UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 10-Q

[

x ]

Quarterly

Report Pursuant To Section 13 or 15(d) of the Securities Exchange

Act of 1934 for the Quarterly Period Ended June 30,

2018

or

[

]

Transition

Report Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934 for the Transition Period from to

Commission File Number 001-32982

|

Atrion Corporation

|

|

(Exact

Name of Registrant as Specified in its Charter)

|

|

|

|

|

|

Delaware

|

|

63-0821819

|

|

(State

or Other Jurisdiction of Incorporation or

Organization)

|

|

(I.R.S.

Employer Identification No.)

|

|

|

|

|

|

One Allentown Parkway, Allen, Texas 75002

|

|

(Address

of Principal Executive

Offices) (Zip

Code)

|

|

(972) 390-9800

|

|

(Registrant’s

Telephone Number, Including Area Code)

|

Indicate

by check mark whether the registrant: (1) has filed all reports

required to be filed by Section 13 or 15(d) of the Securities

Exchange Act of 1934 during the preceding 12 months (or for such

shorter period that the registrant was required to file such

reports), and (2) has been subject to such filing requirements for

the past 90 days. Yes

☒ No ☐

Indicate

by check mark whether the registrant has submitted electronically

and posted on its corporate Web site, if any, every Interactive

Data File required to be submitted and posted pursuant to Rule 405

of Registration S-T (§ 232.405 of this chapter) during the

preceding 12 months (or for such shorter period that the registrant

was required to submit and post such files). Yes ☒ No

☐

Indicate

by check mark whether the registrant is a large accelerated filer,

an accelerated filer, a non-accelerated filer, a smaller reporting

company or an emerging growth company. See definitions of

“accelerated filer,” “large accelerated

filer,” “smaller reporting company” and

“emerging growth company” in Rule 12b-2 of the Exchange

Act (Check one):

|

Large accelerated filer

|

☒

|

Accelerated filer

|

☐

|

|

Non-accelerated

filer

|

☐

(Do not check if a smaller reporting

company)

|

Smaller reporting company

|

☐

|

|

|

|

Emerging

growth company

|

☐

|

If an

emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided

pursuant to Section 13(a) of the Exchange Act ☐

Indicate

by check mark whether the registrant is a shell company (as defined

in Rule 12b-2 of the Exchange Act). Yes ☐ No

☒

Indicate

the number of shares outstanding of each of the issuer's classes of

common stock, as of the latest practicable date.

|

Title of Each Class

|

|

Number of Shares Outstanding at

July 25, 2018

|

|

Common stock, Par Value $0.10 per share

|

|

1,852,756

|

ATRION CORPORATION AND SUBSIDIARIES

TABLE OF CONTENTS

|

PART

I. Financial

Information

|

2

|

|

|

|

|

Item

1.

Financial Statements

|

|

|

|

|

|

Consolidated

Statements of Income (Unaudited) For the Three and Six Months Ended

June 30, 2018 and 2017

|

3

|

|

Consolidated

Statements of Comprehensive Income (Unaudited) For the Three and

Six Months Ended June 30, 2018 and 2017

|

4

|

|

Consolidated

Balance Sheets (Unaudited) June 30, 2018 and December 31,

2017

|

5

|

|

Consolidated

Statements of Cash Flows (Unaudited) For the Six Months Ended June

30, 2018 and 2017

|

6

|

|

Consolidated

Statement of Changes in Stockholders’ Equity (Unaudited) June

30, 2018 and December 31, 2017

|

7

|

|

Notes

to Consolidated Financial Statements (Unaudited)

|

8

|

|

|

|

|

Item

2.

Management's Discussion and Analysis of Financial Condition and

Results of Operations

|

15

|

|

|

|

|

Item 3

.

Quantitative and Qualitative

Disclosures About Market Risk

|

20

|

|

|

|

|

Item

4.

Controls and

Procedures

|

21

|

|

|

|

|

PART II. Other Information

|

21

|

|

|

|

|

Item

1.

Legal Proceedings

|

21

|

|

|

|

|

Item

1A.

Risk Factors

|

21

|

|

|

|

|

Item

6.

Exhibits

|

21

|

|

|

|

|

SIGNATURES

|

22

|

|

|

|

|

Exhibit Index

|

23

|

PART I

FINANCIAL INFORMATION

Item 1. Financial Statements

ATRION CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

(Unaudited)

|

|

Three Months Ended

June 30,

|

Six Months Ended

June 30,

|

|

|

|

|

|

|

|

|

(in

thousands, except per share amounts)

|

|

Revenues

|

$

38,847

|

$

36,164

|

$

78,248

|

$

74,669

|

|

Cost

of goods sold

|

19,624

|

18,470

|

40,074

|

38,344

|

|

Gross

profit

|

19,223

|

17,694

|

38,174

|

36,325

|

|

Operating

expenses:

|

|

|

|

|

|

Selling

|

2,045

|

1,864

|

4,064

|

3,612

|

|

General

and administrative

|

4,309

|

4,287

|

8,537

|

8,304

|

|

Research

and development

|

1,603

|

1,368

|

2,941

|

2,907

|

|

|

7,957

|

7,519

|

15,542

|

14,823

|

|

Operating

income

|

11,266

|

10,175

|

22,632

|

21,502

|

|

|

|

|

|

|

|

Interest

and dividend income

|

411

|

370

|

742

|

519

|

|

Other

investment income (losses)

|

(408

)

|

--

|

(1,197

)

|

1

|

|

|

3

|

370

|

(455

)

|

520

|

|

|

|

|

|

|

|

Income

before provision for income taxes

|

11,269

|

10,545

|

22,177

|

22,022

|

|

Provision

for income taxes

|

(2,472

)

|

(519

)

|

(4,892

)

|

(2,046

)

|

|

|

|

|

|

|

|

Net

income

|

$

8,797

|

$

10,026

|

$

17,285

|

$

19,976

|

|

|

|

|

|

|

|

Net

income per basic share

|

$

4.75

|

$

5.44

|

$

9.33

|

$

10.86

|

|

Weighted

average basic shares outstanding

|

1,852

|

1,844

|

1,853

|

1,839

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

income per diluted share

|

$

4.74

|

$

5.40

|

$

9.31

|

$

10.76

|

|

Weighted

average diluted shares outstanding

|

1,857

|

1,858

|

1,856

|

1,856

|

|

|

|

|

|

|

|

Dividends

per common share

|

$

1.20

|

$

1.05

|

$

2.40

|

$

2.10

|

The accompanying notes are an integral part of these

statements.

ATRION CORPORATION

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(Unaudited)

|

|

Three Months Ended

June 30,

|

Six Months Ended

June 30,

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net

Income

|

$

8,797

|

$

10,026

|

$

17,285

|

$

19,976

|

|

|

|

|

|

|

|

Other Comprehensive

Income

|

|

|

|

|

|

Unrealized income

on investments,

net of tax expense

of $204 and $36 in 2017

|

--

|

379

|

--

|

66

|

|

|

|

|

|

|

|

Comprehensive

Income

|

$

8,797

|

$

10,405

|

$

17,285

|

$

20,042

|

The accompanying notes are an integral part of these

statements.

ATRION CORPORATION AND SUBSIDIARIES

CONSOLIDATED BALANCE SHEETS

(Unaudited)

|

Assets

|

|

|

|

|

|

|

Current assets:

|

|

|

|

Cash and cash

equivalents

|

$

36,063

|

$

30,136

|

|

Short-term

investments

|

24,176

|

35,468

|

|

Accounts

receivable

|

18,269

|

17,076

|

|

Inventories

|

32,503

|

29,354

|

|

Prepaid expenses

and other current assets

|

2,919

|

3,199

|

|

|

113,930

|

115,233

|

|

|

|

|

|

Long-term

investments

|

22,208

|

9,136

|

|

|

|

|

|

Property, plant and

equipment

|

174,322

|

167,080

|

|

Less accumulated

depreciation and amortization

|

104,750

|

100,711

|

|

|

69,572

|

66,369

|

|

|

|

|

|

Other assets and

deferred charges:

|

|

|

|

Patents

|

1,718

|

1,778

|

|

Goodwill

|

9,730

|

9,730

|

|

Other

|

1,624

|

1,534

|

|

|

13,072

|

13,042

|

|

|

|

|

|

Total

assets

|

$

218,782

|

$

203,780

|

|

Liabilities

and Stockholders’ Equity

|

|

|

|

Current

liabilities:

|

|

|

|

Accounts payable

and accrued liabilities

|

$

9,738

|

$

8,876

|

|

Accrued income and

other taxes

|

593

|

746

|

|

|

10,331

|

9,622

|

|

|

|

|

|

Line of

credit

|

--

|

--

|

|

|

|

|

|

Other non-current

liabilities

|

10,394

|

9,770

|

|

|

|

|

|

Stockholders’

equity:

|

|

|

|

Common stock, par

value $0.10 per share; authorized10,000 shares, issued 3,420

shares

|

342

|

342

|

|

Paid-in

capital

|

49,635

|

48,730

|

|

Accumulated other

comprehensive loss

|

--

|

(1,215

)

|

|

Retained

earnings

|

279,807

|

268,194

|

|

Treasury

shares,1,567 at June 30, 2018 and 1,568 at December 31, 2017, at

cost

|

(131,727

)

|

(131,663

)

|

|

Total

stockholders’ equity

|

198,057

|

184,388

|

|

|

|

|

|

|

|

|

|

Total

liabilities and stockholders’ equity

|

$

218,782

|

$

203,780

|

The accompanying notes are an integral part of these financial

statements.

ATRION CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited)

|

|

Six Months Ended

June 30,

|

|

|

|

|

|

|

|

|

|

Cash

flows from operating activities:

|

|

|

|

Net

income

|

$

17,285

|

$

19,976

|

|

Adjustments

to reconcile net income tonet cash provided by operating

activities:

|

|

|

|

Depreciation

and amortization

|

4,455

|

4,223

|

|

Deferred

income taxes

|

(235

)

|

1,009

|

|

Stock-based

compensation

|

917

|

903

|

|

Net change in

unrealized gains and losses on investments

|

1,197

|

--

|

|

Net change in

accrued interest, premiums, and discounts

|

|

|

|

on

investments

|

(125

)

|

(82

)

|

|

Other

|

3

|

(2

)

|

|

|

23,497

|

26,027

|

|

|

|

|

|

Changes

in operating assets and liabilities:

|

|

|

|

Accounts

receivable

|

(1,193

)

|

(2,524

)

|

|

Inventories

|

(3,149

)

|

(950

)

|

|

Prepaid

expenses

|

280

|

(2,841

)

|

|

Other

non-current assets

|

(90

)

|

81

|

|

Accounts

payable and accrued liabilities

|

862

|

(552

)

|

|

Accrued

income and other taxes

|

(153

)

|

862

|

|

Other

non-current liabilities

|

859

|

39

|

|

|

20,913

|

20,142

|

|

|

|

|

|

Cash

flows from investing activities:

|

|

|

|

Property,

plant and equipment additions

|

(7,598

)

|

(5,422

)

|

|

Purchase

of investments

|

(26,887

)

|

(21,911

)

|

|

Proceeds

from maturities of investments

|

24,035

|

19,000

|

|

|

(10,450

)

|

(8,333

)

|

|

|

|

|

|

Cash

flows from financing activities:

|

|

|

|

Shares tendered for employees’ withholding

taxes on

stock-based

compensation

|

(90

)

|

(7,735

)

|

|

Dividends

paid

|

(4,446

)

|

(3,873

)

|

|

|

(4,536

)

|

(11,608

)

|

|

|

|

|

|

Net

change in cash and cash equivalents

|

5,927

|

201

|

|

Cash

and cash equivalents at beginning of period

|

30,136

|

20,022

|

|

Cash

and cash equivalents at end of period

|

$

36,063

|

$

20,223

|

|

|

|

|

|

|

|

|

|

Cash

paid for:

|

|

|

|

Income

taxes

|

$

5,592

|

$

2,295

|

|

|

|

|

|

Non-cash

financing activities:

|

|

|

|

Non-cash

effect of stock option exercises

|

$

--

|

$

10,237

|

The accompanying notes are an integral part of these financial

statements.

ATRION CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENT OF CHANGES IN STOCKHOLDERS’

EQUITY

(Unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balances, January 1,

2017

|

1,852

|

$

342

|

1,568

|

$

(131,663

)

|

$

48,730

|

$

(1,215

)

|

$

268,194

|

$

184,388

|

|

|

|

|

|

|

|

|

|

|

|

Net

income

|

|

|

|

|

|

|

17,285

|

17,285

|

|

Reclass

from adopting ASU 2016-01

|

|

|

|

|

|

1,215

|

(1,215

)

|

--

|

|

Stock-based

compensation transactions

|

1

|

|

(1

)

|

26

|

905

|

|

|

931

|

|

Shares

surrendered in stock transactions

|

|

|

|

(90

)

|

|

|

|

(90

)

|

|

Dividends

|

|

|

|

|

|

|

(4,457

)

|

(4,457

)

|

|

Balances, June 30,

2018

|

1,853

|

$

342

|

1,567

|

$

(131,727

)

|

$

49,635

|

$

0

|

$

279,807

|

$

198,057

|

The accompanying notes are an integral part of these financial

statements

ATRION CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

(1)

Basis

of Presentation

The

accompanying unaudited consolidated financial statements of Atrion

Corporation and its subsidiaries have been prepared in accordance

with accounting principles generally accepted in the United States

for interim financial information and with the instructions to Form

10-Q. Accordingly, they do not include all of the information and

notes required by accounting principles generally accepted in the

United States for complete financial statements. In the opinion of

management, these statements include all normal and recurring

adjustments necessary to present a fair statement of our

consolidated results of operations, financial position and cash

flows. Operating results for any interim period are not necessarily

indicative of the results that may be expected for the full year.

Preparation of the Company’s financial statements in

conformity with accounting principles generally accepted in the

United States requires management to make estimates and assumptions

that affect the reported amounts in the financial statements and

notes. Actual results could differ from those estimates. This

Quarterly Report on Form 10-Q should be read in conjunction with

the Company’s consolidated financial statements and notes

included in its Annual Report on Form 10-K for the fiscal year

ended December 31, 2017 ("2017 Form 10-K"). References herein

to "Atrion," the "Company," "we," "our," and "us" refer to Atrion

Corporation and its subsidiaries.

Inventories

are stated at the lower of cost or net realizable value. Cost is

determined by using the first-in, first-out method. The following

table details the major components of inventories (in

thousands):

|

|

|

|

|

|

|

|

|

Raw

materials

|

$

14,267

|

$

13,545

|

|

Work in

process

|

7,837

|

6,647

|

|

Finished

goods

|

10,399

|

9,162

|

|

Total

inventories

|

$

32,503

|

$

29,354

|

The

following is the computation for basic and diluted income per

share:

|

|

Three Months

Ended

June

30,

|

Six Months

Ended

June

30,

|

|

|

|

|

|

|

|

|

(in

thousands, except per share amounts)

|

|

Net

income

|

$

8,797

|

$

10,026

|

$

17,285

|

$

19,976

|

|

Weighted average

basic shares outstanding

|

1,852

|

1,844

|

1,853

|

1,839

|

|

Add: Effect of

dilutive securities

|

5

|

14

|

3

|

17

|

|

Weighted average

diluted shares outstanding

|

1,857

|

1,858

|

1,856

|

1,856

|

|

Earnings

per share:

|

|

|

|

|

|

Basic

|

$

4.75

|

$

5.44

|

$

9.33

|

$

10.86

|

|

Diluted

|

$

4.74

|

$

5.40

|

$

9.31

|

$

10.76

|

ATRION CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

Incremental shares

from stock options and restricted stock units were included in the

calculation of weighted average diluted shares outstanding using

the treasury stock method. Dilutive securities representing

1,200

and 1,027 shares of

common stock for the quarters ended June 30, 2018 and 2017,

respectively, were excluded from the computation of weighted

average diluted shares outstanding because their effect would have

been anti-dilutive.

As of

June 30, 2018, we held investments in certificates of deposit,

commercial paper, bonds, mutual funds and equity securities that

are required to be measured for disclosure purposes at fair value

on a recurring basis. The certificates of deposit, commercial paper

and bonds are considered held-to-maturity and are recorded at

amortized cost in the accompanying consolidated balance sheet. The

equity securities and mutual funds are recorded at fair value in

the accompanying consolidated balance sheet. These investments are

considered Level 1 or Level 2 as detailed in the table below. We

consider as current assets those investments which will mature in

the next 12 months including interest receivable on the long-term

bonds. The remaining investments are considered non-current assets

including our investment in equity securities we intend to hold

longer than 12 months.

The fair values of these investments

were estimated using recently executed transactions and market

price quotations.

The amortized cost and fair value of our

investments, and the related gross unrealized gains and losses,

were as follows as of the dates shown below (in

thousands):

|

|

|

|

|

|

|

|

|

|

|

As

of June 30, 2018:

|

|

|

|

|

|

|

Short-term

Investments

|

|

|

|

|

|

|

Certificates of

deposit

|

2

|

2,021

|

$

--

|

$

(4

)

|

$

2,017

|

|

Commercial

paper

|

2

|

10,977

|

$

--

|

$

(9

)

|

$

10,968

|

|

Bonds

|

2

|

11,178

|

$

--

|

$

(29

)

|

$

11,149

|

|

|

|

|

|

|

|

|

Long-term

Investments

|

|

|

|

|

|

|

Bonds

|

2

|

18,781

|

$

--

|

$

(259

)

|

$

18,522

|

|

Mutual

funds

|

1

|

485

|

$

--

|

$

(4

)

|

$

481

|

|

Equity

investments

|

2

|

5,675

|

$

--

|

$

(2,729

)

|

$

2,946

|

|

|

|

|

|

|

|

|

As

of December 31, 2017:

|

|

|

|

|

|

|

Short-term

Investments

|

|

|

|

|

|

|

Certificates of

deposit

|

2

|

4,020

|

$

--

|

$

(3

)

|

$

4,017

|

|

Commercial

paper

|

2

|

31,220

|

$

26

|

$

(38

)

|

$

31,208

|

|

Bonds

|

2

|

6

|

$

--

|

$

--

|

$

6

|

|

Mutual

funds

|

1

|

219

|

$

3

|

$

--

|

$

222

|

|

|

|

|

|

|

|

|

Long-term

Investments

|

|

|

|

|

|

|

Bonds

|

2

|

5,000

|

$

--

|

$

(75

)

|

$

4,925

|

|

Equity

investments

|

2

|

5,675

|

$

--

|

$

(1,539

)

|

$

4,136

|

ATRION CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The

above long-term bonds represent investments in various issuers at

June 30, 2018. The unrealized losses for these investments relate

to a rise in interest rates which resulted in a lower market price

for those securities. Only one of these bond investments has been

in a loss position for more than 12 months.

The

certificate of deposit matures in 5.2 months. The commercial paper

securities have maturities ranging from 0.2 months to 3.4 months.

The bonds have maturities ranging from 0.4 months to 53.5

months.

Purchased

patents and license fees paid for the use of other entities’

patents are amortized over the useful life of the patent or

license. The following tables provide information regarding patents

and licenses (dollars in thousands):

|

|

|

Weighted

Average Original Life (years)

|

|

|

Weighted

Average Original Life (years)

|

|

|

|

15.67

|

$

13,840

|

$

12,122

|

15.67

|

$

13,840

|

$

12,062

|

Aggregate

amortization expense for patents and licenses was $30,000 for the

three months ended June 30, 2018 and 2017 and $60,000 and $92,000

for the six months ended June 30, 2018 and 2017,

respectively.

Estimated future

amortization expense for each of the years set forth below ending

December 31 is as follows (in thousands):

|

2019

|

$

119

|

|

2020

|

$

119

|

|

2021

|

$

119

|

|

2022

|

$

117

|

|

2023

|

$

113

|

Income

tax expense for the second quarter of 2018 was $2.5 million

compared to income tax expense of $519,000 for the same period in

the prior year. The effective tax rate for the second quarter of

2018 was 22 percent, compared with 5 percent for the second quarter

of 2017. The Tax Cuts and Jobs Act, enacted in December 2017,

reduced the corporate federal income tax rate in the United States

from 35 percent to 21 percent effective for us on January 1, 2018.

The Tax Cuts and Jobs Act also ended the domestic production

activities deduction under Section 199 which previously helped

lower our effective tax rate by 3 percentage points. The benefit we

received from the lower tax rate under the Tax Cuts and Jobs Act

was not as large as the excess tax benefits we received in the

second quarter of 2017 of $3.0 million from the exercise of stock

options together with the benefit from the Section 199

deduction.

ATRION CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

We

continue to assess the income tax effects of the Tax Cuts and Jobs

Act and whether recorded amounts may be affected due to changes in

our interpretations and assumptions, as well as regulatory guidance

that may be issued.

(7)

Recent

Accounting Pronouncements

Accounting Standards Update 2014-09, Revenue from Contracts with

Customers

In May

2014, the Financial Accounting Standards Board (FASB) issued

Accounting Standards Update (ASU) 2014-09, Revenue from Contracts

with Customers, also known as ASC 606. This new standard requires

an entity to recognize the amount of revenue to which it expects to

be entitled for the transfer of promised goods or services to

customers. ASC 606 replaced most existing revenue recognition

guidance in United States Generally Accepted Accounting Principles

when it became effective for fiscal years beginning after December

15, 2017. We adopted the new standard on January 1, 2018, using the

full retrospective method. Because accounting for revenue from

contracts with customers did not materially change for us under the

new standard as explained below, prior period consolidated

financial statements did not require adjustment.

We

recognize revenue when obligations under the terms of a contract

with our customer are satisfied. This occurs with the transfer of

control of our products to customers when products are shipped.

Revenue is measured as the amount of consideration we expect to

receive in exchange for transferring products or services. Sales

and other taxes we may collect concurrent with revenue-producing

activities are excluded from revenue.

We

believe that our medical device business will benefit in the long

term from an aging world population along with an increase in life

expectancy. In the near term however, demand for our products

fluctuates based on our customer requirements which are driven in

large part by their customers’ needs for medical care which

does not always follow broad economic trends. This affects the

nature, amount, timing and uncertainty of our revenue. Also,

changes in the value of the United States dollar relative to

foreign currencies could make our products more or less affordable

and therefore affect our sales in international

markets.

A

summary of revenues by geographic area, based on shipping

destination, for the three and six months ended June 30, 2018 and

2017 are as follows (in thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

United

States

|

$

24,833

|

$

24,079

|

$

49,440

|

$

47,184

|

|

Germany

|

2,291

|

1,919

|

4,962

|

4,956

|

|

Other countries

less than 5% of revenues

|

11,723

|

10,166

|

23,846

|

22,529

|

|

Total

|

$

38,847

|

$

36,164

|

$

78,248

|

$

74,669

|

ATRION CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

A

summary of revenues by product line for the three and six months

ended June 30, of 2018 and 2017 are as follows (in

thousands):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Fluid

Delivery

|

$

18,128

|

$

15,630

|

$

36,928

|

$

33,636

|

|

Cardiovascular

|

13,003

|

12,222

|

26,213

|

23,686

|

|

Ophthalmology

|

2,852

|

3,762

|

5,637

|

7,435

|

|

Other

|

4,864

|

4,550

|

9,470

|

9,912

|

|

Total

|

$

38,847

|

$

36,164

|

$

78,248

|

$

74,669

|

More

than ninety-eight percent of our total revenue in the periods

presented herein is pursuant to shipments

initiated

by a purchase order, which under the new ASC 606 guidance is the

contract with the customer. As a result, the vast majority of our

revenue is recognized at a single point in time when the

performance obligation of the product being shipped is satisfied,

rather than recognized over time, and presented as a receivable on

the balance sheet.

Our

payment terms vary by the type and location of our customers and

the products or services offered. The term between invoicing and

when payment is due is thirty days in most cases. For certain

products or services and customer types, we require payment before

the products or services are delivered to the

customer.

We

maintain an allowance for doubtful accounts to reflect estimated

losses resulting from the failure of customers to make required

payments. On an ongoing basis, the collectability of accounts

receivable is assessed based upon historical collection trends,

current economic factors and the assessment of the collectability

of specific accounts. We evaluate the collectability of specific

accounts and determine when to grant credit to our customers using

a combination of factors, including the age of the outstanding

balances, evaluation of customers’ current and past financial

condition, recent payment history, current economic environment,

and discussions with our personnel and with the customers directly.

Accounts are written off when it is determined the receivable will

not be collected. If circumstances change, our estimates of the

collectability of amounts could be changed by a material

amount.

We have

elected to recognize the cost for shipping as an expense in cost of

sales when control over the product has transferred to the

customer.

We do

not make any material accruals for product returns and warranty

obligations. Our manufactured products come with a standard

warranty to be free from defect and, in the event of a defect, may

be returned by the customer within a reasonable period of time.

Historically, our returns have been unpredictable but very low due

to our focus on quality control. A one-year warranty is provided

with certain equipment sales but warranty claims and our accruals

for these obligations have been minimal.

ATRION CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

We

expense sales commissions when incurred because the amortization

period would be one year or less. These costs are recorded within

selling expense.

Atrion

has contracts in place with customers for equipment leases,

equipment financing, and equipment and other services. These

contracts represent less than 4 percent of our total revenue in all

periods presented herein. A portion of these contracts representing

less than 3 percent of our revenues include multiple performance

obligations. For such arrangements, we allocate revenue to each

performance obligation which is capable of being distinct and

accounted for as a separate performance obligation based on

relative standalone selling prices. We generally determine

standalone selling prices based on observable inputs, primarily the

prices charged to customers. Lease revenues, including embedded

leases under certain of these contracts, represent less than 1

percent of our total revenue in all periods presented herein.

A

limited number of our contracts have variable consideration

including tiered pricing and rebates which we monitor closely for

potential constraints on revenue. For these contracts we estimate

our position quarterly using the most likely outcome method,

including customer-provided forecasts and historical buying

patterns, and we accrue for any asset or liability these

arrangements may create. The effect of accruals for variable

consideration on our consolidated financial statements is

immaterial.

We do

not disclose the value of unsatisfied performance obligations for

contracts for which we recognize revenue at the amount to which we

have the right to invoice. We believe that the complexity added to

our disclosures by the inclusion of a large amount of insignificant

detail in attempting to disclose information about immaterial

contracts under ASC 606 would potentially obscure more useful and

important information.

ASU 2016-02, Leases

On

February 25, 2016 the FASB issued ASU 2016-02, Leases (ASC

842). The main objective of this new standard is to recognize

lease assets and lease liabilities on the balance sheet and

disclose key information about leasing arrangements. The new

leasing standard requires lessees to recognize a right of use asset

and lease liability on the balance sheet. Lessor accounting is

updated to align with certain changes in the lessee model and the

new revenue recognition standard (ASC 606). Atrion elected to

early adopt this new standard as of January 1, 2018, using the

modified retrospective approach as required.

As a

lessee, Atrion has only two leases for equipment used internally

which we account for as operating leases. Upon adoption of ASC 842,

we recorded a right-of-use asset and a lease liability for these

leases as of January 1, 2018. The monthly expense of $2,025 for

these operating leases, which are our only lessee arrangements, is

immaterial and therefore all other lessee disclosures under ASC 842

have been omitted.

As a

lessor, Atrion has agreements with certain customers for the rental

of our equipment for use in hospitals. These arrangements include

sales type leases, fixed monthly rentals and rental agreements

containing a lease component (embedded lease) and non-lease

components. Lease revenues from all of these agreements represented

less than 1 percent of our total revenue in the first half of 2018

and in all of 2017.

ATRION CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

(Unaudited)

The

fixed monthly rentals and embedded lease arrangements are accounted

for as operating leases. Fixed monthly rentals provide for a flat

fee each month. For our embedded lease agreements we have chosen

under ASC 842 to continue to use a variable basis (based on

consumables sold in the period) to allocate and recognize revenue

as we have in prior periods because it most closely represents the

way in which benefit of the asset is derived.

The

lease assets from our sales type leases are recorded in our

accounts receivables in the accompanying consolidated balance

sheet, and as of June 30, 2018 the balance totaled $517,000. Our

equipment being leased as operating leases to our customers is

included in our Property Plant and Equipment on our balance sheet.

As of June 30, 2018, the cost of this property and related

accumulated depreciation was $8.0 million and $5.65 million,

respectively. Due to the immaterial amount of revenue from our

lessor activity, all other lessor disclosures under ASC 842 have

been omitted.

ASU 2016-01, Financial Instruments - Overall (Subtopic 825-10):

Recognition and Measurement of Financial Assets and Financial

Liabilities.

In

January 2016, the FASB issued ASU 2016-01, Financial Instruments -

Overall (Subtopic 825-10): Recognition and Measurement of Financial

Assets and Financial Liabilities. The main objective of this update

is to enhance the reporting model for financial instruments in

order to provide users of financial statements with more

decision-useful information. Changes to the previous guidance

primarily affect the accounting for equity investments, financial

liabilities under the fair value option, and the presentation and

disclosure requirements for financial instruments.

The

primary impact of this change for us relates to our

available-for-sale equity investment and resulted in unrecognized

gains and losses from this investment being reflected in our income

statement beginning in 2018. We adopted ASU 2016-01 as of

January 1, 2018, applying the update by means of a

cumulative-effect adjustment to the balance sheet by reclassifying

the balance of our Accumulated Other Comprehensive Loss in the

shareholders’ equity section of the balance sheet to Retained

Earnings. The balance reclassified of $1,215,000 was a result

of prior-period unrealized losses from our equity

investment.

In the

second quarter of 2018 we recorded an unrealized loss on our equity

investment of $412,000 as a result of a decline in the market value

of this investment during the quarter. This brings the 2018

year-to-date loss on this investment to $1,190,000. This loss is

reflected in other investment income (loss) in our income

statement. This change in accounting is expected to create greater

volatility in our investment income each quarter in the

future.

ASU 2017-08, Receivables – Non-refundable Fees and Other

Costs (Subtopic 310-20).

In

March 2017, the FASB issued ASU 2017-08, Receivables –

Non-refundable Fees and Other Costs (Subtopic 310-20). The main

objective of this update is to shorten the period of amortization

of the premium on certain callable debt securities to the earliest

call date. However, the amendments do not require an accounting

change for securities held at a discount; the discount continues to

be amortized to maturity. The amendment is effective for annual

periods beginning after December 15, 2018, including interim

periods within those annual periods. We elected to early adopt this

amendment as of January 1, 2018. None of our investments in 2017

had any premium paid, so no adjustments were needed for

prior-period activity. We do not believe the adoption of this

standard will have a material impact on our Financial Statements in

2018 or future periods.

From

time to time, new accounting pronouncements applicable to us are

issued by the FASB, or other standards setting bodies, which we

will adopt as of the specified effective date. Unless otherwise

discussed, we believe the impact of recently issued standards that

are not yet effective will not have a material impact on our

consolidated financial statements upon adoption.

Item 2.

Management’s Discussion and Analysis of Financial Condition

and Results of Operations

Overview

We

develop and manufacture products primarily for medical

applications. We market components to other equipment manufacturers

for incorporation in their products and sell finished devices to

physicians, hospitals, clinics and other treatment centers. Our

medical products primarily serve the fluid delivery,

cardiovascular, and ophthalmology markets. Our other medical and

non-medical products include instrumentation and disposables used

in dialysis and valves and inflation devices used in marine and

aviation safety products.

Our

products are used in a wide variety of applications by numerous

customers. We encounter competition in all of our markets and

compete primarily on the basis of product quality, price,

engineering, customer service and delivery time.

Our

strategy is to provide a broad selection of products in the areas

of our expertise. We focus our research and development, or

R&D, efforts on improving current products and developing

highly-engineered products that meet customer needs and serve niche

markets with meaningful sales potential. Proposed new products may

be subject to regulatory clearance or approval prior to

commercialization and the time period for introducing a new product

to the marketplace can be unpredictable. We also focus on

controlling costs by investing in modern manufacturing technologies

and controlling purchasing processes. We have been successful in

consistently generating cash from operations and have used that

cash to reduce and payoff indebtedness, to fund capital

expenditures, to repurchase stock and to pay

dividends.

Our

strategic objective is to further enhance our position in our

served markets by:

●

Focusing on

customer needs;

●

Expanding existing

product lines and developing new products;

●

Manufacturing

products to exacting quality standards; and

●

Preserving and

fostering a collaborative and entrepreneurial culture.

For the

three months ended June 30, 2018, we reported revenues of $38.8

million, operating income of $11.3 million and net income of $8.8

million, up 7 percent, up 11 percent and down 12 percent,

respectively, from the three months ended June 30, 2017. For the

six months ended June 30, 2018, we reported revenues of $78.2

million, operating income of $22.6 million and net income of $17.3

million, up 5 percent, up 5 percent and down 14 percent,

respectively, from the six months ended June 30, 2017. The decline

in net income for both the three and six month periods ended June

30, 2018 were attributable to higher effective tax rates in the

current year periods.

Results

for the three months ended June 30, 2018

Consolidated net

income totaled $8.8 million, or $4.75 per basic and $4.74 per

diluted share, in the second quarter of 2018. This is compared with

consolidated net income of $10.0 million, or $5.44 per basic and

$5.40 per diluted share, in the second quarter of 2017. The income

per basic share computations are based on weighted average basic

shares outstanding of 1,852,000 in the 2018 period and 1,844,000 in

the 2017 period. The income per diluted share computations are

based on weighted average diluted shares outstanding of 1,857,000

in the 2018 period and 1,858,000 in the 2017 period.

Consolidated

revenues of $38.8 million for the second quarter of 2018 were 7

percent higher than revenues of $36.2 million for the second

quarter of 2017. This increase was primarily attributable to

increased volumes of our fluid delivery products.

Revenues

by product line were as follows (in thousands):

|

|

Three Months ended

June 30,

|

|

|

|

|

|

|

|

|

|

Fluid

Delivery

|

$

18,128

|

$

15,630

|

|

Cardiovascular

|

13,003

|

12,222

|

|

Ophthalmology

|

2,852

|

3,762

|

|

Other

|

4,864

|

4,550

|

|

Total

|

$

38,847

|

$

36,164

|

Cost of

goods sold of $19.6 million for the second quarter of 2018 was 6

percent higher than cost of goods sold of $18.5 million for the

second quarter of 2017 primarily due to increased revenues

partially offset by improved manufacturing efficiencies and the

impact of continued cost improvement projects. Our cost of goods

sold in the second quarter of 2018 was 50.5 percent of revenues

compared with 51.1 percent of revenues in the second quarter of

2017.

Gross

profit of $19.2 million in the second quarter of 2018 was $1.5

million, or 9 percent, higher than in the comparable 2017 period.

Our gross profit percentage in the second quarter of 2018 was 49.5

percent of revenues compared with 48.9 percent of revenues in the

second quarter of 2017. The increase in gross profit percentage in

the 2018 period compared to the 2017 period was primarily related

to improved manufacturing efficiencies and cost improvement

projects mentioned above.

Our

second quarter 2018 operating expenses of $8.0 million were

$438,000 higher than the operating expenses for the second quarter

of 2017. This increase was attributable to a $22,000 increase in

General and Administrative, or G&A, expenses, a $181,000

increase in Selling expenses and a $235,000 increase in R&D

expenses. The increase in G&A expenses for the second quarter

of 2018 was principally attributable to increased outside services,

increased travel and increased software costs partially offset by

lower compensation and benefit costs. The increase in Selling

expenses was principally attributable to increased outside

services, trade shows and compensation. The increase in R&D

expenses was primarily related to increased outside services and

increased compensation partially offset by decreased supply

costs.

Operating income in

the second quarter of 2018 increased $1.1 million to $11.3 million,

an 11 percent increase compared to our operating income in the

quarter ended June 30, 2017. Operating income was 29 percent of

revenues for the second quarter of 2018 as compared to 28 percent

of revenues for the second quarter of 2017.

Interest and

dividend income in the second quarter of 2018 was $411,000,

compared with $370,000 for the same period in the prior year.

Increased levels of investment and increased interest rates were

the primary reasons for the increase.

Other

investment loss in the second quarter of 2018 was $408,000. We

adopted ASU 2016-01 as of January 1, 2018 (see Note 7). For the

second quarter of 2018 we recorded an unrealized loss on an equity

investment of $412,000 as a result of a decline in the market value

of this investment during the quarter.

Income

tax expense for the second quarter of 2018 was $2.5 million

compared to income tax expense of $519,000 for the same period in

the prior year. The effective tax rate for the second quarter of

2018 was 21.9 percent, compared with 4.9 percent for the second

quarter of 2017. The Tax Cuts and Jobs Act, reduced the corporate

federal income tax rate in the United States from 35 percent to 21

percent effective for us on January 1, 2018. Our effective tax rate

for the second quarter of 2017 was favorably impacted by excess tax

benefits of $3.0 million related to stock compensation together

with the benefit from the Section 199 deductions. We expect the

effective tax rate for the remainder of 2018 to be approximately

21.0 percent.

Results

for the six months ended June 30, 2017

Consolidated net

income totaled $17.3 million, or $9.33 per basic and $9.31 per

diluted share, in the first six months of 2018. This is compared

with consolidated net income of $20.0 million, or $10.86 per basic

and $10.76 per diluted share, in the first six months of 2017. The

income per basic share computations are based on weighted average

basic shares outstanding of 1,853,000 in the 2018 period and

1,839,000 in the 2017 period. The income per diluted share

computations are based on weighted average diluted shares

outstanding of 1,856,000 in both the 2018 and 2017

periods.

Consolidated

revenues of $78.2 million for the first six months of 2018 were 5

percent higher than revenues of $74.7 million for the first six

months of 2017. This increase was primarily attributable to

increased volumes of our fluid delivery and cardiovascular

products.

Revenues

by product line were as follows (in thousands):

|

|

Six Months ended

June 30,

|

|

|

|

|

|

|

|

|

|

Fluid

Delivery

|

$

36,928

|

$

33,636

|

|

Cardiovascular

|

26,213

|

23,686

|

|

Ophthalmology

|

5,637

|

7,435

|

|

Other

|

9,470

|

9,912

|

|

Total

|

$

78,248

|

$

74,669

|

Cost of

goods sold of $40.1 million for the first six months of 2018 was

$1.7 million higher than in the comparable 2017 period. The primary

contributor to the increase in our cost of goods sold was increased

revenues in the first six months of 2018. Our cost of goods sold in

the first six months of 2018 was 51.2 percent of revenues compared

with 51.4 percent of revenues in the first six months of

2017.

Gross

profit of $38.2 million in the first six months of 2018 was $1.8

million, or 5 percent, higher than in the comparable 2017 period.

Our gross profit percentage in the first six months of 2018 was

48.8 percent of revenues compared with 48.6 percent of revenues in

the first six months of 2017. The increase in gross profit

percentage in the 2018 period compared to the 2017 period was

primarily related to favorable manufacturing efficiencies in the

first six months of 2018.

Operating expenses

of $15.5 million for the first six months 2018 were $719,000 higher

than the operating expenses for the first six months of 2017. This

increase was comprised of a $233,000 increase in G&A, a

$452,000 increase in Selling expenses expenses and a $34,000

increase in R&D expenses. The increase in G&A expenses for

the first six months of 2018 was principally attributable to

increased outside services, increased travel and increased software

costs partially offset by decreased compensation and benefit costs.

The increase in Selling expenses was primarily related to increased

travel, increased promotion costs, increased outside services and

increased compensation. The increase in R&D costs was primarily

related to increased compensation and travel costs partially offset

by decreased regulatory costs and reduced repairs.

Operating income in

the first six months of 2018 increased $1.1 million to $22.6

million, a 5 percent increase from our operating income in the six

months ended June 30, 2017. Operating income was 29 percent of

revenues in both the first six months of 2018 and the first six

months of 2017.

Interest and

dividend income for the first six months of 2018 was $742,000,

compared with $519,000 for the same period in the prior year.

Increased levels of investment and increased interest rates were

the primary reasons for the increase.

We

adopted ASU 2016-01 as of January 1, 2018 (see Note 7). For the

first six months of 2018 we recorded an unrealized loss on an

equity investment of $1.2 million as a result of a decline in the

market value of this investment during the 2018 period which was

reflected as an Other investment loss on our income

statement.

Income

tax expense for the first six months of 2018 was $4.9 million

compared to income tax expense of $2.0 million for the same period

in the prior year. The effective tax rate for the first six months

of 2018 was 22.1 percent, compared with 9.3 percent for the first

six months of 2017. The effective tax rate for the first six months

of 2017 was favorably impacted by a tax benefit of $5.3 million

related to excess tax benefits from stock compensation together

with the benefit from the Section 199 deductions.

Liquidity

and Capital Resources

As of

June 30, 2018, we had a $75.0 million revolving credit facility

with a money center bank, entered into on February 28, 2017,

pursuant to which the lender is obligated to make advances until

February 28, 2022. The credit facility is secured by substantially

all of our inventories, equipment and accounts receivable. We had

no outstanding borrowings under our credit facility at June 30,

2018. Our ability to borrow funds under the credit agreement from

time to time is contingent on meeting certain covenants in the loan

agreement, the most restrictive of which is the ratio of total debt

to earnings before interest, income tax, depreciation and

amortization. At June 30, 2018, we were in compliance with all

financial covenants.

At June

30, 2018, we had a total of $82.5 million in cash and cash

equivalents, short-term investments and long-term investments, an

increase of $7.7 million from December 31, 2017. The principal

contributor to this increase was operating results.

Cash

flows from operating activities of $20.9 million for the six months

ended June 30, 2018 were primarily comprised of net income plus the

net effect of non-cash expenses, increases to accounts payable and

accrued liabilities partially offset by increases to accounts

receivable and inventories. During the first six months of 2018, we

expended $7.6 million for the addition of property and equipment,

$26.9 million for the purchase of investments and $4.5 million for

dividends.

During the

same period, maturities of investments generated $24.0 million in

cash.

At June

30, 2018, we had working capital of $103.6 million, including $36.1

million in cash and cash equivalents and $24.2 million in

short-term investments. The $2.0 million decrease in working

capital during the first six months of 2018 was primarily related

to decreases in short-term investments and increases in accounts

payable and accrued liabilities. This decrease was partially offset

by increases in cash and cash equivalents and inventories. The net

decrease in cash and short-term investments was primarily related

to a shift in the investments mix to an increase in long-term

investments. The increase in inventories was primarily related to

replenishment of inventories to levels required for operational

effectiveness. The increase in accounts payable and accrued

liabilities is primarily related to timing of payments for

replenishment of inventories and operating

expenditures.

We

believe that our $82.5 million in cash, cash equivalents,

short-term investments and long-term investments, along with cash

flows from operations and available borrowings of up to $75.0

million under our credit facility, will be sufficient to fund our

cash requirements for at least the foreseeable future, including

the costs associated with the planned expansion of one of our

manufacturing facilities. We believe that our strong financial

position would allow us to access equity or debt financing should

that be necessary. Additionally, we believe that our cash and cash

equivalents, short-term investments and long-term investments, as a

whole, will continue to increase during the remainder of

2018

Forward-Looking Statements

Statements

in this Management’s Discussion and Analysis and elsewhere in

this Quarterly Report on Form 10-Q that are forward looking are

based upon current expectations, and actual results or future

events may differ materially. Therefore, the inclusion of such

forward-looking information should not be regarded as a

representation by us that our objectives or plans will be achieved.

Such statements include, but are not limited to, our effective tax

rate for the remainder of 2018, our ability to fund our cash

requirements for the foreseeable future with our current assets,

long-term investments, cash flow and borrowings under the credit

facility, our access to equity and debt financing, and the increase

in cash, cash equivalents, and investments during the remainder of

2018. Words such as “expects,” “believes,”

“anticipates,” “intends,”

“should,” “plans,” and variations of such

words and similar expressions are intended to identify such

forward-looking statements. Forward-looking statements contained

herein involve numerous risks and uncertainties, and there are a

number of factors that could cause actual results or future events

to differ materially, including, but not limited to, the following:

changing economic, market and business conditions; acts of war or

terrorism; the effects of governmental regulation; the impact of

competition and new technologies; slower-than-anticipated

introduction of new products or implementation of marketing

strategies; implementation of new manufacturing processes or

implementation of new information systems; our ability to protect

our intellectual property; changes in the prices of raw materials;

changes in product mix; intellectual property and product liability

claims and product recalls; the ability to attract and retain

qualified personnel; and the loss of, or any material reduction in

sales to, any significant customers. In addition, assumptions

relating to budgeting, marketing, product development and other

management decisions are subjective in many respects and thus

susceptible to interpretations and periodic review which may cause

us to alter our marketing, capital expenditures or other budgets,

which in turn may affect our results of operations and financial

condition. The forward-looking statements in this Quarterly Report

on Form 10-Q are made as of the date hereof, and we do not

undertake any obligation, and disclaim any duty, to supplement,

update or revise such statements, whether as a result of subsequent

events, changed expectations or otherwise, except as required by

applicable law.

Item 3. Quantitative and Qualitative Disclosures About Market

Risk

For

the quarter ended June 30, 2018, we did not experience any material

changes in market risk exposures that affect the quantitative and

qualitative disclosures presented in our 2017 Form

10-K.

Item 4.

Controls and

Procedures

Our

management, with the participation of our Chief Executive Officer

and our Chief Financial Officer, evaluated our disclosure controls

and procedures (as defined in Exchange Act Rules 13a-15(e) and

15d-15(e)) as of June 30, 2018. Based upon this evaluation, our

Chief Executive Officer and Chief Financial Officer have concluded

that our disclosure controls and procedures are effective. There

were no changes in our internal control over financial reporting

for the quarter ended June 30, 2018 that have materially affected

or are reasonably likely to materially affect our internal control

over financial reporting.

PART II

OTHER INFORMATION

Item 1.

Legal

Proceedings

From time to time, we may be involved in claims or

litigation that arise in the normal course of business. We are not

currently a party to any legal proceedings, which, if decided

adversely, would have a material adverse effect on our business,

financial condition, or results of operations

.

Item 1A.

Risk

Factors

There

were no material changes to the risk factors disclosed in our 2017

Form 10-K.

Item 6.

Exhibits

|

Exhibit

|

|

|

|

Number

|

|

Description

|

|

|

|

Amended and Restated Atrion Corporation 2006 Equity Incentive Plan

(As last amended on November 7, 2017)

|

|

|

|

Sarbanes-Oxley Act Section 302 Certification of Chief Executive

Officer

|

|

|

|

Sarbanes-Oxley Act Section 302 Certification of Chief Financial

Officer

|

|

|

|

Certification Pursuant To 18 U.S.C. Section 1350, As Adopted

Pursuant To Section 906 of The Sarbanes – Oxley Act Of

2002

|

|

|

|

Certification Pursuant To 18 U.S.C. Section 1350, As Adopted

Pursuant To Section 906 of The Sarbanes – Oxley Act Of

2002

|

|

101.INS

|

|

XBRL Instance Document

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the

registrant has duly caused this report to be signed on its behalf

by the undersigned thereunto duly authorized.

|

|

Atrion Corporation

(Registrant)

|

|

|

|

|

|

|

|

Date: August 7, 2018

|

By:

|

/s/

David

A. Battat

|

|

|

|

|

David

A. Battat

|

|

|

|

|

President

and

Chief

Executive Officer

|

|

|

|

|

|

|

|

Date: August 7, 2018

|

By:

|

/s/

Jeffery

Strickland

|

|

|

|

|

Jeffery

Strickland

|

|

|

|

|

Vice

President and

Chief

Financial Officer

(Principal Accounting and

Financial Officer)

|

|

Exhibit Index

|

Exhibit

|

|

|

|

Number

|

|

Description

|

|

|

|

Amended

and Restated Atrion Corporation 2006 Equity Incentive Plan (As last

amended on November 7, 2017)

|

|

|

|

Sarbanes-Oxley

Act Section 302 Certification of Chief Executive

Officer

|

|

|

|

Sarbanes-Oxley

Act Section 302 Certification of Chief Financial

Officer

|

|

|

|

Certification

Pursuant To 18 U.S.C. Section 1350, As Adopted Pursuant To Section

906 of The Sarbanes – Oxley Act Of 2002

|

|

|

|

Certification

Pursuant To 18 U.S.C. Section 1350, As Adopted Pursuant To Section

906 of The Sarbanes – Oxley Act Of 2002

|

|

101.INS

|

|

XBRL Instance Document

|

|

101.SCH

|

|

XBRL Taxonomy Extension Schema Document

|

|

101.CAL

|

|

XBRL Taxonomy Extension Calculation Linkbase Document

|

|

101.DEF

|

|

XBRL Taxonomy Extension Definition Linkbase Document

|

|

101.LAB

|

|

XBRL Taxonomy Extension Label Linkbase Document

|

|

101.PRE

|

|

XBRL Taxonomy Extension Presentation Linkbase Document

|

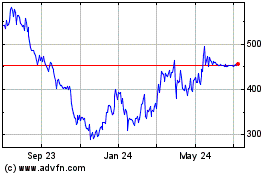

ATRION (NASDAQ:ATRI)

Historical Stock Chart

From Oct 2024 to Nov 2024

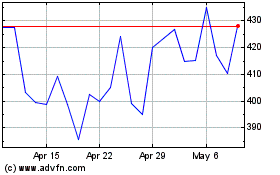

ATRION (NASDAQ:ATRI)

Historical Stock Chart

From Nov 2023 to Nov 2024