UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934 (Amendment No. __)

Filed by the Registrant x

Filed by a Party other than the Registrant

Check the appropriate box:

Preliminary Proxy Statement

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

x Definitive Proxy Statement

Definitive Additional Materials

Soliciting Material Pursuant to § 240.14a-12

ADDvantage Technologies Group, Inc.

(Name of Registrant As Specified In Its Charter

____________________________________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

□ Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11.

(1) Title to each class of securities to which transaction applies:

(2) Aggregate number of securities to which transaction applies:

(3) Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0- 11 (set forth the amount on which the filing fee is calculated and state how it was determined):

(4) Proposed maximum aggregate value of transaction:

(5) Total fee paid:

□ Fee paid previously with preliminary materials.

□ Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

(1) Amount Previously Paid:

(2) Form, Schedule or Registration Statement No.:

(3) Filing Party:

(4) Date Filed:

The 2023 Annual Meeting of Stockholders (the "Annual Meeting") of ADDvantage Technologies Group, Inc (the "Company") will be held:

| | | | | | | | |

| When: | Friday, September 22, 2023 |

| | 9:00 a.m. Central |

| Where: | 1430 Bradley Lane, Suite 196 |

| | Carrollton, TX 75007 |

The purpose of the meeting is to consider and vote on the following proposals:

1.Election of six directors to serve until the 2024 Annual Meeting of Stockholders and until their respective successors are duly elected and qualified;

2.Ratification of the appointment of HoganTaylor LLP as our independent registered public accounting firm for the fiscal year ended December 31, 2023.

3.Approve an amendment to our Certificate of Incorporation to increase our authorized shares of common stock from 35,000,000 to 100,000,000, of which 95,000,000 shares shall be Common Stock with a par value of $0.01 per share, and 5,000,000 shares shall be Preferred Stock with a par value of $1.00 per share;

4.Amendment to our Certificate of Incorporation to effect a reverse stock split of our common stock at a reverse stock split ratio ranging from 2:1 to 10:1, inclusive, as determined by the Chief Executive Officer in his sole discretion with our authorized capital remaining unchanged at 100,000,000 shares;

5.Authorization to effectuate the transactions contemplated by the securities purchase agreements entered into between the Company and Mast Hill Fund, L.P. (“Mast Hill”) on April 7 and April 12, 2023 (the “SPAs”), including the issuance of shares of common stock necessary for the conversion of the promissory notes issued by the Company on April 7 and April 12, 2023 (the “Notes”) and exercise of the purchase warrants issued by the Company on April 7 and April 12, 2023 (the “Warrants”), as disclosed in our Form 8-K dated April 12, 2023 (the SPAs, the Notes and the Warrants are collectively referred to as “Mast Hill Agreements”);

6.Adjournment of the Annual Meeting, if necessary or appropriate, to solicit additional proxies; and

7.Transact such other business as may properly come before the meeting.

These items of business are more fully described in the Proxy Statement accompanying this Notice. We are not aware of any other business to come before the Annual Meeting.

Stockholders of record at the close of business on July 24, 2023, are entitled to vote at the meeting or any adjournment. Your vote at the annual meeting is important to us. Please vote your shares of common stock by completing the enclosed proxy card and returning it to us in the enclosed envelope. We hope you are able to attend the Annual Meeting. Whether or not you attend, it is important that your stock be represented and voted at the meeting. I urge you to please complete, date and return the proxy card in the enclosed envelope. You may revoke your written proxy at any time before it is voted at the

Annual Meeting by giving written notice to the Company’s Chief Financial Officer, by submitting a properly executed paper proxy bearing a later date or by attending the Annual Meeting and voting during the meeting. Stockholders may also revoke their proxies by entering a new vote.

This proxy statement has information about the annual meeting and was prepared by our management and our Board of Directors. This proxy statement is being sent to shareholders on or about August 11, 2023. A copy of our 2022 Annual Report, including our Form 10-K, accompanies this Proxy Statement. You may also access our 2022 Annual Report and this Notice and Proxy Statement on our website at www.addvantagetechnologies.com/filings.

By Order of the Board of Directors,

Joseph E. Hart

Chief Executive Officer

July 24, 2023

| | | | | |

| TABLE OF CONTENTS |

| |

| General Information About The Meeting And Voting | |

| Identification of Officers | |

Security Ownership of Certain Beneficial Owners and Management | |

| Securities Authorized for Issuance Under Equity Compensation Plans | |

| |

| Proposal No. 1: Election of Directors | |

| Board of Directors | |

| Audit Committee | |

| Compensation Committee | |

| Corporate Governance and Nominating Committee | |

| Strategy and Corporate Planning Committee | |

| Board Meetings | |

| Code of Ethics | |

| Hedging Transactions by Insiders | |

| Certain Relationships and Related Transactions | |

| Delinquent Section 16(a) Reports | |

| Involvement in Certain Legal Proceedings | |

| Compensation of Directors and Executive Officers | |

| Summary Compensation Table | |

| Pay Versus Performance | |

| |

Proposal No. 2: Ratification of Appointment of Independent Registered Public Accounting Firm | |

| Principal Accounting Fees and Services | |

| |

| Proposal No. 3: Approve an Amendment to our Certificate of Incorporation to Increase Our Authorized Shares of Common Stock from 35,000,000 to 100,000,000, of which 95,000,000 shares shall be Common Stock with a par value of $0.01 per share, and 5,000,000 shares shall be Preferred Stock with a par value of $1.00 per share | |

| |

Proposal No. 4: Approve an Amendment to Our Certificate of Incorporation to Effect a Reverse Stock Split of Our Common Stock at a Reverse Stock Split Ratio Ranging from 2:1 to 10:1, Inclusive, as Determined by the Chief Executive Officer in His Sole Discretion with our authorized capital remaining unchanged at 100,000,000 shares | |

| |

| Proposal No. 5: Authorization to Effectuate the Transactions Contemplated by the SPAs, Including the Issuance of Shares of Common Stock Necessary for the Conversion of the Notes and Exercise of the Warrants | |

| |

| Proposal No. 6: Adjournment of the Special Meeting, If Necessary or Appropriate, to Solicit Additional Proxies | |

| |

| Shareholder Proposals for 2024 Annual Meeting | |

| Other Matters | |

| Annex A - Certificate of Amendment to the Certificate of Incorporation | |

| Annex B - Certificate of Amendment to the Certificate of Incorporation | |

| | |

| PROXY STATEMENT FOR 2023 ANNUAL MEETING |

GENERAL INFORMATION ABOUT THE MEETING AND VOTING

Who can attend the annual meeting?

All shareholders as of the record date, Monday, July 24, 2023.

Who can vote?

You can vote your shares of common stock if our records show that you owned the shares on Monday, July 24, 2023. A total of 14,982,524 shares of common stock can vote at the annual meeting. You get one vote for each share of common stock. We do not recognize cumulative voting for the election of our directors. The enclosed proxy card shows the number of shares you can vote.

How do I vote by proxy?

Follow the instructions on the enclosed proxy card to vote on each proposal to be considered at the annual meeting. Sign and date the proxy card and mail it back to us in the enclosed envelope. The proxyholders named on the proxy card will vote your shares as you instruct. If you sign and return the proxy card but do not vote on a proposal, the proxyholders will vote for you on that proposal. Unless you instruct otherwise, the proxyholders will vote for each of the six directors, for the ratification of the appointment of HoganTaylor LLP as our independent registered public accounting firm, for the amendment of our certificate of incorporation to effectuate the reverse stock split of our common stock, for the transactions contemplated by the Mast Hill Agreements and issuance of shares thereunder and for the adjournment of the Annual Meeting, if necessary or appropriate, to solicit additional proxies.

What if other matters come up at the annual meeting?

The matters described in this proxy statement are the only matters we know will be voted on at the annual meeting. If other matters are properly presented at the meeting, any proxies returned to us will be voted as the proxyholders see fit.

Can I change my vote after I return my proxy card?

Yes. At any time before the vote on a proposal, you can change your vote either by giving our Secretary

a written notice revoking your proxy card or by signing, dating and returning to us a new proxy card. We will honor the proxy card with the latest date. Attendance at the annual meeting will not, by itself, revoke your proxy card.

Can I vote in person at the annual meeting rather than by completing the proxy card?

Although we encourage you to complete and return the proxy card to ensure that your vote is counted, you can attend the annual meeting and vote your shares in person. If your shares are held in the name of your broker, a bank, or other nominee, that party should give you instructions for voting your shares.

How are votes counted?

We will hold the annual meeting if holders of a majority of the shares of common stock entitled to vote either sign and return their proxy cards or attend the meeting. If you sign and return your proxy card, your shares will be counted to determine whether we have a quorum even if you abstain or fail to vote on any of the proposals listed on the proxy card. Votes will be tabulated by an inspector of election appointed by our Board of Directors. Abstentions from voting, which you may specify on all of the proposals other than the election of directors, and the frequency proposal, will have the effect of a negative vote.

If your shares are held in the name of a nominee, and you do not tell the nominee how to vote your shares (so-called “broker nonvotes”), the nominee may vote them on the proposal to ratify the appointment of HoganTaylor LLP as our independent registered public accounting firm. Uninstructed nominees are not permitted to vote for directors. Broker nonvotes will be counted as present to determine if a quorum exists.

What percentage of stock are the directors and executive officers entitled to vote at the annual meeting?

Together, they have the right to vote approximately 28.2% of our outstanding common stock.

Who are the largest principal shareholders? David E. Chymiak beneficially owns 2,724,252 shares (18.2%) of our common stock. His brother, Kenneth A. Chymiak, beneficially owns 1,085,738 shares (7.2%) of our common stock.

When will the Company announce the voting results?

The Company may announce preliminary voting results after the adjournment of the Annual Meeting and will announce the final voting results of the Annual Meeting on a Current Report on Form 8-K filed with the Securities and Exchange Commission (the "SEC") within four business days after the Annual Meeting.

Who will determine the effectiveness of the amendment to the Company's Certificate of Incorporation?

There are two Proposals seeking stockholder approval of our Certificate of Incorporation with respect to the increase in authorized shares of our common stock and the reverse stock split. The effectiveness of this amendment or the abandonment thereof, notwithstanding stockholder approval, will be determined by the Chief Executive Officer, at his sole option, following the Annual Meeting any time prior to the three-year anniversary of the meeting. The text of the proposed forms of Certificate of Amendment to our Certificate of Incorporation (the "Certificate of Amendment") are attached hereto as Annex A (increase in authorized capital) and Annex B (reverse stock split). If approved by stockholders and if implemented by the Chief Executive Officer, increase in our authorized common stock and the reverse stock split will become effective upon the filing of the Certificates of Amendment with the Secretary of State of the State of Oklahoma, or such later date as is chosen by the Chief Executive Officer and set forth in the Certificates of Amendment. We will publicly announce the reverse stock split ratio chosen by the Chief Executive Officer prior to the effective date of

the reverse stock split.

Do stockholders have dissenter's or appraisal rights with respect to the proposals to amend our Certificate of Incorporation?

Stockholders are not entitled to dissenter's or appraisal rights with respect to the Proposal to amend our Certificate of Incorporation.

Do any directors or officers of the Company have a personal interest in the matter to be acted upon at the Annual Meeting?

Except for those directors who are nominated for election at the Annual Meeting, no officer or director has any substantial interest, direct or indirect, by security holdings or otherwise, in the Proposals that is not shared by all other stockholders.

Who pays for this proxy solicitation?

The accompanying proxy is solicited by and on behalf of our Board of Directors, and the entire cost will be paid by us. In addition to sending you this proxy solicitation, some of our employees may contact you by telephone, by mail or in person. None of these employees will receive any extra compensation for doing this, but they may be reimbursed for their out-of-pocket expenses incurred while assisting us in soliciting your proxy.

Who can help answer my other questions?

If you have more questions or require assistance in submitting your proxy or voting your shares or need additional copies of the proxy statement or the enclosed proxy card, please contact Saratoga Proxy Consulting LLC, our proxy solicitor, at (888) 368-0379 (toll free) or (212) 257-1311 (collect) by email at info@saratogaproxy.com. If your broker, bank or other nominee holds your shares, you should also call your broker, bank or other nominee for additional information.

| | |

| IDENTIFICATION OF OFFICERS |

We have four executive officers. Our officers are elected by our Board of Directors and serve at the pleasure of the Board of Directors.

Identification of Executive Officers

Joseph E. Hart

Mr. Hart, 72, has served as our President and Chief Executive Officer since October 2018. Prior to joining the Company, Mr. Hart was the CEO of Aero Communications, Inc., a company specializing in installation, maintenance, and network design and construction for the telecommunications industry (2015 to 2018). From 2006 to 2014, Mr. Hart served as the Executive Vice President of Network Infrastructure Services and Operations for Goodman Networks, Inc., a provider of end-to-end network infrastructure, professional services and field deployment to the wireless telecommunications and satellite television industry. For the previous 20 years, Mr. Hart served in various executive leadership positions for AT&T and other various telecommunication and wireless companies. Mr. Hart holds a Master of Science degree in systems management from the University of Southern California and Bachelor of Business Administration degree from Baldwin-Wallace College. Mr. Hart’s extensive management experience in operations and corporate strategy in the telecommunications industry allows him to provide significant input to our Board of Directors.

Michael A. Rutledge

Mr. Rutledge, 53, Chief Financial Officer, began his career with ADDVantage Technologies in September 2021. Mr. Rutledge served as Vice President, Finance at SomnoMed Group for the past five years. Previously, he spent two years as the Chief Financial Officer at BG Staffing, where he played a key role in taking the company public and raising $16 million. Prior to that, he spent three years as Vice President of Finance with Cantel Medical Corporation, a publicly owned manufacturer of medical products, which acquired Byrne Medical, Inc., where he was the Chief Financial Officer. He joined Byrne Medical from N.F. Smith & Associates, a privately owned distributor of electronic components, where he spent four years as the Chief Financial Officer. He began his career at Ernst & Young, where he spent 12 years ultimately as Senior Audit Manager and was involved in several IPOs. He is a CPA in the State of Texas and holds a Bachelor of Business Administration in Accounting from Texas A&M University.

Jerry D. (JD) Jones

Mr. Jones, 47, President of Wireless Services, began his career with ADDVantage Technologies in February, 2023. Mr. Jones served as Executive Vice President, Customer Unit at Nexius Solutions, where he was responsible for all customer management, business development, deployment and profit and loss nationwide for all customers. From 2000-2012, he served in various leadership roles for AT&T Mobility, managing site acquisition, real estate, zoning, architectural and engineering requirements for all new build and site acquisition-only sites. JD also served in leadership roles with Goodman Networks, CrossLayer, Ericsson, Downey Telecom Services, 5G LLC, and Trilogy 5G Inc., primarily focused on wireless construction projects and management.

Brian N. Davidson

Mr. Davidson, 49, Chief Revenue Officer (CRO), began his career with ADDVantage Technologies in May, 2023. Mr. Davidson served as CRO at OneVizion, where he spearheaded strategy, marketing, and new account acquisition, including playing a significant role in securing numerous tier-one national accounts. Previously, he co-founded and served as principal of ABIS Solutions, a developer of unique and value-driven software-as-a-service solutions to the telecommunications and utility verticals. From 2014 to 2016, Mr. Davidson was Chief Marketing Officer of QualTek, a national provider of true 'end to end' network solutions to the telecom and utility industry. Before that, he served as Vice President of MasTec / DYNIS,

a large, publicly traded ‘critical infrastructure’ services provider across multiple regions and countries. He holds a Bachelor of Science degree in Accounting and Finance from the University of Baltimore.

We currently do not comply with Nasdaq Rule 5605 requiring at least two (2) members of our Board of Directors who are defined by the Rule as being “Diverse.” We do not have one director who self-identifies as an Underrepresented Minority. As required by Nasdaq Rule 5606 as approved by the SEC in August 2021, we are providing additional information about the gender and demographic diversity of our directors in the format required by such rule. The information in the matrix below is based solely on information provided by our directors about their gender and demographic self-identification.

| | | | | | | | | | | | | | | | | | | | | | | |

Board Diversity Matrix (as of July 24, 2023) |

| Total Number of Directors: 6 | | | | | | | |

| Female | | Male | | Non-Binary | | Did Not Disclose Gender |

| Part I: Gender Identity | | | | | | | |

| Directors | — | | | 6 | | | — | | | — | |

| Part II: Demographic Background | | | | | | | |

| African American or Black | — | | | — | | | — | | | — | |

| Asian | — | | | — | | | — | | | — | |

| Hispanic or Latinx | — | | | — | | | — | | | — | |

| Native Hawaiian or Pacific Islander | — | | | — | | | — | | | — | |

| White | — | | | 6 | | | — | | | — | |

| Two or More Races or Ethnicities | — | | | — | | | — | | | — | |

| LGBTQ+ | — | | | — | | | — | | | — | |

| Did Not Disclose Demographic Background | — | | | — | | | — | | | — | |

| | |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT |

The following table shows the number of shares of common stock beneficially owned as of July 24, 2023 by:

•each person known by us who beneficially owns more than 5% of any class of our voting stock;

•each director and nominee for director;

•each executive officer named in the Summary Compensation Table; and

•our directors and executive officers as a group.

Except as otherwise indicated, the beneficial owners listed in the table have sole voting and investment powers of their shares.

| | | | | | | | | | | | | | |

| Name of Beneficial Owner | | Number of Shares of Common Stock Beneficially Owned (1) | | Percent of Class (1) |

| Directors and Officers: | | | | |

| David Chymiak | | 2,724,252 | | | 18.2% |

| Joseph Hart | | 610,922 | | | 4.1% |

| James McGill | | 203,774 | | | 1.4% |

| Michael Rutledge | | 179,057 | | | 1.2% |

| John Shelnutt | | 132,515 | | | * |

| Timothy Harden | | 124,228 | | | * |

| David Sparkman | | 114,567 | | | * |

| Jerry Jones | | 65,000 | | | * |

| Brian Davidson | | 65,000 | | | * |

| | | | |

| All Executive Officers and Directors as a group (9 persons) | | 4,089,315 | | | 28.2% |

| | | | |

| Others > 5% ownership: | | | | |

| Ken Chymiak | | 1,085,738 | | (2) | 7.2% |

| | | | |

* Less than one percent | | |

(1) Shares which an individual has the right to acquire within 60 days pursuant to the exercise of options are deemed to be outstanding for the purpose of computing the percentage ownership of such individual, but are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. Includes shares for which the person has sole voting and investment power, or has shared voting and investment power with his/her spouse.

(2) Based on a Form 4, filed on January 26, 2021, of the shares beneficially owned by Mr. Chymiak, 1,085,738 are held of record by his spouse, Susan C. Chymiak as trustee of the Susan Chymiak Revocable Trust. Mr. Chymiak has sole voting and investment power over those shares held of record by him. Mr. Chymiak disclaims beneficial ownership of the shares held by his wife

| | |

SECURITIES AUTHORIZED FOR ISSUANCE UNDER EQUITY COMPENSATION PLANS |

The information in the following table is as of July 24, 2023: | | | | | | | | | | | |

| Plan Category | Number of securities to be issued upon exercise of outstanding options, warrants and rights

(a) | Weighted-average exercise price of outstanding options, warrants and rights

(b) | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a))

(c) |

| Equity compensation plans approved by security holders | — | — | 293,813 |

| Equity compensation plans not approved by security holders | — | — | — |

| Total | — | — | 293,813 |

| | | |

| | | |

| | |

PROPOSAL NO. 1 ELECTION OF DIRECTORS |

All of the members of our current Board of Directors are included as Nominees to be elected at the annual meeting. The directors will be elected for one-year terms expiring at the next annual meeting. Our bylaws provide that our Board shall consist of not less than one nor more than nine directors, as determined from time to time by board resolution. Our Board has established the number of directors for the 2023 fiscal year to be six.

Vote Required. The six nominees receiving the highest number of votes will be elected. Votes withheld for a nominee will not be counted. You get one vote for each of your shares of common stock for each of the directorships.

Nominations. At the annual meeting, we will nominate as directors the persons named in this proxy statement. Although we do not know of any reason why one of these nominees might not be able to serve, our Board of Directors will propose a substitute nominee if any nominee is unavailable for election.

General Information About the Nominees. All of the nominees are currently directors of ADDvantage. Each has agreed to be named in this proxy statement and to serve as director if elected. The ages listed for the nominees are as of July 24, 2023.

The following information, including principal occupation or employment for the past five or more years and a summary of each individual’s experience, qualifications, attributes or skills that have led to the conclusion that each individual should serve as a director in light of our current business and structure, is furnished with respect to each nominee.

David E. Chymiak Director since 1999

Mr. Chymiak, 78, served as ADDvantage's Chief Technology Officer from April 2, 2012 through June 30, 2019, which was the effective date of the sale of the Cable Television segment to Mr. Chymiak’s affiliated company, Leveling 8 Inc. (see Certain Relationships and Related Transactions section). Mr. Chymiak

oversaw the operations of the Cable Television segment which he co-founded as Tulsat in 1985. Upon the sale of the Cable Television segment to Leveling 8 on June 30, 2019, Mr. Chymiak is no longer an employee of the Company, but remains on the Company’s Board of Directors. Mr. Chymiak served as our Company’s Chairman of the Board from during the years 1999 to 2012 and 2014 to 2018. Beginning in July 2022, Mr. Chymiak became an independent Director under the rules and listing standards of The NASDAQ Stock Market ("NASDAQ"). Mr. Chymiak brings extensive experience with the various technologies and products within the cable television industry to our Board of Directors with respect to industry matters. Mr. Chymiak also brings to the Board of Directors business leadership and corporate strategy.

Timothy S. Harden Independent Director since 2019

Mr. Harden, 70, has broad Communication Industry experience in various positions of leadership. He currently sits on a number of advisory boards focused on providing products and services in the Communication space. Mr. Harden spent 33 years with AT&T in various operating executive positions, the last of which was President of AT&T’s Worldwide Supply Chain. A few of his previous areas of responsibility included President and CEO of AT&T West, President of network services for AT&T Southwest, and President of Data and Network Services for SBC Operations. Mr. Harden also gained broad telecommunications experience from a series of executive assignments within AT&T’s predecessor companies SBC and Pacific Telesis, including President of SBC Telecom, Inc., President and Chief Executive Officer of Pacific Telesis Business Systems, Chief Operating Officer of Pacific Bell’s Advanced Communications Network, and Senior VP – Network Engineering and Planning of SBC Data Services. Mr. Harden has served as Chairman of the QuEST/TIA Forum Executive Board, managing the quality standard TL 9000 through 200+ companies worldwide. He is a former member of Supply Chain 50 representing the top Supply Chains in the U.S., and a member of Supply Chain World representing the top 200 Supply Chains worldwide.

Mr. Harden is an inductee in the National Football Foundation and College Hall of Fame as a scholar athlete. He currently serves on the board of directors for the San Francisco Chapter of this national organization. In 2007 he was named as a Distinguished American by this group for his efforts in support of their mission to promote and develop the qualities of leadership, sportsmanship, competitive zeal and the drive for academic excellence in America’s young people. This was only the 9th time this honor has been awarded in the 70 year history of the organization. Mr. Harden is a retired Captain in the USN Reserve and a past Associate Professor at the University of Utah. Mr. Harden started his career as an officer in the US Navy after his graduation from the US Naval Academy. Mr. Harden’s extensive experience in the telecommunications industry and background in business leadership and corporate strategy will allow him to provide significant input to our Board of Directors.

Joseph E. Hart Director since 2015

Mr. Hart's biographical information is provided above in the Identification of Officers section.

James C. McGill Independent Director since 2007

Mr. McGill, 79, has served as our Company’s Chairman of the Board since October 2018. Mr. McGill is currently the President of McGill Resources, a venture capital investment company, a position he has held since 1987. In 2015, Mr. McGill formed and owns Ediche, LLC, a clothing importer. He also served in various executive leadership roles and as Chairman of the Board of Directors of MacroSolve, Inc., a technology company focused on wireless data collection, from 2002 to 2013. Mr. McGill serves on boards of organizations in the Tulsa, Oklahoma area, and has served on public company boards with many years serving as audit committee or board chair.

During his career, Mr. McGill has received 25 U.S. and foreign patents in the field of pollution control and has extensive experience in helping to develop early-stage and emerging companies. Mr. McGill is a registered professional engineer with a Bachelor of Science degree in chemical engineering from The University of Tulsa where he graduated cum laude. He is a member of the University’s College of

Engineering and Applied Sciences Hall of Fame and was named a Distinguished Alumni in 2005. In 2013, he was named to the Collins College Business Hall of Fame. Mr. McGill has extensive experience in managing companies in a variety of industries, and his business leadership, corporate strategy background and operating expertise strengthen the Board of Directors.

John M. Shelnutt Independent Director since 2019

Mr. Shelnutt, 61, is the Chief Executive Officer of Fortress Solutions, a global provider of critical infrastructure management and support services for telecommunications carriers, wireless networks, electronic vehicle charging stations, and IoT devices. Previously he served as Vice President of Blue Danube Systems, a company that designs intelligent wireless access solutions using cloud-based analytics and machine learning to deliver high-definition active antenna systems technology to the wireless industry. Prior to 2017 when he joined Blue Danube Systems, Mr. Shelnutt served in executive capacities at Cisco from 2011 to 2016, leading their mobility division with global responsibility for all of the mobile product offerings of the company and managing one of their largest global customers. Prior to that, Mr. Shelnutt spent 12 years in executive leadership roles at Alcatel including the startup of their global DSL division and managing their United States mobility division. Mr. Shelnutt is also currently a partner since March 2021 in NASH21, a company that invests in real estate and rental properties primarily in Florida. Mr. Shelnutt has also served on various boards within the telecommunications industry including the QuEST Forum, ATIS, Broadband Forum and was an advisor to Tech Titans of Dallas, Texas and the City of New York Public Schools Technology group. Mr. Shelnutt’s extensive experience in the telecommunications industry and background in business leadership and corporate strategy will allow him to provide significant input to our Board of Directors.

David W. Sparkman Independent Director since 2015

Mr. Sparkman, 66, recently retired as the Chief Financial Officer of Oklahoma Capital Bank. Prior to that, he was the President of the financial consulting firm, Ulysses Enterprises, in which he also served in 2009-2010. Until the sale of the companies in October 2016, he was the Chief Financial Officer for a group of oil field service companies: Acid Specialists, LLC; Frac Specialists, LLC; and Cement Specialists, LLC. Mr. Sparkman served in that capacity beginning in September 2014, and prior to joining this group full-time in this capacity, he provided accounting and financial consulting services to these companies starting in April 2014. From 2010 to 2011, Mr. Sparkman was the CFO for Great White Energy Services until this company was acquired by Archer Well Company in 2011, and then served as the North America Director of Finance for Archer Well Company until 2013. Mr. Sparkman also spent 12 years with Dollar Thrifty Automotive Group serving in various accounting and finance-related senior management positions. Mr. Sparkman is a certified public accountant (inactive) and holds a bachelor of business administration degree in accounting from the University of Arkansas where he graduated cum laude. Mr. Sparkman’s background in business leadership, corporate strategy and financial and operating expertise allows him to provide significant input to our Board of Directors.

Recommendation of the Board of Directors:

The Board of Directors recommends a vote FOR the election of each nominee.

Board Independence. The Board of Directors has determined that Messrs. Harden, McGill, Shelnutt and Sparkman have no relationship with us that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that such individuals are independent under the rules and listing standards of The NASDAQ and the rules of the SEC implemented pursuant to the Sarbanes-Oxley Act of 2002.

Board Leadership Structure. The Board of Directors does not have a current requirement that the roles of Chief Executive Officer and Chairman of the Board be either combined or separated, because the

Board of Directors believes it is in our best interest to make this determination based on our current position and direction and the constitution of the Board of Directors and management team. The Board of Directors evaluates whether the roles of Chief Executive Officer and Chairman of the Board should be combined or separated. The Board of Directors has determined that having the positions of Chairman and Chief Executive Officer separated is in the best interest of our shareholders at this time. The Chief Executive Officer is primarily responsible for our overall management and the development and implementation of our strategy, and he has access to the people, information and resources necessary to facilitate that function. The Chairman of the Board has extensive experience in managing companies in a variety of industries, and his business leadership, corporate strategy background and operating expertise strengthen the Board of Directors. The Board of Directors believes that separating the roles of Chief Executive Officer and Chairman is an appropriate leadership structure as it promotes the strengths and expertise of these two individuals currently serving on the Board of Directors.

Oversight of Risk Management. It is management’s responsibility to manage our enterprise risks on a day-to-day basis. The Board of Directors is responsible for risk oversight by focusing on our overall risk management strategy and the steps management is taking to manage our risk.

While the Board of Directors as a whole maintains the ultimate oversight responsibility, the Board of Directors has delegated certain risk management oversight responsibilities to its various committees. The Audit Committee reviews and discusses our major financial risk exposures and the steps management has taken to identify, monitor, and control such risks. The Compensation Committee is responsible for overseeing risks related to our compensation programs, including structuring and reviewing our executive compensation programs, considering whether such programs are in line with our strategic objectives and incentivizing appropriate risk-taking. The Corporate Governance and Nominating Committee is tasked with risks associated with corporate governance and compliance.

Committees of the Board. The Board of Directors has four standing committees: the Audit Committee, the Compensation Committee, the Corporate Governance and Nominating Committee, and the Strategy and Corporate Planning Committee. The following section describes the functions and membership of each committee and the number of times it met during our fiscal year ended December 31, 2022.

| | | | | | | | | | | | | | |

Board of Directors

Fiscal Year 2022 | Audit Committee | Corporate Governance and Nominating Committee | Strategy and Corporate Planning Committee | Compensation Committee |

| | | | |

James C. McGill

Chairman of the Board | X | X | X | X |

| David E. Chymiak | | | X | |

| Timothy S. Harden | | X | Chairman | Chairman |

| Joseph E. Hart | | | X | |

| John M. Shelnutt | X | Chairman | X | X |

| David W. Sparkman | Chairman | | X | |

AUDIT COMMITTEE

The functions and members of our Audit Committee are set forth below. The members of the Audit Committee are David W. Sparkman (Chairman), John M. Shelnutt, and James C. McGill. Each of the committee members is independent as defined under the rules and listing standards of the NASDAQ and the rules of the SEC implemented pursuant to the Sarbanes-Oxley Act of 2002. The Audit Committee met

four times during fiscal year 2022. All of the meetings were held prior to the reporting of our quarterly financial results.

Functions

•Selects the firm that will serve as our independent registered public accounting firm;

•Reviews scope and results of audits with our independent registered public accounting firm, compliance with any of our accounting policies and procedures and the adequacy of our system of internal controls;

•Oversees quarterly reporting; and

•Performs the other functions listed in the Charter of the Audit Committee, a current copy of which may be found on our website at www.addvantagetechnologies.com.

Report of the Audit Committee

The Audit Committee of our Board of Directors is comprised of three directors who are not officers. Under currently applicable rules, each member is an independent director of the Company and meets the independence standards applicable for audit committee members under the rules of NASDAQ as well as under rules adopted by the Securities and Exchange Commission pursuant to the Sarbanes-Oxley Act of 2002.

The Audit Committee reviews our financial reporting process on behalf of the Board of Directors. The Audit Committee’s policy is to review and pre-approve all proposed engagements for audit or non-audit services rendered by our independent registered public accounting firm. Under its pre-approval policy, the Audit Committee approved 100% of the services provided by HoganTaylor LLP (“HoganTaylor”) in 2022 as those services are described in the section entitled “Principal Accounting Fees and Services.” Management has the primary responsibility for the financial statements and the reporting process, including the system of internal controls.

In connection with its function to oversee and monitor our financial reporting process, the Audit Committee has done the following:

•selected HoganTaylor as our independent registered public accounting firm for the audit of the fiscal 2022 financial statements and the review of the interim quarterly financial statements;

•reviewed and discussed the audited financial statements for the fiscal year ended December 31, 2022 with management;

•discussed with the independent registered public accounting firm the matters required to be discussed by Statement on Auditing Standards No. 61, as amended (AICPA, Professional Standards, Vol. 1. AU Section 380), adopted by the Public Company Accounting Oversight Board in Rule 3200T;

•received the written disclosures and the letter from the independent registered public accounting firm required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent registered public accounting firm’s communications with the Audit Committee concerning independence, and has discussed with the independent registered public accounting firm the independent registered public accounting firm’s independence; and

•based on the reviews and discussions referred to above, recommended to the Board that the audited financial statements be included in our Annual Report on Form 10-K for fiscal year 2022 for filing with the SEC.

| | | | | | | | |

| David W. Sparkman | John M. Shelnutt | James C. McGill |

Audit Committee Financial Expert

The SEC has adopted rules pursuant to the provisions of the Sarbanes-Oxley Act requiring audit committees to include an “audit committee financial expert,” defined as a person who has the following attributes:

•an understanding of generally accepted accounting principles and financial statements;

•the ability to assess the general application of such principles in connection with the accounting for estimates, accruals and reserves;

•experience preparing, auditing, analyzing or evaluating financial statements that present a breadth and level of complexity of accounting issues that are generally comparable to the breadth and complexity of issues that can reasonably be expected to be raised by the registrant’s financial statements, or experience actively supervising one or more persons engaged in such activities;

•an understanding of internal control over financial reporting; and

•an understanding of audit committee functions.

The financial expert will have to possess all of the attributes listed above to qualify as an audit committee financial expert.

Our Board of Directors has determined that each of David W. Sparkman, John M. Shelnutt, and James C. McGill meets the definitions of an audit committee financial expert.

COMPENSATION COMMITTEE

The current members of the Compensation Committee are Timothy S. Harden (Chairman), James C. McGill, and John M. Shelnutt. The Compensation Committee met two times during fiscal 2022. The functions of the Compensation Committee are set forth below.

Functions

•Evaluates performance and sets compensation and benefits of Chief Executive Officer;

•Approves compensation and benefits programs of our other named executive officer(s);

•Approves compensation and benefits of our non-employee Board of Directors; and

•Performs the other functions listed in the Charter of the Compensation Committee, a current copy of which may be found on our website at www.addvantagetechnologies.com.

Composition and Delegation

The Compensation Committee of our Board of Directors is currently comprised of four directors who are not officers. All functions of the Compensation Committee are to be performed by the Committee members and are not authorized to be delegated outside of the Committee. Under currently applicable rules, three members qualify as “independent directors” as defined under Rule 5605(a)(2) of NASDAQ and each member is a “non-employee director” (within the meaning of Rule 16b-3(b)(3) of the Securities Exchange Act of 1934).

CORPORATE GOVERNANCE AND NOMINATING COMMITTEE

The current members of the Corporate Governance and Nominating Committee are John Shelnutt (Chairman), Timothy S. Harden, and James C. McGill. The Committee met two times during fiscal year 2022. The functions and members of the Corporate Governance and Nominating Committee are set forth below.

•Provides oversight of the governance of the Board of Directors;

•Makes recommendations to the Board as a whole concerning board size and composition;

•Identifies individuals qualified to become Board members;

•Selects or recommends that the Board select the director nominees to stand for election at the annual meeting of shareholders;

•Recommends to the Board nominees for the positions of Chairman of the Board, chairmen of the various committees of the Board, and members of the various committees of the Board; and

•Performs other functions listed in the Charter of the Corporate Governance and Nominating Committee, a current copy of which may be found on our website at www.addvantagetechnologies.com.

The Corporate Governance and Nominating Committee is comprised of directors who are not officers. Under currently applicable rules, each member is an “independent director” as defined under the NASDAQ rules as well as under rules adopted by the SEC pursuant to the Sarbanes-Oxley Act of 2002.

The Corporate Governance and Nominating Committee’s criteria and process for identifying and evaluating the candidates that it selects, or recommends to the full Board for selection, as director nominees, are: (i) regular review of composition and size of the Board; (ii) review of qualifications of candidates properly recommended or nominated by any qualifying shareholder; (iii) evaluation of the performance of the Board and qualification of members of the Board eligible for re-election: and (iv) consideration of the suitability of each candidate, including current members of the Board, in light of the size and composition of the Board. After such review and consideration, the Corporate Governance and Nominating Committee will recommend a slate of director nominees.

While the Corporate Governance and Nominating Committee has not established specific minimum requirements for director candidates, other than they be at least 21 years of age, the Committee believes that candidates and nominees must reflect a board that is comprised of directors who: (i) are predominantly independent; (ii) are of high integrity; (iii) have qualifications that will increase overall board effectiveness; and (iv) meet other requirements as may be required by applicable rules, such as financial literacy or financial expertise with respect to Audit Committee members. The Committee does not have a formal policy regarding the consideration of diversity in identifying director nominees, but the Committee does consider, among other things, a director nominee’s potential contribution to the diversity of background and experience of our Board of Directors, including with respect to age, gender, international background, race and specialized experience.

The Corporate Governance and Nominating Committee has adopted a policy with regard to the consideration of director candidates recommended by shareholders. The Corporate Governance and Nominating Committee will consider director candidates recommended by any shareholder holding 10,000 shares of our common stock for at least 12 months prior to the date of submission of the recommendation or nomination. Additionally, a recommending shareholder shall submit a written statement in support of the candidate, particularly within the context of the criteria for board membership,

including issues of character, judgment, age, independence, expertise, corporate experience, other commitments and the like, personal references, and a written indication by the candidate of his or her willingness to serve, if elected, and evidence of the recommending person’s ownership of our stock sufficient to meet the stock ownership requirements described above.

STRATEGY AND CORPORATE PLANNING COMMITTEE

The current members of the Strategy and Corporate Planning Committee are Timothy S. Harden (Chairman), Joseph E. Hart, James C. McGill, John M. Shelnutt, David W. Sparkman and David E. Chymiak. The Committee met one time during fiscal year 2022. The functions and members of the Strategy and Corporate Planning Committee are set forth below.

•the development of the Company’s short-term and long-term strategic plan;

•oversees the execution of the Company’s strategic plan;

•help develop new and enhance existing relationships with customers;

•assists with business development and internal expansion efforts;

•pursuing merger and acquisition opportunities; and

•the development of a working capital strategy and capital-raise plan to achieve the above.

BOARD MEETINGS

Our Board held seven meetings during fiscal year 2022. Each director attended all of the meetings of the Board and the committees on which he served.

Shareholder Communication with the Board of Directors and Committees

Communication with the Board of Directors or any of the Committees should be directed to the attention of Mr. Sparkman. Written correspondence to Mr. Sparkman may be delivered to our executive offices, 1430 Bradley Lane, Carrollton, Texas, 75007. All shareholder communications directed to Mr. Sparkman will be promptly forwarded to him. All Board members are encouraged, but not required, to attend our annual meeting. Last year, all of our Board members (board members at the date of the meeting) attended our annual meeting.

CODE OF ETHICS

We have adopted a Code of Business Conduct and Ethics which is applicable to all of our directors, officers and employees. A copy of our Code of Business Conduct and Ethics is posted on our website at www.addvantagetechnologies.com. We intend to satisfy the disclosure requirements, including those of Item 406 of Regulation S-K, regarding certain amendments to, or waivers from, provisions of our Code of Business Conduct and Ethics by posting such information on our website.

HEDGING TRANSACTIONS BY INSIDERS

The Company has an Insider Trading Policy, which may be found on our Company’s website at www.addvantagetechnologies.com. Among other transactions, this policy prohibits corporate insiders

(e.g. directors, officers, employees) from engaging in hedging transactions with respect to Company stock. “Hedging transactions” may be understood generally as transactions which lock in the value of stock in exchange for giving up rights to future stock appreciation.

CERTAIN RELATIONSHIPS AND RELATED TRANSACTIONS

Review, Approval or Ratification of Transactions with Related Persons. The Company is not aware of any transaction that was required to be reported in its filings with the SEC where such policies and procedures either did not require review or were not followed. The Company's Audit Committee Charter, which is available on the Corporate Governance page of our website, www.addvantagetechnologies.com, provide that the Company shall conduct an appropriate review of all transactions with related persons for potential conflict of interest situations on an ongoing basis, and all such transactions shall be approved by the Audit Committee or another independent body of the Board.

In addition, the Company also requires each of its directors and executive officers to complete a Director and Officer Questionnaire on an annual basis, and to update such information when the questionnaire responses become incomplete or inaccurate. The Director and Officer Questionnaire requires disclosure of any transactions with the Company in which the director or executive officer, or any member of his or her immediate family, has a direct or indirect material interest.

DELINQUENT SECTION 16(A) REPORTS

Section 16(a) of the Securities Exchange Act of 1934 requires our directors and executive officers, and persons who own more than 10% of our common stock to report their initial ownership of our common stock and any subsequent changes in that ownership to the SEC and to furnish us with a copy of each of these reports. SEC regulations impose specific due dates for these reports and we are required to disclose in this proxy statement any failure to file by these dates during fiscal year 2022.

Based solely on the review of the copies of these reports furnished to us and written representations that no other reports were required, as of December 31, 2022, we believe that these persons have complied with all applicable filing requirements.

INVOLVEMENT IN CERTAIN LEGAL PROCEEDINGS

None of our other directors, executive officers, significant employees or control persons have been involved in any legal proceeding listed in item 401(f) of Regulation S-K in the past 10 years.

| | |

COMPENSATION OF DIRECTORS AND EXECUTIVE OFFICERS |

Compensation of Directors

The director compensation plan compensates each director, with the exception of Mr. McGill, $20,000 per year and the Chairman of the Audit Committee $30,000. Mr. McGill receives $25,000 annually in cash paid in monthly installments per his agreement with the Company.

All directors are eligible to receive awards of restricted shares, which are subject to a 12-month holding period, after the annual shareholders meeting. Each director, with the exception of Messrs. McGill and Chymiak, is to be awarded $50,000 of restricted stock upon each election to the board, which would be subject to a holding period equal to their board term. Mr. McGill is to receive $50,000 of restricted stock

each October, subject to a twelve month holding period, per his agreement with the Company. Mr. Chymiak is to receive $15,000 of restricted stock upon his election to the board, which would be subject to a holding period equal to his board term.

We reimburse all directors for out-of-pocket expenses incurred by them in connection with their service on our Board and any Board committee. The following table reflects the total compensation earned by each non-employee director during the last fiscal year:

Fiscal Year 2022 Director Compensation

| | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Earned or Paid in Cash | | | Restricted Stock Awards (1) (2) | | | Total Compensation |

| James C. McGill (3) | | $ | 25,000 | | | | $ | 50,000 | | | | $ | 75,000 | |

| David E. Chymiak | | 20,000 | | | | 15,000 | | | | 35,000 | |

| Timothy S. Harden | | 20,000 | | | | 50,000 | | | | 70,000 | |

| John M. Shelnutt | | 20,000 | | | | 50,000 | | | | 70,000 | |

| David W. Sparkman | | 30,000 | | | | 50,000 | | | | 80,000 | |

| | | | | | | | | |

| (1) | The fair value of the stock awards are amortized over the estimated period until the next annual shareholders meeting to compensation expense in the Consolidated Financial Statements contained in the Company’s Annual Report on Form 10-K. The fair value of the stock award was based on the closing market price of the stock on the date of grant. |

| (2) | The directors received their fiscal 2022 awards in December, 2022, with a total fair value of $215,000 as of the original dates of the awards. |

| (3) | James C. McGill and the Company entered into an amended Letter Agreement on July 16, 2020, which amended his previous agreement dated October 8, 2018. This amended agreement provides that, for serving as Chairman of the Board, Mr. McGill will receive annual compensation in the form of $25,000 in cash and $50,000 in shares of stock, which will vest over a 12-month period. |

SUMMARY COMPENSATION TABLE

The following information relates to compensation paid by the Company for the fiscal years ended December 31, 2022 and September 30, 2021 to the Company’s Chief Executive Officer, Chief Financial Officer and the next most highly compensated executive officer of the Company:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | Non-Equity | | | | |

| | | | | | | | | Stock | | Option | | Incentive Plan | | All Other | | Total |

| Name and Principal Position* | | Year | | Salary | | Bonus | | Awards | | Awards | | Compensation | | Compensation | | Compensation |

| | | | | ($) | | ($)(1) | | ($) (2) | | ($) | | ($) | | ($)(3) | | ($) |

| Joseph E. Hart | | 2022 | | 300,000 | | | — | | | — | | | — | | | — | | | 32,505 | | | 332,505 | |

| Principal Executive Officer | | 2021 | | 300,000 | | | — | | | 446,450 | | | — | | | — | | | 26,419 | | | 772,869 | |

| | | | | | | | | | | | | | | | | |

| Michael A. Rutledge | | 2022 | | 250,000 | | | — | | | — | | | — | | | — | | | 24,662 | | | 274,662 | |

| Chief Financial Officer (4) | | 2021 | | 15,050 | | | — | | | 234,000 | | | — | | | — | | | — | | | 249,050 | |

| | | | | | | | | | | | | | | | | |

| Scott A. Francis | | | | | | | | | | | | | | | | |

| Chief Accounting Officer (5) | | 2021 | | 108,632 | | | — | | | 222,858 | | | — | | | — | | | 94,660 | | | 426,150 | |

| | | | | | | | | | | | | | | | | |

| Jimmy Taylor | | 2022 | | 128,041 | | | — | | | — | | | — | | | — | | | 8,017 | | | 136,058 | |

| President, Wireless Segment (6) | | 2021 | | 235,383 | | | — | | | — | | | — | | | — | | | 14,116 | | | 249,499 | |

| | | | | | | | | | | | | | | | | |

| (1) | There were no executive bonuses awarded in 2022 or 2021. |

| (2) | The amounts shown are Company officer compensation and represent the total fair value of the stock awards shares on the date of the grant to officers for fiscal years 2022 and 2021. The fair value of the stock awards is amortized over the vesting period to compensation expense in the Consolidated Statements of Operations contained in this Annual Report on Form 10-K. The fair value of the stock awards was based on the closing market prices of the stock on the dates of the grants. The actual value that an executive officer will realize upon vesting of performance or time-based awards will depend upon the market price of the Company’s stock on the vesting date, so there is no assurance that the value realized by an executive officer will be at or near the value of the market price of the Company’s stock on the grant date. Mr. Hart's amount for fiscal year 2021 was inadvertently omitted from the 10-K/A and the Proxy statement filed on January 27, 2022 and August 12, 2022, respectively. Stock award values for 2022 and 2021 for Mr. Rutledge and Mr. Taylor from the 10-K filed on March 21, 2023 have been updated to display grant date values. |

| (3) | Represents amounts paid by the Company on behalf of an officer for matching contributions to the Company’s qualified 401(k) plan, group term life, and auto allowance received during the year. Mr. Francis's other compensation includes severance payments. |

| (4) | Mr. Rutledge's salary for 2021 represents his prorated annual salary of $250,000 as per the terms of his employment agreement from his September 2021 start date. |

| (5) | Mr. Francis was the Vice President and Chief Accounting Officer of the Company until his departure in March 2021. Mr. Francis served as the interim Chief Accounting Officer through August 2021 as an independent contractor. |

| (6) | Mr. Taylor retired in July, 2022. |

| * | Note: Jerry D. Jones and Brian N. Davidson are not included in the table as their employment with the Company began in 2023. |

| |

Potential Payments Upon Termination or Change of Control

We have entered into employment/severance agreements with Mr. Hart, Mr. Rutledge, Mr. Jones and Mr. Davidson. These agreements are designed to promote stability, continuity and focus for key members of leadership during periods of uncertainty that may be created by change of control situations. Additionally, the use of such agreements is a competitive practice that enhances our ability to attract and retain leadership talent.

These agreements have no stated term but provide for the payment of severance benefits in most situations where the employee is terminated without cause or is terminated or resigns in connection with a Change in Control of the Company. Mr. Hart, in this event, will be paid the amount of his annual base salary immediately preceding the termination without cause or Change of Control. Mr. Rutledge, Mr. Jones and Mr. Davidson will be paid the amount of 50% of their annual base salary immediately preceding the termination without cause or Change of Control. Most executive equity awards which are subject to vesting provide for accelerated vesting upon the occurrence of a change in control.

“Change of Control” as used in these agreements has a fairly customary definition designed to reflect that a fundamental change in beneficial ownership or control of the Company has occurred. Specifically, the

agreements incorporate the term a “change of control event”, as defined in United States Treasury Regulations (“Regulations”) promulgated under section 409A of the Internal Revenue Code of 1986, as amended (“Section 409A”) that results from an event in which a person comes to be the owner, directly or indirectly, of 50% or more of outstanding voting securities of the Company or its parent company or the transfer or disposition of all or substantially all of the assets of the Company, its parent or their successor or a person, acquires, directly or indirectly, the voting power to elect a majority of the members of the Board of the Company or its parent (other than in the normal course) or any other similar transaction or series of related transactions.

Senior Management Incentive Compensation Plan

Company executives have received in the past equity and non-equity (cash bonus) incentive compensation. Incentive equity compensation has been awarded in the form of restricted stock or stock options granted under the Company’s 2015 Incentive Stock Plan. Cash bonuses have historically been granted as a result of meeting specified performance metrics.

For fiscal year 2022, the Company partially achieved the threshold performance goals and the Compensation Committee awarded Mr. Hart a bonus of $105,000 and Mr. Rutledge a bonus of $67,500. Those amounts were included in the Company's financial statements at December 31, 2022, but have not been paid as of the date of this report. For fiscal year 2021, the Company did not meet the threshold performance goals approved by the Compensation Committee and as a result no bonuses were awarded to executive officers for fiscal year 2021.

Outstanding Equity Awards at December 31, 2022

The named executive officers of the Company did not have any unvested stock option awards as of December 31, 2022.

The following table reflects the number of shares of unvested restricted stock awards of our named executive officers of the Company as of December 31, 2022:

| | | | | |

| Name | Unvested Restricted Stock |

| Joseph E. Hart | — | |

| Michael A. Rutledge | 37,500 | |

PAY VERSUS PERFORMANCE

As required by Item 402(v) of Regulation S-K, we are providing the following information regarding the relationship between executive compensation and our financial performance for each of the last two completed calendar years. In determining the “compensation actually paid” to our named executive officers ("NEOs"), we are required to make various adjustments to amounts that have been previously reported in the Summary Compensation Table in previous years, as the SEC’s valuation methods for this section differ from those required in the Summary Compensation Table.

Pay Versus Performance Table

The table below summarizes compensation values both previously reported in our Summary Compensation Table, as well as the adjusted values required in this section for fiscal years ended December 31, 2022 and September 30, 2021. Note that for our NEOs other than our principal executive officer (the “PEO”), compensation is reported as an average. Please refer to the Compensation of Directors and Executive Officers section for information about our executive compensation program and the ways in which we align executive compensation with performance.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Year | | Summary Compensation Table Total for PEO (1)(2) | | Compensation Actually Paid to PEO (1)(6) | | Average Summary Compensation Table Total for Non-PEO Named Executive Officers (1)(3) | | Average Compensation Actually Paid to Non-PEO Named Executive Officers (1)(7) | | Value of Initial Fixed $100 Investment Based on Total Shareholder Return (4) | | Net Income (Loss) (in thousands) (5) |

| 2022 | | $ | 332,505 | | | $ | 332,505 | | | $ | 205,360 | | | $ | 110,285 | | | $ | 75.40 | | | $ | 471 | |

| 2021 | | $ | 772,869 | | | $ | 772,869 | | | $ | 308,233 | | | $ | 280,958 | | | $ | 122.72 | | | $ | (2,029) | |

| | | | | | | | | | | | |

| (1) | | During the fiscal years 2022 and 2021, the PEO was Joseph E. Hart. During fiscal year 2022 the non-PEO named executive officers (NEOs) were Michael A. Rutledge and Jimmy Taylor, and during fiscal year 2021 they were Michael A. Rutledge, Scott A. Francis, and Jimmy Taylor. |

| (2) | | The dollar amounts reported are the amounts of total compensation reported for Mr. Hart for the applicable fiscal year in the "Total Compensation" column of the Summary Compensation Table (SCT). |

| (3) | | The dollar amounts reported represent the average of the amounts reported for the non-PEO NEOs for the applicable fiscal year in the "Total Compensation" column of the SCT. |

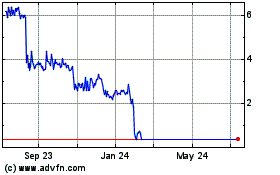

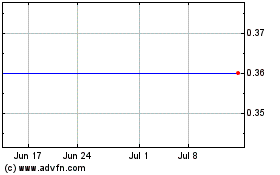

| (4) | | The amounts reported represent the measurement period value of an investment of $100 in our stock on September 30, 2020 (the last trading day before the 2021 fiscal year), and then valued again on each of September 30, 2021 (the last trading day of the 2021 fiscal year) and December 30, 2022 (the last trading day of the 2022 fiscal year), based on the closing price per share of the Company's common stock as of such dates. No dividends were paid by the Company in 2021 or 2022. |

| (5) | | The amounts reported represent net income (loss) for the applicable fiscal year calculated in accordance with generally accepted accounting principles in the United States. |

| (6) | | The following table sets forth the adjustments for the applicable fiscal year which were made to the total compensation per the SCT in order to arrive at "compensation actually paid" to our PEO, as computed in accordance with Item 402(v) of Regulation S-K: |

| | | | | | | | | | | | | | |

| | 2022 | | 2021 |

| SCT Total for PEO | $ | 332,505 | | | $ | 772,869 | |

| Less: Amount reported under the "Stock Awards" column in the SCT | — | | | (446,450) | |

| Add: Fair value of awards granted during the fiscal year that vested during the fiscal year | — | | | 446,450 | |

| Add: Fair value as of fiscal year-end of awards granted during the fiscal year that are outstanding and unvested as of the end of the fiscal year | — | | | — | |

| Add: Change in fair value as of fiscal year-end, compared to prior fiscal year-end, of awards granted in any prior fiscal year that are outstanding and unvested as of the end of the fiscal year | — | | | — | |

| Add: Change in fair value as of vesting date, compared to prior fiscal year-end, of awards granted in any prior fiscal year for which all vesting conditions were satisfied at fiscal year-end or during the fiscal year | — | | | — | |

| Total Adjustments | — | | | — | |

| Compensation Actually Paid to PEO | $ | 332,505 | | | $ | 772,869 | |

| | | | | | | | | | | | | | |

| (7) | The following table sets forth the adjustments for the applicable fiscal year which were made, on an average basis, to the average total compensation per the SCT in order to arrive at "average compensation actually paid" to our non-PEO NEOs, as computed in accordance with Item 402(v) of Regulation S-K: |

| | | | |

| | 2022 | | 2021 |

| Average SCT Total for Non-PEO NEOs | $ | 205,360 | | | $ | 308,233 | |

| Less: Amount reported under the "Stock Awards" column in the SCT | — | | | (456,858) | |

| Add: Fair value of awards granted during the fiscal year that vested during the fiscal year | — | | | 267,858 | |

| Add: Fair value as of fiscal year-end of awards granted during the fiscal year that are outstanding and unvested as of the end of the fiscal year | — | | | 177,000 | |

| Add: Change in fair value as of fiscal year-end, compared to prior fiscal year-end, of awards granted in any prior fiscal year that are outstanding and unvested as of the end of the fiscal year | (40,125) | | | (8,450) | |

| Add: Change in fair value as of vesting date, compared to prior fiscal year-end, of awards granted in any prior fiscal year for which all vesting conditions were satisfied at fiscal year-end or during the fiscal year | (54,950) | | | (6,825) | |

| Total Adjustments | (95,075) | | | (27,275) | |

| Average Compensation Actually Paid to Non-PEO NEOs | $ | 110,285 | | | $ | 280,958 | |

| | |

PROPOSAL NO. 2 RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

Our Audit Committee has selected the accounting firm of HoganTaylor LLP as our independent registered public accounting firm to examine our financial statements for the fiscal year ending December 31, 2023.

Representatives from HoganTaylor will attend the Annual Meeting to answer appropriate questions and make statements if they desire.

Recommendation of the Board of Directors:

The Board of Directors recommends a vote FOR the ratification of the appointment of HoganTaylor.

PRINCIPAL ACCOUNTING FEES AND SERVICES

HoganTaylor LLP audited our consolidated financial statements for the fiscal years ended December 31, 2022 and September 30, 2021. Our Audit Committee considered whether the provisions for the tax services and other services by HoganTaylor were compatible with maintaining their independence and determined that they were.

Fees Incurred by the Company for Services Performed by Audit Firms

The following table shows the fees incurred for the years ended December 31, 2022 and September 30, 2021 for professional services provided by HoganTaylor for the audits of our annual financial statements as well as other professional services. Included within the year ended 2022 are the fees associated with the transition period of three months ended December 31, 2021.

| | | | | | | | | | | |

| 2022 | | 2021 |

Audit Fees(1) | $ | 227,800 | | | $ | 129,000 | |

Audit-Related Fees(2) | 23,500 | | | 7,500 | |

Tax Fees(3) | — | | | 25,006 | |

| All Other Fees | — | | | — | |

| Total | $ | 251,300 | | | $ | 161,506 | |

(1) Audit Fees represent fees for professional services provided in connection with the audit of our annual financial statements and review of our quarterly financial statements and audit services provided in connection with the issuance of comfort letters, consents, and assistance with review of documents filed with the SEC.

(2) Audit-Related Fees represent services in connection with special reports, accounting consultations, and due diligence procedures.

(3) Tax Fees represent fees for annual tax return preparation and research of tax related matters.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Auditor

Consistent with SEC policies regarding auditor independence, the Audit Committee has responsibility for appointing, setting compensation and overseeing the work of the independent registered public accounting firm. In recognition of this responsibility, the Audit Committee has established a policy to pre-approve all audit and permissible non-audit services provided by the independent registered public accounting firm. During the year, the Audit Committee approved all of the services performed by the independent registered public accounting firm. The fees billed for these services approximated 100% of the pre-approved amounts.

Before engagement of the independent registered public accounting firm for the next year’s audit, management will submit a list of services and related fees expected to be rendered during that year within each of the following four categories of services to the Audit Committee for approval:

1.Audit services include audit work performed on the financial statements, internal control over financial reporting, as well as work that generally only the independent registered public accounting firm can reasonably be expected to provide, including comfort letters, statutory audits, and discussions surrounding the proper application of financial accounting and/or reporting standards.

2.Audit-Related services are for assurance and related services that are traditionally performed by the independent registered public accounting firm, including due diligence related to mergers and acquisitions and special procedures required to meet certain regulatory requirements.

3.Tax services include all services, except those services specifically related to the audit of the financial statements, performed by the independent registered public accounting firm’s tax personnel, including tax analysis; assisting with coordination of execution of tax related activities, primarily in the area of

corporate development; supporting other tax related regulatory requirements; and tax compliance and reporting.

4.Other Fees are those associated with services not captured in the other categories. We generally do not request such services from the independent registered public accounting firm other than the annual audit of our Defined Contribution Plan.

Before engagement, the Audit Committee pre-approves the independent registered public accounting firm’s services within each category. During the year, circumstances may arise when it may become necessary to engage the independent registered public accounting firm for additional services not contemplated in the original pre-approval categories. In those instances, the Audit Committee requires specific pre-approval before engaging the independent registered public accounting firm.

The Audit Committee may delegate pre-approval authority to one or more of its members. The member to whom such authority is delegated must report, for informational purposes only, any pre-approval decisions to the Audit Committee at its next scheduled meeting.

| | |

PROPOSAL NO. 3

APPROVE AN AMENDMENT TO OUR CERTIFICATE OF INCORPORATION TO INCREASE OUR AUTHORIZED SHARES OF COMMON STOCK FROM 35,000,000 TO 100,000,000, OF WHICH 95,000,000 SHARES SHALL BE COMMON STOCK WITH A PAR VALUE OF $0.01 PER SHARE, AND 5,000,000 SHARES SHALL BE PREFERRED STOCK WITH A PAR VALUE OF $1.00 PER SHARE |

Our Board has approved, subject to stockholder approval, an amendment to our Articles of Incorporation to increase our authorized shares of common stock from 35,000,000 to 100,000,000 of which 95,000,000 shares shall be Common Stock with a par value of $0.01 per share, and 5,000,000 shares shall be Preferred Stock with a par value of $1.00 per share. The increase in our authorized shares of common stock will become effective upon the filing of the amendment to our Articles of Incorporation with the Oklahoma Secretary of State. If the amendment to increase our authorized shares of common stock is approved by stockholders at the Annual Meeting, we intend to file the amendment to our Articles of Incorporation as soon as practicable following the Annual Meeting.

The form of the text of the amendment (which would be filed with the Oklahoma Secretary of State on its then prescribed form of Certificate of Amendment) is set forth as Appendix A to this proxy statement (subject to any changes required by applicable law).

Outstanding Shares and Purpose of the Proposal

Our Articles of Incorporation currently authorizes us to issue a maximum of 35,000,000 shares, of which 30,000,000 shares shall be Common Stock with a par value of $0.01 per share, and 5,000,000 shares shall be Preferred Stock with a par value of $1.00 per share.

The approval of the amendment to the Articles of Incorporation to increase the authorized shares of common stock is important for the ongoing business of the Company. Without additional authorized shares of common stock, (i) the Company may not be able to raise additional financing, which is needed to fund our ongoing business, (ii) the Company may not be able to attract and retain key employees, officers and directors, and (iii) the Company may not be able to make possible strategic acquisitions, although no such acquisitions are currently contemplated.

The increase in the number of authorized shares of common stock may be available for our Board to issue in future financings, to provide equity incentive to employees, officers and directors, to make stock-based acquisitions and for other general corporate purposes, and we intend to use the additional shares of common stock that will be available to undertake any such issuances. We have no specific plan, commitment, arrangement, understanding or agreement, either oral or written, regarding the issuance of common stock subsequent to this proposed increase in the number of authorized shares at this time, and we have not allocated any specific portion of the proposed increase in the authorized number of shares to any particular purpose. The Company is therefore requesting its stockholders approve this proposal to amend its Articles of Incorporation to increase the authorized shares of common stock.

Rights of Additional Authorized Shares

Any authorized shares of common stock, if and when issued, would be part of our existing class of common stock and would have the same rights and privileges as the shares of common stock currently outstanding. Our stockholders do not have pre-emptive rights with respect to the common stock, nor do they have cumulative voting rights. Accordingly, should the Board issue additional shares of common stock, existing stockholders would not have any preferential rights to purchase any of such shares, and their percentage ownership of our then outstanding common stock could be reduced.

Potential Adverse Effects of Increase in Authorized Common Stock