UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

AMERISERV FINANCIAL, INC.

|

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT COMPANY LLC

DRIVER OPPORTUNITY PARTNERS I LP

J. ABBOTT R. COOPER

KEITH R. MESTRICH

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Driver Management Company

LLC, together with the other participants named herein (collectively, “Driver”), intends to nominate, and to file a preliminary

proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of,

director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation (the “Company”).

On September 25, 2023,

Driver sent the following letter to Mr. J. Michael Adams, Chairman of the board of directors of the Company:

September 25, 2023

Mr. J. Michael Adams

Chairman of the Board

AmeriServ Financial, Inc.

216 Franklin Street

Johnstown, PA 15901

Via email to jmadams@ameriserv.com

and blayton@ameriserv.com

Mr. Adams,

As you are aware, Driver Opportunity Partner I LP (together

with Driver Management Company LLC, “Driver”) is the record owner of 1,000 shares of the common stock (the “Common

Stock”) of AmeriServ Financial, Inc. (“AmeriServ” or the “Corporation”) and is the beneficial

owner of 425,503 additional shares of Common Stock.

By letter dated September 6, 2023 (the “September 6 Letter”),

I requested (i) information regarding the process for obtaining the “approval” contemplated by Section 2.14 (the “Interlocks

Bylaw”) of the Corporation’s Amended and Restated Bylaws (the “Bylaws”), (ii) a copy of the “background

check policy” of AmeriServ’s board of directors (the “Board”) referenced in Section 2.16 (the “Background

Check Bylaw”) of the Bylaws and (iii) information regarding the criteria used and the process followed by the Board when determining

whether “approve” a person for “election, re-election, appointment or re-appointment” to the Board as well as

determining whether a “background check has not revealed any information that in the opinion of the [Board] and outside counsel

should preclude [an individual] from serving as a director.” The information requested in the September 6 Letter is referred to

as the “Necessary Information.”

There has been no response to the September 6 Letter.

By letter dated September 7, 2023, Driver demanded (the “Books

and Records Demand”), pursuant to 15 Pa. C.S § 1508(b) to inspect certain of the Corporation’s books and records,

including books and records that would (or should) contain the Necessary Information.

By letter dated September 14, 2023 (the “Rejection Letter”),

counsel to the Corporation indicated that the Corporation would not provide the Necessary Information pursuant to the Books and Records

Demand on the asserted basis that Driver did not have a proper purpose in making the Books and Records Demand, a contention that rings

particularly false given that—as stated in the September 6 Letter—Driver intends to nominate candidates for election to director

at the Corporation’ 2024 annual meeting of shareholders (the “2024 Annual Meeting”) and was requesting the Necessary

Information in order to comply with the Interlocks Bylaw and the Background Check Bylaw.

While Driver in no way concedes that either the Interlocks Bylaw

or the Background Check Bylaw was validly adopted or comports with 15 Pa. C.S. § 1725(a), in order to avoid more of the litigation

upon which the Board is wasting millions of dollars, Driver again requests the Necessary Information and any other information that Driver

might require in order to comply with the Interlocks Bylaw and the Background Check Bylaw.

This request has taken on additional urgency since Driver currently

intends to nominate, in addition to the undersigned, Keith Mestrich, who Driver believes is uniquely qualified to serve on the Board given

his experience as chief executive officer and member of the board of directors of Amalgamated Financial Corp. (“Amalgamated”).

In addition to his experience at Amalgamated, Mr. Mestrich has over three decades of experience in the intersection of financial management

and labor, including having served as chief financial officer and deputy chief of staff for the Service Employee International Union.

Driver believes that all AmeriServ shareholders would benefit from the addition of Mr. Mestrich to the Board given his directly relevant

experience of service on the board of directors of a financial institution with unionized employees and his track record of value creation

at Amalgamated, which was accomplished while spearheading an increase in Amalgamated’s minimum wage and certification as a public

benefit corporation.

The Requested Information must exist, as evidenced by the fact that

Nedret Vidinli—who was then serving as a director of First Keystone Financial, Inc.—was appointed to the Board in 2008 and

then elected to a three year term on the Board in 2009. Given that you were on the Board at the time Mr. Vidinli was first appointed then

elected to the Board, you must have some familiarity with the “approval” process contemplated by the Interlocks Bylaw.

The Board is pointlessly wasting millions of dollars in defense

of litigation based on claims that Driver’s notice of nomination with respect to the Corporation’s 2023 annual meeting of

shareholders was invalid due to, among other things, Driver’s alleged failure to comply with the Interlocks Bylaw, yet the Board

has so far refused to provide any information that would permit Driver to comply with the Interlocks Bylaw (or the Background Check Bylaw)

in connection with the 2024 Annual Meeting.

It is hard to see the continued failure of the Board to provide

the Requested Information as anything more than simple entrenchment by a Board fearful of being held accountable by shareholders for decades

of underperformance.

/s/ Abbott

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC (“Driver

Management”), together with the other participants named herein (collectively, “Driver”), intends to nominate, and to

file a preliminary proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes

for the election of, director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation

(the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF

THE COMPANY TO READ ANY PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION,

THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF PROXY MATERIALS WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

The participants in the proxy solicitation

are currently anticipated to be Driver Management, Driver Opportunity Partners I LP (“Driver Opportunity”), J. Abbott R. Cooper

and Keith R. Mestrich.

As of the date hereof, the participants in

the proxy solicitation beneficially own in the aggregate 426,503 shares of Common Stock, par value $0.01 per share, of the Company (the

“Common Stock”). As of the date hereof, Driver Opportunity directly beneficially owns 426,503 shares of Common Stock, including

1,000 shares held in record name. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the

426,503 shares of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the managing member of Driver Management,

may be deemed to beneficially own the 426,503 shares of Common Stock directly beneficially owned by Driver Opportunity. As of the date

hereof, Mr. Mestrich does not beneficially own any securities of the Company.

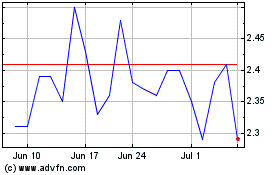

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

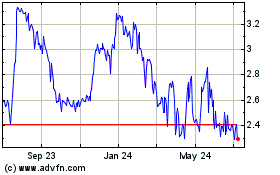

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024