Filed Pursuant to Rule 424(b)(3)

Registration No. 333-269448

PROSPECTUS SUPPLEMENT NO. 7

(to prospectus dated May 30, 2023)

AlTi Global, Inc.

Shares of Class A Common Stock

Warrants to Purchase Class A Common Stock

This prospectus supplement is being filed to update and supplement the information contained in the prospectus dated May 30, 2023, with respect to our Registration Statement on Form S-1 (File No. 333-269448) (as supplemented to date, the “Prospectus”), with the information contained in the attached Current Report on Form 8-K, filed with the Securities and Exchange Commission on September 18, 2023 (the “Form 8-K”). Accordingly, we have attached the Form 8-K to this prospectus supplement.

This prospectus supplement updates and supplements the information in the Prospectus and is not complete without, and may not be delivered or utilized except in combination with, the Prospectus, including any amendments or supplements thereto. This prospectus supplement should be read in conjunction with the Prospectus and if there is any inconsistency between the information in the Prospectus and this prospectus supplement, you should rely on the information in this prospectus supplement. Capitalized terms used but not defined in this prospectus supplement will have the meanings given to them in the Prospectus.

Our shares of Class A Common Stock are traded on the Nasdaq Capital Market under the symbol “ALTI”. On September 15, 2023, the closing price of the Class A Common Stock was $6.78 per share.

Investing in our securities involves risks. You should carefully read the discussion in “Risk Factors” beginning on page 7 of the Prospectus and in any applicable prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if the Prospectus or this prospectus supplement is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus supplement is September 18, 2023.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

____________________

FORM 8-K

____________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): September 18, 2023

____________________

AlTi Global, Inc.

(Exact name of registrant as specified in its charter)

___________________

| | | | | | | | | | | | | | |

| | | | |

Delaware | | 001-40103 | | 92-1552220 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | | | | | | | |

| | |

520 Madison Avenue, 21st Floor New York, New York | | 10022 |

(Address of principal executive offices) | | (Zip Code) |

(212) 396-5904

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

___________________

Check the appropriate box below if the Form 8-K is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| | | | |

Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share | | ALTI | | Nasdaq Capital Market |

| | | | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

________________________________________________________________________________

| | | | | |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On September 18, 2023, AlTi Global, Inc. (the “Company”) announced the appointment of Stephen D. Yarad as Chief Financial Officer.

Mr. Yarad joins the Company from MFA Financial, Inc. (NYSE: MFA), a leading residential mortgage REIT, where he served as Chief Financial Officer and Treasurer since 2010.

In connection with his appointment, the Company entered into a letter agreement with Mr. Yarad on September 5, 2023, setting forth the initial terms of his employment and compensation (the “Offer Letter”). Pursuant to the Offer Letter, Mr. Yarad will receive (i) an initial base salary of $375,000 per year, (ii) a guaranteed cash bonus of $525,000 (the “2023 Guaranteed Cash Bonus”), to be paid on the date in 2024 on which annual discretionary cash bonuses for the year ended 2023 are granted to employees of the Company, and (iii) $280,000 in equity, to be granted on the date in 2024 on which annual equity awards for 2023 are granted to employees generally under the AlTi Global, Inc. 2023 Stock Incentive Plan (the “Stock Plan”).

The Offer Letter also provides for a grant of up to $880,000 in restricted stock units under the Stock Plan to compensate Mr. Yarad for the cancelation of, or ineligibility to receive, certain equity awards granted to Mr. Yarad by his former employer (the “Old Equity Awards”). The award shall be calculated as follows: (i) the aggregate value of the Old Equity Awards, based on the closing share price of the former employer on the date Mr. Yarad’s employment with the Company commences, divided by (ii) the average closing price of the Company’s stock over the 20 trading days preceding the date of employment with the Company. This grant of restricted stock units, which will vest ratably over a three-year period beginning on February 15, 2024, is subject to the terms and conditions of the Stock Plan and applicable award certificates.

No family relationship exists between Mr. Yarad and any of the Company’s directors or executive officers. There are no arrangements or understandings between Mr. Yarad and any other person pursuant to which Mr. Yarad was selected as an officer of the Company, nor are there any transactions to which the Company is or was a participant and in which Mr. Yarad had or will have a direct or indirect material interest subject to disclosure under Item 404(a) of Regulation S-K.

A copy of the related press release, which the Company issued on September 18, 2023, is attached as Exhibit 99.1 hereto.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

The following exhibits are being filed herewith:

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| Date: September 18, 2023 | | ALTI GLOBAL, INC. |

| |

| | /s/ Michael Tiedemann |

| | Michael Tiedemann |

| | Chief Executive Officer |

AlTi Global Appoints Stephen D. Yarad as Chief Financial Officer

NEW YORK, NY, September 18, 2023 – AlTi Global, Inc. (NASDAQ: ALTI) (“AlTi" or the “Company”), a leading independent global wealth and asset manager, today announced the appointment of Stephen D. Yarad as Chief Financial Officer and Treasurer, effective immediately.

“As a seasoned leader with extensive financial services experience, I am pleased to welcome Stephen Yarad to the executive management team”, said Michael Tiedemann, Chief Executive Officer. “Steve’s public company CFO experience and track record spanning over three decades will be valuable as we scale the AlTi operating platform, while delivering innovative wealth and asset management solutions to clients on a global scale. Given his significant exposure to capital markets and international experience, Steve brings deep corporate finance and operational expertise that will benefit AlTi and its shareholders.”

Mr. Yarad joins AlTi from MFA Financial, Inc. (NYSE: MFA), a leading residential mortgage REIT, where he served as Chief Financial Officer and Treasurer since September of 2010. Prior to joining MFA, he was an audit partner in the New York financial services practice of KPMG LLP. Mr. Yarad began his career with KPMG in Australia in 1991 and during his career in public accounting he served several of the firm’s largest global financial services clients in Asia-Pacific, Europe, and North America.

Mr. Yarad holds a Bachelor of Commerce in Accounting and Finance from the University of New South Wales and a Graduate Diploma in Applied Finance and Investment from the Securities Institute of Australia. He is a licensed CPA in New York and New Jersey, a member of the American Institute of Certified Public Accountants, and an associate member of the Institute of Chartered Accountants in Australia.

About AlTi

AlTi is a leading independent global wealth and asset manager providing entrepreneurs, multi-generational families, institutions, and emerging next-generation leaders with fiduciary capabilities as well as alternative investment strategies and advisory services. AlTi’s comprehensive offering is underscored by a commitment to impact or values-aligned investing and generating a net positive impact through its business activities. The firm currently manages or advises on approximately $69 billion in combined assets and has an expansive network with over 470 professionals across three continents. For more information, please visit us at www.Alti-global.com.

Contacts

Lily Arteaga

Head of Investor Relations

AlTi Global, Inc.

investor@alti-global.com

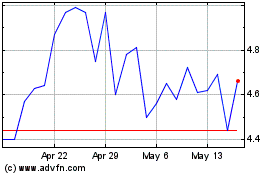

AITi Global (NASDAQ:ALTI)

Historical Stock Chart

From Mar 2024 to Apr 2024

AITi Global (NASDAQ:ALTI)

Historical Stock Chart

From Apr 2023 to Apr 2024