Banner Corporation (Nasdaq:BANR), the parent company of Banner Bank

and Islanders Bank, today reported net income of $2.2 million in

the second quarter ended June 30, 2011, compared to a net loss of

$7.8 million in the immediately preceding quarter and a net loss of

$4.9 million in the second quarter a year ago. In the first six

months of the year, Banner reported a net loss of $5.6 million

compared to a net loss of $6.5 million in the first six months of

2010.

"Banner's return to profitability in the second quarter provided

further evidence of the successful execution of our strategies and

priorities to strengthen the franchise through our super community

bank model," said Mark J. Grescovich, President and Chief Executive

Officer. "The resulting margin expansion and increased net interest

income, as well as increased deposit and payment processing fees,

supported strong revenue generation during the quarter and first

half of the year. Additionally, Banner's credit quality metrics

continued to improve during the second quarter, with non-performing

loans, real estate owned and total non-performing asset levels all

decreasing at June 30, 2011 compared to the prior quarter end,

leading to reduced credit costs for the current quarter and six

months year-to-date."

Banner's second quarter 2011 results included a net gain of $1.9

million ($1.9 million after tax, or $0.12 earnings per share) for

fair value adjustments as a result of changes in the valuation of

financial instruments carried at fair value, compared to a net gain

of $256,000 ($256,000 after tax, or $0.02 earnings per share) in

the first quarter of 2011 and a net loss of $821,000 ($525,000

after tax, or $0.15 earnings per share) in the second quarter a

year ago.

In the second quarter of 2011, Banner paid a $1.6 million

dividend on the $124 million of senior preferred stock it issued to

the U.S. Treasury under the Capital Purchase Program. In addition,

Banner accrued $425,000 for related discount accretion. Including

the preferred stock dividend and related accretion, the net income

to common shareholders was $0.01 per share for the quarter ended

June 30, 2011, compared to a net loss to common shareholders of

$0.61 per share in the first quarter of 2011 and a net loss to

common shareholders of $1.97 per share for the second quarter a

year ago.

Credit Quality

"Charge-offs and delinquencies as well as real estate owned

expenses and valuation adjustments continued to be concentrated in

loans for the construction of single-family homes and residential

land development projects," said Grescovich. "Our exposure to

one-to-four family residential construction and land development

loans has continued to decline and at the end of June had been

reduced to just 8.2% of total loans outstanding. Although this

percentage is slightly below our long-term target range under

improved market conditions, we do expect the land development

portion of our portfolio to continue to decline over the near

term.

"While credit costs remained stubbornly high and well above our

long-term expectations, reflecting the persistent weak economic

environment and additional declines in property values, they were

significantly reduced from recent quarters and compared to a year

ago as we continued to make meaningful progress at reducing problem

assets. Although the economic environment remains challenging, our

capital and reserve levels are substantial and our coverage ratio

relative to non-performing loans continued to increase. We will

remain diligent in our efforts to reduce credit costs in future

periods as we further reduce non-performing assets."

Banner recorded an $8.0 million provision for loan losses in the

second quarter of 2011, compared to $17.0 million in the preceding

quarter and $16.0 million in the second quarter of 2010. The

allowance for loan losses at June 30, 2011 totaled $92.0 million,

representing 2.78% of total loans outstanding and 80% of

non-performing loans. Non-performing loans decreased to $115.2

million at June 30, 2011, compared to $131.7 million in the

immediately preceding quarter and $177.9 million a year

earlier.

Banner's real estate owned and repossessed assets decreased to

$71.3 million at June 30, 2011, compared to $95.0 million three

months earlier and $101.7 million a year earlier. Net charge-offs

in the second quarter of 2011 totaled $13.6 million, or 0.41% of

average loans outstanding, compared to $16.8 million, or 0.50% of

average loans outstanding for the first quarter of 2011 and $16.2

million, or 0.44% of average loans outstanding for the second

quarter a year ago. For the first six months of 2011, net charge

offs totaled $30.4 million, compared to $29.8 million in the first

six months of 2010. Non-performing assets decreased to $188.4

million at June 30, 2011, compared to $228.6 million in the

preceding quarter and $283.1 million a year ago. At June 30, 2011,

Banner's non-performing assets were 4.48% of total assets, compared

to 5.32% at the end of the preceding quarter and 6.02% a year

ago.

One-to-four family residential construction, land and land

development loans were $269.6 million, or 8.2% of the total loan

portfolio at June 30, 2011, compared to $411.1 million, or 11.3% of

the total loan portfolio a year earlier. The geographic

distribution of these residential construction, land and land

development loans was approximately $81.3 million, or 30%, in the

greater Puget Sound market, $119.1 million, or 44%, in the greater

Portland, Oregon market and $9.2 million, or 4%, in the greater

Boise, Idaho market as of June 30, 2011. The remaining $60.0

million, or 22%, was distributed in the various eastern Washington,

eastern Oregon and northern Idaho markets served by Banner

Bank.

Non-performing residential construction, land and land

development loans and related real estate owned were $94.0 million,

or 50% of non-performing assets at June 30, 2011. The geographic

distribution of non-performing construction, land and land

development loans and related real estate owned included

approximately $41.6 million, or 44%, in the greater Puget Sound

market, $37.3 million, or 40%, in the greater Portland market and

$6.6 million, or 7%, in the greater Boise market, with the

remaining $8.5 million, or 9%, distributed in the various eastern

Washington, eastern Oregon and northern Idaho markets served by

Banner Bank.

Income Statement Review

"The realignment of our delivery platforms and execution of our

sales teams as well as further maturing of our expanded branch

system and a targeted marketing campaign have allowed Banner Bank

to add customer relationships and grow core deposits. That

growth has enabled us to significantly reduce our cost of funds

during the first six months of this year through changes in our

deposit mix and pricing strategies and has supported increased

deposit fees despite the adverse impact of regulatory changes on

overdraft revenues. The reduced cost of funds coupled with

changes in our asset mix made it possible for us to improve our net

interest margin by 15 basis points compared to the immediately

preceding quarter and to increase it by 44 basis points compared to

the second quarter a year ago, despite continued downward pressure

on asset yields," said Grescovich. Banner's net interest

margin was 4.09% for the second quarter of 2011, compared to 3.94%

in the preceding quarter and 3.65% in the second quarter a year

ago. For the first six months of 2011, Banner's net interest

margin was 4.01%, a 39 basis point improvement compared to 3.62%

for the first six months of 2010.

Funding costs for the second quarter of 2011 decreased eight

basis points compared to the previous quarter and 68 basis points

from the second quarter a year ago. Deposit costs decreased by

nine basis points compared to the preceding quarter and 74 basis

points compared to the second quarter a year earlier. Asset

yields increased seven basis points compared to the prior quarter,

largely as a result of reductions in low yielding interest-earning

cash balances and nonaccruing loans, but decreased 26 basis points

from the second quarter a year ago. Loan yields declined two

basis points compared to the preceding quarter and decreased eight

basis points from the second quarter a year ago. Nonaccruing

loans reduced the margin by approximately 23 basis points in the

second quarter of 2011 compared to approximately 27 basis points in

the preceding quarter and approximately 34 basis points in the

second quarter of 2010.

Net interest income, before the provision for loan losses, was

$41.2 million in the second quarter of 2011, compared to $40.1

million in the preceding quarter and $38.9 million in the second

quarter a year ago. For the first six months of 2011, net

interest income, before the provision for loan losses, increased 5%

to $81.3 million, compared to $77.1 million for the first six

months of 2010. Revenues from core operations* (net interest

income before the provision for loan losses plus total other

operating income excluding fair value and other-than-temporary

impairment (OTTI) adjustments) were $48.5 million in the second

quarter of 2011, compared to $47.0 million in the first quarter of

2011 and $45.9 million for the second quarter a year

ago. Year-to-date, revenues from core operations increased 5%

to $95.6 million, compared to $91.1 million in the same period a

year earlier. "The continued growth in core deposits and

reduced funding costs over the past year and resulting improvement

in net interest margin led to a solid increase in our revenues from

core operations compared to the same quarter and six-month period a

year earlier," said Grescovich.

Total other operating income, which includes the changes in the

valuation of financial instruments and OTTI adjustments, was $9.3

million in the second quarter of 2011 compared to $7.2 million in

the preceding quarter and $6.2 million in the second quarter a year

ago. For the first six months of the year, total other

operating income was $16.5 million, compared to $13.9 million for

the first six months of 2010. There were no OTTI charges

during the current quarter, the preceding quarter or the second

quarter a year ago; however, OTTI charges during the first quarter

of 2010 were $1.2 million. Total other operating income from

core operations* (other operating income excluding fair value and

OTTI adjustments) for the current quarter was $7.3 million,

compared to $7.0 million for the preceding quarter and $7.0 million

for the second quarter a year ago. For the first six months

of 2011, total other operating income from core operations* was

$14.3 million compared to $14.1 million for the first six months of

2010.

Deposit fees and other service charges were $5.7 million in the

second quarter of 2011 compared to $5.3 million in the preceding

quarter and $5.6 million in the second quarter a year

ago. Income from mortgage banking operations decreased to

$855,000 in the second quarter, compared to $962,000 in the

immediately preceding quarter and $817,000 in the second quarter of

2010.

"Operating expenses were increased during the quarter compared

to the preceding quarter and the same quarter a year ago, largely

due to higher costs associated with the real estate owned

portfolio, particularly valuation adjustments," said

Grescovich. "Aside from these real estate owned costs, our

operating expenses were little changed from recent quarters as

increased compensation and payment processing costs were partially

offset by lower deposit insurance expense and professional services

fees. While we are working diligently to control operating

expenses, we expect collection expenses and costs associated with

real estate owned to remain elevated in the near

term. However, these credit costs will reduce over time as

further problem asset resolution occurs."

Total other operating expenses, or non-interest expenses, were

$40.3 million in the second quarter of 2011, compared to $38.1

million in the preceding quarter and $38.0 million in the second

quarter a year ago. For the first six months of 2011, total

other operating expenses were $78.4 million compared to $73.4

million for the first six months of 2010.

*Earnings information excluding fair value and OTTI adjustments

(alternately referred to as total other operating income from core

operations or revenues from core operations) represent non-GAAP

(Generally Accepted Accounting Principles) financial

measures. Management has presented these non-GAAP financial

measures in this earnings release because it believes that they

provide useful and comparative information to assess trends in the

Company's core operations reflected in the current quarter's

results. Where applicable, the Company has also presented

comparable earnings information using GAAP financial measures.

Balance Sheet Review

"Although loan demand was modest for the quarter as both

businesses and consumers remained cautious in their use of

leverage, the aggressive calling efforts of our bankers are

resulting in a stronger pipeline of new relationships and lending

opportunities for Banner," said Grescovich. "Nonetheless, as

expected, our loan totals declined modestly again this quarter, as

we continued to intentionally reduce our construction and land

development loans as well as non-performing loans."

Net loans were $3.21 billion at June 30, 2011, compared to $3.23

billion at March 31, 2011 and $3.54 billion a year ago. At

June 30, 2011, one-to-four family construction loans totaled $140.7

million, a decrease of $10.3 million for the quarter and a decrease

of $42.3 million over the past year. One-to-four family

construction loans have now been reduced by $514.3 million from

their peak quarter-end balance of $655.0 million at June 30,

2007. Similarly, total construction, land and land development

loans have declined by $879.9 million from their peak quarter-end

balance of $1.24 billion at June 30, 2007.

Total assets were $4.21 billion at June 30, 2011, compared to

$4.30 billion at the end of the preceding quarter and $4.70 billion

a year ago. Deposits totaled $3.47 billion at June 30, 2011,

compared to $3.54 billion at the end of the preceding quarter and

$3.84 billion a year ago. Non-interest-bearing accounts

totaled $645.8 million at June 30, 2011, compared to $622.8 million

at the end of the preceding quarter and $548.3 million a year ago,

a year-over-year increase of 18%. At June 30, 2011,

interest-bearing transaction and savings accounts were $1.42

billion, compared to $1.46 billion at the end of the preceding

quarter and $1.40 billion a year ago.

"We are encouraged by the success we are having in adding

non-interest-bearing and other transaction and savings accounts,

which is allowing us to reduce our reliance on higher cost

certificates of deposit as well as providing additional

opportunities to earn deposit fees," said Grescovich. "This

strategy continues to help improve our cost of funds and has led to

our net interest margin expansion and revenue growth. Lower

rates on renewed and retained certificates of deposit and

interest-bearing transaction and savings accounts also contributed

to the decline in the cost of deposits."

At June 30, 2011, total stockholders' equity was $511.0 million,

including $119.9 million attributable to preferred stock, and

common stockholders' equity was $ 391.2 million, or $23.52 per

share. During 2010, Banner completed a common stock offering,

issuing a total of 85,639,000 shares in the offering, resulting in

net proceeds of approximately $161.6 million. In May 2011,

Banner announced a 1-for-7 reverse stock split, which took effect

on June 1, 2011. Every seven shares of Banner's pre-split

common shares were automatically consolidated into one post-split

share. Taking the reverse stock split into account, Banner had

16.7 million shares outstanding at June 30, 2011, compared to 14.7

million shares outstanding a year ago. Tangible common

stockholders' equity, which excludes preferred stock and other

intangibles, was $383.7 million at June 30, 2011, or 9.14% of

tangible assets, compared to $377.3 million, or 8.79% of tangible

assets at March 31, 2011 and $425.9 million, or 9.08% of tangible

assets a year ago. Tangible book value per common share was

$23.07 at June 30, 2011.

Augmented by the stock offering and continued sales under its

Dividend Reinvestment and Direct Stock Purchase and Sale Plan

(DRIP), Banner Corporation and its subsidiary banks continue to

maintain capital levels significantly in excess of the requirements

to be categorized as "well-capitalized" under applicable regulatory

standards. Banner Corporation used a significant portion of

the net proceeds from the offering to strengthen Banner Bank's

regulatory capital ratios while retaining the balance for general

working capital purposes, including additional capital investments

in its subsidiary banks if appropriate. Through June 30, 2011,

Banner Corporation had invested $110.0 million of the net proceeds

as additional paid-in common equity in Banner Bank, although no

additional equity investment was made during the current

year. Banner Corporation's Tier 1 leverage capital to average

assets ratio improved to 12.90% and its total capital to

risk-weighted assets ratio increased to 17.29% at June 30,

2011. Banner Bank's Tier 1 leverage ratio also improved to

11.37% at June 30, 2011, which is in excess of the 10% minimum

level targeted in its Memorandum of Understanding with the Federal

Deposit Insurance Corporation (FDIC) and the Washington State

Department of Financial Institutions (Washington DFI).

Conference Call

Banner will host a conference call on Thursday, July 21, 2011,

at 8:00 a.m. PDT, to discuss its second quarter results. The

conference call can be accessed live by telephone at (480) 629-9835

to participate in the call. To listen to the call online, go

to the Company's website at www.bannerbank.com. A replay will

be available for a week at (303) 590-3030, using access code

4453037.

About the Company

Banner Corporation is a $4.21 billion bank holding company

operating two commercial banks in Washington, Oregon and

Idaho. Banner serves the Pacific Northwest region with a full

range of deposit services and business, commercial real estate,

construction, residential, agricultural and consumer

loans. Visit Banner Bank on the Web at

www.bannerbank.com.

This press release contains statements that the Company believes

are "forward-looking statements." These statements relate to the

Company's financial condition, results of operations, plans,

objectives, future performance or business. You should not place

undue reliance on these statements, as they are subject to risks

and uncertainties. When considering these forward-looking

statements, you should keep in mind these risks and uncertainties,

as well as any cautionary statements the Company may make.

Moreover, you should treat these statements as speaking only as of

the date they are made and based only on information then actually

known to the Company. There are a number of important factors that

could cause future results to differ materially from historical

performance and these forward-looking statements. Factors which

could cause actual results to differ materially include, but are

not limited to, the credit risks of lending activities, including

changes in the level and trend of loan delinquencies and write-offs

and changes in our allowance for loan losses and provision for loan

losses that may be impacted by deterioration in the housing and

commercial real estate markets and may lead to increased losses and

non-performing assets and may result in our allowance for loan

losses not being adequate to cover actual losses; changes in

general economic conditions, either nationally or in our market

areas; changes in the levels of general interest rates and the

relative differences between short and long-term interest rates,

loan and deposit interest rates, our net interest margin and

funding sources; fluctuations in the demand for loans, the number

of unsold homes, land and other properties and fluctuations in real

estate values in our market areas; secondary market conditions for

loans and our ability to sell loans in the secondary market;

results of examinations of us by the Board of Governors of the

Federal Reserve System and of our bank subsidiaries by the FDIC,

the Washington DFI or other regulatory authorities, including the

possibility that any such regulatory authority may, among other

things, institute a formal or informal enforcement action against

us or any of the Banks which could require us to increase our

reserve for loan losses, write-down assets, change our regulatory

capital position or affect our ability to borrow funds or maintain

or increase deposits, which could adversely affect our liquidity

and earnings; our compliance with regulatory enforcement actions;

the requirements and restrictions that have been imposed upon

Banner and Banner Bank under the memoranda of understanding with

the Federal Reserve Bank of San Francisco (in the case of Banner)

and the FDIC and the Washington DFI (in the case of Banner Bank)

and the possibility that Banner and Banner Bank will be unable to

fully comply with the memoranda of understanding, which could

result in the imposition of additional requirements or

restrictions; legislative or regulatory changes that adversely

affect our business including changes in regulatory policies and

principles, or the interpretation of regulatory capital or other

rules; our ability to attract and retain deposits; increases in

premiums for deposit insurance; our ability to control operating

costs and expenses; the use of estimates in determining fair value

of certain of our assets and liabilities, which estimates may prove

to be incorrect and result in significant changes in valuations;

staffing fluctuations in response to product demand or the

implementation of corporate strategies that affect our workforce

and potential associated charges; the failure or security breach of

computer systems on which we depend; our ability to retain key

members of our senior management team; costs and effects of

litigation, including settlements and judgments; our ability to

implement our business strategies; our ability to successfully

integrate any assets, liabilities, customers, systems, and

management personnel we may acquire into our operations and our

ability to realize related revenue synergies and cost savings

within expected time frames and any goodwill charges related

thereto; our ability to manage loan delinquency rates; increased

competitive pressures among financial services companies; changes

in consumer spending, borrowing and savings habits; the

availability of resources to address changes in laws, rules, or

regulations or to respond to regulatory actions; our ability to pay

dividends on our common and preferred stock and interest or

principal payments on our junior subordinated debentures; adverse

changes in the securities markets; inability of key third-party

providers to perform their obligations to us; changes in accounting

policies and practices, as may be adopted by the financial

institution regulatory agencies or the Financial Accounting

Standards Board including additional guidance and interpretation on

accounting issues and details of the implementation of new

accounting methods; the economic impact of war or terrorist

activities; other economic, competitive, governmental, regulatory,

and technological factors affecting our operations, pricing,

products and services; future legislative changes in the United

States Department of Treasury Troubled Asset Relief Program

Capital Purchase Program; and other risks detailed in Banner's

reports filed with the Securities and Exchange Commission,

including its Annual Report on Form 10-K for the year ended

December 31, 2010. We do not undertake and specifically disclaim

any obligation to revise any forward-looking statements to reflect

the occurrence of anticipated or unanticipated events or

circumstances after the date of such statements. These risks could

cause our actual results for 2011 and beyond to differ materially

from those expressed in any forward-looking statements by, or on

behalf of, us, and could negatively affect our operating and stock

price performance.

| BANR - Second Quarter

2011 Results |

| RESULTS OF

OPERATIONS |

Quarters

Ended |

Six Months

Ended |

| (in thousands except shares and per share

data) |

Jun 30, 2011 |

Mar 31, 2011 |

Jun 30, 2010 |

Jun 30, 2011 |

Jun 30, 2010 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| INTEREST INCOME: |

|

|

|

|

|

| Loans receivable |

$ 46,846 |

$ 46,755 |

$ 52,473 |

$ 93,601 |

$ 105,232 |

| Mortgage-backed securities |

859 |

875 |

1,045 |

1,734 |

2,171 |

| Securities and cash equivalents |

2,183 |

2,033 |

2,116 |

4,216 |

4,201 |

| |

|

|

|

|

|

| |

49,888 |

49,663 |

55,634 |

99,551 |

111,604 |

| |

|

|

|

|

|

| INTEREST EXPENSE: |

|

|

|

|

|

| Deposits |

7,014 |

7,812 |

14,700 |

14,826 |

30,498 |

| Federal Home Loan Bank advances |

64 |

178 |

320 |

242 |

681 |

| Other borrowings |

568 |

579 |

626 |

1,147 |

1,260 |

| Junior subordinated debentures |

1,041 |

1,038 |

1,047 |

2,079 |

2,074 |

| |

|

|

|

|

|

| |

8,687 |

9,607 |

16,693 |

18,294 |

34,513 |

| |

|

|

|

|

|

| Net interest income before provision for

loan losses |

41,201 |

40,056 |

38,941 |

81,257 |

77,091 |

| |

|

|

|

|

|

| PROVISION FOR LOAN

LOSSES |

8,000 |

17,000 |

16,000 |

25,000 |

30,000 |

| |

|

|

|

|

|

| Net interest income |

33,201 |

23,056 |

22,941 |

56,257 |

47,091 |

| |

|

|

|

|

|

| OTHER OPERATING INCOME: |

|

|

|

|

|

| Deposit fees and other service

charges |

5,693 |

5,279 |

5,632 |

10,972 |

10,792 |

| Mortgage banking operations |

855 |

962 |

817 |

1,817 |

1,765 |

| Loan servicing fees |

397 |

256 |

315 |

653 |

628 |

| Miscellaneous |

369 |

493 |

243 |

862 |

869 |

| |

|

|

|

|

|

| |

7,314 |

6,990 |

7,007 |

14,304 |

14,054 |

| Other-than-temporary impairment

losses |

-- -- |

-- -- |

-- -- |

-- -- |

(1,231) |

| Net change in valuation of financial

instruments carried at fair value |

1,939 |

256 |

(821) |

2,195 |

1,087 |

| |

|

|

|

|

|

| Total other operating income |

9,253 |

7,246 |

6,186 |

16,499 |

13,910 |

| |

|

|

|

|

|

| OTHER OPERATING

EXPENSE: |

|

|

|

|

|

| Salary and employee benefits |

18,288 |

17,255 |

16,793 |

35,543 |

33,352 |

| Less capitalized loan origination

costs |

(1,948) |

(1,720) |

(1,740) |

(3,668) |

(3,345) |

| Occupancy and equipment |

5,436 |

5,394 |

5,581 |

10,830 |

11,185 |

| Information / computer data services |

1,521 |

1,567 |

1,594 |

3,088 |

3,100 |

| Payment and card processing services |

1,939 |

1,647 |

1,683 |

3,586 |

3,107 |

| Professional services |

1,185 |

1,672 |

1,874 |

2,857 |

3,161 |

| Advertising and marketing |

1,903 |

1,740 |

1,742 |

3,643 |

3,692 |

| Deposit insurance |

1,389 |

1,969 |

2,209 |

3,358 |

4,341 |

| State/municipal business and use

taxes |

544 |

494 |

533 |

1,038 |

1,013 |

| Real estate operations |

6,568 |

4,631 |

4,166 |

11,199 |

7,224 |

| Amortization of core deposit

intangibles |

570 |

597 |

615 |

1,167 |

1,259 |

| Miscellaneous |

2,860 |

2,898 |

2,974 |

5,758 |

5,350 |

| |

|

|

|

|

|

| Total other operating expense |

40,255 |

38,144 |

38,024 |

78,399 |

73,439 |

| |

|

|

|

|

|

| Income (loss) before provision for

(benefit from) income taxes |

2,199 |

(7,842) |

(8,897) |

(5,643) |

(12,438) |

| |

|

|

|

|

|

| PROVISION FOR (BENEFIT FROM )

INCOME TAXES |

-- -- |

-- -- |

(3,951) |

-- -- |

(5,975) |

| |

|

|

|

|

|

| NET INCOME (LOSS) |

2,199 |

(7,842) |

(4,946) |

(5,643) |

(6,463) |

| |

|

|

|

|

|

| PREFERRED STOCK DIVIDEND AND DISCOUNT

ACCRETION: |

|

|

|

|

|

| Preferred stock dividend |

1,550 |

1,550 |

1,550 |

3,100 |

3,100 |

| Preferred stock discount accretion |

425 |

426 |

399 |

851 |

797 |

| |

|

|

|

|

|

| NET INCOME (LOSS) AVAILABLE TO COMMON

SHAREHOLDERS |

$ 224 |

$ (9,818) |

$ (6,895) |

$ (9,594) |

$ (10,360) |

| |

|

|

|

|

|

| Earnings (loss) per share available to common

shareholder |

|

|

|

|

|

| Basic |

$ 0.01 |

$ (0.61) |

$ (1.97) |

$ (0.58) |

$ (3.11) |

| Diluted |

$ 0.01 |

$ (0.61) |

$ (1.97) |

$ (0.58) |

$ (3.11) |

| |

|

|

|

|

|

| Cumulative dividends declared per common

share |

$ 0.01 |

$ 0.07 |

$ 0.07 |

$ 0.08 |

$ 0.14 |

| |

|

|

|

|

|

| Weighted average common shares

outstanding |

|

|

|

|

|

| Basic |

16,535,082 |

16,008,467 |

3,493,194 |

16,404,079 |

3,328,346 |

| Diluted |

16,535,082 |

16,008,467 |

3,493,194 |

16,404,079 |

3,328,346 |

| |

|

|

|

|

|

| Common shares issued in connection with

exercise of stock options or DRIP |

227,534 |

241,653 |

193,370 |

506,474 |

416,450 |

| |

| BANR - Second Quarter

2011 Results |

|

FINANCIAL CONDITION |

| (in thousands except shares and per share

data) |

Jun 30, 2011 |

Mar 31, 2011 |

Jun 30, 2010 |

Dec 31, 2010 |

| |

|

|

|

|

| |

|

|

|

|

| ASSETS |

|

|

|

|

| Cash and due from banks |

$ 48,246 |

$ 44,381 |

$ 67,322 |

$ 39,756 |

| Federal funds and interest-bearing

deposits |

168,198 |

271,924 |

369,864 |

321,896 |

| Securities - at fair value |

89,374 |

90,881 |

105,381 |

95,379 |

| Securities - available for sale |

287,255 |

240,968 |

140,342 |

200,227 |

| Securities - held to maturity |

76,596 |

75,114 |

73,632 |

72,087 |

| Federal Home Loan Bank stock |

37,371 |

37,371 |

37,371 |

37,371 |

| |

|

|

|

|

| Loans receivable: |

|

|

|

|

| Held for sale |

1,907 |

1,493 |

4,819 |

3,492 |

| Held for portfolio |

3,304,760 |

3,324,587 |

3,626,685 |

3,399,625 |

| Allowance for loan losses |

(92,000) |

(97,632) |

(95,508) |

(97,401) |

| |

|

|

|

|

| |

3,214,667 |

3,228,448 |

3,535,996 |

3,305,716 |

| |

|

|

|

|

| Accrued interest receivable |

15,907 |

16,503 |

16,930 |

15,927 |

| Real estate owned held for sale, net |

71,205 |

94,945 |

101,485 |

100,872 |

| Property and equipment, net |

93,532 |

94,743 |

99,536 |

96,502 |

| Other intangibles, net |

7,442 |

8,011 |

9,811 |

8,609 |

| Bank-owned life insurance |

57,578 |

57,123 |

55,477 |

56,653 |

| Other assets |

38,696 |

39,291 |

88,459 |

55,087 |

| |

|

|

|

|

| |

$ 4,206,067 |

$ 4,299,703 |

$ 4,701,606 |

$ 4,406,082 |

| |

|

|

|

|

| LIABILITIES |

|

|

|

|

| |

|

|

|

|

| Deposits: |

|

|

|

|

| Non-interest-bearing |

$ 645,778 |

$ 622,759 |

$ 548,251 |

$ 600,457 |

| Interest-bearing transaction and savings

accounts |

1,422,290 |

1,459,895 |

1,403,231 |

1,433,248 |

| Interest-bearing certificates |

1,398,332 |

1,457,994 |

1,887,513 |

1,557,493 |

| |

|

|

|

|

| |

3,466,400 |

3,540,648 |

3,838,995 |

3,591,198 |

| |

|

|

|

|

| Advances from Federal Home Loan Bank at fair

value |

10,572 |

10,567 |

47,003 |

43,523 |

| Customer repurchase agreements and other

borrowings |

136,285 |

159,902 |

172,737 |

175,813 |

| |

|

|

|

|

| Junior subordinated debentures at fair

value |

47,986 |

48,395 |

49,808 |

48,425 |

| |

|

|

|

|

| Accrued expenses and other

liabilities |

19,115 |

20,958 |

25,440 |

21,048 |

| Deferred compensation |

14,683 |

14,489 |

13,665 |

14,603 |

| |

|

|

|

|

| |

3,695,041 |

3,794,959 |

4,147,648 |

3,894,610 |

| |

|

|

|

|

| STOCKHOLDERS'

EQUITY |

|

|

|

|

| |

|

|

|

|

| Preferred stock - Series A |

119,851 |

119,426 |

118,204 |

119,000 |

| Common stock |

517,782 |

513,950 |

490,119 |

509,457 |

| Retained earnings (accumulated deficit) |

(126,268) |

(126,318) |

(53,768) |

(115,348) |

| Other components of stockholders' equity |

(339) |

(2,314) |

(597) |

(1,637) |

| |

|

|

|

|

| |

511,026 |

504,744 |

553,958 |

511,472 |

| |

|

|

|

|

| |

$ 4,206,067 |

$ 4,299,703 |

$ 4,701,606 |

$ 4,406,082 |

| |

|

|

|

|

| Common Shares Issued: |

|

|

|

|

| Shares outstanding at end of period |

16,668,694 |

16,443,720 |

14,707,820 |

16,164,781 |

| Less unearned ESOP shares at end of

period |

34,340 |

34,340 |

34,340 |

34,340 |

| |

|

|

|

|

| Shares outstanding at end of period excluding

unearned ESOP shares |

16,634,354 |

16,409,380 |

14,673,480 |

16,130,441 |

| |

|

|

|

|

| Common stockholders' equity per share

(1) |

$ 23.52 |

$ 23.48 |

$ 29.70 |

$ 24.33 |

| Common stockholders' tangible equity per

share (1) (2) |

$ 23.07 |

$ 22.99 |

$ 29.03 |

$ 23.80 |

| |

|

|

|

|

| Tangible common stockholders' equity to

tangible assets |

9.14% |

8.79% |

9.08% |

8.73% |

| Consolidated Tier 1 leverage capital

ratio |

12.90% |

12.50% |

13.02% |

12.24% |

| |

|

|

|

|

| (1) -

Calculation is based on number of common shares outstanding at the

end of the period rather than weighted average shares |

outstanding and excludes unallocated shares

in the ESOP. |

|

|

| (2) - Tangible common

equity excludes preferred stock, goodwill, core deposit and other

intangibles. |

|

|

|

|

| |

|

|

|

|

|

| BANR - Second Quarter 2011

Results |

|

|

|

|

|

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

| |

|

|

|

|

|

| |

Jun 30, 2011 |

Mar 31, 2011 |

Jun 30, 2010 |

Dec 31, 2010 |

|

| LOANS (including loans held for

sale): |

|

|

|

|

|

| Commercial real estate |

|

|

|

|

|

| Owner occupied |

$ 507,751 |

$ 521,823 |

$ 503,796 |

$ 515,093 |

|

| Investment properties |

582,569 |

564,337 |

553,689 |

550,610 |

|

| Multifamily real estate |

147,951 |

147,569 |

149,980 |

134,634 |

|

| Commercial construction |

35,790 |

26,580 |

84,379 |

62,707 |

|

| Multifamily construction |

20,552 |

19,694 |

56,573 |

27,394 |

|

| One- to four-family construction |

140,669 |

151,015 |

182,928 |

153,383 |

|

| Land and land development |

|

|

|

|

|

| Residential |

128,920 |

147,913 |

228,156 |

167,764 |

|

| Commercial |

29,347 |

30,539 |

29,410 |

32,386 |

|

| Commercial business |

566,243 |

577,128 |

635,130 |

585,457 |

|

| Agricultural business including secured by

farmland |

208,485 |

188,756 |

208,815 |

204,968 |

|

| One- to four-family real estate |

658,216 |

665,396 |

702,420 |

682,924 |

|

| Consumer |

97,396 |

104,129 |

103,065 |

99,761 |

|

| Consumer secured by one- to four-family real

estate |

182,778 |

181,201 |

193,163 |

186,036 |

|

| |

|

|

|

|

|

| Total loans outstanding |

$ 3,306,667 |

$ 3,326,080 |

$ 3,631,504 |

$ 3,403,117 |

|

| |

|

|

|

|

|

| Restructured loans performing under their

restructured terms |

$ 55,652 |

$ 60,968 |

$ 43,899 |

$ 60,115 |

|

| |

|

|

|

|

|

| Loans 30 - 89 days past due and on

accrual |

$ 11,560 |

$ 16,587 |

$ 26,050 |

$ 28,847 |

|

| |

|

|

|

|

|

| Total delinquent loans (including loans on

non-accrual) |

$ 126,805 |

$ 148,285 |

$ 203,992 |

$ 180,336 |

|

| |

|

|

|

|

|

| Total delinquent loans / Total

loans outstanding |

3.83% |

4.46% |

5.62% |

5.30% |

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| GEOGRAPHIC CONCENTRATION OF LOANS

AT |

|

|

|

|

|

| June 30, 2011 |

Washington |

Oregon |

Idaho |

Other |

Total |

| |

|

|

|

|

|

| Commercial real estate |

|

|

|

|

|

| Owner occupied |

$ 383,576 |

$ 69,389 |

$ 51,458 |

$ 3,328 |

$ 507,751 |

| Investment properties |

436,279 |

99,304 |

41,016 |

5,970 |

582,569 |

| Multifamily real estate |

120,552 |

17,187 |

9,749 |

463 |

147,951 |

| Commercial construction |

23,267 |

822 |

11,701 |

-- -- |

35,790 |

| Multifamily construction |

12,514 |

8,038 |

-- -- |

-- -- |

20,552 |

| One- to four-family construction |

71,494 |

66,430 |

2,745 |

-- -- |

140,669 |

| Land and land development |

|

|

|

|

|

| Residential |

67,575 |

50,719 |

10,626 |

-- -- |

128,920 |

| Commercial |

25,286 |

949 |

3,112 |

-- -- |

29,347 |

| Commercial business |

382,517 |

109,068 |

61,155 |

13,503 |

566,243 |

| Agricultural business including secured by

farmland |

110,836 |

40,842 |

56,784 |

23 |

208,485 |

| One- to four-family real estate |

416,713 |

211,703 |

27,488 |

2,312 |

658,216 |

| Consumer |

69,094 |

22,734 |

5,568 |

-- -- |

97,396 |

| Consumer secured by one- to four-family real

estate |

125,771 |

44,070 |

12,439 |

498 |

182,778 |

| |

|

|

|

|

|

| Total loans outstanding |

$ 2,245,474 |

$ 741,255 |

$ 293,841 |

$ 26,097 |

$ 3,306,667 |

| |

|

|

|

|

|

| Percent of total loans |

67.9% |

22.4% |

8.9% |

0.8% |

100.0% |

| |

|

|

|

|

|

| |

|

|

|

|

|

| DETAIL OF LAND AND LAND DEVELOPMENT

LOANS AT |

|

|

|

|

|

| June 30, 2011 |

Washington |

Oregon |

Idaho |

Other |

Total |

| |

|

|

|

|

|

| Residential |

|

|

|

|

|

| Acquisition & development |

$ 32,439 |

$ 28,568 |

$ 3,823 |

$ -- |

$ 64,830 |

| Improved lots |

22,026 |

16,592 |

923 |

-- -- |

39,541 |

| Unimproved land |

13,110 |

5,559 |

5,880 |

-- -- |

24,549 |

| |

|

|

|

|

|

| Total residential land and

development |

$ 67,575 |

$ 50,719 |

$ 10,626 |

$ -- -- |

$ 128,920 |

| Commercial & industrial |

|

|

|

|

|

| Acquisition & development |

$ 3,873 |

$ -- |

$ 510 |

$ -- -- |

$ 4,383 |

| Improved land |

8,865 |

-- -- |

200 |

-- -- |

9,065 |

| Unimproved land |

12,548 |

949 |

2,402 |

-- -- |

15,899 |

| |

|

|

|

|

|

| Total commercial land and

development |

$ 25,286 |

$ 949 |

$ 3,112 |

$ -- |

$ 29,347 |

| |

|

|

|

|

|

| BANR - Second Quarter 2011

Results |

|

|

|

|

|

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

| |

|

|

|

|

|

| |

Quarters

Ended |

Six Months

Ended |

| |

Jun 30, 2011 |

Mar 31, 2011 |

Jun 30, 2010 |

Jun 30, 2011 |

Jun 30, 2010 |

| CHANGE IN THE ALLOWANCE FOR

LOAN LOSSES |

|

|

|

|

|

| |

|

|

|

|

|

| Balance, beginning of period |

$ 97,632 |

$ 97,401 |

$ 95,733 |

$ 97,401 |

$ 95,269 |

| |

|

|

|

|

|

| Provision |

8,000 |

17,000 |

16,000 |

25,000 |

30,000 |

| |

|

|

|

|

|

| Recoveries of loans previously charged

off: |

|

|

|

|

|

| Commercial real estate |

15 |

-- -- |

-- -- |

15 |

-- -- |

| Multifamily real estate |

-- -- |

-- -- |

-- -- |

-- -- |

-- -- |

| Construction and land |

716 |

35 |

235 |

751 |

622 |

| One- to four-family real estate |

29 |

52 |

71 |

81 |

71 |

| Commercial business |

76 |

81 |

595 |

157 |

1,885 |

| Agricultural business, including secured

by farmland |

5 |

-- -- |

-- -- |

5 |

-- -- |

| Consumer |

84 |

78 |

69 |

162 |

128 |

| |

925 |

246 |

970 |

1,171 |

2,706 |

| Loans charged off: |

|

|

|

|

|

| Commercial real estate |

(1,871) |

(989) |

-- -- |

(2,860) |

(92) |

| Multifamily real estate |

(244) |

(427) |

-- -- |

(671) |

-- -- |

| Construction and land |

(6,077) |

(10,537) |

(12,255) |

(16,614) |

(19,979) |

| One- to four-family real estate |

(1,894) |

(2,209) |

(2,128) |

(4,103) |

(4,243) |

| Commercial business |

(3,993) |

(2,368) |

(1,447) |

(6,361) |

(6,231) |

| Agricultural business, including secured

by farmland |

(166) |

(123) |

(986) |

(289) |

(988) |

| Consumer |

(312) |

(362) |

(379) |

(674) |

(934) |

| |

(14,557) |

(17,015) |

(17,195) |

(31,572) |

(32,467) |

| Net charge-offs |

(13,632) |

(16,769) |

(16,225) |

(30,401) |

(29,761) |

| |

|

|

|

|

|

| Balance, end of period |

$ 92,000 |

$ 97,632 |

$ 95,508 |

$ 92,000 |

$ 95,508 |

| |

|

|

|

|

|

| Net charge-offs / Average loans

outstanding |

0.41% |

0.50% |

0.44% |

0.91% |

0.80% |

| |

|

|

|

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

| ALLOCATION OF ALLOWANCE FOR

LOAN LOSSES |

Jun 30, 2011 |

Mar 31, 2011 |

Jun 30, 2010 |

Dec 31, 2010 |

|

| Specific or allocated loss allowance |

|

|

|

|

|

| Commercial real estate |

$ 13,087 |

$ 11,871 |

$ 7,042 |

$ 11,779 |

|

| Multifamily real estate |

5,404 |

6,055 |

2,364 |

3,963 |

|

| Construction and land |

25,976 |

30,346 |

45,601 |

33,121 |

|

| Commercial business |

19,912 |

22,054 |

23,905 |

24,545 |

|

| Agricultural business, including secured

by farmland |

1,409 |

1,441 |

679 |

1,846 |

|

| One- to four-family real estate |

8,254 |

8,149 |

3,530 |

5,829 |

|

| Consumer |

1,445 |

1,452 |

1,890 |

1,794 |

|

| |

|

|

|

|

|

| Total allocated |

75,487 |

81,368 |

85,011 |

82,877 |

|

| |

|

|

|

|

|

| Estimated allowance for undisbursed

commitments |

1,001 |

1,158 |

909 |

1,426 |

|

| Unallocated |

15,512 |

15,106 |

9,588 |

13,098 |

|

| |

|

|

|

|

|

| Total allowance for loan losses |

$ 92,000 |

$ 97,632 |

$ 95,508 |

$ 97,401 |

|

| |

|

|

|

|

|

| Allowance for loan losses / Total loans

outstanding |

2.78% |

2.94% |

2.63% |

2.86% |

|

| |

|

|

|

|

|

| Allowance for loan losses / Non-performing

loans |

80% |

74% |

54% |

64% |

|

| |

|

|

|

|

|

| BANR - Second Quarter 2011

Results |

|

|

|

|

|

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

Jun 30, 2011 |

Mar 31, 2011 |

Jun 30, 2010 |

Dec 31, 2010 |

|

| |

|

|

|

|

|

| NON-PERFORMING

ASSETS |

|

|

|

|

|

| |

|

|

|

|

|

| Loans on non-accrual status |

|

|

|

|

|

| Secured by real estate: |

|

|

|

|

|

| Commercial |

$ 22,421 |

$ 23,443 |

$ 9,433 |

$ 24,727 |

|

| Multifamily |

1,560 |

1,361 |

363 |

1,889 |

|

| Construction and land |

53,529 |

67,163 |

110,931 |

75,734 |

|

| One- to four-family |

15,435 |

16,571 |

19,878 |

16,869 |

|

| Commercial business |

15,264 |

15,904 |

23,474 |

21,100 |

|

| Agricultural business, including secured

by farmland |

1,342 |

1,984 |

7,556 |

5,853 |

|

| Consumer |

4,400 |

4,655 |

3,588 |

2,332 |

|

| |

|

|

|

|

|

| |

113,951 |

131,081 |

175,223 |

148,504 |

|

| |

|

|

|

|

|

| Loans more than 90 days delinquent, still on

accrual |

|

|

|

|

|

| Secured by real estate: |

|

|

|

|

|

| Commercial |

-- -- |

-- -- |

1,137 |

-- -- |

|

| Multifamily |

-- -- |

-- -- |

-- -- |

-- -- |

|

| Construction and land |

-- -- |

-- -- |

692 |

-- -- |

|

| One- to four-family |

622 |

561 |

772 |

2,955 |

|

| Commercial business |

1 |

14 |

-- -- |

-- -- |

|

| Agricultural business, including secured

by farmland |

545 |

-- -- |

-- -- |

-- -- |

|

| Consumer |

126 |

42 |

118 |

30 |

|

| |

|

|

|

|

|

| |

1,294 |

617 |

2,719 |

2,985 |

|

| |

|

|

|

|

|

| Total non-performing loans |

115,245 |

131,698 |

177,942 |

151,489 |

|

| Securities on non-accrual |

1,896 |

1,904 |

3,500 |

1,896 |

|

| Real estate owned (REO) and repossessed

assets |

71,265 |

94,969 |

101,701 |

100,945 |

|

| |

|

|

|

|

|

| Total non-performing assets |

$ 188,406 |

$ 228,571 |

$ 283,143 |

$ 254,330 |

|

| |

|

|

|

|

|

| Total non-performing assets / Total

assets |

4.48% |

5.32% |

6.02% |

5.77% |

|

| |

|

|

|

|

|

| DETAIL & GEOGRAPHIC

CONCENTRATION OF |

|

|

|

|

|

| NON-PERFORMING ASSETS

AT |

|

|

|

|

|

| June 30, 2011 |

Washington |

Oregon |

Idaho |

Other |

Total |

| Secured by real estate: |

|

|

|

|

|

| Commercial |

$ 17,852 |

$ 477 |

$ 4,092 |

$ -- |

$ 22,421 |

| Multifamily |

1,560 |

-- -- |

-- -- |

-- -- |

1,560 |

| Construction and land |

|

|

|

|

|

| One- to four-family construction |

6,486 |

3,082 |

641 |

-- -- |

10,209 |

| Commercial construction |

1,510 |

-- -- |

-- -- |

-- -- |

1,510 |

| Multifamily construction |

-- -- |

648 |

-- -- |

-- -- |

648 |

| Residential land acquisition &

development |

18,374 |

6,207 |

1,470 |

-- -- |

26,051 |

| Residential land improved lots |

2,744 |

3,705 |

131 |

-- -- |

6,580 |

| Residential land unimproved |

2,739 |

916 |

2,428 |

-- -- |

6,083 |

| Commercial land acquisition &

development |

-- -- |

-- -- |

-- -- |

-- -- |

-- -- |

| Commercial land improved |

1,954 |

-- -- |

-- -- |

-- -- |

1,954 |

| Commercial land unimproved |

494 |

-- -- |

-- -- |

-- -- |

494 |

| Total construction and land |

34,301 |

14,558 |

4,670 |

-- -- |

53,529 |

| One- to four-family |

12,059 |

2,766 |

1,232 |

-- -- |

16,057 |

| Commercial business |

14,265 |

76 |

775 |

149 |

15,265 |

| Agricultural business, including secured by

farmland |

1,290 |

-- -- |

597 |

-- -- |

1,887 |

| Consumer |

2,205 |

1,851 |

470 |

-- -- |

4,526 |

| |

|

|

|

|

|

| Total non-performing loans |

83,532 |

19,728 |

11,836 |

149 |

115,245 |

| Securities on non-accrual |

-- -- |

-- -- |

500 |

1,396 |

1,896 |

| Real estate owned (REO) and repossessed

assets |

31,457 |

32,827 |

6,981 |

-- -- |

71,265 |

| |

|

|

|

|

|

| Total non-performing assets |

$ 114,989 |

$ 52,555 |

$ 19,317 |

$ 1,545 |

$ 188,406 |

| |

|

|

|

|

|

| BANR - Second Quarter 2011

Results |

|

|

|

|

|

| ADDITIONAL FINANCIAL

INFORMATION |

|

|

|

|

|

| (dollars in thousands) |

|

|

|

|

|

| |

|

|

|

|

|

| |

Quarters

Ended |

Six Months

Ended |

|

| REAL ESTATE OWNED |

Jun 30, 2011 |

Jun 30, 2010 |

Jun 30, 2011 |

Jun 30, 2010 |

|

| |

|

|

|

|

|

| Balance, beginning of period |

$ 94,945 |

$ 95,074 |

$ 100,872 |

$ 77,743 |

|

| Additions from loan foreclosures |

11,918 |

17,885 |

26,834 |

45,212 |

|

| Additions from capitalized costs |

1,532 |

380 |

3,147 |

1,516 |

|

| Dispositions of REO |

(32,437) |

(10,532) |

(51,331) |

(20,411) |

|

| Gain (loss) on sale of REO |

58 |

(498) |

(479) |

(1,235) |

|

| Valuation adjustments in the period |

(4,811) |

(824) |

(7,838) |

(1,340) |

|

| |

|

|

|

|

|

| Balance, end of period |

$ 71,205 |

$ 101,485 |

$ 71,205 |

$ 101,485 |

|

| |

|

|

|

|

|

| |

Quarters

Ended |

| REAL ESTATE OWNED- FIVE

COMPARATIVE QUARTERS |

Jun 30, 2011 |

Mar 31, 2011 |

Dec 31, 2010 |

Sep 30, 2010 |

Jun 30, 2010 |

| |

|

|

|

|

|

| Balance, beginning of period |

$ 94,945 |

$ 100,872 |

$ 107,159 |

$ 101,485 |

$95,074 |

| Additions from loan foreclosures |

11,918 |

14,916 |

16,855 |

25,694 |

17,885 |

| Additions from capitalized costs |

1,532 |

1,615 |

1,650 |

841 |

380 |

| Dispositions of REO |

(32,437) |

(18,894) |

(19,095) |

(12,145) |

(10,532) |

| Gain (loss) on sale of REO |

58 |

(537) |

(524) |

(133) |

(498) |

| Valuation adjustments in the period |

(4,811) |

(3,027) |

(5,173) |

(8,583) |

(824) |

| |

|

|

|

|

|

| Balance, end of period |

$ 71,205 |

$ 94,945 |

$ 100,872 |

$ 107,159 |

$101,485 |

| |

|

|

|

|

|

| REAL ESTATE OWNED- BY TYPE AND

STATE |

Washington |

Oregon |

Idaho |

Total |

|

| |

|

|

|

|

|

| Commercial real estate |

$ 1,533 |

$ 13 |

$ 477 |

$ 2,023 |

|

| One- to four-family construction |

472 |

3,646 |

-- -- |

4,118 |

|

| Land development- commercial |

3,876 |

4,065 |

200 |

8,141 |

|

| Land development- residential |

18,787 |

18,763 |

3,400 |

40,950 |

|

| Agricultural land |

-- -- |

256 |

850 |

1,106 |

|

| One- to four-family real estate |

6,729 |

6,084 |

2,054 |

14,867 |

|

| |

|

|

|

|

|

| Total |

$ 31,397 |

$ 32,827 |

$ 6,981 |

$ 71,205 |

|

| |

| BANR - Second Quarter

2011 Results |

| ADDITIONAL FINANCIAL

INFORMATION |

| (dollars in thousands) |

| |

|

|

|

|

| DEPOSITS & OTHER

BORROWINGS |

|

|

|

|

| |

Jun 30, 2011 |

Mar 31, 2011 |

Jun 30, 2010 |

Dec 31, 2010 |

| DEPOSIT

COMPOSITION |

|

|

|

|

| |

|

|

|

|

| Non-interest-bearing |

$ 645,778 |

$ 622,759 |

$ 548,251 |

$ 600,457 |

| |

|

|

|

|

| Interest-bearing checking |

356,321 |

361,430 |

368,418 |

357,702 |

| Regular savings accounts |

631,688 |

648,520 |

593,591 |

616,512 |

| Money market accounts |

434,281 |

449,945 |

441,222 |

459,034 |

| |

|

|

|

|

| Interest-bearing transaction &

savings accounts |

1,422,290 |

1,459,895 |

1,403,231 |

1,433,248 |

| |

|

|

|

|

| Interest-bearing certificates |

1,398,332 |

1,457,994 |

1,887,513 |

1,557,493 |

| |

|

|

|

|

| Total deposits |

$ 3,466,400 |

$ 3,540,648 |

$ 3,838,995 |

$ 3,591,198 |

| |

|

|

|

|

| |

|

|

|

|

| INCLUDED IN TOTAL

DEPOSITS |

|

|

|

|

| |

|

|

|

|

| Public transaction accounts |

$ 72,181 |

$ 62,873 |

$ 85,292 |

$ 64,482 |

| Public interest-bearing certificates |

69,219 |

67,527 |

81,668 |

81,809 |

| |

|

|

|

|

| Total public deposits |

$ 141,400 |

$ 130,400 |

$ 166,960 |

$ 146,291 |

| |

|

|

|

|

| Total brokered deposits |

$ 73,161 |

$ 92,940 |

$ 145,571 |

$ 102,984 |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| INCLUDED IN OTHER

BORROWINGS |

|

|

|

|

| Customer repurchase agreements / "Sweep

accounts" |

$ 85,822 |

$ 109,227 |

$ 122,755 |

$ 125,140 |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

|

|

| GEOGRAPHIC CONCENTRATION OF

DEPOSITS AT |

|

|

|

|

| June 30,

2011 |

Washington |

Oregon |

Idaho |

Total |

| |

|

|

|

|

| |

$ 2,646,712 |

$ 591,519 |

$ 228,169 |

$ 3,466,400 |

| |

|

|

|

|

| |

|

|

|

|

| |

|

|

Minimum for Capital

Adequacy |

| REGULATORY CAPITAL RATIOS

AT |

Actual |

or "Well

Capitalized" |

| June 30,

2011 |

Amount |

Ratio |

Amount |

Ratio |

| |

|

|

|

|

| Banner Corporation-consolidated |

|

|

|

|

| Total capital to risk-weighted

assets |

$ 591,709 |

17.29% |

$ 273,802 |

8.00% |

| Tier 1 capital to risk-weighted

assets |

548,320 |

16.02% |

136,901 |

4.00% |

| Tier 1 leverage capital to average

assets |

548,320 |

12.90% |

169,964 |

4.00% |

| |

|

|

|

|

| Banner Bank |

|

|

|

|

| Total capital to risk-weighted

assets |

497,052 |

15.32% |

324,376 |

10.00% |

| Tier 1 capital to risk-weighted

assets |

455,902 |

14.05% |

194,626 |

6.00% |

| Tier 1 leverage capital to average

assets |

455,902 |

11.37% |

200,486 |

5.00% |

| |

|

|

|

|

| Islanders Bank |

|

|

|

|

| Total capital to risk-weighted

assets |

30,226 |

14.93% |

20,243 |

10.00% |

| Tier 1 capital to risk-weighted

assets |

27,695 |

13.68% |

12,146 |

6.00% |

| Tier 1 leverage capital to average

assets |

27,695 |

11.78% |

11,756 |

5.00% |

| |

|

|

|

|

|

| BANR - Second Quarter

2011 Results |

| ADDITIONAL FINANCIAL

INFORMATION |

| (dollars in thousands) |

| (rates / ratios annualized) |

| |

|

|

|

|

|

| |

Quarters

Ended |

Six Months

Ended |

| |

|

|

|

|

|

| OPERATING

PERFORMANCE |

Jun 30, 2011 |

Mar 31, 2011 |

Jun 30, 2010 |

Jun 30, 2011 |

Jun 30, 2010 |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Average loans |

$ 3,333,102 |

$ 3,349,978 |

$ 3,677,140 |

$ 3,341,487 |

$ 3,701,552 |

| Average securities |

511,273 |

465,017 |

391,067 |

488,233 |

392,826 |

| Average interest earning cash |

196,211 |

308,575 |

216,576 |

252,094 |

194,188 |

| Average non-interest-earning assets |

215,494 |

233,365 |

268,864 |

224,414 |

262,193 |

| |

|

|

|

|

|

| Total average assets |

$ 4,256,080 |

$ 4,356,935 |

$ 4,553,647 |

$ 4,306,228 |

$ 4,550,759 |

| |

|

|

|

|

|

| Average deposits |

$ 3,504,884 |

$ 3,561,020 |

$ 3,830,659 |

$ 3,532,796 |

$ 3,815,798 |

| Average borrowings |

283,178 |

322,261 |

349,997 |

302,612 |

361,578 |

| Average non-interest-bearing liabilities |

(41,253) |

(39,755) |

(38,527) |

(40,508) |

(37,498) |

| |

|

|

|

|

|

| Total average liabilities |

3,746,809 |

3,843,526 |

4,142,129 |

3,794,900 |

4,139,878 |

| |

|

|

|

|

|

| Total average stockholders' equity |

509,271 |

513,409 |

411,518 |

511,328 |

410,881 |

| |

` |

|

|

|

|

| Total average liabilities and equity |

$ 4,256,080 |

$ 4,356,935 |

$ 4,553,647 |

$ 4,306,228 |

$ 4,550,759 |

| |

|

|

|

|

|

| Interest rate yield on loans |

5.64% |

5.66% |

5.72% |

5.65% |

5.73% |

| Interest rate yield on securities |

2.31% |

2.38% |

3.11% |

2.34% |

3.16% |

| Interest rate yield on cash |

0.20% |

0.23% |

0.23% |

0.22% |

0.23% |

| |

|

|

|

|

|

| Interest rate yield on interest-earning

assets |

4.95% |

4.88% |

5.21% |

4.92% |

5.25% |

| |

|

|

|

|

|

| Interest rate expense on deposits |

0.80% |

0.89% |

1.54% |

0.85% |

1.61% |

| Interest rate expense on borrowings |

2.37% |

2.26% |

2.28% |

2.31% |

2.24% |

| |

|

|

|

|

|

| Interest rate expense on interest-bearing

liabilities |

0.92% |

1.00% |

1.60% |

0.96% |

1.67% |

| |

|

|

|

|

|

| Interest rate spread |

4.03% |

3.88% |

3.61% |

3.96% |

3.58% |

| |

|

|

|

|

|

| Net interest margin |

4.09% |

3.94% |

3.65% |

4.01% |

3.62% |

| |

|

|

|

|

|

| Other operating income / Average assets |

0.87% |

0.67% |

0.54% |

0.77% |

0.62% |

| |

|

|

|

|

|

| Other operating income EXCLUDING change in

valuation of financial instruments carried at fair value / Average

assets (1) |

0.69% |

0.65% |

0.62% |

0.67% |

0.57% |

| |

|

|

|

|

|

| Other operating expense / Average assets |

3.79% |

3.55% |

3.35% |

3.67% |

3.25% |

| |

|

|

|

|

|

| Efficiency ratio (other operating expense /

revenue) |

79.79% |

80.64% |

84.26% |

80.20% |

80.70% |

| |

|

|

|

|

|

| Return (Loss) on average assets |

0.21% |

(0.73%) |

(0.44%) |

(0.26%) |

(0.29%) |

| |

|

|

|

|

|

| Return (Loss) on average equity |

1.73% |

(6.19%) |

(4.82%) |

(2.23%) |

(3.17%) |

| |

|

|

|

|

|

| Return (Loss) on average tangible equity

(2) |

1.76% |

(6.30%) |

(4.94%) |

(2.26%) |

(3.25%) |

| |

|

|

|

|

|

| Average equity / Average

assets |

11.97% |

11.78% |

9.04% |

11.87% |

9.03% |

| |

|

|

|

|

|

| (1) - Earnings

information excluding the fair value adjustments and goodwill

impairment charge (alternately referred to as operating income

(loss) from core operations and expenses from core operations)

represent non-GAAP (Generally Accepted Accounting Principles)

financial measures. |

| (2) - Average

tangible equity excludes goodwill, core deposit and other

intangibles. |

CONTACT: MARK J. GRESCOVICH,

PRESIDENT & CEO

LLOYD W. BAKER, CFO

(509) 527-3636

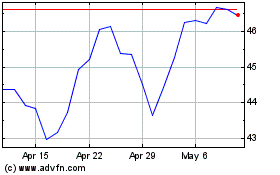

Banner (NASDAQ:BANR)

Historical Stock Chart

From May 2024 to Jun 2024

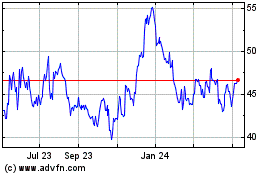

Banner (NASDAQ:BANR)

Historical Stock Chart

From Jun 2023 to Jun 2024