Accolade, Inc. (NASDAQ: ACCD), which provides personalized,

technology-enabled solutions that help people better understand,

navigate, and utilize the healthcare system and their workplace

benefits, today announced financial results for the fiscal second

quarter ended August 31, 2020.

“Accolade is built on the fundamental belief that we can improve

health outcomes for our members while at the same time lowering

total healthcare costs for their employers. While the current

COVID-19 crisis has exacerbated the challenges facing the

healthcare industry, our strong financial results and continuing

momentum demonstrate that we can achieve these objectives, even in

a difficult economic environment and healthcare crisis,” said

Rajeev Singh, Accolade CEO.

Mr. Singh continued, “Our dedicated frontline healthcare team is

a differentiator in the market and is responsible for our

incredible customer engagement and satisfaction. Their success is

underpinned by our innovative platform that allows us to flex our

capabilities to the needs of the market, as seen by the rapid

delivery of Accolade COVID Response Care last quarter and our

launch of Mental Health Integrated Care with our partner, Ginger,

announced last month. Our ability to innovate quickly is drawing

more partners to our platform and fueling our sales momentum across

all our customer segments. We are delighted to build on our success

in the first half of fiscal 2021 and raise our outlook for the full

year.”

Financial Highlights for Fiscal Second Quarter 2021

ended August 31, 2020

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended

August 31, |

|

|

% |

|

|

|

|

2020 |

|

2019 |

|

|

change(2) |

|

|

| |

(in millions, except percentages) |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

GAAP Financial Data: |

|

|

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

36.8 |

|

|

$ |

29.7 |

|

|

24 |

% |

|

| Net

loss |

$ |

(15.4 |

) |

|

$ |

(15.0 |

) |

|

(2 |

)% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-GAAP Financial

Data(1): |

|

|

|

|

|

|

|

|

|

|

|

| Adjusted

EBITDA |

$ |

(8.7 |

) |

|

$ |

(9.6 |

) |

|

9 |

% |

|

| Adjusted

Gross Profit |

$ |

15.9 |

|

|

$ |

13.0 |

|

|

23 |

% |

|

| Adjusted

Gross Margin |

|

43.3 |

% |

|

|

43.8 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1) A reconciliation of GAAP to non-GAAP results has

been provided in this press release in the accompanying Financial

Tables. An explanation of these measures is also included below

under the heading "Non-GAAP Financial Measures."

(2) Percentages are calculated from accompanying

Financial Tables and may differ from percentage change of numbers

in Financial Highlights table due to rounding.

Financial Outlook

Accolade provides forward-looking guidance on Revenue and

Adjusted EBITDA.

For the fiscal third quarter ending November 30, 2020, we

expect:

- Revenue between $36.0 million and

$37.0 million

- Adjusted EBITDA, a non-GAAP

measure, between $(12.0) million and $(14.0) million

For the full fiscal year ending February 28, 2021, we are

revising our initial guidance and now expect:

- Revenue between $159.0 million and

$162.0 million, up from our initial range of $158.0 to $161.0

million

- Adjusted EBITDA, a non-GAAP

measure, between $(32.0) million and $(36.0) million, unchanged

from our initial guidance.

We have not reconciled guidance for Adjusted EBITDA to net loss,

the most directly comparable GAAP measure, and have not provided

forward-looking guidance for net loss, because there are items that

may impact net loss, including stock-based compensation, that are

not within our control or cannot be reasonably predicted.

Quarterly Conference Call Details

The company will host a conference call today, Wednesday,

October 14, 2020 at 5:00 p.m. E.T. to discuss its financial

results. The call can be accessed by dialing 1-833-519-1281 for

U.S. participants, or 1-914-800-3853 for international

participants, referencing conference ID #9551629; or via a live

audio webcast that will be available online at

http://ir.accolade.com. A replay of the call will be available via

webcast for on-demand listening shortly after the completion of the

call, at the same web link, and will remain available for

approximately 90 days.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended,

and the Private Securities Litigation Reform Act of 1995, as

amended. These forward-looking statements include statements

regarding our future growth and our financial outlook.

Forward-looking statements are subject to risks and uncertainties

and are based on potentially inaccurate assumptions that could

cause actual results to differ materially from those expected or

implied by the forward-looking statements. Actual results may

differ materially from the results predicted, and reported results

should not be considered as an indication of future

performance.

Important risks and uncertainties that could cause our actual

results and financial condition to differ materially from those

indicated in the forward-looking statements include, among others,

the following: (i) changes in laws and regulations applicable to

our business model; (ii) changes in market or industry conditions,

regulatory environment and receptivity to our technology and

services; (iii) results of litigation or a security incident; (iv)

the loss of one or more key customers or partners; (v) the impact

of COVID-19 on our business and results of operation; and (vi)

changes to our abilities to recruit and retain qualified team

members. For a detailed discussion of the risk factors that could

affect our actual results, please refer to the risk factors

identified in our SEC reports, including, but not limited to our

prospectus filed with the SEC on July 1, 2020 and the Quarterly

Report on Form 10-Q for the fiscal quarter ended August 31, 2020

expected to be filed with the SEC on or about October 14, 2020. All

information provided in this release and in the attachments is as

of the date hereof, and we undertake no duty to update or revise

this information unless required by law.

About Accolade, Inc.

Accolade provides personalized health and benefits solutions

designed to empower every person to live their healthiest life.

Using a blend of cloud-based technologies, specialized support from

Accolade Health Assistants® and Clinicians, and integrated data and

programs across mobile, online and phone, Accolade navigates people

through the healthcare system with trust, empathy and ease.

Employers offer Accolade to employees and their families as the

single place to turn for all health, healthcare, and benefits

questions or concerns, increasing their engagement in benefits and

connecting them to high-quality providers and care. By empowering

members to make better decisions about their health, Accolade can

support members in lowering the cost and complexity of healthcare

while achieving consumer satisfaction ratings over 90 percent and

an NPS of 60.

Investor Contact:

Todd Friedman, Investor Relations, 484-532-5200,

Todd.Friedman@accolade.com

Asher Dewhurst, Investor Relations, 443-213-0500,

Accolade@westwicke.com

Media Contact:

Megan Torres, Public Relations, 206-679-9630,

Megan.Torres@accolade.com

Source: AccoladeFinancial Tables

|

|

|

Accolade, Inc. and Subsidiaries |

|

Condensed Consolidated Balance Sheets

(unaudited) |

|

(In thousands, except share and per share data) |

|

|

|

|

|

|

|

|

|

|

|

| |

August 31, |

|

|

February 29, |

|

|

Assets |

2020 |

|

|

2020 |

|

| Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

222,111 |

|

|

$ |

33,155 |

|

|

Accounts receivable, net |

|

10,661 |

|

|

|

294 |

|

|

Unbilled revenue |

|

109 |

|

|

|

895 |

|

|

Current portion of deferred contract acquisition costs |

|

1,709 |

|

|

|

1,368 |

|

|

Current portion of deferred financing fees |

|

233 |

|

|

|

279 |

|

|

Prepaid and other current assets |

|

8,014 |

|

|

|

12,944 |

|

|

Total current assets |

|

242,837 |

|

|

|

48,935 |

|

| Property and equipment,

net |

|

11,728 |

|

|

|

13,625 |

|

| Goodwill |

|

4,013 |

|

|

|

4,013 |

|

| Acquired technology, net |

|

1,329 |

|

|

|

2,054 |

|

| Deferred contract acquisition

costs |

|

5,607 |

|

|

|

3,876 |

|

| Other assets |

|

1,363 |

|

|

|

745 |

|

|

Total assets |

$ |

266,877 |

|

|

$ |

73,248 |

|

|

Liabilities, convertible preferred stock and

stockholders’ equity (deficit) |

|

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

|

Accounts payable |

$ |

3,811 |

|

|

$ |

5,273 |

|

|

Accrued expenses |

|

2,631 |

|

|

|

6,580 |

|

|

Accrued compensation |

|

24,488 |

|

|

|

23,838 |

|

|

Deferred rent and other current liabilities |

|

491 |

|

|

|

674 |

|

|

Due to customers |

|

4,741 |

|

|

|

4,674 |

|

|

Current portion of deferred revenue |

|

32,773 |

|

|

|

28,919 |

|

|

Total current liabilities |

|

68,935 |

|

|

|

69,958 |

|

| Loans payable, net of

unamortized issuance costs |

|

— |

|

|

|

21,144 |

|

| Deferred rent and other

noncurrent liabilities |

|

5,516 |

|

|

|

5,523 |

|

| Deferred revenue |

|

322 |

|

|

|

396 |

|

|

Total liabilities |

|

74,773 |

|

|

|

97,021 |

|

| |

|

|

|

|

|

|

|

| Convertible preferred stock

: |

|

|

|

|

|

|

|

|

Preferred stock par value $0.0001; 25,000,000 shares authorized; 0

and 19,513,939 issued and outstanding atAugust 31, 2020 and

February 29, 2020, respectively |

|

— |

|

|

|

233,022 |

|

| |

|

|

|

|

|

|

|

| Commitments (note 11) |

|

|

|

|

|

|

|

| Stockholders’ equity

(deficit) |

|

|

|

|

|

|

|

|

Common stock par value $0.0001; 500,000,000 shares authorized;

49,269,342 and 6,033,450 shares issuedand outstanding at August 31,

2020 and February 29, 2020, respectively |

|

5 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

542,298 |

|

|

|

64,071 |

|

|

Accumulated deficit |

|

(350,199 |

) |

|

|

(320,868 |

) |

|

Total stockholders’ equity (deficit) |

|

192,104 |

|

|

|

(256,795 |

) |

|

Total liabilities, convertible preferred stock and stockholders’

equity (deficit) |

$ |

266,877 |

|

|

$ |

73,248 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Accolade, Inc. and Subsidiaries |

|

Condensed Consolidated Statements of Operation

(unaudited) |

|

(In thousands, except share and per share data) |

| |

| |

Three months ended

August 31, |

|

|

Six months ended

August 31, |

|

| |

2020 |

|

|

2019 |

|

|

2020 |

|

|

2019 |

|

|

Revenue |

$ |

36,788 |

|

|

$ |

29,651 |

|

|

$ |

72,682 |

|

|

$ |

58,414 |

|

| Cost of revenue, excluding

depreciation and amortization |

|

21,071 |

|

|

|

16,764 |

|

|

|

43,310 |

|

|

|

34,199 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Product and technology |

|

12,236 |

|

|

|

11,303 |

|

|

|

23,606 |

|

|

|

22,549 |

|

|

Sales and marketing |

|

7,881 |

|

|

|

7,616 |

|

|

|

15,196 |

|

|

|

15,278 |

|

|

General and administrative |

|

6,453 |

|

|

|

6,011 |

|

|

|

12,120 |

|

|

|

11,574 |

|

|

Depreciation and amortization |

|

2,049 |

|

|

|

2,222 |

|

|

|

3,977 |

|

|

|

4,382 |

|

|

Total operating expenses |

|

28,619 |

|

|

|

27,152 |

|

|

|

54,899 |

|

|

|

53,783 |

|

|

Loss from operations |

|

(12,902 |

) |

|

|

(14,265 |

) |

|

|

(25,527 |

) |

|

|

(29,568 |

) |

| Interest expense, net |

|

(2,347 |

) |

|

|

(701 |

) |

|

|

(3,629 |

) |

|

|

(1,244 |

) |

| Other expense |

|

(104 |

) |

|

|

(46 |

) |

|

|

(119 |

) |

|

|

(80 |

) |

|

Loss before income taxes |

|

(15,353 |

) |

|

|

(15,012 |

) |

|

|

(29,275 |

) |

|

|

(30,892 |

) |

| Income tax expense |

|

(18 |

) |

|

|

(14 |

) |

|

|

(56 |

) |

|

|

(37 |

) |

| Net loss |

$ |

(15,371 |

) |

|

$ |

(15,026 |

) |

|

$ |

(29,331 |

) |

|

$ |

(30,929 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss per share, basic and

diluted |

$ |

(0.47 |

) |

|

$ |

(2.82 |

) |

|

$ |

(1.45 |

) |

|

$ |

(6.02 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted-average common shares

outstanding, basic and diluted |

|

33,029,147 |

|

|

|

5,336,501 |

|

|

|

20,277,416 |

|

|

|

5,141,047 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table summarizes the amount of stock-based

compensation included in the consolidated statements of

operations:

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended

August 31, |

|

Six months ended

August 31, |

| |

2020 |

|

2019 |

|

2020 |

|

2019 |

| Cost of revenue |

$ |

218 |

|

$ |

103 |

|

$ |

327 |

|

$ |

175 |

| Product and technology |

|

718 |

|

|

491 |

|

|

1,152 |

|

|

852 |

| Sales and marketing |

|

490 |

|

|

475 |

|

|

792 |

|

|

822 |

| General and

administrative |

|

679 |

|

|

826 |

|

|

1,093 |

|

|

1,482 |

| Total stock-based

compensation |

$ |

2,105 |

|

$ |

1,895 |

|

$ |

3,364 |

|

$ |

3,331 |

| |

|

|

|

|

|

|

|

|

|

|

|

Accolade, Inc. and

SubsidiariesCondensed Consolidated

Statements of Cash Flows

(unaudited)(In thousands)

|

|

|

|

|

|

|

|

|

| |

Six months ended

August 31, |

|

| |

2020 |

|

|

2019 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

Net loss |

$ |

(29,331 |

) |

|

$ |

(30,929 |

) |

|

Adjustments to reconcile net loss to net cash used in |

|

|

|

|

|

|

|

|

Operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

3,977 |

|

|

|

4,382 |

|

|

Amortization of deferred contract acquisition costs |

|

740 |

|

|

|

460 |

|

|

Noncash interest expense |

|

1,316 |

|

|

|

265 |

|

|

Stock-based compensation expense |

|

3,364 |

|

|

|

3,331 |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable and unbilled revenue |

|

(9,581 |

) |

|

|

149 |

|

|

Accounts payable and accrued expenses |

|

(806 |

) |

|

|

409 |

|

|

Deferred contract acquisition costs |

|

(2,812 |

) |

|

|

(712 |

) |

|

Deferred revenue and due to customers |

|

3,847 |

|

|

|

4,824 |

|

|

Accrued compensation |

|

6,580 |

|

|

|

(1,439 |

) |

|

Deferred rent and other liabilities |

|

(212 |

) |

|

|

(157 |

) |

|

Other assets |

|

(437 |

) |

|

|

(985 |

) |

|

Net cash used in operating activities |

|

(23,355 |

) |

|

|

(20,402 |

) |

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

Capitalized software development costs |

|

(374 |

) |

|

|

— |

|

|

Purchases of property and equipment |

|

(981 |

) |

|

|

(1,064 |

) |

|

Net cash acquired in acquisition of MD Insider |

|

— |

|

|

|

(206 |

) |

|

Earnout payments to MD Insider |

|

(58 |

) |

|

|

— |

|

|

Net cash used in investing activities |

|

(1,413 |

) |

|

|

(1,270 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

Proceeds from IPO, net of underwriters' discounts and commissions

and offering costs |

|

231,675 |

|

|

|

— |

|

|

Proceeds from stock option and warrant exercises |

|

4,802 |

|

|

|

1,241 |

|

|

Proceeds from borrowings on debt |

|

51,166 |

|

|

|

1,660 |

|

|

Repayments of debt principal |

|

(73,166 |

) |

|

|

— |

|

|

Payments related to debt retirement |

|

(753 |

) |

|

|

— |

|

|

Net cash provided by financing activities |

|

213,724 |

|

|

|

2,901 |

|

|

Net increase (decrease) in cash and cash equivalents |

|

188,956 |

|

|

|

(18,771 |

) |

| Cash and cash equivalents,

beginning of period |

|

33,155 |

|

|

|

42,701 |

|

| Cash and cash equivalents, end

of period |

$ |

222,111 |

|

|

$ |

23,930 |

|

| Supplemental cash flow

information: |

|

|

|

|

|

|

|

|

Interest paid |

$ |

2,194 |

|

|

$ |

1,201 |

|

|

Fixed assets included in accounts payable |

$ |

48 |

|

|

$ |

248 |

|

|

Other receivable related to stock option exercises |

$ |

108 |

|

|

$ |

543 |

|

|

Income taxes paid |

$ |

105 |

|

|

$ |

55 |

|

|

Offering costs included in accounts payable and accrued

expenses |

$ |

312 |

|

|

$ |

— |

|

|

Bonus settled in the form of stock options |

$ |

5,735 |

|

|

$ |

— |

|

Non-GAAP Financial Measures

In addition to our financial results determined in accordance

with GAAP, we use the following non-GAAP financial measures to help

us evaluate trends, establish budgets, measure the effectiveness

and efficiency of our operations, and determine employee

incentives. We believe that non-GAAP financial information, when

taken collectively, may be helpful to investors because it provides

consistency and comparability with past financial performance.

However, non-GAAP financial information is presented for

supplemental informational purposes only, has limitations as an

analytical tool and should not be considered in isolation or as a

substitute for financial information presented in accordance with

GAAP. In addition, other companies, including companies in our

industry, may calculate similarly-titled non-GAAP measures

differently or may use other measures to evaluate their

performance. A reconciliation is provided below for each non-GAAP

financial measure to the most directly comparable financial measure

stated in accordance with GAAP. Investors are encouraged to review

the related GAAP financial measures and the reconciliation of these

non-GAAP financial measures to their most directly comparable GAAP

financial measures, and not to rely on any single financial measure

to evaluate our business.

Adjusted Gross Profit and Adjusted Gross

Margin

Adjusted Gross Profit is a non-GAAP financial measure that we

define as revenue less cost of revenue, excluding depreciation and

amortization, and excluding stock-based compensation. We define

Adjusted Gross Margin as our Adjusted Gross Profit divided by our

revenue. We believe Adjusted Gross Profit and Adjusted Gross Margin

are useful to investors, as they eliminate the impact of certain

noncash expenses and allow a direct comparison of these measures

between periods without the impact of noncash expenses and certain

other nonrecurring operating expenses.

Adjusted EBITDA

Adjusted EBITDA is a non-GAAP financial measure that we define

as net loss adjusted to exclude interest expense (net), income tax

expense (benefit), depreciation and amortization, stock-based

compensation, and acquisition and integration-related costs. We

believe Adjusted EBITDA provides investors with useful information

on period-to-period performance as evaluated by management and

comparison with our past financial performance. We believe Adjusted

EBITDA is useful in evaluating our operating performance compared

to that of other companies in our industry, as this measure

generally eliminates the effects of certain items that may vary

from company to company for reasons unrelated to overall operating

performance.

Adjusted Gross Profit, Adjusted Gross Margin and Adjusted EBITDA

have certain limitations, including that they exclude the impact of

certain non-cash charges, such as depreciation and amortization,

whereas underlying assets may need to be replaced and result in

cash capital expenditures, and stock-based compensation expense,

which is a recurring charge. These non-GAAP financial measures may

also not be comparable to similarly titled measures of other

companies because they may not calculate such measures in the same

manner, limiting their usefulness as comparative measures. In

evaluating these non-GAAP financial measures, you should be aware

that in the future we expect to incur expenses similar to the

adjustments in this presentation. Our presentation of non-GAAP

financial measures should not be construed as an inference that our

future results will be unaffected by these expenses or any unusual

or nonrecurring items. When evaluating our performance, you should

consider these non-GAAP financial measures alongside other

financial performance measures, including the most directly

comparable GAAP measures set forth in the reconciliation tables

below and our other GAAP results. The following table presents, for

the periods indicated, a reconciliation of our revenue to Adjusted

Gross Profit:

|

|

For the three months ended |

|

|

For the six months ended |

|

|

August 31, |

|

|

August 31, |

|

|

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

|

|

(in thousands, except percentages) |

|

|

(in thousands, except percentages) |

|

Revenue |

$ |

36,788 |

|

|

$ |

29,651 |

|

|

$ |

72,682 |

|

|

$ |

58,414 |

|

| Less: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue, excluding depreciation and amortization |

|

(21,071 |

) |

|

|

(16,764 |

) |

|

|

(43,310 |

) |

|

|

(34,199 |

) |

| Gross profit, excluding

depreciation and amortization |

|

15,717 |

|

|

|

12,887 |

|

|

|

29,372 |

|

|

|

24,215 |

|

| Add: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Stock‑based compensation, cost of revenue |

|

218 |

|

|

|

103 |

|

|

|

327 |

|

|

|

175 |

|

| Adjusted Gross Profit |

$ |

15,935 |

|

|

$ |

12,990 |

|

|

$ |

29,699 |

|

|

$ |

24,390 |

|

| Gross margin, excluding

depreciation and amortization |

|

42.7 |

% |

|

|

43.5 |

% |

|

|

40.4 |

% |

|

|

41.5 |

% |

| Adjusted Gross Margin |

|

43.3 |

% |

|

|

43.8 |

% |

|

|

40.9 |

% |

|

|

41.8 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The following table presents, for the periods indicated, a

reconciliation of our Adjusted EBITDA to our net loss:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

For the three months ended |

|

|

For the six months ended |

|

|

|

August 31, |

|

|

August 31, |

|

|

|

2020 |

|

2019 |

|

|

2020 |

|

2019 |

|

|

|

(in thousands) |

|

|

(in thousands) |

|

| Net Loss |

$ |

(15,371 |

) |

|

$ |

(15,026 |

) |

|

$ |

(29,331 |

) |

|

$ |

(30,929 |

) |

|

Adjusted for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net |

|

2,347 |

|

|

|

701 |

|

|

|

3,629 |

|

|

|

1,244 |

|

|

Income tax provision |

|

18 |

|

|

|

14 |

|

|

|

56 |

|

|

|

37 |

|

|

Depreciation and amortization |

|

2,049 |

|

|

|

2,222 |

|

|

|

3,977 |

|

|

|

4,382 |

|

|

Stock‑based compensation |

|

2,105 |

|

|

|

1,895 |

|

|

|

3,364 |

|

|

|

3,331 |

|

|

Acquisition and integration‑related costs |

|

— |

|

|

|

552 |

|

|

|

— |

|

|

|

552 |

|

|

Other expense |

|

104 |

|

|

|

46 |

|

|

|

119 |

|

|

|

80 |

|

| Adjusted EBITDA |

$ |

(8,748 |

) |

|

$ |

(9,596 |

) |

|

$ |

(18,186 |

) |

|

$ |

(21,303 |

) |

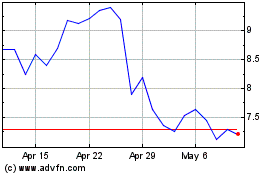

Accolade (NASDAQ:ACCD)

Historical Stock Chart

From Aug 2024 to Sep 2024

Accolade (NASDAQ:ACCD)

Historical Stock Chart

From Sep 2023 to Sep 2024