Eagle Bancorp, Inc. Denies Allegations In Deceptive And Misleading Report

December 01 2017 - 9:06PM

Early this morning, Aurelius Value—an anonymous online firm that

supports short-sellers—published a deceptive and materially

misleading piece about Eagle Bancorp (“Eagle”). Eagle

categorically rejects the assertions and implications in the

piece.

Based on a 36 percent increase in short

positions month over month leading up to the release of the

article, it appears that the goal of this piece was to manipulate

and depress Eagle’s stock price. The piece, which was issued

without contacting Eagle for comment, is filled with demonstrable

falsehoods and material omissions. For example:

- Selective Quoting of Baseless Allegations from

Meritless Lawsuits. The internet piece relies on

unsubstantiated claims in two pending lawsuits. Aurelius

fails to disclose that Eagle is not even a party to one of them and

thus has had no reason to address the allegations. Eagle has

moved to dismiss the other lawsuit in its entirety. It is

utterly frivolous. While it may further Aurelius’ financial

purpose to selectively quote from these lawsuits and omit material

information that investors would surely consider important, such

behavior is both disturbing and misleading.

- All Loans Referenced in the Piece Fully Meet Legal

Requirements. The only credit issued by Eagle to the

identified executive was a line of credit in case of an overdraft;

the line never was used and has not been funded. Eagle takes

seriously its obligation to comply with all applicable laws and

regulations, including Regulation O. Its compliance is regularly

examined internally, and is also examined by agency regulators.

Contrary to the misrepresentations by Aurelius, the loans

identified in the piece were not made to the identified executive,

and, in any event, were approved and disclosed (where required) in

compliance with Regulation O.

- Mischaracterization of Stock

Transactions. Contrary to the incorrect assertions

in the piece, the referenced stock sales by an Eagle executive

constituted only a small fraction of his holdings. The

majority of the proceeds of those sales was used to further

charitable purposes. There have been no non-routine stock

sales by Eagle executive management.

- Falsehoods About “Distressed” Loans. The

piece’s claim that two alleged related party loans are distressed

is false. Those loans are current and performing.

These are but a few examples of the blatant

mischaracterizations, falsehoods, and misleading statements in the

Aurelius Value report. Eagle categorically rejects the

assertions and implications in the piece.

Eagle was founded on, and remains strongly

committed to, abiding by the law and the highest professional and

ethical standards.

EagleBankCorp.com 301.986.1800

MD | VA

| DC

About Eagle Bancorp, Inc. and EagleBankEagle Bancorp, Inc. is

the holding company for EagleBank, which commenced operations in

1998. EagleBank is headquartered in Bethesda, Maryland, and

conducts full service commercial banking through 21 offices,

located in Montgomery County, Maryland, Washington, D.C. and

Northern Virginia. EagleBank focuses on building relationships with

businesses, professionals and individuals in its marketplace.

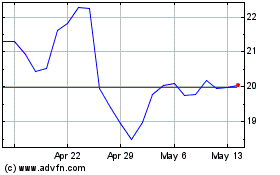

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Oct 2024 to Nov 2024

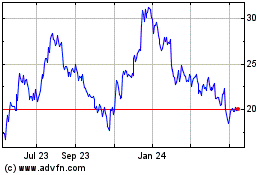

Eagle Bancorp (NASDAQ:EGBN)

Historical Stock Chart

From Nov 2023 to Nov 2024