Current Report Filing (8-k)

June 30 2021 - 5:06PM

Edgar (US Regulatory)

CARROLS RESTAURANT GROUP, INCfalse000080924800008092482020-11-052020-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________________

FORM 8-K

____________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) June 28, 2021

____________________________

Carrols Restaurant Group, Inc.

(Exact name of registrant as specified in its charter)

____________________________

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Delaware

|

001-33174

|

83-3804854

|

(State or other jurisdiction of

incorporation or organization)

|

(Commission

File Number)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

|

|

968 James Street

|

|

|

|

Syracuse,

|

New York

|

|

13203

|

|

(Address of principal executive office)

|

|

(Zip Code)

|

|

|

|

|

|

|

Registrant’s telephone number, including area code:

|

(315)

|

424-0513

|

|

|

|

|

|

|

N/A

|

|

(Former name or former address, if changed since last report.)

|

____________________________

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class

|

|

Trading Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $.01 per share

|

|

TAST

|

|

The NASDAQ Global Market

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

On June 28, 2021, Carrols Restaurant Group, Inc. (“Carrols Restaurant Group”), as issuer, and certain subsidiaries of Carrols Restaurant Group, as guarantors (the “Guarantors”), entered into an Indenture (the “Indenture”) with The Bank of New York Mellon Trust Company, N.A. (the “Trustee”), as trustee, governing $300 million principal amount of 5.875% Senior Notes due 2029 of Carrols Restaurant Group (the “Notes”) sold in a private placement which was consummated on June 28, 2021, as further described in “Item 2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant” which is incorporated by reference in this Item 1.01.

On June 28, 2021, Carrols Restaurant Group, as borrower, and the Guarantors, as guarantors, also entered into a Seventh Amendment to Credit Agreement (the “Seventh Amendment”), dated as of June 28, 2021, with Wells Fargo Bank, National Association, as administrative agent (the “Administrative Agent”), and the lenders party thereto, as further described in “Item 2.03. Creation of a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement of a Registrant” which is incorporated by reference in this Item 1.01.

Item 2.03. CREATION OF A DIRECT FINANCIAL OBLIGATION OR AN OBLIGATION UNDER AN OFF-BALANCE SHEET ARRANGEMENT OF A REGISTRANT.

On June 28, 2021, Carrols Restaurant Group and the Guarantors entered into the Indenture with the Trustee governing the Notes. The Indenture provides that the Notes will mature on July 1, 2029 and will bear interest at the rate of 5.875% per annum, payable semi-annually on July 1 and January 1 of each year, beginning on January 1, 2022. The entire principal amount of the Notes will be due and payable in full on the maturity date. The Indenture further provides that Carrols Restaurant Group (i) may redeem some or all of the Notes at any time after July 1, 2024 at the redemption prices described therein, (ii) may redeem up to 40% of the Notes using the proceeds of certain equity offerings completed before July 1, 2024 and (iii) must offer to purchase the Notes if it sells certain of its assets or if specific kinds of changes in control occur, all as set forth in the Indenture. The Notes are senior unsecured obligations of Carrols Restaurant Group and are guaranteed on an unsecured basis by the Guarantors. The Indenture contains certain covenants that limit the ability of Carrols Restaurant Group and the Guarantors to, among other things: incur indebtedness or issue preferred stock; incur liens; pay dividends or make distributions in respect of capital stock or make certain other restricted payments or investments; sell assets; agree to payment restrictions affecting Restricted Subsidiaries (as defined in the Indenture); enter into transaction with affiliates; or merge, consolidate or sell substantially all of the assets. Such restrictions are subject to certain exceptions and qualifications all as set forth in the Indenture.

Carrols Restaurant Group will use the net proceeds of the offering of the Notes and $46 million of revolving credit borrowings under its Senior Credit Facility (as defined below) (i) to repay $74.0 million of outstanding term loan B-1 borrowings and $244.0 million of outstanding term loan B borrowings under its Senior Credit Facility, (ii) to pay fees and expenses related to the offering of the Notes and the Seventh Amendment and (iii) for working capital and general corporate purposes, including for possible future repurchases of its common stock and/or a dividend payment and/or payments on its common stock.

The foregoing description of the Indenture does not purport to be complete and is qualified in its entirety by reference to the Indenture, which is attached hereto as Exhibit 10.1 and is incorporated by reference herein.

On June 28, 2021, Carrols Restaurant Group and the Guarantors entered into the Seventh Amendment. The Seventh Amendment amends the Credit Agreement dated as of April 30, 2019, as amended by the First Amendment to Credit Agreement dated as of December 13, 2019, as amended by the Second Amendment to Credit Agreement dated as of March 25, 2020, as amended by the Third Amendment to Credit Agreement dated as of April 8, 2020, as

amended by the Fourth Amendment to Credit Agreement dated as of April 16, 2020, as amended by the Fifth Amendment to Credit Agreement dated as of June 23, 2020 and as amended by the Sixth Amendment to Credit Agreement dated as of April 6, 2021 by and among Wells Fargo Bank, National Association, as administrative agent, the lenders from time to time party thereto, Carrols Restaurant Group, as the borrower, and certain of the domestic subsidiaries of Carrols Restaurant Group from time to time party thereto as guarantors (as further amended from time to time, the "Senior Credit Facility"). The Seventh Amendment revises (a) the initial amount for calculating the Available Amount (as defined in the Senior Credit Facility) from $27.0 million to $50.0 million which is utilized, among other items, in determining the amount of Restricted Payments (as defined in the Senior Credit Facility) and Permitted Investments (as defined in the Senior Credit Facility), (b) the calculation of Carrols Restaurant Group's ability to incur an Incremental Term Loan (as defined in the Senior Credit Facility) or an increase to the Revolving Committed Amount from $135.0 million to $180.0 million, and (c) the general basket for Restricted Payments, Permitted Investments and Restricted Junior Debt Payment (as defined in the Senior Credit Facility) from an aggregate amount not to exceed the greater of (i) $27.0 million and (ii) 20% of Consolidated EBITDA (as defined in the Senior Credit Facility) as of the most recently completed Reference Period (as defined in the Senior Credit Facility) to (i) $50.0 million and (ii) 40% of Consolidated EBITDA as of the most recently completed Reference Period. In addition, the Seventh Amendment revises the Total Net Leverage Ratio required for Carrols Restaurant Group to make Restricted Payments or prepay Junior Debt (as defined in the Senior Credit Facility) with unutilized Available Amount from 3.00 to 1.00 to 4.00 to 1.00. Furthermore, the Seventh Amendment provides for affiliates of Carrols Restaurant Group to acquire up to 20% of the outstanding term loans pursuant to certain transactions.

The foregoing description of the Seventh Amendment does not purport to be complete and is qualified in its entirety by reference to the Seventh Amendment, which is attached hereto as Exhibit 10.2 and is incorporated by reference herein.

Item 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

|

|

|

|

|

|

|

|

(d) Exhibits

|

|

|

|

|

|

10.1

|

|

|

10.2

|

|

|

104

|

Cover Page Interactive Data File (formatted as Inline XBRL)

|

Signatures

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: June 30, 2021

CARROLS RESTAURANT GROUP, INC.

|

|

|

|

|

|

|

|

By:

|

/s/ Anthony E. Hull

|

|

Name:

|

Anthony E. Hull

|

|

Title:

|

Vice President, Chief Financial Officer and Treasurer

|

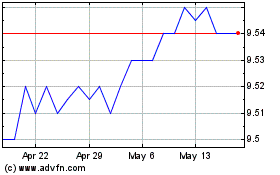

Carrols Restaurant (NASDAQ:TAST)

Historical Stock Chart

From Jun 2024 to Jul 2024

Carrols Restaurant (NASDAQ:TAST)

Historical Stock Chart

From Jul 2023 to Jul 2024