0000874292false12/3100008742922023-11-162023-11-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) November 16, 2023

ADDVANTAGE TECHNOLOGIES GROUP, INC.

(Exact name of Registrant as specified in its Charter)

Oklahoma

(State or other Jurisdiction of Incorporation)

| | | | | |

| 1-10799 | 73-1351610 |

| (Commission file Number) | (IRS Employer Identification No.) |

| |

1430 Bradley Lane, Suite 196, Carrollton, Texas | 75007 |

| (Address of Principal Executive Offices) | (Zip Code) |

(918) 251-9121

(Registrant's Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written Communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, par value $0.01 | AEY | NASDAQ |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 3.03 Material Modifications to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 8.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.03 Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

To the extent required by Item 5.03 of Form 8-K, the information contained in Item 8.01 of this Current Report on Form 8-K is incorporated herein by reference.

Item 8.01 Other Events.

Reverse Stock Split

On November 16, 2023, ADDvantage Technologies Group, Inc (the “Company”) effected a one-for-10 (1:10) reverse stock split of all issued and outstanding shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”) effective as of 12:01 a.m. Eastern Time (the “Reverse Stock Split”), vide a Certificate of Amendment to the Certificate of Incorporation of ADDvantage Technologies Group, Inc (the “Certificate of Amendment”) filed with the Secretary of State of Oklahoma on November 16, 2023, and deemed effective on November 16, 2023 at 12:01 a.m. Eastern Time. The Reverse Stock Split was intended to bring the Company into compliance with the $1.00 minimum bid price requirement for continued listing on the NASDAQ Capital Market, as required by Nasdaq Listing Rule 5550(a)(2).

As previously disclosed, at the Company’s Annual Meeting of Stockholders held on September 22, 2023 (the “Annual Meeting”), the Company’ stockholders approved of a proposal (the “Proposal”) authorizing an amendment to the Company’s Certificate of Incorporation, if necessary, to effect a reverse stock split of all issued and outstanding shares of the Common Stock at an exchange ratio ranging from one-for-ten (1:10) to one-for-two (1:2), with such reverse stock split to be effected at an exchange ratio and at such a date and time, if at all, as determined by the Chief Executive Officer of the Company (the “CEO”) in its sole discretion.

As a result of the Reverse Stock Split, every ten (10) shares of issued and outstanding Common Stock were combined into one (1) validly issued, fully paid and non-assessable share of Common Stock. The Reverse Stock Split uniformly affected all issued and outstanding shares of Common Stock and did not alter any stockholder's percentage ownership interest in the Company, except to the extent that the Reverse Stock Split resulted in the fractional interests. No fractional shares will be or have been issued in connection with the Reverse Stock Split. Stockholders who otherwise would have been entitled to receive fractional shares of Common Stock will receive an amount in cash (without interest or deduction) equal to the fraction of one share to which such stockholder would otherwise be entitled multiplied by $2.60, representing the closing price of Common Stock on the Nasdaq Stock Market on the first business day immediately preceding the effective date of the Reverse Stock Split and the inverse of the Reverse Stock Split ratio. Proportional adjustments have also been made to the Company’s outstanding warrants, stock options, and convertible securities, as well as to the reserves shares to reflect the Reverse Stock Split, in each case, in accordance with the terms thereof.

The Reverse Stock Split has reduced the number of shares of Common Stock issued and outstanding from the earlier 14,947,078 to 1,494,707 shares of Common Stock. The number of authorized shares of Common Stock have not been changed by the Reverse Stock Split.

The Company’s transfer agent, Continental Stock Transfer and Trust Company (“Continental”) has acted as the exchange agent for the reverse stock split. Instructions regarding the exchange of stock certificates, as applicable, are being provided to stockholders of record by Continental. Stockholders who

hold their shares in brokerage accounts or “street name” are not required to take any action to effect the exchange of their shares.

The Common Stock started trading on a split-adjusted basis on the NASDAQ Capital Market at the market open on November 16, 2023. The trading symbol for the Common Stock will remain “AEY.” Following the Reverse Stock Split, the CUSIP for the Company’s Common Stock is 006743 405.

The description of the Certificate of Amendment and the Reverse Stock Split is qualified in its entirety by reference to the text of the Certificate of Amendment, which is filed as Exhibit 3.1 to this Current Report on Form 8-K and is incorporated herein by reference.

On November 16, 2023, the Company issued a press release announcing the completed Reverse Stock Split. The full text of the Company’s press release issued in connection with the foregoing matter is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The following exhibit is furnished herewith:

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ADDvantage Technologies Group, Inc. | |

| | |

| Date: November 16, 2023 | |

| | |

| /s/ Michael A. Rutledge | |

| Michael A. Rutledge | |

| Chief Financial Officer | |

| | |

STATE OF OKLAHOMA

CERTIFICATE OF AMENDMENT

TO THE

CERTIFICATE OF INCORPORATION OF

ADDVANTAGE TECHNOLOGIES GROUP, INC.

TO: THE SECRETARY OF STATE OF OKLAHOMA

State Capitol Building

Oklahoma City, Oklahoma 73105

The undersigned Oklahoma corporation, for the purpose of amending its Certificate of Incorporation as originally filed on September 20, 1989, as provided by Section 1077 of the Oklahoma General Corporation Act, hereby states as follows:

The date of filing its original Certificate of Incorporation with the Secretary of State of Oklahoma was September 20, 1989. Said Certificate of Incorporation was thereafter amended on December 14, 1990, February 14, 1991, June 20, 1991, July 8, 1992, September 14, 1992, October 8, 1998, September 30, 1999, November 22, 1999, December 9, 1999 and March 2, 2000.

That at a meeting of the Board of Directors of ADDvantage Technologies Group, Inc. resolutions were duly adopted setting forth a proposed amendments of the certificate of incorporation of said corporation (the “Certificate of Incorporation”), declaring said amendments to be advisable and calling a meeting of the stockholders of said corporation for consideration thereof. The resolution setting forth the proposed amendment is as follows:

FIRST: that effective as of 12:01 a.m. Eastern Time on November 16, 2023 (the “Effective Time”), each 10 shares of the Corporation’s Common Stock issued and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the Corporation or the respective holders thereof, be combined and converted into one share of Common Stock without increasing or decreasing the par value of each share of Common Stock (the “Reverse Stock Split”). No fractional shares of Common Stock shall be issued as a result of the Reverse Stock Split and, in lieu thereof, upon surrender after the Effective Time of a certificate or book entry position which formerly represented shares of Common Stock that were issued and outstanding immediately prior to the Effective Time, any person who would otherwise be entitled to a fractional share of Common Stock as a result of the Reverse Stock Split, following the Effective Time, shall be entitled to receive a cash payment (without interest and subject to withholding taxes, as applicable) equal to the fraction of a share of Common Stock to which such holder would otherwise be entitled multiplied by the closing price of Common Stock on the Nasdaq Stock Market on the first business day immediately preceding the Effective Time (as adjusted in good faith by the Corporation to account for the reverse stock split ratio). The Reverse Stock Split shall occur whether or not the certificates representing such shares of Common Stock are surrendered to the Corporation or its transfer agent. Each certificate or book entry position that immediately prior to the Effective Time represented shares of Common Stock shall thereafter represent the number of shares of Common Stock into which the shares of Common Stock represented by such certificate or book entry position has been combined, subject to the elimination of fractional interests set forth above. Notwithstanding the Reverse Stock Split, the authorized capital of the Company shall remain unchanged at 100,000,000 shares, of which 95,000,000 shares shall be Common Stock with a par value of $0.01 per share, and 5,000,000 shares shall be Preferred Stock with a par value of $1.00 per share.

SECOND: that the Certificate of Incorporation of this corporation be amended by deleting Article IV in its entirety and inserting the following:

“ARTICLE IV

CAPITALIZATION

The aggregate number of shares of all classes of stock which the Corporation shall have authority to issue is 100,000,000, of which 95,000,000 shares shall be Common Stock with a par value of $0.01 per share, and 5,000,000 shares shall be Preferred Stock with a par value of $1.00 per share.

The designations and preferences, voting powers, restrictions, limitations as to dividends, qualifications and terms and conditions of redemption, conversion and other rights of the shares of each class of stock are as follows:

Preferred Stock

The Preferred Stock may be issued from time to time by the Board of Directors as shares of one or more series.

The description of shares of each series of Preferred Stock, including any preferences, conversion and other rights, voting powers, restrictions, limitations as to dividends, qualifications and terms and conditions of redemption shall be as set forth in resolutions adopted by the Board of Directors and in a Certificate of Designations filed as required by law from time to time prior to the issuance of any shares of such series.

The Board of Directors is expressly authorized, prior to issuance, by adopting resolutions providing for the issuance of, or providing for a change in the number of, shares of any particular series of Preferred Stock and, if and to the extent from time to time required by law, by filing a Certificate of Designations to set or change the number of shares to be included in each series of Preferred Stock and to set or change in any one or more respects the designations, preferences, conversion or other rights, voting powers, restrictions, limitations as to dividends, qualifications or terms and conditions of redemption relating to the shares of each such series. Notwithstanding the foregoing, the Board of Directors shall not be authorized to change the right of the Common Stock of the Corporation to vote one vote per share on all matters submitted for shareholder action.

The authority of the Board of Directors with respect to each series of Preferred Stock shall include, but not be limited to, setting or changing the following:

(a) the distinctive serial designation of such series and the number of shares constituting such series (provided that the aggregate number of shares constituting all series of Preferred Stock shall not exceed 5,000,000);

(b) the annual dividend rate on shares of such series, whether dividends shall be cumulative and, if so, from which date or dates;

(c) whether the shares of such series shall be redeemable and, if so, the terms and conditions of such redemption, including the date or dates upon and after which such shares shall be redeemable, and the amount per share payable in case of redemption, which amount may vary under different conditions and at different redemption dates;

(d) the obligation, if any, of the Corporation to retire shares of such series pursuant to a sinking fund;

(e) whether shares of such series shall be convertible into, or exchangeable for, shares of stock of any other class or classes and, if so, the terms and conditions of such conversion or exchange, including the price or prices or the rate or rates of conversion or exchange and the terms of adjustment, if any;

(f) whether the shares of such series shall have voting rights, in addition to the voting rights provided by law, and, if so, the terms of such voting rights;

(g) the rights of the shares of such shares in the event of voluntary or involuntary liquidation, dissolution or winding-up of the Corporation; and

(h) any other relative rights, powers, preference, qualifications, limitations or restrictions thereof relating to such series.

The shares of Preferred Stock of any one series shall be identical with each other in all respects as to the dates from and after which dividends thereon shall cumulate, if cumulative.

Common Stock

Subject to all of the rights of the Preferred Stock as expressly provided herein, by law or by the Board of Directors pursuant to this ARTICLE IV, the Common Stock of the Corporation shall possess all such rights and privileges as are afforded to capital stock by applicable law in the absence of any express grant of rights or privileges herein, including, but not limited to, the following rights and privileges:

(a) dividends may be declared and paid or set apart for payment upon the Common Stock out of any assets or funds of the Corporation legally available for the payment of dividends;

(b) the holders of Common Stock shall have the right to vote for the election of directors and on all other matters requiring shareholder action, each share being entitled to one vote; and

(c) upon the voluntary or involuntary liquidation, dissolution or winding-up of the Corporation, the net assets of the Corporation shall be distributed pro rata to the holders of the Common Stock in accordance with their respective rights and interests.

Reverse Stock Split. Effective as of 12:01 a.m. Eastern Time on November 16, 2023 (the “Effective Time”), each 10 shares of the Corporation’s Common Stock issued and outstanding immediately prior to the Effective Time shall, automatically and without any action on the part of the Corporation or the respective holders thereof, be combined and converted into one share of Common Stock without increasing or decreasing the par value of each share of Common Stock (the “Reverse Stock Split”). No fractional shares of Common Stock shall be issued as a result of the Reverse Stock Split and, in lieu thereof, upon surrender after the Effective Time of a certificate or book entry position which formerly represented shares of Common Stock that were issued and outstanding immediately prior to the Effective Time, any person who would otherwise be entitled to a fractional share of Common Stock as a result of the Reverse Stock Split, following the Effective Time, shall be entitled to receive a cash payment (without interest and subject to withholding taxes, as applicable) equal to the fraction of a share of Common Stock to which such holder would otherwise be entitled multiplied by the closing price of Common Stock on the Nasdaq Stock Market on the first business day immediately preceding the Effective Time (as adjusted in good faith by the Corporation to

account for the reverse stock split ratio). The Reverse Stock Split shall occur whether or not the certificates representing such shares of Common Stock are surrendered to the Corporation or its transfer agent. Each certificate or book entry position that immediately prior to the Effective Time represented shares of Common Stock shall thereafter represent the number of shares of Common Stock into which the shares of Common Stock represented by such certificate or book entry position has been combined, subject to the elimination of fractional interests set forth above. Notwithstanding the Reverse Stock Split, the authorized capital of the Company shall remain unchanged.”

THIRD: that all other provisions of the Amended Certificate of Incorporation of the Corporation not amended hereby shall remain in full force and effect.

This Amendment to the Amended Certificate of Incorporation was set forth in a resolution duly adopted by the Board of Directors, which declared the adoption of the Amendment to be advisable and which ordered that the Amendment be considered by the shareholders of the Corporation entitled to vote thereon.

Thereafter, at the Annual Meeting of the shareholders of the Corporation duly called and held on September 22, 2023, the necessary number of shares as required by statute were voted in favor of the Amendment.

Thus, this Amendment to the Amended Certificate of Incorporation was duly adopted in accordance with Sections l067 and 1077 of the 0klahoma General Corporation Act.

IN WITNESS WHEREOF, said ADDvantage Technologies Group, Inc. has caused its corporate seal to be affixed hereto and this Amendment to be signed by its President and Secretary this 9th day of November 2023.

ATTEST:

| | | | | | | | | | | | | | |

| | | |

| By: | /s/ Michael A. Rutledge | | By: | /s/ Joseph E. Hart |

| Name: | Michael A. Rutledge | | Name: | Joseph E. Hart |

| Title: | Secretary | | Title: | President |

ADDvantage Technologies Group, Inc.

Completes 1-for-10 Reverse Stock Split as Part of Nasdaq Compliance Plan

Carrollton, Texas, November 16, 2023 – ADDvantage Technologies Group, Inc. (NASDAQ: AEY) (“ADDvantage Technologies” or the “Company”) today announced that On November 16, 2023, ADDvantage Technologies Group, Inc (the “Company”) effected a one-for-10 (1:10) reverse stock split of all issued and outstanding shares of the Company’s common stock, par value $0.01 per share (the “Common Stock”) effective as of 12:01 a.m. Eastern Time on November 16, 2023 (the “Reverse Stock Split”), vide a Certificate of Amendment to the Certificate of Incorporation of ADDvantage Technologies Group, Inc (the “Certificate of Amendment”) filed with the Secretary of State of Oklahoma on November 16, 2023, and deemed effective on November 16, 2023 at 12:01 a.m. Eastern Time. The Reverse Stock Split was intended to bring the Company into compliance with the $1.00 minimum bid price requirement for continued listing on the NASDAQ Capital Market, as required by Nasdaq Listing Rule 5550(a)(2).

As previously disclosed, at the Company’s Annual Meeting of Stockholders held on September 22, 2023 (the “Annual Meeting”), the Company’ stockholders approved of a proposal (the “Proposal”) authorizing an amendment to the Company’s Certificate of Incorporation, if necessary, to effect a reverse stock split of all issued and outstanding shares of the Common Stock at an exchange ratio ranging from one-for-ten (1:10) to one-for-two (1:2), with such reverse stock split to be effected at an exchange ratio and at such a date and time, if at all, as determined by the Chief Executive Officer of the Company (the “CEO”) in its sole discretion.

As a result of the Reverse Stock Split, every ten (10) shares of issued and outstanding Common Stock were combined into one (1) validly issued, fully paid and non-assessable share of Common Stock. The Reverse Stock Split uniformly affected all issued and outstanding shares of Common Stock and did not alter any stockholder's percentage ownership interest in the Company, except to the extent that the Reverse Stock Split resulted in the fractional interests. No fractional shares will be or have been issued in connection with the Reverse Stock Split. Stockholders who otherwise would have been entitled to receive fractional shares of Common Stock will receive an amount in cash (without interest or deduction) equal to the fraction of one share to which such stockholder would otherwise be entitled multiplied by $2.60, representing the closing price of Common Stock on the Nasdaq Stock Market on the first business day immediately preceding the effective date of the Reverse Stock Split and the inverse of the Reverse Stock Split ratio. Proportional adjustments have also been made to the Company’s outstanding warrants, stock options, and convertible securities, as well as to the reserves shares to reflect the Reverse Stock Split, in each case, in accordance with the terms thereof.

The Reverse Stock Split has reduced the number of shares of Common Stock issued and outstanding from the earlier 14,947,078 to 1,494,707 shares of Common Stock. The number of authorized shares of Common Stock have not been changed by the Reverse Stock Split.

The Company’s transfer agent, Continental Stock Transfer and Trust Company (“Continental”) has acted as the exchange agent for the reverse stock split. Instructions regarding the exchange of stock certificates, as applicable, are being provided to stockholders of record by Continental. Stockholders who hold their shares in brokerage accounts or “street name” are not required to take any action to effect the exchange of their shares.

The Common Stock started trading on a split-adjusted basis on the NASDAQ Capital Market at the market open on November 16, 2023. The trading symbol for the Common Stock will remain “AEY.” Following the Reverse Stock Split, the CUSIP for the Company’s Common Stock is 006743 405.

About ADDvantage Technologies Group, Inc.

ADDvantage Technologies Group, Inc. (Nasdaq: AEY) is a communications infrastructure services and equipment provider operating a diversified group of companies through its Wireless Infrastructure Services and Telecommunications segments. Through its Wireless segment, Fulton Technologies provides turn-key wireless infrastructure services including the installation, modification and upgrading of equipment on communication towers and small cell sites for wireless carriers, national integrators, tower owners and major equipment manufacturers. Through its Telecommunications segment, Nave Communications and Triton Datacom sell equipment and hardware used to acquire, distribute, and protect the communications signals carried on fiber optic, coaxial cable and wireless distribution systems. The Telecommunications segment also offers repair services focused on telecommunication equipment and recycling surplus and related obsolete telecommunications equipment.

ADDvantage operates through its subsidiaries, Fulton Technologies, Nave Communications, and Triton Datacom. For more information, please visit the corporate website at www.addvantagetechnologies.com.

Forward-Looking Statements.

This Current Report on Form 8-K includes forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “intends”, “expects,” “may”, “will”, and “would”, or the negative of such terms, or other comparable terminology, and include statements about the Reverse Stock Split and the impact, if any, of the Reverse Stock Split on the Company and the trading price of the Common Stock. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, which could cause actual results to differ materially from the forward-looking statements contained herein due to many factors. These forward-looking statements and such risks, uncertainties

and other factors speak only as of the date of this Current Report on Form 8-K, and the Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statement contained herein, or to reflect any change in our expectations with regard thereto or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by applicable law.

v3.23.3

Cover

|

Nov. 16, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 16, 2023

|

| Entity Registrant Name |

ADDVANTAGE TECHNOLOGIES GROUP, INC.

|

| Entity Incorporation, State or Country Code |

OK

|

| Entity File Number |

1-10799

|

| Entity Tax Identification Number |

73-1351610

|

| Entity Address, Address Line One |

1430 Bradley Lane

|

| Entity Address, Address Line Two |

Suite 196

|

| Entity Address, City or Town |

Carrollton

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75007

|

| City Area Code |

918

|

| Local Phone Number |

251-9121

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Central Index Key |

0000874292

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| Title of 12(b) Security |

Common stock, par value $0.01

|

| Trading Symbol |

AEY

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

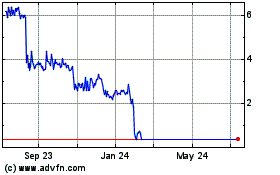

ADDvantage Technologies (NASDAQ:AEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

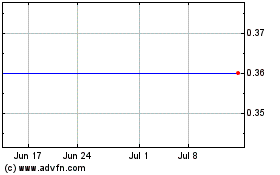

ADDvantage Technologies (NASDAQ:AEY)

Historical Stock Chart

From Apr 2023 to Apr 2024