Highlights:

Dorman Products, Inc. (the “Company” or “Dorman”) (NASDAQ:DORM), a

leading supplier in the automotive aftermarket, today announced its

financial results for the first quarter ended March 30, 2019.

1st Quarter Financial

ResultsThe Company reported first quarter 2019 net sales

of $243.8 million, up 7% compared to net sales of $227.3 million in

the first quarter of 2018. Sales growth in the quarter attributable

to acquisitions was approximately 2%. Increasing sales order rates

and site consolidation activities in the first quarter of 2019

resulted in backlog of approximately 3% of 2019 net sales which

will be realized in future quarters.

Gross profit was $87.5 million in the first

quarter compared to $88.6 million last year. Gross profit

percentage for the first quarter was 35.9% compared to 39.0% in the

same quarter last year. The adjusted gross profit percentage was

36.0% in the quarter compared to 39.4% in the same quarter last

year. The gross profit percentage declined primarily as a result of

the pass-through of tariff costs to our customers (~130bps),

acquisitions completed in the last 12 months which carry lower

gross margins compared to our historical levels (~100bps), and

increased spending due to startup inefficiencies and backlog growth

related to our site consolidation activities (~40bps). Compared to

last year, the gross margin percentage was also impacted by the

rollout of a significant new chassis program which carried higher

costs in the first quarter this year.

Selling, general and administrative (“SG&A”)

expenses grew 19% to $57.8 million, or 23.7% of net sales, in the

first quarter of 2019 compared to $48.6 million, or 21.4% of net

sales, in the same quarter last year. Adjusted SG&A expenses

increased 14% to $54.8 million, or 22.5% of net sales, in the

quarter compared to $48.1 million, or 21.1% of net sales, in the

same quarter last year. The increase in SG&A expenses was

primarily due to increased spending and inefficiencies related to

our site consolidation activities, the inclusion of expenses of

acquired operations, higher factoring costs due to increased

interest rates and sales volume, and wage and benefit

inflation.

Income tax expense was $6.4 million in the first

quarter of 2019, or 21.4% of income before income taxes, down from

$9.5 million, or 23.7% of income before income taxes, recorded in

the same quarter last year. The reduction in tax rate compared to

prior year is primarily a result of lower foreign and state

taxes.

Net income for the first quarter of 2019 was

$23.4 million, or $0.71 per diluted share, compared to $30.6

million, or $0.93 per diluted share, in the prior year quarter.

Adjusted net income in the first quarter was $25.8 million, or

$0.79 per diluted share, compared to $31.7 million, or $0.96 per

diluted share, in the prior year quarter.

Please refer to the Non-GAAP Financial Measures

reported in the supplemental schedules at the end of this release

for a detailed reconciliation of the reported (GAAP) financial

information to the adjusted financial information

(Non-GAAP).

We were engaged in several site consolidation

activities during the first quarter of 2019. Most significantly, we

completed the consolidation of our Montreal facility (acquired as

part of the MAS acquisition) into our new 800,000 square foot

distribution center in Portland, Tennessee. We also completed the

consolidation of a production facility in Michigan with our Flight

facility in Pennsylvania. Additionally, we began to transfer our

existing distribution operations in Portland to our new Portland

distribution center. During the first quarter of 2019, we incurred

approximately $2.4 million of severance, accelerated depreciation,

and other integration expenses related to these site consolidation

activities which are excluded from the calculation of adjusted net

income (Non-GAAP).

During the first quarter of 2019, our operations

costs were $3.1 million higher than in the same period in 2018 due

to startup inefficiencies and redundant facility capacity related

to our site consolidation activities, with approximately $1.0

million included in gross margin and $2.1 million included in

SG&A expenses. We anticipate that we will incur higher costs

throughout 2019 as we complete the consolidation of our Portland

facilities. The impact of these costs is included in our 2019

diluted EPS guidance.

Kevin Olsen, Dorman Products President and Chief

Executive Officer, stated: “2019 started out slow from an orders

perspective but picked up significantly as we moved through the

quarter. Given the planned consolidation activities, combined with

high March sales volumes, we exited the quarter with higher than

normal backlog and realized higher than normal operational

expenses. We expect backlog to normalize during the second quarter

and operational costs to moderate as we move through 2019

concluding with the final consolidation of our Portland facilities

later in the year. These consolidations set us up well for the

future and are expected to enable increased productivity and

capacity to support future growth.”

Mr. Olsen continued: “Our end markets remain

very healthy. We exited the quarter with POS (our customer’s point

of sale) up high-single digits over last year and our new product

pipeline remains robust. We continued to launch new products at a

very healthy pace and expect to deliver our full year goals. During

the first quarter, we also successfully launched a significant new

chassis program to a major retail customer which increases our

penetration in this targeted growth category. I’d like to thank our

many Dorman contributors who were called upon to execute both the

site consolidation activities and the launch of one of the largest

new programs in our Company’s history.”

2019 GuidanceThe Company

confirms its previous 2019 guidance of estimated net sales growth

of between 6%-10% for 2019 and expected diluted EPS of between

$4.22 and $4.38 on a GAAP basis and adjusted diluted EPS of between

$4.37 and $4.53 or between a 4% and 8% growth rate. Please refer to

the 2019 Guidance table at the end of this release for a detailed

reconciliation of the forecasted (GAAP) financial information to

the forecasted adjusted financial information (Non-GAAP). Tariffs

are not expected to have an impact on our 2019 net income, but will

lower our gross and operating profit percentages as these

additional costs are expected to be passed through to customers. We

have not assumed any share repurchases in this guidance.

Share RepurchasesUnder its

share repurchase program, Dorman repurchased 101.0 thousand shares

of its common stock for $8.4 million at an average share price of

$82.89 during the quarter ended March 30, 2019. The Company has

$174.9 million left under its current share repurchase

authorization.

About Dorman ProductsDorman

Products, Inc. is a leading supplier of Dealer “Exclusive”

replacement parts to the Automotive, Medium and Heavy Duty

Aftermarkets. Dorman products are marketed under the Dorman®, OE

Solutions™, HELP!®, AutoGrade™, First Stop™, Conduct‑Tite®,

TECHoice™, Dorman® Hybrid Drive Batteries and Dorman HD Solutions™

brand names.

Non-GAAP MeasuresIn addition to

the financial measures prepared in accordance with generally

accepted accounting principles (GAAP), this earnings release also

contains Non-GAAP financial measures. The reasons why we believe

these measures provide useful information to investors and a

reconciliation of these measures to the most directly comparable

GAAP measures and other information relating to these Non-GAAP

measures are included in the supplemental schedules attached.

Forward-Looking StatementsThis

press release contains “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995,

including statements related to the Company’s site consolidation

activities, backlog converting to net sales, operational costs,

productivity, capacity, future growth, full year goals, net sales,

diluted EPS, adjusted diluted EPS and future growth rates. Words

such as “believe,” “demonstrate,” “expect,” “estimate,” “forecast,”

“anticipate,” “should,” “will” and “likely” and similar expressions

identify forward-looking statements. However, the absence of these

words does not mean the statements are not forward-looking. In

addition, statements that are not historical should also be

considered forward-looking statements. Readers are cautioned not to

place undue reliance on those forward-looking statements, which

speak only as of the date the statement was made. Such

forward-looking statements are based on current expectations that

involve a number of known and unknown risks, uncertainties and

other factors (many of which are outside of our control) which may

cause actual events to be materially different from those expressed

or implied by such forward-looking statements. These risks,

uncertainties and other factors include, but are not limited to:

(i) competition in the automotive aftermarket; (ii) unfavorable

economic conditions; (iii) the loss or decrease in sales among one

of our top customers; (iv) customer consolidation in the automotive

aftermarket; (v) foreign currency fluctuations and our dependence

on foreign suppliers; (vi) extending credit to customers; (vii) the

loss of a key vendor; (viii) limited customer shelf space; (ix)

reliance on new product development; (x) changes in automotive

technology and improvements in the quality of new vehicle parts;

(xi) claims of intellectual property infringement; (xii) quality

problems with products after their production and sale to

customers; (xiii) loss of third party transportation providers on

whom we depend; (xiv) unfavorable results of legal proceedings;

(xv) our executive chairman and his family owning a significant

portion of the Company; (xvi) operations may be subject to

quarterly fluctuations and disruptions from events beyond our

control; (xvii) regulations related to conflict minerals; (xviii)

cyber-attacks; (xix) imposition of taxes, duties or tariffs; (xx)

exposure to risks related to accounts receivable; (xxi) volatility

in the market price of our common stock and potential securities

class action litigation; (xxii) losing the services of our

executive officers or other highly qualified and experienced

contributors; and (xxiii) the inability to identify suitable

acquisition candidates, complete acquisitions or integrate

acquisitions successfully. Should one or more of these risks or

uncertainties materialize, or should underlying assumptions prove

incorrect, actual results may vary materially from those

anticipated, estimated or projected. For additional information

concerning factors that could cause actual results to differ

materially from the information contained in this press release,

reference is made to the information in Part I, “Item 1A Risk

Factors” in the Company’s Annual Report on Form 10-K for the fiscal

year ended December 29, 2018. The Company is under no obligation to

(and expressly disclaims any such obligation to) update any of the

information in this press release if any forward-looking statement

later turns out to be inaccurate whether as a result of new

information, future events or otherwise.

Investor Relations ContactDavid

Hession, SVP and Chief Financial

Officerdhession@dormanproducts.com(215) 997-1800

Visit our website

at: www.dormanproducts.com

| |

| DORMAN PRODUCTS, INC. AND

SUBSIDIARIES |

| Consolidated Statements of Operations |

| (in thousands, except per-share amounts) |

| |

|

|

|

13 Weeks |

|

|

13 Weeks |

|

| First Quarter

(unaudited) |

|

03/30/19 |

|

|

Pct. |

|

|

03/31/18 |

|

|

Pct. |

|

| Net sales |

|

$ |

243,791 |

|

|

|

100.0 |

|

|

$ |

227,262 |

|

|

|

100.0 |

|

| Cost of goods sold |

|

|

156,299 |

|

|

|

64.1 |

|

|

|

138,627 |

|

|

|

61.0 |

|

| Gross profit |

|

|

87,492 |

|

|

|

35.9 |

|

|

|

88,635 |

|

|

|

39.0 |

|

| Selling, general and

administrative expenses |

|

|

57,750 |

|

|

|

23.7 |

|

|

|

48,641 |

|

|

|

21.4 |

|

| Income from

operations |

|

|

29,742 |

|

|

|

12.2 |

|

|

|

39,994 |

|

|

|

17.6 |

|

| Other income, net |

|

|

29 |

|

|

|

0.0 |

|

|

|

152 |

|

|

|

0.1 |

|

| Income before income

taxes |

|

|

29,771 |

|

|

|

12.2 |

|

|

|

40,146 |

|

|

|

17.7 |

|

| Provision for income

taxes |

|

|

6,364 |

|

|

|

2.6 |

|

|

|

9,499 |

|

|

|

4.2 |

|

| Net income |

|

$ |

23,407 |

|

|

|

9.6 |

|

|

$ |

30,647 |

|

|

|

13.5 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Diluted earnings per

share |

|

$ |

0.71 |

|

|

|

|

|

|

$ |

0.93 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

diluted shares outstanding |

|

|

32,889 |

|

|

|

|

|

|

|

33,003 |

|

|

|

|

|

| DORMAN PRODUCTS, INC. AND

SUBSIDIARIES |

| Condensed Consolidated Balance Sheets |

| (in thousands) |

| (Unaudited) |

| |

|

|

|

03/30/19 |

|

|

12/29/18 |

|

|

Assets: |

|

|

|

|

|

|

|

|

| Cash and cash

equivalents |

|

$ |

40,794 |

|

|

$ |

43,458 |

|

| Accounts

receivable |

|

|

297,509 |

|

|

|

310,114 |

|

| Inventories |

|

|

288,862 |

|

|

|

270,504 |

|

| Prepaid expenses |

|

|

7,409 |

|

|

|

5,652 |

|

| Total current

assets |

|

|

634,574 |

|

|

|

629,728 |

|

| Property, plant &

equipment, net |

|

|

101,395 |

|

|

|

98,647 |

|

| Right of use assets

[1] |

|

|

34,819 |

|

|

|

- |

|

| Goodwill and other

intangible assets, net |

|

|

97,264 |

|

|

|

97,770 |

|

| Deferred income taxes,

net |

|

|

6,230 |

|

|

|

6,228 |

|

| Other assets |

|

|

53,200 |

|

|

|

55,184 |

|

| Total assets |

|

$ |

927,482 |

|

|

|

887,557 |

|

| Liabilities

& shareholders’ equity: |

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

98,281 |

|

|

$ |

109,096 |

|

| Accrued expenses and

other [1] |

|

|

35,635 |

|

|

|

32,494 |

|

| Total current

liabilities |

|

|

133,916 |

|

|

|

141,590 |

|

| Long-term lease

liabilities [1] |

|

|

32,856 |

|

|

|

- |

|

| Other long-term

liabilities |

|

|

19,003 |

|

|

|

18,344 |

|

| Shareholders’

equity |

|

|

741,707 |

|

|

|

727,623 |

|

| Total liabilities and

equity |

|

$ |

927,482 |

|

|

$ |

887,557 |

|

[1] - The Company adopted Accounting Standard

Codification 842 – Leases (“ASC 842”) during the first quarter

ended March 30, 2019, using the modified retrospective approach,

which does not require prior periods to be restated.

Selected Cash Flow Information

(unaudited):

|

|

|

13 Weeks (unaudited) |

|

| (in thousands) |

|

03/30/19 |

|

|

03/31/18 |

|

| Depreciation,

amortization and accretion |

|

$ |

7,265 |

|

|

$ |

6,378 |

|

| Capital

expenditures |

|

$ |

8,838 |

|

|

$ |

6,276 |

|

| |

|

|

|

|

|

|

|

|

DORMAN PRODUCTS, INC. AND

SUBSIDIARIESNon-GAAP Financial Measures(in thousands,

except per-share amounts)

Our financial results include certain financial

measures not derived in accordance with generally accepted

accounting principles (GAAP). Non-GAAP financial measures should

not be used as a substitute for GAAP measures, or considered in

isolation, for the purpose of analyzing our operating performance,

financial position or cash flows. Additionally, these non-GAAP

measures may not be comparable to similarly titled measures

reported by other companies. However, we have presented these

non-GAAP financial measures because we believe this presentation,

when reconciled to the corresponding GAAP measure, provides useful

information to investors by offering additional ways of viewing our

results, profitability trends, and underlying growth relative to

prior and future periods and to our peers. Non-GAAP financial

measures may reflect adjustments for charges such as fair value

adjustments, amortization, transaction costs, severance,

accelerated depreciation, and other similar expenses related to

acquisitions as well as other items that are not related to our

ongoing performance.

Adjusted Net Income:

|

|

|

13 Weeks |

|

|

13 Weeks |

|

|

(unaudited) |

|

03/30/19 |

|

|

03/31/18 |

|

| Net income (GAAP) |

|

$ |

23,407 |

|

|

$ |

30,647 |

|

| Pretax

acquisition-related inventory fair value adjustment [1] |

|

|

129 |

|

|

|

899 |

|

| Pretax

acquisition-related intangible assets amortization [2] |

|

|

616 |

|

|

|

500 |

|

| Pretax

acquisition-related transaction and other costs [3] |

|

|

2,453 |

|

|

|

80 |

|

| Tax adjustment (related

to above items) [4] |

|

|

(783 |

) |

|

|

(396 |

) |

| Adjusted net income

(Non-GAAP) |

|

$ |

25,822 |

|

|

$ |

31,730 |

|

| |

|

|

|

|

|

|

|

|

| Adjusted

Diluted Earnings Per Share: |

|

|

|

|

|

|

|

|

|

|

|

13 Weeks |

|

|

13 Weeks |

|

|

(unaudited) |

|

03/30/19 * |

|

|

03/31/18 * |

|

| Diluted earnings per

share (GAAP) |

|

$ |

0.71 |

|

|

$ |

0.93 |

|

| Pretax

acquisition-related inventory fair value adjustment [1] |

|

|

0.00 |

|

|

|

0.03 |

|

| Pretax

acquisition-related intangible assets amortization [2] |

|

|

0.02 |

|

|

|

0.02 |

|

| Pretax

acquisition-related transaction and other costs [3] |

|

|

0.07 |

|

|

|

0.00 |

|

| Tax adjustment (related

to above items) [4] |

|

|

(0.02 |

) |

|

|

(0.01 |

) |

| Adjusted diluted

earnings per share (Non-GAAP) |

|

$ |

0.79 |

|

|

$ |

0.96 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average

diluted shares outstanding |

|

|

32,889 |

|

|

|

33,003 |

|

* Adjusted diluted earnings per share (Non-GAAP)

may not add due to rounding.

[1] – Pretax acquisition-related inventory fair

value adjustments result from adjusting the value of acquired

inventory from historical cost to fair value. Such costs were $0.1

million pretax (or $0.1 million after tax) during the thirteen

weeks ended March 30, 2019 and were included in Cost of Goods

Sold.

[2] – Pretax acquisition-related intangible

asset amortization results from allocating the purchase price of

acquisitions to the acquired tangible and intangible assets of the

acquired business and recognizing the cost of the intangible asset

over the period of benefit. Exclusion of this amortization expense

facilitates more consistent comparisons of operating results over

time between our newly acquired and long-held businesses, and with

both acquisitive and non-acquisitive peer companies. We believe it

is important for investors to understand that such intangible

assets contribute to sales generation and that intangible asset

amortization related to past acquisitions will recur in future

periods until such intangible assets have been fully amortized.

Such costs were $0.6 million pretax (or $0.5 million after tax)

during the thirteen weeks ended March 30, 2019 and were included in

Selling, General and Administrative expenses.

DORMAN PRODUCTS, INC. AND

SUBSIDIARIESNon-GAAP Financial Measures(in thousands,

except per-share amounts)

[3] – Pretax acquisition-related transaction and

other costs include costs incurred to complete and integrate

acquisitions as well as adjustments to contingent consideration

obligations. During the thirteen weeks ended March 30, 2019, we

incurred charges for integration costs, severance, and other plant

closure expenses of $1.6 million pretax (or $1.1 million after tax)

and accelerated depreciation of $0.8 million pretax (or $0.6

million after tax). Each of these were included in Selling, General

and Administrative expenses. Additionally, we recorded inventory

transfer costs of $0.1 million pretax ($0.1 million after tax)

during the thirteen weeks ended March 30, 2019 which was included

in Cost of Goods Sold.

[4] – Tax adjustments represent the aggregate

tax effect of all Non-GAAP adjustments reflected in the table above

of $0.8 million during the thirteen weeks ended March 30, 2019.

Such items are estimated by applying our overall estimated tax rate

to the pretax amount, or, by applying a specific tax rate if one is

appropriate.

Adjusted Gross Profit:

|

|

|

13 Weeks |

|

|

13 Weeks |

|

|

(unaudited) |

|

03/30/19 |

|

|

Pct.* |

|

|

03/31/18 |

|

|

Pct. |

|

| Gross profit (GAAP) |

|

$ |

87,492 |

|

|

|

35.9 |

|

|

$ |

88,635 |

|

|

|

39.0 |

|

| Pretax

acquisition-related inventory fair value adjustment |

|

|

129 |

|

|

|

0.1 |

|

|

|

899 |

|

|

|

0.4 |

|

| Pretax

acquisition-related transaction and other costs |

|

|

133 |

|

|

|

0.1 |

|

|

|

- |

|

|

|

0.0 |

|

| Adjusted gross profit

(Non-GAAP) |

|

$ |

87,754 |

|

|

|

36.0 |

|

|

$ |

89,534 |

|

|

|

39.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

243,791 |

|

|

|

|

|

|

$ |

227,262 |

|

|

|

|

|

* Percentage of sales information does not add

due to rounding.

Adjusted SG&A Expenses:

|

|

|

13 Weeks |

|

|

13 Weeks |

|

|

(unaudited) |

|

03/30/19 |

|

|

Pct. |

|

|

03/31/18 |

|

|

Pct. |

|

| SG&A expenses

(GAAP) |

|

$ |

57,750 |

|

|

|

23.7 |

|

|

$ |

48,641 |

|

|

|

21.4 |

|

| Pretax

acquisition-related intangible assets amortization |

|

|

(616 |

) |

|

|

(0.3 |

) |

|

|

(580 |

) |

|

|

(0.3 |

) |

| Pretax

acquisition-related transaction and other costs |

|

|

(2,320 |

) |

|

|

(0.9 |

) |

|

|

- |

|

|

|

- |

|

| Adjusted SG&A

expenses (Non-GAAP) |

|

$ |

54,814 |

|

|

|

22.5 |

|

|

$ |

48,061 |

|

|

|

21.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

|

$ |

243,791 |

|

|

|

|

|

|

$ |

227,262 |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

DORMAN PRODUCTS, INC. AND

SUBSIDIARIESNon-GAAP Financial Measures(in thousands,

except per-share amounts)

2019 Guidance:

The Company provided the following guidance

ranges related to their fiscal 2019 outlook:

|

|

|

December 28, 2019 |

|

| Fiscal Year

Ended (unaudited) |

|

Low End* |

|

|

High End* |

|

| Diluted earnings per

share (GAAP) |

|

$ |

4.22 |

|

|

$ |

4.38 |

|

| Pretax

acquisition-related inventory fair value adjustment [1] |

|

|

0.00 |

|

|

|

0.00 |

|

| Pretax

acquisition-related intangible assets amortization [2] |

|

|

0.08 |

|

|

|

0.08 |

|

| Pretax

acquisition-related transaction and other costs [1] [2] |

|

|

0.10 |

|

|

|

0.10 |

|

| Tax adjustments

(related to above items) [3] |

|

|

(0.04 |

) |

|

|

(0.04 |

) |

| Adjusted diluted

earnings per share (Non-GAAP) |

|

$ |

4.37 |

|

|

$ |

4.53 |

|

| |

|

|

|

|

|

|

|

|

| Weighted average

diluted shares outstanding |

|

|

33,207 |

|

|

|

33,207 |

|

| |

|

|

|

|

|

|

|

|

| [1] - Included in Cost

of Goods Sold |

|

|

|

|

|

|

|

|

| [2] - Included in

Selling, General and Administrative Expenses |

|

|

|

|

|

|

|

|

| [3] - Included in

Provision for Income Taxes |

|

|

|

|

|

|

|

|

* Adjusted diluted earnings per share (Non-GAAP)

may not add due to rounding.

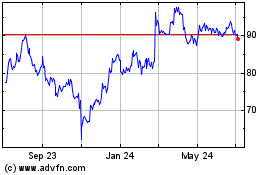

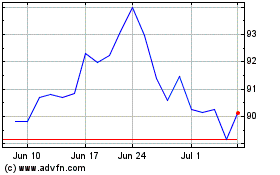

Dorman Products (NASDAQ:DORM)

Historical Stock Chart

From Aug 2024 to Sep 2024

Dorman Products (NASDAQ:DORM)

Historical Stock Chart

From Sep 2023 to Sep 2024