1AlTi Tiedemann Global Second Quarter 2023 Earnings | August 2023

2AlTi Tiedemann Global Disclosures This Presentation (together with oral statements made in connection herewith, the “Presentation”) is for informational purposes only to assist interested parties in evaluating AlTi Global, Inc. (along with its consolidated subsidiaries, “AlTi Global” or the "Company"). About AlTi Global AlTi Global is a multi-disciplinary financial services business with a diverse array of investment, advisory, and administrative capabilities which serves clients and investors around the globe. The firm manages approximately $69 billion in combined assets and provides holistic solutions for wealth management clients through a full spectrum of services, including discretionary investment management services, non-discretionary investment advisory services, fiduciary and trust services, administration services, new generational wealth planning services and family office services. AlTi Global structures, arranges, and provides a network of investors with co-investment opportunities in a variety of alternative assets which are either managed intra-group or by carefully selected managers with a proven track record in the relevant asset class. AlTi Global operates globally, with more than 470 professionals operating in 22 cities in 10 countries across three continents. No Offer or Solicitation This Presentation does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instruments of AlTi Global.The information contained herein does not purport to be all-inclusive and none of AlTi Global nor any of its respective subsidiaries, stockholders, affiliates, representatives, control persons, partners, members, managers, directors, officers, employees, advisers or agents make any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. Prospective investors should consult with their own counsel and tax and financial advisors as to legal and related matters concerning the matters described herein, and, by accepting this Presentation, you confirm that you are not relying solely upon the information contained herein to make any investment decision. The recipient shall not rely upon any statement, representation or warranty made by any other person, firm or corporation in making its investment decision to subscribe for securities of AlTi Global. To the fullest extent permitted by law, in no circumstances will AlTi Global or any of its subsidiaries, stockholders, affiliates, representatives, control persons, partners, members, managers, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. In addition, this Presentation does not purport to be all-inclusive or to contain all of the information that may be required to make a full analysis of AlTi Global. The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs. Forward-Looking Statements Some of the statements in this presentation may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933 (the “Securities Act”), Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact are forward-looking. Words such as “anticipate,” “believe,” “continue,” “estimate,” “expect,” “future,” “intend,” “may,” “plan” and “will” and similar expressions identify forward-looking statements. Forward-looking statements reflect management’s current plans, estimates and expectations and are inherently uncertain. The inclusion of any forward- looking information in this presentation should not be regarded as a representation that the future plans, estimates or expectations contemplated will be achieved. Forward-looking statements are subject to various risks, uncertainties and assumptions. Important factors that could cause actual results to differ materially from those in forward-looking statements include, but are not limited to, global and domestic market and business conditions, successful execution of business and growth strategies and regulatory factors relevant to our business, as well as assumptions relating to our operations, financial results, financial condition, business prospects, growth strategy and liquidity and the risks and uncertainties described in greater detail under “Risk Factors” included in AlTi Global's registration statement on Form 10-K filed April 17, 2023, and in the subsequent reports filed with the Securities and Exchange Commission, as such factors may be updated from time to time. We undertake no obligation to revise or update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law.

3AlTi Tiedemann Global Disclosures (Cont.) Financial Information The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S-X promulgated under the Securities Act. Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any registration statement that may be filed by AlTi Global. Due to rounding, numbers presented throughout this Presentation may not add up precisely to the totals provided and percentages may not precisely reflect the absolute figures. Use of Non-GAAP Financial Measures The non-GAAP financial measures contained in this presentation (including, without limitation, Adjusted Net Income, Adjusted EBITDA and EBITDA) are not GAAP measures of AlTi Global’s financial performance or liquidity and should not be considered as alternatives to net income (loss) as a measure of financial performance or cash flows from operations as measures of liquidity, or any other performance measure derived in accordance with GAAP. A reconciliation of such non-GAAP measures to their most directly comparable GAAP measure is included on pages 34 and 35 of this presentation. You are encouraged to evaluate each adjustment to non-GAAP financial measures and the reasons management considers it appropriate for supplemental analysis. AlTI Global believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating ongoing operating results and trends. Our presentation of these measures should not be construed as an inference that our future results will be unaffected by unusual or non-recurring items. In addition, these measures may not be comparable to similarly titled measures used by other companies in our industry or across different industries. Forward-looking Non-GAAP The Company is not able to reconcile its forward-looking non-GAAP estimates of Adjusted EBITDA margin without unreasonable effort because of the inherent difficulty of accurately forecasting the occurrence and financial impact of the various adjusting items necessary for such reconciliation that have not yet occurred, are out of its control, or cannot be reasonably predicted, which could have a material impact on its future GAAP financial results. Industry and Market Data Certain information contained in this Presentation relates to or is based on studies, publications, surveys and AlTi Global’s own internal estimates and research. In addition, all of the market data included in this Presentation involves a number of assumptions and limitations, and there can be no guarantee as to the accuracy or reliability of such assumptions. Finally, while AlTi Global believes its internal research is reliable, such research has not been verified by any independent source and none of AlTi Global or any of its affiliates nor any of their respective control persons, officers, directors, employees or representatives make any representation or warranty with respect to the accuracy of such information. Trademarks This Presentation may contain trademarks, service marks, trade names and copyrights of other companies, which are the property of their respective owners. Solely for convenience, some of the trademarks, service marks, trade names and copyrights referred to in this Presentation may be listed without the TM, SM © or ® symbols, but AlTi Global, will assert, to the fullest extent under applicable law, the rights of the applicable owners, if any, to these trademarks, service marks, trade names and copyrights.

4AlTi Tiedemann Global AlTi at a Glance Delivering transformational ideas that create enduring value Global footprint with presence in 22 major financial centers with a robust financial profile $69B 470+ Assets Under Advisement (AUM/AUA) Professionals with diverse experience & expertise Year operating historyCommitted to Impact strategies Invested alongside clients $2B$4B 20+ Information as of June 30, 2023, unless otherwise noted.

5AlTi Tiedemann Global Strategic Underpinnings of AlTi One ecosystem delivering innovative, world-class wealth and asset management solutions $49B - Wealth Management $20B - Asset Management $69B AUM/AUA Investment Advisory Family Office Trust, Fiduciary & Administration Alternatives Platform Real Estate – Public & Private Strategic Advisory Tiedemann Advisors o A leading U.S.-focused multi-family office providing comprehensive financial advisory o Client base of ultra-high-net-worth (UHNW) families, entrepreneurs and foundations o Founded in 1999 Alvarium o International multi-family office providing investment advisory across wealth & asset management o Bespoke real estate solutions o Strategic Advisory expertise focused on innovation economy o Founded in 2009 TIG o Established alternatives management firm focused on capital preservation & uncorrelated returns o Strong track record of partnerships with strategic managers o Founded in 1980 • Strengthened origination opportunities • Complementary markets & investors + + • Enhanced suite of solutions • New global product capabilities • Increased operating leverage • Fortified talent attraction & retention Strategic Rationale Information as of June 30, 2023, unless otherwise noted.

6AlTi Tiedemann Global One Platform Approach Serving complementary and attractive industries Asset ManagementWealth Management • Consistent, solid client retention and underlying secular tailwinds • Stable fee rates generating a robust recurring revenue stream • Multiple avenues for co-investment and revenue diversification through ancillary offerings • Highly fragmented industry allowing for accelerated growth through M&A • Ability to compete directly with global banks through differentiated offering • Strong investor demand, particularly in private and real asset markets, driving strong fundraising growth • Longer-locked investment vehicles providing greater revenue visibility • Differentiated investment strategies with performance that is less correlated to the broader markets • Substantial focus on expanding alternative strategies into the wealth management channel • Large universe of mid-market managers results in significant M&A opportunities

7AlTi Tiedemann Global Investment Highlights Uniquely positioned between global family office solutions and alternative asset management Large and growing addressable market Both in asset and wealth management Strong, performing businesses Established reputation in the market Global footprint Strategically located in wealth epicenters Recurring and diversified revenue Consistent, with multiple growth vectors Long-tenured client and investor base Stable and growing relationships Flexible balance sheet Prioritizing opportunistic growth World-class leadership Proven track record and commitment to Impact Investing

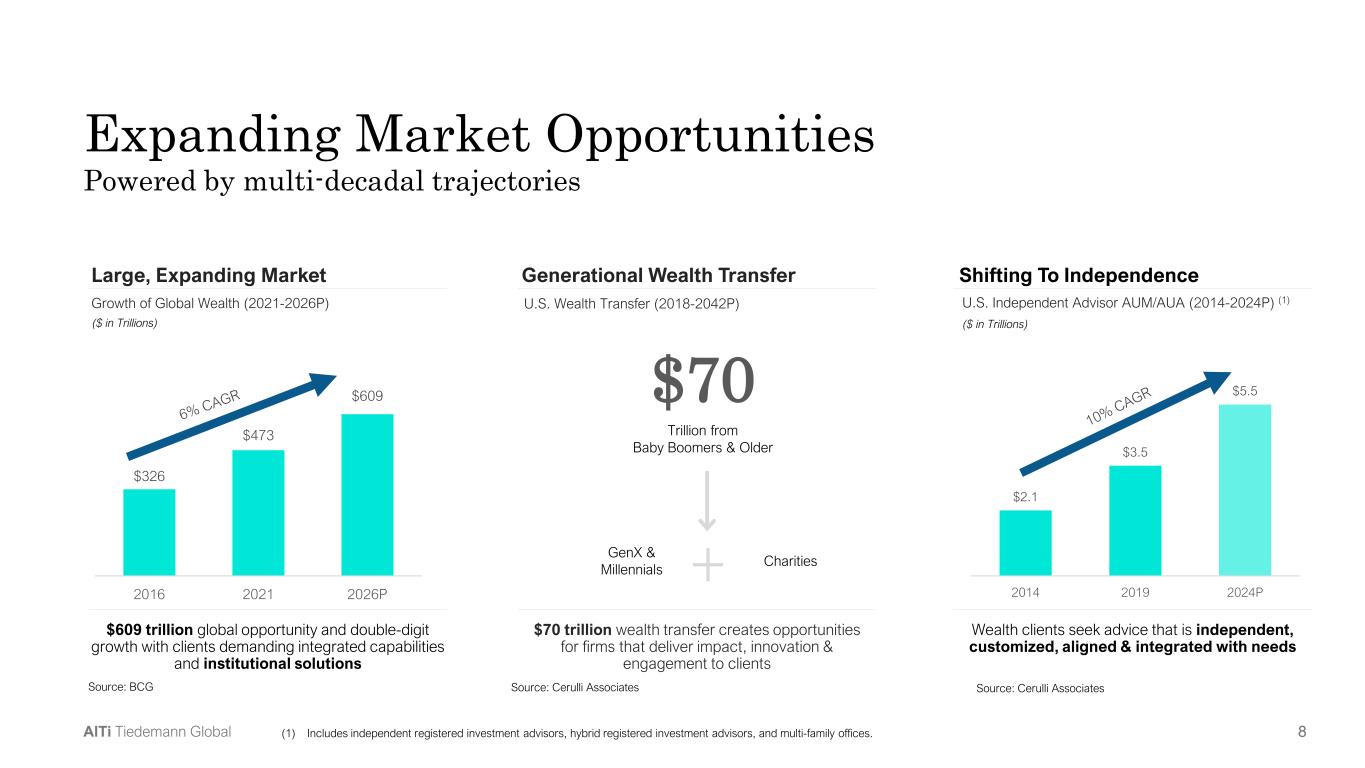

8AlTi Tiedemann Global $326 $473 $609 2016 2021 2026P Expanding Market Opportunities Powered by multi-decadal trajectories Shifting To Independence Generational Wealth Transfer U.S. Wealth Transfer (2018-2042P) (1) Includes independent registered investment advisors, hybrid registered investment advisors, and multi-family offices. Growth of Global Wealth (2021-2026P) GenX & Millennials Charities+ $70 Trillion from Baby Boomers & Older $70 trillion wealth transfer creates opportunities for firms that deliver impact, innovation & engagement to clients $2.1 $3.5 $5.5 2014 2019 2024P U.S. Independent Advisor AUM/AUA (2014-2024P) (1) ($ in Trillions)($ in Trillions) Large, Expanding Market $609 trillion global opportunity and double-digit growth with clients demanding integrated capabilities and institutional solutions Wealth clients seek advice that is independent, customized, aligned & integrated with needs Source: Cerulli AssociatesSource: BCG Source: Cerulli Associates

9AlTi Tiedemann Global Global, Growing Client Base Serving evolving client priorities With Impact PriorityAcross Generations Alt. Asset Exposure by Demographic (2021-2024P)Alternative AUM/AUA Growth and Forecast (2011-2026P) Next generation particularly interested in direct and co-investment in alternatives Relevance of ESG Factors ($ in Trillions) Global Demand for Alternatives Demand for alternatives, a $23 trillion market by the end of 2026, aligns with our expertise Clients and investors understand and want to invest responsibly and with intent, as they think about legacy 32% 32% 81% 48% 60% 85% Global Millennial UHNW 20 21 20 21 20 21 93% 7% Considers ESG factors Does not consider ESG factors 93% of UHNW consider ESG factors when investing Source: Ernst & Young $4.6 $6.3 $7.2 $8.5 $10.1 $13.3 $23.2 2011 2013 2015 2017 2019 2021 2026P Private equity Private debt Hedge funds Real estate Infrastructure Natural resources Source: Preqin Source: Ernst & Young

10AlTi Tiedemann Global 2023 Strategic Priorities Achieving top line growth and at least $16M in annualized net cost savings, creating a clear path to margin expansion Leverage Competitive Advantages to Accelerate Organic Growth Execute Accretive Acquisitions to Generate Topline Momentum Achieve Organizational Efficiencies and Right Size Cost Structure Streamline Capital Structure

11AlTi Tiedemann Global $32 $36 $41 $43 $49 2019 2020 2021 2022 1H23 AlTi Wealth Management – Highlights Resilient and expanding global client base U.S. 59% Non-U.S. 41% Top 25 Client Billable Assets 22% Other AlTi WM Assets 78% Top 25 Client Asset Composition by Geography Client Composition by Assets with AlTi Scale $49B AUM/AUA Global presence 8 Countries with AlTi WM offices High client retention 97% Client retention since 2019 Long-tenured clients ~10 Years average client tenure Net positive Impact firm $4.3B Invested in Impact strategies Alignment with clients $743M Invested alongside clients Experienced team 20+ years operating history Comprehensive capabilities Full suite of Investment Advisory, Multi- family office and Trust services AUM/AUA, $ in Billions Information as of June 30, 2023, unless otherwise noted.

12AlTi Tiedemann Global Wealth Management – Holistic Solutions Trust & Fiduciary Wealth protection & tax optimization Family Office Services Administration of a family’s wealth Philanthropy Strategic giving Family Governance & Education Family structure and next-generation engagement Investment Advisory & Impact Customized risk-adjusted portfolios Estate & Wealth Planning Implementation and management Bespoke AlTi Team Expertise curated from across the firm Access to Co-investments & Strategic Advisory An ecosystem of services to suit clients’ needs and goals Combining the services of a family office with the depth of a world-class, global institution CLIENT

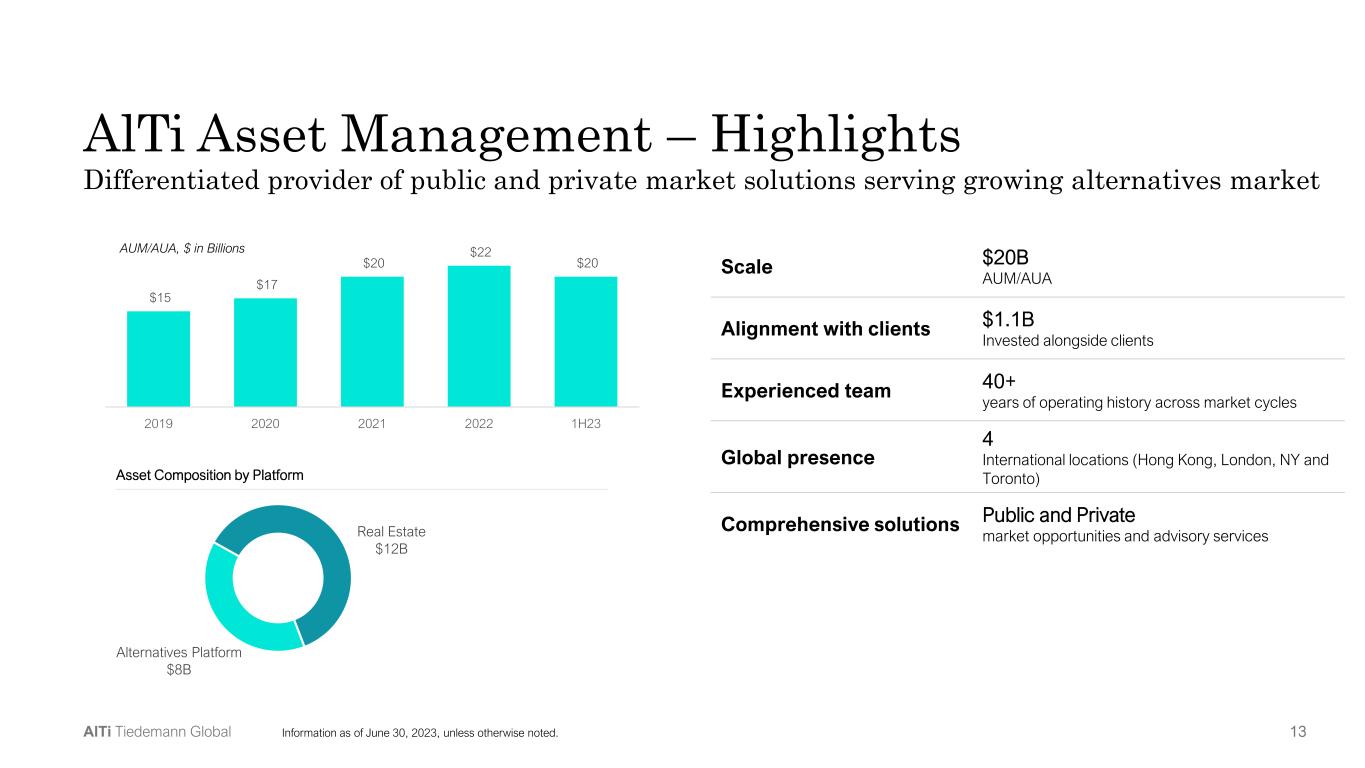

13AlTi Tiedemann Global AlTi Asset Management – Highlights Differentiated provider of public and private market solutions serving growing alternatives market Scale $20B AUM/AUA Alignment with clients $1.1B Invested alongside clients Experienced team 40+ years of operating history across market cycles Global presence 4 International locations (Hong Kong, London, NY and Toronto) Comprehensive solutions Public and Private market opportunities and advisory services $15 $17 $20 $22 $20 2019 2020 2021 2022 1H23 Alternatives Platform $8B Real Estate $12B Asset Composition by Platform AUM/AUA, $ in Billions Information as of June 30, 2023, unless otherwise noted.

14AlTi Tiedemann Global Asset Management – Platform Breakdown Global network of capabilities built on an end-to-end support platform 1980 2009 2011 2017 Alternatives Platform Four fund strategies Strategies • Event-Driven Merger Arbitrage • Real Estate Bridge Lending • Asian Credit Opportunities • European Long Short Equity Focus Uncorrelated investment opportunities in specialist strategies Products Funds, SMAs, SPVs, UCITs, AIF’s Real Estate – Private Markets Direct investments – ~50 equity and debt transactions realized since inception Strategies • Forward funding • Development • Income Focus Geography and sub-sector selection based on themes and teams Products Funds, SPVs Strategic Advisory 175+ transactions (1) Select Clients Real Estate – Public Markets UK REIT Strategy Focus Inflation-protected income and capital growth Products Funds Focus Media, consumer, technology and innovation sectors across both private and public markets Strategies and Services Strategic Advisory, Private Placements, M&A, Co-investments Investors–Institutional Investors, Multi-family Offices, Single-family Offices, Ultra-High-Net-Worth, Consultants, Sovereign Wealth Funds • Value-add • Planning Information as of June 30, 2023, unless otherwise noted. (1) Includes transactions completed by co-heads of Strategic Advisory in their careers with predecessor company.

15AlTi Tiedemann Global 3/31/12 8/31/13 1/31/15 6/30/16 11/30/17 4/30/19 9/30/20 2/28/22 HFRI +54% MSCI +128% TIG Arbitrage +102% Asia Credit MSCI HFRI Annualized Performance 7.2% 6.3% 3.3% Volatility 5.4% 15.2% 5.0% 8/30/14 11/30/15 2/28/17 5/31/18 8/31/19 11/30/20 2/28/22 5/31/23 HFRI +33% MSCI +73% Asia Credit +85% 3/31/17 6/30/18 9/30/19 12/31/20 3/31/22 6/30/23 HFRI +25% MSCI +61% European Equities +98% Euro Equities MSCI HFRI Annualized Performance 11.4% 7.9% 3.6% Volatility 10.3% 16.6% 5.6% TIG Arbitrage MSCI HFRI Annualized Performance 6.4% 7.6% 3.9% Volatility 5.9% 14.3% 4.7% 1/31/97 1/31/01 1/31/05 1/31/09 1/31/13 1/31/17 1/31/21 HFRI +66% MSCI +261% Bridge Lending Real Estate +790% Bridge Lending MSCI HFRI Annualized Performance 8.6% 5.0% 3.3% Volatility 0.7% 15.7% 5.5% 6/30 23 Asset Management Best-in-class performance and uncorrelated returns1 TIG Arbitrage European Equities (1) Past performance does not guarantee or indicate future results. The historical net performance presented above are unaudited. Please see reference page 41 of the appendix for additional information. All information as of June 30, 2023 6/30/23 Bridge Lending Real Estate 6/30/23 Asia Credit and Special Situations 6/30/23 AlTi AM Purchase Date AlTi AM Purchase Date AlTi AM Purchase Date

16AlTi Tiedemann Global 2/27/17 8/27/17 2/27/18 8/27/18 2/27/19 8/27/19 2/27/20 8/27/20 2/27/21 8/27/21 2/27/22 8/27/22 2/27/23 Asset Management: Public Real Estate Long-term outperformance through varied market cycles LXI +17% FTSE 250 +17% o UK main market listed REIT o Market Cap: £1.5B/U.S.$1.9B o Total Return Since IPO (2/27/17): +17% Performance of LXi REIT 6/30/23 All information as of June 30, 2023. Benchmark: FTSE 250 Index.

17AlTi Tiedemann Global M&A Will Continue to be a Key Driver of Growth Compelling universe of opportunities • By focusing on mid-sized specialist firms in our target AUM/AUA range, we seek to capitalize on businesses that have reached a growth inflection point. • We look to accelerate growth by providing efficient, low-touch operational support, strategic guidance and distribution. Alternative Asset Management Industry OPPORTUNITY SET 2,000+ funds have AUM/AUA of $500M to $5B $500M $5B Mid-Market Growth Opportunity Seeding & Incubation Larger Funds Selling Stakes Transacted AUM/AUA by Asset Class and Share ($ in Billions) Source: Piper Sandler $2,961 $3,358 $1,623 $1,120 $- $1,000 $2,000 $3,000 $4,000 2020 2021 2022 YTD June 2023 Traditional Alternative Wealth management Combined alternative and wealth management share of total transactions 92% 91% 82% 80%

18AlTi Tiedemann Global Demonstrated Track Record Strategic acquisition and integration of asset managers & wealth managers Select AlTi M&A Examples Wealth Management • Expand global footprint • Increase scale & talent • Leverage services (i.e., Trust) • Expand Impact strategy • Diversify management fee revenue base • AUM/AUA at acquisition ~$2B to $10B+ Integrated Acquisitions Illustrative Acquisition Criteria Asset Management • Uncorrelated to equity markets • Leverage support platform (distribution, operations) • Expand management fee revenue base • Proven and repeatable earnings streams • AUM/AUA at acquisition ~$1B to $5B+ Participations in Specialist Managers Illustrative Acquisition Criteria

19AlTi Tiedemann Global M&A in 2023 Closed accretive acquisitions with selected global specialists Wealth Management Asset Management Arkkan • Asian Credit and Special situations manager with $1.4B AUM/AUA • Increased GP purchase by 3% to 12% • Performance since inception +85%(1) AL Wealth Partners • Singapore-based UHNW manager with ~$1B AUM • Acquired 100% of the company in April 2023 • Expanded Asian presence and entered a key investment & philanthropic hub for global & regional families • Rebranded as AlTi’s and will be integrated into wealth management platform Zebedee • European Long-Short Equities manager with $1.8B AUM/AUA • Increased GP stake by 5% to 25% • Investor’s Choice Award Winner in 2022 • Performance since inception +98%(1) Increased stakes in two alternative asset managers in Q1 2023 Completed the acquisition of two multi-family offices Hong Kong Singapore London (1) Past performance does not guarantee or indicate future results. The historical net performance presented above are unaudited. Please see reference page 41 of the appendix for additional information. (2) Information as of June 30, 2023, unless otherwise noted Lugano • Lugano-based MFO with ~$1.3B AUM • Acquired remaining 70% stake of the company in August 2023 • Expanded Swiss and Italian presence and client-base Lugano

20AlTi Tiedemann Global Financial Highlights

21AlTi Tiedemann Global Second Quarter 2023 GAAP Results (Unaudited) Note: 2Q’23 represents results for the period ended April 1, 2023 – June 30, 2023 (Successor), 2Q’22 represents results for the period April 1, 2023 – June 30, 2023 (Predecessor), 1Q’23 represents results for the period ended January 3, 2023 – March 31, 2023 (Successor) - Comparability to prior and future periods may be limited. Numbers may not add up due to rounding ($ in Thousands, except share data) 2Q'23 2Q'22 1Q'23 Revenue Management/advisory fees $ 47,440 $ 18,892 $ 46,470 Incentive fees 469 - 577 Distributions from investments 2,203 - 10,030 Other income/fees 1,769 - 970 Total income 51,881 18,892 58,047 Operating Expenses - Compensation and employee benefits 32,636 11,861 63,172 Systems, technology, and telephone 4,110 1,418 3,828 Sales, distribution and marketing 568 219 526 Occupancy costs 3,352 1,135 3,180 Professional fees 15,459 1,668 22,884 Travel and entertainment 1,306 570 1,946 Depreciation and amortization 3,655 597 4,517 Impairment loss on intangible assets 29,393 - - General, administrative and other 2,538 345 1,432 Total operating expenses 93,017 17,813 101,485 Operating income (loss) (41,136) 1,079 (43,438) Other income (expenses) - Gain (loss) on investments (5,154) 44 3,449 Gain (loss) on warrant liability 76 - (12,942) Gain (loss) on earn-out liability 66,083 - (29,206) Gain (loss) on TRA (1,792) - (300) Interest and dividend income (expense) (3,371) (105) (3,261) Other income (expense) (706) 5 58 Income (loss) before taxes 14,000 1,023 (85,640) Income tax (expense) benefit 15,446 (110) (4,650) Net income (loss) 29,446 913 (90,290) Net income (loss) attributed to non-controlling interests in subsidiaries (13,996) (52) (21,550) Net income (loss) attributable to AlTi Global, Inc. $ 43,442 $ 965 $ (68,740) Net income (loss) per share Basic $ 0.73 $ 137.72 $ (1.19) Diluted $ 0.26 $ 137.72 $ (1.19) Weighted average shares of Class A common stock outstanding Basic 59,286,346 7,007 57,546,811 Diluted 114,319,307 7,007 57,546,811 Net income (loss) 29,446 912 (90,290) Other Comprehensive (Loss) Income: Foreign currency translation adjustments 8,237 (687) 9,671 Other comprehensive income (682) - Total comprehensive income (loss) 37,001 226 (80,619) Other income (loss) attributed to non-controlling interests in subsidiaries (10,681) (52) (16,820) Comprehensive income (loss) attributable to AlTi Global, Inc. $ 47,682 $ 278 $ (63,799)

22AlTi Tiedemann Global Financial1 Key Performance Metrics • Revenues $51.9 million • 95% of total revenues are recurring • Net Income $29.4 million, Adjusted Net Income $2.4 million • Adjusted EBITDA $11.1 million • Adjusted basic EPS $0.02 per share, Adjusted Diluted EPS of $0.01 per share Corporate • Completed warrant exchange, increasing share count by ~5 million shares • Concluded registration of PIPE shares, increasing the free float by 19 million shares • Strengthened wealth management presence in Europe subsequent to quarter end, through the acquisition of remaining 70% stake in Lugano-based MFO Second Quarter 2023 Overview (1) See reconciliations of non-GAAP measures and definitions on slide 34 and 40, respectively. • $48.6 billion of AUM/AUA, 7% quarterly growth • $0.4 billion net new client assets Wealth Management • $20.3 billion of AUM/AUA, -3.8% quarterly decline • $0.3 billion of capital raised Asset Management

23AlTi Tiedemann Global Second Quarter 2023 Select Financial and Operating Metrics • Revenue of $52M declined $6M (11%) compared to 1Q’23, due to seasonally lower distributions from investments, partially offset by $1M higher management and advisory fees driven by higher AUM/AUA in Global Wealth Management. 95% of total revenues was from recurring fees. • Total Operating Expenses of $93M declined by $9M (8%) sequentially, driven by a decline in compensation expenses, as well as a reductions in recurring professional fees and T&E expenses. Normalized for $47M in unusual items related to an impairment charge ($29M), cost related to the transaction and organization streamlining ($15M), and non-cash equity compensation ($3M), operating expenses would have been $46M. • Other Income of $55M includes a non-cash $66M gain from the change in fair value of earn-out liabilities as a result of a decrease in the share price. This was partly offset by a non-cash change in fair value of investments and the tax receivable agreement, as well as interest expense. • Adjusted EBITDA of $11M increased $0.3M (3%) QoQ, driven by strong wealth management performance and reduced operating expense, partially offset by a revenue decline in asset management. EBITDA margin of 21% increased 200 bps compared to 1Q’23. • Adjusted Net Income was $2.4M, or $0.02 per share. • AUM/AUA of $69B, composed of Wealth Management ($49B) and Asset Management ($20B). Note: 2Q’22 results only include the results of TWMH as accounting predecessor; comparability to prior periods may be limited. (1) Includes $2.1M in management fees from External Strategic Managers Numbers may not add up due to rounding ($ in Millions) 2Q’23 2Q’22 1Q’23 QoQ Revenue $51.9 $18.9 $58.0 (11%) Mgmt./Advisory Fees 47.4 18.9 46.5 2% Incentive Fees 0.5 - 0.6 (17%) Distributions from Investments(1) 2.2 - 10.0 (78%) Other Income/Fees 1.8 - 1.0 80% Total Operating Expenses $93.0 $17.8 $101.5 (8%) Operating Income (Loss) (41.1) 1.1 (43.4) NM Other Income (loss) 55.1 1.0 (42.2) NM Net Income 29.4 0.9 (90.3) (133%) Adjusted Net Income $2.4 $3.8 $2.5 (4%) Adjusted EBITDA $11.1 $4.1 $10.8 3% EBITDA Margin 21% 22% 19% 200bps AUM/AUA ($B) $68.9 $60.0 $66.7 3%

24AlTi Tiedemann Global Segment Highlights

25AlTi Tiedemann Global • Revenue of $34M increased $2.4M compared to 1Q’23, driven by acquisition of AL Wealth Partners (Singapore), new client wins and market performance. ~100% of revenues are recurring management/advisory fees for Q2. • Total Operating Expenses of $37M down 32% sequentially, primarily due to a decrease in one- time costs associated with the transaction compared to Q1’23, as well a decline in normalized compensation costs, professional fees and T&E expenses. • Adjusted EBITDA of $9M increased $5M (109%) QoQ, driven by higher revenues and an increase in operating margin. EBITDA margin of 26% increased by 13% from 1Q’23. • AUM/AUA of $49B, representing 7% sequential growth, driven by the AL Wealth Partners acquisition, which added $1B, solid market performance and robust new business wins. Business development efforts generated $430M in net new client flows, resulting from significant international wins, as well as growth in the U.S. Wealth Management Select Financial and Operating Metrics ($ in Millions) 2Q’23 1Q’23 QoQ % Revenue $33.9 $31.5 8% Mgmt./Advisory Fees 33.9 31.5 8% Other Income/Fees 0.1 0.0 NM Total Operating Expenses $37.4 $55.1 (32%) Operating Income (Loss) (3.4) (23.6) NM Adjusted EBITDA $8.8 $4.2 109% EBITDA Margin 26% 13% 1,257 bps AUM/AUA ($B) $48.6 $45.6 7% Numbers may not add up due to rounding

26AlTi Tiedemann Global ($ in Millions) 2Q'23 2Q'22 Beginning Balance: $45,623 $32,168 Change 2,972 (3,398) AUA at Period End $48,595 $28,770 Average AUA $47,109 $30,469 ($ in Millions) 2Q'23 2Q'22 Beginning Balance: $30,408 $21,623 New Clients, net 430 513 Cash Flow, net (209) (195) Market Performance, net 1,146 (3,036) Acquisitions 999 - AUM at Period End $32,774 $18,905 Average AUM $31,591 $20,264 Wealth Management Operating Metrics – AUM/AUA Wealth Management AUM: $32.8 billion AUA: $48.6 billion Assets Under Management (AUM) Assets Under Advisement (AUA) See definitions on slide 40. Note: 2Q’22 results only include the results of TWMH as accounting predecessor; comparability to prior periods may be limited.

27AlTi Tiedemann Global • Revenue of $18M decreased $8.6M (32%) primarily driven by seasonally low incentive fees from External Strategic Managers compared to Q1 and a decrease of AUM/AUA resulting from market headwinds. • Total Operating Expenses of $56M increased by $9M (20%) primarily reflecting a one-time impairment ($29M) partly offset by a decrease in one-time costs associated with the transaction compared to Q1’23, as well a decline in normalized compensation costs, professional fees and T&E expenses. • Adjusted EBITDA of $2.3M down by $2.2M, driven by a decline in income from distributions from investments, partially offset by reductions in Operating expenses. • AUM/AUA of $20B decreased 4% QoQ reflecting reduced market capitalization of our public real estate strategy and redemptions in our alternative platform resulting from market headwinds. Asset Management Select Financial and Operating Metrics (1) Includes $2.1M in management fees from External Strategic Managers Numbers may not add up due to rounding ($ in Millions) 2Q’23 1Q’23 QoQ % Revenue $17.9 $26.5 (32%) Mgmt./Advisory Fees 13.5 15.0 (10%) Incentive Fees 0.5 0.6 (19%) Distribution from Investments(1) 2.2 10.0 (78%) Other Income/Fees 1.7 0.9 84% Total Operating Expenses $55.7 $46.4 20% Operating Income (Loss) (37.7) (19.8) NM Adjusted EBITDA $2.3 $6.6 (66%) EBITDA Margin 13% 25% (1,217)bps AUM/AUA ($B) $20.3 $21.1 (4%)

28AlTi Tiedemann Global ($ in Millions) 1-Apr-23 Gross Appreciation New Investments Subscriptions Redemptions Distributions June 30, 2023 (Successor) Average AUM/AUA TIG Arbitrage $2,936 ($11) — $141 ($460) ($7) $2,599 $2,768 External Strategic Managers: Real Estate Bridge Lending Strategy 2,147 45 — — — (9) 2,183 2,165 European Equities 1,729 (26) — 101 (22) (6) 1,776 1,753 Asian Credit and Special Situation 1,461 (40) — 75 (111) (2) 1,383 1,422 External Strategic Managers Subtotal 5,337 (21) — 176 (133) (17) 5,342 5,340 Total $8,273 ($32) — $317 ($593) ($24) $7,941 $8,107 ($ in Millions) 2Q’23 (Successor) Beginning Balance: $12,822 Change (467) AUM/AUA at June 30, 2023(1) $12,355 Average AUM/AUA $12,589 Asset Management Operating Metrics – AUM/AUA Asset Management AUM: $4.8 billion AUA: $20.3 billion Note: See definitions on slide 40. (1) AUA is reported with a one quarter lag for HLIF as management fees are billed on that basis Real Estate - Public & Private Funds Alternatives Platform

29AlTi Tiedemann Global Asset Management Operating Metrics – Fund Performance ($ in Millions) 2Q’23 1Q’23 TIG Arbitrage (0.35%) 0.25% External Strategic Managers: Real Estate Bridge Lending Strategy 0.75% 0.67% European Equities (1.70%) 2.31% Asian Credit and Special Situation (0.74%) 2.28% Alternatives Platform Fund Performance(1) (1) Past performance does not guarantee or indicate future results. The historical net performance presented above are unaudited. Please see reference page 41 of the appendix for additional information.

30AlTi Tiedemann Global Existing Capital Structure – Leverage of 3.4x based on 2Q 2023 LTM Adjusted EBITDA. Senior Credit Facility – Closed January 3, 2023, in conjunction with business combination. – $250 million five-year credit facility to pay down subsidiary debt and fund growth initiatives: o $100 million dollar term loan o $150 million revolving credit facility – Interest rate based on pricing grid based on total leverage ratio. – Amounts drawn at close used to refinance subsidiary debt . – BMO, Fifth Third Bank, PNC Bank, and Texas Capital Bank are Joint Lead Arrangers and Bookrunners. BMO Harris Bank N.A. is the Administrative Agent. Bank of America and CrossFirst Bank are members of the syndicate. Leverage metrics ($ in Millions unless otherwise stated) 2Q’23 x EBITDA Cash and Cash Equivalents $24 Revolving Credit Facility $98 Term loan $73 Total Debt $171 2Q 2023 LTM Adjusted EBITDA $50.4 3.4x Liquidity Metrics

31AlTi Tiedemann Global Our Long-Range Goals Reflect continued execution of proven business model (1) Growth rate represents long-term annual growth, on average and over time. (2) Expect 2023 margins will be negatively impacted by investments in public market infrastructure. • Annual AUM/AUA growth rate High single-digit percentage • Annual Revenue growth rate Low-teens percentage • Adjusted EBITDA margin Expansion to mid 30s (2)

32AlTi Tiedemann Global Appendix

33AlTi Tiedemann Global Second Quarter 2023 Balance Sheet (Unaudited) 2Q'23 represent amounts as of June 30, 2023 (Successor).Amounts as of December 31, 2022 represent balances related to TWMH (Predecessor). Comparability may be limited. ($ in Thousands, except share data) As of June 30, 2023 As of December 31, 2022 Assets Cash and cash equivalents $ 24,106 $ 7,131 Fees receivable, net 29,589 19,540 Other receivable, net — 5,167 Investments at fair value 164,789 145 Equity method investments 38,733 52 Intangible assets, net of accumulated amortization 499,479 20,578 Goodwill 561,188 25,464 Deferred tax asset, net — — Operating lease right-of-use assets 27,788 10,095 Other assets 49,023 3,817 Assets held for sale 11,050 — Investment in subsidiary — — Total assets $ 1,405,745 $ 91,989 Liabilities Accounts payable and accrued expenses $ 38,724 $ 8,073 Accrued compensation and profit sharing 15,245 15,660 Accrued member distributions payable 11,302 11,422 Warrant liability — — Earn-out liability, at fair value 54,884 — TRA liability 15,092 — Delayed share purchase agreement 1,818 1,818 Earn-in consideration payable 1,675 1,519 Operating lease liabilities 29,895 10,713 Debt, net of unamortized deferred financing cost 169,094 21,187 Deferred tax liability, net 28,925 82 Deferred income 458 — Other liabilities 12,883 3,662 Liabilities held for sale 2,694 — Total liabilities $ 382,689 $ 74,136 Commitments and contingencies Shareholders' Equity Class A common stock, $0.01 par value 6 3 Class B common stock, $0.01 par value — 18,607 Additional paid-in capital 516,262 — Retained earnings (accumulated deficit) (53,244) — Accumulated other comprehensive income (loss) 9,182 (1,077) Total AlTi Global, Inc. shareholders' equity 472,206 17,533 Non-controlling interest in subsidiaries 550,850 320 Total shareholders' equity 1,023,056 17,853 Total liabilities and shareholders' equity $ 1,405,745 $ 91,989 Numbers may not add up due to rounding

34AlTi Tiedemann Global 2Q'23 ($ in Thousands) Asset Management Segment Wealth Management Segment Total AlTi (Successor) Adjusted Net Income and Adjusted EBITDA Net income before taxes $ (13,151) $ 27,151 $ 14,000 Stock based compensation (1) 510 2,414 2,924 Stock based compensation – LTIP (2) — — — Transaction expenses (3) 4,918 6,962 11,880 Change in fair value of warrant liability (4) (38) (38) (76) Change in fair value of (gains)/loses on investments (5) 2,514 540 3,055 Change in fair value of earnout liability (6) (33,042) (33,041) (66,083) Organization streamlining cost (7) 2,355 845 3,199 Impairment (non-cash) 31,535 — 31,535 (Gains)/Losses on EMI/Carried Interest (non-cash) 2,671 — 2,671 EMI Adjustments (Interest, Depreciation, Taxes & Amortization) 851 91 942 Adjusted income before taxes (875) 4,922 4,047 Adjusted income tax expense (24) (1,653) (1,677) Adjusted Net Income (899) 3,269 2,370 Adjusted net income attributed to non-controlling interest in subsidiaries (459) 1,509 1,050 Adjusted Net Income attributable to Alvarium Tiedemann (440) 1,760 1,320 Net income attributed to non-controlling interest in subsidiaries (459) 1,509 1,050 Interest expense, net 1,634 1,737 3,371 Income tax expense (7,723) (7,723) (15,446) Adjusted income tax expense less income tax expense 7,747 9,376 1 7,123 Depreciation and amortization 1,518 2,137 3,655 Adjusted EBITDA $ 2,277 $ 8,795 $ 11,072 Non-GAAP Reconciliation Q2 2023 Note: Prior periods in 2022 are not presented as predecessor results not comparable (1) Add-back of non-cash expense related to legacy TWMH 2019, 2020 and 2021 restricted unit awards. (2) Add-back of non-cash expense related to legacy Alvarium Long Term Incentive Plan ("LTIP") awards. (3) Add-back of transaction expenses related to the Business Combination, including professional fees. (4) Represents the change in fair value of the warrant liability. (5) Represents the change in unrealized gains/losses related primarily to Investments held at fair value. (6) Represents the change in fair value of the earn-out liability. (7)Represents cost to implement organization change to derive cost synergy. Numbers may not add up due to rounding

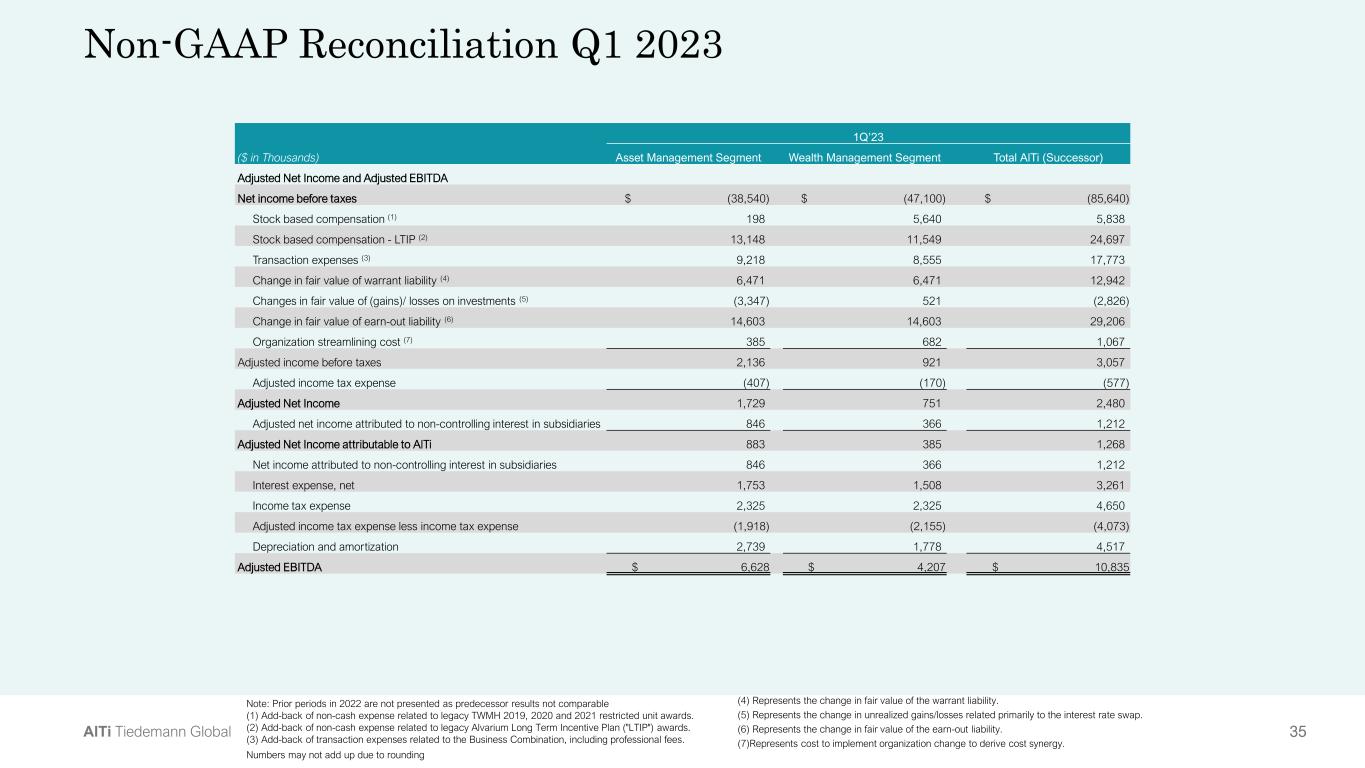

35AlTi Tiedemann Global Non-GAAP Reconciliation Q1 2023 1Q’23 ($ in Thousands) Asset Management Segment Wealth Management Segment Total AlTi (Successor) Adjusted Net Income and Adjusted EBITDA Net income before taxes $ (38,540) $ (47,100) $ (85,640) Stock based compensation (1) 198 5,640 5,838 Stock based compensation - LTIP (2) 13,148 11,549 24,697 Transaction expenses (3) 9,218 8,555 17,773 Change in fair value of warrant liability (4) 6,471 6,471 12,942 Changes in fair value of (gains)/ losses on investments (5) (3,347) 521 (2,826) Change in fair value of earn-out liability (6) 14,603 14,603 29,206 Organization streamlining cost (7) 385 682 1,067 Adjusted income before taxes 2,136 921 3,057 Adjusted income tax expense (407) (170) (577) Adjusted Net Income 1,729 751 2,480 Adjusted net income attributed to non-controlling interest in subsidiaries 846 366 1,212 Adjusted Net Income attributable to AlTi 883 385 1,268 Net income attributed to non-controlling interest in subsidiaries 846 366 1,212 Interest expense, net 1,753 1,508 3,261 Income tax expense 2,325 2,325 4,650 Adjusted income tax expense less income tax expense (1,918) (2,155) (4,073) Depreciation and amortization 2,739 1,778 4,517 Adjusted EBITDA $ 6,628 $ 4,207 $ 10,835 Note: Prior periods in 2022 are not presented as predecessor results not comparable (1) Add-back of non-cash expense related to legacy TWMH 2019, 2020 and 2021 restricted unit awards. (2) Add-back of non-cash expense related to legacy Alvarium Long Term Incentive Plan ("LTIP") awards. (3) Add-back of transaction expenses related to the Business Combination, including professional fees. (4) Represents the change in fair value of the warrant liability. (5) Represents the change in unrealized gains/losses related primarily to the interest rate swap. (6) Represents the change in fair value of the earn-out liability. (7)Represents cost to implement organization change to derive cost synergy. Numbers may not add up due to rounding

36AlTi Tiedemann Global First Half 2023 GAAP Results (Unaudited) ($ in Thousands, except share data) 1H’23 1H’22 Revenue Management/advisory fees $ 93,910 $ 38,862 Incentive fees 1,046 — Distributions from investments 12,233 — Other income/fees 2,739 — Total income 109,928 38,862 Operating Expenses Compensation and employee benefits 95,808 25,421 Systems, technology and telephone 7,939 2,858 Sales, distribution and marketing 1,094 437 Occupancy costs 6,532 2,103 Professional fees 38,343 3,083 Travel and entertainment 3,252 837 Depreciation and amortization 8,172 1,207 Impairment loss on intangible assets 29,393 — General, administrative and other 3,971 663 Total operating expenses 194,504 36,609 Total operating income (loss) (84,576) 2,253 Other Income (Expenses) Gain (loss) on investments (1,704) 25 Gain (loss) on TRA (2,092) — Gain (loss) on warrant liability (12,866) — Gain (loss) on earn-out liability 36,877 — Interest and dividend income (expense) (6,632) (179) Other income (647) 2 Income (loss) before taxes (71,640) 2,101 Income tax (expense) benefit 10,796 (303) Net income (loss) (60,844) 1,798 Net income (loss) attributed to non-controlling interests in subsidiaries (35,546) (65) Net income (loss) attributable to AlTi Global, Inc. $ (25,298) $ 1,863 Net Income (Loss) Per Share Basic $ (0.43) $ 265.88 Diluted $ (0.43) $ 265.88 Weighted Average Shares of Class A Common Stock Outstanding Basic 58,425,916 7,007 Diluted 58,454,342 7,007 Other Comprehensive (Loss) Income Foreign currency translation adjustments 17,908 (962) Other comprehensive income (682) — Total comprehensive loss (43,618) 836 Other income (loss) attributed to non-controlling interests in subsidiaries (27,501) (65) Comprehensive income (loss) attributable to AlTi Global, Inc. (16,117) 901 Note: 1H’23 represents results for the period ended January 3, 2023 – June 30, 2023 (Successor), and 1H’22 represents results for the period January 1 – June 30, 2022 (Predecessor) - Comparability to prior and future periods may be limited Numbers may not add up due to rounding

37AlTi Tiedemann Global Expected Financial Drivers Well-defined path with a clear trajectory for long term growth Stable recurring revenue foundation across both asset and wealth management Topline growth fueled by new partnerships Revenue diversification through emerging strategies and solutions Cost-saving initiatives Economies of scale that leverage global distribution platform Efficiencies driven by centralizing operations Accretive acquisition strategy Opportunistic monetization of investments 01. Topline Growth 02. Margin Expansion 03. Balance Sheet Strength

38AlTi Tiedemann Global Clear Value Creation Roadmap AlTi ecosystem presents significant growth opportunities New investment strategies & global presence • Expand into complementary domestic and international markets • Provide clients in three continents with a localized offering while addressing their multi-jurisdictional needs • Expand geographic focus and product offering in asset management Select acquisitions & stakes in strategic managers • Capture opportunity with identified pipeline of strategic acquisitions and partnerships with strategic managers • Increase ownership stakes in best-in-class managers Growth through Impact offering • Expand Impact strategies across businesses and geographies • Increase total assets committed to Impact strategies Expanded client base & deepened existing relationships • Fortify client base through exceptional service and innovative solutions • Grow client base enhanced by scale, skills and experience gained in combination • Increase existing relationships through new investment solutions and complementary services

39AlTi Tiedemann Global UN PRI UN Principles for Responsible Investment Signatory since 2018 Our Commitment to Impact Sustainable practices across corporate activities Culture at Core – Diversity, Equity & Inclusion is a matter of principle for us and fundamental to how we operate – Commitment to inclusive culture, hiring practices, educational programs, community involvement and environmental programs – Value diversity of thought, ideas and perspectives needed to provide best-in-class services Our goal is generating sustainable financial returns with net positive impact. Our strategy and efforts are led by Chief Impact Officer, Jed Emerson. B Corp Targeting Certification Net Zero Targeting Net Zero carbon emissions by 2030 DEI Diversity, Equity & Inclusion Belonging Pledge

40AlTi Tiedemann Global Glossary Assets Under Management and Assets Under Advisement. For financial presentation purposes, total assets under management and assets under advisement (“AUM/AUA”) of AlTi Global is calculated as set forth below: AUM/AUA includes billable and non-billable assets. Billable assets represent the portion of assets on which we charges fees, including under co-investment arrangements. For the purpose of calculating co- investment assets, we include the gross asset value of all assets managed or supervised by operating partner subsidiaries, affiliates and joint ventures in which we hold either a majority or minority stake. Non- billable assets are exempt of fees. They consist of assets such as cash and cash equivalents, real estate, investment consulting assets and other designated assets. Our AUM/AUA also includes the assets under management of each of our External Strategic Managers. External Strategic Managers are those managers in which the we have made an external investment, and the strategies of these managers include Real Estate Bridge Lending, European Long/Short Equity and Asian Credit. Unless otherwise defined, AUM refers to assets on which a business provides continuous and regular billable supervisory or management services. As noted, our AUM/AUA includes the AUM of our external strategic managers as we believe including such AUM presents a more accurate depiction of the respective businesses. However, the AUM of the external strategic managers should not be viewed as part our AUM for regulatory and/or statutory purposes under the U.S. Investment Advisers Act of 1940, as amended. Adjusted Net Income. We use Adjusted Net Income as a non-US GAAP measure to track our performance and assess our ability to service our borrowings. This is a non-US GAAP financial measure supplement and should be considered in addition to and not in lieu of, the results of operations, prepared in accordance with US GAAP. Adjusted Net Income represents net income (loss) before taxes plus (a) equity-settled share-based payments, (b) transaction-related costs, including professional fees, (c) impairment of equity method investments, (d) change in fair value of investment or other financial instruments, (e) onetime bonuses recorded in the statement of operations, (f) compensation expense related to the earn-in of certain variable interest entities, and (g) adjusted income tax expense. Adjusted EBITDA. We use Adjusted EBITDA as a non-US GAAP measure to track our performance and assess our ability to service our borrowings. This is a non-US GAAP financial measure supplement and should be considered in addition to and not in lieu of, the results of operations, prepared in accordance with US GAAP. Adjusted EBITDA is derived from and reconciled to, but not equivalent to, its most directly comparable GAAP measure of net income (loss). Adjusted EBITDA represents adjusted net income plus (a) interest expense, net, (b) income tax expense, (c) adjusted income tax expense less income tax expense, and (d) depreciation and amortization expense. Billable Assets. Represents the portion of our AUM/AUA on which we charge fees. Mgmt./Advisory Fees. Mgmt/Advisory fees represent fees recurring in nature, primarily management fees. Impact Investing. Investment practices seeking to generate various levels of financial performance together with the generation of positive measurable environmental and social impacts. Successor. AlTi Global, Inc. (the “Registrant”), a Delaware corporation, together with its consolidated subsidiaries (collectively, the “Company”, “AlTi”). Predecessor. Tiedemann Wealth Management Holdings, LLC, a Delaware limited liability company (“TWMH”).

41AlTi Tiedemann Global Footnotes Past performance does not guarantee or indicate future results. The historical net performance presented above are provided from inception of each fund through June 2023 and are unaudited. The TIG Arbitrage returns reflect the deduction of the actual management fees (represents the actual management fees paid by investors for such month which may be lower than the stated management fee) and stated performance fees and expenses at the specified times but do not include the deduction of any applicable taxes and include the reinvestment of all dividends and other earnings with respect to the fund’s assets. The returns for Real Estate Bridge Lending strategy are based on returns for the flagship Real Estate Bridge Lending Strategy fund provided to TIG by an external strategic manager. Returns were provided net of all fees charged to the flagship fund in this strategy, but did not take into account taxes, change in unit values, third-party expenses, or redemption charges. The returns for European Equities are based on returns for European Equities’ benchmark portfolio. Returns for European Equities provided were net of management and incentive fees, expenses, and applicable taxes. The returns for Asia Credit and Special Situations are based on returns for the flagship Asia Credit and Special Situations fund provided to the TIG Entities by our External Strategic Manager. Returns for Asia Credit provided were net of management and incentive fees, expenses, and applicable taxes. Each of the managers managed strategies and/or funds over the relevant periods that are not included in the investment performance information above because they are not the primary strategy and/or fund of the manager. If the performance of the omitted strategies and funds were included, the investment performance shown may be lower. An investor may be subject to different taxation depending on the jurisdiction of the investor or relevant manager. The MSCI and HFRI performance information is included to show relative market performance for the periods indicated and not as a standard of comparison. Each of HFRI and MSCI differs in numerous respects from the portfolio composition of any fund comprising the investment returns presented. The indices are not included to imply that any fund is comparable to an index in composition or element of risk. Returns for the MSCI are gross of dividend reinvestment. No representation is made hereby with respect to the accuracy or completeness of the index data. A description of the strategies is provided below: TIG Arbitrage: The TIG Arbitrage strategy is TIG’s event-driven strategy based in New York. This strategy, which has $2.6 billion of AUM as of June 30, 2023, focuses on 0-to-30-day events within the merger process. The investment team employs deep research on each situation in the portfolio with a focus on complex, hostile, up-for-sale situations where our primary research work can drive uncorrelated alpha. The research and investment process is focused on hard catalyst events and is not dependent on deal flow. Bridge Lending Real Estate: The Bridge Lending Real Estate strategy is managed by an external manager based in Toronto and focuses on complex construction, term, and pre-development bridge loans throughout North America. The strategy has $2.2 billion AUM as of June 30, 2023. The strategy’s diversified portfolio primarily consists of first lien mortgages with little to no structural leverage. The team places an emphasis on risk management via rigorous underwriting consisting of borrower analysis, vetting, and extensive monitoring across all major real estate asset classes. European Equities: The European Equities strategy is managed by an external manager based in London. The strategy has y $1.8 billion AUM as of June 30, 2023, and trades the portfolio actively and absolute return-oriented with a focus on financials, cyclicals, and mining and minerals. The strategy is market agnostic and runs with a variable net exposure, equally comfortable net long or net short. Asia Credit: The Asia Credit strategy is managed by an external manager based in Hong Kong. The strategy has $1.4 billion AUM as of June 30, 2023, and includes performing, stressed, and distressed bonds and loans throughout the Asia Pacific region. The manager strives to capitalize on what It believes is an under-researched and inefficient market with limited competition and attractive levels of stressed and distressed activity.

42AlTi Tiedemann Global Thank You