0000874292false8/14/202300008742922023-08-142023-08-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported) August 14, 2023

ADDVANTAGE TECHNOLOGIES GROUP, INC.

(Exact name of Registrant as specified in its Charter)

Oklahoma

(State or other Jurisdiction of Incorporation)

| | | | | |

| 1-10799 | 73-1351610 |

| (Commission file Number) | (IRS Employer Identification No.) |

| |

1430 Bradley Lane, Carrollton, Texas | 75007 |

| (Address of Principal Executive Offices) | (Zip Code) |

(918) 251-9121

(Registrant's Telephone Number, Including Area Code)

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written Communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Recommencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common stock, par value $0.01 | AEY | NASDAQ |

| | |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 12b-2 of the Exchange Act.

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operation and Financial Condition.

On August 14, 2023, ADDvantage Technologies Group, Inc. (NASDAQ: AEY), reported its financial results for the three month period ended August 14, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report and is incorporated herein by reference.

Item 7.01 Regulation FD Disclosure.

The Company will host a conference call:

Date: Monday, August 14, 2023

Time: 5 p.m. Eastern

Toll-free Dial-in Number: 1-877-407-9039

International Dial-in Number: 1-201-689-8470

Conference ID: 13740347

The conference call will be available via webcast and can be accessed through the Investor Relations section of ADDvantage's website, www.addvantagetechnologies.com. Please allow extra time prior to the call to visit the site and download any necessary software to listen to the Internet broadcast.

A replay of the conference call will be available through August 28, 2023.

Toll-free Replay Number: 1-844-512-2921

International Replay Number: 1-412-317-6671

Replay Passcode: 13740347

An online archive of the webcast will be available on the Company's website for 30 days following the call.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

The following exhibit is furnished herewith:

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| ADDvantage Technologies Group, Inc. | |

| | |

| Date: August 14, 2023 | |

| | |

| /s/ Michael A. Rutledge | |

| Michael A. Rutledge | |

| Chief Financial Officer | |

| | |

ADDvantage Technologies Reports Financial Results for the Quarter Ended June 30, 2023

Carrollton, Texas, August 14, 2023 – ADDvantage Technologies Group, Inc. (NASDAQ: AEY) (“ADDvantage Technologies” or the “Company”) today reported financial results for the three and six months ended June 30, 2023, the second quarter of 2023. Effective September 2022, the Company has changed its fiscal year end from September 30 to December 31, and this report reflects that adjustment.

“Both segments of our business were impacted by macro-headwinds during the quarter," commented Joe Hart, Chief Executive Officer. "Orders for used and refurbished equipment in our Telco segment have been drastically reduced due to the overstocking done in 2022 by our customers and we have been forced to wait for the burn off of that excess inventory by the optical network providers sometime later this year. Our Wireless segment was hit late in the second quarter by a sudden downturn in 5G-related build activity by two major industry customers, and an overall slowdown in the industry by the national wireless carriers. Construction is expected to pick back up later in the year and in 2024 as wireless data consumption and network demand continues to climb at a positive rate.”

“Our efforts to expand our addressable market in the wireless segment are accelerating, and under the leadership of Brian Davidson, our new Chief Revenue Officer, we are optimistic that we can secure additional projects from wireless carriers over the next few quarters," added Mr. Hart. "We are also very encouraged by the Federal Government’s funding of the Rural Broadband Program (BEAD) and the Rural Digital Opportunity Fund (RDOF). Both programs will provide funding of a few hundred billion in fiber and fixed wireless network investment over the next several years. We are aggressively pursuing opportunities to design and build fiber networks across multiple regions. Our recently announced strategic partnership with Walker Technical Solutions (WTS) is also making encouraging progress on a significant multi-year program in the Wireless space. The program will aid in a carrier significantly increasing its diversity spend and create a new source of revenue to Fulton Technologies for many years to come.”

“Simultaneously, we have been methodically reducing our Telco inventory levels in light of lower demand and reducing our overall operating and SG&A expenses to return to profitability in the coming quarters,” continued Mr. Hart.

Financial Results for the Three Months ended June 30, 2023

Second quarter sales were $12.1 million, a decrease of $15.7 million, or 57% compared to $27.8 million last year. The decrease was primarily due to a decrease of $14.8 million, or 72% in Telco revenue, and a decrease of $0.9 million, or 13% in Wireless revenue.

Gross profit was $3.3 million, or 27% gross margin, compared to gross profit of $8.1 million, or 29% gross margin, for the same period last year. Operating expenses decreased $0.5 million, or 23%, to $2.0 million reflecting the previously announced cost-reduction initiatives. Consolidated selling, general and administrative ("SG&A")

expenses include overhead, which consist of personnel, insurance, professional services, communication, and other cost categories, decreased $0.8 million or 21%, to $3.3 million for the three months ended June 30, 2023 from $4.1 million for the same period last year.

Net loss for the quarter was $2.8 million, or $0.20 per basic and diluted share, compared to net income of $0.9 million, or $0.07 per basic and diluted share, for the same quarter last year.

Balance sheet

Cash and cash equivalents were $2.8 million as of June 30, 2023, compared to $2.6 million at December 31, 2022. During the quarter, the Company entered into securities purchase agreements (the “Securities Purchase Agreements”) with Mast Hill Fund, L.P. (the "Purchaser") for the issuance of 13% senior secured promissory notes in the aggregate principal amount of up to $3.0 million (collectively the “Notes”) convertible into shares of common stock of the Company, as well as the issuance of up to 72,000 shares of common stock as a commitment fee and warrants for the purchase of up to 648,000 shares of common stock of the Company, raising net proceeds of $2.8 million. As of June 30, 2023, the Company had net inventories of $8.1 million, down from $8.5 million at March 31, 2023 and $9.6 million at December 31, 2022.

Outstanding debt as of June 30, 2023 was $3.8 million.

As a result of continuing negative operating results, the Company is exploring obtaining other funding arrangements to supplement working capital. Our unaudited financial statements include an explanatory paragraph related to the Company’s ability to continue as a going concern. See further discussion in Note 2 to the Company’s financial statements included in the Company’s Quarterly Report on Form 10-Q for the three and six months ended June 30, 2023. This announcement does not represent any change or amendment to the Company’s financial statements or to its Quarterly Report on Form 10-Q for the three and six months ended June 30, 2023.

Earnings Conference Call

The Company will host a conference call on Monday, August 14, 2023 at 5 p.m. Eastern.

Date: Monday, August 14, 2023

Time: 5 p.m. Eastern

Toll-free Dial-in Number: 1-877-407-9039

International Dial-in Number: 1-201-689-8470

Conference ID: 13740347

Participants can also click this link to have an operator connect interested parties to the call.

The conference call will be available via webcast and can be accessed through the Investor Relations section of ADDvantage's website, www.addvantagetechnologies.com. Please allow extra time prior to the call to visit the site and download any necessary software to listen to the Internet broadcast.

A replay of the conference call will be available through August 28, 2023.

Toll-free Replay Number: 1-844-512-2921

International Replay Number: 1-412-317-6671

Replay Passcode: 13740347

An online archive of the webcast will be available on the Company's website for 30 days following the call.

About ADDvantage Technologies Group, Inc.

ADDvantage Technologies Group, Inc. (Nasdaq: AEY) is a communications infrastructure services and equipment provider operating a diversified group of companies through its Wireless Infrastructure Services and Telecommunications segments. Through its Wireless segment, Fulton Technologies provides turn-key wireless infrastructure services including the installation, modification and upgrading of equipment on communication towers and small cell sites for wireless carriers, national integrators, tower owners and major equipment manufacturers. Through its Telecommunications segment, Nave Communications and Triton Datacom sell equipment and hardware used to acquire, distribute, and protect the communications signals carried on fiber optic, coaxial cable and wireless distribution systems. The Telecommunications segment also offers repair services focused on telecommunication equipment and recycling surplus and related obsolete telecommunications equipment.

ADDvantage operates through its subsidiaries, Fulton Technologies, Nave Communications, and Triton Datacom. For more information, please visit the corporate web site at www.addvantagetechnologies.com.

Cautions Regarding Forward-Looking Statements

The information in this announcement may include forward-looking statements. All statements, other than statements of historical facts, which address activities, events or developments that the Company expects or anticipates will or may occur in the future, are forward-looking statements. These statements are subject to risks and uncertainties, which could cause actual results and developments to differ materially from these statements. A complete discussion of these risks and uncertainties is contained in the Company’s reports and documents filed from time to time with the Securities and Exchange Commission.

-- Tables follow –

ADDvantage Technologies Group, Inc.

Consolidated Balance Sheets

(in thousands, except share amounts)

(Unaudited)

| | | | | | | | | | | |

| June 30,

2023 | | December 31, 2022 |

| Assets | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 2,832 | | | $ | 2,552 | |

| Restricted cash | 739 | | | 1,101 | |

Accounts receivable, net of allowances of $304 and $262, respectively | 1,385 | | | 1,682 | |

| Unbilled revenue | 1,831 | | | 5,005 | |

| | | |

| Income tax receivable | 102 | | | 102 | |

Inventories, net of allowances of $4,097 and $3,871, respectively | 8,076 | | | 9,563 | |

| Prepaid expenses and other current assets | 1,203 | | | 1,399 | |

| Total current assets | 16,168 | | | 21,404 | |

| | | |

| Property and equipment, at cost: | | | |

| Machinery and equipment | 5,565 | | | 5,542 | |

| Leasehold improvements | 899 | | | 899 | |

| Total property and equipment, at cost | 6,464 | | | 6,441 | |

| Less: Accumulated depreciation | (3,533) | | | (3,057) | |

| Net property and equipment | 2,931 | | | 3,384 | |

| Right-of-use lease assets | 1,060 | | | 1,540 | |

| | | |

| Intangibles, net of accumulated amortization | 549 | | | 709 | |

| Goodwill | 58 | | | 58 | |

| | | |

| Other assets | 207 | | | 123 | |

| Total assets | $ | 20,973 | | | $ | 27,218 | |

| | | | | | | | | | | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 6,151 | | | $ | 9,407 | |

| Accrued expenses | 1,428 | | | 1,445 | |

| Deferred revenue | 349 | | | 148 | |

| | | |

| Notes payable | 2,210 | | | — | |

| Right-of-use lease obligations, current | 933 | | | 1,204 | |

| Finance lease obligations, current | 640 | | | 636 | |

| Other current liabilities | 589 | | | 442 | |

| Total current liabilities | 12,300 | | | 13,282 | |

| | | |

| Right-of-use lease obligations, long-term | 288 | | | 635 | |

| Finance lease obligations, long-term | 937 | | | 1,254 | |

| | | |

| Total liabilities | 13,525 | | | 15,171 | |

| Shareholders’ equity: | | | |

Common stock, $0.01 par value; 30,000,000 shares authorized; 14,942,524 and 14,132,033 shares issued and outstanding, respectively | 149 | | | 141 | |

| Paid in capital | 3,559 | | | 2,585 | |

| Retained earnings | 3,740 | | | 9,321 | |

| Total shareholders’ equity | 7,448 | | | 12,047 | |

| Total liabilities and shareholders’ equity | $ | 20,973 | | | $ | 27,218 | |

ADDvantage Technologies Group, Inc.

Consolidated Statements of Operations

(in thousands, except share and per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, | | Six Months Ended June 30, | | |

| 2023 | | 2022 | | 2023 | | 2022 | | | | |

| Sales | $ | 12,088 | | | $ | 27,789 | | | $ | 26,807 | | | $ | 51,548 | | | | | |

| Cost of sales | 8,816 | | | 19,642 | | | 20,118 | | | 37,643 | | | | | |

| Gross profit | 3,272 | | | 8,147 | | | 6,689 | | | 13,905 | | | | | |

| Operating expenses | 1,967 | | | 2,544 | | | 4,014 | | | 5,296 | | | | | |

| Selling, general and administrative expenses | 3,288 | | | 4,145 | | | 6,894 | | | 7,996 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Depreciation and amortization expense | 317 | | | 313 | | | 634 | | | 630 | | | | | |

| Loss on disposal of assets | — | | | — | | | — | | | 2 | | | | | |

| Income (loss) from operations | (2,300) | | | 1,145 | | | (4,853) | | | (19) | | | | | |

| Other income (expense): | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Other income (expense) | (184) | | | (233) | | | (333) | | | (401) | | | | | |

| Interest expense | (334) | | | (37) | | | (379) | | | (99) | | | | | |

| Other income (expense), net | (518) | | | (270) | | | (712) | | | (500) | | | | | |

| | | | | | | | | | | |

| Income (loss) before income taxes | (2,818) | | | 875 | | | (5,565) | | | (519) | | | | | |

| Income tax provision | 16 | | | — | | | 16 | | | — | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net income (loss) | $ | (2,834) | | | $ | 875 | | | $ | (5,581) | | | $ | (519) | | | | | |

| | | | | | | | | | | |

| Income (loss) per share: | | | | | | | | | | | |

| Basic and diluted | $ | (0.20) | | | $ | 0.07 | | | $ | (0.41) | | | $ | (0.04) | | | | | |

| | | | | | | | | | | |

| Shares used in per share calculation: | | | | | | | | | | | |

| Basic and diluted | 13,999,816 | | | 13,191,792 | | | 13,638,538 | | | 13,131,754 | | | | | |

| | | | | | | | | | | |

Non-GAAP Financial Measure

Adjusted EBITDA is a supplemental, non-GAAP financial measure. EBITDA is defined as earnings before interest expense, income taxes, depreciation and amortization. Adjusted EBITDA as presented also excludes impairment charges for operating lease right-of-use assets and intangible assets including goodwill, stock compensation expense, other income, other expense, interest income and income from equity method investment. Adjusted EBITDA is presented below because this metric is used by the financial community as a method of measuring our financial performance and of evaluating the market value of companies considered to be in similar businesses. Since Adjusted EBITDA is not a measure of performance calculated in accordance with GAAP, it should not be considered in isolation of, or as a substitute for, net earnings as an indicator of operating performance. Adjusted EBITDA, as calculated below, may not be comparable to similarly titled measures employed by other companies. In addition, Adjusted EBITDA is not necessarily a measure of our ability to fund our cash needs.

The following table provides a reconciliation by segment of loss from operations to Adjusted EBITDA for the three and six month periods ended June 30, 2023 and 2022, in thousands:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended June 30, 2023 | | Three Months Ended June 30, 2022 |

| Wireless | | Telco | | Total | | Wireless | | Telco | | Total |

| Income (loss) from operations | $ | (1,676) | | | $ | (624) | | | $ | (2,300) | | | $ | (1,461) | | | $ | 2,606 | | | $ | 1,145 | |

| Depreciation and amortization expense | 197 | | | 120 | | | 317 | | | 192 | | | 121 | | | 313 | |

| Stock compensation expense | 108 | | | 91 | | | 199 | | | 44 | | | 59 | | | 103 | |

| Adjusted EBITDA | $ | (1,371) | | | $ | (413) | | | $ | (1,784) | | | $ | (1,225) | | | $ | 2,786 | | | $ | 1,561 | |

| | | | | | | | | | | |

| Six Months Ended June 30, 2023 | | Six Months Ended June 30, 2022 |

| Wireless | | Telco | | Total | | Wireless | | Telco | | Total |

| Income (loss) from operations | $ | (3,780) | | | $ | (1,073) | | | $ | (4,853) | | | $ | (3,659) | | | $ | 3,640 | | | $ | (19) | |

| Depreciation and amortization expense | 394 | | | 240 | | | 634 | | | 388 | | | 242 | | | 630 | |

| Stock compensation expense | 302 | | | 296 | | | 598 | | | 145 | | | 205 | | | 350 | |

| Adjusted EBITDA | $ | (3,084) | | | $ | (537) | | | $ | (3,621) | | | $ | (3,126) | | | $ | 4,087 | | | $ | 961 | |

v3.23.2

Cover

|

Aug. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 14, 2023

|

| Entity Registrant Name |

ADDVANTAGE TECHNOLOGIES GROUP, INC

|

| Entity Incorporation, State or Country Code |

OK

|

| Entity File Number |

1-10799

|

| Entity Tax Identification Number |

73-1351610

|

| Entity Address, Address Line One |

1430 Bradley Lane

|

| Entity Address, City or Town |

Carrollton

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

75007

|

| City Area Code |

(918)

|

| Local Phone Number |

251-9121

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Title of 12(b) Security |

Common stock, par value $0.01

|

| Trading Symbol |

AEY

|

| Security Exchange Name |

NASDAQ

|

| Entity Central Index Key |

0000874292

|

| Amendment Flag |

false

|

| Document Information [Line Items] |

|

| Document Period End Date |

Aug. 14, 2023

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

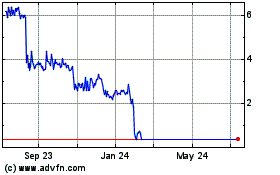

ADDvantage Technologies (NASDAQ:AEY)

Historical Stock Chart

From Mar 2024 to Apr 2024

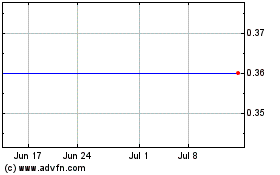

ADDvantage Technologies (NASDAQ:AEY)

Historical Stock Chart

From Apr 2023 to Apr 2024