Company Exceeds Expectations Across all

Guided Metrics

Subscription Portion of Annual Recurring

Revenue (ARR) of $582 million; Growth of 60% Year-over-Year

Total ARR of $774 million; Growth of 36%

Year-over-Year

Subscription Revenue of $472.0 million for Full

Year 2023; Growth of 68% Year-Over-Year

Record Total Revenue of $751.9 million for Full

Year 2023; Growth Accelerates to 27% Year-Over-Year

Net Cash Provided by Operating Activities of

$56.2 million for the Full Year 2023

CyberArk (NASDAQ: CYBR), the identity security company, today

announced strong financial results for the fourth quarter and full

year ended December 31, 2023.

“2023 was a momentous year for CyberArk and with our excellence

in execution, we solidified our position as the leader in identity

security,” said Matt Cohen, CyberArk's Chief Executive Officer.

“Throughout the year, we consistently delivered strong results,

including in the fourth quarter where top line growth accelerated,

operating income and cash flow increased, and we again beat

expectations across all guided metrics. Record demand for our SaaS

solutions drove our subscription bookings mix to 95 percent in 2023

and recurring revenue reached 90 percent of our total revenue – we

are now a fully recurring revenue company. The momentum in our

business and our platform selling motion is demonstrated by our ARR

reaching $774 million and growing 36 percent as well as our

Subscription ARR reaching $582 million, growing 60 percent, with a

record for net new Subscription ARR of $78 million in the fourth

quarter. Our identity security platform is applying the right level

of controls across all identities, human or machine, regardless of

environment. In today’s threat landscape, our platform and security

first approach are a business imperative, resulting in customers

consolidating on our identity platform. With our execution in 2023,

we enter 2024 in a position of strength, poised to continue to

deliver durable growth, profitability, and cash flow.”

Financial Summary for the Fourth Quarter Ended December 31,

2023

- Subscription revenue was $150.3 million in the fourth quarter

of 2023, an increase of 70 percent from $88.5 million in the fourth

quarter of 2022.

- Maintenance and professional services revenue was $64.8 million

in the fourth quarter of 2023, compared to $66.1 million in the

fourth quarter of 2022.

- Perpetual license revenue was $8.0 million in the fourth

quarter of 2023, compared to $14.6 million in the fourth quarter of

2022.

- Total revenue was $223.1 million in the fourth quarter of 2023,

up 32 percent from $169.2 million in the fourth quarter of 2022,

outperforming guidance.

- GAAP operating loss was $(4.7) million, and non-GAAP operating

income was $34.7 million in the fourth quarter of 2023,

outperforming guidance.

- GAAP net income was $8.9 million, or $0.20 per diluted share,

in the fourth quarter of 2023. Non-GAAP net income was $38.1

million, or $0.81 per diluted share, in the fourth quarter of 2023,

outperforming guidance.

Financial Summary for the Full Year Ended December 31,

2023

- Subscription revenue was $472.0 million in the full year 2023,

an increase of 68 percent from $280.6 million in the full year

2022.

- Maintenance and professional services revenue was $258.8

million in the full year 2023, compared to $261.1 million in the

full year 2022.

- Perpetual license revenue was $21.0 million in the full year

2023, compared to $50.0 million in the full year 2022.

- Total revenue was $751.9 million in the full year 2023,

accelerating to 27 percent year over year growth from $591.7

million.

- GAAP operating loss was $(116.5) million, and non-GAAP

operating income was $33.5 million in the full year 2023.

- GAAP net loss was $(66.5) million, or $(1.60) per basic and

diluted share, in the full year 2023. Non-GAAP net income was $52.0

million, or $1.12 per diluted share, in the full year 2023.

Balance Sheet and Net Cash Provided by Operating

Activities

- As of December 31, 2023, CyberArk had $1.3 billion in cash,

cash equivalents, marketable securities, and short-term

deposits.

- During the full year, 2023, the Company’s net cash provided by

operating activities was $56.2 million.

- As of December 31, 2023, total deferred revenue was $480.6

million, an 18 percent increase from $408.4 million at December 31,

2022.

Key Business Highlights

- Annual Recurring Revenue (ARR) was $774 million, an increase of

36 percent from $570 million at December 31, 2022.

- The Subscription portion of ARR was $582 million, or 75 percent

of total ARR at December 31, 2023. This represents an increase of

60 percent from $364 million, or 64 percent of total ARR, at

December 31, 2022.

- The Maintenance portion of ARR was $192 million at December 31,

2023, compared to $206 million at December 31, 2022.

- Recurring revenue in the fourth quarter was $201.5 million, an

increase of 41 percent from $142.6 million for the fourth quarter

of 2022. For the full year 2023, recurring revenue was $679.6

million, an increase of 36 percent from $498.3 million for the full

year 2022.

Recent Developments

- CyberArk was named an Overall Leader in the KuppingerCole

Analysts AG 2023 “Leadership Compass: Cloud Infrastructure

Entitlement Management (CIEM)”(1) report. The company’s leadership

is based on the strength of the CyberArk Identity Security Platform

and its innovative cloud security solutions.

- CyberArk was named an Overall Leader in the KuppingerCole

Analysts AG 2023 “Leadership Compass: Access Management”(2) report.

The company’s overall leadership position is based on the strength

of its CyberArk Identity offering across the report’s product,

innovation and market categories.

- CyberArk Elevates Passwordless Experience with new Passkeys

Authentication for CyberArk Identity customers, furthering its

commitment to help customers reduce credential theft and improve

productivity.

- CyberArk joined the Microsoft Security Copilot Partner Private

Preview.

Business Outlook

Based on information available as of February 8, 2024, CyberArk

is issuing guidance for the first quarter and full year 2024 as

indicated below.

First Quarter 2024:

- Total revenue is expected to be in the range of $209.0 million

and $215.0 million, representing growth of 29 percent to 33 percent

compared to the first quarter of 2023.

- Non-GAAP operating income is expected to be in the range of

$7.5 million to $12.5 million.

- Non-GAAP net income per share is expected to be in the range of

$0.21 to $0.31 per diluted share.

- Assumes 47.8 million weighted average diluted shares.

Full Year 2024:

- Total revenue is expected to be in the range of $920.0 million

to $930.0 million, representing growth of 22 percent to 24 percent

compared to the full year 2023.

- Non-GAAP operating income is expected to be in the range of

$75.5 million to $84.5 million.

- Non-GAAP net income per share is expected to be in the range of

$1.63 to $1.81 per diluted share.

- Assumes 48.0 million weighted average diluted shares.

- ARR as of December 31, 2024 is expected to be in the range of

$968.0 million to $983.0 million, representing growth of 25 percent

to 27 percent from December 31, 2023.

- Non-GAAP free cash flow is expected to be in the range of $85.0

million to $95.0 million for the full year 2024.

(1) KuppingerCole Analysts AG “Leadership

Compass: Cloud Infrastructure Entitlement Management (CIEM),”

November 8, 2023, Paul Fisher

(2) KuppingerCole Analysts AG “Leadership

Compass: Access Management,” August 16, 2023 by Alejandro Leal

Conference Call Information

In conjunction with this announcement, CyberArk will host a

conference call on Thursday, February 8, 2024 at 8:30 a.m. Eastern

Time (ET) to discuss the Company’s fourth quarter and full year

financial results and its business outlook. To access this call,

dial +1 (888) 330-2455 (U.S.) or +1 (240) 789-2717 (international).

The conference ID is 6515982. Additionally, a live webcast of the

conference call will be available via the “Investor Relations”

section of the company’s website at www.cyberark.com.

Following the conference call, a replay will be available for

one week at +1 (800) 770-2030 (U.S.) or +1 (647) 362-9199

(international). The replay pass code is 6515982. An archived

webcast of the conference call will also be available in the

“Investor Relations” section of the company’s website at

www.cyberark.com.

About CyberArk

CyberArk (NASDAQ: CYBR) is the global leader in identity

security. Centered on intelligent privilege controls, CyberArk

provides the most comprehensive security offering for any identity

– human or machine – across business applications, distributed

workforces, hybrid cloud environments and throughout the DevOps

lifecycle. The world’s leading organizations trust CyberArk to help

secure their most critical assets. To learn more about CyberArk,

visit https://www.cyberark.com, read the CyberArk blogs or follow

on LinkedIn, Twitter, Facebook or YouTube.

Copyright © 2024 CyberArk Software. All Rights Reserved. All

other brand names, product names, or trademarks belong to their

respective holders.

Key Performance Indicators and Non-GAAP Financial

Measures

Annual Recurring Revenue (ARR)

- Annual Recurring Revenue (ARR) is a performance indicator that

provides more visibility into the growth of our recurring business

in the upcoming year. ARR is defined as the annualized value of

active SaaS, self-hosted subscriptions and their associated

M&S, and maintenance contracts related to the perpetual

licenses in effect at the end of the reported period. ARR should be

viewed independently of revenues and total deferred revenue as it

is an operating measure and is not intended to be combined with or

to replace either of those measures. ARR is not a forecast of

future revenues and can be impacted by contract start and end dates

and renewal rates. This visibility allows us to make informed

decisions about our capital allocation and level of

investment.

Subscription Portion of Annual Recurring Revenue

- Subscription portion of ARR is defined as the annualized value

of active SaaS and self-hosted subscriptions contracts in effect at

the end of the reported period. The subscription portion of ARR

excludes maintenance contracts related to perpetual licenses.

Maintenance Portion of Annual Recurring Revenue

- Maintenance portion of ARR is defined as the annualized value

of active maintenance contracts related to perpetual licenses. The

Maintenance portion of ARR excludes SaaS and self-hosted

subscriptions contracts in effect at the end of the reported

period.

Recurring Revenue

- Recurring Revenue is defined as revenue derived from SaaS and

self-hosted subscription contracts, and maintenance contracts

related to perpetual licenses during the reported period.

Non-GAAP Financial Measures

CyberArk believes that the use of non-GAAP gross profit,

non-GAAP operating expense, non-GAAP operating income (loss),

non-GAAP net income (loss) and free cash flow is helpful to our

investors. These financial measures are not measures of the

Company’s financial performance under U.S. GAAP and should not be

considered as alternatives to gross profit, operating loss, net

income (loss) or net cash provided by operating activities or any

other performance measures derived in accordance with GAAP.

- Non-GAAP gross profit is calculated as GAAP gross profit

excluding share-based compensation expense, amortization of

intangible assets related to acquisitions, and impairment of

capitalized software development costs.

- Non-GAAP operating expense is calculated as GAAP operating

expenses excluding share-based compensation expense, acquisition

related expenses and amortization of intangible assets related to

acquisitions.

- Non-GAAP operating income (loss) is calculated as GAAP

operating loss excluding share-based compensation expense,

impairment of capitalized software development costs, acquisition

related expenses and amortization of intangible assets related to

acquisitions.

- Non-GAAP net income (loss) is calculated as GAAP net income

(loss) excluding share-based compensation expense, acquisition

related expenses, amortization of intangible assets related to

acquisitions, impairment of capitalized software development costs,

amortization of debt discount and issuance costs, gain from

investment in privately held companies, and the tax effect of

non-GAAP adjustments.

- Free cash flow is calculated as net cash provided by operating

activities less purchase of property and equipment.

The Company believes that providing non-GAAP financial measures

that are adjusted by, as applicable, share-based compensation

expense, acquisition related expenses, amortization of intangible

assets related to acquisitions, impairment of capitalized software

development costs, non-cash interest expense related to the

amortization of debt discount and issuance cost, gain from

investment in privately held companies, and the tax effect of the

non-GAAP adjustments and purchase of property and equipment allows

for more meaningful comparisons of its period to period operating

results. Share-based compensation expense has been, and will

continue to be for the foreseeable future, a significant recurring

expense in the Company’s business and an important part of the

compensation provided to its employees. Share based compensation

expense has varying available valuation methodologies, subjective

assumptions and a variety of equity instruments that can impact a

company’s non-cash expense. The Company believes that expenses

related to its acquisitions, amortization of intangible assets

related to acquisitions, and non-cash interest expense related to

the amortization of debt discount and issuance costs do not reflect

the performance of its core business and impact period-to-period

comparability. The Company believes free cash flow is a liquidity

measure that, after the purchase of property and equipment,

provides useful information about the amount of cash generated by

the business.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in the

Company’s industry, as other companies in the industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. In addition, there are

limitations in using non-GAAP financial measures as they exclude

expenses that may have a material impact on the Company’s reported

financial results. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with U.S. GAAP. CyberArk urges investors to review

the reconciliation of its non-GAAP financial measures to the

comparable U.S. GAAP financial measures included below, and not to

rely on any single financial measure to evaluate its business.

Guidance for non-GAAP financial measures excludes, as

applicable, share-based compensation expense, acquisition related

expenses, amortization of intangible assets related to

acquisitions, non-cash interest expense related to the amortization

of debt discount and issuance costs, the tax effect of the non-GAAP

adjustments, and purchase of property and equipment. A

reconciliation of the non-GAAP financial measures guidance to the

corresponding GAAP measures is not available on a forward-looking

basis due to the uncertainty regarding, and the potential

variability and significance of, the amounts of share-based

compensation expense, amortization of intangible assets related to

acquisitions, and the non-recurring expenses that are excluded from

the guidance as well as changes in interest rates and foreign

exchange rates, which impact other GAAP performance metrics.

Accordingly, a reconciliation of the non-GAAP financial measures

guidance to the corresponding GAAP measures for future periods is

not available without unreasonable effort.

Cautionary Language Concerning Forward-Looking

Statements

This release contains forward-looking statements, which express

the current beliefs and expectations of CyberArk’s (the “Company”)

management. In some cases, forward-looking statements may be

identified by terminology such as “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “expect,”

“predict,” “potential” or the negative of these terms or other

similar expressions. Such statements involve a number of known and

unknown risks and uncertainties that could cause the Company’s

future results, levels of activity, performance or achievements to

differ materially from the results, levels of activity, performance

or achievements expressed or implied by such forward-looking

statements. Important factors that could cause or contribute to

such differences include risks relating to: changes to the drivers

of the Company’s growth and its ability to adapt its solutions to

IT security market demands; fluctuation in the Company’s quarterly

results of operations due to sales cycles and multiple pricing and

delivery models; the Company’s ability to sell into existing and

new customers and industry verticals; an increase in competition

within the Privileged Access Management and Identity Security

markets; unanticipated product vulnerabilities or cybersecurity

breaches of the Company’s, or the Company’s customers’ or partners’

systems; complications or risks in connection with the Company’s

subscription model, including uncertainty regarding renewals from

its existing customer base, and retaining sufficient subscription

or maintenance and support service renewal rates; risks related to

compliance with privacy and data protection laws and regulations;

regulatory and geopolitical risks associated with global sales and

operations, as well as impacts from the ongoing war between Israel

and Hamas and other conflicts in the region, as our principal

executive offices, most of our research and development activities

and other significant operations are located in Israel; risks

regarding potential negative economic conditions in the global

economy or certain regions, including conditions resulting from

financial and credit market fluctuations, rising interest rates,

bank failures, inflation, and the potential for regional or global

recessions; the Company’s ability to hire, train, retain and

motivate qualified personnel; reliance on third-party cloud

providers for the Company’s operations and SaaS solutions; the

Company’s history of incurring net losses and its ability to

achieve profitability in the future; risks related to the Company’s

ongoing transition to a new Chief Executive Officer; risks related

to sales made to government entities; the Company’s ability to

find, complete, fully integrate or achieve the expected benefits of

strategic acquisitions; the Company’s ability to expand its sales

and marketing efforts and expand its channel partnerships across

existing and new geographies; changes in regulatory requirements or

fluctuations in currency exchange rates; the ability of the

Company’s products to help customers achieve and maintain

compliance with government regulations or industry standards; risks

related to intellectual property claims or the Company’s ability to

protect its proprietary technology and intellectual property

rights; and other factors discussed under the heading “Risk

Factors” in the Company’s most recent annual report on Form 20-F

filed with the Securities and Exchange Commission. Forward-looking

statements in this release are made pursuant to the safe harbor

provisions contained in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements are made only

as of the date hereof, and the Company undertakes no obligation to

update or revise the forward-looking statements, whether as a

result of new information, future events or otherwise.

CYBERARK SOFTWARE LTD. Consolidated Statements of

Operations U.S. dollars in thousands (except per share

data) (Unaudited) Three Months Ended

Twelve Months Ended December 31, December 31,

2022

2023

2022

2023

Revenues: Subscription

$

88,451

$

150,257

$

280,649

$

472,023

Perpetual license

14,579

8,009

49,964

21,037

Maintenance and professional services

66,121

64,838

261,097

258,828

Total revenues

169,151

223,104

591,710

751,888

Cost of revenues: Subscription

13,762

19,764

46,249

74,623

Perpetual license

913

700

2,893

1,873

Maintenance and professional services

20,153

19,189

76,904

79,635

Total cost of revenues

34,828

39,653

126,046

156,131

Gross profit

134,323

183,451

465,664

595,757

Operating expenses: Research and development

51,477

53,792

190,321

211,445

Sales and marketing

90,737

106,607

345,273

405,983

General and administrative

22,178

27,763

82,520

94,801

Total operating expenses

164,392

188,162

618,114

712,229

Operating loss

(30,069

)

(4,711

)

(152,450

)

(116,472

)

Financial income, net

9,163

19,302

15,432

53,214

Income (loss) before taxes on income

(20,906

)

14,591

(137,018

)

(63,258

)

Tax benefit (taxes on income)

(1,298

)

(5,680

)

6,650

(3,246

)

Net income (loss)

$

(22,204

)

$

8,911

$

(130,368

)

$

(66,504

)

Basic net income (loss) per ordinary share

$

(0.54

)

$

0.21

$

(3.21

)

$

(1.60

)

Diluted net income (loss) per ordinary share

$

(0.54

)

$

0.20

$

(3.21

)

$

(1.60

)

Shares used in computing net income (loss) per ordinary

shares, basic

40,923,682

42,069,678

40,583,002

41,658,424

Shares used in computing net income (loss) per ordinary shares,

diluted

40,923,682

47,107,294

40,583,002

41,658,424

CYBERARK SOFTWARE LTD.

Consolidated Balance

Sheets

U.S. dollars in

thousands

(Unaudited)

December 31, December 31,

2022

2023

ASSETS CURRENT ASSETS: Cash and cash

equivalents

$

347,338

$

355,933

Short-term bank deposits

305,843

354,472

Marketable securities

301,101

283,016

Trade receivables

120,817

186,472

Prepaid expenses and other current assets

22,482

31,550

Total current assets

1,097,581

1,211,443

LONG-TERM ASSETS: Marketable securities

227,748

324,548

Property and equipment, net

23,474

16,494

Intangible assets, net

27,508

20,202

Goodwill

153,241

153,241

Other long-term assets

217,040

214,816

Deferred tax asset

72,809

81,464

Total long-term assets

721,820

810,765

TOTAL ASSETS

$

1,819,401

$

2,022,208

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Trade payables

$

13,642

$

10,971

Employees and payroll accruals

77,328

95,538

Accrued expenses and other current liabilities

33,584

36,562

Convertible senior notes, net

-

572,340

Deferred revenues

327,918

409,219

Total current liabilities

452,472

1,124,630

LONG-TERM LIABILITIES: Convertible senior notes, net

569,344

-

Deferred revenues

80,524

71,413

Other long-term liabilities

38,917

33,839

Total long-term liabilities

688,785

105,252

TOTAL LIABILITIES

1,141,257

1,229,882

SHAREHOLDERS' EQUITY: Ordinary shares of NIS 0.01 par value

107

111

Additional paid-in capital

660,289

827,260

Accumulated other comprehensive loss

(15,560

)

(1,849

)

Retained earnings (accumulated deficit)

33,308

(33,196

)

Total shareholders' equity

678,144

792,326

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

$

1,819,401

$

2,022,208

CYBERARK SOFTWARE LTD.

Consolidated Statements of

Cash Flows

U.S. dollars in

thousands

(Unaudited)

Twelve Months Ended December 31,

2022

2023

Cash flows from operating activities: Net loss

$

(130,368

)

$

(66,504

)

Adjustments to reconcile net loss to net cash provided by operating

activities: Depreciation and amortization

16,203

19,250

Amortization of premium and accretion of discount on marketable

securities, net

3,894

(4,570

)

Share-based compensation

120,821

140,101

Deferred income taxes, net

(15,630

)

(7,879

)

Increase in trade receivables

(7,606

)

(65,655

)

Amortization of debt discount and issuance costs

2,980

2,996

Increase in prepaid expenses, other current and long-term assets

and others

(37,141

)

(45,016

)

Changes in operating lease right-of-use assets

4,558

6,566

Increase (decrease) in trade payables

4,053

(2,669

)

Increase in short-term and long-term deferred revenues

91,167

72,190

Increase in employees and payroll accruals

714

6,981

Increase in accrued expenses and other current and long-term

liabilities

4,801

7,507

Changes in operating lease liabilities

(8,738

)

(7,094

)

Net cash provided by operating activities

49,708

56,204

Cash flows from investing activities: Investment in

short and long term deposits

(496,894

)

(337,835

)

Proceeds from short and long term deposits

532,563

319,542

Investment in marketable securities and other

(375,731

)

(406,633

)

Proceeds from sales and maturities of marketable securities and

other

325,472

344,046

Purchase of property and equipment

(12,517

)

(4,948

)

Payments for business acquisitions, net of cash acquired

(41,285

)

-

Net cash used in investing activities

(68,392

)

(85,828

)

Cash flows from financing activities: Proceeds from

(payment of) withholding tax related to employee stock plans

(184

)

11,188

Proceeds from exercise of stock options

1,968

11,065

Proceeds in connection with employees stock purchase plan

15,143

15,831

Payments of contingent consideration related to acquisitions

(4,702

)

-

Net cash provided by financing activities

12,225

38,084

Increase (decrease) in cash and cash equivalents

(6,459

)

8,460

Effect of exchange rate differences on cash and cash

equivalents

(3,053

)

135

Cash and cash equivalents at the beginning of the period

356,850

347,338

Cash and cash equivalents at the end of the period

$

347,338

$

355,933

CYBERARK SOFTWARE LTD. Reconciliation of GAAP Measures to

Non-GAAP Measures U.S. dollars in thousands (except per

share data) (Unaudited) Reconciliation

of Net cash provided by operating activities to Free cash flow:

Three Months Ended Twelve Months Ended

December 31, December 31,

2022

2023

2022

2023

Net cash provided by operating activities

$

20,497

$

46,898

$

49,708

$

56,204

Less: Purchase of property and equipment

(3,739

)

(695

)

(12,517

)

(4,948

)

Free cash flow

$

16,758

$

46,203

$

37,191

$

51,256

GAAP net cash used in investing activities

(247

)

(84,140

)

(68,392

)

(85,828

)

GAAP net cash provided by financing activities

563

18,889

12,225

38,084

Reconciliation of Gross Profit to Non-GAAP Gross

Profit: Three Months Ended Twelve Months

Ended December 31, December 31,

2022

2023

2022

2023

Gross profit

$

134,323

$

183,451

$

465,664

$

595,757

Plus: Share-based compensation (1)

4,098

4,500

15,060

17,612

Amortization of share-based compensation capitalized in software

development costs (3)

82

84

346

393

Amortization of intangible assets (2)

1,705

1,704

6,044

6,817

Impairment of capitalized software development costs (3)

-

-

-

2,067

Non-GAAP gross profit

$

140,208

$

189,739

$

487,114

$

622,646

Reconciliation of Operating Expenses to Non-GAAP

Operating Expenses: Three Months Ended Twelve

Months Ended December 31, December 31,

2022

2023

2022

2023

Operating expenses

$

164,392

$

188,162

$

618,114

$

712,229

Less: Share-based compensation (1)

28,130

33,035

105,761

122,489

Amortization of intangible assets (2)

153

137

611

547

Acquisition related expenses

-

-

2,244

-

Non-GAAP operating expenses

$

136,109

$

154,990

$

509,498

$

589,193

Reconciliation of Operating loss to Non-GAAP Operating

Income (loss): Three Months Ended Twelve

Months Ended December 31, December 31,

2022

2023

2022

2023

Operating loss

$

(30,069

)

$

(4,711

)

$

(152,450

)

$

(116,472

)

Plus: Share-based compensation (1)

32,228

37,535

120,821

140,101

Amortization of share-based compensation capitalized in software

development costs (3)

82

84

346

393

Amortization of intangible assets (2)

1,858

1,841

6,655

7,364

Acquisition related expenses

-

-

2,244

-

Impairment of capitalized software development costs (3)

-

-

-

2,067

Non-GAAP operating income (loss)

$

4,099

$

34,749

$

(22,384

)

$

33,453

Reconciliation of Net Income (loss) to Non-GAAP Net

Income (loss): Three Months Ended Twelve

Months Ended December 31, December 31,

2022

2023

2022

2023

Net income (loss)

$

(22,204

)

$

8,911

$

(130,368

)

$

(66,504

)

Plus: Share-based compensation (1)

32,228

37,535

120,821

140,101

Amortization of share-based compensation capitalized in software

development costs (3)

82

84

346

393

Amortization of intangible assets (2)

1,858

1,841

6,655

7,364

Acquisition related expenses

-

-

2,244

-

Amortization of debt discount and issuance costs

746

752

2,980

2,996

Gain from investment in privately held companies

-

(2,213

)

(324

)

(2,757

)

Impairment of capitalized software development costs (3)

-

-

-

2,067

Taxes on income related to non-GAAP adjustments

(5,560

)

(8,848

)

(20,189

)

(31,656

)

Non-GAAP net income (loss)

$

7,150

$

38,062

$

(17,835

)

$

52,004

Non-GAAP net income (loss) per share Basic

$

0.17

$

0.90

$

(0.44

)

$

1.25

Diluted

$

0.16

$

0.81

$

(0.44

)

$

1.12

Weighted average number of shares Basic

40,923,682

42,069,678

40,583,002

41,658,424

Diluted

45,600,508

47,107,294

40,583,002

46,375,198

(1) Share-based Compensation : Three Months

Ended Twelve Months Ended December 31,

December 31,

2022

2023

2022

2023

Cost of revenues - Subscription

$

737

$

1,219

$

2,264

$

4,178

Cost of revenues - Perpetual license

40

15

143

45

Cost of revenues - Maintenance and Professional services

3,321

3,266

12,653

13,389

Research and development

7,315

7,661

27,102

29,458

Sales and marketing

13,684

14,800

51,099

58,790

General and administrative

7,131

10,574

27,560

34,241

Total share-based compensation

$

32,228

$

37,535

$

120,821

$

140,101

(2) Amortization of intangible assets : Three

Months Ended Twelve Months Ended December 31,

December 31,

2022

2023

2022

2023

Cost of revenues - Subscription

$

1,663

$

1,704

$

5,894

$

6,817

Cost of revenues - Perpetual license

42

-

150

-

Sales and marketing

153

137

611

547

Total amortization of intangible assets

$

1,858

$

1,841

$

6,655

$

7,364

(3) Classified as Cost of revenues - Subscription.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240208108110/en/

Investor Relations: Erica Smith CyberArk 617-558-2132

ir@cyberark.com

Media: Nick Bowman CyberArk +44 (0) 7841 673378

press@cyberark.com

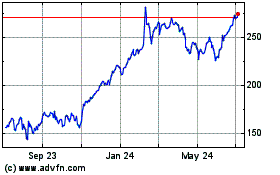

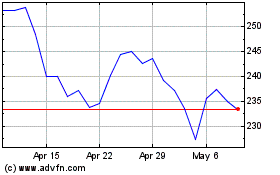

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Oct 2024 to Nov 2024

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Nov 2023 to Nov 2024