Select Comfort's Earnings Disappoint - Analyst Blog

April 18 2013 - 9:36AM

Zacks

Lower sales and increased

promotional expenses took a toll on Select Comfort

Corporation’s (SCSS) first-quarter fiscal 2013 results.

The mattress retailer posted adjusted quarterly earnings of 41

cents a share that missed the Zacks Consensus Estimate by a penny

and decreased 9% year over year. Including one time items, earnings

came in at 42 cents compared with 39 cents earned in the year-ago

quarter.

Net sales for this Zacks Rank #5

(Strong Sell) stock waned 2% year over year to $258 million and

came well below the Zacks Consensus Estimate of $291 million.

Moreover, comparable store sales plunged 9% year over year at

company-controlled stores. Change in its advertising strategy

backfired for the company, leading to reduced traffic and in turn

lower sales.

Gross profit inched down 0.5% to

$163.4 million, while gross margin expanded 70 basis points to

63.3%. The improvement was attributable to contraction in cost of

goods sold as a percentage of sales.

Select Comfort’s adjusted operating

income decreased 12.7% year over year to $34.8 million, whereas the

company’s adjusted operating margin decreased 170 basis points to

13.5%, reflecting rise in sales and marketing expenses coupled with

an increase in research and development costs.

Other Details

Select Comfort ended the quarter

with cash and cash equivalents of $84.8 million and generated cash

flow from operating activities of $45 million. Moreover, the

company incurred capital expenditures of $14.3 million during the

first quarter and repurchased $10 million worth of shares. The

company had no borrowings under its revolving credit

facility.

During the quarter, the company

opened 10 stores and closed 9, bringing the total store count to

411.

Outlook

Trimmed

Following sluggish results, Select

Comfort trimmed its fiscal 2013 outlook. The company now forecasts

GAAP earnings per share to be in the range of $1.30 – $1.45, down

from the previous guidance range of $1.65–$1.80. It expects

company-controlled comparable store sales to increase in the low to

mid single digits range.

Moreover, the company is

anticipating capital expenditure in the range of $70.0 million –

$80.0 million, mainly for new store openings, renovations and

remodels along with improvement in IT systems. Further, Select

Comfort is likely to continue with its share repurchase

activity.

Other Stocks to

Consider

Until any further upward revision

in Select Comfort’s rating, other stocks in the home furnishings

& fixtures industry worth considering include American

Woodmark Corp. (AMWD),Tempur-Pedic International

Inc. (TPX) and La-Z-Boy Incorporated

(LZB), all carrying a favorable Zacks Rank #1 (Strong Buy).

AMER WOODMARK (AMWD): Free Stock Analysis Report

LA-Z-BOY INC (LZB): Free Stock Analysis Report

SELECT COMFORT (SCSS): Free Stock Analysis Report

TEMPUR-PEDIC (TPX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

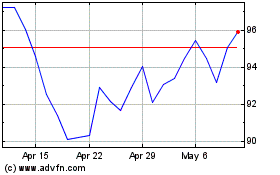

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From Jun 2024 to Jul 2024

American Woodmark (NASDAQ:AMWD)

Historical Stock Chart

From Jul 2023 to Jul 2024