0000006845false00000068452024-01-102024-01-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

January 10, 2024

Date of Report (date of earliest event reported)

___________________________________

APOGEE ENTERPRISES, INC.

(Exact name of registrant as specified in its charter)

___________________________________

| | | | | | | | |

Minnesota (State or other jurisdiction of incorporation or organization) | 0-6365 (Commission File Number) | 41-0919654 (I.R.S. Employer Identification Number) |

4400 West 78th Street - Suite 520 Minneapolis, Minnesota 55435 |

(Address of principal executive offices and zip code) |

(952) 835-1874 |

(Registrant's telephone number, including area code) |

___________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.33 1/3 Par Value | APOG | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 2.05 Costs Associated with Exit or Disposal Activities.

On January 10, 2024, the Board of Directors of Apogee Enterprises, Inc. (the “Company”), approved certain restructuring actions intended to streamline its business structure, enable a more efficient cost model, and better position the Company for profitable growth (referred to as “Project Fortify”). Project Fortify includes strategic changes in the Architectural Framing Systems Segment to simplify the Segment’s organizational structure and brand portfolio, and eliminating certain lower-margin product and service offerings. The Company will also implement actions to optimize processes and streamline resources in its Architectural Services and Corporate Segments. These actions will include a reduction in the Company’s workforce by approximately 250 employees and the closure of a manufacturing facility and certain administrative offices. The Company broadly communicated these actions internally on January 30, 2024.

The Company expects to incur approximately $16 million to $18 million of pre-tax charges in connection with Project Fortify, including: approximately $7 million to $9 million of severance and employee related costs, $2 million to $3 million of contract termination costs, and $6 million to $7 million of other expenses. Cash expenditures related to these actions, which are included in the foregoing amounts, are estimated to be approximately $11 million to $13 million. The Company will record these charges as incurred. The Company expects annualized cost savings from Project Fortify of approximately $12 million to $14 million, with approximately 60% of the savings to be realized in fiscal year 2025 and the remainder in fiscal 2026. The Company expects the actions associated with the plan to be substantially completed by the end of the third quarter of fiscal 2025.

The actual timing, costs and savings associated with Project Fortify may differ from the Company’s expectations and estimates and such differences may be material.

Item 7.01 Regulation FD Disclosure.

On January 30, 2024, the Company issued a press release stating that any restructuring charges incurred associated with Project Fortify as described in Item 2.05 of this Form 8-K, are expected to be adjusted out of GAAP earnings and therefore would not impact its adjusted diluted earnings per share outlook for fiscal 2024 or 2025.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | | | | | | | | | | |

| Exhibit Number | | Description | | | |

| | |

| 104 | | Cover page interactive data file (embedded within the Inline XBRL document) |

Certain statements within this Form 8-K may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “plans”, “goals”, “should” and similar expressions are intended to identify “forward-looking statements”. These forward-looking statements include statements regarding our future structure, growth, profitability, positioning, results, expenses, targets and other statements that are not historical in nature. These statements reflect Apogee management’s expectations or beliefs as of the date of this release. The company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In particular, statements regarding the Company’s restructuring and cost-savings plans disclosed in this release constitute forward-looking statements. These forward-looking statements are subject to significant risks that could cause actual results to differ materially from the expectations reflected in the forward-looking statements. Such risks include, without limitation, that: we may be unable to achieve our anticipated results from the business restructuring initiatives; implementation of the cost-saving and business restructuring initiatives may take more time or cost more than expected; the anticipated cost saving initiatives may not be achieved, or they may be materially less than anticipated; and the restructuring may result in disruption in delivery of services to our customers. More information concerning potential factors that could affect future financial results is included in the company’s Annual Report on Form 10-K for the fiscal year ended February 25, 2023 and in subsequent filings with the U.S. Securities and Exchange Commission.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

APOGEE ENTERPRISES, INC.

By: /s/ Meghan M. Elliott

Meghan M. Elliott

Vice President, General Counsel and Secretary

Date: January 30, 2024

Press Release

FOR RELEASE: January 30, 2024

Apogee Enterprises Announces Strategic Actions to Reduce Costs and Strengthen the Company’s Position for Profitable Growth

MINNEAPOLIS, MN, January 30, 2024 – Apogee Enterprises, Inc. (Nasdaq: APOG) today announced strategic actions to further streamline its business operations, enable a more efficient cost model, and better position the Company for profitable growth (referred to as “Project Fortify”).

Project Fortify includes the following strategic changes related to the Architectural Framing Systems (AFS) segment:

•Eliminating certain lower-margin product and service offerings, enabling the consolidation of AFS into a single operating entity.

•Transferring production operations from the Company’s facility in Walker, Michigan, to the Company’s facilities in Monett, Missouri and Wausau, Wisconsin.

•Simplifying the segment’s brand portfolio and commercial model to improve flexibility, better leverage the Company’s capabilities, and enhance customer service.

Additionally, the Company will implement actions to optimize processes and streamline resources in its Architectural Services and Corporate segments.

“The actions we are announcing today progress our enterprise strategy and help position the Company to build on what we’ve achieved over the past two years,” said Ty R. Silberhorn, Chief Executive Officer. “Project Fortify will further improve our cost structure, enhance organizational efficiency, and enable our team to focus on higher growth, higher margin opportunities.”

The Company will begin executing these actions immediately and expects to be substantially completed in the third quarter of fiscal 2025. The Company expects to incur approximately $16 million to $18 million of pre-tax charges in connection with Project Fortify, including: $7 million to $9 million of severance and employee related costs; $2 million to $3 million of contract termination costs, and $6 million to $7 million of other expenses. The Company will record these charges as incurred. Any restructuring charges incurred associated with Project Fortify are expected to be adjusted out of GAAP earnings and therefore would not impact adjusted diluted earnings per share for fiscal 2024 or 2025.

Apogee Enterprises, Inc. • 4400 West 78th Street • Minneapolis, MN 55435 • (952) 835-1874 • www.apog.com

Apogee Enterprises, Inc.

Page 2

The actions announced today are expected to lead to annualized cost savings of $12 million to $14 million and reduce the Company’s workforce by approximately 250 employees. The Company expects approximately 60% of the savings to be realized in fiscal 2025 and the remainder in fiscal 2026. The Company expects that approximately 70% of the savings will be realized in the AFS segment, 20% in the Architectural Services segment, and 10% in the Corporate segment.

About Apogee Enterprises, Inc.

Apogee Enterprises, Inc. (Nasdaq: APOG) is a leading provider of architectural products and services for enclosing buildings, and glass and acrylic products used for preservation, energy conservation, and enhanced viewing. Headquartered in Minneapolis, MN, our portfolio of industry-leading products and services includes high-performance architectural glass, windows, curtainwall, storefront and entrance systems, integrated project management and installation services, as well as value-added glass and acrylic for custom picture framing and displays. For more information, visit www.apog.com.

Forward-Looking Statements

Certain statements within this press release may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. The words “believe,” “expect,” “anticipate,” “intend,” “estimate,” “forecast,” “project,” “plans”, “goals”, “should” and similar expressions are intended to identify “forward-looking statements”. These forward-looking statements include statements regarding our future structure, growth, profitability, positioning, results, expenses, targets and other statements that are not historical in nature. These statements reflect Apogee management’s expectations or beliefs as of the date of this release. The company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. In particular, statements regarding the Company’s restructuring and cost-savings plans disclosed in this release constitute forward-looking statements. These forward-looking statements are subject to significant risks that could cause actual results to differ materially from the expectations reflected in the forward-looking statements. Such risks include, without limitation, that: we may be unable to achieve our anticipated results from the business restructuring initiatives; implementation of the cost-saving and business restructuring initiatives may take more time or cost more than expected; the anticipated cost saving initiatives may not be achieved, or they may be materially less than anticipated; and the restructuring may result in disruption in delivery of services to our customers. More information concerning potential factors that could affect future financial results is included in the company’s Annual Report on Form 10-K for the fiscal year ended February 25, 2023 and in subsequent filings with the U.S. Securities and Exchange Commission.

Contact:

Jeff Huebschen

Vice President, Investor Relations & Communications

952.487.7538

ir@apog.com

Apogee Enterprises, Inc. • 4400 West 78th Street • Minneapolis, MN 55435 • (952) 835-1874 • www.apog.com

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

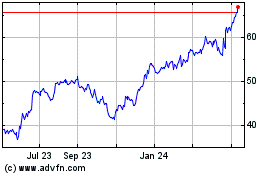

Apogee Enterprises (NASDAQ:APOG)

Historical Stock Chart

From Mar 2024 to Apr 2024

Apogee Enterprises (NASDAQ:APOG)

Historical Stock Chart

From Apr 2023 to Apr 2024