Current Report Filing (8-k)

August 01 2019 - 4:31PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

Ju

ly 26

, 2019

Air T, Inc.

(Exact Name of Registrant as Specified in Charter)

|

Delaware

|

|

001-35476

|

|

52-1206400

|

|

(State or Other Jurisdiction

of Incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification No.)

|

5930 Balsom Ridge Road

Denver, North Carolina 28037

(Address of Principal Executive Offices, and Zip Code)

(828) 464-8741

Registrant’s Telephone Number, Including Area Code

Not applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (

see

General Instruction A.2. below):

|

|

☐

|

Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

|

|

☐

|

Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock

|

AIRT

|

NASDAQ Global Market

|

|

Alpha Income Preferred Securities (also referred

to as 8% Cumulative Capital Securities) (“AIP”)

|

AIRTP

|

NASDAQ Global Market

|

|

Warrant to purchase AIP

|

AIRTW

|

NASDAQ Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

1.01

Entry into a Material Definitive Agreement

To the extent responsive, the information included in Item 2.01 is incorporated herein by reference.

Item 2.01 Completion of Acquisition or Disposition of Assets

On June 21, 2019, Contrail Aviation Leasing, LLC (“

Contrail

Leasing

”), a wholly-owned subsidiary of Contrail Aviation Support, LLC (“

Contrail

Support

”), a 79%-owned subsidiary Air T, Inc. (the “

Company

”), entered into a purchase agreement to acquire 100% interest in the trust holding title to one Boeing B737-700 aircraft with serial number 30241, which is subject to a lease, and two airplane engines, serial numbers 889727 and 889728. The transaction closed on July 26, 2019. The total transaction value for the purchase exceeded $15,000,000.* Contrail Support guarantees the buyer obligations of Contrail Leasing.

The interest in the trust owning the aircraft and engines purchased as discussed above continues Contrail’s business of purchasing aircraft and/or aircraft engines for the purpose of leasing or disassembling them and selling them for parts.

Transaction documents with respect to the transaction are filed as Exhibits 10.1, 10.2, 10.3, 10.4, 10.5, 10.6, and 10.7 hereto, which are incorporated herein by reference.

*Portions of the transaction exhibit have been omitted for confidential treatment.

Item 9.01 Financial Statements and Exhibits

|

10.1

|

Aircraft Asset Sale and Purchase Agreement, dated June 21, 2019 by and between Sapphire Finance I Holding Designated Activity Company, Contrail Aviation Leasing, LLC, and Contrail Aviation Support, LLC.*

|

|

|

|

|

10.2

|

Buyer Guarantee, dated June 25, 2019 by and between Contrail Aviation Support, LLC and Sapphire Finance I Holding Designated Activity Company.

|

|

|

|

|

10.3

|

Notice of Beneficial Interest Transfer, dated July 26, 2019 from Wells Fargo Trust Company, National Association, Sapphire Finance I Holding Designated Activity Company, and Contrail Aviation Leasing, LLC to Sun Country, Inc. d/b/a Sun Country Airlines.*

|

|

|

|

|

10.4

|

Guarantee, dated July 26, 2019 by and between Contrail Aviation Support, LLC and Sun Country, Inc. d/b/a Sun Country Airlines.*

|

|

|

|

|

10.5

|

Third Trust Assignment and Assumption Agreement, dated July 26, 2019 by and between Sapphire Finance I Holding Designated Activity Company and Contrail Aviation Leasing, LLC

.

|

|

|

|

|

10.6

|

Netting Letter, dated July 26, 2019 by and between Sapphire Finance I Holding Designated Activity Company and Contrail Aviation Leasing, LLC.*

|

|

|

|

|

10.7

|

Amendment Number Five to Aircraft Lease Agreement, dated June 20, 2019 by and between Wells Fargo Trust Company, National Association and Sun Country, Inc. d/b/a Sun Country Airlines.*

|

*Portions of the transaction exhibit have been omitted for confidential treatment.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Company has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: August 1, 2019

|

|

AIR T, INC.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

Brian Ochocki

|

|

|

|

|

Brian Ochocki, Chief Financial Officer

|

|

3

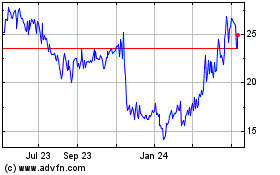

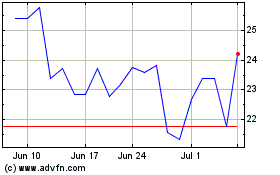

Air T (NASDAQ:AIRT)

Historical Stock Chart

From May 2024 to Jun 2024

Air T (NASDAQ:AIRT)

Historical Stock Chart

From Jun 2023 to Jun 2024