UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

| Filed by the Registrant ☒ |

| |

| Filed by a Party other than the Registrant ☐ |

| |

| Check the appropriate box: |

| |

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☒ |

Soliciting Material under §240.14a-12 |

| |

| Carrols Restaurant Group, Inc. |

| (Name of Registrant as Specified In Its Charter) |

| |

| |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| |

| Payment of Filing Fee (Check the appropriate box): |

| |

| ☒ |

No fee required. |

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

The following recorded communication,

featuring Deborah Derby, the President and Chief Executive Officer of Carrols Restaurant Group, Inc. (“Carrols”),

and Tom Curtis, President, Burger King U.S. & Canada of Restaurant Brands International Inc., was shared with Carrols employees

on January 16, 2024.

Burger King-Carrols’ UpShow Video

January 16, 2024

DEB DERBY:

Hello Carrols team. I’m excited to have Burger King’s President

– Tom Curtis – with me at our office today!

Yesterday we announced that Carrols is going to become part of Burger

King corporate – making us part of one of the world’s largest restaurant companies.

The owner of Burger King is a company called Restaurant Brands International

– they own Burger King, Popeyes, Firehouse Subs and Tim Hortons.

They have more than 31,000 restaurants in more than 100 countries around

the world – so it’s exciting – and a big deal – to be joining this big family.

We wanted to talk directly with

you – our restaurant managers and team members.

First off – what does this

mean? Well, nothing really changes! We need you to keep running amazing restaurants – and looking after our Guests.

But, in some ways – there

is a bit of change – Burger King is going to make sure that all of our restaurants have a modern and fresh image for you to work

in – something to take pride in – and to put our best look in front of our Guests every day.

In a few years from now, they

want to add more franchisees to the system – and create opportunities for those of you who have always dreamed of becoming an entrepreneur

and maybe owning your own Burger King.

The amazing operational excellence that you execute on a daily basis

is the single biggest reason why Burger King corporate wanted us to join them.

I want to thank you so much for your hard work – your dedication

to the Carrols team – and we look forward to an even more exciting future with Burger King.

TOM

Hello Carrols team - I’m thankful to be able to talk with you

today.

When I was in college, I delivered pizza to pay for my school.

That turned into me working in a Dominos – then becoming a manager

– and then becoming a Dominos restaurant owner myself.

I used the money I made from my first restaurant to buy a second restaurant

– and ended up as the owner of XX Dominos restaurants.

I loved owning my own restaurants – I took pride in the food

we made and the guests we served;

we were competitive and wanted to do better than the other restaurants

in town –

we wanted to show up with our best foot forward for our guests –

whether making sure the parking lot was clean; our uniforms were crisp and that we exceeded the high expectations that our guests always

had of us.

I really felt like I was living the American dream – work hard,

move up, and get the opportunity to own something that I could grow for my family – and do good in my community.

That is what I want Burger King to do for all of you.

We are going to invest to make your restaurants beautiful and be the

best on the block. A place you take pride in when you go to work. And a place that your guests look forward to coming to.

And as we start looking for more franchisees to own more Burger Kings

– you will have a great choice to make – plan to step up and take a shot at being an entrepreneur yourself – OR continue

to be an amazing team member, shift leader, manager or even more inside of our global restaurant company.

I want to thank you for making our brand look so good for our Guests

every day. And I want you to know that I wake up every morning committed to making your experience as our brand ambassadors something

you can be proud of every day.

Thank you from the bottom of my heart.

You RULE!

Special Note Regarding Forward-Looking

Statements

This communication includes certain disclosures which contain “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995, including but not limited to those statements

related to that certain Agreement and Plan of Merger, dated of as January 16, 2024, by and among Carrols Restaurant Group, Inc., a Delaware

corporation (“Carrols”), Restaurant Brands International Inc., a corporation existing under the laws of Canada (“RBI”),

and BK Cheshire Corp, a Delaware corporation and subsidiary of RBI (“Merger Sub”), providing for the merger of Merger

Sub with and into Carrols, with Carrols continuing as the surviving corporation (the “Merger”), including financial

estimates and statements as to the expected timing, completion and effects of the Merger. We refer to all of these as forward-looking

statements. Forward-looking statements are forward-looking in nature and, accordingly, are subject to risks and uncertainties. These forward-looking

statements can generally be identified by the use of words such as “believe”, “anticipate”, “expect”,

“intend”, “estimate”, “plan”, “continue”, “will”, “may”, “could”,

“would”, “target”, “potential” and other similar expressions. Forward-looking statements, including

statements regarding the Merger, are based on Carrols’ current expectations and assumptions, including Carrols’ beliefs and

expectations about the value achieved in RBI’s proposed acquisition of Carrols. Because forward-looking statements relate to the

future, they are subject to inherent uncertainties, risks and uncertainties.

Important factors, risks and uncertainties that could cause actual

results to differ materially from such plans, estimates or expectations include but are not limited to: (i) the completion of the

Merger on the anticipated terms and timing, including obtaining required stockholder approval by Carrols’ stockholders, required

regulatory approvals, and the satisfaction of other conditions to the completion of the Merger; (ii) the risk that competing offers or

acquisition proposals will be made; (iii) potential litigation relating to the Merger that could be instituted against RBI, Carrols

or Carrols’ directors, managers or officers, including the effects of any outcomes related thereto; (iv) the ability of Carrols

to retain and hire key personnel; (v) potential adverse reactions or changes to Carrols’ business relationships resulting from

the announcement or completion of the Merger; (vi) legislative, regulatory and economic developments; (vii) potential business

uncertainty, including changes to existing business relationships, during the pendency of the Merger that could affect Carrols’

financial performance; (viii) negative effects from the pendency of the Merger; (ix) the risk that

synergies and other benefits from the Merger may not be fully realized or may take longer to realize than expected, (x) the

possibility that the Merger may be more expensive to complete than anticipated, including as a result of unexpected factors or events;

(xi) the occurrence of any event, change or other circumstance that could give rise to the termination of the Merger; and (xii)

the effects and continued impact of the COVID-19 pandemic, the war in Ukraine, conflict in the Middle

East and related macro-economic pressures, such as inflation, rising interest rates and currency fluctuations on our results of operations,

business, liquidity, prospects and restaurant operations and other risks and uncertainties set forth under the headings “Special

Note Regarding Forward Looking Statements” and “Risk Factors” in RBI’s and Carrols’ most recent Annual Reports

on Form 10-K for the fiscal year ended December 31, 2022 and January 1, 2023, respectively, and other materials that we from

time to time file with, or furnish to, the Securities and Exchange Commission (the “SEC”).

There can be no assurance that the Merger

will be completed, or if it is completed, that it will close within the anticipated time period. These factors should not be construed

as exhaustive and should be read in conjunction with the other forward-looking statements. The forward-looking statements relate only

to events as of the date on which the statements are made. Carrols does not undertake any obligation to publicly update or review any

forward-looking statement except as required by law, whether as a result of new information, future developments or otherwise. If one

or more of these or other risks or uncertainties materialize, or if our underlying assumptions prove to be incorrect, our actual results

may vary materially from what we may have expressed or implied by these forward-looking statements. We caution that you should not place

undue reliance on any of our forward-looking statements. You should specifically consider the factors identified in this communication

that could cause actual results to differ. Furthermore, new risks and uncertainties arise from time to time, and it is impossible for

us to predict those events or how they may affect Carrols.

Important Additional Information and

Where to Find It

This communication does not constitute an offer to sell or the solicitation

of an offer to buy any securities. This communication is being made in connection with the Merger. In connection with the Merger, certain

participants in the Merger will prepare and file with the SEC a Schedule 13E-3 Transaction Statement and certain other documents regarding

the Merger. We make available free of charge on or through the Investor Relations section of our internet website at www.carrols.com,

all materials that we file electronically with the SEC, including the Schedule 13E-3 Transaction Statement and any amendments thereto,

as reasonably practicable after electronically filing or furnishing such material with the SEC. This information is also available at

www.sec.gov, an internet site maintained by the SEC that contains reports, proxy and information statements and other information regarding

issuers that file electronically with the SEC. The references to our website address and the SEC’s website address do not constitute

incorporation by reference of the information contained in these websites and should be not considered part of this document.

Participants in the Solicitation

RBI, Carrols and their directors, and certain of their executive officers

and employees may be deemed to be participants in the solicitation of proxies from Carrols’ stockholders in respect of the proposed

transaction. Information regarding the directors and executive officers of Carrols who may, under the rules of the SEC, be deemed participants

in the solicitation of Carrols’ stockholders in connection with the proposed transaction, including a description of their direct

or indirect interests, by security holdings or otherwise, will be set forth in the proxy statement when it is filed with the SEC. Information

about these persons is included in each company’s annual proxy statement and in other documents subsequently filed with the SEC,

and will be included in the proxy statement when filed. Free copies of the proxy statement and such other materials may be obtained as

described in the preceding paragraph.

3

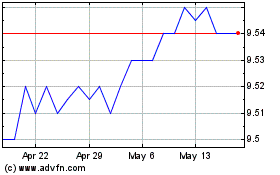

Carrols Restaurant (NASDAQ:TAST)

Historical Stock Chart

From Mar 2024 to Apr 2024

Carrols Restaurant (NASDAQ:TAST)

Historical Stock Chart

From Apr 2023 to Apr 2024