Astronics Corporation (NASDAQ: ATRO) today announced that its

previously reported results for the 2008 fourth quarter and full

year ended December 31, 2008, have been revised to reflect the

write off of all remaining assets related to its business with

Eclipse Aviation, which last week informed its suppliers that it

has suspended all business operations after deciding not to contest

a motion by senior secured creditors to convert its bankruptcy

proceedings to a Chapter 7 liquidation.

On February 12, 2009, Astronics reported its fourth quarter and

full year 2008 results, which included a $7.5 million, or $0.46 per

share, charge related to Eclipse. The charge was comprised of $1.0

million for accounts receivable and $6.5 million for inventory and

equipment. At the time, the Company had $1.0 million of accounts

receivable and $9.0 million of inventory and equipment related to

Eclipse. In November 2008, Eclipse had filed for protection under

Chapter 11 of the bankruptcy law. Its stated intention at that time

was to reorganize and emerge from bankruptcy under new ownership.

Based on this information, Astronics retained inventory and

equipment totaling $2.5 million in anticipation of future business

with Eclipse.

In light of the most recent information, specifically the change

in bankruptcy status which occurred prior to Astronics� filing of

its financial statements, the Company recorded an additional

pre-tax charge of $2.5 million for inventory and equipment related

to the Eclipse business. The effect net of tax was an additional

$1.6 million, or $0.15 per share, reduction in net income for the

2008 fourth quarter and full year compared with earlier released

financial results. As a result, net loss for the fourth quarter of

2008 was $1.8 million, or $0.17 per diluted share, and net income

for 2008 was $8.4 million, or $0.79 per diluted share. Revised

consolidated financial data is included with this release.

Astronics also reaffirms its previous expectations for 2009

revenue to be in the range of approximately $230 and $245

million.

ABOUT ASTRONICS CORPORATION

Astronics Corporation is a designer and manufacturer of high

performance lighting and power management systems for the global

aerospace industry; automated diagnostic test systems, training and

simulation devices for the defense industry; and safety and

survival equipment for airlines and airfields. Astronics� strategy

is to develop and maintain positions of technical leadership in its

chosen aerospace and defense markets, to leverage those positions

to grow the amount of content and volume of product it sells to

those markets and to selectively acquire businesses with similar

technical capabilities that could benefit from our leadership

position and strategic direction. Astronics Corporation, and its

wholly-owned subsidiaries, DME Corporation, Astronics Advanced

Electronic Systems Corp. and Luminescent Systems Inc., have a

reputation for high quality designs, exceptional responsiveness,

strong brand recognition and best-in-class manufacturing practices.

The Company routinely posts news and other important information on

its website at www.Astronics.com.

For more information on Astronics and its products, visit its

website at www.Astronics.com.

Safe Harbor Statement

This press release contains forward-looking statements as

defined by the Securities Exchange Act of 1934. One can identify

these forward-looking statements by the use of the words �expect,�

�anticipate,� �plan,� �may,� �will,� �estimate� or other similar

expression. Because such statements apply to future events, they

are subject to risks and uncertainties that could cause the actual

results to differ materially from those contemplated by the

statements. Important factors that could cause actual results to

differ materially include the state of the aerospace industry, the

market acceptance of newly developed products, internal production

capabilities, the timing of orders received, the status of customer

certification processes, the demand for and market acceptance of

new or existing aircraft which contain the Company�s products,

customer preferences, and other factors which are described in

filings by Astronics with the Securities and Exchange Commission.

The Company assumes no obligation to update forward-looking

information in this press release whether to reflect changed

assumptions, the occurrence of unanticipated events or changes in

future operating results, financial conditions or prospects, or

otherwise.

ASTRONICS CORPORATION

CONSOLIDATED INCOME STATEMENT

DATA

(unaudited) � � � � (in thousands except per share data)

Three

months ended Twelve months ended �

12/31/2008 � �

�

12/31/2007 � � �

12/31/2008 � � �

12/31/2007

� Sales $ 44,381 $ 36,273 $ 173,722 $ 158,240 Cost of products sold

� 42,438 � � � 28,630 � � 143,249 � � � 117,370 � 1,943 7,643

30,473 40,870 Gross margin 4.4 % 21.1 % 17.5 % 25.8 % Selling,

general and administrative 4,867 3,851 17,419 16,408 � � � � � � �

Income(loss) from operations (2,924 ) 3,792 13,054 24,462 Operating

margin -6.6 % 10.5 % 7.5 % 15.5 % Interest expense, net 140 298 694

1,370 Other (income) expense � (3 ) � � 105 � � � 70 � � � 94 �

Income(loss) before tax (3,061 ) 3,389 12,290 22,998 Income

taxes(benefit) � (1,280 ) � � 1,320 � � � 3,929 � � � 7,607 �

Net Income(loss) $ (1,781 ) �

$

2,069 � �

$ 8,361 � �

$ 15,391 �

� *Basic earnings(loss) per share: $ (0.17 ) $ 0.20 $ 0.82 $ 1.52

*Diluted earnings(loss) per share: $ (0.17 ) $ 0.19 $ 0.79 $ 1.44 �

*Weighted average diluted shares outstanding 10,556 10,854 10,650

10,711 � � � � � � � � � Capital Expenditures $ 1,137 $ 2,026 $

4,325 $ 9,592 Depreciation and Amortization � $ 1,153 � � $ 993 � �

$ 4,142 � � $ 3,440 � � � * All share quantities and per share data

reported for 2007 has been restated to reflect the impactof the

one-for-four Class B stock distribution for shareholders of record

on October 6, 2008.

ASTRONICS CORPORATION

CONSOLIDATED BALANCE SHEET

DATA

(unaudited) (in thousands) � �

12/31/2008 �

12/31/2007

ASSETS:

Cash and cash equivalents $ 3,038 $ 2,818 Accounts receivable

22,053 20,720 Inventories 35,586 36,920 Other current assets 6,078

3,563 Property, plant and equipment, net 29,075 30,083 Other assets

� 8,844 � � 10,017 Total Assets $ 104,674 � $ 104,121 �

LIABILITIES AND SHAREHOLDERS'

EQUITY:

Current maturities of long term debt $ 920 $ 951 Note payable -

7,300 Accounts payable and accrued expenses 22,475 23,670 Long-term

debt 13,526 14,684 Other liabilities 9,498 8,284 Shareholders'

equity � 58,255 � � 49,232 Total liabilities and shareholders'

equity $ 104,674 � $ 104,121

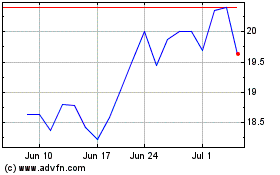

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From May 2024 to Jun 2024

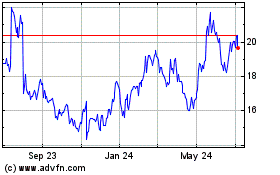

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From Jun 2023 to Jun 2024