CalAmp Completes Refinancing of Bank Debt

December 23 2009 - 7:00AM

Marketwired

CalAmp Corp. (NASDAQ: CAMP), a leading provider of wireless

products, services and solutions, announced today that it has paid

in full the $13.95 million outstanding balance of its credit

facility with Bank of Montreal and two other banks, which had a

maturity date of December 31, 2009. The funds for this payoff were

provided by a drawdown of $7.77 million under a new revolving

credit facility with Square 1 Bank of Durham, North Carolina,

supplemented by aggregate proceeds of $6.18 million from the

private placement of common stock and subordinated debt.

The Square 1 Bank credit facility has a two-year term and

provides for borrowings up to the lesser of $12 million or 85% of

the Company's eligible accounts receivable. Outstanding borrowings

bear interest at Square 1's prime rate plus 2.0%, subject to a

minimum effective interest rate of 6%. The Company also raised

junior capital from a group of investors comprised of $4.25 million

from the sale of approximately 1,932,000 shares of common stock and

$1.93 million in subordinated debt. The subordinated notes bear

interest at 12% per annum and have a maturity date of December 22,

2012. The Company also issued a total of 192,500 common stock

purchase warrants to the subordinated note investors at an exercise

price of $4.02 per share, which represents a 20% premium to the

average closing price of the Company's common stock for the 20

consecutive trading days prior to the closing of the refinancing.

The Company agreed to file a registration statement with the

Securities and Exchange Commission to register the privately issued

shares and the shares of common stock underlying the warrants.

Rick Gold, President and CEO of CalAmp, commented, "This

refinancing is an important milestone for CalAmp. It provides

working capital for growth and eliminates the uncertainty

associated with the maturing bank credit agreement. We want to

thank our past lenders for their patience and support and now look

forward to working with Square 1."

"We are very pleased to extend this credit facility to CalAmp,"

said Richard Suhl, Senior Vice President of Square 1 Bank. "We look

forward to a long and mutually beneficial relationship with the

Company."

B. Riley & Co., LLC served as CalAmp's financial advisor in

connection with this refinancing.

About CalAmp Corp.

CalAmp provides wireless communications solutions that enable

anytime/anywhere access to critical data and content. The Company

serves customers in the public safety, industrial monitoring and

controls, mobile resource management, and direct broadcast

satellite markets. The Company's products are marketed under the

CalAmp, Dataradio, SmartLink, Aercept, LandCell and Omega trade

names. For more information, please visit www.calamp.com.

AT THE COMPANY: Rick Vitelle Chief Financial Officer (805)

987-9000 AT FINANCIAL RELATIONS BOARD: Lasse Glassen General

Information (213) 486-6546 Email Contact

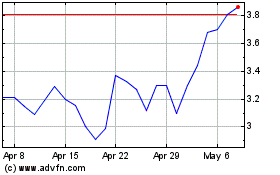

CAMP4 Therapeutics (NASDAQ:CAMP)

Historical Stock Chart

From Oct 2024 to Nov 2024

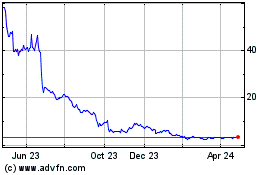

CAMP4 Therapeutics (NASDAQ:CAMP)

Historical Stock Chart

From Nov 2023 to Nov 2024