UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

(Amendment No. )

|

|

|

|

|

|

Filed by the Registrant

x

|

|

Filed by a party other than the Registrant

☐

|

|

Check the appropriate box:

|

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a‑6(e)(2))

|

|

x

|

Definitive Proxy Statement

|

|

☐

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a‑12

|

|

|

|

|

|

|

|

AquaBounty Technologies, Inc.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

x

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a‑6(i)(1) and 0‑11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0‑11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0‑11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

|

|

|

|

(3)

|

Filing Party:

|

|

|

|

|

|

|

(4)

|

Date Filed:

|

|

|

|

|

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

APRIL 30, 2019

The 2019 annual meeting of stockholders of AquaBounty Technologies, Inc. (“AquaBounty” or the “Company”) will be held on April 30, 2019, at 8:30 a.m. Eastern Time, at the Bostonian Hotel, 26 North Street, Boston, Massachusetts 02109, for the following purposes:

|

|

|

|

•

|

to elect seven directors to serve on our Board of Directors for a one-year term of office until the next annual meeting of stockholders, with each director to hold office until his or her successor is duly elected and qualified or until his or her earlier resignation or removal;

|

|

|

|

|

•

|

to ratify the appointment of Wolf & Company, P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2019;

|

|

|

|

|

•

|

to approve our 2016 Equity Incentive Plan, as amended (the “2016 Plan”), to increase the number of authorized shares of our common stock, $0.001 par value per share (“Common Stock”) issuable under the 2016 Plan from 450,000 to 900,000; and

|

|

|

|

|

•

|

to transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof.

|

Only stockholders of record at the close of business on March 8, 2019, the record date, are entitled to notice of and to vote at the annual meeting.

Your vote is very important. Whether or not you plan to attend the annual meeting, we hope you will vote as soon as possible. Please vote before the annual meeting using the internet; telephone; or by signing, dating, and mailing the proxy card in the pre-paid envelope, to ensure that your vote will be counted. Please review the instructions on each of your voting options described in the accompanying proxy statement. Your proxy may be revoked before the vote at the annual meeting by following the procedures outlined in the accompanying proxy statement.

|

|

|

|

|

|

|

Sincerely,

|

|

|

|

|

|

Sylvia Wulf

President, Chief Executive Officer, and Director

|

Maynard, Massachusetts

March 21, 2019

2018 PROXY STATEMENT

TABLE OF CONTENTS

2 Mill & Main Place, Suite 395

Maynard, Massachusetts 01754

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON APRIL 30, 2019

General

This proxy statement is furnished to our stockholders in connection with the solicitation of proxies by our Board of Directors for use at our annual meeting of stockholders to be held on April 30, 2019, at 8:30 a.m. Eastern Time, at the Bostonian Hotel, 26 North Street, Boston, Massachusetts 02109, for the following purposes:

|

|

|

|

•

|

to elect seven directors to serve on our Board of Directors for a one-year term of office until the next annual meeting of stockholders, with each director to hold office until his or her successor is duly elected and qualified or until his or her earlier resignation or removal;

|

|

|

|

|

•

|

to ratify the appointment of Wolf & Company, P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2019;

|

|

|

|

|

•

|

to approve the 2016 Plan, as amended, to increase the number of authorized shares of our Common Stock issuable under the 2016 Plan from 450,000 to 900,000; and

|

|

|

|

|

•

|

to transact such other business as may properly come before the annual meeting or any adjournment or postponement thereof.

|

NASDAQ Listing and Intrexon Distribution

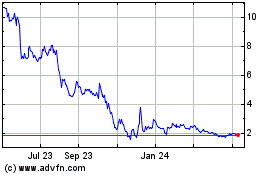

On January 18, 2017, we sold 2,421,073 shares of our common stock to Intrexon Corporation (“Intrexon”), a U.S. company listed on Nasdaq and our largest stockholder, for proceeds of approximately $25 million. Following the closing of that sale, Intrexon distributed 1,776,557 shares of our common stock that it held prior to that sale via a share dividend to its stockholders (the “Distribution”). As of March 15, 2019, Intrexon holds approximately 54% of our outstanding common stock. In connection with the Distribution and the sale of common stock, on January 19, 2017, our common stock began “regular way” trading on the NASDAQ Capital Market.

Proxy Materials

A copy of our proxy materials is available, free of charge, on

www.proxyvote.com

, the SEC website at

www.sec.gov

, and our corporate website at

www.aquabounty.com

. By referring to our website, we do not incorporate our website or any portion of that website by reference into this proxy statement.

If your shares are held in more than one account at a brokerage firm, bank, broker-dealer, or other similar organization, you may receive more than one copy of the proxy materials. Please follow the voting instructions on the proxy cards or voting instruction forms, as applicable, and vote all proxy cards or voting instruction forms, as applicable, to ensure that all of your shares are voted. We encourage you to have all accounts registered in the same name and address whenever possible. If you are a registered holder, you can accomplish this by contacting our transfer agent, Computershare, at (800) 736-3001 or in writing to Computershare, PO. Box 30170, College Station, Texas 77842. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, you can accomplish this by contacting that organization.

Householding of Proxy Materials

Some banks, brokers, and other nominee record holders may be participating in the practice of “householding” proxy statements and annual reports. This means that only one copy of the Proxy Statement and Annual Report on Form 10‑K for the year ended December 31, 2018, as applicable, is being delivered to multiple shareholders sharing an address unless we have received contrary instructions. We will promptly deliver a separate copy of any of these documents to you if you write to us at 2 Mill & Main Place, Suite 395, Maynard, MA 01754, Attention: Corporate Secretary or call us at (978) 648-6000. If you want to receive separate copies of the Proxy Statement or Annual Report on Form 10‑K in the future, or if you are receiving multiple copies and would like to

receive only one copy for your household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address or telephone number.

Voting; Quorum

Our outstanding common stock constitutes the only class of securities entitled to vote at the annual meeting. Common stockholders of record at the close of business on March 8, 2019, the record date for the annual meeting, are entitled to notice of and to vote at the annual meeting. On the record date, 1

5,275,398

shares of our common stock were issued and outstanding. Each share of common stock is entitled to one vote. The presence at the annual meeting, in person or by proxy, of the holders of a majority of the shares of common stock issued and outstanding on March 8, 2019, will constitute a quorum.

All votes will be tabulated by the Inspector of Elections appointed for the annual meeting, who will separately tabulate affirmative and negative votes, abstentions, and broker non-votes. Broker non-votes occur when a nominee, such as a brokerage firm or financial institution, that holds shares on behalf of a beneficial owner does not receive voting instructions from such owner regarding a matter for which such nominee does not have discretion to vote without such instructions. The rules applicable to brokerage firms and financial institutions permit nominees to vote in their discretion on routine matters in the absence of voting instructions from the beneficial holder. The ratification of the appointment of Wolf & Company, P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2019, is a routine matter. On non-routine matters, nominees cannot vote unless they receive instructions from the beneficial owner. The election of seven directors to serve on our Board of Directors and the approval of the 2016 Plan, as amended, to increase the number of authorized shares of Common Stock available for issuance under the 2016 Plan are non-routine matters. Abstentions and broker non-votes are counted as present for purposes of determining whether there is a quorum for the transaction of business. Broker non-votes will not be counted for purposes of determining whether a proposal has been approved. See “Voting Procedure—Beneficial Owners of Shares Held in Street Name” below.

The election of directors will be by plurality vote of our outstanding shares of common stock represented in person or by proxy at the annual meeting and entitled to vote, and the seven nominees receiving the highest number of affirmative votes will be elected. Votes marked “withhold” and broker non-votes will not affect the outcome of the election, although they will be counted as present for purposes of determining whether there is a quorum.

Ratification of the appointment of Wolf & Company, P.C. requires the affirmative vote of holders of a majority of the shares of our common stock represented in person or by proxy at the annual meeting and entitled to vote on the matter. Abstentions with respect to this proposal will count as votes against this proposal.

Approval of the 2016 Plan, as amended, to increase the number of authorized shares of Common Stock available for issuance under the 2016 Plan requires the affirmative vote of holders of a majority of the outstanding shares of common stock. Abstentions with respect to this proposal will count as votes against this proposal.

Voting Procedure

Stockholders of Record

. If your shares are registered directly in your name with our transfer agent, Computershare, you are a stockholder of record and you received the proxy materials by mail with instructions regarding how to view our proxy materials on the internet, how to receive a paper or email copy of the proxy materials, and how to vote by proxy. You can vote in person at the annual meeting or by proxy. There are three ways stockholders of record can vote by proxy: (1) by telephone (by following the instructions on the proxy card, or by following the instructions on the internet); (2) by internet (by following the instructions provided on the proxy card); or (3) by mail, (by completing and returning the proxy card enclosed in the proxy materials prior to the annual meeting) or submitting a signed proxy card at the annual meeting. Unless there are different instructions on the proxy card, all shares represented by valid proxies (and not revoked before they are voted) will be voted as follows at the annual meeting:

|

|

|

|

•

|

FOR the election of each of the director nominees listed in Proposal One (unless the authority to vote for the election of any such director nominee is withheld);

|

|

|

|

|

•

|

FOR the ratification of the appointment of Wolf & Company, P.C. as our independent registered public accounting firm as described in Proposal Two; and

|

|

|

|

|

•

|

FOR the approval of the 2016 Plan, as amended, to increase the number of authorized shares of our Common Stock available for issuance under the 2016 Plan as described in Proposal Three.

|

Beneficial Owners of Shares Held in Street Name

. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and such organization forwarded to you the proxy materials by mail. There are two ways beneficial owners of shares held in street name can vote by proxy: (1) by mail, by following the instructions on the voting instruction form; or (2) by internet, by following the instructions provided herein. The organization holding your account is considered the stockholder of record for purposes of voting at the annual meeting. If you do not provide such organization with specific voting instructions, under the rules of the various national and regional securities exchanges, the organization that holds your shares may generally vote on routine matters but cannot vote on non-routine matters. If such organization does not receive instructions from you on how to vote your shares on a non-routine matter, the organization will

inform our Inspector of Elections that it does not have the authority to vote on this matter with respect to your shares. This is generally referred to as a “broker non-vote.” A broker non-vote will have the effects described above under “Voting; Quorum.”

Although we do not know of any business to be considered at the annual meeting other than the proposals described in this proxy statement, if any other business is presented at the annual meeting, your signed proxy or your authenticated internet or telephone proxy, will give authority to each of David A. Frank and Christopher Martin to vote on such matters at his discretion.

YOUR VOTE IS IMPORTANT. PLEASE VOTE WHETHER OR NOT YOU PLAN TO ATTEND THE ANNUAL MEETING IN PERSON.

You may revoke your proxy at any time before it is actually voted at the annual meeting by:

|

|

|

|

•

|

delivering written notice of revocation to our Corporate Secretary at 2 Mill & Main Place, Suite 395, Maynard, Massachusetts 01754;

|

|

|

|

|

•

|

submitting a later dated proxy; or

|

|

|

|

|

•

|

attending the annual meeting and voting in person.

|

Your attendance at the annual meeting will not, by itself, constitute a revocation of your proxy. You may also be represented by another person present at the annual meeting by executing a form of proxy designating that person to act on your behalf.

Shares may only be voted by or on behalf of the record holder of shares as indicated in our stock transfer records. If you are a beneficial owner of our shares, but those shares are held of record by another person such as a brokerage firm or bank, then you must provide voting instructions to the appropriate record holder so that such person can vote the shares. In the absence of such voting instructions from you, the record holder may not be entitled to vote those shares.

Solicitation

This solicitation is made on behalf of our Board of Directors, and we will pay the costs of solicitation. Copies of solicitation materials will be furnished to banks, brokerage firms, and other custodians, nominees, and fiduciaries holding shares in their names that are beneficially owned by others so that they may forward the solicitation material to such beneficial owners upon request. We will reimburse banks, brokerage firms, and other custodians, nominees, and fiduciaries for reasonable expenses incurred by them in sending proxy materials to our stockholders. In addition to the solicitation of proxies by mail, our directors, officers, and employees may solicit proxies by telephone, facsimile, or personal interview. No additional compensation will be paid to these individuals for any such services. If you choose to access the proxy materials or vote over the Internet, you are responsible for any Internet access charges that you may incur.

Stockholder Proposals for 2020 Annual Meeting

Stockholder proposals that are intended to be presented at our 2020 annual meeting of stockholders and included in our proxy statement relating to the 2020 annual meeting must be received by us no later than November 22, 2019, which is 120 calendar days before the anniversary of the date on which this proxy statement was first distributed to our stockholders. If the date of the 2020 annual meeting is moved more than 30 days prior to, or more than 30 days after, April 30, 2020, the deadline for inclusion of proposals in our proxy statement for the 2020 annual meeting instead will be a reasonable time before we begin to print and mail our proxy materials. All stockholder proposals must be in compliance with applicable laws and regulations in order to be considered for possible inclusion in the proxy statement and form of proxy for the 2020 annual meeting.

If a stockholder wishes to present a proposal at our 2020 annual meeting of stockholders and the proposal is not intended to be included in our proxy statement relating to the 2020 annual meeting, the stockholder must give advance notice to us prior to the deadline (the “Bylaw Deadline”) for the annual meeting determined in accordance with our Amended and Restated Bylaws (“bylaws”) and comply with certain other requirements specified in our bylaws. Under our bylaws, in order to be deemed properly presented, the notice of a proposal must be delivered to our Corporate Secretary no later than February 5, 2020, which is 45 calendar days prior to the first anniversary of the date on which we mailed the proxy materials for the 2019 annual meeting.

However, if we change the date of the 2020 annual meeting so that it occurs more than 30 days prior to, or more than 30 days after, April 30, 2020, stockholder proposals intended for presentation at the 2020 annual meeting, but not intended to be included in our proxy statement relating to the 2020 annual meeting, must be delivered to or mailed and received by our Corporate Secretary at 2 Mill & Main Place, Suite 395, Maynard, Massachusetts 01754 no later than the close of business on the ninetieth calendar day prior to the 2020 annual meeting or the twentieth calendar day following the day on which public disclosure on the date of the 2020 annual meeting is first made (the “Alternate Date”). If a stockholder gives notice of such proposal after the Bylaw Deadline (or the Alternate Date, if applicable), the stockholder will not be permitted to present the proposal to the stockholders for a vote at the 2020 annual meeting.

All notices of stockholder proposals submitted pursuant to our bylaws must include the following: (i) a description in reasonable detail of the business desired to be brought before the annual meeting and the reasons for conducting such business at the annual meeting; (ii) the name and address of the stockholder proposing such business and the beneficial owner, if any, on whose

behalf the proposal is made; (iii) the class or series and number of shares of the common stock of the Company that are owned by the stockholder proposing the business to be brought before the annual meeting; (iv) a description of all arrangements or understandings among the stockholder submitting the proposal, the beneficial owner on whose behalf the proposal is made, and any other person or persons in connection with the proposal and any material interest of such stockholder in the proposal; and (v) a representation that the stockholder submitting the proposal intends to appear in person or by proxy at the annual meeting to bring such business before the annual meeting.

We have not been notified by any stockholder of his or her intent to present a stockholder proposal from the floor at this year’s annual meeting. The enclosed proxy grants the proxy holders discretionary authority to vote on any matter properly brought before the annual meeting or any adjournment or postponement thereof.

MATTERS TO BE CONSIDERED AT ANNUAL MEETING

PROPOSAL ONE:

ELECTION OF DIRECTORS

Our Board of Directors is comprised of seven directors who are elected for a one-year term to hold office until the next annual meeting of our stockholders or until removed from office in accordance with our bylaws. The nominees named below have agreed to serve if elected, and we have no reason to believe that they will be unavailable to serve. If, however, the nominees named below are unable to serve or decline to serve at the time of the annual meeting, the proxies will be voted for any nominee who may be designated by our Board of Directors. Unless a stockholder specifies otherwise, a returned, signed proxy will be voted FOR the election of each of the nominees listed below.

The following table sets forth information with respect to the persons nominated for re-election at the annual meeting:

|

|

|

|

|

|

|

|

Name

|

Age

|

Director Since

|

Position(s)

|

|

Richard J. Clothier

|

73

|

2006

|

Chairman of the Board of Directors

|

|

Jack A. Bobo

|

53

|

2015

|

Director

|

|

Richard L. Huber

|

82

|

2006

|

Director

|

|

Christine St.Clare

|

68

|

2014

|

Director

|

|

Rick Sterling

|

55

|

2013

|

Director

|

|

James C. Turk, Jr.

|

62

|

2013

|

Director

|

|

Sylvia Wulf

|

61

|

2019

|

Director, Chief Executive Officer, and President

|

Richard J. Clothier

. Mr. Clothier has served as Chairman of the Board of Directors of AquaBounty since April 2006. He also has served as the Chairman of Robinson Plc from 2004 until 2018, of Spearhead International Ltd from 2005 to 2015, and of Exosect Ltd from 2013 to 2015. Mr. Clothier retired as Group Chief Executive of PGI Group Plc, an international agricultural products producer, following 20 years with Dalgety Plc, where he was chief executive officer of the genetics firm Pig Improvement Company until 1992 and then Group Chief Executive Officer until 1997. He holds a Bachelor of Science in Agriculture from Natal University and attended the Advanced Management Program at Harvard Business School. Mr. Clothier’s extensive experience, both as an executive in the food industry and as a director of public and private companies, provides considerable operating, strategic, and policy knowledge to our Board of Directors.

Jack A. Bobo

. Mr. Bobo joined the Board of Directors of AquaBounty in November 2015. He has significant expertise in the analysis and communication of global trends in biotechnology, food, and agriculture to audiences around the world and is currently Senior Vice-President and Chief Communications Officer of Intrexon Corporation, a position he has held since July 2015. He was previously at the U.S. Department of State, where he worked for 13 years, most recently as Senior Advisor for Food Policy following his position as Senior Advisor for Biotechnology. Mr. Bobo was an attorney at Crowell & Moring, LLP. He received his Juris Doctor from Indiana University School of Law and a Masters in environmental science from Indiana University School of Public and Environmental Affairs. Mr. Bobo’s knowledge of our industry and public policy and his executive leadership experience make him well qualified to serve as a director.

Richard L. Huber

. Mr. Huber joined the Board of Directors of AquaBounty after our public offering in 2006. Mr. Huber is the former Chairman, President, and Chief Executive Officer of Aetna, a major U.S. health insurer, and is currently an independent investor in a number of companies operating in a wide range of businesses, mainly in South America. Following a 40-year career in the financial services industry, Mr. Huber now serves as a director of Viña San Rafael and Invina, SA, both non-public wine producers in Chile. Previously he served on the boards of Gafisa, the largest integrated residential housing developer in Brazil, and Antarctic Shipping, SA of Chile, as well as several other companies in the U.S. and elsewhere in the world. He holds a Bachelor of Arts in Chemistry from Harvard University. Mr. Huber brings unique knowledge and experience in strategic planning, organizational leadership, accounting, and legal and governmental affairs to our Board of Directors.

Christine St.Clare

. Ms. St.Clare joined the Board of Directors of AquaBounty in May 2014. She retired as a partner of KPMG LLP in 2010, where she worked for a total of 35 years. While at KPMG, Ms. St.Clare worked as an Audit Partner serving publicly held companies until 2005, when she transferred to the Advisory Practice, serving in the Internal Audit, Risk and Compliance practice until her retirement; she also served a four-year term on KPMG’s Board of Directors. She currently serves on the boards, and chairs the Audit Committees, of Fibrocell Science, Inc., a company that specializes in the development of personalized biologics, and Tilray, Inc., a leading cannabis research and cultivation company, and formerly served on the board of Polymer Group, Inc., a global manufacturer of engineered materials. Ms. St.Clare has a Bachelor of Science from California State University at Long Beach and has been a licensed Certified Public Accountant in California, Texas, and Georgia. Ms. St.Clare’s background in accounting and support of publicly held companies, as well as her experience with biotechnology, makes her well suited for service on our Board of Directors.

Rick Sterling

. Mr. Sterling joined the Board of Directors of AquaBounty in September 2013. He is the Chief Financial Officer of Intrexon Corporation, a position he has held since 2007. Prior to joining Intrexon, he was with KPMG LLP, where he worked in the audit practice for over 17 years, with a client base primarily in the healthcare, technology, and manufacturing industries. Mr. Sterling’s experience includes serving clients in both the private and public sector, including significant experience with SEC filings and compliance with the Sarbanes-Oxley Act. He has a Bachelor of Science in Accounting and Finance from Virginia Tech and is a licensed Certified Public Accountant. Mr. Sterling’s background in audit and finance, as well as his experience with technology companies, make him well suited for service on our Board of Directors.

James C. Turk

.

Jr

. Mr. Turk joined the Board of Directors of AquaBounty in February 2013. Mr. Turk has served as a partner in the law firm Harrison & Turk, P.C. since 1987, having practiced two years before that with other firms. He has previously served as a member of the board of directors for multiple companies and foundations including Intrexon Corporation, the New River Community College Education Foundation, the Virginia Student Assistance Authorities and Synchrony Inc. before it was acquired by Dresser-Rand in January, 2012. He presently serves as a member of Roanoke/New River Valley Advisory Council of SunTrust Bank, a director of the Virginia Tech Athletic Foundation and a member of the Roanoke College President’s advisory board. Mr. Turk received a Bachelor of Arts from Roanoke College and a Juris Doctor from Cumberland School of Law at Samford University. Mr. Turk’s legal background and his experience on multiple boards make him well qualified for service on our Board of Directors.

Sylvia Wulf

. Ms. Wulf was appointed Executive Director, President, and Chief Executive Officer of AquaBounty January 1, 2019. Prior to joining AquaBounty, Ms. Wulf served as a Senior Vice President of US Foods, Inc., where she had been President of the Manufacturing Division since June 2011. Prior to US Foods, Ms. Wulf held senior positions in Tyson Foods, Inc., Sara Lee Corporation, and Bunge Corp. She is also currently on the Board of Directors and the Executive Committee of the National Fisheries Institute. Ms. Wulf was chosen for her experience in the food industry in North America, including its fish sector. Ms. Wulf received a B.S. in Finance from Western Illinois University and an MBA from DePaul University.

Corporate Governance Principles

We are committed to having sound corporate governance principles. Having such principles is essential to maintaining our integrity in the marketplace. Our Code of Business Conduct and Ethics and the charters for each of the Audit, Compensation, and Nominating and Corporate Governance (“NCG”) Committees are available on the investor relations section of our corporate website (www.aquabounty.com). A copy of our Code of Business Conduct and Ethics and the committee charters may also be obtained upon request to Corporate Secretary, AquaBounty Technologies, Inc., 2 Mill & Main Place, Suite 395, Maynard, Massachusetts 01754.

Code of Ethics

Our Code of Business Conduct and Ethics applies to all of our outside directors, officers, and employees, including, but not limited to, our Chief Executive Officer and Chief Financial Officer. The Code of Business Conduct and Ethics constitutes our “code of ethics” within the meaning of Section 406 of the Sarbanes-Oxley Act and is our “code of conduct” within the meaning of the NASDAQ listing standards.

Stockholder Communications with Directors

Stockholders may communicate with our directors by sending communications to the attention of the Chairman of the Board of Directors, the Chairperson of a committee of the Board of Directors, or an individual director via U.S. Mail or Expedited Delivery Services to our address at AquaBounty Technologies, Inc., 2 Mill & Main Place, Suite 395, Maynard, Massachusetts 01754. The Company will forward by U.S. Mail any such communication to the mailing address most recently provided by the Board member identified in the “Attention” line of the communication. All communications must be accompanied by the following information:

|

|

|

|

•

|

A statement of the type and amount of the securities of the Company that the submitting individual holds, if any;

|

|

|

|

|

•

|

Any special interest, other than in the capacity of security holder, of the submitting individual in the subject matter of the communication; and

|

|

|

|

|

•

|

The address, telephone number, and email address of the submitting individual.

|

Board Independence

As required by the NASDAQ listing rules, our Board of Directors evaluates the independence of its members at least once annually and at other appropriate times when a change in circumstances could potentially impact the independence or effectiveness of one of our directors.

In November 2018, our Board of Directors undertook a review of the composition of our Board of Directors and its committees and the independence of each director. Based upon information requested from and provided by each director concerning his or her background, employment, and affiliations, including family relationships, our Board of Directors has determined each of Messrs. Clothier, Huber, and Turk and Ms. St.Clare is an “independent director” as defined under NASDAQ Listing Rule 5605(a)(2). The remaining members of our Board of Directors may not satisfy these “independence” definitions because they are employed by AquaBounty or have been chosen by and/or are affiliated with our controlling stockholder, Intrexon, in a non-independent capacity.

Our Board of Directors has three standing committees: the Audit Committee, the Compensation Committee, and the NCG Committee. As discussed below, each member of the Audit Committee satisfies the special independence standards for such committee established by the SEC and NASDAQ. Because we are eligible to be a “controlled company” within the meaning of NASDAQ Listing Rule 5615(c), and our Board of Directors has chosen to rely on this exception, we are exempt from certain NASDAQ listing rules that would otherwise require us to have a majority independent board and fully independent standing nominating and compensation committees. We determined that we are such a “controlled company” because Intrexon holds more than 50% of the voting power for the election of our directors. If Intrexon’s voting power were to fall below this level, however, we would cease to be permitted to rely on the controlled company exception and would be required to have a majority independent board and fully independent standing nominating and compensation committees.

Board Leadership Structure and Role in Risk Oversight

Our Board of Directors understands that board structures vary greatly among U.S. public corporations, and our Board of Directors does not believe that any one leadership structure is more effective at creating long-term stockholder value. Our Board of Directors believes that an effective leadership structure could be achieved either by combining or separating the Chairman and Chief Executive Officer positions, so long as the structure encourages the free and open dialogue of competing views and provides for strong checks and balances. Specifically, the Board of Directors believes that, to be effective, the governance structure must balance the powers of the Chief Executive Officer and the independent directors and ensure that the independent directors are fully informed, able to discuss and debate the issues that they deem important, and able to provide effective oversight of management.

Currently, Ms. Wulf serves as our Chief Executive Officer and President, and Mr. Clothier serves as our Chairman of the Board of Directors. Our Board of Directors believes that this leadership structure, which separates the Chairman and Chief Executive Officer roles, is appropriate for the company at this time because it allows Ms. Wulf to focus on operating and managing the company. At the same time, Mr. Clothier can focus on leadership of the Board of Directors, including calling and presiding over Board meetings and executive sessions of the independent directors, preparing meeting agendas in collaboration with the Chief Executive Officer, serving as a liaison and supplemental channel of communication between independent directors and the Chief Executive Officer, and serving as a sounding board and advisor to the Chief Executive Officer. Nevertheless, the Board of Directors believes that “one size” does not fit all, and the decision of whether to combine or separate the positions of Chairman and Chief Executive Officer will vary from company to company and depend upon a company’s particular circumstances at a given point in time. Accordingly, the Board of Directors will continue to consider from time to time whether the Chairman and Chief Executive Officer positions should be combined based on what the Board of Directors believes is best for our company and stockholders.

Our Board of Directors is primarily responsible for assessing risks associated with our business. However, our Board of Directors delegates certain of such responsibilities to other groups. The Audit Committee is responsible for reviewing with management our company’s policies and procedures with respect to risk assessment and risk management, including reviewing certain risks associated with our financial and accounting systems, accounting policies, investment strategies, regulatory compliance, insurance programs, and other matters. In addition, under the direction of our Board of Directors and certain of its committees, our legal department assists in the oversight of corporate compliance activities. The Compensation Committee also reviews certain risks associated with our overall compensation program for employees to help ensure that the program does not encourage employees to take excessive risks.

Board Committees and Meetings

Our Board of Directors has determined that a board consisting of between six and ten members is appropriate and has currently set the number at seven members. Our Board of Directors will evaluate the appropriate size of our Board of Directors from time to time. Our Board of Directors has three standing committees: the Audit Committee, the Compensation Committee, and the NCG Committee, each of which operate pursuant to a written charter adopted by our Board of Directors.

During 2018, each director attended or participated in 75% or more of the aggregate of (i) the total number of meetings of the Board of Directors and (ii) the total number of meetings held by all committees of the Board of Directors on which such director served. Members of the Board of Directors and its committees also consulted informally with management from time to time. Additionally, non-management Board members met in executive sessions without the presence of management periodically during 2018. We do not have a formal policy regarding board members’ attendance at our annual meetings of stockholders, but encourage them to do so; all did in 2018.

Audit Committee

. Messrs. Huber and Turk and Ms. St.Clare serve as members of our Audit Committee, and Ms. St.Clare serves as its chair. Each member of the Audit Committee satisfies the special independence standards for such committee established by the SEC and NASDAQ, as applicable. Ms. St.Clare is an “audit committee financial expert,” as that term is defined by the SEC in Item 407(d) of Regulation S-K. Stockholders should understand that this designation is an SEC disclosure requirement relating to Ms. St.Clare’s experience and understanding of certain accounting and auditing matters, which the SEC has stated does not impose on the director so designated any additional duty, obligation, or liability than otherwise is imposed generally by virtue of serving on the Audit Committee and/or our Board of Directors. Our Audit Committee is responsible for, among other things, oversight of our independent auditors and the integrity of our financial statements. Our Audit Committee held five meetings in 2018.

Compensation Committee

. Messrs. Huber and Sterling serve as members of our Compensation Committee, and Mr. Huber serves as its chair. As discussed above, because we are eligible to be a “controlled company” within the meaning of NASDAQ Listing Rule 5615(c), and our Board of Directors has chosen to rely on this exception, we are exempt from certain NASDAQ listing rules that would otherwise require us to have a fully independent Compensation Committee. Our Compensation Committee is responsible for, among other things, establishing and administering our policies, programs, and procedures for compensating our executive officers and board of directors. The Compensation Committee may only delegate its authority to subcommittees of its members. Our Compensation Committee held one meeting in 2018.

Compensation Committee Interlocks and Insider Participation

. None of our executive officers serves, or in the past has served, as a member of our Board of Directors or Compensation Committee, or other committee serving an equivalent function, of any entity that has one or more executive officers who serve as members of our Board of Directors or our Compensation Committee. None of the members of our Compensation Committee is also an officer or employee of AquaBounty, nor have any of them ever been an officer or employee of AquaBounty.

Nominating and Corporate Governance Committee

. Mr. Clothier is the sole permanent member of our NCG Committee and serves as its chair, inviting other directors to participate in meetings of the Committee as necessary. As discussed above, because we are eligible to be a “controlled company” within the meaning of NASDAQ Listing Rule 5615(c), and our Board of Directors has chosen to rely on this exception, we are exempt from certain NASDAQ listing rules that would otherwise require us to have a fully independent NCG Committee. Our NCG Committee is responsible for, among other things, evaluating new director candidates and incumbent directors and recommending directors to serve as members of our Board committees. Our NCG Committee held one meeting in 2018.

Director Nominees

. Our Board of Directors believes that the Board should be composed of individuals with varied, complementary backgrounds who have exhibited proven leadership capabilities within their chosen fields. Directors should have the ability to quickly grasp complex principles of business and finance, particularly those related to our industry. Directors should possess the highest personal and professional ethics, integrity, and values and should be committed to representing the long-term interests of our stockholders. When considering a candidate for director, the NCG Committee will take into account a number of factors, including, without limitation, the following: depth of understanding of our industry; education and professional background; judgment, skill, integrity, and reputation; existing commitments to other businesses as a director, executive, or owner; personal conflicts of interest, if any; diversity; and the size and composition of the existing Board. Although the Board of Directors does not have a policy with respect to consideration of diversity in identifying director nominees, among the many other factors considered by the NCG Committee are the benefits of diversity in board composition, including with respect to age, gender, race, and specialized background. When seeking candidates for director, the NCG Committee may solicit suggestions from incumbent directors, management, stockholders, and others. Additionally, the NCG Committee may use the services of third-party search firms to assist in the identification of appropriate candidates; no fees were paid for such services in 2018. The NCG Committee will also evaluate the qualifications of all candidates properly nominated by stockholders, in the same manner and using the same criteria. A stockholder desiring to nominate a person for election to the Board of Directors must comply with the advance notice procedures of our Amended and Restated Bylaws.

Director Compensation

We believe that the compensation we provide to our Board of Directors is both competitive and in line with that provided to boards of directors of similar companies in our industry. A survey of Nasdaq-listed biotechnology companies with minimal revenues and a market capitalization of less than $50 million confirmed that our compensation package was close to the average for the group.

Through December 31, 2018, the Chairman of our Board of Directors received annual compensation of £50,000

(approximately $63,670 using the pound sterling to U.S. Dollar spot exchange rate of 1.2734 published in The Wall Street Journal as of December 31, 2018)), payable in one annual installment. He also received an annual grant of restricted common shares equal to £20,000 (approximately $27,878) (based on the fair market value on the date of grant), with vesting over three years.

Through December 31, 2018, all other non-employee directors, except for directors who are employees of Intrexon per the Relationship Agreement described under “Related Party Transactions, Policies and Procedures—Other Agreements with Intrexon—Relationship Agreement” received annual compensation of $40,000, payable in one annual installment. The Chair of the Audit Committee received $20,000 per annum, the Chair of the Compensation Committee received $15,000 per annum, and members of a board committee, except for directors employed and appointed by Intrexon per the Relationship Agreement, received $5,000 per annum, all payable annually. All non-employee directors, except for directors employed and appointed by Intrexon per the Relationship Agreement, received an annual grant of options to purchase 2,500 shares of our common stock (with an exercise price equal to the fair market value on the date of grant), with vesting over one year.

The following table discloses all compensation provided to the non-employee directors for the most recently completed fiscal year ending December 31, 2018:

Director Summary Compensation Table

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name

|

|

Fees earned or paid

in cash

($)

|

|

Stock Awards

($)

|

|

Option Awards

($) (1)

|

|

Total

($)

|

|

R. Clothier

|

|

63,670

|

|

|

27,878

|

(2)

|

|

|

91,548

|

|

|

J. Bobo (3)

|

|

—

|

|

|

|

|

|

|

—

|

|

|

C. St.Clare

|

|

60,000

|

|

|

|

|

4,125

|

(4)

|

64,125

|

|

|

R. Huber

|

|

60,000

|

|

|

|

|

4,125

|

(5)

|

64,125

|

|

|

R. Sterling (3)

|

|

—

|

|

|

|

|

|

|

—

|

|

|

J. Turk

|

|

45,000

|

|

|

|

|

4,125

|

(6)

|

49,125

|

|

|

Total

|

|

228,670

|

|

|

27,878

|

|

12,375

|

|

268,923

|

|

|

|

|

|

(1)

|

The Option Awards included for each individual consists of stock option awards granted under the 2016 Plan. The value for each of these awards is its grant date fair value calculated by multiplying the number of shares subject to the award by the fair value of the stock option award on the date such award was granted, computed in accordance with FASB Accounting Standards Codification Topic 718.

For purposes of this calculation, we have disregarded forfeiture assumptions related to service-based vesting conditions. For a discussion of the assumptions used in calculating these values, see Note 9 to our consolidated financial statements in our annual report on Form 10

‑

K for the fiscal year ended December 31, 2018, filed with the SEC on March 7, 2019.

|

|

|

|

|

(2)

|

This a

mount represents the grant date fair value of a restricted share award granted to Mr. Clothier in 2018 under the 2016 Plan, computed in accordance with FASB Accounting Standards Codification Topic 718. For purposes of this calculation, we have disregarded forfeiture assumptions related to service-based vesting conditions. For a discussion of the assumptions used in calculating these values, see Note 9 to our consolidated financial statements in our annual report on Form 10‑K for the fiscal year ended December 31, 2018, filed with the SEC on March 7, 2019.

As of December 31, 2018, Mr. Clothier held 8,867 shares of unvested restricted stock.

|

|

|

|

|

(3)

|

Messrs. Bobo and Sterling are employees of Intrexon and do not receive any compensation from AquaBounty at this time.

|

|

|

|

|

(4)

|

As of December 31, 2018, Ms. St.Clare held unexercised options to purchase 10,800 shares.

|

|

|

|

|

(5)

|

As of December 31, 2018, Mr. Huber held unexercised options to purchase 16,400 shares.

|

|

|

|

|

(6)

|

As of December 31, 2018, Mr. Turk held unexercised options to purchase 11,600 shares.

|

Vote Required

The vote of a plurality of our outstanding shares of common stock represented in person or by proxy at the annual meeting and entitled to vote is required to elect the seven director nominees to serve on our Board of Directors for a one-year term, to hold office until the next annual meeting of our stockholders or until removed from office in accordance with our bylaws. The nominees receiving the highest number of affirmative votes will be elected.

Recommendation of the Board of Directors

Our Board of Directors recommends that the stockholders vote FOR the election of the director nominees listed above.

PROPOSAL TWO:

RATIFICATION OF INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM

The Audit Committee of the Board of Directors has appointed the firm of Wolf & Company, P.C. (“Wolf”) to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2019, and is asking the stockholders to ratify this appointment. A representative of Wolf is expected to be present at the annual meeting, will have the opportunity to make a statement if he or she desires to do so, and will be available to respond to appropriate questions.

In the event the stockholders fail to ratify the appointment of Wolf as our independent registered public accounting firm, the Audit Committee may reconsider its selection.

Principal Accountant Fees and Services

Wolf has served as our independent registered public accounting firm since 2011. The aggregate fees billed by Wolf for the professional services described below for the fiscal years ended December 31, 2018 and 2017, respectively, are set forth in the table below.

|

|

|

|

|

|

|

|

|

|

|

|

Year Ended December 31,

|

|

|

2018

|

2017

|

|

Audit Fees(1)

|

$

|

166,500

|

|

$

|

157,000

|

|

|

Tax Fees(2)

|

$

|

12,000

|

|

$

|

10,500

|

|

|

All Other Fees(3)

|

$

|

—

|

|

$

|

46,710

|

|

|

Total

|

$

|

178,500

|

|

$

|

214,210

|

|

|

|

|

|

(1)

|

For 2018 and 2017, represents fees incurred for the audit of our consolidated financial statements, as well as fees incurred for audit services that are normally provided by Wolf in connection with other statutory or regulatory filings or engagements.

|

|

|

|

|

(2)

|

For 2018 and 2017, represents fees incurred for tax preparation and tax-related compliance services.

|

|

|

|

|

(3)

|

For 2017, represents fees for services related to the filing of our Form S

‑

1, Form S

‑

8, and Form 10 registration statements with the SEC.

|

Determination of Independence

The Audit Committee of the Board of Directors has determined that, as Wolf provided no services covered under the heading “All Other Fees” above, Wolf maintained its independence for the fiscal year ended December 31, 2018.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services

Under its charter, the Audit Committee must pre-approve all engagements of our independent registered public accounting firm, unless an exception to such pre-approval exists under the Exchange Act or the rules of the SEC. The Audit Committee maintains a policy requiring the pre-approval of all services to be provided by our independent registered public accounting firm. The Audit Committee has delegated to its Chair the authority to evaluate and approve service engagements on behalf of the full Audit Committee in the event a need arises for specific pre-approval between Audit Committee meetings. All of the audit, audit-related, tax services, and all other services provided by our independent registered public accounting firm for the 2018 fiscal year were approved by the Audit Committee in accordance with the foregoing procedures.

Vote Required

The affirmative vote of holders of a majority of the shares of our common stock represented in person or by proxy at the annual meeting and entitled to vote on the matter is required to ratify the appointment of Wolf to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2019.

Recommendation of the Board of Directors

Our Board of Directors recommends that the stockholders vote FOR the ratification of the appointment of Wolf to serve as our independent registered public accounting firm for the fiscal year ending December 31, 2019.

PROPOSAL THREE:

APPROVAL OF OUR 2016 EQUITY INCENTIVE PLAN, AS AMENDED

Introduction

Our 2016 Equity Incentive Plan, adopted on March 11, 2016 (the “2016 Plan”), currently authorizes us to issue a total of 450,000 shares of Common Stock. On March 5, 2019, our Board of Directors determined that the number of shares of Common Stock available for issuance under the 2016 Plan was insufficient to continue to attract, retain, and motivate our employees, consultants, and directors using equity compensation. Subject to stockholder approval, the Board of Directors therefore unanimously approved an amendment to the 2016 Plan to increase the number of shares of Common Stock authorized for issuance under the 2016 Plan from 450,000 shares to

900,000

shares (the “Plan Amendment”). In accordance with the General Corporation Law of the State of Delaware, we are hereby seeking approval of the Plan, as amended by the Plan Amendment, by our stockholders.

The proposed Plan Amendment would delete

Section 3(a) of the 2016 Plan and replace it with the following text:

|

|

|

|

|

|

|

|

a.

Share Reserve

. Subject to Section 9(a) relating to Capitalization Adjustment, the aggregate number of shares of Common Stock that may be issued pursuant to Awards will not exceed

900,000

shares (the “

Share Reserve

”).

|

|

No other changes to the 2016 Plan are being proposed, and the Plan Amendment would not modify the number of shares held by, or the rights of, existing stockholders or participants in the 2016 Plan.

Reasons for the Plan Amendment

Equity awards have been historically and, we believe, will continue to be, an integral component of our overall compensation program for our employees, directors, and consultants. Approval of the 2016 Plan, as amended, will allow us to continue to grant equity awards at levels we determine to be appropriate in order to attract new employees and directors, retain our existing employees and directors, and provide incentives for such persons to exert maximum efforts for our success. The 2016 Plan, as amended, allows us to continue to utilize a broad array of equity incentives with flexibility in designing equity incentives, including stock option grants, stock appreciation rights, stock awards, and stock unit awards.

We believe it is critical for our long-term success that the interests of our employees and directors are tied to our success as “owners” of our business. The equity incentive programs we have in place are intended to build stockholder value by attracting and retaining talented employees and directors. We believe that we must continue to offer competitive equity compensation packages in order to retain and motivate the talent necessary for our continued growth and success. We carefully monitor the equity compensation and equity holdings of our employees, directors, and consultants, as well as the type of equity awards we grant, to ensure that these awards continue to provide incentives for the recipients to work toward our success. To date, stock options have been the primary component of our equity program, the only exception being the restricted stock received by our Chairman. The potential value of stock options is realized only if our share price increases, and so stock options provide a strong incentive for individuals to work to build stockholder value.

Of the 450,000 shares of Common Stock that are currently authorized to be issued under the 2016 Plan, as of March 15, 2019, 192,362 shares are issued and outstanding, 173,561 are issuable upon exercise of outstanding option grants, and 84,077 remain reserved for issuance. We have and we expect to continue to experience growth in personnel as we progress our business. If our stockholders do not approve the 2016 Plan, as amended, we believe that we will be unable to successfully use equity as part of our compensation program, as most biotech companies do, putting us at a significant disadvantage. The Board believes that, if the 2016 Plan, as amended by the Plan Amendment, is approved, the increase in the share reserve will leave sufficient reserves of authorized but unissued shares (

i.e.

, 534,077 shares of Common Stock) for the purpose of future equity grants under the 2016 Plan for the foreseeable future. Therefore, we believe that approval of this request is in the best interest of our stockholders and our company.

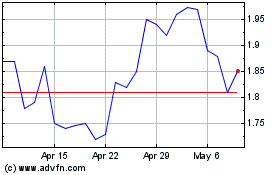

Based solely on the closing price of our common stock as reported by NASDAQ on March 15, 2019, and the maximum number of shares that would have been available for awards as of such date under the 2016 Plan (taking into account the increase contemplated by the Plan Amendment), the maximum aggregate market value of the common stock that could potentially be issued under the 2016 Plan is $840,000.

Key Features Designed to Protect Stockholders’ Interests

The design of the 2016 Plan reflects our commitment to corporate governance and the desire to preserve stockholder value as demonstrated by the following features:

|

|

|

|

•

|

Independent Administrator

. Our Board of Directors administers the 2016 Plan, and all compensation matters are approved by the Compensation Committee of the Board of Directors, which is comprised entirely on non-employee directors.

|

|

|

|

|

•

|

No Evergreen Feature

. The maximum number of shares available for issuance under the 2016 Plan is fixed and cannot be increased without stockholder approval.

|

|

|

|

|

•

|

No Discount Awards; Maximum Term Specified

. Stock options and stock appreciation rights must have an exercise price or base price no less than the fair market value on the date the award is granted (unless granted pursuant to an assumption of substitution for an existing award in connection with a change in control) and a term no longer than ten years’ duration.

|

|

|

|

|

•

|

Award Design Flexibility

. Different kinds of awards may be granted under the 2016 Plan, giving us the flexibility to design our equity incentives to compliment the other elements of compensation and to support the attainment of our strategic goals.

|

|

|

|

|

•

|

No Tax Gross-ups

. The 2016 Plan does not provide for tax gross-ups.

|

|

|

|

|

•

|

Fixed term

. The 2016 Plan has a fixed term of ten years from its initial effective date, or March 11, 2026.

|

Summary of the 2016 Equity Incentive Plan

The following summary of the material provisions of the 2016 Plan, as amended by the Plan Amendment, is not intended to be exhaustive and is qualified in its entirety by the terms of the 2016 Plan, which is included as Exhibit 10.6 to the Company’s Registration Statement on Form 10, filed on November 7, 2016, and the terms of the Plan Amendment, a copy of which is set forth as Appendix A hereto.

Shares Available Under the 2016 Plan

. The 2016 Plan, as amended, has a maximum share reserve of

900,000

shares of our common stock, subject to the permitted adjustments as explained below. Shares will return to the 2016 Plan, and will not reduce the number of shares available for issuance under the 2016 Plan, if the award: (1) expires or otherwise terminates without all of the shares covered by such award having been issued; (2) is settled in cash (

i.e.

, the participant receives cash rather than stock); (3) is forfeited back to or repurchased by the Company because of the failure to meet a contingency or condition required to vest such shares in the participant; or (4) is reacquired by the Company in satisfaction of tax withholding obligations or as consideration for the exercise or purchase price of an award.

Administration

. The 2016 Plan provides that the Board or a duly authorized committee thereof may administer the 2016 Plan (in such capacity, the “Administrator”). One or more of our officers may be empowered to designate employees to receive awards under the 2016 Plan and determine the size of any such awards (subject to certain limitations described in the 2016 Plan).

The Administrator determines which persons will receive awards, the number of shares subject to such awards, and the material terms and conditions of those awards, including the vesting, exercise, and delivery schedule for shares acquired under the awards. In addition, the Administrator may undertake an action that is treated as a repricing under generally accepted accounting principles, including reducing the exercise price to the then-current fair market value or canceling an outstanding underwater option in exchange for a new award or a cash payment. The Company will document these awards using forms approved by the 2016 Plan administrator. We may grant multiple awards to any participant, even if previously granted awards remain outstanding. The decisions of the Administrator are final and binding.

Eligibility

. We may grant awards under the 2016 Plan to the officers, employees, directors, and consultants of the Company and its subsidiaries. As of March 15, 2019, approximately 48 individuals would have been eligible to participate in the Plan had it been effective on such date, which includes five executive officers, 39 employees who are not executive officers, and four non-employee directors.

Permitted Awards

. Under the 2016 Plan, we may grant stock options, stock appreciation rights (SARs), restricted stock, restricted stock units, and other awards whose value is determined by reference to shares of our common stock.

Stock Options

. A stock option is the right to purchase shares of common stock at a price not less than the fair market value per share at the date of grant (except to the extent permitted by the U.S. Internal Revenue Code (the “Code”) in connection with the assumption of or substitution of an option for another option or stock appreciation right in connection with a change in control). No stock option may be exercisable more than ten years from the date of grant. Each grant will specify the period of continuous service with us or any subsidiary that is necessary before the stock options become exercisable. The aggregate number of shares of our common stock actually issued or transferred on the exercise of incentive stock options will not exceed 1,800,000 shares of our common stock.

SARs

. An SAR is a right to receive the appreciation distribution payable on the exercise of the SAR in an amount not greater than the excess of (i) the fair market value of the share of vested common stock subject to such award on the date of the exercise of the SAR over (ii) the strike price. SARs may be settled in cash, in shares of common stock, or in any combination of the two. The strike price for an SAR is generally not less than the fair market value per share at the date of grant (except to the extent permitted by the Code in connection with the assumption of or substitution of an option for another option or stock appreciation right in connection with a change in control).

Restricted Stock

. A grant of restricted stock involves the transfer by us to a participant of ownership of a specific number of shares of common stock in consideration of the performance of services. A holder of restricted stock has voting, dividend, and other ownership rights in such shares. The transfer may be made without additional consideration or in consideration of a purchase price determined by the Administrator. Any dividends or other distributions paid with respect to unvested restricted stock will generally be subject to the same restrictions and risk of forfeiture as the underlying award.

RSUs

. A grant of RSUs is the right to receive shares of common stock in the future, subject to any restrictions specified by the 2016 Plan administrator. During the restriction period and until shares are actually issued, the participant will have no rights of ownership in the shares of common stock. The Administrator may authorize the payment of dividend equivalents on RSUs, generally subject to the same restrictions and risk of forfeiture that apply to the underlying award.

Other Awards

. The Administrator may, subject to limitations under applicable law, grant to any participant such other awards that may be denominated or payable in, valued in whole or in part by reference to, or otherwise based on, or related to, shares of common stock.

Amendments

. We may amend the 2016 Plan from time to time. If required by the rules of Nasdaq (or any other applicable securities exchange), we will seek stockholder approval of any Plan amendment that (i) would materially increase the benefits accruing to participants under the 2016 Plan, (ii) would materially increase the number of securities that may be issued under the 2016 Plan, (iii) would materially expand the class of participants under the 2016 Plan, or (iv) must otherwise be approved by the our stockholders to comply with applicable law or the rules of Nasdaq (or such other securities exchange).

The Administrator has the right to effect, with the consent of any adversely affected participant, (A) the reduction of the exercise, purchase, or strike price of any outstanding award; (B) the cancellation of any outstanding award and the grant in substitution therefor of a new award, cash, or other valuable consideration; or (C) any other action that is treated as a repricing under generally accepted accounting principles.

Transferability

. Except as otherwise determined by the Administrator, awards are generally not transferable by the participant except by will or the laws of descent and distribution. In no event may any award granted under the 2016 Plan be transferred for value.

Adjustments

. In the event of a change in our common stock without the receipt of consideration by the Company through a merger, consolidation, reorganization, recapitalization, reincorporation, stock dividend, dividend in property other than cash, large nonrecurring cash dividend, stock split, reverse stock split, liquidating dividend, combination of shares, exchange of shares, change in corporate structure, or any similar equity restructuring transaction, the Board will appropriately and proportionately adjust: (i) the class(es) and maximum number of securities subject to the 2016 Plan as the share reserve, (ii) the class(es) and maximum number of securities that may be issued pursuant to the exercise of incentive stock options, and (iii) the class(es) and number of securities and price per share subject to outstanding awards. The Board will make such adjustments, and its determination will be final, binding, and conclusive.

Change in Control

. If we are subject to a change in control, the Administrator may: (i) arrange for the surviving corporation or acquiring corporation to assume or continue the award or to substitute a similar stock award (including, but not limited to, an award to acquire the same consideration paid to the stockholders of the Company in the transaction); (ii) arrange for the assignment of any reacquisition or repurchase rights held by the Company in respect of the award to the surviving corporation or acquiring corporation; (iii) accelerate the vesting, in whole or in part, of the award (and, if applicable, exercisability), with the award terminating if not exercised (if applicable) immediately prior to the effective time; (iv) arrange for the lapse, in whole or in part, of any reacquisition or repurchase rights held by the Company with respect to the award; (iv) cancel or arrange for the cancellation of the award, to the extent not vested or not exercised, in exchange for such cash consideration, if any, as the Board, in its sole discretion, may consider appropriate; or (v) make a payment equal to the excess, if any, of (A) the value of the property the holder would have received on the exercise of the award immediately prior to the transaction over (B) any exercise price payable in connection with such exercise. For clarity, this payment may be zero if the fair market value of the property is equal to or less than the exercise price. The Board need not take the same action or actions with respect to all awards or portions thereof or with respect to all participants.

Claw-Back Provisions

. All awards granted under the 2016 Plan will be subject to recoupment in accordance with any clawback policy that the Company adopts or is required to adopt pursuant to the listing standards of any national securities exchange or association on which the Company’s securities are listed or as is otherwise required by applicable law (

e.g.

, the Dodd- Frank Wall Street Reform and Consumer Protection Act). In addition, the Board may impose such other clawback, recovery, or recoupment provisions in an award agreement as the Board determines necessary or appropriate, including, but not limited to, a reacquisition right in respect of previously acquired shares of or other cash or property on the occurrence of cause.

Effective Date and Termination

. The 2016 Plan became effective as of March 11, 2016, subject to the approval of our stockholders (the “Effective Date”). No grant will be made under the 2016 Plan after March 11, 2026, the tenth anniversary of the Effective Date. All grants made on or prior to such date will continue in effect thereafter subject to the terms of the applicable award agreement and the terms of the 2016 Plan.

New Plan Benefits

Because the grant of awards under the 2016 Plan is within the discretion of the Administrator, the Company cannot determine the dollar value or number of shares of common stock that will in the future be received by or allocated to any participant in the 2016 Plan. Accordingly, in lieu of providing information regarding benefits that will be received under the 2016 Plan, the following table provides information concerning the benefits that were received by the following persons and groups during 2018 under the 2016 Plan: each named executive officer; all current executive officers, as a group; all current directors who are not executive officers, as a group; and all current employees who are not executive officers, as a group.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Options

|

|

Stock Awards

|

|

Name and Position

|

Average Exercise Price

($)

|

Number of Awards

(#)

|

|

Dollar Value

($)

1

|

Number of Awards

(#)

|

|

Ronald L. Stotish, Former President and Chief Executive Officer

|

2.50

|

|

|

60,606

|

|

|

—

|

|

|

—

|

|

|

David A. Frank, Chief Financial Officer and Treasurer

|

2.50

|

|

|

15,152

|

|

|

—

|

|

|

—

|

|

|

Alejandro Rojas, Chief Operating Officer

|

2.50

|

|

|

30,303

|

|

|

—

|

|

|

—

|

|

|

All current executive officers, as a group

|

2.50

|

|

(2)

|

106,061

|

|

|

—

|

|

|

—

|

|

|

All current directors who are not executive officers, as a group

|

2.50

|

|

(2)

|

7,500

|

|

|

27,878

|

|

(3)

|

11,151

|

|

|

All current employees who are not executive officers, as a group

|

—

|

|

(2)

|

—

|

|

|

—

|

|

|

—

|

|

|

|

|

|

(1)

|

The valuation of stock awards is based on the grant date fair value computed in accordance with FASB ASC Topic 718. For a discussion of the assumptions used in calculating these values, see Note 9 to our consolidated financial statements in our annual report on Form 10

‑

K for the fiscal year ended December 31, 2018, filed with the SEC on March 7, 2019.

|

|

|

|

|

(2)

|

Represents the weighted-average exercise price for the group.

|

|

|

|

|

(3)

|

Represents the aggregate grant date fair value for the group.

|

Tax Aspects Under the Code

The following is a summary of the principal federal income tax consequences of certain transactions under the 2016 Plan. It does not describe all federal tax consequences under the 2016 Plan, nor does it describe state or local tax consequences.

Incentive Options

. No taxable income is generally realized by the optionee upon the grant or exercise of an incentive option. If shares of common stock issued to an optionee pursuant to the exercise of an incentive option are sold or transferred after two years from the date of grant and after one year from the date of exercise, then (i) upon sale of such shares, any amount realized in excess of the option price (the amount paid for the shares) will be taxed to the optionee as a long-term capital gain, and any loss sustained will be a long-term capital loss, and (ii) the Company will not be entitled to any deduction for federal income tax purposes. The exercise of an incentive option will give rise to an item of tax preference that may result in alternative minimum tax liability for the optionee.

If shares of common stock acquired upon the exercise of an incentive option are disposed of prior to the expiration of the two-year and one-year holding periods described above (a “disqualifying disposition”), generally (i) the optionee will realize ordinary income in the year of disposition in an amount equal to the excess (if any) of the fair market value of the shares of common stock at exercise (or, if less, the amount realized on a sale of such shares of common stock) over the option price thereof, and (ii) we will be entitled to deduct such amount. Special rules will apply where all or a portion of the exercise price of the incentive option is paid by tendering shares of common stock.

If an incentive option is exercised at a time when it no longer qualifies for the tax treatment described above, the option is treated as a non-qualified option. Generally, an incentive option will not be eligible for the tax treatment described above if it is exercised more than three months following termination of employment (or one year in the case of termination of employment by reason of disability). In the case of termination of employment by reason of death, the three-month rule does not apply.

Non-Qualified Options