(Address, Including Zip

Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices)

(Name, Address, Including

Zip Code, and Telephone Number, Including Area Code, of Agent For Service)

If the only securities being registered on this Form are being

offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities being registered on this Form are to

be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, other than securities offered

only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to register additional securities for

an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration

statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to

Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the

earlier effective registration statement for the same offering. ¨

If this Form is a registration statement pursuant to General

Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission pursuant to

Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective amendment to a registration

statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities

pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions

of “large accelerated filer,” “accelerated filer,” “smaller reporting company” and “emerging

growth company” in Rule 12b-2 of the Exchange Act.

If an emerging growth company, indicate by check mark if the

registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING STATEMENTS

We make forward-looking statements in this

prospectus, any prospectus supplement and the documents incorporated by reference herein and therein within the meaning of the

Private Securities Litigation Reform Act of 1995. These forward-looking statements relate to expectations for future financial

performance, business strategies or expectations for our business. These statements may be preceded by, followed by or include

the words “may,” “might,” “will,” “will likely result,” “should,” “estimate,”

“plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,”

“believe,” “seek,” “continue,” “target” or similar expressions.

These forward-looking statements are based

on information available to us as of the date they were made, and involve a number of risks and uncertainties which may cause them

to turn out to be wrong. Accordingly, forward-looking statements should not be relied upon as representing our views as of any

subsequent date, and we do not undertake any obligation to update forward-looking statements to reflect events or circumstances

after the date they were made, whether as a result of new information, future events or otherwise, except as may be required under

applicable securities laws. As a result of a number of known and unknown risks and uncertainties, our actual results or performance

may be materially different from those expressed or implied by these forward-looking statements. Some factors that could cause

actual results to differ include:

|

|

·

|

competition and the ability of our business to grow and manage growth profitably;

|

|

|

·

|

changes in applicable laws or regulations;

|

|

|

·

|

fluctuations in the U.S. and/or global stock markets;

|

|

|

·

|

the possibility that we may be adversely affected by other economic, business, and/or competitive factors;

|

|

|

·

|

the impact of the coronavirus (COVID-19) pandemic and our response to it;

|

|

|

·

|

failure to consummate or realize the expected benefits of the acquisition of AeroCare Holdings, Inc.; and

|

|

|

·

|

other risks and uncertainties set forth in this prospectus or in any applicable prospectus supplement, as well as the documents

incorporated by reference herein and therein.

|

FREQUENTLY USED TERMS

“A&R AdaptHealth Holdings LLC

Agreement” means the Fifth Amended and Restated Limited Liability Company Agreement of AdaptHealth Holdings, dated as

of November 8, 2019;

“A&R Registration Rights Agreement”

means the Amended and Restated Registration Rights Agreement, dated as of July 1, 2020, by and among AdaptHealth, AdaptHealth Holdings,

and certain investors party thereto, as amended on December 1, 2020;

“AdaptHealth Holdings”

means AdaptHealth Holdings LLC, a Delaware limited liability company

“AdaptHealth Units” means

units representing limited liability company interests in AdaptHealth Holdings;

“Business Combination”

means our business combination with AdaptHealth Holdings, which we completed on November 8, 2019;

“Class A Common Stock”

means our Class A Common Stock, par value $0.0001 per share;

“Class B Common Stock”

means our Class B Common Stock, par value $0.0001 per share;

“Common Stock” means

our Class A Common Stock and our Class B Common Stock, collectively;

“Consideration Unit”

means one AdaptHealth Unit together with one share of Class B Common Stock;

“Deerfield Private Design Fund

IV” means Deerfield Private Design Fund IV, L.P.;

“Deerfield Management”

means, collectively, entities affiliated with Deerfield Management Company, L.P.;

“Deerfield Partners”

means Deerfield Partners, L.P., a Delaware limited partnership;

“Exchange Agreement”

means the Exchange Agreement, dated as of November 8, 2019, by and among AdaptHealth, AdaptHealth Holdings, and holders of AdaptHealth

Units;

“OEP Investment” means

the investment whereby the OEP Purchaser purchased, on July 1, 2020, in a private placement, 10,930,471 shares of Class A Common

Stock and 39,706 shares of Series A Preferred Stock for an aggregate purchase price of $190 million;

“OEP Purchaser” means

OEP AHCO Investment Holdings, LLC, a Delaware limited liability company;

“RAB Ventures” means

RAB Ventures (DFB) LLC;

“Series A Preferred Stock”

means the series of preferred stock of the Company designated as “Series A Convertible Preferred Stock,” par value

$0.0001 per share;

“Series B-1 Preferred Stock”

means the series of preferred stock of the Company designated as “Series B-1 Convertible Preferred Stock,” par value

$0.0001 per share;

“Series B-2 Preferred Stock”

means the series of preferred stock of the Company designated as “Series B-2 Convertible Preferred Stock,” par value

$0.0001 per share;

“Series C Preferred Stock”

means the series of preferred stock of the Company to be designated as “Series C Convertible Preferred Stock,” par

value $0.0001 per share; and

“Sponsor” means Deerfield/RAB

Ventures LLC.

THE COMPANY

We

are a leading provider of home healthcare equipment, medical supplies to the home and related services in the United States. We

focus primarily on providing (i) sleep therapy equipment, supplies and related services (including continuous positive airway pressure

and bilevel positive airway pressure services) to individuals suffering from obstructive sleep apnea, (ii) medical devices and

supplies to patients for the treatment of diabetes (including continuous glucose monitors and insulin pumps), (iii) home medical

equipment (“HME”) to patients discharged from acute care and other facilities, (iv) oxygen and related chronic therapy

services in the home and (v) other HME medical devices and supplies on behalf of chronically ill patients with wound care, urological,

incontinence, ostomy and nutritional supply needs. We service beneficiaries of Medicare, Medicaid and commercial insurance payors.

As of September 30, 2020, we serviced approximately 1.8 million patients annually in all 50 states through our network of 269 locations

in 41 states.

We were originally formed in November 2017

as a special purpose acquisition company under the name DFB Healthcare Acquisitions Corp. for the purpose of effecting a merger,

capital stock exchange, asset acquisition, stock purchase, reorganization, or similar business combination involving one or more

businesses. On November 8, 2019, we completed our initial business combination with AdaptHealth Holdings. As part of the Business

Combination, we changed our name from DFB Healthcare Acquisitions Corp. to AdaptHealth Corp.

Our principal executive office is located

at 220 West Germantown Pike, Suite 250, Plymouth Meeting, Pennsylvania 19462, and its telephone number is (610) 630-6357. Our website

is https://www.adapthealth.com. The information on our website does not constitute part of, and is not incorporated by reference

in, this prospectus or any accompanying prospectus supplement, and you should not rely on our website or such information in making

a decision to invest in our securities.

Recent Developments

AeroCare Acquisition

On December 1, 2020, we entered into a merger

agreement (the “Merger Agreement”) pursuant to which we agreed to acquire AeroCare Holdings, Inc. (“AeroCare”),

subject to the satisfaction or waiver of certain conditions as described in the Merger Agreement (the “AeroCare Acquisition”).

The purchase price for the AeroCare Acquisition consists of $1.1 billion in cash plus shares of Class A Common Stock and shares

of Series C Preferred Stock, representing, in the aggregate, on an as-converted basis, the economic equivalent of 31 million shares

of Class A Common Stock, subject to customary adjustments to the cash portion of such consideration for cash, indebtedness, transaction

expenses and net working capital (as compared to an agreed target net working capital amount) and certain other adjustments and

subject to escrows to fund certain potential indemnification matters and potential amounts owed by AeroCare equityholders with

respect to post-closing purchase price adjustments, if any. We intend to fund the cash portion of the consideration for the AeroCare

Acquisition and associated costs through cash on hand and incremental debt.

The obligations of the parties to consummate

the transactions contemplated by the Merger Agreement are subject to the satisfaction or waiver of, among other closing conditions,

the accuracy of the representations and warranties in the Merger Agreement, the compliance by the parties with the covenants in

the Merger Agreement, the absence of any legal order barring the AeroCare Acquisition, the termination or expiration of the waiting

period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended and the receipt of certain regulatory approvals.

Our obligation to effect the closing is also subject to the satisfaction or waiver of the condition that no more than 3.5% of the

shares of common stock of AeroCare issued and outstanding as of immediately prior to the closing have properly demanded appraisal

for such shares pursuant to Section 262 of the General Corporation Law of the State of Delaware.

Pursuant to the Merger Agreement, the parties

are provided with customary termination rights, including the right of either party to terminate the Merger Agreement if the consummation

of the AeroCare Acquisition has not occurred on or prior to May 31, 2021 unless the party electing to terminate the Merger Agreement

is in breach of its representations or obligations under the Merger Agreement and such breach caused the failure of a condition

to closing or was the primary cause of the failure to consummate the closing prior to outside date. We will be required to pay

a termination fee to AeroCare equal to $60 million if the Merger Agreement is terminated for breach by us that primarily gives

rise to the failure of certain conditions to closing of AeroCare or for our failure to close when required. The AeroCare Acquisition

is expected to close in the first quarter of 2021 subject to the satisfaction of the closing conditions as described above.

In connection with the entry into the Merger

Agreement, we entered into a debt commitment letter, dated as of December 1, 2020, pursuant to which Jefferies Finance LLC (together

with any additional commitment parties party thereto) committed to provide to us (i) a senior secured term loan B facility (the

“Term B Facility”) in an aggregate principal amount of up to $900.0 million and (ii) a senior unsecured bridge facility

(the “Bridge Facility”) in an aggregate principal amount of up to $450.0 million, on the terms and subject to certain

conditions as described in the debt commitment letter. The Term B Facility commitment consists of $250.0 million to backstop a

required amendment on our existing $250.0 million term loan A facility, which was received on December 14, 2020, and up to $650.0

million to finance the cash consideration payable in the AeroCare Acquisition and related fees and expenses (together with the

$450.0 million Bridge Facility). Additionally, on December 15, 2020, we priced an offering of $500.0 million aggregate principal

amount of 4.625% Senior Notes due 2029 (the “Notes”). The proceeds of the Notes will reduce commitments in respect

of the Bridge Facility on a dollar-for-dollar basis, and upon the consummation of such offering, we do not expect to enter into

the Bridge Facility. On or prior to the consummation of the AeroCare Acquisition, the commitments in respect of the Term B Facility

may be automatically reduced on a dollar-for-dollar basis by certain debt incurrences (excluding the Notes) and equity issuances

by the Company. We are currently considering various alternatives for our permanent capital structure with respect to the $600.0

million aggregate principal amount in new senior secured term loan borrowings that we expect to incur in connection with the AeroCare

Acquisition, which may include an incremental term loan A facility or a combination of a term loan B facility and an incremental

term loan A facility.

For more information on the AeroCare Acquisition

and the debt commitment letter, see “Where You Can Find More Information”.

Put/Call Agreement

We and AdaptHealth Holdings are party to

the Put/Call Option and Consent Agreement, dated as of May 25, 2020, as amended on October 16, 2020, with BlueMountain Foinaven

Master Fund L.P., BMSB L.P., BlueMountain Fursan Fund L.P. and BlueMountain Summit Opportunities Fund II (US) L.P. (the “Option

Parties”), pursuant to which the parties were granted certain put and call rights with respect to our securities. On December

9, 2020, we exercised our right under the agreement to purchase 1,898,967 shares of our Class A Common Stock from the Option Parties

at a price per share of $15.76, resulting in a $29.9 million payment to the Option Parties, which closed on December 15, 2020.

Up-C Unwinding

In anticipation of the closing of the AeroCare

Acquisition, we will complete an internal restructuring such that, for the fiscal year ending December 31, 2021, we will no longer

be an “Up-C”. In connection with this restructuring, our subsidiary will merge with and into AdaptHealth Holdings and

the members of AdaptHealth Holdings (other than us) will receive one share of Class A Common Stock in exchange for each Consideration

Unit. Following the Up-C Unwinding, AdaptHealth Holdings will be our wholly owned indirect subsidiary. The Up-C Unwinding is intended

to reduce our tax compliance costs and enhance our ability to structure future acquisitions and will result in the Class A Common

Stock being our only class of Common Stock outstanding.

In addition, on December 7, 2020 prior to

the Up-C Unwinding, certain members of our management elected to exchange an aggregate of 4,652,351 Consideration Units directly

or indirectly held thereby for Class A Common Stock subject to the terms of the Exchange Agreement. We elected to deliver an amount

in cash as set forth in the Exchange Agreement in lieu of delivering shares of Class A Common Stock for 1,507,808 of such Consideration

Units surrendered for exchange pursuant to the Exchange Agreement. The amount in cash delivered in lieu of shares of Class A Common

Stock was an amount sufficient to permit such members of our management to satisfy their tax obligations in connection with such

exchange.

Our Emerging Growth Company Status

We qualify as an “emerging growth company” as defined in the JOBS Act. As an

emerging growth company, we are eligible for certain exemptions from various reporting requirements applicable to other public

companies that are not emerging growth companies for as long as we continue to be an emerging growth company, including (i) the

exemption from the auditor attestation requirements with respect to internal control over financial reporting under Section 404

of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), (ii) the exemptions from say-on-pay, say-on-frequency

and say-on-golden parachute voting requirements and (iii) reduced disclosure obligations regarding executive compensation in our

periodic reports, proxy statements and registration statements.

We may take advantage of these

provisions until we are no longer an emerging growth company, which will occur on the earliest of (i) the last day of the

fiscal year in which the market value of our Class A Common Stock that is held by non-affiliates exceeds $700 million as of

June 30 of that fiscal year, (ii) the last day of the fiscal year in which we have total annual gross revenue of $1.07

billion or more during such fiscal year, (iii) the date on which we have issued more than $1.0 billion in non-convertible

debt in the prior three-year period or (iv) the last day of the fiscal year following the fifth anniversary of the date of

the first sale of our common stock in the IPO, which would be December 31, 2023. We expect to exceed $1.07 billion in revenue

for the year ended December 31, 2021, meaning we would no longer be an emerging growth company as of December 31, 2021 or

sooner if our non-convertible debt exceeds $1.0 billion.

In addition, Section 107 of the JOBS Act

also provides that an emerging growth company can take advantage of the exemption from complying with new or revised accounting

standards provided in Section 7(a)(2)(B) of the Securities Act as long as we are an emerging growth company. An emerging growth

company can therefore delay the adoption of certain accounting standards until those standards would otherwise apply to private

companies. We have elected to take advantage of such extended transition period, which means that when a standard is issued or

revised and it has different application dates for public or private companies, we, as an emerging growth company, can adopt the

new or revised standard at the same time private companies adopt the new or revised standard.

Our Smaller Reporting Company Status

We are also currently a “smaller

reporting company,” meaning that as of the last business day of our most recent second fiscal quarter, we had a public

float of less than $250 million or annual revenues of less than $100 million. In the event that we are still considered a

“smaller reporting company” at such time as we cease being an “emerging growth company,” the

disclosure we will be required to provide in our SEC filings will increase, but will still be less than it would be if we

were not considered either an “emerging growth company” or a “smaller reporting company.”

Specifically, similar to “emerging growth companies,” “smaller reporting companies” are able to

provide simplified executive compensation disclosures in their filings; may be exempt from the provisions of Section 404(b)

of the Sarbanes-Oxley Act requiring that independent registered public accounting firms provide an attestation report on the

effectiveness of internal control over financial reporting; and have certain other decreased disclosure obligations in their

SEC filings.

Accordingly, the information that we provide

you may be different than what you may receive from other public companies in which you hold equity interests.

Summary Risk Factors

Investment in our securities involves a

high degree of risk. You should consider carefully the risks and uncertainties described under the heading “Risk Factors”

in this prospectus, any applicable prospectus supplement and the documents incorporated herein by reference, before you decide

whether to purchase any of our securities. These risks could materially adversely affect our business, financial condition, results

of operations and cash flows, and you may lose part or all of your investment. Such risks include, but are not limited to:

|

|

·

|

the coronavirus (COVID-19) pandemic and the global attempt to contain it;

|

|

|

·

|

our reliance on relatively few suppliers for the majority of our patient service equipment and supplies;

|

|

|

·

|

federal and state changes to reimbursement and other Medicaid and Medicare policies;

|

|

|

·

|

healthcare reform efforts, including repeal of or significant modifications to the Affordable Care Act;

|

|

|

·

|

continuing efforts by private third-party payors to control their costs;

|

|

|

·

|

changes in governmental or private payor supply replenishment schedules;

|

|

|

·

|

our reliance for a significant portion of our revenue on the provision of sleep therapy equipment and supplies to patients;

|

|

|

·

|

consolidation among health insurers and other industry participants;

|

|

|

·

|

our payor contracts being subject to renegotiation or termination;

|

|

|

·

|

our ability to manage the complex and lengthy reimbursement process;

|

|

|

·

|

changes in the authorizations or documentation necessary for our products;

|

|

|

·

|

audits of reimbursement claims by various governmental and private payor entities;

|

|

|

·

|

significant reimbursement reductions and/or exclusion from markets or product lines;

|

|

|

·

|

our failure to maintain controls and processes over billing and collections or the deterioration of the financial condition

of our payors or disputes with third parties;

|

|

|

·

|

our ability to maintain or develop relationships with patient referral sources;

|

|

|

·

|

our ability to successfully design, modify and implement technology-based and other process changes;

|

|

|

·

|

our dependence on information systems, including software licensed from third parties;

|

|

|

·

|

competition from numerous other home respiratory and mobility equipment providers;

|

|

|

·

|

changes in medical equipment technology and development of new treatments;

|

|

|

·

|

the risk of rupture or other accidents due to our transport of compressed and liquid oxygen;

|

|

|

·

|

our ability to comply with applicable law, including healthcare fraud and abuse and false claims laws and regulations, and

data protection, privacy and security, and consumer protection laws;

|

|

|

·

|

our ability to maintain required licenses and accreditation;

|

|

|

·

|

our ability to attract and retain key members of senior management and other key personnel;

|

|

|

·

|

our ability to execute our strategic growth plan, which involves the acquisition of other companies;

|

|

|

·

|

the impact if we were required to write down all or part of our goodwill;

|

|

|

·

|

our ability to obtain additional capital to fund our operating subsidiaries and finance our growth;

|

|

|

·

|

risks relating to our indebtedness, including our ability to meeting operating covenants and the impact from changes to LIBOR;

|

|

|

·

|

the impact of political and economic conditions;

|

|

|

·

|

the risk of substantial monetary penalties or suspension or termination from participation in the Medicare and Medicaid programs

if our subsidiary fails to comply with the terms of its Corporate Integrity Agreement;

|

|

|

·

|

our exposure to unexpected costs from our current insurance program;

|

|

|

·

|

the outsourcing of a portion of our internal business functions to third-party providers;

|

|

|

·

|

our ability to generate the funds necessary to meet our financial obligations or to pay any dividends on our Class A Common

Stock;

|

|

|

·

|

fluctuations in the price of our securities;

|

|

|

·

|

our ability to timely and effectively implement controls and procedures required by the Sarbanes-Oxley Act;

|

|

|

·

|

certain of our principal stockholders have significant influence over us;

|

|

|

·

|

significant increased expenses and administrative burdens as a result of being a public company;

|

|

|

·

|

our management’s limited experience in operating a public company;

|

|

|

·

|

the ability of stockholders to receive any return on investment because we have no current plans to pay cash dividends on our

Class A Common Stock for the foreseeable future;

|

|

|

·

|

risks related to the Tax Receivable Agreement we entered into at the closing of our Business Combination;

|

|

|

·

|

our ability to continue to comply with the continued listing standards of Nasdaq;

|

|

|

·

|

the impact of the private placement warrants on our Class A Common Stock;

|

|

|

·

|

our status as an “emerging growth company” and a “smaller reporting company” which allow us to take

advantage of certain exemptions from various reporting requirements;

|

|

|

·

|

certain provisions in our governing documents which may have the effect of discouraging lawsuits against our directors and

officers; and

|

|

|

·

|

failure to consummate or realize the expected benefits of the AeroCare Acquisition.

|

RISK FACTORS

Investment in our securities involves a

high degree of risk. You should consider carefully the following risks and the risks and uncertainties described under the heading

“Risk Factors” in any applicable prospectus supplement, our Annual Report on Form 10-K for the fiscal year ended December

31, 2019, as updated by our subsequent Quarterly Reports on Form 10-Q, and our other filings with the SEC pursuant to Sections

13(a), 13(c), 14 or 15(d) of the Securities Exchange Act of 1934 (the “Exchange Act”), which are incorporated herein

by reference, before you decide whether to purchase any of our securities. These risks could materially adversely affect our business,

financial condition, results of operations and cash flows, and you may lose part or all of your investment. For more information,

see “Where You Can Find More Information.”

Risks Related to the AeroCare Acquisition

We may experience difficulties in integrating

the operations of AeroCare into our business and in realizing the expected benefits of the AeroCare Acquisition.

The success of the AeroCare Acquisition

will depend in part on our ability to realize the anticipated business opportunities from combining the operations of AeroCare

with our business in an efficient and effective manner. The integration process could take longer than anticipated and could result

in the loss of key employees, the disruption of each company’s ongoing businesses, tax costs or inefficiencies, or inconsistencies

in standards, controls, information technology systems, procedures and policies, any of which could adversely affect our ability

to maintain relationships with customers, employees or other third parties, or our ability to achieve the anticipated benefits

of the AeroCare Acquisition, and could harm our financial performance. If we are unable to successfully or timely integrate the

operations of AeroCare with our business, we may incur unanticipated liabilities and be unable to realize the revenue growth, synergies

and other anticipated benefits resulting from the AeroCare Acquisition, and our business, results of operations and financial condition

could be materially and adversely affected.

We have incurred significant costs in connection

with the AeroCare Acquisition. The substantial majority of these costs are non-recurring expenses related to the AeroCare Acquisition.

These non-recurring costs and expenses are not reflected in the unaudited pro forma condensed combined financial information incorporated

by reference in the registration statement of which this prospectus forms a part. We may incur additional costs in the integration

of AeroCare’s business, and may not achieve cost synergies and other benefits sufficient to offset the incremental costs

of the AeroCare Acquisition.

USE OF PROCEEDS

We intend to use the net proceeds we receive

from the sale of securities by us as set forth in the applicable prospectus supplement. We will not receive any proceeds from the

sale of securities by any selling securityholder, but we are required to pay certain offering fees and expenses in connection with

the registration of the selling securityholders’ securities and to indemnify the selling securityholders against certain

liabilities.

DESCRIPTION OF CAPITAL

STOCK

The following summary of the material terms

of our capital stock is not intended to be a complete summary of the rights and preferences of our capital stock. We urge you to

read our second amended and restated certificate of incorporation, as in effect on the date of this prospectus (our “Charter”),

in its entirety for a complete description of the rights and preferences of our capital stock.

Authorized and Outstanding Stock

Our Charter authorizes the issuance of 250,000,000

shares of Common Stock, consisting of 210,000,000 shares of Class A Common Stock and 35,000,000 shares of Class B Common Stock,

and 5,000,000 shares of undesignated preferred stock, $0.0001 par value per share. The outstanding shares of our Common Stock are

duly authorized, validly issued, fully paid and non-assessable. As of December 15, 2020, there were 71,390,810 shares of Class

A Common Stock and 18,938,269 shares of Class B Common Stock issued and outstanding.

In anticipation of the closing of the AeroCare

Acquisition, we will complete an internal restructuring such that, for the fiscal year ending December 31, 2021, we will no longer

be an “Up-C”. In connection with this restructuring, our subsidiary will merge with and into AdaptHealth Holdings and

the members of AdaptHealth Holdings (other than us) will receive one share of Class A Common Stock in exchange for each Consideration

Unit. Following the Up-C Unwinding, AdaptHealth Holdings will be our wholly owned indirect subsidiary. The Up-C Unwinding is intended

to reduce our tax compliance costs and enhance our ability to structure future acquisitions and will result in the Class A Common

Stock being our only class of Common Stock outstanding.

Common Stock

Our

Charter provides for two classes of Common Stock, Class A Common Stock and Class B Common Stock. In connection with the Business

Combination, certain pre-Business Combination owners of AdaptHealth Holdings were issued AdaptHealth Units and an equal

number of shares of Class B Common Stock, and such parties collectively own all of our outstanding shares of Class B Common Stock.

We expect to continue to maintain a one-to-one ratio between the number of outstanding shares of Class B Common Stock and the number

of AdaptHealth Units held by persons other than AdaptHealth, so holders of AdaptHealth Units (other than AdaptHealth) will continue

to have a voting interest in AdaptHealth that is proportionate to their economic interest in AdaptHealth Holdings.

Shares of Class B Common Stock (i) may be

issued only in connection with the issuance by AdaptHealth Holdings of a corresponding number of AdaptHealth Units and only to

the person or entity to whom such AdaptHealth Units are issued and (ii) may be registered only in the name of (a) a person or entity

to whom shares of Class B Common Stock are issued as described above, (b) its successors and assigns, (c) their respective permitted

transferees or (d) any subsequent successors, assigns and permitted transferees. A holder of shares of Class B Common Stock may

transfer shares of Class B Common Stock to any transferee (other than AdaptHealth) only if, and only to the extent permitted by

the A&R AdaptHealth Holdings LLC Agreement, such holder also simultaneously transfers an equal number of such holder’s

AdaptHealth Units to the same transferee in compliance with the A&R AdaptHealth Holdings LLC Agreement.

Voting Power

Except as otherwise required by law or as

otherwise provided in any certificate of designation for any series of preferred stock, the holders of Common Stock possess all

voting power for the election of our directors and all other matters requiring stockholder action. Holders of Common Stock are

entitled to one vote per share on matters to be voted on by stockholders. Holders of shares of our Class B Common Stock vote together

as a single class with holders of shares of our Class A Common Stock on all matters properly submitted to a vote of the stockholders.

Dividends

Holders of Class A Common Stock are entitled

to receive such dividends, if any, as may be declared from time to time by our board of directors in its discretion out of funds

legally available therefor. In no event will any stock dividends or stock splits or combinations of stock be declared or made on

Class A Common Stock unless the shares of Class A Common Stock at the time outstanding are treated equally and identically. Holders

of shares of Class B Common Stock are not entitled to receive any dividends on account of such shares.

Liquidation, Dissolution and Winding

Up

In the event of our voluntary or involuntary

liquidation, dissolution, distribution of assets or winding-up, the holders of the Class A Common Stock will be entitled to receive

an equal amount per share of all of our assets of whatever kind available for distribution to stockholders, after the rights of

the holders of the preferred stock have been satisfied. Holders of shares of Class B Common Stock will not be entitled to receive

any of our assets on account of such shares.

Preemptive or Other Rights

Our stockholders have no preemptive or other

subscription rights and there are no sinking fund or redemption provisions applicable to our Common Stock.

Election of Directors

Our board of directors is divided into three

classes, each of which generally serves for a term of three years with only one class of directors being elected in each year.

There is no cumulative voting with respect to the election of directors, with the result that the holders of more than 50% of the

shares voted for the election of directors can elect all of the directors.

Founder Shares

The shares that were issued to our Sponsor

in a private placement prior to our IPO (“founder shares”) are identical to the shares of Common Stock sold in our

IPO, and holders of founder shares have the same stockholder rights as public stockholders.

Preferred Stock

Our Charter provides that shares of preferred

stock may be issued from time to time in one or more series. Our board of directors is authorized to fix the voting rights, if

any, designations, powers and preferences, the relative, participating, optional or other special rights, and any qualifications,

limitations and restrictions thereof, applicable to the shares of each series of preferred stock. The board of directors is able

to, without stockholder approval, issue preferred stock with voting and other rights that could adversely affect the voting power

and other rights of the holders of the Common Stock and could have anti-takeover effects. The ability of our board of directors

to issue preferred stock without stockholder approval could have the effect of delaying, deferring or preventing a change of control

of us or the removal of existing management.

The particular terms of any series of preferred

stock to be offered by this prospectus will be set forth in the prospectus supplement relating to the offering. The description

of the terms of a particular series of preferred stock that will be set forth in the applicable prospectus supplement does not

purport to be complete and will be qualified in its entirety by reference to the certificate of designation relating to the series.

As of the date hereof, we have 185,000 shares

of Series B-1 Preferred Stock authorized and 183,560.02 shares of Series B-1 Preferred Stock outstanding. Each share of Series

B-1 Preferred Stock is convertible into 100 shares of Class A Common Stock (subject to certain anti-dilution adjustments) at the

holder's election, except to the extent that, following such conversion, the number of shares of Class A Common Stock held by such

holder, its affiliates and any other persons whose beneficial ownership of Class A Common Stock would be aggregated with such holder’s

for purposes of Section 13(d) of the Exchange Act , including shares held by any “group” (as defined in Section 13(d)

of the Exchange Act and applicable regulations of the Securities and Exchange Commission) of which such holder is a member, but

excluding shares beneficially owned by virtue of the ownership of securities or rights to acquire securities that have similar

limitations on the right to convert, exercise or purchase, exceed 4.9% of the outstanding Class A Common Stock. The Series B-1

Preferred Stock ranks senior to the Class A Common Stock with respect to rights on the distribution of assets on any voluntary

or involuntary liquidation, dissolution or winding up of the affairs of the Company, in respect of a liquidation preference equal

to its par value of $0.0001 per share. The Series B-1 Preferred Stock participates equally and ratably on an as-converted basis

with the holders of Class A Common Stock in all cash dividends paid on the Class A Common Stock. The Series B-1 Preferred Stock

is non-voting.

In

connection with the acquisition of AeroCare Holdings, Inc., we will issue shares of newly designated Series C Preferred Stock.

As of the date hereof, we have no shares of Series C Preferred Stock authorized or outstanding. For more information on the acquisition

and the Series C Preferred Stock to be issued, see “The Company—Recent Developments” and “Where

You Can Find More Information.”

Our Transfer Agent

The transfer agent for our Common Stock

is Continental Stock Transfer & Trust Company. We have agreed to indemnify Continental Stock Transfer & Trust Company in

its role as transfer agent, its agents and each of its stockholders, directors, officers and employees against all liabilities,

including judgments, costs and reasonable counsel fees that may arise out of acts performed or omitted for its activities in that

capacity, except for any liability due to any gross negligence, willful misconduct or bad faith of the indemnified person or entity.

Certain Anti-Takeover Provisions of our

Charter and Bylaws

Our Charter provides that our board of directors

is classified into three classes of directors. As a result, in most circumstances, a person can gain control of our board only

by successfully engaging in a proxy contest at three or more annual meetings.

Our authorized but unissued Common Stock

and preferred stock are available for future issuances without stockholder approval and could be utilized for a variety of corporate

purposes, including future offerings to raise additional capital, acquisitions and employee benefit plans. The existence of authorized

but unissued and unreserved Common Stock and preferred stock could render more difficult or discourage an attempt to obtain control

of us by means of a proxy contest, tender offer, merger or otherwise.

Exclusive

forum for certain lawsuits. Our Charter requires, to the fullest extent permitted by law, other than any claim to

enforce a duty or liability created by the Exchange Act or any other claim for which federal courts have exclusive jurisdiction,

that derivative actions brought in our name, actions against directors, officers and employees for breach of fiduciary duty and

other similar actions may be brought only in the Court of Chancery in the State of Delaware and, if brought outside of the State

of Delaware, the stockholder bringing such suit will be deemed to have consented to service of process on such stockholder’s

counsel. Although we believe these provisions benefit us by providing increased consistency in the application of Delaware law

in the types of lawsuits to which it applies, the provisions may have the effect of discouraging lawsuits against our directors

and officers. In addition, the federal district courts of the United States of America shall be the exclusive forum for the resolution

of any complaint asserting a cause of action arising under the Securities Act.

Special

meeting of stockholders. Our Amended and Restated Bylaws (our “Bylaws”) provide that special meetings

of our stockholders may be called only by a majority vote of our board of directors, by our Chief Executive Officer or by our chairman.

Advance

notice requirements for stockholder proposals and director nominations. Our Bylaws provide that stockholders seeking

to bring business before our annual meeting of stockholders, or to nominate candidates for election as directors at our annual

meeting of stockholders must provide timely notice of their intent in writing. To be timely, a stockholder’s notice must

be received by the secretary to our principal executive offices not later than the close of business on the 90th day nor earlier

than the opening of business on the 120th day prior to the scheduled date of the annual meeting of stockholders. If our annual

meeting is called for a date that is not within 45 days before or after such anniversary date, a stockholder’s notice must

be received no earlier than the opening of business on the 120th day before the meeting and not later than the later of (x) the

close of business on the 90th day before the meeting or (y) the close of business on the 10th day following the day on which we

first publicly announce the date of the annual meeting. Our Bylaws also specify certain requirements as to the form and content

of a stockholder’s notice for an annual meeting. Specifically, a stockholder’s notice must include: (i) a brief description

of the business desired to be brought before the annual meeting, the text of the proposal or business and the reasons for conducting

such business at the annual meeting, (ii) the name and record address of such stockholder and the name and address of the beneficial

owner, if any, on whose behalf the proposal is made, (iii) the class or series and number of shares of our capital stock owned

beneficially and of record by such stockholder and by the beneficial owner, if any, on whose behalf the proposal is made, (iv)

a description of all arrangements or understandings between such stockholder and the beneficial owner, if any, on whose behalf

the proposal is made and any other person or persons (including their names) in connection with the proposal of such business by

such stockholder, (v) any material interest of such stockholder and the beneficial owner, if any, on whose behalf the proposal

is made in such business and (vi) a representation that such stockholder intends to appear in person or by proxy at the annual

meeting to bring such business before such meeting. These notice requirements will be deemed satisfied by a stockholder as to any

proposal (other than nominations) if the stockholder has notified us of such stockholder’s intention to present such proposal

at an annual meeting in compliance with Rule 14a-8 of the Exchange Act, and such stockholder has complied with the requirements

of such rule for inclusion of such proposal in the proxy statement we prepare to solicit proxies for such annual meeting. Pursuant

to Rule 14a-8 of the Exchange Act, proposals seeking inclusion in our annual proxy statement must comply with the notice periods

contained therein. The foregoing provisions may limit our stockholders’ ability to bring matters before our annual meeting

of stockholders or from making nominations for directors at our annual meeting of stockholders.

Registration Rights

On July 1, 2020, we entered into the A&R

Registration Rights Agreement, which provides certain stockholders, including the selling stockholders named herein, with customary

registration rights with respect to (i) the shares of Class A Common Stock held by those parties at the closing of the Business

Combination or issuable upon the future exercise of private placement warrants or upon the future exchange of AdaptHealth Units

and shares of Class B Common Stock, (ii) the private placement warrants held by these parties, in each case held by them at the

closing of the Business Combination, (iii) such shares of Class A Common Stock issued to the OEP Purchaser in the OEP Investment,

and (iv) all shares of Class A Common Stock issued upon conversion of the Series A Preferred Stock and the shares of Class A Common

Stock issuable upon conversion of the Series B-1 Preferred Stock issued upon conversion of the Series B-2 Preferred Stock to Deerfield

Partners in the Deerfield Investment (collectively, “Registrable Securities”). The Registrable Securities also included

12,500,000 shares of Class A Common Stock issued in connection with the closing of the Business Combination. Our Sponsor was dissolved

on January 17, 2020, and its rights associated with equity securities of the Company were distributed to its members.

Pursuant to the A&R Registration Rights

Agreement, we agreed to file a registration statement under the Securities Act registering the resale of all of the Registrable

Securities. In addition, (i) certain holders of Registrable Securities may request such number of long-form registrations as provided

in the A&R Registration Rights Agreement, pursuant to which we would pay all registration expenses only if the aggregate market

price of Registrable Securities included exceeds $20 million, and (ii) certain holders of Registrable Securities may request an

unlimited number of short-form registrations, provided that we are not required to pay the expenses of any short-form registration

if the holders propose to include Registrable Securities with an aggregate market price of less than $5 million. The holders of

Registrable Securities also have certain “piggy-back” rights with respect to underwritten offerings initiated by us

or other of our stockholders.

Except as set forth above, we are required

to bear all expenses incurred in connection with the filing of any such registration statements and any such offerings, other than

underwriting discounts and commissions on the sale of Registrable Securities and the fees and expenses of counsel to holders of

Registrable Securities. The A&R Registration Rights Agreement also included customary provisions regarding indemnification

and contribution.

The A&R Registration Rights Agreement

also provides that, subject to certain exceptions, if requested by the managing underwriter(s), in connection with any underwritten

public offering, each holder that beneficially owns 1% or more of the outstanding Class A Common Stock will enter into a lock-up

agreement with the managing underwriter(s) of such underwritten public offering in such form as agreed to by such managing underwriter(s).

We are registering the resale of the

80,479,526 shares of Class A Common Stock on the registration statement of which this prospectus forms a part pursuant to the

A&R Registration Rights Agreement.

In connection with the entry into the Merger

Agreement, we entered into an amendment to the A&R Registration Rights Agreement, pursuant to which, among other things, the

stockholders of AeroCare receiving Class A Common Stock and Series C Preferred Stock pursuant to the Merger Agreement and that

deliver a joinder to the A&R Registration Rights Agreement to the Company, effective as of the closing of the AeroCare Acquisition,

will be provided with certain registration rights with respect to the shares of Class A Common Stock and the shares of Class A

Common Stock issuable upon conversion (subject to the terms and conditions of the certificate of designations relating thereto)

of the Series C Preferred Stock to be issued pursuant to the Merger Agreement.

Quotation of Securities

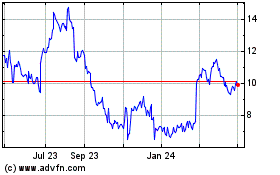

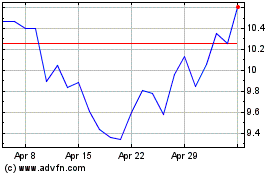

Our Class A Common Stock is listed on Nasdaq

and trades under the symbol “AHCO”.

DESCRIPTION OF DEBT

SECURITIES

We may issue debt securities from time to

time, in one or more series. The paragraphs below describe the general terms and provisions of the debt securities we may offer

under this prospectus. When we offer to sell a particular series of debt securities, we will describe the specific terms of the

securities in a prospectus supplement, including any additional covenants or changes to existing covenants relating to such series.

The prospectus supplement also will indicate whether the general terms and provisions described in this prospectus apply to a particular

series of debt securities.

If we issue debt securities at a discount

from their principal amount, then, for purposes of calculating the aggregate initial offering price of the offered securities issued

under this prospectus, we will include only the initial offering price of the debt securities and not the principal amount of the

debt securities.

We have summarized below the material provisions

of the indenture that will govern debt securities that we may issue, or indicated which material provisions will be described in

the related prospectus supplement. The prospectus supplement relating to any particular securities offered will describe the specific

terms of the securities, which may be in addition to or different from the general terms summarized in this prospectus. We have

included the form of the indenture as an exhibit to our registration statement of which this prospectus is a part, and it is incorporated

herein by reference. Because the summary in this prospectus and in any applicable prospectus supplement does not contain all of

the information that you may find useful, you should read the documents relating to the securities that are described in this prospectus

or in any applicable prospectus supplement. These documents will be filed as an exhibit to the registration statement of which

this prospectus forms a part or will be incorporated by reference from another report that we file with the SEC. See “Where

You Can Find More Information.” References to an “indenture” are references to the indenture, including any applicable

supplemental indenture, under which a particular series of debt securities is issued.

General

The indenture:

|

|

·

|

does not limit the amount of debt securities that we may issue;

|

|

|

·

|

allows us to issue debt securities in one or more series;

|

|

|

·

|

does not require us to issue all of the debt securities of a series at the same time; and

|

|

|

·

|

allows us to reopen a series to issue additional debt securities without the consent of the holders of the debt securities

of such series.

|

The prospectus supplement for each offering

of debt securities will provide the following terms, where applicable:

|

|

·

|

the title of the debt securities and whether they are senior, senior subordinated or subordinated debt securities;

|

|

|

·

|

the aggregate principal amount of the debt securities being offered and any limit on their aggregate principal amount, and,

if the series is to be issued at a discount from its face amount, the method of computing the accretion of such discount;

|

|

|

·

|

the price at which the debt securities will be issued, expressed as a percentage of the principal and, if other than the full

principal amount thereof, the portion of the principal amount thereof payable upon declaration of acceleration of the maturity

thereof or, if applicable, the portion of the principal amount of such debt securities that is convertible into common stock or

preferred stock or the method by which any such portion shall be determined;

|

|

|

·

|

if convertible, the terms on which such debt securities are convertible, including the initial conversion price or rate or

the method of calculation, how and when the conversion price or exchange ratio may be adjusted, whether conversion or exchange

is mandatory, at the option of the holder or at our option, the conversion or exchange period, and any other provision in relation

thereto, and any applicable limitations on the ownership or transferability of common stock or preferred stock received on conversion;

|

|

|

·

|

the date or dates, or the method for determining the date or dates, on which the principal of the debt securities will be payable;

|

|

|

·

|

the fixed or variable interest rate or rates of the debt securities, or the method by which the interest rate or rates is determined;

|

|

|

·

|

the date or dates, or the method for determining the date or dates, from which interest will accrue;

|

|

|

·

|

the dates on which interest will be payable;

|

|

|

·

|

the record dates for interest payment dates, or the method by which we will determine those dates;

|

|

|

·

|

the persons to whom interest will be payable;

|

|

|

·

|

the basis upon which interest will be calculated if other than that of a 360-day year of twelve 30-day months;

|

|

|

·

|

any collateral securing the performance of our obligations under the debt securities;

|

|

|

·

|

the place or places where the principal of, premium, if any, and interest on, the debt securities will be payable;

|

|

|

·

|

where the debt securities may be surrendered for registration of transfer or conversion or exchange;

|

|

|

·

|

where notices or demands to or upon us in respect of the debt securities and the applicable indenture may be served;

|

|

|

·

|

any provisions regarding our right to redeem or purchase debt securities or the right of holders to require us to redeem or

purchase debt securities;

|

|

|

·

|

any right or obligation we have to redeem, repay or purchase the debt securities pursuant to any sinking fund or analogous

provision;

|

|

|

·

|

the currency or currencies (including any composite currency) in which the debt securities are denominated and payable if other

than United States dollars, and the currency or currencies (including any composite currency) in which principal, premium, if any,

and interest, if any, will be payable, and if such payments may be made in a currency other than that in which the debt securities

are denominated, the manner for determining such payments, including the time and manner of determining the exchange rate between

the currency in which such securities are denominated and the currency in which such securities or any of them may be paid, and

any additions to, modifications of or deletions from the terms of the debt securities to provide for or to facilitate the issuance

of debt securities denominated or payable in a currency other than U.S. dollars;

|

|

|

·

|

whether the amount of payments of principal of, premium, if any, or interest on, the debt securities may be determined according

to an index, formula or other method and how such amounts will be determined;

|

|

|

·

|

whether the debt securities will be in registered form, bearer form or both, and the terms of these forms;

|

|

|

·

|

whether the debt securities will be issued in whole or in part in the form of a global security and, if applicable, the identity

of the depositary for such global security;

|

|

|

·

|

any provision for electronic issuance of the debt securities or issuance of the debt securities in uncertificated form;

|

|

|

·

|

whether and upon what terms the debt securities of such series may be defeased or discharged, if different from the provisions

set forth in the indenture for the series to which the supplemental indenture or authorizing resolution relates;

|

|

|

·

|

any provisions granting special rights to holders of securities upon the occurrence of such events as specified in the applicable

prospectus supplement;

|

|

|

·

|

any deletions from, modifications of, or additions to our events of default or covenants or other provisions set forth in the

indenture for the series to which the supplemental indenture or authorizing resolution relates; and

|

|

|

·

|

any other material terms of the debt securities, which may be different from the terms set forth in this prospectus.

|

Events of Default

Unless the applicable prospectus supplement

states otherwise, when we refer to “events of default” as defined in the indenture with respect to any series of debt

securities, we mean:

|

|

·

|

our failure to pay interest on any debt security of such series when the same becomes due and payable and the continuance of

any such failure for a period of 30 days;

|

|

|

·

|

our failure to pay the principal or premium of any debt security of such series when the same becomes due and payable at maturity,

upon acceleration, redemption or otherwise;

|

|

|

·

|

our failure or the failure of any restricted subsidiary to comply with any of its agreements or covenants in, or provisions

of, the debt securities of such series or the indenture (as they relate thereto) and such failure continues for a period of 90

days after our receipt of notice of the default from the trustee or from the holders of at least 25 percent in aggregate principal

amount of the then outstanding debt securities of that series (except in the case of a default with respect to the provisions of

the indenture regarding the consolidation, merger, sale, lease, conveyance or other disposition of all or substantially all of

the assets of us (or any other provision specified in the applicable supplemental indenture or authorizing resolution), which will

constitute an event of default with notice but without passage of time); or

|

|

|

·

|

certain events of bankruptcy, insolvency or reorganization occur with respect to the Company or any restricted subsidiary of

the Company that is a significant subsidiary (as defined in the indenture).

|

If an event of default occurs and is continuing

with respect to debt securities of any series outstanding, then the trustee or the holders of 25% or more in principal amount of

the outstanding debt securities of that series will have the right to declare the principal amount of all the debt securities of

that series to be due and payable immediately. However, the holders of at least a majority in principal amount of outstanding debt

securities of such series may rescind and annul such declaration and its consequences, except an acceleration due to nonpayment

of principal or interest on such series, if the rescission would not conflict with any judgment or decree and if all existing events

of default with respect to such series have been cured or waived.

The indenture also provides that the holders

of at least a majority in principal amount of the outstanding debt securities of any series, by notice to the trustee, may, on

behalf of all holders, waive any existing default and its consequences with respect to such series of debt securities, other than

any event of default in payment of principal or interest.

The indenture will require the trustee to

give notice to the holders of debt securities within 90 days after the trustee obtains knowledge of a default that has occurred

and is continuing. However, the trustee may withhold notice to the holders of any series of debt securities of any default, except

a default in payment of principal or interest, if any, with respect to such series of debt securities, if the trustee considers

it in the interest of the holders of such series of debt securities to do so.

The holders of a majority of the outstanding

principal amount of the debt securities of any series will have the right to direct the time, method and place of conducting any

proceedings for any remedy available to the trustee with respect to such series, subject to limitations specified in the indenture.

Modification, Amendment, Supplement

and Waiver

Without notice to or the consent of any

holder of any debt security, we and the trustee may modify, amend or supplement the indenture or the debt securities of a series:

|

|

·

|

to cure any ambiguity, omission, defect or inconsistency;

|

|

|

·

|

to comply with the provisions of the indenture regarding the consolidation, merger, sale, lease, conveyance or other disposition

of all or substantially all of our assets;

|

|

|

·

|

to provide that specific provisions of the indenture shall not apply to a series of debt securities not previously issued or

to make a change to specific provisions of the indenture that only applies to any series of debt securities not previously issued

or to additional debt securities of a series not previously issued;

|

|

|

·

|

to create a series and establish its terms;

|

|

|

·

|

to provide for uncertificated debt securities in addition to or in place of certificated debt securities;

|

|

|

·

|

to release a guarantor in respect of any series which, in accordance with the terms of the indenture applicable to such series,

ceases to be liable in respect of its guarantee;

|

|

|

·

|

to add a guarantor subsidiary in respect of any series of debt securities;

|

|

|

·

|

to secure any series of debt securities;

|

|

|

·

|

to add to the covenants of the Company for the benefit of the holders or surrender any right or power conferred upon the Company;

|

|

|

·

|

to appoint a successor trustee with respect to the securities;

|

|

|

·

|

to comply with requirements of the SEC in order to effect or maintain the qualification of the indenture under the Trust Indenture

Act of 1939, as amended;

|

|

|

·

|

to make any change that does not adversely affect the rights of holders in any material respect; or

|

|

|

·

|

to conform the provisions of the indenture to the final offering document in respect of any series of debt securities.

|

The indenture will provide that we and the

trustee may modify, amend, supplement or waive any provision of the debt securities of a series or of the indenture relating to

such series with the written consent of the holders of at least a majority in principal amount of the outstanding debt securities

of such series. However, without the consent of each holder of a debt security the terms of which are directly modified, amended,

supplemented or waived, a modification, amendment, supplement or waiver may not:

|

|

·

|

reduce the amount of debt securities of such series whose holders must consent to a modification, amendment, supplement or

waiver;

|

|

|

·

|

reduce the rate of or extend the time for payment of interest, including defaulted interest;

|

|

|

·

|

reduce the principal of or extend the fixed maturity of any debt security or alter the provisions with respect to redemptions

or mandatory offers to repurchase debt securities of a series in a manner adverse to holders;

|

|

|

·

|

make any change that adversely affects any right of a holder to convert or exchange any debt security into or for shares of

our common stock or other securities, cash or other property in accordance with the terms of such security;

|

|

|

·

|

modify the ranking or priority of the debt securities of the relevant series;

|

|

|

·

|

release any guarantor of any series from any of its obligations under its guarantee or the indenture otherwise than in accordance

with the terms of the indenture;

|

|

|

·

|

make any change to any provision of the indenture relating to the waiver of existing defaults, the rights of holders to receive

payment of principal and interest on the debt securities, or to the provisions regarding amending or supplementing the indenture

or the debt securities of a particular series with the written consent of the holders of such series, except to increase the percentage

required for modification or waiver or to provide for consent of each affected holder of debt securities of such series;

|

|

|

·

|

waive a continuing default or event of default in the payment of principal of or interest on the debt securities; or

|

|

|

·

|

make any debt security payable at a place or in money other than that stated in the debt security, or impair the right of any

holder of a debt security to bring suit as permitted by the indenture.

|

The holders of a majority in aggregate principal

amount of the outstanding debt securities of such series may, on behalf of all holders of debt securities of that series, waive

any existing default under, or compliance with, any provision of the debt securities of a particular series or of the indenture

relating to a particular series of debt securities, other than any event of default in payment of interest or principal.

Defeasance

The indenture will permit us to terminate

all our respective obligations under the indenture as they relate to any particular series of debt securities, other than the obligation

to pay interest, if any, on and the principal of the debt securities of such series and certain other obligations, at any time

by:

|

|

·

|

depositing in trust with the trustee, under an irrevocable trust agreement, money or government obligations in an amount sufficient

to pay interest, if any, on and the principal of the debt securities of such series to their maturity or redemption; and

|

|

|

·

|

complying with other conditions, including delivery to the trustee of an opinion of counsel to the effect that holders will

not recognize income, gain or loss for federal income tax purposes as a result of our exercise of such right and will be subject

to federal income tax on the same amount and in the same manner and at the same times as would have been the case otherwise.

|

The indenture will also permit us to terminate

all of our respective obligations under the indenture as they relate to any particular series of debt securities, including the

obligations to pay interest, if any, on and the principal of the debt securities of such series and certain other obligations,

at any time by:

|

|

·

|

depositing in trust with the trustee, under an irrevocable trust agreement, money or government obligations in an amount sufficient

to pay interest, if any, on and the principal of the debt securities of such series to their maturity or redemption; and

|

|

|

·

|

complying with other conditions, including delivery to the trustee of an opinion of counsel to the effect that (A) we have

received from, or there has been published by, the Internal Revenue Service a ruling, or (B) since the date such series of debt

securities were originally issued, there has been a change in the applicable federal income tax law, in either case to the effect

that, and based thereon such opinion of counsel shall state that, holders will not recognize income, gain or loss for federal income

tax purposes as a result of our exercise of such right and will be subject to federal income tax on the same amount and in the

same manner and at the same times as would have been the case otherwise.

|

In addition, the indenture will permit us

to terminate substantially all our respective obligations under the indenture as they relate to a particular series of debt securities

by depositing with the trustee money or government obligations sufficient to pay all principal of and interest on such series at

its maturity or redemption date if the debt securities of such series will become due and payable at maturity within one year or

are to be called for redemption within one year of the deposit.

Transfer and Exchange

A holder will be able to transfer or exchange

debt securities only in accordance with the indenture. The registrar may require a holder, among other things, to furnish appropriate

endorsements and transfer documents, and to pay any taxes and fees required by law or permitted by the indenture.

Concerning the Trustee

The indenture will contain limitations on

the rights of the trustee, should it become our creditor, to obtain payment of claims in specified cases or to realize on property

received in respect of any such claim as security or otherwise. The indenture will permit the trustee to engage in other transactions;

however, if the trustee acquires any conflicting interest, it must eliminate such conflict or resign.

No Recourse Against Others

The indenture will provide that there is

no recourse under any obligation, covenant or agreement in the applicable indenture or with respect to any debt security against

any of our or our successor’s past, present or future stockholders, employees, officers or directors.

Governing Law

The laws of the State of New York will govern

the indenture and the debt securities.

DESCRIPTION OF WARRANTS

General

We may issue warrants for the purchase of

common stock, preferred stock and/or debt securities in one or more series, from time to time. We may issue warrants independently

or together with Class A Common Stock, preferred stock and/or debt securities, and the warrants may be attached to or separate

from those securities. The warrants issuable by us may be convertible into or exchangeable for Class A Common Stock.

If we issue warrants, they will be evidenced

by warrant agreements or warrant certificates issued under one or more warrant agreements, which are contracts between us and an

agent for the holders of the warrants. We urge you to read the prospectus supplement and any free writing prospectus related to

any series of warrants we may offer, as well as the complete warrant agreement and warrant certificate that contain the terms of

the warrants. If we issue warrants, forms of warrant agreements and warrant certificates relating to warrants for the purchase

of Class A Common Stock, preferred stock and debt securities will be incorporated by reference into the registration statement

of which this prospectus is a part from reports we would subsequently file with the SEC.

Private Placement Warrants

The selling securityholders may also sell

private placement warrants pursuant to this prospectus. Each whole private placement warrant entitles the registered holder to

purchase one share of our Class A Common Stock at a price of $11.50 per share, subject to adjustment as discussed below. This means

that only a whole private placement warrant may be exercised at any given time by a warrant holder. For example, if a warrant holder

holds one-third of one private placement warrant, such private placement warrant will not be exercisable. The private placement

warrants will expire five years after the date on which they first became exercisable, at 5:00 p.m., New York time, or earlier

upon redemption or liquidation.

Redemption of private placement warrants

The private placement warrants will not

be redeemable by us so long as they are held by the Sponsor or its permitted transferees. If the private placement warrants are

held by holders other than the Sponsor or its permitted transferees, the private placement warrants will be redeemable by us and

exercisable by the holders as described below.

We will not be obligated to deliver any

shares of Class A Common Stock pursuant to the exercise of a private placement warrant and will have no obligation to settle such

private placement warrant exercise unless a registration statement under the Securities Act with respect to the shares of Class

A Common Stock underlying the private placement warrants is then effective and a prospectus relating thereto is current, subject

to our satisfying our obligations described below with respect to registration. No private placement warrant will be exercisable

and we will not be obligated to issue shares of Class A Common Stock upon exercise of a private placement warrant unless Class

A Common Stock issuable upon such private placement warrant exercise has been registered, qualified or deemed to be exempt under

the securities laws of the state of residence of the registered holder of the private placement warrants. In the event that the

conditions in the two immediately preceding sentences are not satisfied with respect to a private placement warrant, the holder