to peers, but it is also

focused on all factors that contribute to Earnings Per Share

(“EPS”) growth.

Total revenue (net interest income plus

noninterest income) for the first quarter of 2018 was $81.1

million, or 11% above the $73.0 million of total revenue earned for

the first quarter of 2017. The primary driver of revenue growth for

the first quarter of 2018 as compared to the first quarter of 2017

was net interest income growth of 13% ($75.8 million versus $66.9

million). Noninterest income declined in the first quarter 2018

compared to the same period in 2017, due substantially to lower net

investment gains and lower gains on sales of loans in the first

quarter of 2018 as compared to 2017. Excluding net gains on sales

of investment securities, noninterest income was $5.3 million in

the first quarter of 2018 as compared to $5.6 million for the first

quarter of 2017, a decrease of 5%.

While the Company’s primary focus continues to

be on generating spread income, management also looks to the

origination and sale of residential mortgage loans, Small Business

Administration (“SBA”) loan activity and FHA Multifamily lending

and securitization as components of the Company’s ongoing

noninterest income initiatives. For the first quarter of 2018,

gains on the sale of residential mortgage loans were $1.4 million

as compared to $2.0 million for the first quarter of 2017. The

lesser revenue was due to lower volumes. Sales of SBA guaranteed

loans resulted in modest gains of $169 thousand on sales for the

first quarter of 2018 versus $57 thousand for the same period in

2017. Gains on sales of FHA multifamily loans in the first quarter

of 2018 were $48 thousand versus no revenue in the first quarter of

2017.

Asset quality measures remained solid at March

31, 2018. Annualized net charge-offs were 0.06% of average loans

for the first quarter of 2018, as compared to 0.04% of average

loans for the first quarter of 2017. At March 31, 2018, the

Company’s nonperforming loans amounted to $13.4 million (0.20% of

total loans) as compared to $14.4 million (0.25% of total loans) at

March 31, 2017 and $13.2 million (0.21% of total loans) at December

31, 2017. Nonperforming assets amounted to $14.8 million (0.19% of

total assets) at March 31, 2018 compared to $15.7 million (0.22% of

total assets) at March 31, 2017 and $14.6 million (0.20% of total

assets) at December 31, 2017.

Management continues to remain attentive to any

signs of deterioration in borrowers’ financial conditions and is

proactive in taking the appropriate steps to mitigate risk,

including placing loans on nonaccrual status. Based on a thorough

risk analysis and consistent application of allowance methodology,

management believes that its allowance for credit losses, at 1.00%

of total loans (excluding loans held for sale) at March 31, 2018,

is adequate to absorb potential credit losses within the loan

portfolio at that date. The allowance for credit losses was 1.03%

at March 31, 2017 and 1.01% of total loans at December 31, 2017.

The allowance for credit losses represented 492% of nonperforming

loans at March 31, 2018, as compared to 417% at March 31, 2017 and

489% at December 31, 2017.

“The Company’s productivity remained quite

strong in the quarter,” noted Mr. Paul. The efficiency ratio of

38.38% reflects management’s ongoing efforts to maintain superior

operating leverage. Further, the annualized level of noninterest

expenses as a percentage of average assets has declined to 1.64% in

the first quarter of 2018 as compared to 1.73% in the first quarter

of 2017. The Company’s goal is to maximize operating performance

without inhibiting growth or negatively impacting our ability to

service our customers. Mr. Paul further noted, “Our favorable

efficiency ratio is due in a large part to our streamlined branch

system and control of occupancy costs. We maintain $298 million of

average deposits per branch as compared to the regional average of

$125 million per branch.”

Total assets at March 31, 2018 were $7.70

billion, a 9% increase as compared to $7.09 billion at March 31,

2017, and a 3% increase as compared to $7.48 billion at December

31, 2017. Total loans (excluding loans held for sale) were $6.60

billion at March 31, 2018, a 13% increase as compared to $5.82

billion at March 31, 2017, and a 3% increase as compared to $6.41

billion at December 31, 2017. Loans held for sale amounted to $25.9

million at March 31, 2018 as compared to $29.6 million at March 31,

2017, a 13% decrease, and $25.1 million at December 31, 2017, a 3%

increase. The investment portfolio totaled $578.3 million at March

31, 2018, a 16% increase from the $499.8 million balance at March

31, 2017. As compared to December 31, 2017, the investment

portfolio at March 31, 2018 decreased by $11.0 million or 2%.

Total deposits at March 31, 2018 were $6.12

billion compared to deposits of $5.79 billion at March 31, 2017, a

6% increase and $5.85 billion at December 31, 2017, a 5% increase.

We continue to work on expanding the breadth and depth of our

existing customer relationships while we pursue new relationships.

Total borrowed funds (excluding customer repurchase agreements)

were $492.0 million at March 31, 2018, $291.6 million at March 31,

2017 and $541.9 million at December 31, 2017.

Total shareholders’ equity at March 31, 2018

increased 13%, to $985.2 million, compared to $873.0 million at

March 31, 2017, and increased 4%, from $950.4 million, at December

31, 2017. The increase in shareholders’ equity at March 31, 2018

compared to the same period in 2017 was primarily the result of

retained earnings. The Company’s capital position remains

substantially in excess of regulatory requirements for well

capitalized status, with a total risk based capital ratio of 15.32%

at March 31, 2018, as compared to 14.97% at March 31, 2017, and

15.02% at December 31, 2017. In addition, the tangible common

equity ratio was 11.57% at March 31, 2018, compared to 10.97% at

March 31, 2017 and 11.44% at December 31, 2017.

For the three months ended March 31, 2018, the

Company reported an annualized ROAA of 1.91% as compared to 1.62%

for the three months ended March 31, 2017. The annualized ROACE for

the three months ended March 31, 2018 was 14.99% as compared to

12.74% for the three months ended March 31, 2017.

Net interest income increased 13% for the three

months ended March 31, 2018 over the same period in 2017 ($75.8

million versus $66.9 million), resulting from growth in average

earning assets of 13%. The net interest margin was 4.17% for the

three months ended March 31, 2018, as compared to 4.14% for the

three months ended March 31, 2017. The Company believes its current

net interest margin remains favorable compared to peer banking

companies and that its disciplined approach to managing the loan

portfolio yield to 5.30% for the first quarter of 2018 (as

compared to 5.13% for the same period in 2017) has been a

significant factor in its overall profitability.

The provision for credit losses was $2.0 million

for the three months ended March 31, 2018 as compared to $1.4

million for the three months ended March 31, 2017. The higher

provisioning in the first quarter of 2018, as compared to the first

quarter of 2017, is due to higher loan growth coupled with higher

net charge-offs. Net charge-offs of $921 thousand in the first

quarter of 2018 represented an annualized 0.06% of average loans,

excluding loans held for sale, as compared to $623 thousand, or an

annualized 0.04% of average loans, excluding loans held for sale,

in the first quarter of 2017. Net charge-offs in the first quarter

of 2018 were attributable primarily to commercial loans ($981

thousand) and commercial real estate loans ($61 thousand) offset by

a net recovery in consumer loans ($120 thousand).

Noninterest income for the three months ended

March 31, 2018 decreased to $5.3 million from $6.1 million for the

three months ended March 31, 2017, a 13% decrease, due

substantially to lower net investment gains in the first quarter of

2018 as compared to 2017 and due to lower gains on the sale of

residential mortgage loans ($1.4 million versus $2.0 million)

resulting from lower volume. Residential mortgage loans closed were

$100 million for the first quarter of 2018 versus $150 million

for the first quarter of 2017. Net investment gains were $42

thousand for the three months ended March 31, 2018 compared to $505

thousand for the same period in 2017.

The efficiency ratio, which measures the ratio

of noninterest expense to total revenue, was 38.38% for the first

quarter of 2018, as compared to 40.06% for the first quarter of

2017. Noninterest expenses totaled $31.1 million for the three

months ended March 31, 2018, as compared to $29.2 million for the

three months ended March 31, 2017, a 6% increase.

Cost increases for salaries and benefits were

$181 thousand, due primarily to increased staff and merit

increases. Data processing expense increased by $276 thousand due

primarily to increased vendor fees associated with higher volumes

and rates. Legal, accounting and professional fees increased $2.0

million, a significant portion of which was due to independent

consulting and professional services associated with the internet

event late in 2017. FDIC expenses increased $131 thousand due to a

higher assessment base resulting from growth in total assets. Other

expenses decreased $795 thousand, due primarily to a net loss on

the sale of Other Real Estate Owned (“OREO”) in the first quarter

of 2017 ($361 thousand), lower business development expenses ($172

thousand), and lower costs to maintain OREO properties pending sale

($90 thousand).

The effective income tax rate for the first

quarter of 2018 was 25.6% as compared to 36.2% for the first

quarter of 2017 due largely to a reduction in the federal corporate

tax rate from 35% to 21% pursuant to The Tax Cuts and Jobs Act of

2017.

The financial information which follows provides

more detail on the Company’s financial performance for the three

months ended March 31, 2018 as compared to the three months ended

March 31, 2017 as well as providing eight quarters of trend data.

Persons wishing additional information should refer to the

Company’s Form 10-K for the year ended December 31, 2017 and other

reports filed with the Securities and Exchange Commission (the

“SEC”).

About Eagle Bancorp: The

Company is the holding company for EagleBank, which commenced

operations in 1998. The Bank is headquartered in Bethesda,

Maryland, and operates through twenty branch offices, located in

Montgomery County, Maryland, Washington, D.C. and Northern

Virginia. The Company focuses on building relationships with

businesses, professionals and individuals in its marketplace.

Conference Call: Eagle Bancorp

will host a conference call to discuss its first quarter 2018

financial results on Thursday, April 19, 2018 at 10:00 a.m. eastern

daylight time. The public is invited to listen to this conference

call by dialing 1.877.303.6220, conference ID Code is 5488038, or

by accessing the call on the Company’s website,

www.EagleBankCorp.com. A replay of the conference call will be

available on the Company’s website through May 3, 2018.

Forward-looking Statements:

This press release contains forward-looking statements within the

meaning of the Securities Exchange Act of 1934, as amended,

including statements of goals, intentions, and expectations as to

future trends, plans, events or results of Company operations and

policies and regarding general economic conditions. In some cases,

forward-looking statements can be identified by use of words such

as “may,” “will,” “anticipates,” “believes,” “expects,” “plans,”

“estimates,” “potential,” “continue,” “should,” and similar words

or phrases. These statements are based upon current and anticipated

economic conditions, nationally and in the Company’s market,

interest rates and interest rate policy, competitive factors, and

other conditions which by their nature, are not susceptible to

accurate forecast and are subject to significant uncertainty.

Because of these uncertainties and the assumptions on which this

discussion and the forward-looking statements are based, actual

future operations and results in the future may differ materially

from those indicated herein. For details on factors that could

affect these expectations, see the risk factors and other

cautionary language included in the Company’s Annual Report on Form

10-K for the year ended December 31, 2017 and in other periodic and

current reports filed with the SEC. Readers are cautioned against

placing undue reliance on any such forward-looking statements. The

Company’s past results are not necessarily indicative of future

performance.

| |

|

|

|

|

Eagle Bancorp, Inc. |

|

|

|

| Consolidated

Financial Highlights (Unaudited) |

|

|

|

| (dollars in thousands,

except per share data) |

|

| |

Three Months Ended March 31, |

| |

2018 |

|

2017 |

| Income

Statements: |

|

|

|

| Total interest

income |

$ |

89,049 |

|

|

$ |

75,794 |

|

| Total interest

expense |

|

13,269 |

|

|

|

8,900 |

|

| Net interest

income |

|

75,780 |

|

|

|

66,894 |

|

| Provision for credit

losses |

|

1,969 |

|

|

|

1,397 |

|

| Net interest income

after provision for credit losses |

|

73,811 |

|

|

|

65,497 |

|

| Noninterest income

(before investment gains) |

|

5,262 |

|

|

|

5,565 |

|

| Gain on sale of

investment securities |

|

42 |

|

|

|

505 |

|

| Total noninterest

income |

|

5,304 |

|

|

|

6,070 |

|

| Total noninterest

expense |

|

31,121 |

|

|

|

29,232 |

|

| Income before income

tax expense |

|

47,994 |

|

|

|

42,335 |

|

| Income tax expense |

|

12,279 |

|

|

|

15,318 |

|

| Net income |

$ |

35,715 |

|

|

$ |

27,017 |

|

| |

|

|

|

| Per Share

Data: |

|

|

|

| Earnings per weighted

average common share, basic |

$ |

1.04 |

|

|

$ |

0.79 |

|

| Earnings per weighted

average common share, diluted |

$ |

1.04 |

|

|

$ |

0.79 |

|

| Weighted average common

shares outstanding, basic |

|

34,260,882 |

|

|

|

34,069,528 |

|

| Weighted average common

shares outstanding, diluted |

|

34,406,310 |

|

|

|

34,284,316 |

|

| Actual shares

outstanding at period end |

|

34,303,056 |

|

|

|

34,110,056 |

|

| Book value per common

share at period end |

$ |

28.72 |

|

|

$ |

25.59 |

|

| Tangible book value per

common share at period end (1) |

$ |

25.60 |

|

|

$ |

22.45 |

|

| |

|

|

|

| Performance

Ratios (annualized): |

|

|

|

| Return on average

assets |

|

1.91 |

% |

|

|

1.62 |

% |

| Return on average

common equity |

|

14.99 |

% |

|

|

12.74 |

% |

| Net interest

margin |

|

4.17 |

% |

|

|

4.14 |

% |

| Efficiency ratio

(2) |

|

38.38 |

% |

|

|

40.06 |

% |

| |

|

|

|

| Other

Ratios: |

|

|

|

| Allowance for credit

losses to total loans (3) |

|

1.00 |

% |

|

|

1.03 |

% |

| Allowance for credit

losses to total nonperforming loans |

|

491.56 |

% |

|

|

416.91 |

% |

| Nonperforming loans to

total loans (3) |

|

0.20 |

% |

|

|

0.25 |

% |

| Nonperforming assets to

total assets |

|

0.19 |

% |

|

|

0.22 |

% |

| Net charge-offs

(annualized) to average loans (3) |

|

0.06 |

% |

|

|

0.04 |

% |

| Common equity to total

assets |

|

12.80 |

% |

|

|

12.31 |

% |

| Tier 1 capital (to

average assets) |

|

11.76 |

% |

|

|

11.51 |

% |

| Total capital (to risk

weighted assets) |

|

15.32 |

% |

|

|

14.97 |

% |

| Common equity tier 1

capital (to risk weighted assets) |

|

11.57 |

% |

|

|

10.97 |

% |

| Tangible common equity

ratio (1) |

|

11.57 |

% |

|

|

10.97 |

% |

| |

|

|

|

| Loan Balances -

Period End (in thousands): |

|

|

|

| Commercial and

Industrial |

$ |

1,426,042 |

|

|

$ |

1,235,832 |

|

| Commercial real estate

- owner occupied |

$ |

800,747 |

|

|

$ |

638,132 |

|

| Commercial real estate

- income producing |

$ |

3,137,498 |

|

|

$ |

2,538,734 |

|

| 1-4 Family

mortgage |

$ |

103,932 |

|

|

$ |

155,021 |

|

| Construction -

commercial and residential |

$ |

1,000,266 |

|

|

$ |

1,021,620 |

|

| Construction - C&I

(owner occupied) |

$ |

40,547 |

|

|

$ |

130,513 |

|

| Home equity |

$ |

90,271 |

|

|

$ |

100,265 |

|

| Other

consumer |

$ |

3,223 |

|

|

$ |

4,829 |

|

| |

|

|

|

| Average

Balances (in thousands): |

|

|

|

| Total assets |

$ |

7,597,485 |

|

|

$ |

6,772,164 |

|

| Total earning

assets |

$ |

7,373,535 |

|

|

$ |

6,538,377 |

|

| Total loans |

$ |

6,433,730 |

|

|

$ |

5,705,261 |

|

| Total deposits |

$ |

6,063,017 |

|

|

$ |

5,554,402 |

|

| Total borrowings |

$ |

523,369 |

|

|

$ |

318,143 |

|

| Total shareholders’

equity |

$ |

966,585 |

|

|

$ |

859,779 |

|

| |

|

|

|

(1) Tangible common equity to tangible assets

(the "tangible common equity ratio") and tangible book value per

common share are non-GAAP financial measures derived from GAAP

based amounts. The Company calculates the tangible common equity

ratio by excluding the balance of intangible assets from common

shareholders' equity and dividing by tangible assets. The Company

calculates tangible book value per common share by dividing

tangible common equity by common shares outstanding, as compared to

book value per common share, which the Company calculates by

dividing common shareholders' equity by common shares outstanding.

The Company considers this information important to shareholders as

tangible equity is a measure that is consistent with the

calculation of capital for bank regulatory purposes, which excludes

intangible assets from the calculation of risk based ratios and as

such is useful for investors, regulators, management and others to

evaluate capital adequacy and to compare against other financial

institutions. The table below provides a reconciliation of these

non-GAAP financial measures with financial measures defined by

GAAP.

| |

|

|

|

|

| GAAP

Reconciliation (Unaudited) |

|

|

|

|

| (dollars in thousands

except per share data) |

|

|

|

|

| |

Three Months Ended |

|

Three Months Ended |

|

| |

March 31, 2018 |

|

March 31, 2017 |

|

| Common shareholders'

equity |

$ |

985,180 |

|

|

$ |

873,042 |

|

|

| Less: Intangible

assets |

|

(107,097 |

) |

|

|

(107,124 |

) |

|

| Tangible common

equity |

$ |

878,083 |

|

|

$ |

765,918 |

|

|

| |

|

|

|

|

| Book value per common

share |

$ |

28.72 |

|

|

$ |

25.59 |

|

|

| Less: Intangible book

value per common share |

|

(3.12 |

) |

|

|

(3.14 |

) |

|

| Tangible book

value per common share |

$ |

25.60 |

|

|

$ |

22.45 |

|

|

| |

|

|

|

|

| Total assets |

$ |

7,698,060 |

|

|

$ |

7,090,163 |

|

|

| Less: Intangible

assets |

|

(107,097 |

) |

|

|

(107,124 |

) |

|

| Tangible

assets |

$ |

7,590,963 |

|

|

$ |

6,983,039 |

|

|

| Tangible common

equity ratio |

|

11.57 |

% |

|

|

10.97 |

% |

|

| |

|

|

|

|

(2) Computed by dividing noninterest expense by

the sum of net interest income and noninterest income.

(3) Excludes loans held for sale.

| |

|

|

|

|

|

| Eagle Bancorp,

Inc. |

|

|

|

|

|

| Consolidated

Balance Sheets (Unaudited) |

|

|

|

|

|

| (dollars in thousands,

except per share data) |

|

|

|

|

|

| |

|

|

|

|

|

|

Assets |

March 31, 2018 |

|

December 31, 2017 |

|

March 31, 2017 |

| Cash and due from

banks |

$ |

7,954 |

|

|

$ |

7,445 |

|

|

$ |

9,210 |

|

| Federal funds sold |

|

29,552 |

|

|

|

15,767 |

|

|

|

3,222 |

|

| Interest bearing

deposits with banks and other short-term investments |

|

167,347 |

|

|

|

167,261 |

|

|

|

466,750 |

|

| Investment securities

available for sale, at fair value |

|

578,317 |

|

|

|

589,268 |

|

|

|

499,807 |

|

| Federal Reserve and

Federal Home Loan Bank stock |

|

34,768 |

|

|

|

36,324 |

|

|

|

25,573 |

|

| Loans held for

sale |

|

25,873 |

|

|

|

25,096 |

|

|

|

29,567 |

|

| Loans |

|

6,602,526 |

|

|

|

6,411,528 |

|

|

|

5,824,946 |

|

| Less allowance for

credit losses |

|

(65,807 |

) |

|

|

(64,758 |

) |

|

|

(59,848 |

) |

| Loans,

net |

|

6,536,719 |

|

|

|

6,346,770 |

|

|

|

5,765,098 |

|

| Premises and equipment,

net |

|

19,808 |

|

|

|

20,991 |

|

|

|

20,535 |

|

| Deferred income

taxes |

|

30,203 |

|

|

|

28,770 |

|

|

|

48,203 |

|

| Bank owned life

insurance |

|

61,291 |

|

|

|

60,947 |

|

|

|

60,496 |

|

| Intangible assets,

net |

|

107,097 |

|

|

|

107,212 |

|

|

|

107,124 |

|

| Other real estate

owned |

|

1,394 |

|

|

|

1,394 |

|

|

|

1,394 |

|

| Other assets |

|

97,737 |

|

|

|

71,784 |

|

|

|

53,184 |

|

|

Total Assets |

$ |

7,698,060 |

|

|

$ |

7,479,029 |

|

|

$ |

7,090,163 |

|

|

|

|

|

|

|

|

| Liabilities and

Shareholders' Equity |

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

Noninterest bearing demand |

$ |

1,909,210 |

|

|

$ |

1,982,912 |

|

|

$ |

1,831,837 |

|

| Interest

bearing transaction |

|

366,986 |

|

|

|

420,417 |

|

|

|

372,947 |

|

| Savings

and money market |

|

2,767,721 |

|

|

|

2,621,146 |

|

|

|

2,794,030 |

|

| Time,

$100,000 or more |

|

598,307 |

|

|

|

515,682 |

|

|

|

455,830 |

|

| Other

time |

|

479,577 |

|

|

|

313,827 |

|

|

|

334,845 |

|

| Total

deposits |

|

6,121,801 |

|

|

|

5,853,984 |

|

|

|

5,789,489 |

|

| Customer repurchase

agreements |

|

48,365 |

|

|

|

76,561 |

|

|

|

82,160 |

|

| Other short-term

borrowings |

|

275,000 |

|

|

|

325,000 |

|

|

|

75,000 |

|

| Long-term

borrowings |

|

217,003 |

|

|

|

216,905 |

|

|

|

216,612 |

|

| Other liabilities |

|

50,711 |

|

|

|

56,141 |

|

|

|

53,860 |

|

|

Total liabilities |

|

6,712,880 |

|

|

|

6,528,591 |

|

|

|

6,217,121 |

|

|

|

|

|

|

|

|

| Shareholders'

Equity |

|

|

|

|

|

| Common stock, par value

$.01 per share; shares authorized 100,000,000, shares |

|

|

|

|

|

| issued

and outstanding 34,303,056, 34,185,163, and 34,110,056,

respectively |

|

341 |

|

|

|

340 |

|

|

|

339 |

|

| Additional paid in

capital |

|

522,316 |

|

|

|

520,304 |

|

|

|

515,656 |

|

| Retained

earnings |

|

467,933 |

|

|

|

431,544 |

|

|

|

358,328 |

|

| Accumulated other

comprehensive loss |

|

(5,410 |

) |

|

|

(1,750 |

) |

|

|

(1,281 |

) |

|

Total Shareholders' Equity |

|

985,180 |

|

|

|

950,438 |

|

|

|

873,042 |

|

|

Total Liabilities and Shareholders' Equity |

$ |

7,698,060 |

|

|

$ |

7,479,029 |

|

|

$ |

7,090,163 |

|

|

|

|

|

|

|

|

| |

|

|

|

| Eagle Bancorp,

Inc. |

|

|

|

| Consolidated

Statements of Income (Unaudited) |

|

|

|

| (dollars in thousands,

except per share data) |

|

|

|

| |

|

| |

Three Months Ended March 31, |

| Interest

Income |

2018 |

|

2017 |

| Interest

and fees on loans |

$ |

84,430 |

|

$ |

72,471 |

| Interest

and dividends on investment securities |

|

3,592 |

|

|

2,833 |

| Interest

on balances with other banks and short-term investments |

|

981 |

|

|

483 |

| Interest

on federal funds sold |

|

46 |

|

|

7 |

| Total

interest income |

|

89,049 |

|

|

75,794 |

| Interest

Expense |

|

|

|

| Interest

on deposits |

|

9,129 |

|

|

5,830 |

| Interest

on customer repurchase agreements |

|

50 |

|

|

38 |

| Interest

on other short-term borrowings |

|

1,111 |

|

|

53 |

| Interest

on long-term borrowings |

|

2,979 |

|

|

2,979 |

| Total

interest expense |

|

13,269 |

|

|

8,900 |

| Net Interest

Income |

|

75,780 |

|

|

66,894 |

| Provision for

Credit Losses |

|

1,969 |

|

|

1,397 |

| Net Interest

Income After Provision For Credit Losses |

|

73,811 |

|

|

65,497 |

| |

|

|

|

| Noninterest

Income |

|

|

|

| Service

charges on deposits |

|

1,614 |

|

|

1,472 |

| Gain on

sale of loans |

|

1,523 |

|

|

2,048 |

| Gain on

sale of investment securities |

|

42 |

|

|

505 |

| Increase

in the cash surrender value of bank owned life

insurance |

|

344 |

|

|

367 |

| Other

income |

|

1,781 |

|

|

1,678 |

| Total

noninterest income |

|

5,304 |

|

|

6,070 |

| Noninterest

Expense |

|

|

|

| Salaries

and employee benefits |

|

16,858 |

|

|

16,677 |

| Premises

and equipment expenses |

|

3,929 |

|

|

3,847 |

| Marketing

and advertising |

|

937 |

|

|

894 |

| Data

processing |

|

2,317 |

|

|

2,041 |

| Legal,

accounting and professional fees |

|

2,973 |

|

|

1,002 |

| FDIC

insurance |

|

675 |

|

|

544 |

| Other

expenses |

|

3,432 |

|

|

4,227 |

| Total

noninterest expense |

|

31,121 |

|

|

29,232 |

| Income Before

Income Tax Expense |

|

47,994 |

|

|

42,335 |

| Income Tax

Expense |

|

12,279 |

|

|

15,318 |

| Net

Income |

$ |

35,715 |

|

$ |

27,017 |

| |

|

|

|

| Earnings Per

Common Share |

|

|

|

|

Basic |

$ |

1.04 |

|

$ |

0.79 |

|

Diluted |

$ |

1.04 |

|

$ |

0.79 |

| |

|

|

|

| |

| Eagle Bancorp, Inc. |

| Consolidated Average Balances, Interest Yields And

Rates (Unaudited) |

| (dollars in thousands) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended March 31, |

| |

2018 |

|

2017 |

|

|

Average Balance |

Interest |

AverageYield/Rate |

|

Average Balance |

Interest |

AverageYield/Rate |

|

ASSETS |

|

|

|

|

|

|

|

| Interest earning

assets: |

|

|

|

|

|

|

|

| Interest

bearing deposits with other banks and other short-term

investments |

$ |

282,440 |

$ |

981 |

1.41 |

% |

|

$ |

272,131 |

$ |

483 |

0.72 |

% |

| Loans

held for sale (1) |

|

24,960 |

|

274 |

4.39 |

% |

|

|

29,378 |

|

283 |

3.85 |

% |

| Loans

(1) (2) |

|

6,433,730 |

|

84,156 |

5.30 |

% |

|

|

5,705,261 |

|

72,188 |

5.13 |

% |

|

Investment securities available for sale (2) |

|

614,064 |

|

3,592 |

2.37 |

% |

|

|

526,210 |

|

2,833 |

2.18 |

% |

| Federal

funds sold |

|

18,341 |

|

46 |

1.02 |

% |

|

|

5,397 |

|

7 |

0.53 |

% |

|

Total interest earning assets |

|

7,373,535 |

|

89,049 |

4.90 |

% |

|

|

6,538,377 |

|

75,794 |

4.70 |

% |

|

|

|

|

|

|

|

|

|

| Total

noninterest earning assets |

|

289,333 |

|

|

|

|

293,094 |

|

|

| Less:

allowance for credit losses |

|

65,383 |

|

|

|

|

59,307 |

|

|

|

Total noninterest earning assets |

|

223,950 |

|

|

|

|

233,787 |

|

|

|

TOTAL ASSETS |

$ |

7,597,485 |

|

|

|

$ |

6,772,164 |

|

|

|

|

|

|

|

|

|

|

|

| LIABILITIES AND

SHAREHOLDERS' EQUITY |

|

|

|

|

|

|

|

| Interest bearing

liabilities: |

|

|

|

|

|

|

|

| Interest

bearing transaction |

$ |

372,893 |

$ |

464 |

0.50 |

% |

|

$ |

331,235 |

$ |

237 |

0.29 |

% |

| Savings

and money market |

|

2,769,722 |

|

5,664 |

0.83 |

% |

|

|

2,690,526 |

|

3,865 |

0.58 |

% |

| Time

deposits |

|

888,083 |

|

3,001 |

1.37 |

% |

|

|

737,777 |

|

1,728 |

0.95 |

% |

|

Total interest bearing deposits |

|

4,030,698 |

|

9,129 |

0.92 |

% |

|

|

3,759,538 |

|

5,830 |

0.63 |

% |

| Customer

repurchase agreements |

|

68,043 |

|

50 |

0.30 |

% |

|

|

69,628 |

|

38 |

0.22 |

% |

| Other

short-term borrowings |

|

238,356 |

|

1,111 |

1.86 |

% |

|

|

31,944 |

|

53 |

0.66 |

% |

|

Long-term borrowings |

|

216,970 |

|

2,979 |

5.49 |

% |

|

|

216,571 |

|

2,979 |

5.50 |

% |

|

Total interest bearing liabilities |

|

4,554,067 |

|

13,269 |

1.18 |

% |

|

|

4,077,681 |

|

8,900 |

0.89 |

% |

|

|

|

|

|

|

|

|

|

|

Noninterest bearing liabilities: |

|

|

|

|

|

|

|

|

Noninterest bearing demand |

|

2,032,319 |

|

|

|

|

1,794,864 |

|

|

| Other

liabilities |

|

44,514 |

|

|

|

|

39,840 |

|

|

|

Total noninterest bearing liabilities |

|

2,076,833 |

|

|

|

|

1,834,704 |

|

|

|

|

|

|

|

|

|

|

|

| Shareholders’

Equity |

|

966,585 |

|

|

|

|

859,779 |

|

|

|

TOTAL LIABILITIES AND SHAREHOLDERS'

EQUITY |

$ |

7,597,485 |

|

|

|

$ |

6,772,164 |

|

|

|

|

|

|

|

|

|

|

|

| Net interest

income |

|

$ |

75,780 |

|

|

|

$ |

66,894 |

|

| Net interest

spread |

|

|

3.72 |

% |

|

|

|

3.81 |

% |

| Net interest

margin |

|

|

4.17 |

% |

|

|

|

4.14 |

% |

| Cost of funds |

|

|

0.73 |

% |

|

|

|

0.56 |

% |

| |

|

|

|

|

|

|

|

| (1) Loans placed on nonaccrual status are included in average

balances. Net loan fees and late charges included in interest

income on loans totaled $4.7 million and $4.0 million for the

three months ended March 31, 2018 and 2017,

respectively. |

| (2)

Interest and fees on loans and investments exclude tax equivalent

adjustments. |

|

|

|

|

| Eagle Bancorp, Inc. |

| Statements of Income and Highlights Quarterly Trends

(Unaudited) |

| (dollars in thousands, except per share data) |

| |

| |

Three Months

Ended |

| |

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

| Income

Statements: |

2018 |

|

2017 |

|

2017 |

|

2017 |

|

2017 |

|

2016 |

|

2016 |

|

2016 |

| Total interest

income |

$ |

89,049 |

|

|

$ |

86,526 |

|

|

$ |

82,370 |

|

|

$ |

79,344 |

|

|

$ |

75,794 |

|

|

$ |

75,795 |

|

|

$ |

72,431 |

|

|

$ |

69,772 |

|

| Total interest

expense |

|

13,269 |

|

|

|

11,167 |

|

|

|

10,434 |

|

|

|

9,646 |

|

|

|

8,900 |

|

|

|

8,771 |

|

|

|

7,703 |

|

|

|

5,950 |

|

| Net interest

income |

|

75,780 |

|

|

|

75,359 |

|

|

|

71,936 |

|

|

|

69,698 |

|

|

|

66,894 |

|

|

|

67,024 |

|

|

|

64,728 |

|

|

|

63,822 |

|

| Provision for credit

losses |

|

1,969 |

|

|

|

4,087 |

|

|

|

1,921 |

|

|

|

1,566 |

|

|

|

1,397 |

|

|

|

2,112 |

|

|

|

2,288 |

|

|

|

3,888 |

|

| Net interest income

after provision for credit losses |

|

73,811 |

|

|

|

71,272 |

|

|

|

70,015 |

|

|

|

68,132 |

|

|

|

65,497 |

|

|

|

64,912 |

|

|

|

62,440 |

|

|

|

59,934 |

|

| Noninterest

income (before investment gains) |

|

5,262 |

|

|

|

9,496 |

|

|

|

6,773 |

|

|

|

6,997 |

|

|

|

5,565 |

|

|

|

6,943 |

|

|

|

6,404 |

|

|

|

7,077 |

|

| Gain on sale of

investment securities |

|

42 |

|

|

|

- |

|

|

|

11 |

|

|

|

26 |

|

|

|

505 |

|

|

|

71 |

|

|

|

1 |

|

|

|

498 |

|

| Total noninterest

income |

|

5,304 |

|

|

|

9,496 |

|

|

|

6,784 |

|

|

|

7,023 |

|

|

|

6,070 |

|

|

|

7,014 |

|

|

|

6,405 |

|

|

|

7,575 |

|

| Salaries and

employee benefits |

|

16,858 |

|

|

|

16,678 |

|

|

|

16,905 |

|

|

|

16,869 |

|

|

|

16,677 |

|

|

|

17,853 |

|

|

|

17,130 |

|

|

|

15,908 |

|

| Premises and

equipment |

|

3,929 |

|

|

|

4,019 |

|

|

|

3,846 |

|

|

|

3,920 |

|

|

|

3,847 |

|

|

|

3,699 |

|

|

|

3,786 |

|

|

|

3,807 |

|

| Marketing and

advertising |

|

937 |

|

|

|

1,222 |

|

|

|

732 |

|

|

|

1,247 |

|

|

|

894 |

|

|

|

944 |

|

|

|

857 |

|

|

|

920 |

|

| Other

expenses |

|

9,397 |

|

|

|

7,884 |

|

|

|

8,033 |

|

|

|

7,965 |

|

|

|

7,814 |

|

|

|

7,284 |

|

|

|

7,065 |

|

|

|

7,660 |

|

| Total noninterest

expense |

|

31,121 |

|

|

|

29,803 |

|

|

|

29,516 |

|

|

|

30,001 |

|

|

|

29,232 |

|

|

|

29,780 |

|

|

|

28,838 |

|

|

|

28,295 |

|

| Income before income

tax expense |

|

47,994 |

|

|

|

50,965 |

|

|

|

47,283 |

|

|

|

45,154 |

|

|

|

42,335 |

|

|

|

42,146 |

|

|

|

40,007 |

|

|

|

39,214 |

|

| Income tax expense |

|

12,279 |

|

|

|

35,396 |

|

|

|

17,409 |

|

|

|

17,382 |

|

|

|

15,318 |

|

|

|

16,429 |

|

|

|

15,484 |

|

|

|

15,069 |

|

| Net income |

|

35,715 |

|

|

|

15,569 |

|

|

|

29,874 |

|

|

|

27,772 |

|

|

|

27,017 |

|

|

|

25,717 |

|

|

|

24,523 |

|

|

|

24,145 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Per Share

Data: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Earnings per weighted

average common share, basic |

$ |

1.04 |

|

|

$ |

0.46 |

|

|

$ |

0.87 |

|

|

$ |

0.81 |

|

|

$ |

0.79 |

|

|

$ |

0.76 |

|

|

$ |

0.73 |

|

|

$ |

0.72 |

|

| Earnings per weighted

average common share, diluted |

$ |

1.04 |

|

|

$ |

0.45 |

|

|

$ |

0.87 |

|

|

$ |

0.81 |

|

|

$ |

0.79 |

|

|

$ |

0.75 |

|

|

$ |

0.72 |

|

|

$ |

0.71 |

|

| Weighted average common

shares outstanding, basic |

|

34,260,882 |

|

|

|

34,179,793 |

|

|

|

34,173,893 |

|

|

|

34,128,598 |

|

|

|

34,069,528 |

|

|

|

33,650,963 |

|

|

|

33,590,183 |

|

|

|

33,588,141 |

|

| Weighted average common

shares outstanding, diluted |

|

34,406,310 |

|

|

|

34,334,873 |

|

|

|

34,338,442 |

|

|

|

34,324,120 |

|

|

|

34,284,316 |

|

|

|

34,233,940 |

|

|

|

34,187,171 |

|

|

|

34,183,209 |

|

| Actual shares

outstanding at period end |

|

34,303,056 |

|

|

|

34,185,163 |

|

|

|

34,174,009 |

|

|

|

34,169,924 |

|

|

|

34,110,056 |

|

|

|

34,023,850 |

|

|

|

33,590,880 |

|

|

|

33,584,898 |

|

| Book value per common

share at period end |

$ |

28.72 |

|

|

$ |

27.80 |

|

|

$ |

27.33 |

|

|

$ |

26.42 |

|

|

$ |

25.59 |

|

|

$ |

24.77 |

|

|

$ |

24.28 |

|

|

$ |

23.48 |

|

| Tangible book value per

common share at period end (1) |

$ |

25.60 |

|

|

$ |

24.67 |

|

|

$ |

24.19 |

|

|

$ |

23.28 |

|

|

$ |

22.45 |

|

|

$ |

21.61 |

|

|

$ |

21.08 |

|

|

$ |

20.27 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Performance

Ratios (annualized): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average

assets |

|

1.91 |

% |

|

|

0.82 |

% |

|

|

1.66 |

% |

|

|

1.60 |

% |

|

|

1.62 |

% |

|

|

1.46 |

% |

|

|

1.50 |

% |

|

|

1.57 |

% |

| Return on average

common equity |

|

14.99 |

% |

|

|

6.49 |

% |

|

|

12.86 |

% |

|

|

12.51 |

% |

|

|

12.74 |

% |

|

|

12.26 |

% |

|

|

12.04 |

% |

|

|

12.40 |

% |

| Net interest

margin |

|

4.17 |

% |

|

|

4.13 |

% |

|

|

4.14 |

% |

|

|

4.16 |

% |

|

|

4.14 |

% |

|

|

3.95 |

% |

|

|

4.11 |

% |

|

|

4.30 |

% |

| Efficiency ratio

(2) |

|

38.38 |

% |

|

|

35.12 |

% |

|

|

37.49 |

% |

|

|

39.10 |

% |

|

|

40.06 |

% |

|

|

40.22 |

% |

|

|

40.54 |

% |

|

|

39.63 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other

Ratios: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Allowance for credit

losses to total loans (3) |

|

1.00 |

% |

|

|

1.01 |

% |

|

|

1.03 |

% |

|

|

1.02 |

% |

|

|

1.03 |

% |

|

|

1.04 |

% |

|

|

1.04 |

% |

|

|

1.05 |

% |

| Allowance for credit

losses to total nonperforming loans |

|

491.56 |

% |

|

|

489.20 |

% |

|

|

379.11 |

% |

|

|

356.00 |

% |

|

|

416.91 |

% |

|

|

330.49 |

% |

|

|

255.29 |

% |

|

|

264.44 |

% |

| Nonperforming loans to

total loans (3) |

|

0.20 |

% |

|

|

0.21 |

% |

|

|

0.27 |

% |

|

|

0.29 |

% |

|

|

0.25 |

% |

|

|

0.31 |

% |

|

|

0.41 |

% |

|

|

0.40 |

% |

| Nonperforming assets to

total assets |

|

0.19 |

% |

|

|

0.20 |

% |

|

|

0.24 |

% |

|

|

0.26 |

% |

|

|

0.22 |

% |

|

|

0.30 |

% |

|

|

0.41 |

% |

|

|

0.39 |

% |

| Net charge-offs

(annualized) to average loans (3) |

|

0.06 |

% |

|

|

0.15 |

% |

|

|

0.00 |

% |

|

|

0.02 |

% |

|

|

0.04 |

% |

|

|

-0.01 |

% |

|

|

0.14 |

% |

|

|

0.15 |

% |

| Tier 1 capital (to

average assets) |

|

11.76 |

% |

|

|

11.45 |

% |

|

|

11.78 |

% |

|

|

11.61 |

% |

|

|

11.51 |

% |

|

|

10.72 |

% |

|

|

11.12 |

% |

|

|

11.24 |

% |

| Total capital (to risk

weighted assets) |

|

15.32 |

% |

|

|

15.02 |

% |

|

|

15.30 |

% |

|

|

15.13 |

% |

|

|

14.97 |

% |

|

|

14.89 |

% |

|

|

15.05 |

% |

|

|

12.71 |

% |

| Common equity tier 1

capital (to risk weighted assets) |

|

11.57 |

% |

|

|

11.23 |

% |

|

|

11.40 |

% |

|

|

11.18 |

% |

|

|

10.97 |

% |

|

|

10.80 |

% |

|

|

10.83 |

% |

|

|

10.74 |

% |

| Tangible common equity

ratio (1) |

|

11.57 |

% |

|

|

11.44 |

% |

|

|

11.35 |

% |

|

|

11.15 |

% |

|

|

10.97 |

% |

|

|

10.84 |

% |

|

|

10.64 |

% |

|

|

10.88 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

Balances (in thousands): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Total assets |

$ |

7,597,485 |

|

|

$ |

7,487,624 |

|

|

$ |

7,128,769 |

|

|

$ |

6,959,994 |

|

|

$ |

6,772,164 |

|

|

$ |

6,984,492 |

|

|

$ |

6,492,274 |

|

|

$ |

6,191,164 |

|

| Total earning

assets |

$ |

7,373,535 |

|

|

$ |

7,242,994 |

|

|

$ |

6,897,613 |

|

|

$ |

6,728,055 |

|

|

$ |

6,538,377 |

|

|

$ |

6,754,935 |

|

|

$ |

6,266,311 |

|

|

$ |

5,968,488 |

|

| Total loans |

$ |

6,433,730 |

|

|

$ |

6,207,505 |

|

|

$ |

5,946,411 |

|

|

$ |

5,895,174 |

|

|

$ |

5,705,261 |

|

|

$ |

5,591,790 |

|

|

$ |

5,422,677 |

|

|

$ |

5,266,305 |

|

| Total deposits |

$ |

6,063,017 |

|

|

$ |

6,101,727 |

|

|

$ |

5,827,953 |

|

|

$ |

5,660,119 |

|

|

$ |

5,554,402 |

|

|

$ |

5,796,516 |

|

|

$ |

5,353,834 |

|

|

$ |

5,178,501 |

|

| Total borrowings |

$ |

523,369 |

|

|

$ |

382,687 |

|

|

$ |

344,959 |

|

|

$ |

375,124 |

|

|

$ |

318,143 |

|

|

$ |

312,842 |

|

|

$ |

300,083 |

|

|

$ |

207,221 |

|

| Total shareholders’

equity |

$ |

966,585 |

|

|

$ |

951,727 |

|

|

$ |

921,493 |

|

|

$ |

890,498 |

|

|

$ |

859,779 |

|

|

$ |

834,823 |

|

|

$ |

809,973 |

|

|

$ |

783,318 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Tangible common equity to tangible assets (the

"tangible common equity ratio") and tangible book value per common

share are non-GAAP financial measures derived from GAAP based

amounts. The Company calculates the tangible common

equity ratio by excluding the balance of intangible assets

from common shareholders' equity and dividing by tangible assets.

The Company calculates tangible book value per common share by

dividing tangible common equity by common shares

outstanding, as compared to book value per common share, which

the Company calculates by dividing common shareholders' equity by

common shares outstanding. The Company considers this information

important to shareholders as tangible equity is a measure that

is consistent with the calculation of capital for bank regulatory

purposes, which excludes intangible assets from the calculation of

risk based ratios and as such is useful for investors, regulators,

management and others to evaluate capital adequacy and to

compare against other financial institutions. |

| (2) Computed by dividing noninterest expense by the

sum of net interest income and noninterest income. |

| (3) Excludes loans held for sale. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EAGLE BANCORP,

INC.CONTACT:Michael T.

Flynn301.986.1800

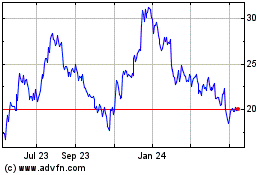

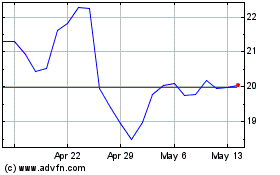

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Nov 2023 to Nov 2024