Shareholder Class Action Filed Against Crocs Inc. by the Law Firm of Schiffrin Barroway Topaz & Kessler, LLP

November 27 2007 - 6:47PM

PR Newswire (US)

RADNOR, Pa., Nov. 27 /PRNewswire/ -- The following statement was

issued today by the law firm of Schiffrin Barroway Topaz &

Kessler, LLP: Notice is hereby given that a class action lawsuit

was filed in the United States District Court for the District of

Colorado on behalf of all purchasers of securities of Crocs Inc.

(NASDAQ:CROX) ("Crocs" or the "Company") from July 27, 2007 through

October 31, 2007, inclusive (the "Class Period"). If you wish to

discuss this action or have any questions concerning this notice or

your rights or interests with respect to these matters, please

contact Schiffrin Barroway Topaz & Kessler, LLP (Darren J.

Check, Esq. or Richard A. Maniskas, Esq.) toll free at

1-888-299-7706 or 1-610-667-7706, or via e-mail at . The Complaint

charges Crocs and certain of its officers and directors with

violations of the Securities Exchange Act of 1934. Crocs is a

designer, manufacturer and marketer of footwear for men, women and

children under the "crocs" brand. More specifically, the Complaint

alleges that the Company failed to disclose and misrepresented the

following material adverse facts which were known to defendants or

recklessly disregarded by them: (1) that the Company was

experiencing significant product distribution problems in Europe

and Asia; (2) that these distribution problems were causing the

Company to be unable to capitalize on tens of millions of dollars

in sales of its products due to their seasonal nature and changing

weather conditions in certain markets; (3) as a result, the

Company's inventory levels were significantly increasing due to

such distribution problems and seasonal product sales; and (4)

that, as a result of the foregoing, the Company's statements about

its financial well-being and future business prospects were lacking

in any reasonable basis when made. On October 31, 2007, the Company

shocked investors when it announced disappointing third quarter

earnings. Following this announcement, the Company held a

conference call where it disclosed that it had experienced a

significant slowdown in sales during the quarter. The Company

admitted that it had missed sales opportunities in Europe and Asia

due to an inability to fulfill orders, and that it had "only

shipped about 50% of the orders" in these markets. As a result of

distribution problems, the Company was unable to capitalize on over

$20 million of sales in Europe, as well as on an additional $10 to

$15 million of sales in Asia. Further, the Company disclosed that

its sales were being negatively impacted as the weather turned

colder throughout Europe and Asia. These distribution problems were

particularly devastating for the Company's sales during the quarter

as its products are subject to seasonal variations and are

significantly impacted by weather conditions, and because over 75

percent of the Company's revenues during a quarter are attributable

to its fair-weather footwear. As a result of the distribution

problems, the Company's inventories increased to $195.3 million for

the quarter, as compared to $49.1 million for the prior year's

quarter. Most of the increased inventory position for the quarter

was as a result of the Company's problems in Europe and Asia, where

it admittedly "struggle[d] to keep up with their torrid growth and

orders early in the quarter." On this news, the Company's shares

fell $27.01 per share, or over 36 percent, to close on November 1,

2007 at $47.74 per share, on unusually heavy trading volume.

Plaintiff seeks to recover damages on behalf of class members and

is represented by the law firm of Schiffrin Barroway Topaz &

Kessler which prosecutes class actions in both state and federal

courts throughout the country. Schiffrin Barroway Topaz &

Kessler is a driving force behind corporate governance reform, and

has recovered billions of dollars on behalf of institutional and

individual investors from the United States and around the world.

For more information about Schiffrin Barroway Topaz & Kessler

or to sign up to participate in this action online, please visit

http://www.sbtklaw.com/ If you are a member of the class described

above, you may, not later than January 7, 2008, move the Court to

serve as lead plaintiff of the class, if you so choose. A lead

plaintiff is a representative party that acts on behalf of other

class members in directing the litigation. In order to be appointed

lead plaintiff, the Court must determine that the class member's

claim is typical of the claims of other class members, and that the

class member will adequately represent the class. Your ability to

share in any recovery is not, however, affected by the decision

whether or not to serve as a lead plaintiff. Any member of the

purported class may move the court to serve as lead plaintiff

through counsel of their choice, or may choose to do nothing and

remain an absent class member. CONTACT: Schiffrin Barroway Topaz

& Kessler, LLP Darren J. Check, Esq. Richard A. Maniskas, Esq.

280 King of Prussia Road Radnor, PA 19087 1-888-299-7706 (toll

free) or 1-610-667-7706 Or by e-mail at DATASOURCE: Schiffrin

Barroway Topaz & Kessler, LLP CONTACT: Darren J. Check, Esq. or

Richard A. Maniskas, Esq., both of Schiffrin Barroway Topaz &

Kessler, LLP, +1-1-888-299-7706, +1-1-610-667-7706, Web site:

http://www.sbtklaw.com/

Copyright

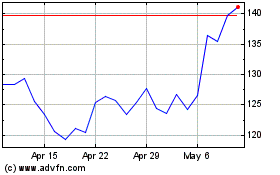

Crocs (NASDAQ:CROX)

Historical Stock Chart

From May 2024 to Jun 2024

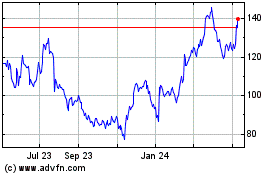

Crocs (NASDAQ:CROX)

Historical Stock Chart

From Jun 2023 to Jun 2024