atai Life Sciences N.V. (Nasdaq: ATAI) (“atai”), a clinical-stage

biopharmaceutical company aiming to transform the treatment of

mental health disorders, today reported financial results for the

quarter ended March 31, 2022 and provided a business update.

“We made great progress in the first quarter on our mission to

achieve clinically meaningful behavioral change in people living

with mental health disorders – seeing strong momentum across our

three strategic pillars. We dosed the first subject in our Phase 1

KUR-101 trial and launched our fourth drug discovery program,

Invyxis. In addition, we initiated a usability study of Psyber in

patients receiving ketamine treatment, further advancing our

ongoing digital support programs,” said Florian Brand, Chief

Executive Officer & Co-Founder of atai.

“The first quarter of 2022 continued with strong execution of

our clinical pipeline. We anticipate several clinical milestones in

2022 and beyond, including data from the Phase 2 proof-of-concept

study of PCN-101 as a potential at-home-use therapy in treatment

resistant depression (TRD). We also anticipate results from a

relative bioavailability study comparing subcutaneous formulation

of PCN-101 to existing IV formulation, and additional Phase 1

readouts, including GRX-917, DMX-1002, and KUR-101. Finally, we

expect Phase 2 trial initiations for GRX-917 and RL-007, as well as

Phase 1 initiations for EMP-01 and VLS-101 during 2022 and RLS-01

in the first half of 2023. It’s a testament to our phenomenal team

that we anticipate to have 10 compounds in the clinic.” said

Srinivas Rao, Chief Scientific Officer & Co-Founder of

atai.

Video Interview with Management

A video interview with atai Life Sciences CEO & Co-Founder

Florian Brand, CSO & Co-Founder Srinivas Rao, and CFO Greg

Weaver will be available today at 8:30 a.m. Eastern Time at

https://vimeo.com/atailifesciences.

The interview will also be accessible for replay in the “Events”

section of the Company’s website at www.atai.life. The archived

copy of the interview will be available on the Company’s website

for at least 30 days.

Pipeline Highlights

The Company continued to execute in the first quarter advancing

many of its programs and is looking forward to additional clinical

milestones for the remainder of 2022 and beyond. The Company

anticipates 10 compounds in clinical development. atai’s

development pipeline of pharmaceuticals, digital therapeutics, and

precision mental health are supported by a total of 171 issued

patents and 49 pending non-provisional patents.

Treatment Resistant Depression (TRD)

Perception Neuroscience – PCN-101: After receiving FDA IND

Clearance in December 2021, Perception has reached agreement with

the FDA to move forward to expand its PCN-101 Phase 2a clinical

study initiated last September in Europe to the United States.

Perception has also initiated enrollment in a clinical drug-drug

interaction study in April 2022 to assess the pharmacokinetics of

PCN-101 when used concurrently with other drugs. In addition, a

relative bioavailability study comparing the subcutaneous

formulation to the existing IV formulation is anticipated to be

initiated later this year.

COMPASS Pathways – COMP-360: COMPASS held a productive

end-of-Phase 2 meeting with the FDA in April 2022.

Cognitive Impairment Associated with Schizophrenia (CIAS)

Recognify Life Sciences – RL-007: Recognify is expected to

initiate a Phase 2a proof-of concept trial in CIAS in the second

half of 2022, with the goal of demonstrating the pro-cognitive

benefit of RL-007 in CIAS.

Generalized Anxiety Disorder (GAD)

GABA Therapeutics – GRX-917: In June 2021, GABA initiated a

Phase 1 single and multiple ascending dose trial of GRX-917.

Topline data for this trial is expected by mid of this year and the

initiation of a Phase 2a proof-of-concept trial is anticipated to

follow in the second half of this year.

Opioid Use Disorder (OUD)

Kures – KUR-101: Kures initiated a Phase 1 trial in March 2022.

The trial is a randomized, double-blind, two-part study of the

safety, tolerability, pharmacokinetics, analgesic and respiratory

effects of KUR-101 in healthy volunteers. Part 1 is a five-cohort,

single ascending dose study of KUR-101. Part 2 is a three-period

crossover study to compare the analgesic and respiratory effects of

a single oral dose of KUR-101, a single oral dose of immediate

release oxycodone (OxyNorm™) and a single oral dose of placebo in

healthy male volunteers. Topline results are expected in the second

half of 2022.

Drug Discovery

Further strengthening atai’s commitment to next-generation

treatments, atai launched Invyxis in late January 2022 to

accelerate discovery of next generation mental health treatments.

Invyxis will add proven medicinal chemistry and comprehensive

biological evaluation capabilities to grow atai’s portfolio of new

chemical entities. The early focus will be on designing unique,

novel compounds targeting the serotonin 5-HT2A receptor with other

central nervous system receptor targets to follow. This new

platform company complements atai’s machine learning-powered

computational chemistry with EntheogeniX and biosynthesis-based

drug discovery approaches with TryptageniX.

Team Expansion

atai continued to strengthen its team in the first quarter by

securing key hires. At GABA Therapeutics Mario David Saltarelli,

M.D., Ph.D., was appointed as Chief Executive Officer and Chief

Medical Officer. Maju Mathews, M.D., and Cedric Burg were appointed

as CMO and SVP of Clinical Operations, respectively, at Perception

Neuroscience.

Consolidated Financial Results

atai ended the first quarter of 2022 with a cash position of

$335 million which it anticipates will be sufficient to provide a

cash runway through year end 2023.

Cash, Cash Equivalents, and Short-term investments

Cash, cash equivalents and short-term investments totaled $335

million as of March 31, 2022, compared to $362 million as of

December 31, 2021. The three-month net use of cash of $27 million

was primarily attributable to net cash used in operating activities

of $24.0 million and $3 million of additional investments in the

platform companies.

Operating Costs and Expenses

Research and development expenses were $15.5 million for the

three months ended March 31, 2022, as compared to $5.6 million for

the same prior year period. The increase of $9.9 million was

primarily attributable to an increase of $4.8 million of personnel

costs, which included a $3.6 million increase in stock-based

compensation expense and $4.9 million of increased contract

research organization expenses related to the advancement of

R&D programs.

There was no acquisition of in-process R&D expense for the

three months ended March 31, 2022. Acquisition of in-process

R&D expense for the same prior year period was $1.0 million,

which was primarily related to IPR&D acquired from

InnarisBio.

General and administrative expenses for the three months ended

March 31, 2022, were $18.0 million, as compared to $9.3 million in

the same prior year period. The increase of $8.7 million was

primarily attributable to a $6.4 million increase in stock-based

compensation expense, a $1.7 million increase in insurance costs,

and a $0.7 million increase in personnel and facilities costs.

Net loss attributable to shareholders for the three months ended

March 31, 2022, was $36.9 million. For the three months ended March

31, 2021, the Company recognized $0.7 million in net income

attributable to shareholders, primarily due to the recognition of

$19.9 million of license revenue related to the Otsuka Agreement

during the period.

About atai Life Sciences

atai Life Sciences is a clinical-stage biopharmaceutical company

aiming to transform the treatment of mental health disorders.

Founded in 2018 as a response to the significant unmet need and

lack of innovation in the mental health treatment landscape, atai

is dedicated to acquiring, incubating, and efficiently developing

innovative therapeutics to treat depression, anxiety, addiction,

and other mental health disorders.

atai's business model combines funding, technology, scientific,

and regulatory expertise with a focus on innovative compounds,

including psychedelic therapy and other drugs with differentiated

safety profiles and therapeutic potential. By pooling resources and

best practices, atai aims to responsibly accelerate the development

of new medicines across its companies to achieve clinically

meaningful and sustained behavioral change in mental health

patients.

atai's vision is to heal mental health disorders so

that everyone, everywhere can live a more fulfilled life. For more

information, please visit www.atai.life.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995, as amended. We intend such forward-looking statements to be

covered by the safe harbor provisions for forward-looking

statements contained in Section 27A of the Securities Act of 1933,

as amended (the “Securities Act”), and Section 21E of the

Securities Exchange Act of 1934, as amended (the “Exchange Act”).

The words “believe,” “may,” “will,” “estimate,” “continue,”

“anticipate,” “intend,” “expect,” “anticipate,” “initiate,”

“could,” “would,” “project,” “plan,” “potentially,” “preliminary,”

“likely,” and similar expressions are intended to identify

forward-looking statements, although not all forward-looking

statements contain these words. All statements contained in this

press release other than statements of historical fact, including

statements regarding our future operating results and financial

position, the success, cost, and timing of development of our

product candidates, including the progress of preclinical studies

and clinical trials and related milestones, the commercialization

of our current product candidates and any other product candidates

we may identify and pursue, if approved, including our ability to

successfully build a specialty sales force and commercial

infrastructure to market our current product candidates and any

other product candidates we may identify and pursue, the timing of

and our ability to obtain and maintain regulatory approvals, our

business strategy and plans, potential acquisitions, and the plans

and objectives of management for future operations and capital

expenditures, are forward-looking statements. The forward-looking

statements in this press release are neither promises nor

guarantees, and you should not place undue reliance on these

forward-looking statements because they involve known and unknown

risks, uncertainties, and other factors, many of which are beyond

our control and which could cause actual results, levels of

activity, performance or achievements to differ materially from

those expressed or implied by these forward-looking statements.

We have based these forward-looking statements largely on our

current expectations and projections about future events and trends

that we believe may affect our financial condition, results of

operations, business strategy, short-term and long-term business

operations and objectives, and financial needs. These

forward-looking statements are subject to a number of risks,

uncertainties, and assumptions, including without limitation:

statements regarding our future operating results and financial

position, the success, cost and timing of development of our

product candidates, including the progress of preclinical studies

and clinical trials and related milestones, the commercialization

of our current product candidates and any other product candidates

we may identify and pursue, if approved, including our ability to

successfully build a specialty sales force and commercial

infrastructure to market our current product candidates and any

other product candidates we may identify and pursue, the timing of

and our ability to obtain and maintain regulatory approvals, our

business strategy and plans, potential acquisitions, and the plans

and objectives of management for future operations and capital

expenditures. Other risk factors include the important factors

described in the section titled “Risk Factors” in our most recent

Annual Report on Form 10-K filed with the Securities and Exchange

Commission (“SEC”), as updated by our subsequent filings with the

SEC, that may cause our actual results, performance, or

achievements to differ materially and adversely from those

expressed or implied by the forward-looking statements.

Any forward-looking statements made herein speak only as of the

date of this press release, and you should not rely on

forward-looking statements as predictions of future events.

Although we believe that the expectations reflected in the

forward-looking statements are reasonable, we cannot guarantee that

the future results, performance, or achievements reflected in the

forward-looking statements will be achieved or will occur. Except

as required by applicable law, we undertake no obligation to update

any of these forward-looking statements for any reason after the

date of this press release or to conform these statements to actual

results or revised expectations.

Contact Information

Investor Contact:Greg WeaverChief Financial

Officergreg.weaver@atai.life

Media Contact:Maggie GordonSenior Manager of

Communicationsmaggie@atai.life

|

ATAI LIFE SCIENCES N.V. |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Amounts in thousands, except share and per share

amounts) |

|

(unaudited) |

| |

|

|

|

|

| |

|

Three Months Ended |

| |

|

March 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

License revenue |

|

$ |

— |

|

|

$ |

19,880 |

|

|

Operating expenses: |

|

|

|

|

|

Research and development |

|

|

15,460 |

|

|

|

5,585 |

|

|

Acquisition of in-process research and development |

|

|

— |

|

|

|

972 |

|

|

General and administrative |

|

|

17,982 |

|

|

|

9,273 |

|

|

Total operating expenses |

|

|

33,442 |

|

|

|

15,830 |

|

|

Income (loss) from operations |

|

|

(33,442 |

) |

|

|

4,050 |

|

|

Other income (expense), net |

|

|

1,521 |

|

|

|

1,703 |

|

|

Net income (loss) before income taxes |

|

|

(31,921 |

) |

|

|

5,753 |

|

|

Provision for income taxes |

|

|

(41 |

) |

|

|

(6 |

) |

|

Losses from investments in equity method investees, net of tax |

|

|

(5,596 |

) |

|

|

(1,703 |

) |

|

Net income (loss) |

|

|

(37,558 |

) |

|

|

4,044 |

|

|

Net income (loss) attributable to redeemable noncontrolling

interests and noncontrolling interests |

|

|

(689 |

) |

|

|

3,356 |

|

|

Net income (loss) attributable to ATAI Life Sciences N.V.

stockholders |

|

$ |

(36,869 |

) |

|

$ |

688 |

|

|

Net income (loss) per share attributable to ATAI Life Sciences N.V.

stockholders-- basic |

|

$ |

(0.24 |

) |

|

$ |

0.01 |

|

|

Net income (loss) per share attributable to ATAI Life Sciences N.V.

stockholders-- diluted |

|

$ |

(0.24 |

) |

|

$ |

0.01 |

|

|

Weighted average common shares outstanding attributable to ATAI

Life Sciences N.V. stockholders — basic |

|

|

153,529,268 |

|

|

|

119,258,529 |

|

|

Weighted average common shares outstanding attributable to ATAI

Life Sciences N.V. stockholders — diluted |

|

|

153,529,268 |

|

|

|

121,374,430 |

|

|

|

|

|

|

|

| ATAI LIFE

SCIENCES N.V. |

| CONDENSED

CONSOLIDATED BALANCE SHEET |

| (Amounts in

thousands) |

| |

|

|

|

|

| |

|

March

31, |

|

December

31, |

| |

|

2022 |

|

2021 |

| |

|

(unaudited) |

|

(1) |

|

Assets |

|

|

|

|

|

Cash and cash equivalents |

|

$ |

123,975 |

|

$ |

362,266 |

| Debt

securities carried at fair value |

|

|

210,939 |

|

|

— |

| Prepaid

expenses and other current assets |

|

|

12,985 |

|

|

11,903 |

| Short term

notes receivable |

|

|

887 |

|

|

913 |

| Property and

equipment, net |

|

|

178 |

|

|

149 |

| Equity

method investments |

|

|

9,749 |

|

|

16,131 |

| Other

investments |

|

|

10,587 |

|

|

11,628 |

| Long term

notes receivable - related parties |

|

|

6,928 |

|

|

3,835 |

| Other

assets |

|

|

7,504 |

|

|

7,341 |

|

Total assets |

|

$ |

383,732 |

|

$ |

414,166 |

|

Liabilities and Stockholders' Equity |

|

|

|

|

| Accounts

payable |

|

|

3,612 |

|

|

6,004 |

| Accrued

liabilities |

|

|

18,252 |

|

|

14,829 |

| Current

portion of contingent consideration liability - related

parties |

|

|

— |

|

|

51 |

| Other

current liabilities |

|

|

227 |

|

|

51 |

| Non-current

portion of contingent consideration liability - related

parties |

|

|

2,433 |

|

|

2,432 |

| Convertible

promissory notes - related parties, net of discounts and deferred

issuance costs |

|

|

725 |

|

|

743 |

| Other

liabilities |

|

|

4,126 |

|

|

4,097 |

| Total

stockholders' equity attributable to ATAI Life Sciences N.V.

stockholders |

|

|

346,006 |

|

|

376,908 |

|

Noncontrolling interests |

|

|

8,351 |

|

|

9,051 |

|

Total liabilities and stockholders' equity |

|

$ |

383,732 |

|

$ |

414,166 |

| |

|

|

|

|

|

(1) The condensed consolidated financial statements as of and for

the year ended December 31, 2021 are derived from the audited

consolidated financial statements as of that date. |

|

|

|

|

|

|

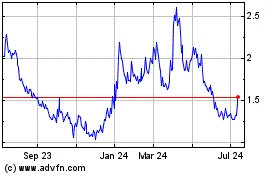

ATAI Life Sciences NV (NASDAQ:ATAI)

Historical Stock Chart

From Oct 2024 to Nov 2024

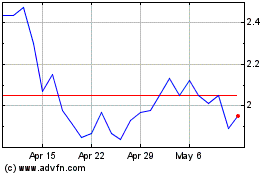

ATAI Life Sciences NV (NASDAQ:ATAI)

Historical Stock Chart

From Nov 2023 to Nov 2024