Form 8-K - Current report

March 04 2024 - 4:05PM

Edgar (US Regulatory)

false

0001868269

0001868269

2024-02-27

2024-02-27

0001868269

LATGU:UnitseachconsistingofoneClassAordinaryshareMember

2024-02-27

2024-02-27

0001868269

LATGU:ClassAordinarysharesparvaluepershareMember

2024-02-27

2024-02-27

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

March 4, 2024 (February 27, 2024)

Chenghe Acquisition I Co.

(Exact Name of Registrant as Specified in its Charter)

| Cayman Islands |

|

001-41246 |

|

98-1605340 |

(State

or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(I.R.S. Employer

Identification No.) |

| |

|

|

|

|

|

38 Beach Road #29-11

South Beach Tower

Singapore |

|

189767 |

| (Address of Principal Executive Offices) |

|

(Zip

Code) |

Registrant’s telephone number,

including area code: (+65) 9851 8611

LatAmGrowth SPAC

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Securities Exchange

Act of 1934:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which

registered |

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable warrant |

|

LATGU |

|

The Nasdaq Stock Market LLC |

| Class

A ordinary shares, par value $0.0001 per share |

|

LATG |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

Item 4.01 Changes in Registrant’s Certifying

Accountant.

(a) On

February 27, 2024, Marcum LLP (“Marcum US”) was dismissed as the independent registered public accounting firm for the Company.

The decision to dismiss Marcum US was approved by the Audit Committee of the Board of Directors of the Company.

During the year ended December

31, 2022, the period from May 20, 2021 (inception) through December 31, 2021and the subsequent interim period through February 27, 2024,

(i) there were no disagreements between the Company and Marcum US on any matter of accounting principles or practices, financial statement

disclosure, or auditing scope or procedures, which disagreements, if not resolved to their satisfaction, would have caused Marcum US to

make reference to such disagreements in its report on the financial statements for such years; and (ii) there were no “reportable

events” as such term is defined in Item 304(a)(1)(v) of Regulation S-K), except for the following:

Marcum US advised the Company,

and the Company’s management concurred, that the following material weaknesses in internal control over financial reporting existed

as of September 30, 2023 (which have been disclosed in our Quarterly Report for the quarter ended September 30, 2023):

| 1. | a failure to record accounting transactions in the proper accounting period; |

| 2. | a failure to properly account and disclose of complex financial instruments, including those requiring the application of complex accounting principles as a means of differentiating between liability, temporary equity and permanent equity classification; |

| 3. | a failure to timely reconcile accrued legal expenses and NASDAQ filing fees; and |

| 4. | a failure to estimate the fair value of complex financial instruments, such as Class B ordinary

shares, earnout provisions, and forfeiture provision. |

The Audit Committee discussed

the reportable events with Marcum US. The Company has authorized Marcum US to respond fully to the inquiries of Marcum Asia, as successor

auditor, concerning the subject matter of the reportable events.

The report of Marcum US

on the Company’s balance sheets as of December 31, 2022 and 2021, and the related statements of operations, changes in shareholders’

deficit and cash flows for the year ended December 31, 2022 and for the period from May 20, 2021 (inception) through December 31, 2021,

did not contain an adverse opinion or a disclaimer of opinion, nor was it qualified or modified as to uncertainty, audit scope or accounting

principles, except that such report contained an explanatory paragraph which noted that there was substantial doubt as to the Company’s

ability to continue as a going concern because of the Company’s liquidity condition and date for mandatory liquidation.

Before filing this Current

Report on Form 8-K with the SEC, the Company provided Marcum US with a copy of the disclosures contained in this Item 4.01(a). The Company

has requested that Marcum US issues a letter, addressed to the SEC, stating whether or not Marcum US agrees with the statements contained

in this Item 4.01(a). A copy of Marcum US’s letter dated March 4, 2024, addressed to the SEC, is filed as Exhibit 16.1 to this Current

Report on Form 8-K.

(b) On February 27,

2024, Marcum Asia CPAs LLP (“Marcum Asia”) was engaged as the independent registered public accounting firm for the

Company. The decision to replace Marcum US with Marcum Asia was approved the Audit Committee of the Board of Directors of the

Company. During the Company’s two most recent fiscal years and through February 27, 2024, neither the Company nor anyone

acting on the Company’s behalf consulted Marcum Asia with respect to any of the matters or reportable events set forth in

Item 304(a)(2) of Regulation S-K.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Chenghe Acquisition I Co. |

| |

|

| |

By: |

/s/ Zhiyang Zhou |

| |

Name: |

Zhiyang Zhou |

| |

Title: |

Chief Executive Officer and Chief Financial Officer |

Date: March 4, 2024

Exhibit 16. 1

March 4, 2024

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

Commissioners:

We have read the statements made by Chenghe Acquisition

I Co. (formerly known as LatAmGrowth SPAC) under Item 4.01 of its Form 8-K dated March 4, 2024. We agree with the statements concerning

our Firm in such Form 8-K; we are not in a position to agree or disagree with other statements of Chenghe Acquisition I Co. (formerly

known as LatAmGrowth SPAC) contained therein.

Very truly yours,

/s/ Marcum llp

Marcum llp

v3.24.0.1

Cover

|

Feb. 27, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Feb. 27, 2024

|

| Entity File Number |

001-41246

|

| Entity Registrant Name |

Chenghe Acquisition I Co.

|

| Entity Central Index Key |

0001868269

|

| Entity Tax Identification Number |

98-1605340

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

38 Beach Road #29-11

|

| Entity Address, City or Town |

South Beach Tower

|

| Entity Address, Country |

SG

|

| Entity Address, Postal Zip Code |

189767

|

| City Area Code |

65

|

| Local Phone Number |

9851 8611

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Entity Information, Former Legal or Registered Name |

LatAmGrowth SPAC

|

| Units, each consisting of one Class A ordinary share and one-half of one redeemable warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable warrant

|

| Trading Symbol |

LATGU

|

| Security Exchange Name |

NASDAQ

|

| Class A ordinary shares, par value $0.0001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Class

A ordinary shares, par value $0.0001 per share

|

| Trading Symbol |

LATG

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LATGU_UnitseachconsistingofoneClassAordinaryshareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=LATGU_ClassAordinarysharesparvaluepershareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

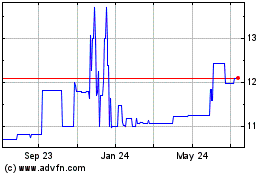

Chenghe Acquisition I (NASDAQ:LATGU)

Historical Stock Chart

From Apr 2024 to May 2024

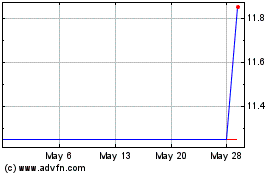

Chenghe Acquisition I (NASDAQ:LATGU)

Historical Stock Chart

From May 2023 to May 2024