Amended Statement of Ownership (sc 13g/a)

February 13 2018 - 9:44AM

Edgar (US Regulatory)

SCHEDULE 13G

Amendment No. 2

CYBER-ARK SOFTWARE LTD (ISR)

COMMON STOCK

Cusip #M2682V108

Check the appropriate box to designate the rule pursuant to which this

Schedule is filed:

[x] Rule 13d-1(b)

[ ] Rule 13d-1(c)

[ ] Rule 13d-1(d)

Cusip #M2682V108

Item 1: Reporting Person - FMR LLC

Item 2: (a) [ ]

(b) [ ]

Item 4: Delaware

Item 5: 0

Item 6: 0

Item 7: 0

Item 8: 0

Item 9: 0

Item 11: 0.000 %

Item 12: HC

Cusip #M2682V108

Item 1: Reporting Person - Abigail P. Johnson

Item 2: (a) [ ]

(b) [ ]

Item 4: United States of America

Item 5: 0

Item 6: 0

Item 7: 0

Item 8: 0

Item 9: 0

Item 11: 0.000 %

Item 12: IN

Item 1(a). Name of Issuer:

CYBER-ARK SOFTWARE LTD (ISR)

Item 1(b). Address of Issuer's Principal Executive Offices:

94 Em-Hamoshavot Road

Park Ofer, P.O. Box 3143

Petach Tikva 4970602,

Israel

Item 2(a). Name of Person Filing:

FMR LLC

Item 2(b). Address or Principal Business Office or, if None,

Residence:

245 Summer Street, Boston, Massachusetts 02210

Item 2(c). Citizenship:

Not applicable

Item 2(d). Title of Class of Securities:

COMMON STOCK

Item 2(e). CUSIP Number:

M2682V108

Item 3. This statement is filed pursuant to Rule 13d-1(b) or 13d-2(b)

or (c) and the

person filing, FMR LLC, is a parent holding company in accordance with

Section 240.13d-1(b)(1)(ii)(G). (Note: See Exhibit A).

Item 4. Ownership

(a) Amount Beneficially Owned: 0

(b) Percent of Class: 0.000 %

(c) Number of shares as to which such person has:

(i) sole power to vote or to direct the vote: 0

(ii) shared power to vote or to direct the vote: 0

(iii) sole power to dispose or to direct the

disposition of: 0

(iv) shared power to dispose or to direct the

disposition of: 0

|

Item 5. Ownership of Five Percent or Less of a Class.

If this statement is being filed to report the fact that as

of the date hereof,the reporting person has ceased to be the beneficial

owner of any of the class of securities, check the following (X).

Item 6. Ownership of More than Five Percent on Behalf of Another

Person.

Not applicable.

Item 7. Identification and Classification of the Subsidiary Which

Acquired the Security Being Reported on By the Parent Holding Company.

See attached Exhibit A.

Item 8. Identification and Classification of Members of the Group.

Not applicable.

Item 9. Notice of Dissolution of Group.

Not applicable.

Item 10. Certifications.

By signing below I certify that, to the best of my knowledge and belief,

the securities referred to above were acquired and are held in the ordinary

course of business and were not acquired and are not held for the purpose

of or with the effect of changing or influencing the control of the issuer

of the securities and were not acquired and are not held in connection with

or as a participant in any transaction having that purpose or effect.

Signature

After reasonable inquiry and to the best of my knowledge and belief, I

certify that the information set forth in this statement is true, complete

and correct.

February 13, 2018

Date

/s/ Marc R. Bryant

Signature

Marc R. Bryant

Duly authorized under Power of Attorney effective as of September 23,

2015, by and on behalf of FMR LLC and its direct and indirect subsidiaries*

|

* This power of attorney is incorporated herein by reference to Exhibit 24

to the Schedule 13G filed by FMR LLC on June 10, 2016, accession number:

0000315066-16-005935

Exhibit A

Abigail P. Johnson is a Director, the Chairman and the

Chief Executive Officer of FMR LLC.

Members of the Johnson family, including Abigail P.

Johnson, are the predominant owners, directly or through trusts, of Series

B voting common shares of FMR LLC, representing 49% of the voting power of

FMR LLC. The Johnson family group and all other Series B shareholders have

entered into a shareholders' voting agreement under which all Series B

voting common shares will be voted in accordance with the majority vote of

Series B voting common shares. Accordingly, through their ownership of

voting common shares and the execution of the shareholders' voting

agreement, members of the Johnson family may be deemed, under the

Investment Company Act of 1940, to form a controlling group with respect to

FMR LLC.

This filing reflects the securities beneficially owned, or

that may be deemed to be beneficially owned, by FMR LLC, certain of its

subsidiaries and affiliates, and other companies (collectively, the "FMR

Reporters"). This filing does not reflect securities, if any, beneficially

owned by certain other companies whose beneficial ownership of securities

is disaggregated from that of the FMR Reporters in accordance with

Securities and Exchange Commission Release No. 34-39538 (January 12, 1998).

RULE 13d-1(k)(1) AGREEMENT

The undersigned persons, on February 13, 2018, agree and

consent to the joint filing on their behalf of this Schedule 13G in

connection with their beneficial ownership of the COMMON STOCK of CYBER-ARK

SOFTWARE LTD (ISR) at December 29, 2017.

FMR LLC

By /s/ Marc R. Bryant

Marc R. Bryant

Duly authorized under Power of Attorney effective as of September 23,

2015, by and on behalf of FMR LLC and its direct and indirect subsidiaries*

|

Abigail P. Johnson

By /s/ Marc R. Bryant

Marc R. Bryant

Duly authorized under Power of Attorney effective as of December 16,

2015, by and on behalf of Abigail P. Johnson*

|

* This power of attorney is incorporated herein by reference to Exhibit 24

to the Schedule 13G filed by FMR LLC on June 10, 2016, accession number:

0000315066-16-005935

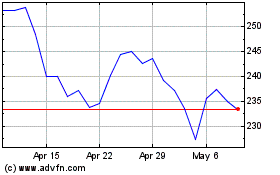

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Oct 2024 to Nov 2024

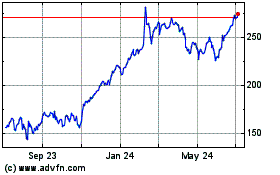

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Nov 2023 to Nov 2024