California Amplifier to Acquire Vytek Corporation

December 23 2003 - 4:05PM

PR Newswire (US)

California Amplifier to Acquire Vytek Corporation Acquisition

Strengthens California Amplifier's Engineering Capability And

Market Presence, and Diversifies Product and Customer Base

CAMARILLO, Calif., Dec. 23 /PRNewswire-FirstCall/ -- California

Amplifier, Inc. announced today that it has signed a definitive

agreement to acquire Vytek Corporation. The acquisition represents

a pivotal step in California Amplifier's strategic growth plan to

diversify its customer base, expand its core engineering

capability, and broaden its market offerings. Vytek, a

privately-held company headquartered in San Diego, California, is a

provider of hardware and software solutions and services that

enable wired and wireless access to information. Vytek has a

diversified Fortune 1000 customer base consisting of world-class

technology companies, consumer electronics companies, household

names in retailing and distribution, and companies in various

vertical markets such as healthcare and public safety. Vytek has

approximately 280 employees with 10 offices nationwide, and has

longstanding customer relationships dating back 18 years through

its prior acquisitions. In commenting on the acquisition, Fred

Sturm, Chief Executive Officer of California Amplifier, stated,

"Customers today are looking for total solutions for their

communications needs. This acquisition will add strong

complementary engineering capabilities, a world-class professional

services team, and an expanded customer presence. Our goal will be

to accelerate bringing our previously announced product

technologies to market, and to leverage our expanded customer

contact and solutions approach to drive new product initiatives."

Mr. Sturm continued, "The combined Company will have strong

engineering development capabilities spanning firmware and

software, digital processor-based design, and wireless system, RF

and antenna design. This product development capability, combined

with California Amplifier's high-volume manufacturing capability

and Vytek's systems integration and professional services

organization, will enable us to offer comprehensive solutions to

our customers. As a result of this acquisition, our customer base

will grow and diversify beyond satellite television and

telecommunications service providers to include large and medium

sized Enterprise customers, thereby expanding our market reach and

distribution channels." Commenting on the acquisition, Jim Ousley,

Chief Executive Officer of Vytek, said, "We believe the combination

of California Amplifier and Vytek is an excellent fit for all our

stakeholders -- our customers, employees and shareholders.

Integrating the resources of both companies will provide for the

rapid expansion of our wired and wireless solutions into the

marketplace." For the unaudited eleven month period ended November

30, 2003, Vytek had revenues of approximately $38.4 million. During

this period, Vytek generated approximately 40% of its revenues from

wireless products and 60% of its revenues from software development

and professional services. Vytek is backed by private equity

investors including Charterhouse Group International, CIBC Capital

Partners, Frontenac Company, Goldman Sachs, Mission Ventures and

Mobius Venture Capital. The terms of the definitive agreement

provide that California Amplifier will acquire Vytek by merging it

with and into a newly formed, wholly owned subsidiary of California

Amplifier in exchange for fixed number of 8,200,000 shares of

California Amplifier's common stock with an aggregate value of

approximately $76.8 million at yesterday's closing stock price.

California Amplifier and Vytek expect to complete the transaction

during the first quarter of calendar 2004. The transaction is

subject to customary closing conditions, including approvals by

regulatory agencies and by the stockholders of Vytek and California

Amplifier. The stockholders of Vytek will be asked to approve the

merger, and the stockholders of California Amplifier will be asked

to approve the issuance of the shares of its common stock in the

transaction. Certain stockholders of Vytek holding in the aggregate

approximately 32% of the voting power of Vytek on an

as-if-converted to common stock basis have signed voting agreements

and irrevocable proxies committing to vote their shares of Vytek

stock in support of the proposed merger. As a condition to the

completion of the merger, the same Vytek stockholders are expected

to sign lock-up agreements not to sell the shares of California

Amplifier received by them in the merger for a period of 6 to 12

months after the closing. In addition, there will be a 15 month

escrow of shares with an initial value of approximately $8 million

to support any post-closing claims that California Amplifier may

have under the definitive agreement. These escrowed shares could be

sold under certain circumstances prior to the end of the escrow

period and replaced with an equivalent amount of cash. Given

Vytek's cost structure and growth outlook, this transaction is

anticipated to have a positive impact on gross margins and be

accretive in California Amplifier's fiscal year 2006. Additional

financial details will be made available in the Company's filings

with the Securities and Exchange Commission. California Amplifier

will file with the Securities and Exchange Commission a

registration statement on Form S-4 to register the offer and sale

of shares of its common stock in connection with the proposed

merger under the Securities Act of 1933, as amended. The

registration statement will contain important information and

stockholders of Vytek should carefully read the registration

statement and any amendments or supplements thereto before making a

decision with respect to the proposed merger. California Amplifier

will also file with the SEC a proxy statement in connection with

the solicitation of proxies for use at a special meeting of its

stockholders to approve the issuance of shares of its common stock

in connection with the proposed merger. The proxy statement will

contain important information and stockholders of California

Amplifier should carefully read the proxy statement before making a

decision with respect to the issuance of shares in the proposed

merger. The officers and directors of California Amplifier may be

deemed to be participants in connection with this solicitation of

proxies. Copies of the registration statement and the proxy

statement when filed may be obtained without charge at the SEC's

website at http://www.sec.gov/ or from California Amplifier.

Statements in this release about the California Amplifier's future

financial performance, customer relationships, initiatives to

develop innovative wireless access solutions, anticipated business

synergies, and the market potential of new products and service

offerings are forward-looking statements and are subject to risks

and uncertainties that could cause actual results to differ

materially from expectations. Words such as "may", "will",

"expects," "anticipates," "intends," "plans," "believes," "seeks,"

"could," "estimate" and variations of these words and similar

expressions are intended to identify forward-looking statements.

Factors that could cause or contribute to such differences may

include, but are not limited to, the requirement that the

transaction receive approval from California Amplifier's

stockholders, the risk that the conditions relating to regulatory

clearance might not be satisfied in a timely manner or at all,

risks relating to the integration of the businesses of California

Amplifier and Vytek, unanticipated expenditures, changing

relationships with customers, suppliers and strategic partners,

risks relating to the protection of intellectual property, the

impact of competitive products, changes to the competitive

environment, pricing pressures, supplier constraints, manufacturing

yields, market acceptance of new products, and the viability and

market acceptance of new technologies. Although the Company

believes the expectations reflected in such forward-looking

statements are based upon reasonable assumptions, it can give no

assurance that its expectations will be attained. The Company

undertakes no obligation to update or revise any forward-looking

statements, whether as a result of new information, future events

or otherwise. More information about California Amplifier's risks

is available in the Company's Annual Report on Form 10-K and other

filings made from time to time with the Securities and Exchange

Commission. About VYTEK Corporation VYTEK Corporation is a provider

of technology integration solutions and wireless access hardware

and software. Vytek has expertise in wireless technologies from

802.11a/b/g, Bluetooth and GPRS to RFID for next generation devices

and products. Vytek provides engineering expertise in developing

both software and hardware solutions that includes: Business &

Technology Assessment; Prototype, Architect & Design Solutions;

Services/Product Development; Integration & Implementation; and

Support. Headquartered in San Diego, California with offices

nationwide, Vytek serves both large and small clients in a variety

of industries. More information can be found at

http://www.vytek.com/ . About California Amplifier, Inc. California

Amplifier designs, manufactures and markets a broad line of

integrated microwave equipment used primarily in conjunction with

satellite television and terrestrial broadband wireless and video

applications. The Company's Satellite business unit designs and

markets outdoor reception equipment for the U.S. Direct Broadcast

Satellite (DBS) television market as well as a full line of

consumer and commercial products for video and data reception. The

Wireless Access business unit designs and markets integrated

reception and two-way transmission fixed wireless equipment for

broadband data and video applications. California Amplifier is an

ISO 9001 certified company. For additional information, visit

California Amplifier's web site at http://www.calamp.com/ . For

more information, contact: Crocker Coulson Rick Vitelle Partner

Chief Financial Officer CCG Investor Relations California

Amplifier, Inc. (818) 789-0100 (805) 987-9000 DATASOURCE:

California Amplifier, Inc. CONTACT: Rick Vitelle, Chief Financial

Officer of California Amplifier, Inc., +1-805-987-9000; or Crocker

Coulson, Partner of CCG Investor Relations, +1-818-789-0100, , for

California Amplifier, Inc. Web site: http://www.calamp.com/

http://www.vytek.com/

Copyright

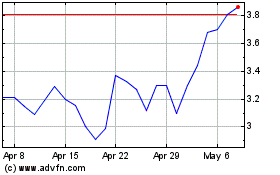

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jun 2024 to Jul 2024

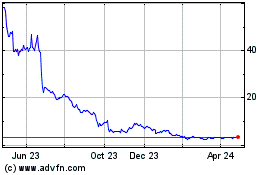

CalAmp (NASDAQ:CAMP)

Historical Stock Chart

From Jul 2023 to Jul 2024