Astronics Corporation (NASDAQ: ATRO), a trusted leader in

innovative, high performance lighting, power generation, control

and distribution systems for the global aerospace industry, today

reported sales of $40.4 million in the third quarter of 2008, which

ended September 27, 2008, up 7.0% compared with $37.7 million in

the third quarter of 2007. Net income declined to $2.4 million, or

$0.22 per diluted share, in the third quarter of 2008 compared with

$4.1 million, or $0.38 per diluted share, in the same period the

prior year. Net income was adversely impacted by higher engineering

and development spending, higher manufacturing costs related to

increased infrastructure and capacity, and sales mix. All per share

data was adjusted to reflect a one-for-four Class B Stock

distribution that was distributed on or about October 17, 2008.

Commercial transport market sales increased to $25.5 million in the

third quarter of 2008, up 10.3% compared with $23.1 million in the

same period the prior year primarily as a result of increased cabin

electronics sales. Military sales increased 12.2% to $7.6 million

in the third quarter of 2008 compared with $6.7 million in the

prior year�s third quarter. Sales to the business jet market

decreased $0.5 million to $7.1 million compared with $7.6 million

in the third quarters of 2008 and 2007, respectively. Lower sales

to this market were directly related to a $1.7 million decline in

sales to Eclipse Aviation, a very light jet manufacturer, in the

third quarter of 2008 compared with the prior year�s third quarter.

This decrease was mostly offset by higher sales to other business

jet manufacturers, which included new aircraft that had higher

values of product content. Peter J. Gundermann, President and Chief

Executive Officer of Astronics, commented, �Our third quarter

demonstrated solid results despite weakening macro-economic

conditions and the reduction in aircraft production by Eclipse

Aviation. However, strong sales to our customers in the commercial

transport and military markets, as well as other business jet

manufacturers, more than offset the impact of Eclipse�s decline.�

Third Quarter Operating Results Gross profit was $7.9 million, or

19.6% of sales, in the third quarter of 2008 compared with $10.1

million, or 26.9% of sales, in the same period the prior year. The

third quarter of 2007 was positively impacted by a $0.9 million

adjustment related to the 2007 estimated manufacturing overhead

cost absorption. The reduction in gross margin reflects higher

engineering and development (E&D) spending, combined with

overall higher manufacturing costs primarily related to increased

infrastructure and capacity somewhat offset by greater operating

leverage from higher sales. E&D expenses were $5.7 million in

the third quarter of 2008 compared with $3.9 million in the third

quarter of 2007. Selling, general and administrative and other

(SG&A) expense was $4.1 million, or 10.1% of sales, in the

third quarter of 2008, up slightly on an absolute basis compared

with $3.9 million, or 10.3% of sales, in the same period the prior

year. Operating margin for the third quarter of 2008 was 9.6%

compared with 16.6% in the third quarter of 2007, primarily as a

result of the lower gross margin. Nine-Month Review For the first

nine months of 2008, sales were $129.3 million, up $7.3 million, or

6.0%, compared with $122.0 million in the first nine months of

2007. Gross profit was down $4.7 million in the 2008 nine-month

period. Gross margin was 22.1% in the first nine months of 2008,

down from 27.2% in the same period the prior year primarily due to

higher E&D expenses, combined with an overall increase in

manufacturing costs related to increased infrastructure and

capacity somewhat offset by greater operating leverage from higher

sales and sales mix. E&D expense for the first nine months of

2008 was $16.6 million compared with $11.1 million in the first

nine months on 2007. E&D expense is expected to be

approximately $22 million for 2008. SG&A expense remained flat

at $12.6 million for the first nine months of 2008 and 2007.

Operating margin was 12.4% for the first nine months of 2008

compared with 16.9% in the same period the prior year reflecting

the lower gross margin. Net income was $10.1 million, or $0.95 per

diluted share, in the first nine months of 2008 compared with $13.3

million, or $1.25 per diluted share, in the same period the prior

year. Mr. Gundermann noted, �Margins this year have been affected

by our increased E&D spending, which is focused on applied

development of new technologies and products. We believe these

innovations are key enablers of our future growth.� Liquidity and

Capital Expenditures Cash and cash equivalents were $0.5 million at

September 27, 2008 compared with $2.8 million at December 31, 2007,

as cash was used to pay down debt and fund increasing working

capital requirements. The Company has a $60 million line of credit

of which $56 million was available at the end of the third quarter.

Capital expenditures for the third quarter and first nine months of

2008 were $1.1 million and $3.2 million, respectively, compared

with $1.6 million and $7.6 million in the same periods the prior

year, respectively. The higher expenditures in 2007 were primarily

to support facility expansions and equipment investments. Capital

expenditures are expected to be approximately $4.5 million to $6

million for 2008. Outlook Orders in the third quarter of 2008 were

$30.8 million compared with $33.3 million in the third quarter of

2007. Backlog at September 27, 2008 was $92.1 million, up from

backlog of $90.0 million at the end of the third quarter of 2007.

Approximately 50% of backlog is currently planned for shipment in

the fourth quarter of 2008. Mr. Gundermann concluded, �Bookings in

the third quarter were lower than our recent pace due, in part, to

the removal of $3.6 million in Eclipse orders and because the third

quarter tends to be the lightest quarter for bookings. While we

recognize that there are serious economic issues right now, our

market continues to show strength. Most of our original equipment

manufacturer customers are planning production levels next year

that will be at or above the current rates. We are maintaining a

revenue forecast at the lower end of our previous range at

approximately $175 million for fiscal 2008, which represents an 11%

increase compared with 2007 sales. We plan to provide revenue

guidance for 2009 when we release our fourth quarter results early

in 2009.� Third Quarter 2008 Webcast and Conference Call The

Company will host a teleconference at 11 a.m. ET today. During the

teleconference, Peter J. Gundermann, President and CEO, and David

C. Burney, Vice President and CFO, will review the financial and

operating results for the period and discuss Astronics� corporate

strategy and outlook. A question-and-answer session will follow.

The Astronics conference call can be accessed the following ways:

The live webcast can be found at http://www.astronics.com.

Participants should go to the website 10 - 15 minutes prior to the

scheduled conference in order to register and download any

necessary audio software. The teleconference can be accessed by

dialing (201) 689-8562 and requesting conference ID number 300129

approximately 5 - 10 minutes prior to the call. To listen to the

archived call: The archived webcast will be at

http://www.astronics.com. A transcript will also be posted once

available. A replay can also be heard by calling (201) 612-7415 and

referencing account number 3055 and conference ID number 300129.

The telephonic replay will be available from 2 p.m. ET the day of

the call through 11:59 p.m. ET on November 6, 2008. ABOUT ASTRONICS

CORPORATION Astronics Corporation is a trusted leader in

innovative, high performance lighting, power generation, control

and distribution systems for the global aerospace industry. Its

strategy is to expand the value and content it provides to various

aircraft platforms through product development and acquisition.

Astronics Corporation, and its wholly-owned subsidiaries Astronics

Advanced Electronic Systems Corp. and Luminescent Systems Inc.,

have a reputation for high quality designs, exceptional

responsiveness, strong brand recognition and best-in-class

manufacturing practices. For more information on Astronics and its

products, visit its website at www.Astronics.com. Safe Harbor

Statement This press release contains forward-looking statements as

defined by the Securities Exchange Act of 1934. One can identify

these forward-looking statements by the use of the words �expect,�

�anticipate,� �plan,� �may,� �will,� �estimate� or other similar

expression. Because such statements apply to future events, they

are subject to risks and uncertainties that could cause the actual

results to differ materially from those contemplated by the

statements. Important factors that could cause actual results to

differ materially include the state of the aerospace industry, the

market acceptance of newly developed products, internal production

capabilities, the timing of orders received, the status of customer

certification processes, the demand for and market acceptance of

new or existing aircraft which contain the Company�s products,

customer preferences, and other factors which are described in

filings by Astronics with the Securities and Exchange Commission.

The Company assumes no obligation to update forward-looking

information in this press release whether to reflect changed

assumptions, the occurrence of unanticipated events or changes in

future operating results, financial conditions or prospects, or

otherwise. ASTRONICS CORPORATION CONSOLIDATED INCOME STATEMENT DATA

(unaudited) � � (in thousands except per share data) Three months

ended Nine months ended � 9/27/2008 � � 9/29/2007 � � � � 9/27/2008

� � 9/29/2007 � Sales $ 40,363 $ 37,724 $ 129,341 $ 121,967 Cost of

products sold � 32,455 � � 27,582 � � 100,811 � � 88,740 � Gross

profit 7,908 10,142 28,530 33,227 Gross margin 19.6 % 26.9 % 22.1 %

27.2 % Selling general and administrative � 4,030 � � 3,877 � � � �

12,552 � � 12,557 � Income from operations 3,878 6,265 15,978

20,670 Operating margin 9.6 % 16.6 % 12.4 % 16.9 % Interest

expense, net 182 396 554 1,072 Other (income) expense � 60 � � - �

� � � 73 � � (11 ) Income before tax 3,636 5,869 15,351 19,609

Income taxes � 1,257 � � 1,743 � � � � 5,209 � � 6,287 � Net Income

$ 2,379 � $ 4,126 � � � $ 10,142 � $ 13,322 � � Basic earnings per

share:* $ 0.23 $ 0.41 $ 0.99 $ 1.32 Diluted earnings per share:* $

0.22 $ 0.38 $ 0.95 $ 1.25 � Weighted average diluted shares

outstanding* 10,688 10,669 10,681 10,618 � � � � � � � Capital

Expenditures $ 1,058 $ 1,649 $ 3,188 $ 7,566 Depreciation and

Amortization $ 980 � $ 876 � � � $ 2,989 � $ 2,447 � * All share

quantities and per share data reported have been adjusted to

reflect the impact of a one-for-four Class B stock distribution

that was distributed on or about October 17, 2008. ASTRONICS

CORPORATION ORDER AND BACKLOG TREND � � � � � � � ($, in thousands)

2007 2008 Q1 2007 Q2 2007 Q3 2007 Q4 2007 Twelve Months Q1 2008 Q2

2008 Q3 2008 � � � 3/31/07 � � � 6/30/07 � � � 9/29/07 � � �

12/31/07 � � � 12/31/07 � � � 3/29/08 � � � 6/28/08 � � � 9/27/08

Sales $ � 42,875 � $ � 41,368 � $ � 37,724 � $ � 36,273 � $ �

158,240 � $ � 41,089 � $ � 47,889 � $ � 40,363 Net Income $ � 4,695

� $ � 4,501 � $ � 4,126 � $ � 2,069 � $ � 15,391 � $ � 2,647 � $ �

5,116 � $ � 2,379 Bookings $ � 40,351 � $ � 38,711 � $ � 33,347 � $

� 38,712 � $ � 151,121 � $ � 45,830 � $ � 52,386 � $ � 30,798

Backlog $ � 97,003 � $ � 94,346 � $ � 89,969 � $ � 92,408 � $ �

92,408 � $ � 97,149 � $ � 101,646 � $ � 92,081 Book:Bill � 0.94 �

0.94 � 0.88 � 1.07 � 0.96 � 1.12 � 1.09 � 0.76 ASTRONICS

CORPORATION CONSOLIDATED BALANCE SHEET DATA (unaudited) (in

thousands) � � 9/27/2008 � � 12/31/2007 ASSETS: Cash and cash

equivalents $ 509 $ 2,818 Accounts receivable 27,818 20,720

Inventories 42,661 36,920 Other current assets 3,184 3,563

Property, plant and equipment, net 30,611 30,083 Other assets �

9,169 � � 10,017 Total Assets $ 113,952 � $ 104,121 � LIABILITIES

AND SHAREHOLDERS' EQUITY: Current maturities of long term debt $

943 $ 951 Note payable 4,000 7,300 Accounts payable and accrued

expenses 25,986 23,670 Long-term debt 14,093 14,684 Other

liabilities 8,253 8,284 Shareholders' equity � 60,677 � � 49,232

Total liabilities and shareholders' equity $ 113,952 � $ 104,121

ASTRONICS CORPORATION SALES BY MARKET ($, in thousands) � � � � � �

� Three Months Ended Nine Months Ended � 9/27/2008 � � 9/29/2007 �

% change � � � 9/27/2008 � � 9/29/2007 � % change � � 2008 YTD % �

Commercial Transport $ 25,501 $ 23,116 10 % $ 77,609 $ 79,433 -2 %

60 % Military 7,556 6,731 12 % 24,225 19,696 23 % 19 % Business Jet

7,052 7,626 -8 % 26,687 21,952 22 % 20 % Other 254 251 1 % 820 886

-7 % 1 % � � � � � � � � � � � � � Total $ 40,363 � $ 37,724 � 7 %

� $ 129,341 � $ 121,967 � 6 % � 100 % � ASTRONICS CORPORATION �

SALES BY PRODUCT ($, in thousands) � � � � � Three Months Ended

Nine Months Ended � 9/27/2008 � � 9/29/2007 � % change � � �

9/27/2008 � � 9/29/2007 � % change � � 2008 YTD % � Cabin

Electronics $ 20,548 $ 18,803 9 % $ 63,418 $ 65,556 -3 % 49 %

Cockpit Lighting 9,689 10,051 -4 % 32,679 27,064 21 % 25 % Airframe

Power 5,169 4,079 27 % 17,493 15,362 14 % 14 % Exterior Lighting

2,247 2,353 -5 % 8,065 6,437 25 % 6 % Cabin Lighting 2,456 2,187 12

% 6,866 6,662 3 % 5 % Other 254 251 1 % 820 886 -7 % 1 % � � � � �

� � � � � � � � Total $ 40,363 � $ 37,724 � 7 % � $ 129,341 � $

121,967 � 6 % � 100 %

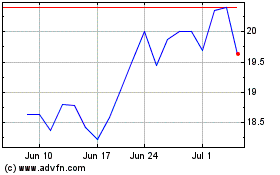

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From May 2024 to Jun 2024

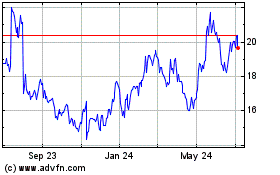

Astronics (NASDAQ:ATRO)

Historical Stock Chart

From Jun 2023 to Jun 2024