AAON, Inc. (NASDAQ-AAON) today announced its operating results for

the second quarter and six months ended June 30, 2019.

In the quarter ended June 30, 2019, net

sales were $119.4 million, up 9.0% from $109.6 million in 2018. Net

income was $13.0 million, an increase of 10.9% from $11.7 million

in the same period a year ago. Net sales for the six

months ended June 30, 2019 were $233.3 million,

increasing 11.8% from $209

million in 2018. Net income for the six months ended

June 30, 2019 was $23.9 million, up 49.6%

from $16.0 million in 2018.

Our backlog at June 30, 2019, increased

18.3% to $179.6 million, from $151.8 million at December 31, 2018,

and increased 15.0% from $156.6 million at June 30, 2018.

Earnings per diluted share for the second

quarter of 2019 were $0.25, an increase of 13.6% from $0.22 for the

same period in 2018, based upon 52.7 million and 52.7 million

shares outstanding at June 30, 2019 and 2018,

respectively. Earnings per diluted share for the six

months ended June 30, 2019 were $0.45, an increase

of 50.0% from $0.30 in 2018, based

upon 52.6 million and 52.8 million shares

outstanding at June 30, 2019 and 2018,

respectively.

Gross profit, benefiting from moderating raw

material costs and improved productivity, increased 30.2% to $56.0

million (24.0% of sales) for the six months ended June 30, 2019,

versus $43.0 million (20.6% of sales) for the same period a year

ago.

Norman H. Asbjornson, CEO, said, "In the fourth

quarter of 2018 we became aware of the need for additional sheet

metal fabrication equipment and ordered four additional systems at

that time. However, due to the substantial increase in business, we

pushed our existing equipment as hard as possible which caused

additional downtime on the equipment, thus limiting the amount of

additional growth we were able to attain. As the year has

progressed we experienced strengthening demand and thus recently

ordered another four machines, totaling eight machines on

order."

Selling, general and administrative

expenses increased 3.0% to $13.5

million (11.3% of sales) from $13.1

million (11.9% of sales) as compared to the second

quarter of 2018. For the six months ended June 30,

2019, selling, general and administrative expenses increased 5.1%

to $24.5 million (10.5% of sales) compared to $23.3 million (11.2%

of sales) for the same period a year ago.

Mr. Asbjornson continued, "Our financial

condition at June 30, 2019 remained strong with a current ratio of

2.9:1, including cash and investments totaling $17.7 million, and

we continue to operate debt free."

Gary Fields, President, stated, "Our recently

purchased Salvagnini sheet metal fabrication machines started to

arrive in early July and will continue to arrive throughout 2019,

with the final machine scheduled to arrive January of 2020. Each

Salvagnini system will be in full production within 45 days of

arrival. Furthermore, we have taken significant steps to

improve our sheet metal fabrication equipment maintenance and

production capabilities through the hiring of a former long-term

Salvagnini employee to implement and oversee strengthened

maintenance and replacement initiatives."

Mr. Fields concluded, "We believe the steps

taken to address our manufacturing capacity issues will allow us to

see improvements in our overall operations as the year

progresses."

The Company will host a conference call today at

4:15 P.M. Eastern Time to discuss the second quarter results. To

participate, call 1-888-241-0551 (code 3096466); or, for

rebroadcast, call 1-855-859-2056 (code 3096466).

About AAONAAON, Inc. is engaged

in the engineering, manufacturing, marketing and sale of air

conditioning and heating equipment consisting of standard,

semi-custom and custom rooftop units, chillers, packaged outdoor

mechanical rooms, air handling units, makeup air units, energy

recovery units, condensing units, geothermal/water-source heat

pumps, coils and controls. Since the founding of AAON in 1988, AAON

has maintained a commitment to design, develop, manufacture and

deliver heating and cooling products to perform beyond all

expectations and demonstrate the value of AAON to our customers.

For more information, please visit www.AAON.com.

Certain statements in this news release may be

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933. Statements regarding future prospects

and developments are based upon current expectations and involve

certain risks and uncertainties that could cause actual results and

developments to differ materially from the forward-looking

statements.

Contact InformationJerry R.

LevinePhone: (561) 482-4046 or (914) 244-0292Fax: (914)

244-0295Email: jrladvisor@yahoo.com

|

AAON, Inc. and Subsidiaries |

|

Consolidated Statements of Income |

|

(Unaudited) |

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

(in thousands, except share and per share data) |

| Net sales |

$ |

119,437 |

|

|

$ |

109,588 |

|

|

$ |

233,259 |

|

|

$ |

208,670 |

|

| Cost of

sales |

89,262 |

|

|

82,003 |

|

|

177,291 |

|

|

165,695 |

|

| Gross

profit |

30,175 |

|

|

27,585 |

|

|

55,968 |

|

|

42,975 |

|

| Selling,

general and administrative expenses |

13,481 |

|

|

13,086 |

|

|

24,482 |

|

|

23,305 |

|

| Loss (gain) on

disposal of assets |

6 |

|

|

(4 |

) |

|

290 |

|

|

(11 |

) |

| Income from

operations |

16,688 |

|

|

14,503 |

|

|

31,196 |

|

|

19,681 |

|

| Interest

income, net |

31 |

|

|

67 |

|

|

40 |

|

|

135 |

|

| Other expense,

net |

17 |

|

|

12 |

|

|

(9 |

) |

|

6 |

|

| Income before

taxes |

16,736 |

|

|

14,582 |

|

|

31,227 |

|

|

19,822 |

|

| Income tax

provision |

3,775 |

|

|

2,891 |

|

|

7,364 |

|

|

3,871 |

|

| Net

income |

$ |

12,961 |

|

|

$ |

11,691 |

|

|

$ |

23,863 |

|

|

$ |

15,951 |

|

| Earnings per

share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.25 |

|

|

$ |

0.22 |

|

|

$ |

0.46 |

|

|

$ |

0.30 |

|

|

Diluted |

$ |

0.25 |

|

|

$ |

0.22 |

|

|

$ |

0.45 |

|

|

$ |

0.30 |

|

| Cash dividends

declared per common share: |

$ |

0.16 |

|

|

$ |

0.16 |

|

|

$ |

0.16 |

|

|

$ |

0.16 |

|

| Weighted

average shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

52,120,272 |

|

|

52,383,842 |

|

|

52,087,626 |

|

|

52,348,912 |

|

|

Diluted |

52,747,199 |

|

|

52,717,787 |

|

|

52,589,845 |

|

|

52,754,045 |

|

|

AAON, Inc. and Subsidiaries |

|

Consolidated Balance Sheets |

|

(Unaudited) |

| |

June 30, 2019 |

|

December 31, 2018 |

|

Assets |

(in thousands, except share and per share data) |

| Current

assets: |

|

|

|

|

Cash and cash equivalents |

$ |

13,683 |

|

|

$ |

1,994 |

|

|

Certificates of deposit |

4,000 |

|

|

— |

|

|

Accounts receivable, net |

68,933 |

|

|

54,078 |

|

|

Income tax receivable |

3,246 |

|

|

6,104 |

|

|

Note receivable |

28 |

|

|

27 |

|

|

Inventories, net |

77,044 |

|

|

77,612 |

|

|

Prepaid expenses and other |

1,696 |

|

|

1,046 |

|

| Total current

assets |

168,630 |

|

|

140,861 |

|

| Property,

plant and equipment: |

|

|

|

|

Land |

3,125 |

|

|

3,114 |

|

|

Buildings |

99,193 |

|

|

97,393 |

|

|

Machinery and equipment |

219,438 |

|

|

212,779 |

|

|

Furniture and fixtures |

17,107 |

|

|

16,597 |

|

|

Total property, plant and equipment |

338,863 |

|

|

329,883 |

|

|

Less: Accumulated depreciation |

171,232 |

|

|

166,880 |

|

| Property,

plant and equipment, net |

167,631 |

|

|

163,003 |

|

| Intangible

assets, net |

389 |

|

|

506 |

|

| Goodwill |

3,229 |

|

|

3,229 |

|

| Right of use

assets |

1,764 |

|

|

— |

|

| Note

receivable |

608 |

|

|

598 |

|

| Total

assets |

$ |

342,251 |

|

|

$ |

308,197 |

|

| |

|

|

|

|

Liabilities and Stockholders' Equity |

|

|

|

| Current

liabilities: |

|

|

|

|

Revolving credit facility |

$ |

— |

|

|

$ |

— |

|

|

Accounts payable |

7,885 |

|

|

10,616 |

|

|

Dividends payable |

8,355 |

|

|

— |

|

|

Accrued liabilities |

42,713 |

|

|

37,455 |

|

| Total current

liabilities |

58,953 |

|

|

48,071 |

|

| Deferred tax

liabilities |

14,938 |

|

|

10,826 |

|

| Other

long-term liabilities |

3,791 |

|

|

1,801 |

|

| Commitments

and contingencies |

|

|

|

| Stockholders'

equity: |

|

|

|

|

Preferred stock, $.001 par value, 5,000,000 shares authorized, no

shares issued |

— |

|

|

— |

|

|

Common stock, $.004 par value, 100,000,000 shares authorized,

52,118,180 and 51,991,242 issued and outstanding at June 30, 2019

and December 31, 2018, respectively |

209 |

|

|

208 |

|

|

Additional paid-in capital |

1,586 |

|

|

— |

|

|

Retained earnings |

262,774 |

|

|

247,291 |

|

| Total

stockholders' equity |

264,569 |

|

|

247,499 |

|

| Total

liabilities and stockholders' equity |

$ |

342,251 |

|

|

$ |

308,197 |

|

|

AAON, Inc. and Subsidiaries |

|

Consolidated Statements of Cash Flows |

|

(Unaudited) |

| |

Six Months Ended June 30, |

| |

2019 |

|

2018 |

|

Operating Activities |

(in thousands) |

|

Net income |

$ |

23,863 |

|

|

$ |

15,951 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

|

Depreciation and amortization |

11,760 |

|

|

8,438 |

|

|

Amortization of bond premiums |

— |

|

|

8 |

|

|

Provision for losses on accounts receivable, net of

adjustments |

128 |

|

|

89 |

|

|

Provision for excess and obsolete inventories |

1,153 |

|

|

299 |

|

|

Share-based compensation |

5,073 |

|

|

3,699 |

|

|

Loss (gain) on disposition of assets |

290 |

|

|

(11 |

) |

|

Foreign currency transaction gain |

(13 |

) |

|

15 |

|

|

Interest income on note receivable |

(26 |

) |

|

14 |

|

|

Deferred income taxes |

4,112 |

|

|

438 |

|

|

Changes in assets and liabilities: |

|

|

|

|

Accounts receivable |

(14,983 |

) |

|

(2,087 |

) |

|

Income taxes |

2,858 |

|

|

(3,328 |

) |

|

Inventories |

(585 |

) |

|

1,400 |

|

|

Prepaid expenses and other |

(650 |

) |

|

(935 |

) |

|

Accounts payable |

(2,592 |

) |

|

12,974 |

|

|

Deferred revenue |

172 |

|

|

(931 |

) |

|

Accrued liabilities |

5,312 |

|

|

213 |

|

|

Net cash provided by operating activities |

35,872 |

|

|

36,246 |

|

|

Investing Activities |

|

|

|

|

Capital expenditures |

(16,784 |

) |

|

(25,925 |

) |

|

Cash paid in business combination |

— |

|

|

(6,377 |

) |

|

Proceeds from sale of property, plant and equipment |

59 |

|

|

11 |

|

|

Investment in certificates of deposits |

(6,000 |

) |

|

(7,200 |

) |

|

Maturities of certificates of deposits |

2,000 |

|

|

4,560 |

|

|

Purchases of investments held to maturity |

— |

|

|

(9,001 |

) |

|

Maturities of investments |

— |

|

|

11,620 |

|

|

Proceeds from called investments |

— |

|

|

495 |

|

|

Principal payments from note receivable |

28 |

|

|

16 |

|

|

Net cash used in investing activities |

(20,697 |

) |

|

(31,801 |

) |

|

Financing Activities |

|

|

|

|

Stock options exercised |

7,685 |

|

|

2,299 |

|

|

Repurchase of stock |

(10,191 |

) |

|

(11,539 |

) |

|

Employee taxes paid by withholding shares |

(980 |

) |

|

(808 |

) |

|

Net cash used in financing activities |

(3,486 |

) |

|

(10,048 |

) |

| Net

increase (decrease) in cash and cash

equivalents |

11,689 |

|

|

(5,603 |

) |

| Cash

and cash equivalents, beginning of period |

1,994 |

|

|

21,457 |

|

| Cash

and cash equivalents, end of period |

$ |

13,683 |

|

|

$ |

15,854 |

|

Use of Non-GAAP Financial Measures

To supplement the Company’s consolidated

financial statements presented in accordance with generally

accepted accounting principles (“GAAP”), an additional non-GAAP

financial measure is provided and reconciled in the following

table. The Company believes that this non-GAAP financial measure,

when considered together with the GAAP financial measures, provides

information that is useful to investors in understanding

period-over-period operating results. The Company believes that

this non-GAAP financial measure enhances the ability of investors

to analyze the Company’s business trends and operating

performance.

EBITDAX

EBITDAX (as defined below) is presented herein

and reconciled from the GAAP measure of net income because of its

wide acceptance by the investment community as a financial

indicator of a company's ability to internally fund operations.

The Company defines EBITDAX as net income, plus

(1) depreciation and amortization, (2) amortization of bond

premiums, (3) share-based compensation, (4) interest (income)

expense and (5) income tax expense. EBITDAX is not a measure of net

income or cash flows as determined by GAAP.

The Company’s EBITDAX measure provides

additional information which may be used to better understand the

Company’s operations. EBITDAX is one of several metrics that the

Company uses as a supplemental financial measurement in the

evaluation of its business and should not be considered as an

alternative to, or more meaningful than, net income, as an

indicator of operating performance. Certain items excluded from

EBITDAX are significant components in understanding and assessing a

company's financial performance. EBITDAX, as used by the Company,

may not be comparable to similarly titled measures reported by

other companies. The Company believes that EBITDAX is a widely

followed measure of operating performance and is one of many

metrics used by the Company’s management team and by other users of

the Company’s consolidated financial statements.

The following table provides a reconciliation of

net income (GAAP) to EBITDAX (non-GAAP) for the periods

indicated:

| |

Three Months Ended June 30, |

|

Six Months Ended June 30, |

| |

|

| |

2019 |

|

2018 |

|

2019 |

|

2018 |

| |

(in thousands) |

| Net Income, a

GAAP measure |

$ |

12,961 |

|

|

$ |

11,691 |

|

|

$ |

23,863 |

|

|

$ |

15,951 |

|

| Depreciation

and amortization |

5,846 |

|

|

4,309 |

|

|

11,760 |

|

|

8,438 |

|

| Amortization

of bond premiums |

— |

|

|

3 |

|

|

— |

|

|

8 |

|

| Share-based

compensation |

3,043 |

|

|

1,975 |

|

|

5,073 |

|

|

3,699 |

|

| Interest

income |

(31 |

) |

|

(70 |

) |

|

(40 |

) |

|

(143 |

) |

| Income tax

expense |

3,775 |

|

|

2,891 |

|

|

7,364 |

|

|

3,871 |

|

| EBITDAX, a

non-GAAP measure |

$ |

25,594 |

|

|

$ |

20,799 |

|

|

$ |

48,020 |

|

|

$ |

31,824 |

|

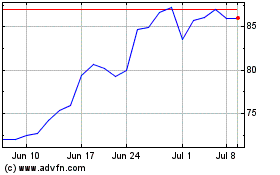

AAON (NASDAQ:AAON)

Historical Stock Chart

From Mar 2024 to Apr 2024

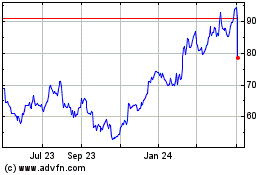

AAON (NASDAQ:AAON)

Historical Stock Chart

From Apr 2023 to Apr 2024