Filed Pursuant to Rule 424(b)(5)

Registration No. 333-231537

PROSPECTUS SUPPLEMENT

(To Prospectus dated June 5, 2019)

1,710,600 SHARES

OF COMMON STOCK

Pursuant to this prospectus supplement and the accompanying

prospectus, we are offering 1,710,600 shares of our common stock, par value $0.001 per share. Our common stock is currently listed

on the Nasdaq Capital Market under the symbol “BPTH.” On February 12, 2021, the last reported sales price per share

of our common stock on the Nasdaq Capital Market was $8.93.

As of the date of this prospectus supplement, the aggregate

market value of our outstanding common stock held by non-affiliates was $61,243,052.86, based on 5,237,312 shares of outstanding

common stock, of which 5,203,318 shares are held by non-affiliates, and the last reported sale price of our common stock of $11.77

per share on February 11, 2021. Pursuant to General Instruction I.B.6 of Form S-3, in no event will we sell securities in

a primary offering with a value exceeding more than one-third of our public float in any 12-month period so long as our public

float remains below $75,000,000. Following the sale of shares in this offering, we will have sold securities with an aggregate

market value of $19,956,271.84 pursuant to General Instruction I.B.6 of Form S-3 during the 12-month calendar period that ends

on and includes the date hereof.

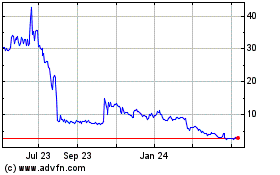

The trading price of our common stock has

been volatile. From February 1, 2021 through February 12, 2021, our stock price has fluctuated from a low of $4.1117

to a high of $24.34. The high of $24.34 occurred on February 10, 2021, the same day that the Company publicly announced that

the United States Patent and Trademark Office (“USPTO”) granted the Company a new patent and that the USPTO had mailed

an Issue Notification for a separate patent scheduled to be issued. As a result of volatility in the trading price of our common

stock, you may not be able to sell your common stock at or above the public offering price.

Investing in our securities involves

a high degree of risk, including that the trading price of our common stock has been subject to volatility and investors in this

offering may not be able to sell their shares of common stock at or above the public offering price. You should review carefully

the risks and uncertainties described in the section titled “Risk Factors” on page S-6 of this prospectus supplement

and under similar headings in the other documents that are incorporated by reference into this prospectus supplement.

|

|

|

Per Share

|

|

|

Total

|

|

|

Offering price

|

|

$

|

7.60

|

|

|

$

|

13,000,560.00

|

|

|

Placement agent fees (1)

|

|

$

|

0.38

|

|

|

$

|

650,028.00

|

|

|

Proceeds, before expenses, to us

|

|

$

|

7.22

|

|

|

$

|

12,350,532.00

|

|

(1) We have agreed to pay the placement agent a cash fee equal

to 5.0% of the gross proceeds received from investors who purchase securities in the offering. In addition, we have agreed to reimburse

the placement agent for certain expenses as described under the “Plan of Distribution” on page S-13 of this prospectus

supplement.

We have retained Roth Capital Partners,

LLC to act as our exclusive placement agent in connection with this offering. The placement agent is not purchasing the securities

offered by us in this offering, and is not required to sell any specific number or dollar amount of securities, but will assist

us in this offering on a reasonable best efforts basis. There is no required minimum number of shares of common stock that must

be sold as a condition to completion of this offering. Because there is no minimum offering amount required as a condition to the

closing of this offering, the actual offering amount, placement agent fees and proceeds to us are not presently determinable and

may be substantially less than the maximum amounts set forth above. We may sell fewer than all of the shares of common stock offered

hereby, which may significantly reduce the amount of proceeds received by us, and investors in this offering will not receive a

refund in the event that we do not sell an amount of common stock sufficient to pursue the business goals outlined in this prospectus

supplement and the accompanying prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this

prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

Delivery of the shares of common stock offered hereby is expected

to take place on or about February 18, 2021, subject to satisfaction of certain conditions.

Roth Capital

Partners

Prospectus supplement dated February 16, 2021

TABLE OF CONTENTS

Prospectus Supplement

Prospectus

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement and the accompanying

prospectus are part of a registration statement that we filed with the U.S. Securities and Exchange Commission utilizing a “shelf”

registration process. This document is in two parts. The first part is this prospectus supplement, which describes the terms of

this offering and also adds to and updates information contained in the accompanying prospectus as well as the documents incorporated

by reference into this prospectus supplement and the accompanying prospectus. The second part, the accompanying prospectus, gives

more general information about securities we may offer from time to time, some of which does not apply to this offering. This prospectus

supplement and the accompanying prospectus incorporate by reference important business and financial information about us that

is not included in or delivered with this prospectus supplement and the accompanying prospectus.

You should rely only on the information

we have provided or incorporated by reference in this prospectus supplement or in the accompanying prospectus. If information in

this prospectus supplement is inconsistent with the accompanying prospectus or any document incorporated by reference therein filed

prior to the date of this prospectus supplement, you should rely on this prospectus supplement; provided that if any statement

in one of these documents is inconsistent with a statement in another document having a later date—for example, a document

incorporated by reference in the accompanying prospectus—the statement in the document having the later date modifies or

supersedes the earlier statement. We have not authorized anyone to provide you with different information. No dealer, salesperson

or other person is authorized to give any information or to represent anything not contained in this prospectus or the applicable

prospectus supplement. You must not rely on any unauthorized information or representation. You should assume that the information

in this prospectus supplement and accompanying prospectus is accurate only as of the dates on the front of the respective document

and that any information we have incorporated by reference is accurate only as of the date of the document incorporated by reference.

Our business, financial condition, results of operations and prospects may have changed since those dates. You should read this

prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and

the accompanying prospectus when making your investment decision.

Unless the context requires otherwise, references

in this prospectus supplement or the accompanying prospectus to “we,” “our,” “us,” “the

Company” and “Bio-Path” refer to Bio-Path Holdings, Inc. and its wholly-owned subsidiary. Bio-Path Holdings, Inc.’s

wholly-owned subsidiary, Bio-Path, Inc., is sometimes referred to herein as “Bio-Path Subsidiary.”

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights selected information

contained elsewhere in this prospectus supplement, in the accompanying prospectus or in documents incorporated by reference. This

summary does not contain all of the information that you should consider before making an investment decision. This prospectus

supplement and the accompanying prospectus include or incorporate by reference information about this offering, our business and

our financial and operating data. You should carefully read the entire prospectus supplement, the accompanying prospectus, including

under the sections titled “Risk Factors” included therein, and the documents incorporated by reference into this prospectus

supplement and the accompanying prospectus, before making an investment decision.

Our Company

We are a clinical and preclinical stage

oncology focused RNAi nanoparticle drug development company utilizing a novel technology that achieves systemic delivery for target

specific protein inhibition for any gene product that is over-expressed in disease. Our drug delivery and antisense technology,

called DNAbilize®, is a platform that uses P-ethoxy, which is a deoxyribonucleic acid (DNA) backbone modification that is intended

to protect the DNA from destruction by the body’s enzymes when circulating in vivo, incorporated inside of a lipid bilayer

having neutral charge. We believe this combination allows for high efficiency loading of antisense DNA into non-toxic, cell-membrane-like

structures for delivery of the antisense drug substance into cells. In vivo, the DNAbilize® delivered antisense drug substances

are systemically distributed throughout the body to allow for reduction or elimination of target proteins in blood diseases and

solid tumors. Through testing in numerous animal studies and treatment in over 80 patients, the Company’s DNAbilize®

drug candidates have demonstrated an excellent safety profile. DNAbilize® is a registered trademark of the Company.

Using

DNAbilize® as a platform for drug development and manufacturing, we currently have four drug candidates in development to treat

at least five different cancer disease indications. Our lead drug candidate, prexigebersen (pronounced prex” i je ber’

sen), which targets growth factor receptor-bound protein 2 (Grb2), initially started the efficacy portion of a Phase 2 clinical

trial for untreated acute myeloid leukemia (“AML”) patients in combination with low-dose cytarabine (“LDAC”).

The interim data we released on March 6, 2019 showed that 11 (65%) of the 17 evaluable patients had a response, including

five (29%) who achieved CR, including one CRi and one morphologic leukemia

free state, and six (35%) stable disease responses, including two patients who had greater than a 50% reduction in bone marrow

blasts. However, DNA hypomethylating agents are now the most frequently used agents in the treatment of elderly AML patients in

the U.S. and Europe. Accordingly, a second cohort of untreated AML patients was subsequently added to the clinical trial for treatment

with prexigebersen in combination with decitabine, a DNA hypomethylating agent. As a result, Stage 2 of the Phase 2 trial in AML

dropped was amended to, among other things, remove the combination treatment of prexigebersen and LDAC and replace it with the

combination treatment of prexigebersen and decitabine. Since decitabine is also used as a treatment for relapsed/refractory AML

patients, a second cohort of relapsed/refractory AML patients was also added to the study.

The U.S. Food and Drug Administration (“FDA”)

recently granted approval of venetoclax in combination with LDAC, decitabine, or azacytidine (the latter two drugs are DNA hypomethylating

agents) as frontline therapy for newly diagnosed AML in adults 75 years or older, or who have comorbidities precluding intensive

induction chemotherapy. We believe this recent frontline therapy approval provides an opportunity to include prexigebersen with

the combination therapy for the treatment of de novo AML patients. Preclinical efficacy studies for the triple combination

treatment of prexigebersen, decitabine and venetoclax in AML have been successfully completed. In the preclinical efficacy studies,

four AML cancer cell lines were treated with three different combinations of decitabine, venetoclax and prexigebersen. Decrease

in AML cell viability was the primary measure of efficacy. The triple combination of decitabine, venetoclax and prexigebersen

showed significant improvement in efficacy in three of the four AML cell lines. Based on these results, the Company believes that

adding prexigebersen to the treatment combination of decitabine and venetoclax could lead to improved efficacy in AML patients.

The amendment for Stage 2 of this Phase 2 clinical trial to add the triple combination treatment comprised of prexigebersen, decitabine

and venetoclax had been approved by the FDA.

Bio-Path’s approved amended Stage

2 for this Phase 2 clinical trial has three cohorts of patients. The first two cohorts will treat patients with the triple combination

of prexigebersen, decitabine and venetoclax. The first cohort will include untreated AML patients, and the second cohort will include

relapsed/refractory AML patients. Finally, the third cohort will treat relapsed/refractory AML patients, who are venetoclax-resistant

or -intolerant, with the two-drug combination of prexigebersen and decitabine. The full trial design plans have approximately 98

evaluable patients for the first cohort having untreated AML patients with a preliminary review performed after 19 evaluable patients

and a formal interim analysis after 38 evaluable patients. The full trial design plans have approximately 54 evaluable patients

for each of the second cohort, having relapsed/refractory AML patients, and the third cohort, having AML patients who are venetoclax-resistant

or -intolerant, in each case with a review performed after 19 evaluable patients. The study is anticipated to be conducted at ten

clinical sites in the U.S., and Gail J. Roboz, MD will be the national coordinating Principal Investigator for the Phase 2 trial.

Dr. Roboz is a professor of medicine and director of the Clinical and Translational Leukemia Program at the Weill Medical

College of Cornell University and the New York-Presbyterian Hospital in New York City. On August 13, 2020, we announced the

enrollment and dosing of the first patient in this approved amended Stage 2 of the Phase 2 clinical study.

Our second drug candidate, Liposomal Bcl-2

(“BP1002”), targets the protein Bcl-2, which is responsible for driving cell survival in up to 60% of all cancers.

On November 21, 2019, we announced that the FDA cleared an IND application for BP1002. An initial Phase 1 clinical trial will

evaluate the safety of BP1002 in refractory/relapsed lymphoma and chronic lymphocytic leukemia (“CLL”) patients. Initially,

a total of six evaluable patients are scheduled to be treated with BP1002 monotherapy in a standard 3+3 design. The Phase 1 clinical

trial is being conducted at several leading cancer centers, including The University of Texas MD Anderson Cancer Center (“MD

Anderson”), the Georgia Cancer Center and the Sarah Cannon Research Institute, and is now open for enrollment. Ian W. Flynn,

MD is the national coordinating Principal Investigator for the Phase 1 trial. Dr. Flynn serves as the director of lymphoma

research at the Sarah Cannon Research Institute.

Our third drug candidate, Liposomal STAT3

(“BP1003”), targets the STAT3 protein and is currently in IND enabling studies as a potential treatment of pancreatic

cancer, non-small cell lung cancer (“NSCLC”) and AML. Preclinical models have shown BP1003 to inhibit cell viability

and STAT3 protein expression in NSCLC and AML cell lines. Further, BP1003 successfully penetrated pancreatic tumors and significantly

enhanced the efficacy of gemcitabine, a treatment for patients with advanced pancreatic cancer, in a pancreatic cancer patient

derived tumor model. Our lead indication for BP1003 is pancreatic cancer due to the severity of this disease and the lack of effective,

life-extending treatments. For example, pancreatic adenocarcinoma is projected to be the second most lethal cancer behind lung

cancer by 2030. Typical survival for a metastatic pancreatic cancer patient is about three to six months from diagnosis. We expect

to complete several IND enabling studies of BP1003 in 2021. If those studies are successful, our goal is to file an IND in late

2021 for the first-in-humans Phase 1 study of BP1003 in patients with refractory, metastatic solid tumors, including pancreatic

cancer and NSCLC.

In addition, a modified product named prexigebersen-A,

Bio-Path’s fourth drug candidate, has shown to enhance chemotherapy efficacy in preclinical solid tumor models. Prexigebersen-A

incorporates the same drug substance as prexigebersen but has a slightly modified formulation designed to enhance nanoparticle

properties. In late 2019, we filed an Investigational New Drug (“IND”) application to initiate a Phase 1 clinical trial

of prexigebersen-A in patients with solid tumors, including ovarian, endometrial, pancreatic and breast cancer. Ovarian cancer

is one of the most common type of gynecologic malignancies, with approximately 50% of all cases occurring in women older than 63

years. This trial is expected to commence after the IND has been cleared by the FDA, which we currently anticipate being in 2021.

Our DNAbilize® technology-based products

are available for out-licensing or partnering. We intend to apply our drug delivery technology template to new disease-causing

protein targets to develop new nanoparticle antisense RNAi drug candidates. We have a new product identification template in place

to define a process of scientific, preclinical, commercial and intellectual property evaluation of potential new drug candidates

for inclusion into our drug product development pipeline. As we expand, we will look at indications where a systemic delivery

is needed and antisense RNAi nanoparticles can be used to slow, reverse or cure a disease, either alone or in combination with

another drug. On September 25, 2019, we announced that the United States Patent and Trademark Office (“USPTO”)

issued a patent for claims related to DNAbilize®, including its use in the treatment of cancers, autoimmune diseases and infectious

diseases. This is the second patent issued to the Company for its platform technology. In February 2021, the Company announced

that the USPTO has granted U.S. Patent No. 10,898,506 titled, "P-ethoxy nucleic acids for liposomal formulation."

The new patent builds on earlier patents granted that protect the platform technology for DNAbilize®, the Company’s

novel RNAi nanoparticle drugs. The new patent is the third patent in our family of platform intellectual property and offers expanded

defense of our DNAbilize® platform technology. In addition, the USPTO has mailed an Issue Notification for a patent

related to the Company’s lead product candidate, prexigebersen, in combination with either a cytidine analogue, such as

decitabine, or the Bcr-Abl tyrosine kinase inhibitors dasatinib and nilotinib. The new patent is scheduled to issue as U.S. Patent

No. 10,927,379 on February 23, 2021. This patent will offer target-specific protection for on-going clinical trials

using prexigebersen in combination with decitabine as a treatment for AML. We continue our efforts to build protection around

our technology as it safeguards our platform technology and target-specific technology, is a deterrent to would-be competitors

and creates value around our core competencies.

We have certain intellectual property as

the basis for our current drug products in clinical development, prexigebersen, prexigebersen-A, BP1002 and BP1003. We are developing

RNAi antisense nanoparticle drug candidates based on our own patented technology to treat cancer and autoimmune disorders where

targeting a single protein may be advantageous and result in reduced patient adverse effects as compared to small molecule inhibitors

with off-target and non-specific effects. We have composition of matter and method of use intellectual property for the design

and manufacture of antisense RNAi nanoparticle drug products.

Recent Developments

On February 10, 2021, we announced

that the USPTO granted U.S. Patent No. 10,898,506 titled, “P-ethoxy nucleic acids for liposomal formulation.”

We also announced that the USPTO mailed an Issue Notification for a patent related to the Company’s lead product candidate,

prexigebersen, in combination with either a cytidine analogue, such as decitabine, or the Bcr-Abl tyrosine kinase inhibitors dasatinib

and nilotinib.

Subsequent to September 30, 2020, we

sold 1,128,800 shares of our common stock under the Company’s At-The-Market Offering Agreement (the “Offering Agreement”)

with H. C. Wainwright & Co., LLC and issued 416,655 shares of our common stock pursuant to the exercise warrants to purchase

shares of our common stock.

Corporate Information

The Company was incorporated in May 2000

as a Utah corporation. In February 2008, Bio-Path Subsidiary completed a reverse merger with the Company, which at the time

was traded over the counter and had no current operations. The prior name of the Company was changed to Bio-Path Holdings, Inc.

and the directors and officers of Bio-Path Subsidiary became the directors and officers of Bio-Path Holdings, Inc. On March 10,

2014, our common stock ceased trading on the OTCQX and commenced trading on the Nasdaq Capital Market under the ticker symbol “BPTH.”

Effective December 31, 2014, we changed our state of incorporation from Utah to Delaware through a statutory conversion pursuant

to the Utah Revised Business Corporation Act and the Delaware General Corporation Law.

On February 8, 2018, we effected a

reverse stock split of our outstanding shares of common stock at a ratio of 1-for-10, and our common stock began trading on the

split-adjusted basis on the Nasdaq Capital Market at the commencement of trading on February 9, 2018. In addition, on January 17,

2019, we effected a reverse stock split of our outstanding shares of common stock at a ratio of 1-for-20, and our common stock

began trading on the split-adjusted basis on the Nasdaq Capital Market at the commencement of trading on January 18, 2019.

All common stock share and per share amounts in this prospectus supplement and in the accompanying prospectus have been adjusted

to give effect to both the 1-for-10 reverse stock split and the 1-for-20 reverse stock split, retrospectively.

Our principal executive offices are located

at 4710 Bellaire Boulevard, Suite 210, Bellaire, Texas 77401, and our telephone number is (832) 742-1357. Our Internet address

is www.biopathholdings.com. None of the information on our website forms a part of, or incorporated by reference into,

this prospectus supplement or the accompanying prospectus.

The Offering

|

Common stock offered by us

|

|

1,710,600 shares.

|

|

|

|

|

|

Common stock to be outstanding immediately after this offering (1)

|

|

6,947,912 shares (assuming that we sell the maximum number of

shares of common stock offered in this offering).

|

|

|

|

|

|

Offering price per share

|

|

$7.60 per share.

|

|

|

|

|

|

Use of proceeds

|

|

We currently expect to use the net proceeds from this offering for working capital and general corporate purposes. See “Use of Proceeds” on page S-11

|

|

|

|

|

|

Risk factors

|

|

An investment in our company involves a high degree of risk, including that the trading price of our common stock has been subject to volatility and investors in this offering may not be able to sell their shares of common stock at or above the public offering price. Please refer to the sections titled “Risk Factors,” “Special Note Regarding Forward-Looking Statements” and other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus for a discussion of factors you should carefully consider before investing our securities.

|

|

|

|

|

|

Nasdaq Capital Market Symbol

|

|

“BPTH”

|

(1) The number of shares of common stock to be outstanding

after this offering is based on 5,237,312 shares of our common stock outstanding as of the date of this prospectus supplement,

which excludes as of such date:

|

|

·

|

274,008 shares of common stock reserved for issuance upon the exercise of outstanding options granted under our equity incentive plans with a weighted average exercise price of $20.57 per share;

|

|

|

|

|

|

|

·

|

402,724 additional shares of common stock reserved for future issuance under our 2017 Stock Incentive Plan; and

|

|

|

|

|

|

|

·

|

442,043 shares of common stock issuable upon exercise of outstanding warrants with a weighted average exercise price of $26.94 per share.

|

RISK FACTORS

An investment in our company involves

a high degree of risk. Before you make a decision to invest in our securities, you should consider carefully the risks described

below, as well as the risks described in or incorporated by reference in this prospectus supplement and the accompanying prospectus,

including the risks and uncertainties discussed under the section titled “Risk Factors” in our most recent Annual Report

on Form 10-K and any subsequent Quarterly Reports on Form 10-Q or Current Reports on Form 8-K, and all other documents

incorporated by reference into this prospectus supplement and accompanying prospectus, as updated by our subsequent filings under

the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Any of these risks could have a material

adverse effect on our business, prospects, financial condition and results of operations. In any such case, the trading price of

our securities could decline and you could lose all or part of your investment. Additional risks not presently known to us or that

we currently deem immaterial may also adversely affect our business operations.

This is a best efforts offering,

no minimum amount of shares is required to be sold, and we may not raise the amount of capital we believe is required for our business.

We have retained Roth Capital Partners,

LLC to act as our exclusive placement agent in connection with this offering. The placement agent has agreed to use its reasonable

best efforts to solicit offers to purchase the shares of common stock in this offering. The placement agent has no obligation to

buy any of the shares of common stock from us or to arrange for the purchase or sale of any specific number or dollar amount of

the shares of common stock. There is no required minimum number of securities that must be sold as a condition to completion of

this offering. Because there is no minimum offering amount required as a condition to the closing of this offering, the actual

offering amount, placement agent fees and proceeds to us are not presently determinable and may be substantially less than the

maximum amounts set forth herein. We may sell fewer than all of the shares of common stock offered hereby, which may significantly

reduce the amount of proceeds received by us, and investors in this offering will not receive a refund in the event that we do

not sell an amount of shares sufficient to pursue the business goals outlined in this prospectus. Thus, we may not raise the amount

of capital we believe is required for our business and may need to raise additional funds, which may not be available or available

on terms acceptable to us. Despite this, any proceeds from the sale of shares offered by us will be available for our immediate

use, and because there is no escrow account and no minimum offering amount in this offering, investors could be in a position where

they have invested in us, but we are unable to fulfill our objectives.

You will experience immediate and

substantial dilution in the net tangible book value per share of the common stock you purchase.

Since the price per share of our common stock being offered

is substantially higher than the net tangible book value per share of our common stock, you will suffer substantial dilution in

the net tangible book value of the common stock you purchase in this offering. Based on an offering price of $7.60 per share of

common stock, if you purchase shares of common stock in this offering, you will suffer immediate and substantial dilution of approximately

$2.41 per share in the net tangible book value of the common stock. See the section titled “Dilution” in this prospectus

supplement for a more detailed discussion of the dilution you will incur if you purchase common stock in this offering.

There may be future sales of our securities

or other dilution of our equity, which may adversely affect the market price of our common stock.

With limited exceptions, we are generally

not restricted from issuing additional common stock, including any securities that are convertible into or exchangeable for, or

that represent the right to receive, common stock. The market price of our common stock could decline as a result of sales of common

stock or securities that are convertible into or exchangeable for, or that represent the right to receive, common stock after this

offering or the perception that such sales could occur.

Our management has significant flexibility

in using the net proceeds of this offering.

We currently intend generally to use the

net proceeds from this offering for working capital and general corporate purposes. Our management will have significant flexibility

in applying the net proceeds of this offering. Management’s failure to use these funds effectively would have an adverse

effect on the value of our common stock and could make it more difficult and costly to raise funds in the future.

We are a clinical stage biotechnology

company with no significant revenue. We have incurred significant operating losses since our inception, and we expect to incur

losses for the foreseeable future and may never achieve profitability.

We have incurred significant operating losses

since our inception. As of September 30, 2020, we had an accumulated deficit of $64.7 million. To date, we have not generated

any revenue from the sale of our drug candidates and we do not expect to generate any revenue from sales of our drug candidates

for the foreseeable future. We expect to continue to incur significant operating losses and we anticipate that our losses may increase

substantially as we expand our drug development programs and commercialization efforts.

To achieve profitability, we must successfully

develop and obtain regulatory approval for one or more of our drug candidates and effectively commercialize any drug candidates

we develop. Even if we succeed in developing and commercializing one or more of our drug candidates, we may not be able to generate

sufficient revenue and we may never be able to achieve or sustain profitability.

We will continue to require substantial

additional capital for the foreseeable future. If we are unable to raise additional capital when needed, we may be forced to delay,

reduce or eliminate our drug development programs and commercialization efforts.

We expect to continue to incur significant

operating expenses in connection with our ongoing activities, including conducting clinical trials, manufacturing and seeking regulatory

approval of our drug candidates, prexigebersen, BP1002, BP1003 and prexigebersen-A. In addition, if we obtain regulatory approval

of one or more of our drug candidates, we expect to incur significant commercialization expenses related to product sales, marketing,

manufacturing and distribution.

As of September 30, 2020, we had $12.1

million in cash on hand, compared to $20.4 million as of December 31, 2019. Our ongoing future capital requirements will depend

on numerous factors, including:

|

|

·

|

the rate of progress, results and costs of completion of ongoing clinical trials of our drug candidates;

|

|

|

·

|

the rate of progress, results and costs of completion of the ongoing preclinical testing of prexigebersen, BP1002, BP1003 and

prexigebersen-A;

|

|

|

·

|

the size, scope, rate of progress, results and costs of completion of any potential future clinical trials and preclinical

tests of our drug candidates that we may initiate;

|

|

|

·

|

the costs to obtain adequate supply of the compounds necessary for our drug candidates;

|

|

|

·

|

the costs of obtaining regulatory approval of our drug candidates;

|

|

|

·

|

the scope, prioritization and number of drug development programs we pursue;

|

|

|

·

|

the costs for preparing, filing, prosecuting, maintaining and enforcing our intellectual property rights and defending intellectual

property-related claims;

|

|

|

·

|

the extent to which we acquire or in-license other products and technologies and the costs to develop those products and technologies;

|

|

|

·

|

the costs of future commercializing activities, including product sales, marketing, manufacturing and distribution, of any

of our drug candidates or other products for which marketing approval has been obtained;

|

|

|

·

|

our ability to establish strategic collaborations and licensing or other arrangements on terms favorable to us; and

|

|

|

·

|

competing technological and market developments.

|

Any additional fundraising efforts may divert

our management from their day to day activities, which may adversely affect our ability to develop and commercialize our drug candidates.

Our ability to raise additional funds will depend, in part, on the success of our product development activities and other factors

related to financial, economic and market conditions, many of which are beyond our control. There can be no assurance that we will

be able to raise additional capital when needed or on terms that are favorable to us, if at all. If adequate funds are not available

on a timely basis, we may be forced to:

|

|

·

|

delay, reduce the scope of or eliminate one or more of our drug development programs;

|

|

|

·

|

relinquish, license or otherwise dispose of rights to technologies, drug candidates or products that we would otherwise seek

to develop or commercialize ourselves at an earlier stage or on terms that are less favorable than might otherwise be available;

or

|

|

|

·

|

liquidate and dissolve the Company.

|

If our operating plans change, we may require

additional capital sooner than planned. Such additional financing may not be available when needed or on terms favorable to us.

In addition, we may seek additional capital due to favorable market conditions or strategic considerations, even if we believe

we have sufficient funds for our current and future operating plan.

The trading price of our common stock

has been volatile and is likely to be volatile in the future.

The trading price of our common stock has

been highly volatile. From January 1, 2018 through December 31, 2020, our stock price has fluctuated from a low of $1.61

to a high of $73.52, after adjustment for reverse stock splits. In addition, from February 1, 2021 through February 12,

2021, our stock price has fluctuated from a low of $4.1117 to a high of $24.34. The high of $24.34 occurred on February 10,

2021, the same day that the Company publicly announced that the USPTO granted the Company a new patent and that the USPTO had mailed

an Issue Notification for a separate patent scheduled to be issued. The market price for our common stock will be affected by a

number of factors, including:

|

|

·

|

the denial or delay of regulatory approvals of our drug candidates or receipt of regulatory approval of competing products;

|

|

|

·

|

our ability to accomplish clinical, regulatory and other drug development milestones;

|

|

|

·

|

the ability of our drug candidates, if they receive regulatory approval, to achieve market success;

|

|

|

·

|

the performance of third-party manufacturers and suppliers;

|

|

|

·

|

developments with respect to patents and other intellectual property rights;

|

|

|

·

|

sales of common stock or other securities by us or our stockholders in the future;

|

|

|

·

|

additions or departures of key scientific or management personnel;

|

|

|

·

|

disputes or other developments relating to proprietary rights, including patents, litigation matters and our ability to obtain

patent protection for our drug candidates;

|

|

|

·

|

trading volume of our common stock;

|

|

|

·

|

investor perceptions about us and our industry;

|

|

|

·

|

public reaction to our press releases, other public announcements and SEC and other filings;

|

|

|

·

|

the failure of analysts to cover us, or changes in analysts’ estimates or recommendations;

|

|

|

·

|

the failure by us to meet analysts’ projections or guidance;

|

|

|

·

|

general market conditions and other factors unrelated to our operating performance or the operating performance of our competitors;

and

|

|

|

·

|

other risk factors described elsewhere in our public filings.

|

Continued market fluctuations could result

in extreme volatility in the price of our common stock, which could cause a decline in the value of our common stock and the loss

of some or all of your investment. The stock prices of many companies in the biotechnology industry have experienced wide fluctuations

that have often been unrelated to the operating performance of these companies. Following periods of volatility in the market price

of a company’s securities, securities class action litigation often has been initiated against a company. If any class action

litigation is initiated against us, we may incur substantial costs and our management’s attention may be diverted from our

operations, which could materially adversely affect our business and financial condition.

SPECIAL NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement, the accompanying

prospectus and the documents incorporated by reference into this prospectus supplement and the accompanying prospectus contain

“forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the

Exchange Act. Forward-looking statements can be identified by words such as “anticipate,” “expect,” “intend,”

“plan,” “believe,” “seek,” “estimate,” “project,” “goal,”

“strategy,” “future,” “likely,” “may,” “should,” “will”

and variations of these words and similar references to future periods, although not all forward-looking statements contain these

identifying words. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they

are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies,

projections, anticipated events and trends, the economy and other future conditions. Because forward-looking statements relate

to the future, they are subject to inherent risks, uncertainties, and changes in circumstances, including but not limited to risk

factors incorporated by reference under “Item 1A. Risk Factors” to Part I of our Annual Report on Form 10-K for the fiscal year ended December 31, 2019 and other factors described elsewhere in this prospectus supplement, the accompanying

prospectus or in our current and future filings with the SEC. As a result, our actual results may differ materially from those

expressed or forecasted in the forward-looking statements, and you should not rely on such forward-looking statements. You should

carefully read this prospectus supplement and the accompanying prospectus, together with the information incorporated by reference

herein and therein as described under the sections titled “Where You Can Find More Information,” completely and with

the understanding that our actual future results may be materially different from what we expect. We can give no assurances that

any of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on

our results of operations and financial condition. Important factors that could cause our actual results and financial condition

to differ materially from those indicated in the forward-looking statements include, among others, the following:

|

|

·

|

the impact, risks and uncertainties related to COVID-19 and actions taken by governmental authorities or others in connection therewith;

|

|

|

·

|

our lack of significant revenue to date, our history of recurring operating losses and our expectation of future operating losses;

|

|

|

·

|

our need for substantial additional capital and our need to delay, reduce or eliminate our drug development and commercialization efforts if we are unable to raise additional capital;

|

|

|

·

|

the highly-competitive nature of the pharmaceutical and biotechnology industry and our ability to compete effectively;

|

|

|

·

|

the success of our plans to use collaboration arrangements to leverage our capabilities;

|

|

|

·

|

our ability to retain and attract key personnel;

|

|

|

·

|

the risk of misconduct of our employees, agents, consultants and commercial partners;

|

|

|

·

|

disruptions to our operations due to expansions of our operations;

|

|

|

·

|

the costs we would incur if we acquire or license technologies, resources or drug candidates;

|

|

|

·

|

risks associated with product liability claims;

|

|

|

·

|

our reliance on information technology systems and the liability or interruption associated with cyber-attacks or other breaches of our systems;

|

|

|

·

|

our ability to use net operating loss carryforwards;

|

|

|

·

|

provisions in our charter documents and state law that may prevent a change in control;

|

|

|

·

|

work slowdown or stoppage at government agencies could negatively impact our business;

|

|

|

·

|

our need to complete extensive clinical trials and the risk that we may not be able to demonstrate the safety and efficacy of our drug candidates;

|

|

|

·

|

risks that that our clinical trials may be delayed or terminated;

|

|

|

·

|

our ability to obtain domestic and foreign regulatory approval for our drug candidates;

|

|

|

·

|

changes in existing laws and regulations affecting the healthcare industry;

|

|

|

·

|

our reliance on third parties to conduct clinical trials for our drug candidates;

|

|

|

·

|

our ability to maintain orphan drug exclusivity for our drug candidates;

|

|

|

·

|

our reliance on third parties for manufacturing our clinical drug supplies;

|

|

|

·

|

risks associated with the manufacture of our drug candidates;

|

|

|

·

|

our ability to establish sales and marketing capabilities relating to our drug candidates;

|

|

|

·

|

market acceptance of our drug candidates;

|

|

|

·

|

third-party payor reimbursement practices;

|

|

|

·

|

our ability to adequately protect the intellectual property of our drug candidates;

|

|

|

·

|

infringement on the intellectual property rights of third parties;

|

|

|

·

|

costs and time relating to litigation regarding intellectual property rights;

|

|

|

·

|

our ability to adequately prevent disclosure by our employees or others of trade secrets and other proprietary information;

|

|

|

·

|

our need to raise additional capital;

|

|

|

·

|

the volatility of the trading price of our common stock;

|

|

|

·

|

our common stock being thinly traded;

|

|

|

·

|

our ability to issue shares of common or preferred stock without approval from our stockholders;

|

|

|

·

|

our ability to pay cash dividends;

|

|

|

·

|

costs and expenses associated with being a public company; and

|

|

|

·

|

our ability to maintain compliance with the listing standards of the Nasdaq Capital Market.

|

Any forward-looking statement made by us

in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein is based

only on information currently available to us and speaks only as of the date on which it is made. We undertake no obligation to

publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise. However,

you should carefully review the risk factors set forth in other reports or documents we file from time to time with the SEC.

USE OF PROCEEDS

We expect to receive net proceeds from this offering of approximately

$12.2 million after deducting the placement agent fees and estimated offering expenses payable by us. We currently intend to use

the net proceeds from this offering for working capital and general corporate purposes.

However, the amount and timing of what we

actually spend for these purposes may vary and will depend on a number of factors, including our future revenue and cash generated

by operations, if any, and the other factors described in “Risk Factors.” Accordingly, our management will have discretion

and flexibility in applying the net proceeds of this offering.

Because there is no minimum offering amount

required as a condition to the closing of this offering, the actual offering amount, placement agent fees and proceeds to us are

not presently determinable and may be substantially less than the amount set forth herein. We may sell fewer than all of the shares

of common stock offered hereby, which may significantly reduce the amount of proceeds received by us. Thus, we may not raise the

amount of capital we believe is required for our business and may need to raise additional funds, which may not be available or

available on terms acceptable to us.

DILUTION

If you invest in our securities, you will

experience immediate and substantial dilution to the extent of the difference between the amount per share paid in this offering

and the adjusted net tangible book value per share of our common stock immediately after the offering.

Our net tangible book value per share is determined by subtracting

our total liabilities from our total tangible assets, which is total assets less intangible assets, and dividing this amount by

the number of shares of common stock outstanding. The historical net tangible book value of our common stock as of September 30,

2020 was approximately $13.2 million, or $3.57 per share, based on 3,691,857 shares of common stock outstanding at September 30,

2020. Subsequent to September 30, 2020, we sold 1,128,800 shares of our common stock under the Offering Agreement with H. C. Wainwright

& Co., LLC for net proceeds of approximately $6.5 million and issued 416,655 pursuant to the exercise warrants to purchase

shares of our common stock for net proceeds of approximately $4.1 million. After giving effect to the sales under the Offering

Agreement and the exercise of warrants to purchase shares of our common stock, the pro forma net tangible book value of our common

stock as of September 30, 2020 would have been approximately $23.8 million, or $4.55 per share, based on 5,237,312 shares of common

stock outstanding.

After giving effect to the sales under the Offering Agreement

and the exercise of warrants to purchase shares of our common stock described above, as well as our sale of shares of common stock

to be sold in this offering, and after deducting the placement agent fees and our estimated offering expenses payable by us, our

pro forma as adjusted net tangible book value as of September 30, 2020 would have been approximately $36.0 million, or $5.19 per

share of common stock. This represents an immediate increase in net tangible book value of $0.64 per share to existing stockholders

and an immediate dilution of $2.41 per share to new investors in this offering. The following table illustrates this dilution on

a per share basis:

|

Offering price per share

|

|

|

|

|

|

$

|

7.60

|

|

|

Pro forma net tangible book value per share as of September 30, 2020, after giving effect to the sales under the Offering Agreement and the exercise of warrants to purchase shares of our common stock described above

|

|

$

|

4.55

|

|

|

|

|

|

|

Increase in net tangible book value per share attributable to new investors

|

|

$

|

0.64

|

|

|

|

|

|

|

As adjusted net tangible book value per share after the offering

|

|

|

|

|

|

$

|

5.19

|

|

|

Dilution per share to new investors

|

|

|

|

|

|

$

|

2.41

|

|

The above discussion and table are based

on 5,237,312 shares of our common stock outstanding as of September 30, 2020, after giving effect to the sales under the Offering

Agreement and the exercise of warrants to purchase shares of our common stock described above, which excludes as of September 30,

2020:

|

|

·

|

274,008 shares of common stock reserved for issuance upon the exercise of outstanding options granted under our equity incentive plans with a weighted average exercise price of $20.57 per share;

|

|

|

|

|

|

|

·

|

402,724 additional shares of common stock reserved for future issuance under our 2017 Stock Incentive Plan;

|

|

|

|

|

|

|

·

|

442,043 shares of common stock issuable upon exercise of outstanding warrants with a weighted average exercise price of $26.94 per share.

|

The above illustration of dilution per share

to investors participating in this offering assumes no exercise of outstanding options to purchase our common stock or outstanding

warrants to purchase shares of our common stock. To the extent that any of these outstanding options or warrants are exercised

or we issue additional shares under our equity incentive plans, there will be further dilution to new investors. In addition, we

may choose to raise additional capital due to market conditions or strategic considerations even if we believe we have sufficient

funds for our current or future operating plans. To the extent that additional capital is raised through the sale of equity or

convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

PLAN OF DISTRIBUTION

Roth Capital Partners, LLC has agreed to act as placement agent

in connection with this offering subject to the terms and conditions of the placement agency agreement dated February 16, 2021.

Roth Capital Partners, LLC is not purchasing or selling any of the shares of our common stock offered by this prospectus supplement,

nor is it required to arrange the purchase or sale of any specific number or dollar amount of shares of our common stock, but has

agreed to use its reasonable best efforts to arrange for the sale of all of the shares of our common stock offered hereby.

Therefore, we will enter into a securities

purchase agreement directly with investors in connection with this offering and we may not sell the entire amount of shares of

our common stock offered pursuant to this prospectus supplement. Investors who do not enter into a securities purchase agreement

will rely solely on this prospectus in connection with the purchase of our securities in this offering. This agreement includes

representations and warranties by us and such purchasers.

Delivery of the shares of common stock offered hereby is expected

to take place on or about February 18, 2021, subject to satisfaction of certain conditions.

We have agreed to pay the placement agent a cash fee equal to

5.0% of the gross proceeds received from investors who purchase securities in the offering. In addition, subject to FINRA Rule

5110(f)(2)(d)(i), we have also agreed to reimburse the placement agent at closing up to a maximum aggregate amount of $50,000 for

expenses in connection with this offering.

|

|

|

Per Share

|

|

|

Total

|

|

|

Offering price

|

|

$

|

7.60

|

|

|

$

|

13,000,560.00

|

|

|

Placement agent fees

|

|

$

|

0.38

|

|

|

$

|

650,028.00

|

|

|

Proceeds, before expenses, to us

|

|

$

|

7.22

|

|

|

$

|

12,350,532.00

|

|

Because there is no minimum offering amount

required as a condition to closing in this offering, the actual offering amount, placement agent fees, and proceeds to us, if any,

are not presently determinable and may be substantially less than the total maximum offering amounts set forth above.

The placement agent may be deemed to be

an underwriter within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit

realized on the resale of the shares sold by it while acting as principal might be deemed to be underwriting discounts or commissions

under the Securities Act. As an underwriter, the placement agent would be required to comply with the requirements of the Securities

Act and the Exchange Act, including, without limitation, Rule 415(a)(4) under the Securities Act and Rule 10b-5

and Regulation M under the Exchange Act. These rules and regulations may limit the timing of purchases and sales of shares

by the placement agent acting as principal. Under these rules and regulations, the placement agent:

|

|

·

|

may not engage in any stabilization activity in connection with our securities; and

|

|

|

·

|

may not bid for or purchase any of our securities or attempt to induce any person to purchase any of our securities, other

than as permitted under the Exchange Act, until it has completed its participation in the distribution.

|

Determination of Offering Price

The public offering price of the shares

of common stock we are offering was negotiated between us and the investors, in consultation with the placement agent based on

the trading of our common stock prior to the offering, among other things. Other factors considered in determining the public offering

price of our common stock we are offering include the history and prospects of the Company, the stage of development of our business,

our business plans for the future and the extent to which they have been implemented, an assessment of our management, general

conditions of the securities markets at the time of the offering and such other factors as were deemed relevant.

Indemnification

We have agreed to indemnify the placement

agent and certain other persons against certain liabilities under the Securities Act relating to or arising out of the placement

agent’s activities under the placement agency agreement. We have also agreed to contribute to payments the placement agent

may be required to make in respect of such liabilities.

Electronic Distribution

This prospectus supplement and the accompanying

prospectus may be made available in electronic format on websites or through other online services maintained by the placement

agent, or by an affiliate. Other than this prospectus supplement and the accompanying prospectus in electronic format, the information

on the placement agent’s websites and any information contained in any other website maintained by the placement agent is

not part of this prospectus supplement and the accompanying prospectus or the registration statement of which this prospectus supplement

and the accompanying prospectus form a part, has not been approved and/or endorsed by us or the placement agent, and should not

be relied upon by investors.

Lock-Up Agreements

Each of our directors and executive officers

has entered into a lock-up agreement with the Company in connection with this offering. Under the lock-up agreements, from the

date of the lock-up agreements until ninety (90) days after the closing of this offering, the directors and executive officers

will not offer, sell, contract to sell, hypothecate, pledge or otherwise dispose of (or enter into any transaction which is designed

to, or might reasonably be expected to, result in the disposition (whether by actual disposition or effective economic disposition

due to cash settlement or otherwise) by the director or executive officer), directly or indirectly, or establish or increase a

put equivalent position or liquidate or decrease a call equivalent position within the meaning of Section 16 of the Securities

Exchange Act, with respect to, any shares of the Company’s common stock or securities convertible, exchangeable or exercisable

into, shares of common stock.

Passive Market Making

In connection with this offering, the placement

agent may engage in passive market making transactions in our common stock on the Nasdaq Capital Market in accordance with Rule 103

of Regulation M promulgated under the Exchange Act during a period before the commencement of offers or sales of shares of our

common stock and extending through the completion of the distribution. A passive market maker must display its bid at a price not

in excess of the highest independent bid of that security. If all independent bids are lowered below the passive market maker’s

bid, however, that bid must then be lowered when specified purchase limits are exceeded.

Other

From time to time, the placement agent and

its respective affiliates may in the future provide various investment banking, financial advisory and other services to us and

our affiliates for which services they may receive customary fees. In the course of their businesses, the placement agent and its

respective affiliates may actively trade our securities or loans for their own account or for the accounts of customers, and, accordingly,

the placement agent and its respective affiliates may at any time hold long or short positions in such securities or loans. Except

for services provided in connection with this offering, the placement agent has not provided any investment banking or other financial

services during the 180-day period preceding the date of this prospectus supplement and we do not expect to retain the placement

agent to perform any investment banking or other financial services for at least 90 days after the date of this prospectus supplement.

The foregoing does not purport to be a complete

statement of the terms and conditions of the placement agency agreement and securities purchase agreement. A copy of the placement

agency agreement and the form of securities purchase agreement with the investors will be included as exhibits to our Current Report

on Form 8-K that will be filed with the SEC and incorporated by reference into the Registration Statement of which this prospectus

supplement forms a part.

The transfer agent for our common stock

to be issued in this offering is American Stock Transfer & Trust Company, LLC.

LEGAL MATTERS

The validity of the issuance of the securities

offered hereby will be passed upon for us by Winstead PC, Houston, Texas. Pryor Cashman LLP, New York, New York is acting as counsel

for the placement agent in connection with this offering.

EXPERTS

The consolidated financial statements as

of December 31, 2019 and 2018 and for the years then ended incorporated by reference in this prospectus supplement have been

so incorporated in reliance on the report of BDO USA, LLP, an independent registered public accounting firm, incorporated herein

by reference, given on the authority of said firm as experts in auditing and accounting.

WHERE YOU CAN FIND MORE INFORMATION

We have filed with the SEC a registration

statement on Form S-3 under the Securities Act with respect to the securities being offered hereby. This prospectus supplement

and the accompanying prospectus, which constitute a part of the registration statement, do not contain all of the information set

forth in the registration statement or the exhibits and schedules filed therewith. For further information about us and the securities

offered hereby, we refer you to the registration statement and the exhibits filed thereto. Statements contained in this prospectus

supplement and the accompanying prospectus regarding the contents of any contract or any other document that is filed as an exhibit

to the registration statement are not necessarily complete, and each such statement is qualified in all respects by reference to

the full text of such contract or other document filed as an exhibit to the registration statement.

We file annual, quarterly and current reports,

proxy statements and other information with the SEC. The SEC maintains an Internet site that contains reports, proxy and information

statements, and other information regarding issuers that file electronically with the SEC, including us. The SEC’s Internet

site can be found at http://www.sec.gov. In addition, we make available on or through our Internet site copies of these

reports as soon as reasonably practicable after we electronically file or furnished them to the SEC. Our Internet site can be found

at http://www.biopathholdings.com. The information contained in, or that can be accessed through, our website is not

incorporated by reference in, and is not part of, this prospectus supplement or the accompanying prospectus.

INFORMATION INCORPORATED BY REFERENCE

We are incorporating by reference into this

prospectus supplement and the accompanying prospectus certain information that we file with the SEC, which means that we are disclosing

important information to you by referring you to those documents. The information incorporated by reference is deemed to be part

of this prospectus supplement and the accompanying prospectus, except for information incorporated by reference that is superseded

by information contained in this prospectus supplement and the accompanying prospectus. This means that you must look at all of

the SEC filings that we incorporate by reference to determine if any statements in this prospectus supplement, the accompanying

prospectus or any document previously incorporated by reference have been modified or superseded. This prospectus supplement incorporates

by reference the documents set forth below that we have previously filed with the SEC:

|

|

·

|

our Annual Report on Form 10-K for the fiscal year ended December 31, 2019;

|

|

|

·

|

our Quarterly Reports on Form 10-Q for the quarters ended March 31, June 30, and September 30, 2020;

|

|

|

·

|

our Definitive Proxy Statement on Schedule 14A relating to our 2020 Annual Meeting of Stockholders, filed November 5, 2020;

|

|

|

·

|

our Current Reports on Form 8-K filed with the SEC on November 19, 2020; December 18, 2020; and February 10, 2021; and

|

|

|

·

|

the description of our common stock contained in Exhibit 4.17 to our Annual Report on Form 10-K for the fiscal year ended December 31, 2019.

|

Any information in any of the foregoing

documents will automatically be deemed to be modified or superseded to the extent that information in this prospectus supplement

or in a later filed document that is incorporated or deemed to be incorporated herein by reference modifies or replaces such information.

We also incorporate by reference all documents

we subsequently file in the future pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of

this prospectus supplement until the termination of the offering. These documents include periodic reports, such as Annual Reports

on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K (except, in any such case, the portions

furnished and not filed pursuant to Item 2.02, Item 7.01 or otherwise), as well as any proxy statements.

We will provide to each person, including

any beneficial owner, to whom a prospectus supplement and accompanying prospectus are delivered, without charge upon written or

oral request, a copy of any or all of the documents that are incorporated by reference into this prospectus supplement and the

accompanying prospectus but not delivered with the prospectus supplement and accompanying prospectus, including exhibits which

are specifically incorporated by reference into such documents. You may request a copy of these filings at no cost, by writing

to or telephoning us at the following address:

Bio-Path Holdings, Inc.

Attention: Secretary

4710 Bellaire Boulevard, Suite 210

Bellaire, Texas 77401

(832) 742-1357

PROSPECTUS

$125,000,000

COMMON STOCK

PREFERRED STOCK

WARRANTS

UNITS

We may from time to time offer and sell

up to $125,000,000 of common stock, preferred stock, warrants to purchase common stock or preferred stock or any combination of

the foregoing, either individually or in units, at prices and on terms described in one or more supplements to this prospectus.

We may also offer securities as may be issuable upon conversion, redemption, repurchase, exchange or exercise of any securities

registered hereunder, including any applicable anti-dilution provisions.

This prospectus provides the general terms

of the securities we may offer and the general manner in which these securities will be offered. Each time we offer to sell securities,

we will provide specific terms related to such offers in a supplement to this prospectus. The prospectus supplements may also add,

update or change information contained in this prospectus. Before you invest, you should carefully read this prospectus and the

applicable prospectus supplement, as well the documents incorporated by referenced in this prospectus. This prospectus may not

be used to consummate a sale of securities unless accompanied by the applicable prospectus supplement.

Our common stock is currently listed on

the Nasdaq Capital Market under the symbol “BPTH.” On May 14, 2019, the last reported sales price per share of our

common stock on the Nasdaq Capital Market was $18.00.

We will sell these securities directly,

through agents, dealers or underwriters as designated from time to time, or through a combination of these methods. For additional

information on the methods of sale, you should refer to the section titled “Plan of Distribution” in this prospectus.

If any agents, dealers or underwriters are involved in the sale of these securities, the applicable prospectus supplement will

set forth the names of the agents, dealers or underwriters and any applicable fees, commissions or discounts. The price to the

public of such securities and the net proceeds that we expect to receive from such sale will also be set forth in a supplement

to this prospectus.

Investing in our securities involves

a high degree of risk. Before making an investment decision, you should review carefully and consider all of the information set

forth in this prospectus, the applicable prospectus supplement and the documents incorporated by reference in this prospectus and

applicable prospectus supplement. See “Risk Factors” on page 4 of this prospectus and under similar headings in the

other documents that are incorporated by reference into this prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful

or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is June

5, 2019

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement on Form S-3 that we filed with the Securities and Exchange Commission (the “SEC”) using a “shelf”

registration process. Under this shelf registration statement process, we may from time to time sell common stock, preferred stock,

warrants to purchase common stock or preferred stock or any combination of the foregoing, either individually or in units, in one

or more offerings up to an offering amount of $125,000,000. This prospectus provides you with a general description of the securities

we may offer and the general manner in which these securities will be offered.

Each time we offer securities hereunder,

we will provide specific terms related to such offering in a supplement to this prospectus.

The prospectus supplements may add, update

or change any of the information contained in this prospectus or in the documents that we have incorporated by reference into this

prospectus. We urge you to read carefully this prospectus and the applicable prospectus supplement, together with the information

incorporated herein by reference as described under the sections titled “Where You Can Find More Information” and “Information

Incorporated by Reference” below. If there is any inconsistency between the information in this prospectus and any prospectus

supplement, you should rely on the information contained in that prospectus supplement.

This prospectus may not be used to consummate

a sale of securities unless it is accompanied by a prospectus supplement.

You should rely only on the information

we have provided or incorporated by reference in this prospectus and the applicable prospectus supplement. We have not authorized

anyone to provide you with different information. No dealer, salesperson or other person is authorized to give any information

or to represent anything not contained in this prospectus or the applicable prospectus supplement. You must not rely on any unauthorized

information or representation. This prospectus or any applicable supplement to this prospectus do not constitute an offer to sell

or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus

or any applicable supplement to this prospectus constitute an offer to sell or the solicitation of an offer to buy securities in

any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should assume

that the information in this prospectus is accurate only as of the date on the front of the document and that any information we

have incorporated by reference is accurate only as of the date of the document incorporated by reference. Our business, financial

condition, results of operations and prospects may have changed since those dates.

This prospectus contains summaries of certain

provisions contained in some of the documents described herein, but reference is made to the actual documents for complete information.

All of the summaries are qualified in their entirety by the actual documents. Copies of some of the documents referred to herein

have been filed, will be filed or will be incorporated by reference as exhibits to the registration statement of which this prospectus

is a part, and you may obtain copies of those documents as described below under the section titled “Where You Can Find More

Information.”

Unless the context requires otherwise, references

in this prospectus to “we,” “our,” “us,” “the Company” and “Bio-Path”

refer to Bio-Path Holdings, Inc. and its wholly-owned subsidiary. Bio-Path Holdings, Inc.’s wholly-owned subsidiary, Bio-Path,

Inc., is sometimes referred to herein as “Bio-Path Subsidiary.”

PROSPECTUS

SUMMARY

This prospectus summary highlights

selected information contained elsewhere in this prospectus or in documents incorporated by reference. This summary does not contain

all of the information that you should consider before making an investment decision. You should carefully read the entire prospectus,

the applicable prospectus supplement, including under the section titled “Risk Factors” and the documents incorporated

by reference into this prospectus, before making an investment decision.

Our Company

We are a clinical and preclinical stage

oncology focused RNAi nanoparticle drug development company utilizing a novel technology that achieves systemic delivery for target

specific protein inhibition for any gene product that is over-expressed in disease. Our drug delivery and antisense technology,

called DNAbilize®, is a platform that uses P-ethoxy, which is a deoxyribonucleic acid (DNA) backbone modification that is intended

to protect the DNA from destruction by the body’s enzymes when circulating in vivo, incorporated inside of a neutral

charged lipid bilayer. We believe this combination allows for high efficiency loading of antisense DNA into non-toxic, cell-membrane-like

structures for delivery of the antisense drug substance into cells. In vivo, the DNAbilize® delivered antisense drug

substances are systemically distributed throughout the body to allow for reduction or elimination of target proteins in blood diseases

and solid tumors. Through testing in numerous animal studies and treatment in over 70 patients, the Company’s DNAbilize®

drug candidates have demonstrated an excellent safety profile. DNAbilize® is a registered trademark of the Company.

Using DNAbilize® as a platform for drug