Company Exceeds Guidance Across all Guided

Metrics Subscription Portion of Annual Recurring Revenue (ARR) of

$451 million; Growth of 77% Year-over-Year Total ARR of $653

million; Growth of 40% Year-over-Year Subscription Revenue of

$106.2 million in Q2; Growth of 61% Year-Over-Year Total Revenue of

$175.8 million in Q2 Exceeds Guidance; Growth of 24% Year-Over-Year

Company Raises Full Year ARR Guidance to a Range of $743 million to

$753 million from $735 million to $745 million

CyberArk (NASDAQ: CYBR), the identity security company, today

announced strong financial results for the second quarter ended

June 30, 2023.

“We had a great quarter, beating our guidance across all

metrics, which demonstrates the momentum in our business and the

durability of demand for our identity security platform,” said Matt

Cohen, CyberArk's Chief Executive Officer. “We had a strong new

business quarter and existing customers expanded across our

identity security platform as we continue to deliver

transformational value to customers, across hybrid and cloud

environments. This drove robust net new ARR, with strong 77 percent

growth in Subscription ARR to $451 million and 40 percent growth in

total ARR to $653 million. The explosion of new identities, new

environments and new attack methods has rapidly expanded the attack

surface, creating an acute need for organizations to secure all

identities, humans and machines. Today, organizations are turning

to CyberArk to address their most pressing cybersecurity

challenges. We have a tremendous opportunity in front of us and are

executing our strategy. As the clear leader in identity security,

we are well positioned to deliver strong long-term growth,

profitability and cash flow.”

Financial Summary for the Second Quarter Ended June 30,

2023

- Subscription revenue was $106.2 million in the second quarter

of 2023, an increase of 61 percent from $66.0 million in the second

quarter of 2022.

- Maintenance and professional services revenue was $64.6 million

in the second quarter of 2023, compared to $65.3 million in the

second quarter of 2022.

- Perpetual license revenue was $5.1 million in the second

quarter of 2023, compared to $11.0 million in the second quarter of

2022.

- Total revenue was $175.8 million in the second quarter of 2023,

up 24 percent from $142.3 million in the second quarter of 2022,

outperforming guidance.

- GAAP operating loss was $(39.9) million and non-GAAP operating

loss was $(5.6) million in the second quarter of 2023,

outperforming guidance.

- GAAP net loss was $(25.8) million, or $(0.62) per basic and

diluted share, in the second quarter of 2023. Non-GAAP net income

was $1.3 million, or $0.03 per diluted share, in the second quarter

of 2023, outperforming guidance.

Balance Sheet and Net Cash Provided by Operating

Activities

- As of June 30, 2023, CyberArk had $1.2 billion in cash, cash

equivalents, marketable securities, and short-term deposits.

- During the six months ended June 30, 2023, the Company’s net

cash used in operating activities was $(5.0) million.

- As of June 30, 2023, total deferred revenue was $418.7 million,

a 19 percent increase from $352.1 million at June 30, 2022.

Key Business Highlights

- Annual Recurring Revenue (ARR) was $653 million, an increase of

40 percent from $465 million at June 30, 2022.

- The Subscription portion of ARR was $451 million, or 69 percent

of total ARR at June 30, 2023. This represents an increase of 77

percent from $255 million, or 55 percent of total ARR, at June 30,

2022.

- The Maintenance portion of ARR was $201 million at June 30,

2023, compared to $210 million at June 30, 2022.

- Recurring revenue in the second quarter was $157.8 million, an

increase of 31 percent from $120.4 million for the second quarter

of 2022.

Recent Developments

- Announced Artificial Intelligence (AI) and Automation

innovations across CyberArk’s Identity Security Platform.

- Announced CyberArk Secure Browser, the first identity security

based enterprise browser, enabling organizations to better protect

employee and third-party access to enterprise resources.

- Announced launch of BT’s global Privileged Identity Security

managed service, built exclusively on CyberArk’s identity security

platform, delivering scalable and effective cybersecurity risk

reduction.

- Released CyberArk 2023 Identity Security Threat Landscape

Report, showing how technology innovation – including AI – is

growing the number of identities, compounding ‘cyber debt’.

- Published third annual Environmental, Social and Governance

(ESG) Report, in an ongoing commitment to building a diverse,

equitable and sustainable organization.

Business Outlook

Based on information available as of August 10, 2023, CyberArk

is issuing guidance for the third quarter and full year 2023 as

indicated below.

Third Quarter 2023:

- Total revenue is expected to be in the range of $181.5 million

and $186.5 million, representing growth of 19 percent to 22 percent

compared to the third quarter of 2022.

- Non-GAAP operating income is expected to be in the range of

$4.0 million to $8.0 million.

- Non-GAAP net income per share is expected to be in the range of

$0.19 to $0.27 per diluted share.

- Assumes 46.8 million weighted average diluted shares.

Full Year 2023:

- Total revenue is expected to be in the range of $726.0 million

to $736.0 million, representing growth of 23 percent to 24 percent

compared to the full year 2022.

- Non-GAAP operating income is expected to be in the range of

breakeven to $9.0 million.

- Non-GAAP net income per share is expected to be in the range of

$0.44 to $0.63 per diluted share.

- Assumes 46.4 million weighted average diluted shares.

- ARR as of December 31, 2023 is expected to be in the range of

$743 million to $753 million, representing growth of 30 percent to

32 percent from December 31, 2022.

Conference Call Information

In conjunction with this announcement, CyberArk will host a

conference call on Thursday, August 10, 2023 at 8:30 a.m. Eastern

Time (ET) to discuss the Company’s second quarter financial results

and its business outlook. To access this call, dial +1 (888)

330-2455 (U.S.) or +1 (240) 789-2717 (international). The

conference ID is 6515982. Additionally, a live webcast of the

conference call will be available via the “Investor Relations”

section of the company’s website at www.cyberark.com.

Following the conference call, a replay will be available for

one week at +1 (800) 770-2030 (U.S.) or +1 (647) 362-9199

(international). The replay pass code is 6515982. An archived

webcast of the conference call will also be available in the

“Investor Relations” section of the company’s website at

www.cyberark.com.

About CyberArk

CyberArk (NASDAQ: CYBR) is the global leader in identity

security. Centered on intelligent privilege controls, CyberArk

provides the most comprehensive security offering for any identity

– human or machine – across business applications, distributed

workforces, hybrid cloud environments and throughout the DevOps

lifecycle. The world’s leading organizations trust CyberArk to help

secure their most critical assets. To learn more about CyberArk,

visit https://www.cyberark.com, read the CyberArk blogs or follow

on LinkedIn, Twitter, Facebook or YouTube.

Copyright © 2023 CyberArk Software. All Rights Reserved. All

other brand names, product names, or trademarks belong to their

respective holders.

Key Performance Indicators and Non-GAAP Financial

Measures

Annual Recurring Revenue (ARR)

- Annual Recurring Revenue (ARR) is defined as the annualized

value of active SaaS, self-hosted subscription and maintenance

contracts related to perpetual licenses in effect at the end of the

reported period.

Subscription Portion of Annual Recurring Revenue

- Subscription portion of ARR is defined as the annualized value

of active SaaS and self-hosted subscription contracts in effect at

the end of the reported period. The subscription portion of ARR

excludes maintenance contracts related to perpetual licenses.

Maintenance Portion of Annual Recurring Revenue

- Maintenance portion of ARR is defined as the annualized value

of active maintenance contracts related to perpetual licenses. The

Maintenance portion of ARR excludes SaaS and self-hosted

subscription contracts in effect at the end of the reported

period.

Recurring Revenue

- Recurring Revenue is defined as revenue derived from SaaS and

self-hosted subscription contracts, and maintenance contracts

related to perpetual licenses during the reported period.

Non-GAAP Financial Measures

CyberArk believes that the use of non-GAAP gross profit,

non-GAAP operating expense, non-GAAP operating loss, non-GAAP net

income/(loss) and free cash flow is helpful to our investors. These

financial measures are not measures of the Company’s financial

performance under U.S. GAAP and should not be considered as

alternatives to gross profit, operating loss, net loss or net cash

provided by operating activities or any other performance measures

derived in accordance with GAAP.

- Non-GAAP gross profit is calculated as GAAP gross profit

excluding share-based compensation expense, and amortization of

intangible assets related to acquisitions.

- Non-GAAP operating expense is calculated as GAAP operating

expenses excluding share-based compensation expense, acquisition

related expenses and amortization of intangible assets related to

acquisitions.

- Non-GAAP operating loss is calculated as GAAP operating loss

excluding share-based compensation expense, acquisition related

expenses and amortization of intangible assets related to

acquisitions.

- Non-GAAP net income/(loss) is calculated as GAAP net loss

excluding share-based compensation expense, acquisition related

expenses, amortization of intangible assets related to

acquisitions, amortization of debt discount and issuance costs,

gain from investment in privately held companies, and the tax

effect of non-GAAP adjustments.

- Free cash flow is calculated as net cash provided by (used in)

operating activities less purchase of property and equipment.

The Company believes that providing non-GAAP financial measures

that are adjusted by, as applicable, share-based compensation

expense, acquisition related expenses, amortization of intangible

assets related to acquisitions, non-cash interest expense related

to the amortization of debt discount and issuance cost, gain from

investment in privately held companies, and the tax effect of the

non-GAAP adjustments and purchase of property and equipment allows

for more meaningful comparisons of its period to period operating

results. Share-based compensation expense has been, and will

continue to be for the foreseeable future, a significant recurring

expense in the Company’s business and an important part of the

compensation provided to its employees. Share based compensation

expense has varying available valuation methodologies, subjective

assumptions and a variety of equity instruments that can impact a

company’s non-cash expense. The Company believes that expenses

related to its acquisitions, amortization of intangible assets

related to acquisitions, and non-cash interest expense related to

the amortization of debt discount and issuance costs do not reflect

the performance of its core business and impact period-to-period

comparability. The Company believes free cash flow is a liquidity

measure that, after the purchase of property and equipment,

provides useful information about the amount of cash generated by

the business.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in the

Company’s industry, as other companies in the industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. In addition, there are

limitations in using non-GAAP financial measures as they exclude

expenses that may have a material impact on the Company’s reported

financial results. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with U.S. GAAP. CyberArk urges investors to review

the reconciliation of its non-GAAP financial measures to the

comparable U.S. GAAP financial measures included below, and not to

rely on any single financial measure to evaluate its business.

Guidance for non-GAAP financial measures excludes, as

applicable, share-based compensation expense, acquisition related

expenses, amortization of intangible assets related to

acquisitions, non-cash interest expense related to the amortization

of debt discount and issuance costs and the tax effect of the

non-GAAP adjustments. A reconciliation of the non-GAAP financial

measures guidance to the corresponding GAAP measures is not

available on a forward-looking basis due to the uncertainty

regarding, and the potential variability and significance of, the

amounts of share-based compensation expense, amortization of

intangible assets related to acquisitions, and the non-recurring

expenses that are excluded from the guidance. Accordingly, a

reconciliation of the non-GAAP financial measures guidance to the

corresponding GAAP measures for future periods is not available

without unreasonable effort.

Cautionary Language Concerning Forward-Looking

Statements

This release contains forward-looking statements, which express

the current beliefs and expectations of CyberArk’s (the “Company”)

management. In some cases, forward-looking statements may be

identified by terminology such as “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “expect,”

“predict,” “potential” or the negative of these terms or other

similar expressions. Such statements involve a number of known and

unknown risks and uncertainties that could cause the Company’s

future results, levels of activity, performance or achievements to

differ materially from the results, levels of activity, performance

or achievements expressed or implied by such forward-looking

statements. Important factors that could cause or contribute to

such differences include risks relating to: changes to the drivers

of the Company’s growth and its ability to adapt its solutions to

IT security market demands; fluctuation in the Company’s quarterly

results of operations due to sales cycles and multiple pricing and

delivery models; the Company’s ability to sell into existing and

new customers and industry verticals; an increase in competition

within the Privileged Access Management and Identity Security

markets; unanticipated product vulnerabilities or cybersecurity

breaches of the Company’s, or the Company’s customers’ or partners’

systems; complications or risks in connection with the Company’s

subscription model, including uncertainty regarding renewals from

its existing customer base, and retaining sufficient subscription

or maintenance and support service renewal rates; risks related to

compliance with privacy and data protection laws and regulations;

risks regarding potential negative economic conditions in the

global economy or certain regions, including conditions resulting

from financial and credit market fluctuations, rising interest

rates, bank failures, inflation, and the potential for regional or

global recessions; the Company’s ability to hire, train, retain and

motivate qualified personnel; reliance on third-party cloud

providers for the Company’s operations and SaaS solutions; the

Company’s history of incurring net losses and its ability to

achieve profitability in the future; risks related to the Company’s

ongoing transition to a new Chief Executive Officer; risks related

to sales made to government entities; the Company’s ability to

find, complete, fully integrate or achieve the expected benefits of

strategic acquisitions; the duration and scope of the COVID-19

pandemic and its resulting effect on the demand for the Company’s

solutions and on its expected revenue growth rates and costs; the

Company’s ability to expand its sales and marketing efforts and

expand its channel partnerships across existing and new

geographies; regulatory and geopolitical risks associated with

global sales and operations, as well as the location of our

principal executive offices, most of our research and development

activities and other significant operations in Israel; changes in

regulatory requirements or fluctuations in currency exchange rates;

the ability of the Company’s products to help customers achieve and

maintain compliance with government regulations or industry

standards; risks related to intellectual property claims or the

Company’s ability to protect its proprietary technology and

intellectual property rights; and other factors discussed under the

heading “Risk Factors” in the Company’s most recent annual report

on Form 20-F filed with the Securities and Exchange Commission.

Forward-looking statements in this release are made pursuant to the

safe harbor provisions contained in the U.S. Private Securities

Litigation Reform Act of 1995. These forward-looking statements are

made only as of the date hereof, and the Company undertakes no

obligation to update or revise the forward-looking statements,

whether as a result of new information, future events or

otherwise.

CYBERARK SOFTWARE LTD. Consolidated Statements of

Operations U.S. dollars in thousands (except per share

data) (Unaudited)

Three Months Ended

Six Months Ended

June 30,

June 30,

2022

2023

2022

2023

Revenues: Subscription

$

65,999

$

106,167

$

117,949

$

198,887

Perpetual license

11,038

5,090

21,595

8,972

Maintenance and professional services

65,290

64,586

130,345

129,689

Total revenues

142,327

175,843

269,889

337,548

Cost of revenues: Subscription

11,076

17,633

20,273

33,578

Perpetual license

385

319

1,277

531

Maintenance and professional services

19,258

20,815

37,203

40,630

Total cost of revenues

30,719

38,767

58,753

74,739

Gross profit

111,608

137,076

211,136

262,809

Operating expenses: Research and development

46,964

53,664

90,407

105,920

Sales and marketing

86,805

101,089

164,238

200,517

General and administrative

19,868

22,221

39,604

42,396

Total operating expenses

153,637

176,974

294,249

348,833

Operating loss

(42,029

)

(39,898

)

(83,113

)

(86,024

)

Financial income, net

1,572

11,882

2,628

21,488

Loss before taxes on income

(40,457

)

(28,016

)

(80,485

)

(64,536

)

Tax benefit

2,829

2,238

5,046

3,730

Net loss

$

(37,628

)

$

(25,778

)

$

(75,439

)

$

(60,806

)

Basic loss per ordinary share

$

(0.93

)

$

(0.62

)

$

(1.87

)

$

(1.47

)

Diluted loss per ordinary share

$

(0.93

)

$

(0.62

)

$

(1.87

)

$

(1.47

)

Shares used in computing net loss per ordinary shares, basic

40,517,587

41,599,364

40,344,422

41,384,895

Shares used in computing net loss per ordinary shares, diluted

40,517,587

41,599,364

40,344,422

41,384,895

CYBERARK SOFTWARE LTD.

Consolidated Balance

Sheets

U.S. dollars in

thousands

(Unaudited)

December 31,

June 30,

2022

2023

ASSETS CURRENT ASSETS: Cash and cash

equivalents

$

347,338

$

396,184

Short-term bank deposits

305,843

243,779

Marketable securities

301,101

265,171

Trade receivables

120,817

105,495

Prepaid expenses and other current assets

22,482

27,048

Total current assets

1,097,581

1,037,677

LONG-TERM ASSETS: Marketable securities

227,748

315,599

Property and equipment, net

23,474

21,457

Intangible assets, net

27,508

23,828

Goodwill

153,241

153,241

Other long-term assets

217,040

194,089

Deferred tax asset

72,809

82,295

Total long-term assets

721,820

790,509

TOTAL ASSETS

$

1,819,401

$

1,828,186

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Trade payables

$

13,642

$

13,647

Employees and payroll accruals

77,328

64,555

Accrued expenses and other current liabilities

33,584

32,890

Deferred revenues

327,918

349,833

Total current liabilities

452,472

460,925

LONG-TERM LIABILITIES: Convertible senior notes, net

569,344

570,841

Deferred revenues

80,524

68,821

Other long-term liabilities

38,917

35,706

Total long-term liabilities

688,785

675,368

TOTAL LIABILITIES

1,141,257

1,136,293

SHAREHOLDERS' EQUITY: Ordinary shares of NIS 0.01 par value

107

110

Additional paid-in capital

660,289

732,777

Accumulated other comprehensive loss

(15,560

)

(13,496

)

Retained earnings (accumulated deficit)

33,308

(27,498

)

Total shareholders' equity

678,144

691,893

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

$

1,819,401

$

1,828,186

CYBERARK SOFTWARE LTD.

Consolidated Statements of

Cash Flows

U.S. dollars in

thousands

(Unaudited)

Six Months Ended

June 30,

2022

2023

Cash flows from operating activities: Net loss

$

(75,439

)

$

(60,806

)

Adjustments to reconcile net loss to net cash provided by operating

activities: Depreciation and amortization

7,729

8,787

Amortization of premium and accretion of discount on marketable

securities, net

3,319

(1,474

)

Share-based compensation

56,851

63,966

Deferred income taxes, net

(10,358

)

(8,430

)

Decrease in trade receivables

25,375

15,322

Amortization of debt discount and issuance costs

1,488

1,496

Increase in prepaid expenses, other current and long-term assets

and others

(14,651

)

(16,328

)

Changes in operating lease right-of-use assets

1,407

3,865

Increase in trade payables

1,382

370

Increase in short-term and long-term deferred revenues

34,823

10,212

Decrease in employees and payroll accruals

(17,110

)

(17,868

)

Increase in accrued expenses and other current and long-term

liabilities

1,781

614

Changes in operating lease liabilities

(5,867

)

(4,773

)

Net cash provided by (used in) operating activities

10,730

(5,047

)

Cash flows from investing activities: Investment in

short and long term deposits

(205,703

)

(87,318

)

Proceeds from short and long term deposits

265,010

178,603

Investment in marketable securities and other

(194,309

)

(228,232

)

Proceeds from sales and maturities of marketable securities and

other

156,384

181,569

Purchase of property and equipment

(4,160

)

(3,522

)

Payments for business acquisitions, net of cash acquired

(12,987

)

-

Net cash provided by investing activities

4,235

41,100

Cash flows from financing activities: Proceeds from

withholding tax related to employee stock plans

3,316

5,213

Proceeds from exercise of stock options

1,210

777

Proceeds in connection with employees stock purchase plan

8,738

7,695

Net cash provided by financing activities

13,264

13,685

Increase in cash and cash equivalents

28,229

49,738

Effect of exchange rate differences on cash and cash

equivalents

(3,552

)

(892

)

Cash and cash equivalents at the beginning of the period

356,850

347,338

Cash and cash equivalents at the end of the period

$

381,527

$

396,184

CYBERARK SOFTWARE LTD. Reconciliation of GAAP

Measures to Non-GAAP Measures U.S. dollars in thousands

(except per share data) (Unaudited)

Reconciliation of Net cash provided by (used in) operating

activities to Free cash flow:

Three Months Ended

Six Months Ended

June 30,

June 30,

2022

2023

2022

2023

Net cash provided by (used in) operating activities

$

(14,254

)

$

(10,868

)

$

10,730

$

(5,047

)

Less: Purchase of property and equipment

(2,147

)

(1,747

)

(4,160

)

(3,522

)

Free cash flow

$

(16,401

)

$

(12,615

)

$

6,570

$

(8,569

)

GAAP net cash provided by investing activities

37,781

35,816

4,235

41,100

GAAP net cash provided by financing activities

12,784

8,468

13,264

13,685

Reconciliation of Gross Profit to Non-GAAP Gross Profit:

Three Months Ended

Six Months Ended

June 30,

June 30,

2022

2023

2022

2023

Gross profit

$

111,608

$

137,076

$

211,136

$

262,809

Plus: Share-based compensation (1)

3,742

4,379

6,932

8,332

Amortization of share-based compensation capitalized in software

development costs (3)

88

103

176

206

Amortization of intangible assets (2)

1,422

1,705

2,700

3,409

Non-GAAP gross profit

$

116,860

$

143,263

$

220,944

$

274,756

Reconciliation of Operating Expenses to Non-GAAP Operating

Expenses:

Three Months Ended

Six Months Ended

June 30,

June 30,

2022

2023

2022

2023

Operating expenses

$

153,637

$

176,974

$

294,249

$

348,833

Less: Share-based compensation (1)

25,831

27,991

49,919

55,634

Amortization of intangible assets (2)

152

134

304

271

Acquisition related expenses

113

-

591

-

Non-GAAP operating expenses

$

127,541

$

148,849

$

243,435

$

292,928

Reconciliation of Operating Loss to Non-GAAP Operating Loss:

Three Months Ended

Six Months Ended

June 30,

June 30,

2022

2023

2022

2023

Operating loss

$

(42,029

)

$

(39,898

)

$

(83,113

)

$

(86,024

)

Plus: Share-based compensation (1)

29,573

32,370

56,851

63,966

Amortization of share-based compensation capitalized in software

development costs (3)

88

103

176

206

Amortization of intangible assets (2)

1,574

1,839

3,004

3,680

Acquisition related expenses

113

-

591

-

Non-GAAP operating loss

$

(10,681

)

$

(5,586

)

$

(22,491

)

$

(18,172

)

Reconciliation of Net Loss to Non-GAAP Net Income (Loss):

Three Months Ended

Six Months Ended

June 30,

June 30,

2022

2023

2022

2023

Net loss

$

(37,628

)

$

(25,778

)

$

(75,439

)

$

(60,806

)

Plus: Share-based compensation (1)

29,573

32,370

56,851

63,966

Amortization of share-based compensation capitalized in software

development costs (3)

88

103

176

206

Amortization of intangible assets (2)

1,574

1,839

3,004

3,680

Acquisition related expenses

113

-

591

-

Amortization of debt discount and issuance costs

744

748

1,488

1,496

Gain from investment in privately held companies

-

(294

)

-

(294

)

Taxes on income related to non-GAAP adjustments

(5,211

)

(7,708

)

(9,322

)

(13,914

)

Non-GAAP net income (loss)

$

(10,747

)

$

1,280

$

(22,651

)

$

(5,666

)

Non-GAAP net income (loss) per share Basic

$

(0.27

)

$

0.03

$

(0.56

)

$

(0.14

)

Diluted

$

(0.27

)

$

0.03

$

(0.56

)

$

(0.14

)

Weighted average number of shares Basic

40,517,587

41,599,364

40,344,422

41,384,895

Diluted

40,517,587

46,065,943

40,344,422

41,384,895

(1) Share-based Compensation : Three Months

Ended Six Months Ended June 30, June 30,

2022

2023

2022

2023

Cost of revenues - Subscription

$

517

$

978

$

893

$

1,810

Cost of revenues - Perpetual license

31

12

61

19

Cost of revenues - Maintenance and Professional services

3,194

3,389

5,978

6,503

Research and development

6,754

7,192

12,804

13,930

Sales and marketing

12,361

13,595

23,761

28,190

General and administrative

6,716

7,204

13,354

13,514

Total share-based compensation

$

29,573

$

32,370

$

56,851

$

63,966

(2) Amortization of intangible assets : Three

Months Ended Six Months Ended June 30, June

30,

2022

2023

2022

2023

Cost of revenues - Subscription

$

1,425

$

1,705

$

2,633

$

3,409

Cost of revenues - Perpetual license

(3

)

-

67

-

Sales and marketing

152

134

304

271

Total amortization of intangible assets

$

1,574

$

1,839

$

3,004

$

3,680

(3) Classified as Cost of revenues - Subscription.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230810199482/en/

Investor Contact: Erica Smith CyberArk Phone: +1

617-558-2132 ir@cyberark.com Media Contact: Liz Campbell

CyberArk Phone: +1-617-558-2191 press@cyberark.com

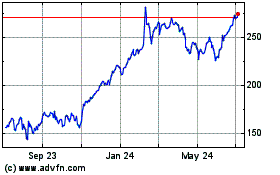

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Oct 2024 to Nov 2024

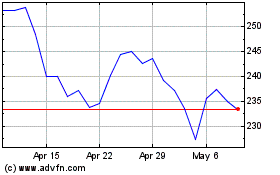

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Nov 2023 to Nov 2024