Astec Industries, Inc. (Nasdaq: ASTE) announced today the

appointment of Mr. Barry Ruffalo as its President and Chief

Executive Officer to be effective on August 12, 2019. Mr. Ruffalo

has also been elected to the Board of Directors. Mr. Ruffalo will

join the Board of Directors as a Class I director and will stand

for re-election at the Company’s 2020 annual meeting. On the

effective date of Mr. Ruffalo’s appointment, Richard Dorris,

Interim Chief Executive Officer, will resume his role as Chief

Operating Officer.

Prior to his appointment, Mr. Ruffalo was

employed by Valmont Industries, a publicly-traded diversified

global producer of highly-engineered fabricated metal products,

where he served in Group President roles since 2016, having

previously served as its Executive Vice President, Operational

Excellence beginning in 2015. Prior to his work with Valmont

Industries, Mr. Ruffalo was employed by Lindsay Corporation, a

publicly-traded global leader in proprietary water management and

road infrastructure products and services.

“After a comprehensive search that included a

number of highly qualified candidates, we are excited to hire Mr.

Ruffalo,” said Bill Gehl, Chairman of Astec. “Barry brings a wealth

of experience to Astec. He is a leader that has driven change,

understands infrastructure and will add tremendous value.”

“I am excited to join Astec as its CEO and a

member of the Board of Directors, said Mr. Ruffalo. “I look forward

to moving forward with measures to make Astec more profitable and

agile while building on the strength of its world-class

products.”

In addition, the Company reported results for

its second quarter ended June 30, 2019.

Net sales for the second quarter of 2019 were

$304.8 million compared to $272.5 million for the second quarter of

2018, an 11.8% increase. Domestic sales increased 21.1% to $246.2

million for the second quarter of 2019 from $203.4 million for the

second quarter of 2018. International sales decreased 15.3% to

$58.6 million for the second quarter of 2019 from $69.1 million for

the second quarter of 2018. During the quarter, the Company

recognized $20.0 million of pre-tax profit on the sale of its

Hazlehurst, Georgia wood pellet plant.

Net income for the second quarter of 2019 was

$23.4 million or $1.03 per diluted share, compared to a net loss of

$40.7 million or $1.76 per diluted share for the second quarter of

2018.

Net sales for the first half of 2019 were $630.6

million compared to $598.0 million for the first half of 2018, an

increase of 5.5%. Domestic sales increased 7.5% to $509.0 million

for the first half of 2019 from $473.5 million for the first half

of 2018. International sales decreased 2.4% to $121.5 million for

the first half of 2019 from $124.5 million for the first half of

2018.

Net income for the first half of 2019 was $37.7

million or $1.66 per diluted share, compared to a net loss of $20.4

million or $0.89 per diluted share for the first half of 2018.

The following financial information for the

second quarter and first half of 2019 and 2018 excludes all of the

impact of wood pellet plant activity on the Company’s results

during those periods. International sales were not impacted by wood

pellet plant activity in any period.

Net sales for the

second quarter of 2019 were $284.8 million compared to $347.1

million for the second quarter of 2018, a decrease of $62.3 million

or 17.9%. Domestic sales decreased 18.6% to $226.2 million for the

second quarter of 2019 from $277.9 million for the second quarter

of 2018.

Earnings for the

second quarter of 2019 were $8.1 million or $0.36 per diluted

share, compared to $24.0 million or $1.03 per diluted share for the

second quarter of 2018, a decrease in earnings per share of

65.0%.

Net sales for the

first half of 2019 were $610.6 million compared to $672.8 million

for the first half of 2018, a decrease of $62.2 million or 9.2%.

Domestic sales decreased 10.8% to $489.0 million for the first half

of 2019 from $548.2 million for the first half of 2018.

Earnings for the

first half of 2019 were $22.4 million or $0.99 per diluted share,

compared to $46.9 million or $2.02 per diluted share for the first

half of 2018, a decrease in earnings per share of 51.0%.

Commenting on the quarterly results, Richard

Dorris, Interim Chief Executive Officer, stated, “We are pleased

the sale of the Hazlehurst, Georgia wood pellet plant completely

ended our involvement in the wood pellet plant business. Our EPS,

less the payment received for the wood pellet plant, however, was

$0.36 and below our expectations. The lower than expected earnings

are a result of lower than projected volume and under absorption of

production costs.”

The Company’s backlog at June 30, 2019 was

$246.1 million, a decrease of $56.8 million or 18.8% compared to

the June 30, 2018 backlog of $302.9 million. The June 30, 2019

backlog was up 4.1% or $9.6 million compared to the March 31, 2019

backlog of $236.5 million. Domestic backlog decreased 25.8% to

$161.6 million at June 30, 2019 from $217.9 million at June 30,

2018. The international backlog at June 30, 2019 was $84.5 million

compared to $85.0 million at June 30, 2018, remaining

flat.

Mr. Dorris concluded, “We have experienced

reduced demand in the first half of this year, but our ongoing

strategic procurement and operational excellence initiatives along

with manpower reductions at our most affected subsidiaries will

help us maintain and improve profitability even if market

conditions do not improve in the short term.”

Consolidated financial information for the

second quarter and six months ended June 30, 2019 and additional

information related to segment revenues and profits are attached as

addenda to this press release.

Investor Conference Call and Web

Simulcast

Astec will conduct a conference call today, July

23, 2019, at 10:00 A.M. Eastern Time, to review its second quarter

and six-month results as well as current business conditions. The

number to call for this interactive teleconference is (877)

407-9210. International callers should dial (201) 689-8049. Please

reference Astec Industries.

The Company will also provide an online Web

simulcast and rebroadcast of the conference call. The live

broadcast of Astec’s conference call will be available online at

the Company’s website: www.astecindustries.com/conferencecalls. An

archived webcast will be available for 90 days at

www.astecindustries.com.

A replay of the conference call will be

available through August 6, 2019 by dialing (877) 481-4010, or

(919) 882-2331 for international callers, Replay ID #50107. A

transcription of the conference call will be made available under

the Investor Relations section of the Astec Industries, Inc.

website within 5 business days after the call.

Astec Industries, Inc.,

(www.astecindustries.com), is a manufacturer of specialized

equipment for asphalt road building; aggregate processing; oil, gas

and water well drilling and concrete production. Astec's

manufacturing operations are divided into three primary business

segments: road building, (Infrastructure Group); aggregate

processing and mining equipment (Aggregate and Mining Group); and

equipment for the extraction and production of fuels and water

drilling equipment (Energy Group).

The information contained in this press release

contains “forward-looking statements” (within the meaning of the

Private Securities Litigation Reform Act of 1995) regarding the

future performance of the Company, including statements about the

effects on the Company from (i) product demand, (ii) the effect of

its strategic procurement and operational excellence initiatives,

(iii) efforts to adjust manpower, and (iv) its backlog activity.

These forward-looking statements reflect management’s expectations

and are based upon currently available information, and the Company

undertakes no obligation to update or revise such statements. These

statements are not guarantees of performance and are inherently

subject to risks and uncertainties, many of which cannot be

predicted or anticipated. Future events and actual results,

financial or otherwise, could differ materially from those

expressed in or implied by the forward-looking statements.

Important factors that could cause future events or actual results

to differ materially include: general uncertainty in the economy,

oil, gas and liquid asphalt prices, rising steel prices, decreased

funding for highway projects, the relative strength/weakness of the

dollar to foreign currencies, production capacity, general business

conditions in the industry, demand for the Company’s products,

seasonality and cyclicality in operating results, seasonality of

sales volumes or lower than expected sales volumes, lower than

expected margins on custom equipment orders, competitive activity,

tax rates and the impact of future legislation thereon, and those

other factors listed from time to time in the Company’s reports

filed with the Securities and Exchange Commission, including but

not limited to the Company’s annual report on Form 10-K for the

year ended December 31, 2018.

For Additional Information

Contact:

Richard J. Dorris Interim Chief Executive

Officer & Chief Operating Officer Phone: (423) 867-4210

Fax: (423) 867-4127 E-mail: rdorris@astecindustries.com

or

David C. Silvious Vice President and Chief

Financial Officer Phone: (423) 899-5898 Fax: (423) 899-4456

E-mail: dsilvious@astecindustries.com

or

Stephen C. Anderson Vice President, Director of

Investor Relations & Corporate Secretary Phone: (423) 899-5898

Fax: (423) 899-4456 E-mail: sanderson@astecindustries.com

| |

|

|

|

|

|

Astec Industries, Inc. |

|

|

|

Condensed Consolidated Balance Sheets |

|

|

|

(in thousands) |

|

|

|

(unaudited) |

|

|

|

|

|

|

|

|

June 30 |

June 30 |

|

|

|

|

|

2019 |

|

|

2018 |

|

|

|

|

Assets |

|

|

|

|

|

Current assets |

|

|

|

|

| Cash and

cash equivalents |

$ |

24,905 |

|

$ |

65,206 |

|

|

|

|

Investments |

|

1,211 |

|

|

1,972 |

|

|

|

|

Receivables, net |

|

139,196 |

|

|

144,205 |

|

|

|

|

Inventories |

|

360,883 |

|

|

394,789 |

|

|

|

| Prepaid

expenses and other |

|

31,340 |

|

|

36,044 |

|

|

|

| Total

current assets |

|

557,535 |

|

|

642,216 |

|

|

|

| Property

and equipment, net |

|

191,854 |

|

|

185,455 |

|

|

|

| Other

assets |

|

99,166 |

|

|

96,165 |

|

|

|

|

Total assets |

$ |

848,555 |

|

$ |

923,836 |

|

|

|

|

Liabilities and equity |

|

|

|

|

|

Current liabilities |

|

|

|

|

| Accounts

payable - trade |

$ |

70,338 |

|

$ |

64,702 |

|

|

|

| Other

current liabilities |

|

103,598 |

|

|

177,978 |

|

|

|

| Total

current liabilities |

|

173,936 |

|

|

242,680 |

|

|

|

| Long-term

debt, less current maturities |

|

28,891 |

|

|

1,062 |

|

|

|

|

Non-current liabilities |

|

25,120 |

|

|

23,113 |

|

|

|

| Total

equity |

|

620,608 |

|

|

656,981 |

|

|

|

|

Total liabilities and equity |

$ |

848,555 |

|

$ |

923,836 |

|

|

|

| |

|

|

|

|

| |

|

|

|

|

|

Astec Industries, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(in thousands, except per share data) |

|

(unaudited) |

|

|

|

|

|

|

Three Months Ended |

Six Months Ended |

|

|

June 30 |

June 30 |

|

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

Net sales |

$ |

304,802 |

|

$ |

272,528 |

|

$ |

630,582 |

|

$ |

597,981 |

|

|

Cost of sales |

|

221,352 |

|

|

271,420 |

|

|

470,606 |

|

|

518,868 |

|

|

Gross profit |

|

83,450 |

|

|

1,108 |

|

|

159,976 |

|

|

79,113 |

|

|

Selling, general, administrative & engineering expenses |

|

52,968 |

|

|

51,263 |

|

|

111,316 |

|

|

103,341 |

|

|

Income (loss) from operations |

|

30,482 |

|

|

(50,155 |

) |

|

48,660 |

|

|

(24,228 |

) |

|

Interest expense |

|

(484 |

) |

|

(168 |

) |

|

(1,131 |

) |

|

(318 |

) |

|

Other |

|

387 |

|

|

1,146 |

|

|

911 |

|

|

1,658 |

|

|

Income (loss) before income taxes |

|

30,385 |

|

|

(49,177 |

) |

|

48,440 |

|

|

(22,888 |

) |

|

Income tax expense (benefit) |

|

7,008 |

|

|

(8,503 |

) |

|

10,789 |

|

|

(2,481 |

) |

|

Net income (loss) attributable to controlling interest |

$ |

23,377 |

|

$ |

(40,674 |

) |

$ |

37,651 |

|

$ |

(20,407 |

) |

|

|

|

|

|

|

| |

|

|

|

|

|

Earnings (loss) per Common Share |

|

|

|

|

|

Net income (loss) attributable to controlling interest |

|

|

|

|

|

Basic |

$ |

1.04 |

|

$ |

(1.76 |

) |

$ |

1.67 |

|

$ |

(0.89 |

) |

|

Diluted |

$ |

1.03 |

|

$ |

(1.76 |

) |

$ |

1.66 |

|

$ |

(0.89 |

) |

|

|

|

|

|

|

| |

|

|

|

|

| Weighted average common shares

outstanding |

|

|

|

|

|

Basic |

|

22,509 |

|

|

23,061 |

|

|

22,503 |

|

|

23,053 |

|

|

Diluted |

|

22,667 |

|

|

23,061 |

|

|

22,656 |

|

|

23,053 |

|

|

Astec Industries, Inc. |

|

Segment Revenues and Profit (Loss) |

|

For the three months ended June 30, 2019 and 2018 |

|

(in thousands) |

|

(unaudited) |

|

|

|

|

Infrastructure Group |

Aggregate and Mining Group |

Energy Group |

Corporate |

Total |

|

2019 Revenues |

133,235 |

|

|

106,837 |

|

|

64,730 |

|

|

- |

|

304,802 |

|

|

2018 Revenues |

83,202 |

|

|

116,297 |

|

|

73,029 |

|

|

- |

|

272,528 |

|

|

Change $ |

50,033 |

|

|

(9,460 |

) |

|

(8,299 |

) |

|

- |

|

32,274 |

|

|

Change % |

60.1 |

% |

|

(8.1 |

%) |

|

(11.4 |

%) |

|

- |

|

11.8 |

% |

|

|

|

|

|

|

|

|

2019 Gross Profit |

42,689 |

|

|

25,493 |

|

|

15,187 |

|

|

81 |

|

83,450 |

|

|

2019 Gross Profit % |

32.0 |

% |

|

23.9 |

% |

|

23.5 |

% |

|

- |

|

27.4 |

% |

|

2018 Gross Profit (Loss) |

(47,817 |

) |

|

29,042 |

|

|

19,808 |

|

|

75 |

|

1,108 |

|

|

2018 Gross Profit (Loss)% |

(57.5 |

%) |

|

25.0 |

% |

|

27.1 |

% |

|

- |

|

0.4 |

% |

|

Change |

90,506 |

|

|

(3,549 |

) |

|

(4,621 |

) |

|

6 |

|

82,342 |

|

|

|

|

|

|

|

|

|

2019 Profit (Loss) |

24,445 |

|

|

8,489 |

|

|

3,138 |

|

|

(13,220 |

) |

22,852 |

|

|

2018 Profit (Loss) |

(62,734 |

) |

|

12,548 |

|

|

8,477 |

|

|

596 |

|

(41,113 |

) |

|

Change $ |

87,179 |

|

|

(4,059 |

) |

|

(5,339 |

) |

|

(13,816 |

) |

63,965 |

|

|

Change % |

139.0 |

% |

|

(32.3 |

%) |

|

(63.0 |

%) |

|

(2318.1 |

%) |

155.6 |

% |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Segment revenues

are reported net of intersegment revenues. Segment gross

profit (loss) is net of profit on intersegment |

|

revenues. A reconciliation of total segment profit (loss) to

the Company's net income (loss) attributable to controlling

interest is as follows (in thousands): |

|

|

|

|

|

|

|

| |

|

Three months ended June 30 |

|

| |

|

|

2019 |

|

|

2018 |

|

Change $ |

|

| Total profit (loss) for all

segments |

|

$ |

22,852 |

|

$ |

(41,113 |

) |

$ |

63,965 |

|

|

| Recapture of intersegment

profit |

|

|

509 |

|

|

345 |

|

|

164 |

|

|

| Net loss

attributable to non-controlling interest |

|

16 |

|

|

94 |

|

|

(78 |

) |

|

|

Net income (loss) attributable to controlling interest |

$ |

23,377 |

|

$ |

(40,674 |

) |

$ |

64,051 |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

Astec Industries, Inc. |

|

Segment Revenues and Profit (Loss) |

|

For the six months ended June 30, 2019 and 2018 |

|

(in thousands) |

|

(unaudited) |

|

|

|

|

Infrastructure Group |

Aggregate and Mining Group |

Energy Group |

Corporate |

Total |

|

2019 Revenues |

288,229 |

|

|

213,368 |

|

|

128,985 |

|

|

- |

|

630,582 |

|

|

2018 Revenues |

230,296 |

|

|

235,364 |

|

|

132,321 |

|

|

- |

|

597,981 |

|

|

Change $ |

57,933 |

|

|

(21,996 |

) |

|

(3,336 |

) |

|

- |

|

32,601 |

|

|

Change % |

25.2 |

% |

|

(9.3 |

%) |

|

(2.5 |

%) |

|

- |

|

5.5 |

% |

|

|

|

|

|

|

|

|

2019 Gross Profit |

78,196 |

|

|

51,038 |

|

|

30,666 |

|

|

76 |

|

159,976 |

|

|

2019 Gross Profit % |

27.1 |

% |

|

23.9 |

% |

|

23.8 |

% |

|

- |

|

25.4 |

% |

|

2018 Gross Profit (Loss) |

(14,536 |

) |

|

58,331 |

|

|

35,095 |

|

|

223 |

|

79,113 |

|

|

2018 Gross Profit (Loss)% |

(6.3 |

%) |

|

24.8 |

% |

|

26.5 |

% |

|

- |

|

13.2 |

% |

|

Change |

92,732 |

|

|

(7,293 |

) |

|

(4,429 |

) |

|

(147 |

) |

80,863 |

|

|

|

|

|

|

|

|

|

2019 Profit (Loss) |

39,683 |

|

|

17,166 |

|

|

6,532 |

|

|

(26,690 |

) |

36,691 |

|

|

2018 Profit (Loss) |

(47,882 |

) |

|

25,658 |

|

|

13,088 |

|

|

(10,652 |

) |

(19,788 |

) |

|

Change $ |

87,565 |

|

|

(8,492 |

) |

|

(6,556 |

) |

|

(16,038 |

) |

56,479 |

|

|

Change % |

182.9 |

% |

|

(33.1 |

%) |

|

(50.1 |

%) |

|

(150.6 |

%) |

285.4 |

% |

| |

|

|

|

|

|

| |

|

|

|

|

|

| Segment revenues

are reported net of intersegment revenues. Segment gross profit

(loss) is net of profit on intersegment |

|

revenues. A reconciliation of total segment profit (loss) to the

Company's net income (loss) attributable to controlling interest is

as follows (in thousands): |

|

|

|

|

|

|

|

| |

|

Six months ended June 30 |

|

| |

|

|

2019 |

|

|

2018 |

|

Change $ |

|

| Total profit (loss) for all

segments |

|

$ |

36,691 |

|

$ |

(19,788 |

) |

$ |

56,479 |

|

|

| Recapture

(elimination) of intersegment profit |

|

888 |

|

|

(764 |

) |

|

1,651 |

|

|

| Net loss

attributable to non-controlling interest |

|

72 |

|

|

145 |

|

|

(72 |

) |

|

|

Net income (loss) attributable to controlling interest |

$ |

37,651 |

|

$ |

(20,407 |

) |

$ |

58,058 |

|

|

| |

|

|

|

|

|

| |

|

|

|

|

|

|

Astec Industries, Inc. |

|

|

Backlog by Segment |

|

|

June 30, 2019 and 2018 |

|

|

(in thousands) |

|

|

(unaudited) |

|

|

|

|

|

|

Infrastructure Group |

Aggregate and Mining Group |

Energy Group |

Total |

|

|

2019 Backlog |

94,855 |

|

|

87,904 |

|

|

63,333 |

|

|

246,092 |

|

|

|

2018 Backlog |

105,888 |

|

|

128,342 |

|

|

68,662 |

|

|

302,892 |

|

|

|

Change $ |

(11,033 |

) |

|

(40,438 |

) |

|

(5,329 |

) |

|

(56,800 |

) |

|

|

Change % |

(10.4 |

%) |

|

(31.5 |

%) |

|

(7.8 |

%) |

|

(18.8 |

%) |

|

| |

|

|

|

|

|

GLOSSARY

In its earnings release, Astec refers to various

GAAP (U.S. generally accepted accounting principles) and non-GAAP

financial measures. These non-GAAP measures may not be comparable

to similarly titled measures being disclosed by other companies.

Non-GAAP financial measures should be considered in addition to,

and not in lieu of, GAAP financial measures. Nonetheless, this

non-GAAP information can be useful in understanding the Company’s

operating results and the performance of its core businesses.

The amounts described below are unaudited,

reported in thousands of U.S. dollars (except share data), and as

of or for the periods indicated.

| |

| Second Quarter

2019 |

As Reported (GAAP) |

Impact of Pellet Plants |

As Adjusted (Non-GAAP) |

|

Net Sales |

304,802 |

|

20,000 |

|

284,802 |

|

| Domestic Sales |

246,213 |

|

20,000 |

|

226,213 |

|

| GM |

83,450 |

|

20,000 |

|

63,450 |

|

| GM% |

27.4 |

% |

100.0 |

% |

22.3 |

% |

| Income Tax Expense (1) |

7,008 |

|

4,731 |

|

2,277 |

|

| Net Income |

23,377 |

|

15,269 |

|

8,108 |

|

| EPS |

1.03 |

|

0.67 |

|

0.36 |

|

| |

|

|

|

| Year to

DateJune 30, 2019 |

|

|

|

| Net Sales |

630,582 |

|

20,000 |

|

610,582 |

|

| Domestic Sales |

509,042 |

|

20,000 |

|

489,042 |

|

| GM |

159,976 |

|

20,000 |

|

139,976 |

|

| GM% |

25.4 |

% |

100.0 |

% |

22.9 |

% |

| Income Tax Expense (1) |

10,789 |

|

4,731 |

|

6,058 |

|

| Net Income |

37,651 |

|

15,269 |

|

22,382 |

|

| EPS |

1.66 |

|

0.67 |

|

0.99 |

|

| |

|

|

|

|

(1) Tax effect on adjustments is calculated using the applicable

jurisdictional blended tax rate |

|

|

|

|

|

| |

|

|

|

| Second Quarter

2018 |

As Reported (GAAP) |

Impact of Pellet Plants |

As Adjusted (Non-GAAP) |

| Net Sales |

272,528 |

|

(74,522 |

) |

347,050 |

|

| Domestic Sales |

203,388 |

|

(74,522 |

) |

277,910 |

|

| GM |

1,108 |

|

(80,923 |

) |

82,031 |

|

| GM% |

0.4 |

% |

|

23.6 |

% |

| Income Tax (Benefit) Expense

(1) |

(8,503 |

) |

(16,258 |

) |

7,755 |

|

| Net Income (Loss) |

(40,674 |

) |

(64,665 |

) |

23,991 |

|

| EPS |

(1.76 |

) |

(2.80 |

) |

1.03 |

|

| |

|

|

|

| Year to Date

June 30, 2018 |

|

|

|

| Net Sales |

597,981 |

|

(74,778 |

) |

672,759 |

|

| Domestic Sales |

473,464 |

|

(74,778 |

) |

548,242 |

|

| GM |

79,113 |

|

(84,341 |

) |

163,454 |

|

| GM% |

13.2 |

% |

|

24.3 |

% |

| Income Tax (Benefit) Expense

(1) |

(2,481 |

) |

(17,011 |

) |

14,530 |

|

| Net Income (Loss) |

(20,407 |

) |

(67,330 |

) |

46,923 |

|

| EPS |

(0.89 |

) |

(2.92 |

) |

2.02 |

|

| |

|

|

|

|

(1) Tax effect on adjustments is calculated using the applicable

jurisdictional blended tax rate |

|

|

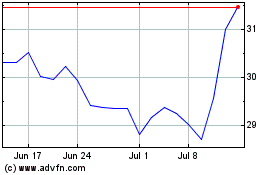

Astec Industries (NASDAQ:ASTE)

Historical Stock Chart

From Mar 2024 to Apr 2024

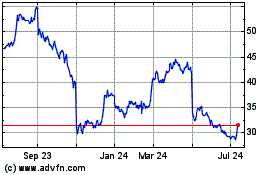

Astec Industries (NASDAQ:ASTE)

Historical Stock Chart

From Apr 2023 to Apr 2024