Career Education Corporation (NASDAQ: CECO) today reported total

revenue of $437.4 million and net income of $23.3 million, or $0.26

per diluted share, for the first quarter of 2009 compared to total

revenue of $451.9 and net income of $16.4 million, or $0.18 per

diluted share, for the first quarter of 2008. Excluding significant

items as detailed below in this press release, net income per

diluted share was $0.32 for the first quarter of 2009, compared to

$0.25 for the first quarter of 2008.

�I am encouraged by our overall performance in the first

quarter,� said Gary E. McCullough, president and chief executive

officer. �Our Health Education schools delivered another record

quarter with a 24% increase in student population. Our Culinary

schools posted a 13% increase in student starts, thanks to our

efforts in 2008 to evolve the business to meet the changing needs

of our students. However, in our University institutions, while we

generated strong improvements in operating income and margins, I am

not satisfied with the level of our student starts. We will

continue to improve in this important area as we move toward our

goal of meaningful and consistent revenue growth across the

organization.�

Three Months Ended March 31, 2009

- Total revenue from continuing

operations was $437.4 million during the first quarter of 2009, a

3.2 percent decrease from $451.9 million during the first quarter

of 2008.

- Revenue for the Transitional

Schools was $6.7 million in the first quarter of 2009, as compared

to $24.4 million for the first quarter of 2008 reflecting the

reduction in student population associated with the teach-out of

these operations.

- Excluding the Transitional

Schools, revenue was $430.7 million in the first quarter, a 0.7

percent increase from $427.5 million in the first quarter of

2008.

- Operating income was $35.4

million during the first quarter of 2009, a 46 percent increase

from $24.2 million of operating income during the first quarter of

2008. Operating margin percentage was 8.1 percent during the first

quarter of 2009, a 2.7 percentage point increase relative to an

operating profit margin percentage of 5.4 percent during the first

quarter of 2008.

- Included in pretax income for

the three months ended March 31, 2009 and the three months ended

March 31, 2008 are the following significant items:

�

�

�

Pretax Expense/ (Income)

(In Millions)

�

�

Diluted Earnings per Share

Impact

Income Gain/ (Loss)

Three Months Ended March 31, 2009

Lease Exit Charges $7.8 ($0.06 ) �

Three Months Ended March 31, 2008

Severance and Stay Bonuses $10.5 ($0.08 )

Impairment Charges

$2.2

($0.02

)

Gain from Termination of Affiliate

Relationship (1)

($4.7

)

$0.03

� TOTAL $8.0 � ($0.07 )

(1) (Reported within other income)

- Transitional Schools reported a

loss of $17.2 million in the first quarter of 2009, as compared to

a loss of $15.6 million for the first quarter of 2008. Included in

the operating loss in the first quarter of 2009 were charges

associated with vacated real estate of $7.8 million. Included in

the operating loss in the first quarter of 2008 was $7.2 million of

charges related to severance and stay bonuses and a $2.2 million

charge related to the impairment of long-lived assets.

- Excluding the Transitional

Schools, operating income was $52.6 million in the first quarter of

2009, up 32 percent from $39.8 million in the first quarter of

2008. Included in operating income in the first quarter of 2008 was

$3.3 million of severance expenses. Operating margin excluding the

Transitional Schools was 12.2 percent during the first quarter of

2009, a 2.9 percentage point increase relative to an operating

profit margin percentage of 9.3 percent during the first quarter of

2008.

CONSOLIDATED CASH FLOWS AND

FINANCIAL POSITION

Cash Flows

- Cash provided by operating

activities was $48.7 million during the first quarter of 2009,

compared to cash provided by operating activities of $35.5 million

during the first quarter of 2008.

- Capital expenditures decreased

to $14.9 million during the first quarter of 2009, from $18.8

million during the first quarter of 2008. Capital expenditures

represented 3.4 percent of total revenue during the first quarter

of 2009.

Financial Position

- As of March 31, 2009 and

December 31, 2008, cash and cash equivalents and investments

totaled $499.7 million and $508.7 million, respectively.

- Days sales outstanding (DSO)

were 13 days as of March 31, 2009, compared to 14 days as of March

31, 2008.

Stock Repurchase Program

Our Board of Directors has authorized the use of a total of

$800.2�million to repurchase outstanding shares of our common

stock. Stock repurchases under this program may be made on the open

market or in privately negotiated transactions from time to time,

depending on various factors, including market conditions and

corporate and regulatory requirements. The stock repurchase program

does not have an expiration date and may be suspended or

discontinued at any time.

During the three months ended March 31, 2009, the company

repurchased 1.7 million shares of our common stock for

approximately $40.0 million at an average price of $22.83 per

share. Since the inception of the program, the company has

repurchased 20.9 million shares of our common stock for

approximately $644.7 million at an average price of $30.80 per

share.

As of March 31, 2009, approximately $155.5 million is available

under the program to repurchase outstanding shares of our common

stock.

Revenue

�

For the three months ended

March 31,

�

% Change

2009 �

2008 2009 vs. 2008 Revenue (in

millions) University $189.8 $177.1 7% Culinary Arts 75.3 87.2

(14%) Health Education 67.4 57.8 17% Art & Design 63.8 70.9

(10%) International 34.5 34.5 - Corporate (0.1 ) - N/M

Subtotal $430.7 $427.5 1% Transitional

Schools 6.7 � 24.4 N/M

Total Revenue $437.4 �

$451.9 (3%) �

Operating Income

�

For the three months ended

March 31,

�

% Change

2009 �

2008 2009 vs. 2008 Operating Income

(in millions) University $38.1 $25.0 52% Culinary Arts (0.6 )

5.4 (111%) Health Education 13.5 4.4 207% Art & Design 7.4 10.7

(31%) International 11.4 12.8 (11%) Corporate (17.2 ) (18.5 ) N/M

Subtotal $52.6 $39.8 32% Transitional

Schools (17.2 ) (15.6 ) N/M

Total Operating Income

$35.4 �

$24.2 �

46% �

Operating Margin

�

For the three months ended

March 31,

2009 �

2008 Operating Margin University 20.1%

14.1% Culinary Arts -0.8% 6.2% Health Education 20.0% 7.7% Art

& Design 11.5% 15.1% International 33.0% 37.1% Corporate N/M

N/M

Subtotal 12.2% 9.3% Transitional Schools

N/M -63.9%

Total 8.1% 5.4% �

STUDENT POPULATION AND NEW

STUDENT START DATA

Student Population

Total student population by reportable segment as of April 30,

2009 and 2008, were as follows:

�

As of April 30, �

% Change 2009 �

2008 2009 vs. 2008 STUDENT POPULATION

University 48,600 43,500 12% Culinary Arts 9,800 10,200 (4%) Health

Education 19,300 15,600 24% Art & Design 12,500 12,800 (2%)

International 8,300 7,000 19%

Subtotal 98,500

89,100 11%

Transitional Schools

1,300 4,700 (72%)

Total Student Population 99,800

93,800 6% �

ONLINE STUDENT

POPULATION

Art & Design 1,100 500 120% University 38,400 33,900 13%

Total Online Student Population 39,500 34,400

15% �

New Student Starts

New student starts by reportable segment during the first

quarter of 2009 and 2008, were as follows:

�

For the three months ended

March 31,

�

% Change

2009 �

2008 2009 vs. 2008 NEW STUDENT

STARTS University 16,120 15,830 2% Culinary Arts 2,840 2,520

13% Health Education 6,380 5,110 25% Art & Design 1,950 2,070

(6%) International 710 560 27%

Subtotal 28,000

26,090 7% Transitional Schools 10 1,300 N/M

Total

New Student Starts 28,010 27,390 2% �

ONLINE STUDENT STARTS

Art & Design 330 300 10% University 13,640 � 13,460 1%

Total

Online Student Starts 13,970 �

13,760 2%

CONFERENCE CALL INFORMATION

Career Education Corporation will host a conference call on May

7, 2009 at 10:00 AM (Eastern Time). Interested parties can access

the live webcast of the conference call at www.careered.com.

Participants can also listen to the conference call by dialing

800-573-4842 (domestic) or 617-224-4327 (international) and citing

code 27904153. Please log-in or dial-in at least 10 minutes prior

to the start time to ensure a connection. An archived version of

the webcast will be accessible for 90 days at www.careered.com. A

replay of the call will also be available for seven days by calling

888-286-8010 (domestic) or 617-801-6888 (international) and citing

code 52594782.

About Career Education

Corporation

The colleges, schools, and universities that are part of the

Career Education Corporation (CEC) family offer high quality

education to a diverse population of approximately 99,000 students

across the world in a variety of career-oriented disciplines. The

more than 75 campuses that serve these students are located

throughout the U.S. and in France, Italy, and the United Kingdom,

and offer doctoral, master's, bachelor's, and associate degrees and

diploma and certificate programs. Approximately one-third of its

students attend the web-based virtual campuses of American

InterContinental University Online and Colorado Technical

University Online.

CEC is an industry leader whose gold-standard brands are

recognized globally. Those brands include, among others, the Le

Cordon Bleu Schools North America; Harrington College of Design;

Brooks Institute; International Academy of Design & Technology;

American InterContinental University; Colorado Technical University

and Sanford-Brown Institutes and Colleges. Through its schools, CEC

is committed to providing quality education, enabling students to

graduate and pursue rewarding careers.

For more information, see the company�s website at

www.careered.com. The company's website includes a detailed listing

of individual campus locations and web links to its more than 75

colleges, schools, and universities.

Except for the historical and present factual information

contained herein, the matters set forth in this release, including

statements identified by words such as "anticipate," "believe,"

"plan," "expect," "intend," "project," "will," and similar

expressions, are forward-looking statements as defined in Section

21E of the Securities Exchange Act of 1934, as amended. These

statements are based on information currently available to us and

are subject to various risks, uncertainties and other factors that

could cause our actual growth, results of operations, performance

and business prospects, and opportunities to differ materially from

those expressed in, or implied by, these statements. Except as

expressly required by the federal securities laws, we undertake no

obligation to update such factors or to publicly announce the

results of any of the forward-looking statements contained herein

to reflect future events, developments, or changed circumstances or

for any other reason. These risks and uncertainties, the outcome of

which could materially and adversely affect our financial condition

and operations, include, but are not limited to, the following: the

adverse impact and potential impacts on the availability of Title

IV and private student loans for our students of (1) the

willingness or ability of private lenders to make private student

loans in the current U.S. credit markets, (2) new student lending

related reporting and disclosure obligations on institutions that

participate in Title IV federal student financial aid programs

under The Higher Education Opportunity Act (�HEOA�), signed into

law on August 14, 2008, in the first full reauthorization of the

Higher Education Act of 1965, as amended, and (3) pending

regulations under HEOA and Congress� willingness or ability to

maintain or increase funding for Title IV programs; potential

higher bad debt expense or reduced revenue associated with

requiring students to pay more of their educational expenses while

in school or with directly making student loans to our students;

increased competition; the effectiveness of our regulatory

compliance efforts; impairment of goodwill and other intangible

assets as we continue to redefine the company and manage our brands

and marketing to improve effectiveness and reduce costs; charges

and expenses associated with exiting excess facility space,

centralizing various functional areas, such as human resources and

financial aid, and continuing to align the SBUs and corporate staff

to remove layers, overlaps and redundancies; the impact on our

revenues and profitability of our transitional segment; our ability

to comply with accrediting agency requirements or obtain

accrediting agency approvals; our dependence on information

technology system; our ownership or use of intellectual property ;

costs and impacts of legal and administrative proceedings and

investigations, governmental regulations, and class action and

other lawsuits; costs and difficulties related to the integration

of acquired businesses; our ability to manage and continue growth;

and other factors discussed in our Annual Report on Form 10-K for

the year ended December 31, 2008, our Quarterly Report on Form 10-Q

for the most recent fiscal quarter, and from time to time in our

current reports filed with the Securities and Exchange

Commission.

CAREER EDUCATION CORPORATION AND SUBSIDIARIES UNAUDITED

CONSOLIDATED BALANCE SHEETS (In thousands) � �

March 31,

December 31, 2009

2008(1)

�

ASSETS CURRENT ASSETS: Cash and cash equivalents $

159,121 $ 244,743 Investments 340,566 � 263,953 � Total cash and

cash equivalents and investments 499,687 508,696 Receivables:

Students, net of allowance for doubtful accounts of $35,738 and

$35,226 as of March 31, 2009 and December 31, 2008, respectively

57,134 59,119 Other, net 6,844 9,191 Prepaid expenses 47,473 46,416

Inventories 12,362 12,352 Deferred income tax assets 17,472 17,472

Other current assets 9,601 9,223 Assets of discontinued operations

4,848 � 5,003 � Total current assets 655,421 � 667,472 �

NON-CURRENT ASSETS: Property and equipment, net 298,044

304,970 Goodwill 374,048 376,072 Intangible assets, net 39,245

39,904 Deferred income tax assets 11,566 11,440 Other assets, net

18,879 � 17,465 �

TOTAL ASSETS $ 1,397,203 �

$

1,417,323 � �

LIABILITIES AND STOCKHOLDERS' EQUITY

CURRENT LIABILITIES: Current maturities of long-term debt

and capital lease obligations $ 337 $ 354 Accounts payable 42,862

28,450 Accrued expenses: Payroll and related benefits 48,729 63,757

Advertising and production costs 19,729 21,504 Income taxes 34,216

29,224 Other 50,107 49,526 Deferred tuition revenue 142,524 153,727

Liabilities of discontinued operations 7,294 � 8,753 � Total

current liabilities 345,798 � 355,295 � �

NON-CURRENT

LIABILITIES: Long-term debt and capital lease obligations, net

of current maturities 1,658 1,889 Deferred rent obligations 99,299

97,644 Other liabilities, net 20,368 � 13,983 � Total non-current

liabilities 121,325 � 113,516 � �

SHARE-BASED AWARDS SUBJECT TO

REDEMPTION 1,693 860 �

STOCKHOLDERS' EQUITY: Preferred

stock - - Common stock 954 933 Additional paid-in capital 226,200

222,523 Accumulated other comprehensive income 571 5,774 Retained

earnings 829,924 807,500 Cost of shares in treasury (129,262 )

(89,078 ) Total stockholders' equity 928,387 � 947,652 �

TOTAL

LIABILITIES AND STOCKHOLDERS' EQUITY $ 1,397,203 �

$

1,417,323 � � � � � � �

(1)

�

Prior period financial results have been reclassified to account

for the teach-out of our schools previously reported as

transitional, the change in our reportable business segments during

the first quarter of 2008 and to present Brooks College - Sunnyvale

and Long Beach, CA, IADT - Pittsburgh, PA, IADT - Toronto, Canada

and Katharine Gibbs School and Gibbs College - Piscataway, NJ as

discontinued operations.

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF

OPERATIONS (In thousands, except per share amounts and

percentages) � � � � � �

For the Three Months Ended March

31, % of % of

2009 Revenue

2008(1)

Revenue �

REVENUE: Tuition and registration

fees $ 420,197 96.1 % $ 432,051 95.6 % Other 17,250 � 3.9 % 19,833

� 4.4 % Total revenue 437,447 � 451,884 � �

OPERATING

EXPENSES: Educational services and facilities 163,074 37.3 %

166,649 36.9 % General and administrative 222,141 50.8 % 238,626

52.8 % Depreciation and amortization 16,802 3.8 % 20,215 4.5 %

Goodwill and asset impairment - � 0.0 % 2,169 � 0.5 % Total

operating expenses 402,017 � 91.9 % 427,659 � 94.6 % Operating

income 35,430 � 8.1 % 24,225 � 5.4 % �

OTHER INCOME

(EXPENSE): Interest income 1,158 0.3 % 3,433 0.8 % Interest

expense (10 ) 0.0 % (227 ) -0.1 % Share of affiliate earnings - 0.0

% 4,665 1.0 % Miscellaneous expense (243 ) -0.1 % (191 ) 0.0 %

Total other income 905 � 0.2 % 7,680 � 1.7 % � Pretax income 36,335

8.3 % 31,905 7.1 % � Provision for income taxes 13,008 � 3.0 %

10,535 � 2.3 % �

Income from continuing operations 23,327

5.3 % 21,370 4.7 % � Loss from discontinued operations, net of tax

(70 ) $ (4,986 ) �

NET INCOME $ 23,257 �

$

16,384 � �

NET INCOME (LOSS) PER SHARE - DILUTED Income

from continuing operations $ 0.26 $ 0.24 Loss from discontinued

operations (0.00 ) (0.06 ) Net income $ 0.26 � $ 0.18 � �

DILUTED WEIGHTED AVERAGE SHARES OUTSTANDING 90,162 �

90,289 � � �

(1)

�

Prior period financial results have been reclassified to account

for the teach-out of our schools previously reported as

transitional, the change in our reportable business segments during

the first quarter of 2008 and to present Brooks College - Sunnyvale

and Long Beach, CA, IADT - Pittsburgh, PA, IADT - Toronto, Canada

and Katharine Gibbs School and Gibbs College - Piscataway, NJ as

discontinued operations.

CAREER EDUCATION CORPORATION AND

SUBSIDIARIES UNAUDITED CONSOLIDATED STATEMENTS OF CASH

FLOWS (In thousands) � � � � � �

For the Three Months

Ended March 31, 2009 2008 �

CASH FLOWS

FROM OPERATING ACTIVITIES: Net income $ 23,257 $ 16,384

Adjustments to reconcile net income to net cash provided

by operating activities: Goodwill and asset impairment - 6,613

Depreciation and amortization expense 16,802 21,403 Bad debt

expense 9,943 11,765 Compensation expense related to share-based

awards 3,157 3,029 Loss (gain) on disposition of property and

equipment 295 (134 ) Share of affiliate earnings, net of cash

received - 939 Deferred income taxes - 533 Changes in operating

assets and liabilities (4,755 ) (25,017 ) Net cash provided by

operating activities 48,699 � 35,515 � �

CASH FLOWS FROM

INVESTING ACTIVITIES: Purchases of available-for-sale

investments (225,622 ) (213,501 ) Sales of available-for-sale

investments 149,009 177,569 Purchases of property and equipment

(14,898 ) (18,814 ) Other (266 ) 433 � Net cash used in investing

activities (91,777 ) (54,313 ) �

CASH FLOWS FROM FINANCING

ACTIVITIES: Purchase of treasury stock (40,184 ) (13,990 )

Issuance of common stock 520 793 Tax benefit associated with stock

option exercises 21 26 Borrowings on revolving loans - 999 Payments

of capital lease obligations and other long-term debt (141 ) (118 )

Net cash used in financing activities (39,784 ) (12,290 ) � �

EFFECT OF FOREIGN CURRENCY EXCHANGE RATE CHANGES ON CASH

AND CASH EQUIVALENTS: (2,875 ) 8,292 � �

NET DECREASE IN CASH AND CASH

EQUIVALENTS

(85,737 ) (22,796 ) Add: Cash balance of discontinued operations,

beginning of the year 115 15,735 Less: Cash balance of discontinued

operations, end of the year - 2,855

CASH AND CASH EQUIVALENTS,

beginning of the year 244,743 � 221,970 �

CASH AND CASH

EQUIVALENTS, end of the year $ 159,121 � $ 212,054 �

CAREER

EDUCATION CORPORATION SELECTED UNIVERSITY SEGMENT

INFORMATION (Dollars in thousands) � � � � �

For the Three

Months Ended March 31, 2009

2008 (1)

�

UNIVERSITY REVENUE: AIU Online $ 77,762 $ 71,972 On-ground

20,131 22,982 CTU Online 68,083 59,198 On-ground 15,048 13,538

Briarcliffe 8,750 � 9,461 � University

$ 189,774

�

$ 177,151

� �

UNIVERSITY SEGMENT OPERATING INCOME (LOSS): AIU Online $

21,086 $ 8,531 On-ground (588 ) (1,535 ) CTU Online 18,491 16,165

On-ground (666 ) 828 Briarcliffe (215 ) 1,002 � University

$ 38,108

�

$ 24,991

� �

UNIVERSITY SEGMENT OPERATING INCOME (LOSS) PERCENTAGE:

AIU Online 27.1 % 11.9 % On-ground -2.9 % -6.7 % CTU Online 27.2 %

27.3 % On-ground -4.4 % 6.1 % Briarcliffe -2.5 % 10.6 % University

20.1 % 14.1 % � �

Student Population as of April 30,

2009 2008 AIU Online 18,300 16,900 On-ground 3,600

3,500 CTU Online 20,100 17,000 On-ground 5,000 4,300 Briarcliffe

1,600 � 1,800 � University

48,600

�

43,500

� � �

Student Starts for the year ended March 31,

2009 2008 AIU Online 8,040 8,160 On-ground 1,240

1,140 CTU Online 5,600 5,300 On-ground 920 860 Briarcliffe 320 �

370 � University

16,120

�

15,830

� � � � � � � � �

(1)

�

Prior period financial results have been reclassified to account

for the teach-out of our schools previously reported as held for

sale and the change in our reportable business segments during the

first quarter of 2008.

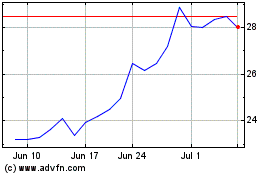

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jun 2024 to Jul 2024

CECO Environmental (NASDAQ:CECO)

Historical Stock Chart

From Jul 2023 to Jul 2024