Amended Statement of Beneficial Ownership (sc 13d/a)

July 01 2022 - 4:31PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 1)*

comScore,

Inc.

(Name

of Issuer)

Common

Stock, par value $0.001 per share

(Title

of Class of Securities)

20564W105

(CUSIP

Number)

with

a copy to:

| Cerberus

Capital Management, L.P. |

|

Robert

G. Minion, Esq. |

| Attn:

Andrew Kandel, Chief Compliance Officer |

|

Lowenstein

Sandler LLP |

| 875

Third Avenue, 11th Floor |

|

1251

Avenue of the Americas, 17th Floor |

| New

York, NY 10022 |

|

New

York, NY 10020 |

| (212)

891-2100 |

|

(646)

414-6930 |

(Name,

Address and Telephone Number of Person

Authorized

to Receive Notices and Communications)

June

30, 2022

(Date

of Event Which Requires Filing of This Statement)

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 240.13d-7

for other parties to whom copies are to be sent.

*The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover

page.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

CUSIP

No. 20564W105

| 1. |

Names

of Reporting Persons:

Pine

Investor, LLC

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions):

(a)

☐

(b)

☒

|

| 3. |

SEC

Use Only

|

| 4. |

Source

of Funds (See Instructions): OO

|

| 5. |

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e): ☐

|

| 6. |

Citizenship

or Place of Organization:

Delaware

|

Number

of

Shares

Beneficially

Owned

by

Each

Reporting

Person

With |

7.

|

Sole Voting Power:

|

27,509,203

(1) |

| 8.

|

Shared Voting Power:

|

0 |

| 9.

|

Sole Dispositive Power:

|

27,509,203

(1) |

| 10. |

Shared Dispositive Power:

|

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person: |

27,509,203 (1)

|

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares (See

Instructions):

|

☒ (1) |

| 13. |

Percent of Class Represented by Amount in Row (11):

|

23.3% (1) |

| 14. |

Type of Reporting Person (See Instructions): OO

|

|

(1)

Represents 27,509,203 shares of common stock, par value $0.001 per share (“Common Stock”), of comScore, Inc., a Delaware

corporation (the “Issuer”), issuable upon conversion of the Issuer’s Series B Convertible Preferred Stock, par value

$0.001 per share (the “Series B Preferred Stock”).

CUSIP

No. 20564W105

| 1. |

Names

of Reporting Persons: |

| |

|

|

Cerberus Capital Management, L.P.

|

| 2. |

Check

the Appropriate Box if a Member of a Group (See Instructions): |

| |

(a)

☐ |

| |

(b) ☒

|

| 3. |

SEC Use Only

|

| |

|

| 4. |

Source of Funds (See Instructions): OO

|

| 5. |

Check if Disclosure of Legal Proceedings is Required Pursuant to Items 2(d) or 2(e): ☐

|

| 6. |

Citizenship

or Place of Organization: |

| |

|

| |

Delaware |

Number

of

Shares

Beneficially

Owned

by

Each

Reporting Person With |

7.

|

Sole

Voting Power:

|

27,586,272

(1) |

| 8.

|

Shared

Voting Power:

|

0 |

| 9.

|

Sole

Dispositive Power:

|

27,586,272

(1) |

| 10. |

Shared

Dispositive Power:

|

0 |

| 11. |

Aggregate Amount Beneficially Owned by Each Reporting Person: |

27,586,272 (1) |

| |

|

|

| 12. |

Check if the Aggregate Amount in Row (11) Excludes Certain Shares |

☒ (1) |

| |

(See Instructions): |

|

| |

|

|

| 13. |

Percent

of Class Represented by Amount in Row (11): | 23.3%

(1) |

| |

|

|

| 14. |

Type of Reporting Person (See Instructions):

|

IA |

(1)

Represents (i) 27,509,203 shares of Common Stock issuable upon conversion of Series B Preferred Stock and (ii) 77,069 shares of Common

Stock underlying vested, deferred stock units resulting from restricted stock unit awards previously granted by the Issuer to Nana Banerjee

and assigned by Dr. Banerjee to Cerberus Capital Management, L.P.

| Item

5. | Interest

in Securities of the Issuer. |

Item

5 is hereby amended in its entirety as follows:

The

Reporting Persons may be deemed to beneficially own, in the aggregate, 27,586,272 shares of Common Stock, consisting of (i) 27,509,203

shares of Common Stock issuable upon conversion of 27,509,203 shares of Series B Preferred Stock beneficially owned by the Reporting

Persons, and (ii) 77,069 shares of Common Stock underlying vested, deferred stock units resulting from restricted stock unit awards previously

granted by the Issuer to Nana Banerjee in 2021 in respect of director fees and assigned by Dr. Banerjee to Cerberus (the “Deferred

Stock Units”). The Series B Preferred Stock is convertible into shares of Common Stock at any time at the holder’s option,

based on a conversion rate subject to certain adjustments, including for anti-dilution and accrued dividends (which accrue at 7.5% per

annum), determined in the manner set forth in the Certificate of Designations.

The

27,586,272 shares of Common Stock referred to above are based upon a conversion rate of the Series B Preferred Stock equal

to 1:1 as of June 30, 2022, and represent approximately 23.3% of the outstanding shares of Common Stock, based upon 90,705,342

shares of Common Stock outstanding as of May 6, 2022, as reported by the Issuer in its Quarterly Report on Form 10-Q for the quarterly

period ended March 31, 2022, filed with the Securities and Exchange Commission on May 10, 2022, and as calculated pursuant to Rule 13d-3

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

As

a result of the Stockholders Agreement, the Reporting Persons may be deemed to be members of a group with the parties to the Stockholders

Agreement under Section 13(d) of the Exchange Act. Please refer to the separate Schedule 13Ds (and any amendments thereto) that have

been or may be filed by Charter and Qurate with respect to their beneficial ownership of Common Stock. Neither the filing of this Statement

nor any of its contents shall be deemed to constitute an admission by any Reporting Person that, except as expressly set forth herein,

it has or shares beneficial ownership of any shares of Common Stock held by any other person for purposes of Section 13(d) of the Exchange

Act or for any other purpose, and such beneficial ownership thereof is expressly disclaimed.

Pine

and Cerberus have the sole power to vote or to direct the voting of and the sole power to dispose or direct the disposition of the 27,509,203

shares of Common Stock underlying the Series B Preferred Stock, and Cerberus has the sole power to vote or to direct the voting of and

the sole power to dispose or direct the disposition of the 77,069 shares of Common Stock underlying the Deferred Stock Units, subject

in each case to the restrictions described in Item 6.

Except

as set forth herein, no Reporting Person, or to the knowledge of the Reporting Persons, any other individual named in Item 2, has effected

any transaction in the Common Stock in the 60 days preceding the date hereof.

No

other person has the right to receive or the power to direct the receipt of dividends from, or the proceeds from the sale of, the securities

described in this Statement.

Signature

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this Statement is true, complete

and correct.

| Dated:

July 1, 2022 |

PINE

INVESTOR, LLC |

| |

|

|

| |

By: |

/s/

Alexander D. Benjamin |

| |

Name: |

Alexander

D. Benjamin |

| |

Title: |

Managing

Director |

| |

CERBERUS

CAPITAL MANAGEMENT, L.P. |

| |

|

|

| |

By: |

/s/

Alexander D. Benjamin |

| |

Name: |

Alexander

D. Benjamin |

| |

Title: |

Senior

Managing Director and |

| |

|

General

Counsel |

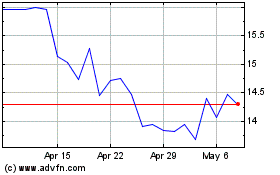

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Mar 2024 to Apr 2024

comScore (NASDAQ:SCOR)

Historical Stock Chart

From Apr 2023 to Apr 2024