Form 8-K - Current report

February 02 2024 - 4:16PM

Edgar (US Regulatory)

false000168006200016800622024-01-262024-01-26

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 26, 2024

ACM Research, Inc.

(Exact Name of Registrant as Specified in its Charter)

|

Delaware

|

001-38273

|

94-3290283

|

|

(State or Other Jurisdiction of Incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

42307 Osgood Road, Suite I

|

|

|

|

Fremont, California

|

|

94539

|

|

(Address of Principal Executive Offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (510) 445-3700

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading symbol

|

|

Name of each exchange on which registered

|

|

Class A Common Stock, par value $0.0001 per share

|

|

ACMR

|

|

The Nasdaq Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined

in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934: Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to

use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The shares of our operating subsidiary ACM Research (Shanghai), Inc. (“ACM Shanghai”) are

listed on the Sci-Tech innovation board (the “STAR Market”) of the Shanghai Stock Exchange (the “SSE”). In accordance with the SSE’s rules governing the STAR Market, ACM

Shanghai filed with the SSE a Record of January 2024 Investor Relations Activity (the “Record”). The SSE posted the Record to the SSE’s website on January 26, 2024. A copy of the Record is attached as Exhibit 99.1 hereto.

| Item 9.01 |

Financial Statements and Exhibits.

|

(d) Exhibits.

|

Exhibit

|

|

Description

|

|

|

|

Record of January 2024 Investor Relations Activity filed by ACM Research (Shanghai), Inc. with the Shanghai Stock Exchange on January 26, 2024

|

|

104

|

|

Cover Page Interactive Data File (embedded within the XBRL document)

|

* Unofficial English translation of original document prepared in Mandarin Chinese.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto

duly authorized.

| |

ACM RESEARCH, INC.

|

| |

|

|

| |

By:

|

/s/ Mark McKechnie

|

|

| |

|

Mark McKechnie

|

| |

|

Chief Financial Officer and Treasurer

|

| |

|

|

|

Dated: February 2, 2024

|

|

|

3

Exhibit 99.1

|

Stock Code: 688082

|

Short Name: ACMSH

|

ACM Research (Shanghai), Inc.

Record of Investor Relations Activities

No.: 2024-01

|

Categories of investor relations activities

|

☐Specific object survey

|

√Analyst meeting

|

|

☐Media interview

|

☐Performance briefing

|

|

☐Press conference

|

☐Roadshow

|

|

☐Site visit

|

☐Others

|

|

Date

|

January 26, 2024

|

|

Venue

|

Conference call

|

|

Participants of the listed company

|

Chairman: HUI WANG

General Manager: JIAN WANG

Person in Charge of Financial Matters: LISA YI LU FENG

Board Secretary: MINGZHU LUO

|

|

Summary of investor relations activities

|

I. Company Introduction: Leaders of ACM

Research (Shanghai), Inc. (the “Company”) gave a brief introduction to the Company’s current business development and operating performance and answered questions of concern from investors.

II. Q&A

1. Is the Company’s “R&D and Process Test Platform Program” primarily targeted at Track?

A: The Company’s current product range includes cleaning equipment, copper plating equipment, furnace equipment, PECVD, and Track, among

others. Our aim is to conduct combined and coherent testing across multiple products. The process begins with the silicon wafer being cleaned, then coated using the furnace tube and PECVD. This is followed by integration with the lithography

equipment through Track, which includes coating, exposure, and development steps. Next, the product undergoes dry etching in the experimental line’s etching system, and then stripping photoresist and cleaning. We are also equipped with SP7

particle detectors and other measurement equipment to test and verify each process step. The aim of this program is to synergize our five major products within a single line, mirroring inline testing conditions of a production line. This

approach is designed to accelerate the development and validation of various types of equipment, thereby shortening the time needed for testing and verification by the customer.

|

| |

2. What factors does the Company consider when selecting a lithography model?

A: In purchasing lithography equipment, our priority is not necessarily to choose the most advanced model. The KrF-line is our primary target,

but the final model to be selected, whether domestic or international, has not yet been determined. The primary reasons for selecting the KrF-line include: 1) We believe the KrF-line Track equipment represents the largest market opportunity

because it encompasses the most process steps, including both advanced and mature processes; 2) A certain foreign company is expected to launch next generation 400WPH KrF-line lithography equipment by the end of 2024, which requires Track

systems that can support a high throughput rate of 450WPH; 3) The 300WPH KrF-line model of our Track equipment was our initial Track product, and this year we also plan to develop immersion-type ArF Track equipment. Therefore, our strategy is

to start with KrF-line and 300WPH, and then gradually develop 400WPH models. In addition, our Track equipment is targeted not only to solve the issue of localization but also to enter the global market.

|

| |

3. Could you please provide a description of the Company’s high-end semiconductor equipment iterative R&D program?

A: Regarding cleaning equipment, as of the end of last year, the Company estimates it has successfully addressed 95% of the cleaning process

steps. Our range of cleaning equipment includes single wafer front-end, single wafer back-end, edge etching, single wafer high-temperature sulfuric acid, Tahoe single wafer-wet bench combined cleaning, megasonic cleaning, advanced IPA drying

technology, supercritical CO2 cleaning and other products, offering extensive process coverage.

Our focus is on enhancing and making our products more practical. Our goal is to not only dominate the Chinese market but also to be widely

adopted in the global market. To achieve this, the Company intends to continue to increase its investment in the R&D of cleaning equipment.

Additionally, in the realm of PECVD, we have our own differentiated design. Unlike the industry's existing designs of “one chamber with four

chucks” and “one chamber with two chucks”, the Company adopts a unique “one chamber with three chucks” design. This allows us to combine the advantages of both designs and to implement various PECVD processes on the same platform. Our

chamber's internal design, for which we have independent intellectual property rights, effectively improves film uniformity and stress control while reducing particle contamination. This year, we expect to add 3 to 5 more strategic core

customers.

|

|

|

4. Could you share with us the specific progress of the Company’s several important overseas customers?

A: 1) A major U.S. customer has provided positive feedback on our products, and we expect to have a greater chance to receive repeat orders

from it; 2) The equipment for a European customer was delivered last September, and its installation is progressing smoothly. We expect future repeat orders from this customer following the verification of this equipment; 3) The Company is

also focusing on developing major customers in Singapore and its surrounding areas. As Singapore is expected to become a semiconductor hotspot, we are closely following this market; 4) In the Taiwan market, we have been actively expanding,

particularly in electroplating equipment, where several customers are using our products. This area is expected to be a highlight for the Company in the future; 5) In South Korea, SK Hynix has been our customer since 2011. We are currently

cooperating in various areas, not only limited to cleaning equipment, but also actively promoting cooperation in other existing products.

To sum up, we believe the Company has achieved notable progress in its internationalization efforts over recent years. The coming year and the

next are pivotal for us. We aim to take the lead in introducing our cleaning and electroplating equipment to the market. After their successful verification in China, we plan to launch furnace tube equipment, ALD, PECVD, and Track to the

international markets.

5. Could you provide an update on the progress and plans for the Company’s current products in high-end applications?

A: In high-end applications, the Company has already achieved mass production of cleaning and electroplating equipment and has secured

multiple batch orders. As for electroplating equipment, our production line is capable of meeting customer demands. Regarding furnace tube equipment, Track, and PECVD, the furnace tube equipment has shown relatively rapid progress,

primarily due to the successful development of ALD. ALD is currently in the production verification phase with our customers. We expect an increase in customer numbers for this equipment throughout this year.

|

| |

6. Regarding PECVD, is the Company's current development direction focused on areas unexplored by competitors or more

towards advanced processing and memory applications? How does the Company plan to capture a significant market share in areas where competitors have already established themselves? What is the strategy for gaining a better market share in

areas where competitors are present but not excelling?

A: While developing PECVD, the Company is also positioning its own products. Currently, there are two main designs for PECVD products both

domestically and internationally. The Company’s differentiated design advantage allows for the realization of processes mastered by two major foreign companies with only minor modifications on the same platform, thus meeting comprehensive

customer process needs. Therefore, a major benefit is that in the future, we expect customers will be able to achieve almost all PECVD processes with just one platform.

Additionally, targeting mid-to-high-end process applications, including both logic and memory, is a goal for the Company. The main challenges

in PECVD lie in film uniformity, film stress and particle characteristics. Our core design focuses heavily on these aspects, which will be our competitive edge and product strength moving forward. The Company has already established a global

IP layout in these areas. After development and verification in China, this equipment is expected to be introduced to the international market. These differentiated features provide the Company confidence to compete with global giants in the

market.

|

| |

7. Could you update us on the Company’s current strategy and progress in advanced packaging equipment?

A: The Company has been strategically engaged in advanced packaging equipment for quite some time. Around 2013 and 2014, we started the

development of cleaning, coating and developing equipment. We believe we are the company with the most comprehensive range of advanced packaging wet process equipment in the world. Our products, including cleaning, wet etching, coating,

developing, stripping, electroplating and polishing equipment (such as electropolishing), having been utilized in major production lines by customers.

8. With the Company offering a comprehensive range of equipment in its advanced packaging layout, which type of equipment

is currently making the fastest progress?

A: In advanced packaging, our primary focus is on cooperation with international customers. In the next 5 to 10 years, we believe advanced

packaging will become increasingly important in the chip industry, with its depth, dimensions and technical challenges all escalating. The Company’s future strategy includes significantly increasing our R&D investment in advanced

packaging equipment and expanding our market outreach. A key direction for our international market development will be introducing our copper-plating equipment into global markets such as South Korea, Taiwan, the U.S., and Europe.

|

|

|

9. What is the forecast for the sales of semiconductor equipment in the Chinese and overseas markets for 2024? What level

of new orders is expected for the Company? What is the leadership’s view on the forecast that the growth rate of orders will slow down after 2025?

A: We believe that China’s semiconductor chip industry is still in a multi-year expansion period driven by huge market demand. And we believe that there will be a market for middle-to-high-end products as long as they can be effectively produced. With the expansion of product lines by enterprises, we see potential for further

development. Thus, if Chinese companies continue to advance technology, we expect that the Chinese market, much like the international market, will continue its growth trajectory in the coming years.

10. Does the Company have any specific targets for orders in 2024?

A: We are optimistic about the outlook for 2024 and believe that the Chinese market will perform better than last year. We are confident in

the Chinese market’s development over the next few years. We expect to launch our furnace tube products in 2024, and to introduce our Track and PECVD products in 2025. These launches are part of our strategy to support growth over the next 5

to 8 years. Our current strategic goal is to achieve a balanced distribution of 50% in domestic sales and 50% in overseas sales long-term. This target is set with the aim of positioning the Company among the top tier of global semiconductor

equipment providers.

|

Encl.: List of Participants

Ariose Capital

Cyber Atlas

JP Morgan

lygh capital

Panview Capital

Point 72

Torito Capital

Essence Fund Management

Banyan Partners

Bosera Asset Management

Oriental Alpha Fund

Orient Fund

Founder Securities Equity

Founder Proprietary

Fullerton Fund Management

ICBC Credit Suisse Asset Management

GF Fund Management

GF Securities

CPIC Fund Management

China Life Asset Management

Guotai Fund

Haitong Securities

Broad Vision Investment

Orient Semiconductor Electronics Ltd.

Huatai Securities

China Asset Management

Huian Fund

HSBC Jintrust

HSBC Jintrust Fund Management

Harvest Fund Management

CCB Principal Asset Management

Eureka Investment

Jingshun Great Wall Fund

StillBrook Capital

Minsheng Jiayin Fund

China Southern Asset Management

Lion Fund

Cephei Capital Management

Samsung Asset Management

China International Fund Management

Tenbagger Capital Management

Taiping Assets Management

Xinhua Fund Management

Xinran Investment Management

Aegon-Industrial Fund

China Galaxy Securities Proprietary

Yinhua Fund Management

Yong Rong Asset Management

Golden Trust Sinopac Fund Management

Great Wall Fund Management

Chang Xin Asset Management

ZoomTrend Investment Management

Zheshang Securities

China International Capital Corporation

Lombarda China Fund Management

Zhongtai Electronics

Zhongtai Securities

CSC Financial

CSC Financial

CSC Financial

CITIC Securities

China Post

China Post Fund

China Post Securities

Rosefinch Fund

* * *

The following information is provided in connection with the furnishing of the above Record of January 2024 Investor Relation Activity of ACM Research

(Shanghai), Inc. (“ACMSH”) (the “Record”) pursuant to the Current Report on Form 8-K reporting requirements of ACM Research, Inc.:

Forward-Looking Statements

Information presented in the Record includes forward-looking statements for purposes of the safe harbor provisions of the Private Securities Litigation Reform Act of

1995. All statements contained in the Record that do not relate to matters of historical fact should be considered forward-looking statements. Forward-looking statements are based on ACMSH management’s current expectations and beliefs, and involve a

number of risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from those stated or implied by the forward-looking statements. Those risks and uncertainties include, but are not limited to,

the following, any of which could be exacerbated even further by the continuing COVID-19 outbreak in China and globally: anticipated customer orders or identified market opportunities may not grow or develop as anticipated; customer orders already

received may be postponed or canceled; ACMSH may be unable to obtain the qualification and acceptance of its delivered tools when anticipated or at all, which would delay or preclude ACMSH’s recognition of revenue from the sale of those tools;

suppliers may not be able to meet ACMSH’s demands on a timely basis; ACMSH’s technologies and tools may not gain market acceptance; ACMSH may be unable to compete effectively by, among other things, enhancing its existing tools, adding additional

production capacity and engaging additional major customers; ACMSH may incur significant expenses long before it can recognize revenue from new products, if at all, due to the costs and length of research, development, manufacturing and customer

evaluation process cycles; volatile global economic, market, industry and other conditions could result in sharply lower demand for products containing semiconductors and for ACMSH’s products and in disruption of capital and credit markets; ACMSH’s

failure to successfully manage its operations, including its inability to hire, train, integrate and manage additional qualified engineers for research and development activities; and trade regulations, including those recently published by the U.S.

Department of Commerce imposing certain restrictions on equipment shipments and business practices with China-based semiconductor manufacturers, currency fluctuations, political instability and war, all of which may materially adversely affect ACMSH

due to its substantial non-U.S. customer and supplier base and its substantial non-U.S. manufacturing operations. A further description of these risks, uncertainties and other matters can be found in filings ACM Research, Inc. makes with the U.S.

Securities and Exchange Commission. Because forward-looking statements involve risks and uncertainties, actual results and events may differ materially from results and events currently expected by ACMSH. ACMSH undertakes no obligation to publicly

update these forward-looking statements to reflect events or circumstances that occur after the date hereof or to reflect any change in its expectations with regard to these forward-looking statements or the occurrence of unanticipated events.

v3.24.0.1

Document and Entity Information

|

Jan. 26, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 26, 2024

|

| Entity File Number |

001-38273

|

| Entity Registrant Name |

ACM Research, Inc.

|

| Entity Central Index Key |

0001680062

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

94-3290283

|

| Entity Address, Address Line One |

42307 Osgood Road

|

| Entity Address, Address Line Two |

Suite I

|

| Entity Address, City or Town |

Fremont

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94539

|

| City Area Code |

510

|

| Local Phone Number |

445-3700

|

| Title of 12(b) Security |

Class A Common Stock, par value $0.0001 per share

|

| Trading Symbol |

ACMR

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

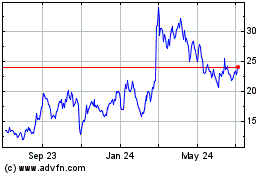

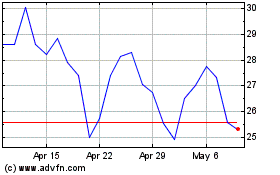

ACM Research (NASDAQ:ACMR)

Historical Stock Chart

From Mar 2024 to Apr 2024

ACM Research (NASDAQ:ACMR)

Historical Stock Chart

From Apr 2023 to Apr 2024