JOHNSTOWN, Pa., July 15 /PRNewswire-FirstCall/ -- AmeriServ

Financial, Inc. (NASDAQ:ASRV) reported second quarter 2008 net

income of $1,516,000 or $0.07 per diluted share. This represents an

increase of $708,000 or 87.6% over the second quarter 2007 net

income of $808,000 or $0.04 per diluted share. For the six month

period ended June 30, 2008, the Company has now earned $2,745,000

or $0.13 per diluted share. This also represents an increase of

$1.5 million or over 122% when compared to net income of $1,236,000

or $0.06 per diluted share for the first six months of 2007. The

following table highlights the Company's financial performance for

the both the three and six month periods ended June 30, 2008 and

2007: Six Months Six Months Second Second Ended Ended Quarter 2008

Quarter 2007 June 30, 2008 June 30, 2007 Net income $1,516,000

$808,000 $2,745,000 $1,236,000 Diluted earnings per share $0.07

$0.04 $0.13 $0.06 Allan R. Dennison, President and Chief Executive

Officer, commented on the second quarter 2008 financial results,

"The strong earnings growth that AmeriServ Financial has achieved

in 2008 resulted from the execution of our community bank focused

strategic plan and the actions we have taken over the past several

years to conservatively position our balance sheet. Our improved

net interest margin, good asset quality, and strong capital levels

provide AmeriServ with better financial ability to work through

this period of economic uncertainty and turmoil within the

financial markets." The Company's net interest income in the second

quarter of 2008 increased by $953,000 from the prior year's second

quarter and for the first six months of 2008 increased by $1.7

million or 14.5% when compared to the first six months of 2007. The

Company's net interest margin is also up sharply by 57 and 46 basis

points, respectively for the quarter and six-month periods ended

June 30, 2008. The Company's balance sheet positioning allowed it

to benefit from the significant Federal Reserve reductions in

short-term interest rates and the return to a more traditional

positively sloped yield curve. As a result of these changes, the

Company's interest expense on deposits and borrowings declined at a

faster rate than the interest income on loans and investment

securities. These factors, combined with greater average loans

outstanding over the past 12 months, caused the increased net

interest income and margin in 2008. Overall, net interest income

has now increased for six consecutive quarters and the Company

believes its balance sheet is well positioned for continuation of a

lower interest rate environment in 2008. The Company recorded a

$1,375,000 provision for loan losses in the second quarter of 2008

and a $1,525,000 provision for the six month period ended June 30,

2008 compared to no loan loss provision for either period in 2007.

When determining the provision for loan losses, the Company

considers a number of factors some of which include periodic credit

reviews, delinquency and charge- off trends, concentrations of

credit, loan volume trends and broader local and national economic

trends. The higher loan provision in 2008 was caused by the

Company's decision to strengthen its allowance for loan losses due

to higher net charge-offs and the downgrade of the rating

classification of a few specific performing commercial loans due to

the slowing economy. Net charge- offs in the second quarter of 2008

amounted to $721,000 or 0.46% of total loans compared to net

charge-offs of $99,000 or 0.07% of total loans in the second

quarter of 2007. The higher second quarter 2008 net charge-offs

were primarily due to a $786,000 charge down on a commercial real

estate apartment property which the Company took ownership of and

transferred to other real- estate owned during the quarter. For the

six month period ended June 30, 2008, net charge-offs have amounted

to $814,000 or 0.26% of total loans compared to net charge-offs of

$181,000 or 0.06% of total loans for the same six month period in

2007. Non-performing assets increased moderately since the first

quarter of 2008 but are still lower than the year-end 2007 level.

Non-performing assets totaled $3.7 million or 0.60% of total loans

at June 30, 2008 compared to $5.3 million or 0.83% of total loans

at December 31, 2007. Overall, the allowance for loan losses

provided 214% coverage of non- performing assets and was 1.28% of

total loans at June 30, 2008 compared to 137% of non-performing

assets and 1.14% of total loans at December 31, 2007. Note also

that the Company has no exposure to sub-prime mortgage loans in

either the loan or investment portfolios. The Company's

non-interest income in the second quarter of 2008 increased by $1.8

million from the prior year's second quarter and for the first six

months of 2008 increased by $2.4 million when compared to the first

six months of 2007. The largest item causing the increase in 2008

was a $1.6 million increase in revenue from bank owned life

insurance due to the payment of two death claims. The remainder of

the increase in non-interest income was driven by increases in

almost all reported non-interest revenue categories. Trust fees

increased by $48,000 for the 2008 quarterly period and by $134,000

or 4.0% for the six-month period due to continued successful new

business development efforts. The fair market value of trust assets

totaled $1.8 billion at June 30, 2008. Deposit service charges also

increased by $171,000 for the 2008 quarterly period and $320,000 or

26.2% for the six-month period due to increased overdraft fees and

greater service charge revenue that resulted from a realignment of

the bank's checking accounts to include more fee based products.

The Company also recorded an increase on gains realized on

residential mortgage loan sales into the secondary market that

amounted to $42,000 for the second quarter of 2008 and $106,000 for

the six month period ended June 30, 2008. This increase reflects

improved residential mortgage production from the Company's primary

market as this has been an area of emphasis in the Company's

strategic plan. Other income increased by $271,000 for the 2008

six-month period due primarily to a gain realized on the mandatory

redemption of shares of VISA stock that occurred in the first

quarter of 2008 and increased revenue from financial services

activities. Finally, these positive items were partially offset by

a $137,000 loss realized on the sale of $18 million of investment

securities in the second quarter of 2008. The Company took

advantage of the positively sloped yield curve to position the

investment portfolio for better future earnings by selling some of

the lower yielding securities in the portfolio and replacing them

with higher yielding securities with a modestly longer duration.

Total non-interest expense in the second quarter of 2008 increased

by $503,000 from the prior year's second quarter and for the first

six months of 2008 increased by $609,000 or 3.5% when compared to

the first six months of 2007. The higher 2008 second quarter

expenses were due to a $552,000 increase in other expenses, a

$92,000 increase in professional fees, and a $91,000 charge on the

prepayment of $6 million of Federal Home Loan Bank Advances. Note

that the increase in other expenses was largely caused by the non-

recurrence of a favorable $400,000 recovery on a previous mortgage

loan securitization that was realized in the second quarter of

2007. The $91,000 FHLB debt prepayment charge resulted from the

Company's decision to retire some higher cost advances and replace

them with lower cost current market rate advances in order to

reduce ongoing interest expense. These negative items were

partially offset by expense decreases recorded in salaries and

employee benefits and equipment expense as a result of the

Company's continuing focus on containing and reducing non-interest

expenses. For the first six months of 2008, salaries and employee

benefits costs are down by $173,000 or 1.8% due to a 23 or 6.1%

reduction in total full-time equivalent employees and reduced

medical insurance premiums. The $265,000 reduction in equipment

expense resulted from the benefits achieved on the migration to a

new core data processing operating system and mainframe processor.

ASRV had total assets of $877 million and shareholders' equity of

$92.2 million or a book value of $4.22 per share at June 30, 2008.

The Company further built its capital during the second quarter of

2008 and the asset leverage ratio grew to 10.47%. During the first

quarter of 2008, the Company repurchased 354,500 shares of its

common stock at an average price of $3.11 in conjunction with the

terms of the Company's stock buyback program that was announced on

January 22, 2008. The Company did not repurchase any additional

shares during the second quarter. This news release may contain

forward-looking statements that involve risks and uncertainties, as

defined in the Private Securities Litigation Reform Act of 1995,

including the risks detailed in the Company's Annual Report and

Form 10-K to the Securities and Exchange Commission. Actual results

may differ materially. NASDAQ: ASRV SUPPLEMENTAL FINANCIAL

PERFORMANCE DATA July 15, 2008 (In thousands, except per share and

ratio data) (All quarterly and 2008 data unaudited) 2008 1QTR 2QTR

YEAR TO DATE PERFORMANCE DATA FOR THE PERIOD: Net income $1,229

$1,516 $2,745 PERFORMANCE PERCENTAGES (annualized): Return on

average assets 0.55% 0.71% 0.63% Return on average equity 5.43 6.64

6.04 Net interest margin 3.32 3.58 3.45 Net charge-offs as a

percentage of average loans 0.06 0.46 0.26 Loan loss provision as a

percentage of average loans 0.10 0.89 0.49 Efficiency ratio 82.87

73.20 77.67 PER COMMON SHARE: Net income: Basic $0.06 $0.07 $0.13

Average number of common shares outstanding 22,060 21,847 21,954

Diluted 0.06 0.07 0.13 Average number of common shares outstanding

22,062 21,848 21,955 2007 1QTR 2QTR YEAR TO DATE PERFORMANCE DATA

FOR THE PERIOD: Net income $428 $808 $1,236 PERFORMANCE PERCENTAGES

(annualized): Return on average assets 0.20% 0.37% 0.28% Return on

average equity 2.05 3.79 2.93 Net interest margin 2.97 3.01 2.99

Net charge-offs as a percentage of average loans 0.06 0.07 0.06

Loan loss provision as a percentage of average loans - - -

Efficiency ratio 94.16 88.52 91.28 PER COMMON SHARE: Net income:

Basic $0.02 $0.04 $0.06 Average number of common shares outstanding

22,159 22,164 22,162 Diluted 0.02 0.04 0.06 Average number of

common shares outstanding 22,166 22,171 22,168 AMERISERV FINANCIAL,

INC. (In thousands, except per share, statistical, and ratio data)

(All quarterly and 2008 data unaudited) 2008 1QTR 2QTR PERFORMANCE

DATA AT PERIOD END: Assets $902,349 $877,230 Investment securities

151,967 148,819 Loans 632,934 623,798 Allowance for loan losses

7,309 7,963 Goodwill and core deposit intangibles 14,254 14,038

Deposits 682,459 722,913 FHLB borrowings 106,579 40,214

Stockholders' equity 91,558 92,248 Non-performing assets 3,050

3,717 Asset leverage ratio 9.78% 10.47% PER COMMON SHARE: Book

value (A) $4.19 $4.22 Market value 2.79 2.98 Market price to book

value 66.62% 70.59% Trust assets - fair market value (B) 1,838,029

1,813,231 STATISTICAL DATA AT PERIOD END: Full-time equivalent

employees 350 353 Branch locations 19 18 Common shares outstanding

21,842,691 21,850,773 2007 1QTR 2QTR 3QTR 4QTR PERFORMANCE DATA AT

PERIOD END: Assets $891,559 $876,160 $897,940 $904,878 Investment

securities 185,338 174,508 170,765 163,474 Loans 603,834 604,639

629,564 636,155 Allowance for loan losses 8,010 7,911 7,119 7,252

Goodwill and core deposit intangibles 15,119 14,903 14,687 14,470

Deposits 768,947 762,902 763,771 710,439 FHLB borrowings 15,170

4,258 23,482 82,115 Stockholders' equity 85,693 86,226 88,517

90,294 Non-performing assets 2,706 2,825 2,463 5,280 Asset leverage

ratio 10.23% 10.36% 10.44% 9.74% PER COMMON SHARE: Book value $3.87

$3.89 $3.99 $4.07 Market value 4.79 4.40 3.33 2.77 Market price to

book value 123.88% 113.12% 83.44% 68.07% Trust assets - fair market

value (B) 1,828,475 1,872,366 1,846,240 1,883,307 STATISTICAL DATA

AT PERIOD END: Full-time equivalent employees 375 376 358 351

Branch locations 21 21 20 19 Common shares outstanding 22,161,445

22,167,235 22,180,650 22,188,997 Note: (A) Other comprehensive

income had a negative impact of $0.17 on book value per share at

June 30, 2008. (B) Not recognized on the balance sheet AMERISERV

FINANCIAL, INC. CONSOLIDATED STATEMENT OF INCOME (In thousands)

(All quarterly and 2008 data unaudited) 2008 1QTR 2QTR YEAR TO DATE

INTEREST INCOME Interest and fees on loans $10,462 $9,862 $20,324

Total investment portfolio 1,820 1,588 3,408 Total Interest Income

12,282 11,450 23,732 INTEREST EXPENSE Deposits 4,499 3,861 8,360

All borrowings 1,048 623 1,671 Total Interest Expense 5,547 4,484

10,031 NET INTEREST INCOME 6,735 6,966 13,701 Provision for loan

losses 150 1,375 1,525 NET INTEREST INCOME AFTER PROVISION FOR LOAN

LOSSES 6,585 5,591 12,176 NON-INTEREST INCOME Trust fees 1,790

1,737 3,527 Net realized losses on investment securities available

for sale - (137) (137) Net realized gains on loans held for sale 89

121 210 Service charges on deposit accounts 734 807 1,541

Investment advisory fees 226 218 444 Bank owned life insurance 249

1,923 2,172 Other income 750 674 1,424 Total Non-Interest Income

3,838 5,343 9,181 NON-INTEREST EXPENSE Salaries and employee

benefits 4,830 4,812 9,642 Net occupancy expense 661 653 1,314

Equipment expense 431 414 845 Professional fees 769 910 1,679 FHLB

prepayment penalty - 91 91 FDIC deposit insurance expense 22 20 42

Amortization of core deposit intangibles 216 216 432 Other expenses

1,850 1,909 3,759 Total Non-Interest Expense 8,779 9,025 17,804

PRETAX INCOME 1,644 1,909 3,553 Income tax expense 415 393 808 NET

INCOME $1,229 $1,516 $2,745 2007 1QTR 2QTR YEAR TO DATE INTEREST

INCOME Interest and fees on loans $10,061 $10,303 $20,364 Total

investment portfolio 2,114 2,005 4,119 Total Interest Income 12,175

12,308 24,483 INTEREST EXPENSE Deposits 5,699 5,931 11,630 All

borrowings 521 364 885 Total Interest Expense 6,220 6,295 12,515

NET INTEREST INCOME 5,955 6,013 11,968 Provision for loan losses -

- - NET INTEREST INCOME AFTER PROVISION FOR LOAN LOSSES 5,955 6,013

11,968 NON-INTEREST INCOME Trust fees 1,704 1,689 3,393 Net

realized gains (losses) on investment securities available for sale

- - - Net realized gains on loans held for sale 25 79 104 Service

charges on deposit accounts 585 636 1,221 Investment advisory fees

102 329 431 Bank owned life insurance 258 265 523 Other income 559

594 1,153 Total Non-Interest Income 3,233 3,592 6,825 NON-INTEREST

EXPENSE Salaries and employee benefits 4,885 4,930 9,815 Net

occupancy expense 664 615 1,279 Equipment expense 546 564 1,110

Professional fees 695 818 1,513 FDIC deposit insurance expense 22

22 44 Amortization of core deposit intangibles 216 216 432 Other

expenses 1,645 1,357 3,002 Total Non-Interest Expense 8,673 8,522

17,195 PRETAX INCOME 515 1,083 1,598 Income tax expense (benefit)

87 275 362 NET INCOME $428 $808 $1,236 AMERISERV FINANCIAL, INC.

AVERAGE BALANCE SHEET DATA (In thousands) (All quarterly and 2008

data unaudited) Note: 2007 data appears before 2008. 2007 2008 SIX

SIX 2QTR MONTHS 2QTR MONTHS Interest earning assets: Loans and

loans held for sale, net of unearned income $599,395 $596,176

$621,395 $625,989 Deposits with banks 666 625 446 395 Federal funds

6,355 3,389 - 212 Total investment securities 183,293 192,714

149,889 161,676 Total interest earning assets 789,709 792,904

771,730 788,272 Non-interest earning assets: Cash and due from

banks 17,445 17,264 17,056 17,495 Premises and equipment 8,822

8,779 9,101 8,993 Other assets 71,021 68,572 72,596 72,780

Allowance for loan losses (7,971) (8,016) (7,350) (7,329) Total

assets 879,026 879,503 863,133 880,211 Interest bearing

liabilities: Interest bearing deposits: Interest bearing demand

56,250 57,273 65,495 64,902 Savings 73,640 73,916 70,976 69,822

Money market 183,911 189,400 105,308 104,744 Other time 345,285

336,555 350,229 348,681 Total interest bearing deposits 659,086

657,144 592,008 588,149 Borrowings: Federal funds purchased,

securities sold under agreements to repurchase, and other

short-term borrowings 2,367 9,282 35,822 56,409 Advanced from

Federal Home Loan Bank 3,930 2,661 11,822 11,770 Guaranteed junior

subordinated deferrable interest debentures 13,085 13,085 13,085

13,085 Total interest bearing liabilities 678,468 682,172 652,737

669,413 Non-interest bearing liabilities: Demand deposits 105,055

103,477 109,316 109,980 Other liabilities 9,956 8,829 9,220 9,374

Stockholders' equity 85,547 85,025 91,860 91,444 Total liabilities

and stockholders' equity $879,026 $879,503 $863,133 $880,211

DATASOURCE: AmeriServ Financial, Inc. CONTACT: Jeffrey A. Stopko,

Senior Vice President & Chief Financial Officer of AmeriServ

Financial, Inc., +1-814-533-5310 Web site:

http://www.ameriservfinancial.com/

Copyright

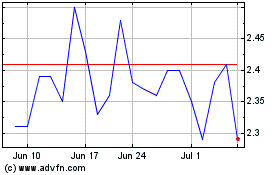

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Sep 2024 to Oct 2024

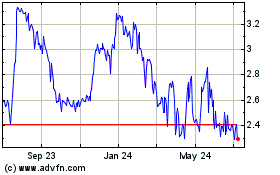

AmeriServ Financial (NASDAQ:ASRV)

Historical Stock Chart

From Oct 2023 to Oct 2024