UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

(Rule

14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☐

Filed by a Party other than the Registrant ☒

Check the appropriate box:

| ☐ | Preliminary Proxy Statement |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ | Definitive Proxy Statement |

| ☐ | Definitive Additional Materials |

| ☒ | Soliciting Material Under § 240.14a-12 |

| AmeriServ Financial, Inc. |

(Name of Registrant as Specified In Its Charter)

|

| |

DRIVER MANAGEMENT

COMPANY LLC

Driver Opportunity

Partners I LP

J. Abbott R. Cooper

|

(Name of Persons(s) Filing Proxy Statement, if other than the Registrant)

|

Payment of Filing Fee (Check all boxes that apply):

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

Driver Management Company

LLC, together with the other participants named herein (collectively, “Driver”), intends to nominate, and to file a preliminary

proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes for the election of,

director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation (the “Company”).

On September 7, 2023, Driver

delivered to the Company a demand pursuant to Pennsylvania law to inspect certain of the Company’s books and records, a copy of

which is attached hereto as Exhibit 1 and incorporated herein by reference.

CERTAIN INFORMATION CONCERNING THE PARTICIPANTS

Driver Management Company LLC (“Driver

Management”), together with the other participants named herein (collectively, “Driver”), intends to nominate, and to

file a preliminary proxy statement and accompanying proxy card with the Securities and Exchange Commission to be used to solicit votes

for the election of, director nominees at the 2024 annual meeting of shareholders of AmeriServ Financial, Inc., a Pennsylvania corporation

(the “Company”).

DRIVER STRONGLY ADVISES ALL SHAREHOLDERS OF

THE COMPANY TO READ ANY PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. SUCH PROXY MATERIALS

WILL BE AVAILABLE AT NO CHARGE ON THE SEC’S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION,

THE PARTICIPANTS IN THIS PROXY SOLICITATION WILL PROVIDE COPIES OF PROXY MATERIALS WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST.

The participants in the proxy solicitation

are currently anticipated to be Driver Management, Driver Opportunity Partners I LP (“Driver Opportunity”) and J. Abbott R.

Cooper.

As of the date hereof, the participants in

the proxy solicitation beneficially own in the aggregate 350,503 shares of Common Stock, par value $0.01 per share, of the Company (the

“Common Stock”). As of the date hereof, Driver Opportunity directly beneficially owns 350,503 shares of Common Stock, including

1,000 shares held in record name. Driver Management, as the general partner of Driver Opportunity, may be deemed to beneficially own the

350,503 shares of Common Stock directly beneficially owned by Driver Opportunity. Mr. Cooper, as the managing member of Driver Management,

may be deemed to beneficially own the 350,503 shares of Common Stock directly beneficially owned by Driver Opportunity.

Exhibit 1

September 7, 2023

J. Michael Adams

Chairman

Board of Directors

AmeriServ Financial, Inc.

216 Franklin Street

Johnstown, PA 15901

Via Email and FedEx

DEMAND PURSUANT TO 15 Pa. C.S. § 1508 – RESPONSE WITHIN

FIVE BUSINESS DAYS REQUIRED

Mr. Adams,

Driver Opportunity Partners I LP (together with its general partner,

Driver Management Company LLC, “Driver”) is the record owner of 1,000 shares of the common stock (the “Common

Stock”), par value $0.01, of AmeriServ Financial, Inc. (the “Corporation” or “AmeriServ”).

Pursuant to 15 Pa. C.S. § 1508(b), Driver is hereby exercising

its right to inspect certain books and records (collectively, the “Books and Records”) and demands to inspect (and

make copies or extracts therefrom) the following documents relating to the adoption, enforcement, and application of Section 2.14 (the

“Interlocks Bylaw”) and Section 2.16 (the “Background Check Bylaw”; together with the Interlocks

Bylaw, the “Challenged Bylaws”) of the Corporation’s bylaws (the “Bylaws”):

| 1. | A complete set of the minutes of any meetings of AmeriServ’s board of directors (including any committees thereof, the “Board”)

concerning the Interlocks Bylaw and the Background Check Bylaw, including without limitation any meetings during which the Board discussed,

considered, or contemplated (i) the purpose of either the Interlocks Bylaw or the Background Check Bylaw, (ii) the impact of either the

Interlocks Bylaw or the Background Check Bylaw on the ability of any AmeriServ shareholder to nominate any individual for election to

director or the ability of any person so nominated to be elected as a director, (iii) whether either the Interlocks Bylaw or the Background

Check Bylaw fixed any qualifications for service on the Board, (iv) whether the Bylaws in effect prior to the inclusion of Interlocks

Bylaw or the Background Check Bylaw allowed for amendment of the Bylaws to include the Interlocks Bylaw or the Background Check Bylaw

without the approval of AmeriServ shareholders, (v) whether any applicable law or regulation made adoption of either the Interlocks Bylaw

or the Background Check Bylaw necessary or desirable, (vi) any connection between the Interlocks Bylaw and the Depository Institution

Management Interlocks Act, 12 U.S.C. §§ 3201 et seq., and the related rules, 12 C.F.R. § 212, 238.91-99, promulgated by

the Board of Governors of the Federal Reserve System (taken together, the “Interlocks Rules”), (vii) the process for,

and the criteria to be used, in deciding whether to grant the approval contemplated by the Interlocks Bylaw, (viii) the process for, and

the criteria to be used, in determining whether a person should be precluded from serving as a director as contemplated by the Background

Check Bylaw, (ix) the Board’s background check policy, (x) whether, as contemplated by the Interlocks Bylaw, to approve J. Abbott

R. Cooper for service on the Board, (xi) the determination to declare that the Interlocks bylaw rendered Mr. Cooper ineligible for election

to the Board prior to becoming a director of a depositary institution, including, without limitation, any analysis whether the Corporation

competes with The First of Long Island Corporation, or (xii) any decision to waive the background check requirement contemplated by the

Background Check Bylaw, (together, the “Relevant Matters”); |

| 2. | All documents provided to the Board concerning any of the Relevant Matters; |

1266 East Main Street

Suite 700R

Stamford, CT 06902

| 3. | Any documents and communications between or among the Board (including any individual member(s) or committee(s) thereof and any advisor)

concerning the Relevant Matters; |

| 4. | Copies of all correspondence between AmeriServ (including through its counsel or any other AmeriServ agent or representative) and

the United States Securities and Exchange Commission regarding the Interlocks Bylaw; |

| 5. | Documents and communications sufficient to demonstrate whether all the individuals serving on the Board since the adoption of the

Background Check Bylaw have undergone a background check as contemplated by the Background Check Bylaw and whether the Board has, with

respect to each of those individuals, made an affirmative decision that the information revealed by the background check would not preclude

the individual from serving as a director; and |

| 6. | Documents reflecting or referring to the procedure for requesting the “approval” contemplated by the Interlocks Bylaw

and the criteria (if any) employed by the Board in determining whether to grant such approval; and |

| 7. | Documents reflecting or referring to the Board’s “background check policy” and the criteria (if any) employed by

the Board in determining whether any information revealed in a background check “should preclude” an individual from serving

on the Board. |

* * *

Under Pennsylvania law, Driver has the right to make its own inspection

of the Books and Records, including non-public Books and Records, for any proper purpose, including to make its own determination as to

whether the Corporation is being properly managed.1

The burden of demonstrating that Driver has an improper or unreasonable purpose falls on the Corporation.2

Mere claims by the Corporation that Driver is an “activist” investor or is seeking information to be used in connection with

a contested election of directors are not sufficient to establish an improper purpose.3

The purpose of this demand is (i) to investigate possible breaches

of fiduciary duty and violations of the Pennsylvania Business Corporation Law by members of the Board in connection with the adoption

and enforcement of the Challenged Bylaws, (ii) to use information obtained through inspection of the Books and Records to evaluate possible

litigation (including litigation seeking to declare the Challenged Bylaws invalid) or other corrective matters, and (iii) to communicate

information obtained through inspection of the Books and Records to other AmeriServ shareholders so that they may be informed of Board

actions and policies that interfere with a shareholder’s right to nominate candidates for election to director.

15 Pa. C.S. § 1725(a) provides that the directors of a Pennsylvania

corporation shall be elected by its shareholders. Both the Interlocks Bylaw and the Background Check Bylaw give the Board the unfettered

right to veto candidates for election to director without reference to any objective criteria, making a mockery of corporate democracy’s

fundamental principle of shareholder democracy. The right to elect directors—a right expressly given shareholders by Pennsylvania

law—means little if the Board can determine, without reference to any objective criteria to which shareholders have been provided

reasonable prior notice, that information revealed in a background check “should preclude” any individual from being eligible

for election to director. Similarly, the notion that—unless “approved” by the Board—any individual that is serving,

or has within the previous five years has served, on the board of another depositary institution (theoretically the kind of individual

that would have the most relevant experience) is barred from being elected to the Board represents an impermissible restriction on the

shareholder franchise.

1 See, Zerbey v. J.H. Zerbey Newspapers, Inc., 560 A.2d 191, 198 (Pa. Super. Ct. 1989)(holding that wanting to determine whether a corporation “is being properly managed in a general sense” constitutes a proper purpose under 15 Pa. C.S. § 1508).

2 Goldman v. Trans-United Industries, Inc., 171 788, 790 (Pa. 1961).

3 See, Sto-Rox Focus on Renewal Neighborhood Corp. v. King, 398 A.2d 241, 243 (Pa. Commw. Ct. 1979).

In addition, the Board has failed to provide AmeriServ shareholders

with any information that might permit an AmeriServ shareholder to attempt to comply with either the Interlocks Bylaw or the Background

Check Bylaw. There is no publicly available description of the process by which an individual can request the “approval” contemplated

by the Interlocks bylaw. Indeed, that the Board publicly declared that the Interlocks Bylaw prohibited Mr. Cooper from election to the

Board before Mr. Cooper had even become a director of another depositary institution and thus became subject to the Interlocks

Bylaw suggests that there is no process by which an individual can seek the contemplated “approval” and, instead, such “approval”

is granted entirely at the whim of the Board.4

Similarly, the Board’s “background check policy” is not publicly available, so there is no way for an individual to

be able to comply with that policy.

Finally, with respect to both the Interlocks Bylaw and the Background

Check Bylaw, the lack of objective criteria for granting “approval” for, or determining that an individual is “precluded”

from, election to the Board both gives the Board an absolute veto right over who may be elected to the Board and deprives any AmeriServ

shareholder wishing to nominate an individual for election to director any ability to reasonably predict whether that individual will

be eligible for election to director. Such uncertainty is likely to have an extreme chilling effect on both a shareholder’s willingness

to nominate an individual to be a candidate for election to director as well as that individual’s willingness to be nominated. Taken

in their totality, the Challenged Bylaws constitute an impermissible interference by the Board in AmeriServ shareholders’ rights

to elect directors.

* * *

For the record, Driver believes that both the Interlocks Bylaw and

the Background Check Bylaw are invalid and in violation of 15 Pa. C.S. § 1725(a). Nothing contained in this letter shall be deemed

to be or construed as an admission by Driver that the Challenged Bylaws are valid or enforceable.

Pursuant to 15 Pa. C.S. § 1508(c), the Corporation has five

business days from receipt of this demand to reply substantively to this demand. Please advise the undersigned as promptly as practicable

when and where the books and records covered by this demand will be made available to Driver. To the extent the Corporation wishes to

provide Driver with copies of the books and records covered by this demand, Driver will bear the reasonable out of pocket costs incurred

by the Corporation in copying and delivering those books and records to Driver. If the Corporation contends this demand is incomplete

or deficient in any respect, please notify the undersigned immediately in writing setting forth the facts that the Corporation contends

support its position and specifying any additional information believed to be required. In the absence of such prompt notice, Driver will

assume that this demand complies in all respects with the requirements of 15 Pa. C.S. § 1508(b).

| |

Driver Opportunity Partners I LP |

| |

|

| |

By: |

Driver Management Company, its general partner |

| |

|

|

| |

By: |

/s/ J. Abbott R. Cooper |

| |

|

Managing Member |

I verify that the statements made in this demand are true and correct.

I understand that any false statements made herein are subject to the penalties of 18 Pa. C.S. § 4904.

| Date: September 7, 2023 |

Signed: /s/ J. Abbott R.. Cooper |

4 See, e.g., https://www.sec.gov/Archives/edgar/data/707605/000155837023003930/tmb-20230315xex99d2.htm (stating “Additionally, the Notice’s purported nomination of Mr. Cooper – who is set to become a director of New York-based First of Long Island Corporation – does not comply with AmeriServ’s interlocks bylaw that prohibits Board members and nominees to the Board from, among other things, concurrent directorships with other depository institutions” (emphasis added)).

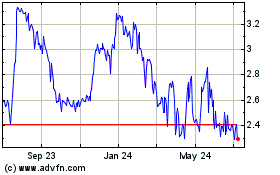

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

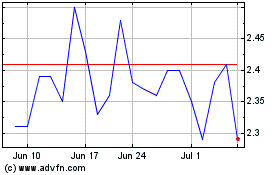

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024