Table of Contents

Filed pursuant to General Instruction II.L. of Form F-10

File No. 333-225493

PROSPECTUS SUPPLEMENT TO THE

SHORT FORM BASE SHELF PROSPECTUS DATED JUNE 26, 2018

BALLARD POWER SYSTEMS INC.

Up to US$75,000,000

Common Shares

This prospectus supplement (the “Prospectus Supplement”), together with the accompanying short form base shelf prospectus dated June 26, 2018 (the “Shelf Prospectus”), qualifies the distribution (the “Offering”) of common shares (the “Offered Shares”) in the share capital of Ballard Power Systems Inc. (the “Company”, “Ballard”, “us” or “we”) having an aggregate offering amount of up to US$75,000,000. We have entered into an equity distribution agreement dated March 10, 2020 (the “Equity Distribution Agreement”) with BMO Capital Markets Corp. (“BMO”), CIBC World Markets Corp., Cormark Securities Inc. and TD Securities (USA) LLC (collectively with BMO, the “Selling Agents”) pursuant to which we may distribute the Offered Shares through the Selling Agents, as our agent for the distribution of the Offered Shares or as principal. The Offering is being made in the United States only under a registration statement on Form F-10 (File No. 333-225493) (the “Registration Statement”), filed with and declared effective by the United States Securities and Exchange Commission (the “SEC”). See “Plan of Distribution”.

The outstanding common shares of the Company (the “Common Shares”) are currently traded on the Toronto Stock Exchange (the “TSX”) and on the NASDAQ Global Market (the “NASDAQ”) under the symbol “BLDP”. On March 9, 2020, the last trading day before the date hereof, the closing price of the Common Shares was CDN$11.62 on the TSX and US$8.50 on the NASDAQ.

Upon delivery by us of an agency transaction notice, if any, the Selling Agents may sell the Offered Shares under this Prospectus Supplement and the accompanying Shelf Prospectus in the United States only and such sales will be made by transactions that are deemed to be “at-the-market distributions” as defined in National Instrument 44-102 — Shelf Distributions (“NI 44-102”), including, without limitation, sales made directly through the NASDAQ or on any other existing trading market for the Common Shares in the United States, or as otherwise agreed between the Selling Agents and us. No Offered Shares will be offered or sold in Canada. The Selling Agents will make all sales using commercially reasonable efforts consistent with their normal sales and trading practices and on terms that are mutually agreed between the Selling Agents and us. The Offered Shares will be distributed at the market prices prevailing at the time of the sale of such Offered Shares. As a result, prices at which the Offered Shares are sold may vary as between purchasers and during the period of distribution. There is no arrangement for funds to be received in escrow, trust or similar arrangement. There is no minimum amount of funds that must be raised under the Offering. This means that the Offering may terminate after raising only a portion of the offering amount set out above, or none at all. See “Plan of Distribution”.

THESE SECURITIES HAVE NOT BEEN APPROVED OR DISAPPROVED BY THE SEC NOR HAS THE SECURITIES COMMISSION OF ANY STATE OF THE UNITED STATES OR ANY CANADIAN SECURITIES REGULATOR APPROVED OR DISAPPROVED THESE SECURITIES OR PASSED UPON THE ACCURACY OR ADEQUACY OF THIS PROSPECTUS. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

This offering is made by a Canadian issuer that is permitted, under a multijurisdictional disclosure system (“MJDS”) adopted by the United States and Canada, to prepare this Prospectus Supplement in accordance with Canadian disclosure requirements. Investors should be aware that such requirements are different from those of the United States. Financial statements included or incorporated herein have been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) and are subject to Canadian auditing and auditor independence standards and thus may not be comparable to financial statements of United States companies.

Investors should be aware that the acquisition, holding or disposition of the Offered Shares may have tax consequences both in the United States and in Canada. Such consequences for investors who are resident in, or citizens of, the United States and Canada may not be described in this Prospectus Supplement or the accompanying Shelf Prospectus. You should consult and rely on your own tax advisors with respect to your own particular circumstances. See “Certain Canadian Federal Income Tax Considerations” and “Certain U.S. Federal Income Tax Considerations”.

The enforcement by investors of civil liabilities under the United States federal securities laws may be affected adversely by the fact that we are incorporated or organized under the laws of a foreign country, that some or all of our officers and directors may be residents of a foreign country, that some or all of the underwriters or experts named in this Prospectus Supplement and accompanying Shelf Prospectus may by residents of a foreign country and that all or a substantial portion of the assets of the Company and said persons may be located outside the United States.

In connection with the sale of the Offered Shares on our behalf, each of the Selling Agents may be deemed to be an “underwriter” within the meaning of Section 2(a)(11) of the United States Securities Act of 1933, as amended (the “U.S. Securities Act”), and the compensation of the Selling Agents may be deemed to be underwriting commissions

Table of Contents

or discounts. We have agreed to provide indemnification and contribution to the Selling Agents against certain liabilities, including liabilities under the U.S. Securities Act.

We will pay the Selling Agents up to 2% of the gross proceeds from the sale of the Offered Shares pursuant to the Equity Distribution Agreement. See “Plan of Distribution” and “Use of Proceeds” for how the net proceeds, if any, from sales under this Prospectus Supplement will be used. The proceeds we receive from sales will depend on the number of Offered Shares actually sold, the offering price of such Offered Shares and the compensation paid to the Selling Agents.

As sales agent, the Selling Agents will not engage in any transactions to stabilize or maintain the price of the Offered Shares. No underwriter or dealer involved in the Offering, no affiliate of such an underwriter or dealer, and no person acting jointly or in concert with such an underwriter or dealer has over-allotted, or will over-allot, Offered Shares in connection with the Offering or effect any other transactions that are intended to stabilize or maintain the market price of the Offered Shares.

Investing in the Offered Shares involves a high degree of risk. You should carefully review the risks outlined in the “Risk Factors” section and elsewhere in this Prospectus Supplement and the accompanying Shelf Prospectus and the documents incorporated by reference herein and therein for a discussion of certain considerations relevant to an investment in the Offered Shares offered hereby. See “Forward-Looking Information” and “Risk Factors”.

Ms. Duy-Loan Le, Mr. Marty Neese, Mr. Sherman Sun and Mr. Kevin Jiang, directors of the Company, each reside outside of Canada, and have each appointed 152928 Canada Inc., Suite 1700, 666 Burrard Street, Vancouver, British Columbia, V6C 2X8, as agent for service of process. Purchasers are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated, continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the person or company has appointed an agent for service of process.

Table of Contents

Our head office is located at 9000 Glenlyon Parkway, Burnaby, British Columbia, V5J 5J8. Our registered office is located at Suite 1700, 666 Burrard Street, Vancouver, British Columbia, V6C 2X8.

The financial information of the Company contained in the documents incorporated by reference herein are presented in United States dollars. References in this Prospectus Supplement to “$” and “US$” are to United States dollars. Canadian dollars are indicated by the symbol “CDN$”.

Table of Contents

TABLE OF CONTENTS FOR THIS PROSPECTUS SUPPLEMENT

TABLE OF CONTENTS FOR THE SHELF PROSPECTUS

S-i

Table of Contents

ABOUT THIS PROSPECTUS SUPPLEMENT

This document is in two parts. The first part is this Prospectus Supplement, which describes the terms of the Offering and adds to and updates information contained in the accompanying Shelf Prospectus and the documents incorporated by reference therein. The second part is the Shelf Prospectus, which gives more general information, some of which may not apply to the Offering. This Prospectus Supplement is deemed to be incorporated by reference into the Shelf Prospectus solely for the purpose of this Offering.

Neither we nor the Selling Agents have authorized anyone to provide readers with information different from that contained in this Prospectus Supplement and the accompanying Shelf Prospectus (or incorporated by reference herein or therein). We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give readers of this Prospectus Supplement and the accompanying Shelf Prospectus. If the description of the Offered Shares or any other information varies between this Prospectus Supplement and the accompanying Shelf Prospectus (including the documents incorporated by reference herein and therein), you should rely on the information in this Prospectus Supplement. The Offered Shares are not being offered in any jurisdiction where the offer or sale is not permitted.

Readers should not assume that the information contained or incorporated by reference in this Prospectus Supplement and the accompanying Shelf Prospectus is accurate as of any date other than the date of this Prospectus Supplement and the accompanying Shelf Prospectus or the respective dates of the documents incorporated by reference herein or therein, unless otherwise noted herein or as required by law. It should be assumed that the information appearing in this Prospectus Supplement, the accompanying Shelf Prospectus and the documents incorporated by reference herein and therein are accurate only as of their respective dates. The business, financial condition, results of operations and prospects of the Company may have changed since those dates.

This Prospectus Supplement shall not be used by anyone for any purpose other than in connection with the Offering. We do not undertake to update the information contained or incorporated by reference herein or in the Shelf Prospectus, except as required by applicable securities laws. Information contained on, or otherwise accessed through, our website shall not be deemed to be a part of this Prospectus Supplement or the accompanying Shelf Prospectus and such information is not incorporated by reference herein or therein.

DOCUMENTS INCORPORATED BY REFERENCE

This Prospectus Supplement is deemed to be incorporated by reference into the accompanying Shelf Prospectus solely for the purposes of this Offering.

The following documents, filed by the Company with securities commissions or similar regulatory authorities in Canada, which have also been filed with, or furnished to, the SEC, are specifically incorporated by reference into, and form an integral part of, this Prospectus Supplement and the accompanying Shelf Prospectus:

(a) the annual information form of the Company dated March 5, 2020 for the year ended December 31, 2019 (the “AIF”);

(b) the audited consolidated statements of financial position of the Company as at December 31, 2019 and December 31, 2018 and the related consolidated statements of loss and other comprehensive income (loss), changes in equity and cash flows for the years ended December 31, 2019 and December 31, 2018 together with the notes thereto, and the auditors’ report thereon;

(c) the management’s discussion and analysis of financial condition and results of operations of the Company dated March 5, 2020 for the year ended December 31, 2019; and

(d) the management proxy circular of the Company dated April 8, 2019 in connection with the annual meeting of shareholders held on June 4, 2019.

Any statement contained in this Prospectus Supplement, in the accompanying Shelf Prospectus or in any document incorporated or deemed to be incorporated by reference herein or therein shall be deemed to be modified or superseded, for purposes of this Prospectus Supplement, to the extent that a statement contained

S-1

Table of Contents

herein or in the accompanying Shelf Prospectus or in any other subsequently filed document which also is, or is deemed to be, incorporated by reference herein or in the accompanying Shelf Prospectus modifies or supersedes such prior statement. The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission for any purposes that the modified or superseded statement when made, constituted a misrepresentation, an untrue statement of a material fact or an omission to state a material fact that is required to be stated or that is necessary to prevent a statement that is made from being false or misleading in the circumstances in which it was made. Any statement so modified or superseded shall not be deemed, except as so modified or superseded, to constitute part of this Prospectus Supplement.

Any document of the type referred to in paragraphs (a)-(d) above or similar material and any documents required by National Instrument 44-101 — Short Form Prospectus Distributions to be incorporated by reference into a short form prospectus, including any annual information forms, all material change reports (excluding confidential reports, if any), all annual and interim financial statements and management’s discussion and analysis relating thereto, or information circular or amendments thereto filed by the Company with any securities commissions or similar regulatory authority in Canada after the date of this Prospectus Supplement and during the period that this Prospectus Supplement is effective, will be deemed to be incorporated by reference in this Prospectus Supplement and will automatically update and supersede information contained or incorporated by reference in this Prospectus Supplement. The documents incorporated or deemed to be incorporated herein by reference contain meaningful and material information relating to the Company and readers should review all information contained in this Prospectus Supplement, the accompanying Shelf Prospectus and the documents incorporated or deemed to be incorporated by reference herein and therein.

Documents and information in an annual report on Form 40-F filed by the Company with the SEC under the United States Securities Exchange Act of 1934, as amended (the “U.S. Exchange Act”), from the date of this Prospectus Supplement and prior to the completion of the Offering shall be deemed incorporated by reference into this Prospectus Supplement and the Registration Statement of which this Prospectus Supplement forms a part. To the extent that any document or information incorporated by reference into this Prospectus Supplement is included in any report on Form 20-F, 10-K, 10-Q, 8-K or 6-K (or any respective successor form) that is filed with or furnished to the SEC after the date of this Prospectus Supplement, such document or information shall be deemed to be incorporated by reference as an exhibit to the Registration Statement of which this Prospectus Supplement forms a part. In addition, we may incorporate by reference into this Prospectus Supplement, or the registration statement of which it forms a part, other information from documents that we file with or furnish to the SEC pursuant to Section 13(a) or 15(d) of the Exchange Act, if and to the extent expressly provided therein.

References to our website in any documents that are incorporated by reference into this Prospectus Supplement and the Shelf Prospectus do not incorporate by reference the information on such website into this Prospectus Supplement or the Shelf Prospectus, and we disclaim any such incorporation by reference.

WHERE YOU CAN FIND MORE INFORMATION

Copies of the documents incorporated herein by reference may be obtained on request without charge from the Corporate Secretary at 9000 Glenlyon Parkway, Burnaby, British Columbia, Canada V5J 5J8 or by calling the Investor Relations Department at (604) 454-0900, and are also available electronically from the Canadian System for Electronic Document Analysis and Retrieval filing website of Canadian Securities Administrators (www.sedar.com) (“SEDAR”) and from the EDGAR filing website of the SEC (www.sec.gov) (“EDGAR”). The Company’s filings through SEDAR and EDGAR are not incorporated by reference in this Prospectus Supplement except as specifically set out herein.

The Company is subject to the information requirements of the U.S. Exchange Act, and in accordance therewith files reports and other information with the SEC on EDGAR. Under MJDS, such reports and other information may be prepared in accordance with the disclosure requirements of Canada, which requirements are different from those of the United States. Prospective investors may read any document the Company files with or furnishes to the SEC at the SEC’s public reference room at Room 1580, 100 F Street, N.E., Washington, D.C., 20549. Copies of the same documents may also be obtained from the public reference room of the SEC by paying a fee. Please call the SEC at 1-800-SEC-0330 or access its website at www.sec.gov for further information on the public reference room.

S-2

Table of Contents

FORWARD-LOOKING STATEMENTS

This Prospectus Supplement, the accompanying Shelf Prospectus, and the documents incorporated herein and therein by reference contain certain “forward-looking information” and “forward-looking statements” (collectively, “forward-looking statements”) which are based upon the Company’s current internal expectations, estimates, projections, assumptions and beliefs. Such statements can be identified by the use of forward-looking terminology such as “expect”, “likely”, “may”, “will”, “should”, “intend”, or “anticipate”, “potential”, “proposed”, “estimate” and other similar words, including negative and grammatical variations thereof, or statements that certain events or conditions “may” or “will” happen, or by discussions of strategy. Forward-looking statements include estimates, plans, expectations, opinions, forecasts, projections, targets, guidance or other statements that are not statements of fact. Such forward-looking statements are made as of the date of this Prospectus Supplement, or in the case of any document incorporated by reference herein, as of the date of each such document. Forward-looking statements in this Prospectus Supplement, the accompanying Shelf Prospectus and the documents incorporated by reference herein include, but are not limited to, statements with respect to:

· our objectives, goals, liquidity, sources and uses of capital, outlook, strategy, order backlog, order book of expected deliveries, future product costs and selling prices, future product sales, future production volumes, the markets for our products, expenses / costs, contributions and cash requirements to and from joint venture operations and research and development activities;

· our plan to build value for our shareholders by developing, manufacturing, selling and servicing industry-leading fuel cell products to meet the needs of our customers in select target markets;

· our ability to develop commercially viable fuel cell products on the timetable we anticipate, or at all;

· our ability to achieve, sustain and increase profitability;

· demand and market acceptance for our products;

· our limited experience manufacturing fuel cell products on a commercial basis;

· warranty claims may negatively impact our gross margins and financial performance;

· our ability to successfully execute our business plan;

· our dependence on a single customer in certain of our markets including our engineering services market and materials handling market;

· the impact of global economic conditions on our business and our key suppliers and customers;

· our ability to predict future revenues or results of operations;

· the expansion of our business through acquisitions;

· our focus on bolstering our cash reserves and our continued efforts on both product cost reduction and managing our operating expense base;

· the risks inherent in international operations;

· the impact of exchange rate fluctuations on our business, operating results, financial condition and profitability;

· commodity price fluctuations, and in particular, the price of platinum, are beyond our control and may have a material adverse effect on our business, operating results, financial condition and profitability;

· our dependence on system integrators and original equipment manufacturers (“OEMs”);

· ongoing relationships between us and third-party suppliers and our dependence on them for the supply of key materials and components for our products and services;

· our ability to compete with our competitors and their technologies;

· our ability to attract and retain qualified personnel;

· the effect of public policy and regulatory changes on the market for our products;

· our ability to protect, expand and exploit our intellectual property;

· our compliance with increasingly stringent environmental laws and regulations including liability for environmental damages resulting from our research and development or manufacturing operations;

· the potential exposure of our products to product liability claims including the use of flammable fuels in our products, some of which generate high voltages; and

· our use of the proceeds of the Offering.

The forward-looking statements are based on a number of key expectations and assumptions made by our management, including, but not limited to:

S-3

Table of Contents

· our ability to generate new sales;

· our ability to produce, deliver and sell the expected product volumes at the expected prices;

· our ability to control costs;

· market demand for our products;

· the successful execution of our business plan;

· achievement of current timetables for product development programs and sales;

· the availability and cost of raw materials, labour and supplies;

· the availability of additional capital; and

· general economic and financial market conditions.

Forward-looking statements contained in or incorporated by reference in this Prospectus Supplement or the accompanying Shelf Prospectus are based on the assumptions described in this Prospectus Supplement or the accompanying Shelf Prospectus. Although management believes the expectations reflected in such forward-looking statements are reasonable, forward-looking statements are based on the opinions, assumptions and estimates of management at the date the statements are made, and are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking statements. These factors include, but are not limited to:

· the condition of the global economy, including trade, public health and other geopolitical risks;

· the rate of mass adoption of our products, or related ecosystem, including the availability of cost-effective hydrogen;

· changes in product or service pricing or cost;

· changes in our customers’ requirements, the competitive environment and/or related market conditions;

· the relative strength of the value proposition that we offer our customers with our products or services;

· changes in competitive technologies, including battery and fuel cell technologies;

· product safety, liability or warranty issues; challenges or delays in our technology and product development activities;

· product development delays;

· product safety, liability or warranty issues;

· challenges or delays in our technology and product development activities;

· changes in the availability or price of raw materials, labour and supplies;

· our ability to attract and retain business partners, suppliers, employees and customers;

· changing government or environmental regulations, including subsidies or incentives associated with the adoption of clean energy products, including hydrogen and fuel cells;

· potential fluctuations in our financial and business results make forecasting difficult and may restrict our access to funding for our commercialization plan;

· we are subject to risks inherent in international operations;

· our access to funding and our ability to provide the capital required for product development, operations and marketing efforts, working capital requirements, and joint venture capital contributions;

· our ability to protect our intellectual property;

· our ability to extract value from joint venture operations;

· currency fluctuations, including the magnitude of the rate of change of the Canadian dollar versus the United States dollar;

· potential merger and acquisition activities, including risks related to integration, loss of key personnel, disruptions to operations, costs of integration, and the integration failing to achieve the expected benefits of the transaction; and

· those risks discussed in this Prospectus Supplement and in the Shelf Prospectus under the heading “Risk Factors”.

These factors are not intended to represent a complete list of the factors that could affect the Company; however, these factors should be considered carefully by prospective purchasers of the Offered Shares. A more detailed assessment of the risks that could cause actual events or results to materially differ from our current expectations can be found under the heading “Risk Factors” in this Prospectus Supplement and the Shelf Prospectus.

S-4

Table of Contents

Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those anticipated, believed, estimated or expected. We caution readers not to place undue reliance on any such forward-looking statements, which speak only as of the date made. Although Ballard has attempted to identify important factors that could cause actual results to differ materially from forward-looking statements, there may be other factors that cause results not to be as anticipated, estimated, described or intended.

A number of factors could cause actual events, performance or results to differ materially from what is projected in forward-looking statements. The purpose of forward-looking statements is to provide the reader with a description of management’s expectations, and such forward-looking statements may not be appropriate for any other purpose. You should not place undue reliance on forward-looking statements contained in this Prospectus Supplement, the accompanying Shelf Prospectus or in any document incorporated by reference herein or therein. Although the Company believes that the expectations reflected in such forward-looking statements are reasonable, it can give no assurance that such expectations will prove to have been correct. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable law.

We qualify all the forward-looking statements contained in this Prospectus Supplement, the Shelf Prospectus and the documents incorporated by reference herein and therein by the foregoing cautionary statements.

FINANCIAL INFORMATION AND CURRENCY

The financial statements of the Company incorporated by reference in this Prospectus Supplement are reported in United States dollars. The Company’s consolidated financial statements for the years ended December 31, 2019 and 2018, as incorporated by reference in this Prospectus Supplement, have been prepared in accordance with IFRS.

References in this Prospectus Supplement to “$” and “US$” are to United States dollars. Canadian dollars are indicated by the symbol “CDN$”.

The following table sets forth (i) the rate of exchange for the Canadian dollar, expressed in United States dollars, in effect at the end of the periods indicated; (ii) the average exchange rates for the Canadian dollar during such periods, expressed in U.S. dollars; and (iii) the high and low exchange rates for the Canadian dollar, expressed in United States dollars, during such periods, each based on the daily rate of exchange as reported by the Bank of Canada for conversion of Canadian dollars into United States dollars:

|

|

|

Fiscal Year Ended December 31

|

|

|

|

|

2019

|

|

2018

|

|

|

Rate at the end of period

|

|

$

|

0.7699

|

|

$

|

0.7330

|

|

|

Average rate during period

|

|

$

|

0.7537

|

|

$

|

0.7721

|

|

|

Highest rate during period

|

|

$

|

0.7699

|

|

$

|

0.8138

|

|

|

Lowest rate during period

|

|

$

|

0.7353

|

|

$

|

0.7330

|

|

On March 9, 2020, the daily exchange rate for Canadian dollars in terms of the United States dollar, as quoted by the Bank of Canada, was CDN$1.00 = US$0.7354.

S-5

Table of Contents

BALLARD POWER SYSTEMS INC.

At Ballard, our vision is to deliver fuel cell power for a sustainable planet. We are recognized as a world leader in proton exchange membrane (“PEM”) fuel cell and power system development and commercialization.

Our principal business is the design, development, manufacture, sale and service of PEM fuel cell products for a variety of applications, focusing on our power product markets of Heavy-Duty Motive (consisting of bus, truck, rail and marine applications), Portable Power / UAV, Material Handling, and Backup Power, as well as the delivery of Technology Solutions, including engineering services, technology transfer, and the license and sale of our extensive intellectual property portfolio and fundamental knowledge for a variety of PEM fuel cell applications.

A fuel cell is an environmentally clean electrochemical device that combines hydrogen fuel with oxygen (from the air) to produce electricity. The hydrogen fuel can be obtained from natural gas, kerosene, methanol or other hydrocarbon fuels, or from water through electrolysis. Ballard’s PEM fuel cell products feature high fuel efficiency, low operating temperature, low noise and vibration, compact size, quick response to changes in electrical demand and modular design. Embedded in each Ballard PEM fuel cell product lies a stack of unit cells designed with Ballard’s proprietary technology, which include membrane electrode assemblies, catalysts, plates, and other key components, and which draw on intellectual property from our patent portfolio together with our extensive experience and know-how, in key areas of PEM fuel cell stack design, operation, production processes and system integration.

We strive to build value for our shareholders by developing, manufacturing, selling and servicing zero-emission, industry-leading PEM fuel cell technology products and services to meet the needs of our customers in select target markets.

Our two-pronged approach is to build shareholder value through the sale and service of power products and the delivery of technology solutions. In power product sales, our focus is on meeting the power needs of our customers by delivering high value, high reliability, high quality and innovative PEM fuel cell products. Through technology solutions, our focus is on enabling our customers to solve their technical and business challenges or address new business opportunities and accelerate the adoption of fuel cell technology by delivering customized, high value, bundled technology solutions, including specialized engineering services, access to our intellectual property portfolio and know-how through licensing or sale, and by providing technology component supply.

Prospective purchasers of the Offered Shares should read the description of the Company and its business under the heading “The Company” in the Shelf Prospectus and under the heading “Our Business” in the AIF.

USE OF PROCEEDS

The net proceeds from the Offering are not determinable in light of the nature of the distribution. The net proceeds of any given distribution of the Offered Shares through the Selling Agents in an “at-the-market distribution” will represent the gross proceeds after deducting the applicable compensation payable to the Selling Agents under the Equity Distribution Agreement and the expenses of the distribution. The Selling Agents will receive a cash fee of up to 2% of the gross proceeds from the sale of the Offered Shares in connection with the Offering. The proceeds we receive from sales will depend on the number of Offered Shares actually sold and the offering price of such Offered Shares. We intend to use the net proceeds of the Offering for general corporate purposes.

The Company will retain significant discretion over the use of the net proceeds from the sale of the Offered Shares. See “Risk Factors”.

DESCRIPTION OF SHARE CAPITAL

The authorized capital of the Company consists of an unlimited number of Common Shares and an unlimited number of preferred shares (issuable in series). As of the date of this Prospectus Supplement, there were 235,096,567 Common Shares outstanding and no preferred shares outstanding.

See “Description of the Share Capital” in the Shelf Prospectus for a detailed description of the attributes of our Common Shares.

S-6

Table of Contents

Pursuant to investor rights agreements entered into between Ballard and Weichai, and Ballard and Broad Ocean, each of Weichai Power Hong Kong International Development Co., Limited (“Weichai”) and Zhongshan Broad-Ocean Motor Co., Ltd. (“Broad-Ocean”) is entitled to pre-emptive rights to maintain their current level of ownership. Each of Weichai and Broad-Ocean will be entitled to exercise their pre-emptive rights in connection with any Offered Shares issued in the Offering.

CONSOLIDATED CAPITALIZATION

Other than as set out herein under “Prior Sales”, there have been no material changes in the share and loan capital of the Company since December 31, 2019 to the date of this Prospectus Supplement.

PRIOR SALES

The following table sets forth the details regarding all issuances of Common Shares, including issuances of all securities convertible or exchangeable into Common Shares, during the 12-month period before the date of this Prospectus Supplement.

|

Date of Grant/ Issuance

|

|

Price per Security ($)

|

|

Number of Securities Issued

|

|

|

Common Shares:

|

|

|

|

|

|

|

March 12, 2019(1)

|

|

CDN $1.80-2.67

|

|

8,666

|

|

|

March 13, 2019(1)

|

|

CDN $1.69

|

|

2,000

|

|

|

March 14, 2019(1)

|

|

USD $2.00

|

|

6,667

|

|

|

March 21, 2019(1)

|

|

CDN $1.69

|

|

2,000

|

|

|

March 22, 2019(1)

|

|

CDN $1.69

|

|

1,000

|

|

|

March 25, 2019(1)

|

|

CDN $2.67

|

|

666

|

|

|

March 26, 2019(1)

|

|

CDN $1.69

|

|

5,667

|

|

|

March 28, 2019(1)

|

|

CDN $1.22

|

|

5,000

|

|

|

April 2, 2019(1)

|

|

CDN $2.67-2.98

|

|

11,666

|

|

|

April 3, 2019(1)

|

|

CDN $2.98

|

|

1,334

|

|

|

April 9, 2019(1)

|

|

CDN $2.67

|

|

1,000

|

|

|

April 25, 2019(1)

|

|

USD $2.00

|

|

6,667

|

|

|

May 3, 2019(1)

|

|

CDN $4.33

|

|

13,418

|

|

|

May 7, 2019(1)

|

|

CDN $1.80-3.73

|

|

34,225

|

|

|

May 10, 2019(1)

|

|

CDN $2.67

|

|

1,333

|

|

|

May 14, 2019(1)

|

|

CDN $2.67-2.98

|

|

12,666

|

|

|

May 15, 2019(1)

|

|

CDN $2.67-2.98

|

|

8,916

|

|

|

May 16, 2019(1)

|

|

CDN $1.22-2.67

|

|

39,667

|

|

|

May 17, 2019(1)

|

|

CDN $1.22-2.67

|

|

2,833

|

|

|

May 20, 2019(1)

|

|

USD $1.23-1.33

|

|

20,000

|

|

|

May 21, 2019(1)

|

|

CDN $1.22-2.98

|

|

19,367

|

|

|

May 22, 2019(1)

|

|

CDN $1.80-2.98

|

|

12,313

|

|

|

May 23, 2019(1)

|

|

USD $0.83-1.19

|

|

2,000

|

|

|

May 24, 2019(1)

|

|

CDN $1.22-2.67

|

|

7,000

|

|

|

May 27, 2019(1)

|

|

CDN $1.80

|

|

334

|

|

|

May 28, 2019(1)

|

|

USD $0.83-CDN $4.82

|

|

10,666

|

|

|

May 29, 2019(1)

|

|

CDN $1.22-4.82

|

|

21,929

|

|

|

May 30, 2019(1)

|

|

CDN $1.80-USD $3.35

|

|

25,133

|

|

|

May 31, 2019(1)

|

|

CDN $1.80-2.98

|

|

21,200

|

|

|

June 6, 2019(2)

|

|

CDN $3.81

|

|

1,317

|

|

|

June 12, 2019(1)

|

|

USD $1.33-$2.36

|

|

18,499

|

|

|

June 13, 2019(1)

|

|

CDN $1.80-2.98

|

|

1,500

|

|

|

June 14, 2019(1)

|

|

CDN $2.67

|

|

3,333

|

|

|

July 3, 2019(1)

|

|

CDN $1.22-2.67

|

|

8,833

|

|

|

July 4, 2019(1)

|

|

CDN $2.67

|

|

666

|

|

S-7

Table of Contents

|

Date of Grant/ Issuance

|

|

Price per Security ($)

|

|

Number of Securities Issued

|

|

|

July 22, 2019(1)

|

|

CDN $1.80-3.63

|

|

1,667

|

|

|

July 31, 2019(1)

|

|

CDN $1.80-3.63

|

|

10,002

|

|

|

August 1, 2019(1)

|

|

USD $2.00

|

|

1,600

|

|

|

August 6, 2019(1)

|

|

USD $2.00-2.36

|

|

2,397

|

|

|

August 7, 2019(1)

|

|

CDN $1.22-2.98

|

|

16,581

|

|

|

August 8, 2019(1)

|

|

CDN $1.22-4.82

|

|

18,333

|

|

|

August 9, 2019(1)

|

|

CDN $3.73

|

|

1,000

|

|

|

August 13, 2019(1)

|

|

CDN $1.22-3.73

|

|

8,500

|

|

|

August 14, 2019(1)

|

|

CDN $2.98

|

|

3,500

|

|

|

August 15, 2019(1)

|

|

CDN $2.98

|

|

2,000

|

|

|

August 20, 2019(1)

|

|

CDN $2.98

|

|

3,000

|

|

|

August 21, 2019(1)

|

|

CDN $1.80

|

|

2,000

|

|

|

August 22, 2019(1)

|

|

CDN $1.22

|

|

9,000

|

|

|

August 23, 2019(1)

|

|

CDN $1.80-$2.67

|

|

15,833

|

|

|

August 26, 2019(1)

|

|

CDN $1.80

|

|

2,000

|

|

|

August 27, 2019(1)

|

|

CDN $2.67

|

|

333

|

|

|

August 28, 2019(1)

|

|

USD $0.83

|

|

10,000

|

|

|

September 3, 2019(1)

|

|

USD $1.23-CDN $3.63

|

|

4,000

|

|

|

September 5, 2019(1)

|

|

CDN $2.67-3.63

|

|

9,166

|

|

|

September 6, 2019(1)

|

|

USD $0.83-CDN $1.80

|

|

15,500

|

|

|

September 9, 2019(1)

|

|

CDN $1.22-3.73

|

|

23,233

|

|

|

September 10, 2019(1)

|

|

CDN $1.22-USD $1.23

|

|

56,667

|

|

|

September 11, 2019(1)

|

|

CDN $1.22-4.82

|

|

103,298

|

|

|

September 12, 2019(1)

|

|

CDN $2.67-3.73

|

|

8,666

|

|

|

September 13, 2019(1)

|

|

CDN $1.22-3.73

|

|

26,832

|

|

|

September 16, 2019(1)

|

|

CDN $1.22-2.98

|

|

29,134

|

|

|

September 17, 2019(1)

|

|

CDN $1.22-USD$3.74

|

|

176,295

|

|

|

September 18, 2019(1)

|

|

CDN $1.22-3.73

|

|

46,184

|

|

|

September 19, 2019(1)

|

|

CDN $1.80-3.73

|

|

174,865

|

|

|

September 20, 2019(1)

|

|

CDN $1.80-3.73

|

|

36,167

|

|

|

September 23, 2019(1)

|

|

CDN $2.67

|

|

3,333

|

|

|

September 24, 2019(1)

|

|

CDN $1.22-3.63

|

|

29,666

|

|

|

September 25, 2019(1)

|

|

CDN $3.63-4.82

|

|

13,332

|

|

|

September 26, 2019(1)

|

|

CDN $1.80-3.73

|

|

8,332

|

|

|

October 1, 2019(1)

|

|

CDN $3.63-4.82

|

|

13,332

|

|

|

October 22, 2019(1)

|

|

CDN $2.98-4.82

|

|

4,000

|

|

|

October 23, 2019(1)

|

|

CDN $2.98

|

|

4,667

|

|

|

October 24, 2019(1)

|

|

CDN $2.98-3.73

|

|

1,000

|

|

|

October 25, 2019(1)

|

|

CDN $2.98-4.82

|

|

1,334

|

|

|

October 28, 2019(1)

|

|

CDN $1.80-3.63

|

|

4,678

|

|

|

October 31, 2019(1)

|

|

CDN $1.80-2.98

|

|

3,000

|

|

|

November 1, 2019(1)

|

|

CDN $3.73

|

|

1,000

|

|

S-8

Table of Contents

|

Date of Grant/ Issuance

|

|

Price per Security ($)

|

|

Number of Securities Issued

|

|

|

November 6, 2019(1)

|

|

CDN $1.80-3.73

|

|

32,333

|

|

|

November 8, 2019(1)

|

|

CDN $4.82-USD $3.74

|

|

13,333

|

|

|

November 12, 2019(1)

|

|

CDN $4.82

|

|

6,666

|

|

|

November 13, 2019(1)

|

|

CDN $1.22-4.82

|

|

382,066

|

|

|

November 14, 2019(1)

|

|

USD $1.23-CDN $4.82

|

|

79,545

|

|

|

November 15, 2019(1)

|

|

USD $1.23-CDN $4.82

|

|

34,788

|

|

|

November 18, 2019(1)

|

|

CDN $1.22-4.82

|

|

77,612

|

|

|

November 19, 2019(1)

|

|

CDN $1.80-USD $3.74

|

|

53,431

|

|

|

November 20, 2019(1)

|

|

CDN $1.80-4.82

|

|

103,899

|

|

|

November 21, 2019(1)

|

|

CDN $1.80-4.82

|

|

10,166

|

|

|

November 22, 2019(1)

|

|

CDN $2.67-3.73

|

|

1,500

|

|

|

November 26, 2019(1)

|

|

CDN $2.67

|

|

2,000

|

|

|

November 27, 2019(1)

|

|

CDN $1.80-3.73

|

|

25,000

|

|

|

November 28, 2019(1)

|

|

CDN $2.98

|

|

3,000

|

|

|

November 29, 2019(1)

|

|

USD $2.36-3.35

|

|

2,000

|

|

|

December 2, 2019(1)

|

|

USD $3.35

|

|

1,000

|

|

|

December 6, 2019(2)

|

|

CDN $3.83

|

|

3,964

|

|

|

December 12, 2019(1)

|

|

CDN $2.98-3.63

|

|

2,666

|

|

|

December 16, 2019(1)

|

|

CDN $1.80-3.83

|

|

2,916

|

|

|

December 17, 2019(1)

|

|

CDN $1.80-3.73

|

|

1,250

|

|

|

December 18, 2019(1)

|

|

CDN $1.80-4.82

|

|

117,997

|

|

|

December 19, 2019(1)

|

|

CDN $2.98

|

|

2,000

|

|

|

December 20, 2019(1)

|

|

CDN $1.80-3.73

|

|

1,266

|

|

|

December 27, 2019(1)

|

|

CDN $1.80-4.82

|

|

4,000

|

|

|

December 30, 2019(1)

|

|

CDN $1.80-3.73

|

|

3,400

|

|

|

December 31, 2019(1)

|

|

CDN $2.67-2.98

|

|

2,990

|

|

|

January 2, 2020(1)

|

|

CDN $1.80-3.73

|

|

250

|

|

|

January 3, 2020(1)

|

|

CDN $1.80-3.73

|

|

2,333

|

|

|

January 6, 2020(1)

|

|

CDN $1.80-3.73

|

|

4,666

|

|

|

January 7, 2020(1)

|

|

CDN $2.98

|

|

3,000

|

|

|

January 8, 2020(1)

|

|

CDN $1.22-USD $2.36

|

|

6,050

|

|

|

January 9, 2020(1)

|

|

CDN $1.80-$3.73

|

|

5,434

|

|

|

January 10, 2020(1)

|

|

CDN $1.80-3.73

|

|

6,000

|

|

|

January 13, 2020(1)

|

|

CDN $2.98

|

|

2,000

|

|

|

January 14, 2020(1)

|

|

CDN $1.80-USD $3.74

|

|

12,933

|

|

|

January 15, 2020(1)

|

|

CDN $2.98-3.73

|

|

4,500

|

|

|

January 16, 2020(1)

|

|

CDN $2.67

|

|

66

|

|

|

January 17, 2020(1)

|

|

CDN $3.73

|

|

5,000

|

|

|

January 20, 2020(1)

|

|

CDN $2.98

|

|

1,125

|

|

|

January 21, 2020(1)

|

|

CDN $2.67-3.73

|

|

25,194

|

|

|

January 22, 2020(1)

|

|

CDN $2.67-3.63

|

|

3,166

|

|

|

January 23, 2020(1)

|

|

CDN $1.80-3.73

|

|

10,000

|

|

S-9

Table of Contents

|

Date of Grant/ Issuance

|

|

Price per Security ($)

|

|

Number of Securities Issued

|

|

|

January 24, 2020(1)

|

|

CDN $1.80-3.73

|

|

19,000

|

|

|

January 29, 2020(1)

|

|

CDN $3.73

|

|

500

|

|

|

January 30, 2020(1)

|

|

CDN $1.80

|

|

1,000

|

|

|

January 31, 2020(1)

|

|

CDN $1.80

|

|

1,000

|

|

|

February 7, 2020(1)

|

|

CDN $2.98

|

|

2,000

|

|

|

February 12, 2020(1)

|

|

CDN $3.73

|

|

1,000

|

|

|

February 13, 2020(1)

|

|

CDN $1.22

|

|

1,000

|

|

|

February 19, 2020(1)

|

|

CDN $2.67

|

|

666

|

|

|

February 20, 2020(1)

|

|

CDN $2.98

|

|

4,067

|

|

|

February 21, 2020(1)

|

|

CDN $2.98-USD $3.35

|

|

5,500

|

|

|

February 24, 2020(1)

|

|

CDN $1.80

|

|

700

|

|

|

February 26, 2020(1)

|

|

CDN $2.98

|

|

2,000

|

|

|

March 2, 2020(1)

|

|

USD $1.19

|

|

1,000

|

|

|

March 4, 2020(1)

|

|

CDN $4.82

|

|

1,000

|

|

|

March 5, 2020(1)

|

|

CDN $2.98-USD $3.74

|

|

31,333

|

|

|

March 6, 2020(1)(2)

|

|

USD $2.00-9.72

|

|

268,322

|

|

|

March 9, 2020(1)

|

|

CDN $2.67

|

|

1,268

|

|

|

March 10, 2020(1)

|

|

CDN $1.22-4.82

|

|

149,168

|

|

|

Options to purchase Common Shares:

|

|

|

|

|

|

|

March 18, 2019

|

|

CDN $4.08-USD $3.06

|

|

1,260,521

|

|

|

September 6, 2019

|

|

CDN $5.99

|

|

57,000

|

|

|

March 6, 2020

|

|

CDN $14.22-USD $10.64

|

|

1,351,919

|

|

|

Restricted Share Units:

|

|

|

|

|

|

|

March 15, 2019

|

|

CDN $4.08-USD $3.06

|

|

444,616

|

|

|

September 5, 2019

|

|

CDN $5.99

|

|

5,008

|

|

|

March 5, 2020

|

|

CDN $14.22-USD $10.64

|

|

148,375

|

|

|

Deferred Share Units:

|

|

|

|

|

|

|

March 29, 2019

|

|

CDN $4.05

|

|

22,761

|

|

|

June 28, 2019

|

|

CDN $5.35

|

|

17,229

|

|

|

September 30, 2019

|

|

CDN $6.47

|

|

14,245

|

|

|

December 31, 2019

|

|

CDN $9.28

|

|

9,930

|

|

Notes:

(1) Issued on the exercise of previously granted options.

(2) Issued on the exercise of previously granted restricted stock units from the Consolidated Share Distribution Plan.

S-10

Table of Contents

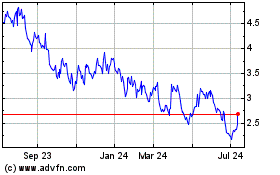

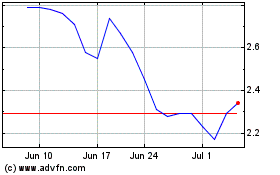

TRADING PRICE AND VOLUME

The outstanding Common Shares are traded on the TSX and the NASDAQ under the trading symbol “BLDP”. The following tables set forth the reported intraday high and low prices and monthly trading volumes of the Common Shares for the 12-month period prior to the date of this Prospectus Supplement.

|

|

|

TSX

(prices in Canadian dollars)

|

|

NASDAQ

(prices in United States dollars)

|

|

|

|

|

Price Range

(low - high)

|

|

Average

Volume

|

|

Price Range

(low - high)

|

|

Average

Volume

|

|

|

March 1 – 9, 2020

|

|

$11.62 - $14.22

|

|

1,940,000

|

|

$8.50 - $10.64

|

|

5,005,000

|

|

|

February 2020

|

|

$12.06 - $18.66

|

|

1,621,000

|

|

$8.44 - $14.14

|

|

4,697,000

|

|

|

January 2020

|

|

$10.13 - $16.29

|

|

1,791,000

|

|

$7.81 - $12.04

|

|

4,611,000

|

|

|

December 2019

|

|

$7.98 - $9.30

|

|

331,000

|

|

$6.07 - $7.18

|

|

1,232,000

|

|

|

November 2019

|

|

$7.38 - $9.57

|

|

477,000

|

|

$5.64 - $7.26

|

|

1,844,000

|

|

|

October 2019

|

|

$6.34 - $7.95

|

|

392,000

|

|

$4.78 - $6.10

|

|

1,336,000

|

|

|

September 2019

|

|

$5.96 - $7.45

|

|

781,000

|

|

$4.48 - $5.64

|

|

1,673,000

|

|

|

August 2019

|

|

$5.49 - $6.19

|

|

260,000

|

|

$4.15 - $4.68

|

|

930,000

|

|

|

July 2019

|

|

$5.20 - $5.58

|

|

142,000

|

|

$3.99 - $4.24

|

|

848,000

|

|

|

June 2019

|

|

$4.62 - $5.55

|

|

193,000

|

|

$3.50 - $4.17

|

|

838,000

|

|

|

May 2019

|

|

$4.38 - $5.75

|

|

294,000

|

|

$3.29 - $4.27

|

|

1,221,000

|

|

|

April 2019

|

|

$4.04 - $4.67

|

|

136,000

|

|

$3.04 - $3.51

|

|

697,000

|

|

|

March 2019

|

|

$3.96 - $4.75

|

|

168,000

|

|

$2.97 - $3.59

|

|

698,000

|

|

The closing price of the Common Shares on the TSX and the NASDAQ on March 9, 2020 was CDN$11.62 and US$8.50, respectively.

PLAN OF DISTRIBUTION

We entered into the Equity Distribution Agreement with the Selling Agents, under which we may issue and sell from time to time Offered Shares through or to the Selling Agents having an aggregate offering amount of up to US$75,000,000 of Offered Shares in the United States, pursuant to agency transaction notices delivered by us to the Selling Agents from time to time in accordance with the terms of the Equity Distribution Agreement. Sales of the Offered Shares, if any, will be made at market prices by any method that is deemed to be an “at-the-market” distribution as defined in NI 44-102, including sales made by the Selling Agents directly on the NASDAQ or any other trading market for the Common Shares in the United States If authorized by us, the Selling Agents may also sell the Offered Shares in privately negotiated transactions in the United States. None of the Offered Shares will be sold on the TSX or other trading markets in Canada. The purchase price of the Offered Shares may vary as between purchasers during the term of the distribution. We cannot predict the number of Offered Shares that we may sell under the Equity Distribution Agreement on the NASDAQ or any other trading market for the Common Shares in the United States, or whether any Offered Shares will be sold.

S-11

Table of Contents

The applicable Selling Agent will offer the Offered Shares subject to the terms and conditions of the Equity Distribution Agreement from time to time as agreed upon by us and the Selling Agents. We will designate the maximum amount of Offered Shares pursuant to any single agency transaction notice to the applicable Selling Agent. Subject to the terms and conditions of the Equity Distribution Agreement, the applicable Selling Agent will use commercially reasonable efforts to sell on our behalf all of the Offered Shares requested to be sold by us. We may instruct the Selling Agent not to sell the Offered Shares if the sales cannot be effected at or above the price designated by us in any such instruction. Under the Equity Distribution Agreement, no Selling Agent has any obligation to purchase as principal for its own account any Offered Shares that we propose to sell pursuant to any placement notice delivered by us to the applicable Selling Agent. Under the terms of the Equity Distribution Agreement, the Company also may sell Offered Shares to a Selling Agent as principal for its own account at a price agreed upon at the time of sale. If the Company sells Offered Shares to a Selling Agent as principal, the Company will enter into a separate terms agreement with the Selling Agent and the Company will describe this terms agreement in a separate prospectus supplement or pricing supplement.

The Selling Agents or we may suspend the offering of the Offered Shares being made through the Selling Agents under the Equity Distribution Agreement upon notice to the other in writing. Neither we nor the Selling Agents will undertake any act, advertisement, solicitation, conduct or negotiation directly or indirectly in furtherance of the sale of the Offered Shares in Canada, undertake an offer or sale of any of the Offered Shares to a person that it knows or has reason to believe is in Canada or has been pre-arranged with a buyer in Canada, or to any person who it knows or has reason to believe is acting on behalf of persons in Canada or to any person whom it knows or has reason to believe intends to reoffer, resell or deliver the Offered Shares in Canada on the TSX or on other trading markets in Canada or to any persons in Canada or acting on behalf of persons in Canada. We have the right, and BMO has the right, by giving written notice as specified in the Equity Distribution Agreement, to terminate the Equity Distribution Agreement in each party’s sole discretion at any time. The Equity Distribution Agreement and the offering of the Offered Shares pursuant to the Equity Distribution Agreement will terminate upon the earlier of: (i) the termination of the Equity Distribution Agreement by the Company or BMO; (ii) the issuance and sale of all the Offered Shares subject to the Equity Distribution Agreement by the Selling Agents, or (iii) on July 24, 2020.

The aggregate compensation payable to the Selling Agents as sales agent will be up to 2% of the gross sales price of the Offered Shares sold through them pursuant to the Equity Distribution Agreement. The remaining sales proceeds, after deducting any expenses payable by us and any transaction fees imposed by any governmental, regulatory, or self-regulatory organization in connection with the sales, will equal our net proceeds for the sale of the Offered Shares.

The applicable Selling Agent will provide written confirmation to us prior to the opening of trading on the NASDAQ following each day in which the Offered Shares are sold through it as sales agent under the Equity Distribution Agreement. Each confirmation will include the number of Offered Shares sold through it as sales agent on that day, the volume weighted average price of the shares sold, the commission payable by us to the Selling Agents in connection with the sales of Offered Shares and the net proceeds payable to us.

We will report the number and average price of the Offered Shares sold through the Selling Agents under the Equity Distribution Agreement, the gross proceeds, the compensation paid by us to the Selling Agents in connection with the sales of Offered Shares and the net proceeds from sales in our annual and interim financial statements and management’s discussion and analysis filed on SEDAR and EDGAR, for any financial periods in which sales of Offered Shares occur.

Unless otherwise specified in the applicable placement notice, settlement for sales of the Offered Shares will occur on the second business day that is also a trading day following the date on which any sales were made in return for payment of the net proceeds to us. There is no arrangement for funds to be received in an escrow, trust or similar arrangement. Sales of Offered Shares will be settled through the facilities of The Depository Trust Company or by such other means as the Company and the Selling Agents may agree upon.

In connection with the sales of the Offered Shares on our behalf, each of the Selling Agents may be deemed to be an “underwriter” within the meaning of the U.S. Securities Act, and the compensation paid to the Selling Agents may be deemed to be underwriting commissions or discounts. We have agreed in the Equity Distribution Agreement to provide indemnification and contribution to the Selling Agents against certain liabilities, including liabilities under

S-12

Table of Contents

the U.S. Securities Act. Neither the Selling Agents nor any other sales agent for the Offering that we may engage will engage in any transactions to stabilize or maintain the price of the Common Shares in connection with any offer or sales of the Offered Shares pursuant to the Equity Distribution Agreement. No underwriter or dealer involved in the distribution, no affiliate of such an underwriter or dealer and no person or company acting jointly or in concert with such an underwriter or dealer has over-allotted, or will over-allot, the Offered Shares in connection with the distribution or effected, or will effect, any other transactions that are intended to stabilize or maintain the market price of the Offered Shares.

If either we or the Selling Agents have reason to believe that the exemptive provisions set forth in Rule 101(c)(1) of Regulation M under the Exchange Act are not satisfied with respect to the Common Shares, it shall promptly notify the other party, and the Selling Agents may, at their sole discretion, suspend sales of the Offered Shares under the Equity Distribution Agreement.

We have applied to list the Offered Shares for trading on the TSX. Listing will be subject to the Company fulfilling all of the listing requirements of the TSX. The Offered Shares will be listed for trading on the NASDAQ.

The Selling Agents will not, directly or indirectly, advertise or solicit offers to purchase any of the Offered Shares in Canada. The Selling Agents will only sell Offered Shares on marketplaces in the United States. Other than in the United States, no action has been taken by the Company that would permit a public offering of the Offered Shares in any jurisdiction outside the United States where action for that purpose is required. The Offered Shares may not be offered or sold, directly or indirectly, nor may this Prospectus Supplement or any other offering material or advertisements in connection with the offer and sale of any such Offered Shares be distributed or published in any jurisdiction, except under circumstances that will result in compliance with the applicable rules and regulations of that jurisdiction. Persons into whose possession this Prospectus Supplement comes are advised to inform themselves about and to observe any restrictions relating to the Offering and the distribution of this Prospectus Supplement. This Prospectus Supplement does not constitute an offer to sell or a solicitation of an offer to buy any Offered Shares in any jurisdiction in which such an offer or a solicitation is unlawful.

CERTAIN CANADIAN FEDERAL INCOME TAX CONSIDERATIONS

The following is, as of the date of this Prospectus Supplement, a summary of the principal Canadian federal income tax considerations under the Income Tax Act (Canada) and the regulations thereunder (collectively, the “Tax Act”) generally applicable to an investor who acquires Offered Shares pursuant to the Offering as beneficial owner and who, for the purposes of the Tax Act and at all relevant times, deals at arm’s length with the Company and each Selling Agent, is not affiliated with the Company or either Selling Agent, is not exempt from tax under Part I of the Tax Act, and acquires and holds the Offered Shares as capital property (herein, a “Holder”). Generally, the Offered Shares will be considered to be capital property to a Holder thereof provided that the Holder does not use or hold the Offered Shares in the course of carrying on a business of trading or dealing in securities and such Holder has not acquired them or been deemed to have acquired them in one or more transactions considered to be an adventure or concern in the nature of trade.

This summary is generally applicable to a Holder who, for the purposes of the Tax Act, and at all relevant times: (i) is not, and is not deemed to be, resident in Canada for the purposes of the Tax Act or any applicable income tax treaty or convention, (ii) does not and will not use or hold, and is not and will not be deemed to use or hold, the Offered Shares in the course of carrying on a business in Canada, or otherwise in respect of a business carried on in Canada. Holders who meet all of the foregoing requirements are referred to in this summary as “Non-Resident Holders”, and this summary only applies to such Non-Resident Holders. This summary does not apply to a Holder (including a Non-Resident Holder) that (i) carries on, or is deemed to carry on, an insurance business in Canada or elsewhere, (ii) is an “authorized foreign bank” as defined in the Tax Act, or (iii) has entered into or will enter into a “synthetic disposition arrangement” or “derivative forward agreement” (as such terms are defined in the Tax Act) with respect to Offered Share. Such Holders, and all other holders (including Non-Resident Holders) of special status or in special circumstances, should consult their own tax advisors with respect to an investment in the Offered Shares.

This summary is based on the current provisions of the Tax Act in force as of the date hereof and our understanding of the administrative policies and assessing practices of the Canada Revenue Agency (the “CRA”) published in

S-13

Table of Contents

writing by the CRA prior to the date hereof. This summary takes into account all specific proposals to amend the Tax Act publicly announced by or on behalf of the Minister of Finance (Canada) prior to the date hereof (the “Tax Proposals”) and assumes that the Tax Proposals will be enacted in the form proposed, although no assurance can be given that the Tax Proposals will be enacted in their current form or at all. Other than the Tax Proposals, this summary does not otherwise take into account or anticipate any changes in law, whether by legislative, governmental, administrative or judicial decision or action, nor does it take into account or consider any provincial, territorial or foreign income tax considerations, which considerations may differ significantly from the Canadian federal income tax considerations discussed in this summary. This summary also does not take into account or anticipate any change in the administrative policies or assessing practices of the CRA.

This summary is of a general nature only, is not exhaustive of all possible Canadian federal income tax considerations and is not intended to be, nor should it be construed to be, legal or tax advice to any particular Non-Resident Holder. Investors (including Non-Resident Holders) should consult their own tax advisors with respect to their particular circumstances.

Currency

For purposes of the Tax Act, all amounts relating to the acquisition, holding or disposition of the Offered Shares (including dividends, adjusted cost base and proceeds of disposition) must be expressed in Canadian dollars. Amounts denominated in any other currency must be converted into Canadian dollars based on the exchange rate as quoted by the Bank of Canada for the applicable day or such other rate of exchange that is acceptable to the Minister of National Revenue (Canada).

Acquisitions of Offered Shares

For purposes of the Tax Act, when any Offered Shares are acquired by a Non-Resident Holder who already owns Common Shares, the cost of the newly acquired Offered Shares will be averaged with the adjusted cost base of all Common Shares owned by the Non-Resident Holder as capital property before that time for the purposes of determining the Non-Resident Holder’s adjusted cost base of all Offered Shares held by such person.

Dividends

Dividends paid or credited (or deemed to be paid or credited under the Tax Act) to a Non-Resident Holder by the Company on the Offered Shares are subject to Canadian withholding tax at the rate of 25% on the gross amount of the dividend unless such rate is reduced by the terms of an applicable tax treaty. Under the Canada-United States Tax Convention (1980), as amended (the “Treaty”), the rate of withholding tax on dividends paid or credited to a Non-Resident Holder who is resident in the United States for purposes of the Treaty and who is fully entitled to the benefits of the Treaty (a “U.S. Holder”) is generally limited to 15% of the gross amount of the dividend (or 5% in the case of a U.S. Holder that is a corporation that beneficially owns at least 10% of our voting shares). Non-Resident Holders should consult their own tax advisors to determine their entitlement to relief under an applicable income tax treaty.

Dispositions of Offered Shares

A Non-Resident Holder generally will not be subject to tax under the Tax Act in respect of a capital gain realized on the disposition or deemed disposition of an Offered Share unless the Offered Share constitutes “taxable Canadian property” to the Non-Resident Holder for purposes of the Tax Act and the Non-Resident Holder is not entitled to relief under the terms of an applicable tax treaty. In addition, capital losses arising on the disposition or deemed disposition of an Offered Share will not be recognized under the Tax Act unless the Offered Share constitutes “taxable Canadian property” to the Non- Resident Holder for purposes of the Tax Act.

Provided the Offered Shares are listed on a “designated stock exchange” as defined in the Tax Act (which currently includes the TSX and the NASDAQ) at the time of disposition, the Offered Shares will not constitute taxable Canadian property to the Non-Resident Holder at that time, unless at any time during the 60-month period immediately preceding the disposition the following two conditions are met concurrently: (i) one or any combination of (a) the Non-Resident Holder, (b) persons with whom the Non-Resident Holder did not deal at arm’s length, or (c) partnerships in which the Non-Resident Holder or a person with whom the Non-Resident Holder did not deal at

S-14

Table of Contents

arm’s length holds a membership interest (directly or indirectly through one or more partnerships) owned 25% or more of the issued shares of any class or series of shares of the Company; and (ii) more than 50% of the fair market value of the shares of the Company was derived directly or indirectly from one or any combination of (a) real or immovable property situated in Canada, (b) “Canadian resource properties” (as defined in the Tax Act), (c) “timber resource properties” (as defined in the Tax Act) or (d) an option in respect of, an interest in, or for civil law a right in any of the foregoing property, whether or not such property exists. Notwithstanding the foregoing, an Offered Share may also be deemed to be taxable Canadian property to a Non-Resident Holder under other provisions of the Tax Act.

Non-Resident Holders whose Offered Shares may be taxable Canadian property should consult their own tax advisors.

CERTAIN U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following is a general summary of certain material U.S. federal income tax considerations relevant to a U.S. Holder (as defined below) arising from and relating to the acquisition, ownership, and disposition of Offered Shares acquired pursuant to this Offering.

This summary is for general information purposes only and does not purport to be a complete analysis or listing of all potential U.S. federal income tax consequences that may apply to a U.S. Holder arising from and relating to the acquisition, ownership, and disposition of Common Shares. In addition, this summary does not take into account the individual facts and circumstances of any particular U.S. Holder that may affect the U.S. federal income tax consequences to such U.S. Holder. Accordingly, this summary is not intended to be, and should not be construed as, legal or U.S. federal income tax advice with respect to any U.S. Holder. Except as discussed below, this summary does not discuss applicable income tax reporting requirements. This summary does not address the U.S. federal net investment income, U.S. federal alternative minimum, U.S. federal estate and gift, U.S. state and local, and non U.S. tax consequences to U.S. Holders of the acquisition, ownership, and disposition of Common Shares. Each prospective U.S. Holder should consult its own tax advisor regarding the U.S. federal, U.S. federal net investment income, U.S. federal alternative minimum, U.S. federal estate and gift, U.S. state and local, and non-U.S. tax consequences relating to the acquisition, ownership, and disposition of Common Shares.

No legal opinion from U.S. legal counsel or ruling from the Internal Revenue Service (the “IRS”) has been requested, or will be obtained, regarding the U.S. federal income tax consequences of the acquisition, ownership, and disposition of Common Shares. This summary is not binding on the IRS, and the IRS is not precluded from taking a position that is different from, and contrary to, the positions taken in this summary.

Each U.S. Holder should also review the separate discussion regarding Canadian income tax considerations discussed above under “Certain Canadian Federal Income Tax Considerations”.

Scope of this Summary

Authorities

This summary is based on the Internal Revenue Code of 1986, as amended (the “Code”), Treasury Regulations (whether final, temporary, or proposed), published rulings of the IRS, published administrative positions of the IRS, the Treaty, and U.S. court decisions that are applicable, and, in each case, as in effect and available, as of the date hereof. Any of the authorities on which this summary is based could be changed in a material and adverse manner at any time, and any such change could be applied retroactively or prospectively which could affect the U.S. federal income tax considerations described in this summary. This summary does not discuss the potential effects, whether adverse or beneficial, of any proposed legislation that, if enacted, could be applied on a retroactive or prospective basis.

U.S. Holders

For purposes of this summary, the term “U.S. Holder” means a beneficial owner of the Offered Shares acquired in the Offering that is for U.S. federal income tax purposes:

• an individual who is a citizen or resident of the U.S.;

S-15

Table of Contents

• a corporation (or other entity classified as a corporation for U.S. federal income tax purposes) created or organized under the laws of the U.S., any state thereof or the District of Columbia;

• an estate whose income is subject to U.S. federal income taxation regardless of its source; or

• a trust that (a) is subject to the primary supervision of a court within the U.S> and the control of one or more U.S. persons for all substantial decisions or (b) has a valid election in effect under applicable Treasury Regulations to be treated as a U.S. person.

U.S. Holders Subject to Special U.S. Federal Income Tax Rules Not Addressed