0000707605

false

0000707605

2023-08-31

2023-08-31

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13

or 15(d) of the

Securities Exchange Act

of 1934

Date of Report (Date of

earliest event reported) August 31, 2023

AmeriServ Financial, Inc.

(exact name of registrant

as specified in its charter)

| Pennsylvania |

|

0-11204 |

|

25-1424278 |

| (State or other jurisdiction |

|

(Commission |

|

(IRS Employer |

| of incorporation) |

|

File Number) |

|

Identification No.) |

| Main and Franklin Streets, Johnstown, PA |

15901 |

| (address of principal executive offices) |

(Zip Code) |

Registrant's telephone number, including area

code: 814-533-5300

N/A

(Former name or former address,

if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

¨ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities

registered pursuant to Section 12(b) of the Act:

| Title

Of Each Class |

|

Trading

Symbol |

|

Name

of Each Exchange On Which

Registered |

| Common Stock |

|

ASRV |

|

The NASDAQ Stock Market LLC |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter).

Emerging

growth company ¨

If an

emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 7.01 | Regulation FD Disclosure. |

On

August 31, 2023, AmeriServ Financial, Inc. sent a letter to its shareholders, a copy of which is attached to this Current Report

on Form 8-K as Exhibit 99.1 and incorporated herein by reference.

The

information in this Item 7.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section 18

of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section,

nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act,

except as expressly set forth by specific reference in such filing.

| Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits:

Pursuant to the

requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

| |

AMERISERV FINANCIAL, Inc. |

| |

|

|

| Date: August 31, 2023 |

By |

/s/ Michael D. Lynch |

| |

|

Michael D. Lynch |

| |

|

EVP & CFO |

Exhibit 99.1

LETTER

TO SHAREHOLDERS FROM J. MICHAEL ADAMS, JR., CHAIRMAN OF

THE BOARD, AND JEFFREY A. STOPKO, PRESIDENT AND CEO

August 31, 2023

Dear Shareholder,

We are excited

about the future of AmeriServ and are executing our strategy to create long-term value for you and all our stakeholders. Our Board of

Directors (the “Board”) is committed to making sure we achieve this goal.

The Board has a

responsibility to represent your best interests and has always worked hard to do that. Over the past year, this resulted in some public

back and forth with a shareholder who gained control of 8.6% of the Company’s stock, agitated publicly for the election of his

hand-picked directors, and then recently relinquished control of most of these stock holdings.

This investor,

Driver Management Company LLC (collectively with its affiliates, “Driver”), recently mailed a highly misleading letter to

shareholders penned by its founder and managing member, J. Abbott R. Cooper. Driver’s letter is seemingly intended to sow confusion

among AmeriServ shareholders. We are writing to you today to ensure this does not happen and to set the record straight.

Please consider

the following facts.

FACT

#1: DRIVER HAS NO TRACK RECORD OF CREATING SHAREHOLDER VALUE

| ● | Driver

is a serial activist investor and, since 2018, has targeted a total of nine (9) community

banks with proxy campaigns – primarily to win influence on their boards. |

| ● | The

share prices of those nine companies declined an average of 15% during Driver’s involvement.1 |

| ● | Driver’s

aggressive tactics, disregard for long-term shareholders and oftentimes reckless communications

have destroyed value. |

FACT

#2: DRIVER OPERATES WITH A SHORT-TERM MENTALITY

| ● | Driver

first bought AmeriServ stock in May of 2022, just months before announcing its nomination

of director candidates for election to the Board. |

| ● | Mr. Cooper

is clearly not aligned with long-term shareholders, but rather – we believe –

bought into the stock with the intention of getting a quick profit and then selling out. |

1 Source: “Driver Files

13D/A on AmeriServ Financial; Updates Item 4,” August 9, 2023, Bloomberg.

FACT

#3: DRIVER HAS GIVEN UP CONTROL OF THE VAST MAJORITY OF ITS AMERISERV STOCK

| ● | When

Driver did not get what it wanted following the 2023 Annual Meeting of Shareholders (the

“2023 Annual Meeting”), it relinquished control of the majority of its AmeriServ

stock within months. |

| ● | Driver

began its campaign at AmeriServ in January of 2023 beneficially owning 8.6% of the common

stock. |

| ● | On

August 9, 2023, it reported beneficial ownership of only 1.6%. |

| ● | We

question Mr. Cooper’s commitment to creating value at the Company given his now

drastically reduced stake. |

FACT

#4: MR. COOPER DID NOT DISCLOSE KEY INFORMATION ABOUT HIS NOMINEES

| ● | Shareholders

should take Driver’s statements with a grain of salt, given that its nomination notice

for the 2023 Annual Meeting failed to disclose important information about its candidates

and the fact that Mr. Cooper’s election to the Board would not comply with our

interlocks bylaw because of his impending service on the board of another depository institution. |

| ● | Our

bylaws exist to protect the best interests of all stakeholders, including you, our shareholders,

as well as our customers, employees and community, and we take their requirements very seriously. |

| ● | Driver’s

disregard of our bylaws – and failure to present information essential for shareholders

to make full assessments of its candidates’ qualifications and ability to serve on

the Board – should give everyone serious pause. |

FACT

#5: DRIVER’S ATTACKS HAVE COST SHAREHOLDERS DEARLY

| ● | As

we announced in our second quarter 2023 earnings, we had to spend $1.7 million in the first

two quarters of 2023 to defend the Company and the best interests of all shareholders by

not allowing Driver’s candidates to stand for election to the Board after Mr. Cooper

hid critical information about at least one of them. |

| ● | It

should not be lost on Mr. Cooper that he himself is directly responsible for the costs

we have had to incur. |

| ● | Although

this spend resulted in a net loss of $187,000 for the second quarter, we continued to operate

effectively and in a conservative manner. |

| ● | Since

the end of 2022, we have seen an increase of $19 million, or 1.7%, in deposits, which demonstrates

customer confidence and the strength and loyalty of our core deposit base. |

| ● | Additionally,

wealth management revenues showed modest growth for the past two consecutive quarters. |

FACT

#6: DRIVER HAS BROUGHT FRIVOLOUS LITIGATION AGAINST THE COMPANY

| ● | Unfortunately,

Driver continues to force the Company to incur costs by entangling us in ongoing litigation. |

| ● | Previously,

Driver sought a preliminary injunction to delay our 2023 Annual Meeting – and deprive

shareholders of the opportunity to cast their votes – and this request was rejected

by the United States District Court for the Western District of Pennsylvania. |

| o | The

Court declared “Driver’s inability to have its director nominees considered

for election at the 2023 Annual Meeting is entirely a result of its own failures, not as

a result of AmeriServ’s conduct.” |

| ● | Not

content to accept the United States District Court’s decision, and the subsequent election

of our highly qualified new directors at the 2023 Annual Meeting, Mr. Cooper is now

apparently attempting to re-fight the proxy contest through the courts – despite his

failed attempt to do so in the past. |

| ● | To

that end, the Company is currently involved in two (three until recently) court cases caused

by Driver. |

FACT

#7: DRIVER CONTINUES TO PUSH FOR ADDITIONAL LITIGATION – EVEN DEMANDING THAT THE BOARD SUE ITS OWN MEMBERS

| ● | In

an August 1, 2023 letter, Mr. Cooper demands that the Board sue, on behalf of the

Company – its own members (as well as two recently retired directors) – for “breach

of their fiduciary duty.” |

| ● | This

demand – while extreme – is not surprising given Driver’s litigious history

with target companies. Notably, Driver has filed lawsuits against several other community

banks, including First Foundation, Inc., First United Corporation and Republic First

Bancorp, Inc. |

| ● | In

fact, in April of 2021, Driver “greenmailed” First United Corporation into

buying back the firm’s shares for $6.5 million and also paying $3.3 million in order

to settle litigation that Driver brought against that company.2

This action calls into question Driver’s alignment with long-term shareholders

in general. |

| ● | As

we previously stated in a letter to Driver, we have no intention of agreeing to the type

of seemingly self-enriching share repurchases and cash payments that Driver has extracted

from other community banks in order to end litigious contests.3 |

| ● | That

said, we take all shareholder concerns seriously. Therefore, despite the potential additional

costs involved, we are acting according to the Pennsylvania Business Corporation Law and

forming a Special Litigation Committee made up of outside, independent individuals who will

hire their own independent counsel and evaluate Mr. Cooper’s demand, and the Board

looks forward to their conclusions. |

2 Source: “First United

in Maryland buys out activist investor,” April 19, 2021, American Banker.

3 See Current Report on Form

8-K filed by AmeriServ on January 19, 2023.

FACT

#8: DRIVER HAS NEVER ARTICULATED A VIABLE ALTERNATIVE STRATEGY OR PLAN FOR AMERISERV

| ● | Shareholders

reading Driver’s public materials would be left scratching their heads if they tried

to find any sort of plan or strategy to improve the Company. |

| ● | Unsurprisingly,

Mr. Cooper presented no plans in private discussions either. |

| ● | This

should leave shareholders asking what exactly Driver wants to accomplish with AmeriServ. |

FACT

#9: OUR BOARD HAS BEEN SIGNIFICANTLY REFRESHED WITH HIGHLY QUALIFIED AND VALUE ADDITIVE INDIVIDUALS

| ● | The

Board is committed to ongoing refreshment with new, independent perspectives, and pursuing

sound corporate governance. Four of our nine Board members (44%) have joined over approximately

the past three years. |

| ● | At

the 2023 Annual Meeting, shareholders elected the Company’s slate of three highly qualified

director candidates – Richard “Rick” W. Bloomingdale, David J. Hickton

and Daniel A. Onorato. |

| ● | Mr. Onorato

was an incumbent Board member, and Messrs. Bloomingdale and Hickton were selected following

thorough search and vetting processes, which were informed by shareholder feedback and supported

by independent advisors. |

| ● | All

three individuals bring important professional experience and subject matter expertise directly

relevant to our strategic growth areas and business operations: |

| o | Mr. Bloomingdale,

the recently retired President of the Pennsylvania American Federation of Labor and Congress

of Industrial Organizations (“Pennsylvania AFL-CIO”), brings finance and labor

experience to strengthen AmeriServ’s human capital management efforts and position

the Company to further expand its union business throughout Pennsylvania. |

| o | Mr. Hickton,

the Founding Director of the Institute for Cyber Law, Policy and Security at the University

of Pittsburgh and former U.S. Attorney for the Western District of Pennsylvania, has experience

in legal affairs, regulatory matters, and data security and privacy approaches directly benefitting

the Company as it meets customers’ expectations for online and mobile services. |

| o | Mr. Onorato,

an executive at Highmark Health and former two-term Chief Executive of Allegheny County,

possesses valuable knowledge of AmeriServ and its markets as well as relevant experience

across the accounting and legal fields that has been additive in the boardroom. |

FACT

#10: WE ARE EXECUTING A CLEAR STRATEGY TO CREATE LONG-TERM VALUE FOR OUR STAKEHOLDERS

| ● | We

are focused on executing our three-pronged strategy to create value for shareholders. |

| ● | We

have a deep understanding of Western Pennsylvania and are therefore able to build the kind

of banking and investment strategies needed by our customers. |

| ● | First,

we are maintaining a strong balance sheet, with diversified revenue streams and strong liquidity

and capital allocations – helped by deposits being up since the beginning of 2023. |

| ● | Second,

we are appropriately managing risk – successfully weathering banking sector headwinds

and leveraging our strengths as a relationship-focused community bank. |

| ● | Third,

we are focused on consistently achieving shareholder returns. In 2022, we achieved our highest

EPS performance in over 20 years and instituted a 15% increase in dividend payments. |

###

While the first

six months of 2023 have presented a more difficult operating environment for the banking industry due to higher interest rates and an

inverted yield curve, we have proactively managed our balance sheet to limit net interest margin compression. Specifically, we have executed

$60 million of interest rate hedges to help control rising deposit costs, focused on booking floating rate assets and continued to effectively

manage our strong core deposit base. We also have a strong focus on controlling non-interest expenses. Excluding the $1.7 million of

activist-related costs, our total non-interest expenses for the first six months of 2023 have actually declined by $185,000 despite the

challenges of the current inflationary environment.

We look forward

to continuing to communicate with you and thank you for your investment.

Sincerely,

|

|

| |

|

| J. Michael Adams, Jr. |

Jeffrey A. Stopko |

| Chairman |

President & CEO |

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

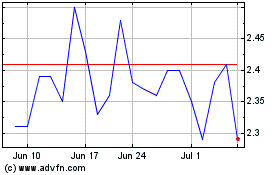

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Mar 2024 to Apr 2024

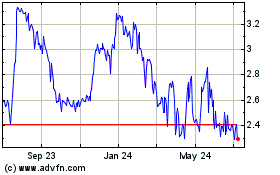

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Apr 2023 to Apr 2024