Ameristar Casinos, Inc. (NASDAQ: ASCA) today announced financial

results for the third quarter of 2009.

"In the third quarter, Ameristar once again demonstrated its

ability to produce solid financial results during challenging

economic conditions," said Gordon Kanofsky, Ameristar's Chief

Executive Officer. "This has been particularly evident at our Black

Hawk property, where favorable regulatory reform spurred third

quarter year-over-year net revenue growth of 24.2% that, combined

with our cost controls put in place over the past year, drove a

58.3% improvement in Adjusted EBITDA and a 7.9 percentage-point

increase in the related margin. Additionally, we are pleased by the

overwhelmingly positive guest reaction to our new Black Hawk hotel

and spa, which offers resort destination amenities and services

that are unprecedented in the greater Denver gaming market. The

synergy created between the September 29 opening of the hotel and

the casino's recently introduced 24-hour operations, increased bet

limits and expanded table games has resulted in a substantial

improvement in Ameristar Black Hawk's net revenues and an even more

substantial improvement in Adjusted EBITDA."

Third Quarter 2009 Results Net revenue

decreased 6.8%, from $321.4 million in the prior-year quarter to

$299.4 million in the third quarter of 2009, mostly as a result of

recessionary market pressures. For the third quarter of 2009, we

generated operating income of $51.0 million, compared to $46.2

million in the same period in 2008. Adjusted EBITDA for the third

quarter of 2009 decreased 2.1% to $79.3 million, compared to $81.0

million in the 2008 third quarter. However, Adjusted EBITDA margin

increased 1.3 percentage points to 26.5%, compared to 25.2% in the

third quarter of 2008.

"Favorable regulatory changes affecting three of our properties

and the effective implementation of our cost initiatives enabled

five of our locations -- Black Hawk, Kansas City, St. Charles,

Jackpot and Council Bluffs -- to report Adjusted EBITDA margin

growth when compared to the prior-year third quarter," Kanofsky

said. "East Chicago maintained its Adjusted EBITDA margin, in spite

of the more challenging competitive conditions in that market.

Vicksburg was the only Ameristar property that reported a decline

in Adjusted EBITDA margin. We believe this property has been

negatively impacted by the entry of a new competitor into that

market in October 2008 and higher fixed costs for the expanded

facility."

For the three months ended September 30, 2009 and 2008, our

effective tax rate was 33.2% and 44.7%, respectively. The decrease

in the tax rate was mostly due to the permanent reversal of certain

contingent tax liabilities and the absence in 2009 of

non-deductible costs we incurred in 2008 associated with Missouri

and Colorado ballot initiatives. For the third quarter of 2009, the

Company's net income of $14.5 million, or $0.25 per diluted share,

was relatively unchanged year over year. Savings realized from our

leaner cost structure were offset by higher borrowing costs

resulting from the Company's debt restructuring to address upcoming

maturities under our senior credit facility, which is described

below. Additionally, net income and diluted EPS for the third

quarter of 2009 were favorably impacted by the decrease in the tax

rate from the previously mentioned reversal of contingent tax

liabilities. Adjusted EPS was $0.27 for the quarter ended September

30, 2009, compared to $0.34 for the 2008 third quarter.

Additional Financial Information

Debt. We are currently addressing the

outstanding balance of our revolving credit facility by requesting

the lenders to extend the maturity date from November 2010 to

August 2012. We expect to secure extensions on the vast majority of

the principal outstanding under the revolving credit facility. Any

balance that is not extended is expected to be retired timely

through free cash flow. The maturity date extension will require us

to pay upfront fees and a higher interest rate on the extended

portion of the revolving loans.

At September 30, 2009, the face amount of our outstanding debt

was $1.68 billion. Net repayments in the third quarter of 2009

totaled $1.2 million. At September 30, 2009, our total leverage and

senior leverage ratios (each as defined in the senior credit

facility) were required to be no more than 6.00:1 and 5.75:1,

respectively. As of that date, our total leverage ratio and senior

leverage ratio were each 4.91:1.

Interest Expense. For the third quarter of

2009, net interest expense was $30.1 million, compared to $19.0

million in the prior-year third quarter. The increase was due

mostly to higher interest rate add-ons resulting from a March 2009

amendment to the senior credit facility and the May 2009 issuance

of our 9-1/4% senior unsecured notes due in 2014. Capitalized

interest increased from $1.6 million for the third quarter of 2008

to $4.2 million in the 2009 third quarter, due mostly to increased

construction in progress associated with the Black Hawk hotel and a

higher weighted-average borrowing rate.

Stock-Based Compensation. For the quarter

ended September 30, 2009, stock-based compensation expense was $4.1

million, compared to $2.2 million in the prior-year third

quarter.

Capital Expenditures. For the third

quarter of 2009, capital expenditures were $33.3 million, including

$15.3 million for the Black Hawk hotel construction.

Dividends. During the third quarter of

2009, our Board of Directors declared two dividends, each in the

amount of $0.105 per share, which we paid on July 27 and October

6.

Outlook

"Over the last 12 months, we have substantially reduced

operating costs and believe we can sustain these savings," Kanofsky

said. "The enhanced flexibility built into our operating structure

over the last year has enabled us to maximize margins without

adversely affecting the guest experience. At Ameristar Black Hawk,

this operating structure has helped maximize Adjusted EBITDA from

net revenues that have risen significantly following the regulatory

enhancements and the hotel opening. We are confident that we are

well-positioned for efficient profitability growth in our other

markets when our revenue trends improve with the regional

economies.

"As a result of the opening of the Black Hawk hotel, we

anticipate decreases in capital spending and capitalized interest

and increases in promotional spending, depreciation and free cash

flow," Kanofsky added. "We believe the utilization of the free cash

flow to repay debt will also result in increased profitability and

a further strengthening of our balance sheet."

For the full year 2009, the Company currently expects:

-- depreciation to range from $106 million to $107 million.

-- interest expense, net of capitalized interest, to be between

$106 million and $107 million, including non-cash interest expense

of approximately $8.2 million.

-- the combined state and federal income tax rate to be in the

range of 41% to 42%.

-- capital spending of $157 million to $159 million.

-- capitalized interest of $9.0 million to $9.3 million.

-- non-cash stock-based compensation expense of $12.8 million to

$13.3 million.

Conference Call Information We will hold a

conference call to discuss our third quarter results on Wednesday,

November 4, 2009 at 11 a.m. EST. The call may be accessed live by

dialing (888) 694-4728 toll-free domestically, or (973) 582-2745,

and referencing conference ID number 36216401. Conference call

participants are requested to dial in at least five minutes early

to ensure a prompt start. Interested parties wishing to listen to

the conference call and view corresponding informative slides on

the Internet may do so live at our web site -- www.ameristar.com --

by clicking on "About Us/Investor Relations" and selecting the

"Webcasts and Events" link. A copy of the slides will be available

in the corresponding "Earnings Releases" section one-half hour

before the conference call. In addition, the call will be recorded

and can be replayed from November 4, 2009 at 2:30 p.m. EST until

November 18, 2009 at 11:59 p.m. EST. To listen to the replay, call

toll-free domestically (800) 642-1687, or (706) 645-9291, and

reference the conference ID number above.

Forward-Looking Information This release

contains certain forward-looking information that generally can be

identified by the context of the statement or the use of

forward-looking terminology, such as "believes," "estimates,"

"anticipates," "intends," "expects," "plans," "is confident that,"

"should" or words of similar meaning, with reference to Ameristar

or our management. Similarly, statements that describe our future

plans, objectives, strategies, financial results or position,

operational expectations or goals are forward-looking statements.

It is possible that our expectations may not be met due to various

factors, many of which are beyond our control, and we therefore

cannot give any assurance that such expectations will prove to be

correct. For a discussion of relevant factors, risks and

uncertainties that could materially affect our future results,

attention is directed to "Item 1A. Risk Factors" and "Item 7.

Management's Discussion and Analysis of Financial Condition and

Results of Operations" in our Annual Report on Form 10-K for the

year ended December 31, 2008, and "Item 2. Management's Discussion

and Analysis of Financial Condition and Results of Operations" in

our Quarterly Report on Form 10-Q for the quarter ended June 30,

2009.

On a monthly basis, gaming regulatory authorities in certain

states in which we operate publish gross gaming revenue and/or

certain other financial information for the gaming facilities that

operate within their respective jurisdictions. Because various

factors in addition to our gross gaming revenue (including

operating costs, promotional allowances and corporate and other

expenses) influence our operating income, EBITDA and diluted

earnings per share, such reported information, as it relates to

Ameristar, may not accurately reflect the results of our operations

for such periods or for future periods.

About Ameristar Ameristar Casinos, Inc. is

a leading Las Vegas-based gaming and entertainment company known

for its premier properties characterized by innovative

architecture, state-of-the-art casino floors and superior dining,

lodging and entertainment offerings. Ameristar's focus on the total

entertainment experience and the highest-quality guest service has

earned it leading positions in the markets in which it operates.

Founded in 1954 in Jackpot, Nev., Ameristar has been a public

company since November 1993. The Company has a portfolio of eight

casinos in seven markets: Ameristar Casino Resort Spa St. Charles

(greater St. Louis); Ameristar Casino Hotel East Chicago

(Chicagoland area); Ameristar Casino Hotel Kansas City; Ameristar

Casino Hotel Council Bluffs (Omaha, Neb., and southwestern Iowa);

Ameristar Casino Hotel Vicksburg (Jackson, Miss., and Monroe, La.);

Ameristar Casino Resort Spa Black Hawk (Denver metropolitan area);

and Cactus Petes Resort Casino and The Horseshu Hotel and Casino in

Jackpot, Nev. (Idaho and the Pacific Northwest).

Visit Ameristar Casinos' web site at www.ameristar.com (which

shall not be deemed to be incorporated in or a part of this news

release).

Please refer to the tables near the end of this release for the

reconciliation of the non-GAAP financial measures EBITDA, Adjusted

EBITDA and Adjusted EPS reported throughout this release.

Additionally, more information on these non-GAAP financial measures

can be found under the caption "Use of Non-GAAP Financial Measures"

at the end of this release.

AMERISTAR CASINOS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Amounts in Thousands, Except Per Share Data)

(Unaudited)

Three Months Ended Nine Months Ended

September 30, September 30,

2009 2008 2009 2008

----------- ----------- ----------- -----------

REVENUES:

Casino $ 311,143 $ 329,841 $ 949,547 $ 1,000,514

Food and beverage 31,198 39,636 103,970 120,521

Rooms 16,598 15,868 47,084 42,197

Other 8,197 10,120 25,012 29,806

----------- ----------- ----------- -----------

367,136 395,465 1,125,613 1,193,038

Less: promotional

allowances (67,706) (74,064) (201,444) (218,772)

----------- ----------- ----------- -----------

Net revenues 299,430 321,401 924,169 974,266

OPERATING EXPENSES:

Casino 135,418 151,666 421,898 465,163

Food and beverage 16,186 18,941 49,270 56,643

Rooms 2,162 2,856 6,496 8,584

Other 3,593 5,318 11,340 16,568

Selling, general and

administrative 64,995 69,494 180,579 201,766

Depreciation and

amortization 26,106 26,773 78,807 78,901

Impairment loss on

assets 12 110 107 129,449

----------- ----------- ----------- -----------

Total operating

expenses 248,472 275,158 748,497 957,074

Income from

operations 50,958 46,243 175,672 17,192

OTHER INCOME (EXPENSE):

Interest income 122 190 390 593

Interest expense, net

of capitalized

interest (30,100) (19,034) (72,617) (56,849)

Loss on early

retirement of debt (155) - (5,365) -

Net loss on disposition

of assets (264) (369) (99) (927)

Other 1,091 (1,132) 1,675 (1,459)

----------- ----------- ----------- -----------

INCOME (LOSS) BEFORE

INCOME TAX PROVISION

(BENEFIT) 21,652 25,898 99,656 (41,450)

Income tax provision

(benefit) 7,190 11,566 41,013 (11,875)

----------- ----------- ----------- -----------

NET INCOME (LOSS) $ 14,462 $ 14,332 $ 58,643 $ (29,575)

=========== =========== =========== ===========

EARNINGS (LOSS) PER SHARE:

Basic $ 0.25 $ 0.25 $ 1.02 $ (0.52)

=========== =========== =========== ===========

Diluted $ 0.25 $ 0.25 $ 1.01 $ (0.52)

=========== =========== =========== ===========

CASH DIVIDENDS DECLARED

PER SHARE $ 0.21 $ 0.11 $ 0.32 $ 0.32

=========== =========== =========== ===========

WEIGHTED-AVERAGE SHARES

OUTSTANDING:

Basic 57,648 57,198 57,491 57,177

=========== =========== =========== ===========

Diluted 58,647 57,597 58,233 57,177

=========== =========== =========== ===========

AMERISTAR CASINOS, INC. AND SUBSIDIARIES

SUMMARY CONSOLIDATED FINANCIAL DATA

(Dollars in Thousands)

(Unaudited)

September 30, 2009 December 31, 2008

---------------------- ----------------------

Balance sheet data

Cash and cash equivalents $ 132,124 $ 73,726

Total assets $ 2,316,655 $ 2,225,238

Total debt, net of

$13,508 discount at

September 30, 2009 $ 1,665,427 $ 1,648,500

Stockholders' equity $ 394,668 $ 338,780

Three Months Ended Nine Months Ended

September 30, September 30,

2009 2008 2009 2008

---------- ---------- ---------- ----------

Consolidated cash flow

information

Net cash provided by

operating activities $ 86,040 $ 64,041 $ 212,244 $ 206,447

Net cash used in

investing activities $ (40,165) $ (62,329) $ (136,569) $ (195,501)

Net cash used in

financing activities $ (7,781) $ (12,665) $ (17,277) $ (41,196)

Net revenues

Ameristar St. Charles $ 72,065 $ 73,070 $ 222,548 $ 220,085

Ameristar East Chicago 59,967 69,961 196,088 219,783

Ameristar Kansas City 57,528 59,795 176,354 183,657

Ameristar Council Bluffs 38,451 44,113 120,689 134,346

Ameristar Vicksburg 27,918 34,879 92,063 101,985

Ameristar Black Hawk 26,246 21,125 67,292 61,804

Jackpot Properties 17,255 18,458 49,135 52,606

---------- ---------- ---------- ----------

Consolidated net

revenues $ 299,430 $ 321,401 $ 924,169 $ 974,266

========== ========== ========== ==========

Operating income (loss)

Ameristar St. Charles $ 17,952 $ 14,816 $ 56,432 $ 45,694

Ameristar East Chicago 6,330 6,029 29,897 (104,752)

Ameristar Kansas City 15,087 12,224 47,635 37,731

Ameristar Council Bluffs 12,375 13,701 36,436 38,481

Ameristar Vicksburg 6,139 8,796 25,429 29,559

Ameristar Black Hawk 4,567 3,401 10,437 8,999

Jackpot Properties 4,171 3,908 11,471 9,624

Corporate and other (15,663) (16,632) (42,065) (48,144)

---------- ---------- ---------- ----------

Consolidated operating

income $ 50,958 $ 46,243 $ 175,672 $ 17,192

========== ========== ========== ==========

EBITDA

Ameristar St. Charles $ 24,439 $ 21,407 $ 76,534 $ 63,955

Ameristar East Chicago 10,220 9,678 40,973 (94,548)

Ameristar Kansas City 18,996 16,864 59,407 52,484

Ameristar Council Bluffs 15,078 16,182 44,838 47,225

Ameristar Vicksburg 10,092 13,200 37,642 41,174

Ameristar Black Hawk 7,456 6,116 18,871 17,434

Jackpot Properties 5,646 5,432 15,920 13,802

Corporate and other (14,863) (15,863) (39,706) (45,433)

---------- ---------- ---------- ----------

Consolidated EBITDA $ 77,064 $ 73,016 $ 254,479 $ 96,093

========== ========== ========== ==========

AMERISTAR CASINOS, INC. AND SUBSIDIARIES

SUMMARY CONSOLIDATED FINANCIAL DATA - CONTINUED

(Dollars in Thousands)

(Unaudited)

Three Months Ended Nine Months Ended

September 30, September 30,

2009 2008 2009 2008

-------- -------- -------- --------

Operating income (loss) margins (1)

Ameristar St. Charles 24.9% 20.3% 25.4% 20.8%

Ameristar East Chicago 10.6% 8.6% 15.2% -47.7%

Ameristar Kansas City 26.2% 20.4% 27.0% 20.5%

Ameristar Council Bluffs 32.2% 31.1% 30.2% 28.6%

Ameristar Vicksburg 22.0% 25.2% 27.6% 29.0%

Ameristar Black Hawk 17.4% 16.1% 15.5% 14.6%

Jackpot Properties 24.2% 21.2% 23.3% 18.3%

Consolidated operating income

margin 17.0% 14.4% 19.0% 1.8%

EBITDA margins (2)

Ameristar St. Charles 33.9% 29.3% 34.4% 29.1%

Ameristar East Chicago 17.0% 13.8% 20.9% -43.0%

Ameristar Kansas City 33.0% 28.2% 33.7% 28.6%

Ameristar Council Bluffs 39.2% 36.7% 37.2% 35.2%

Ameristar Vicksburg 36.1% 37.8% 40.9% 40.4%

Ameristar Black Hawk 28.4% 29.0% 28.0% 28.2%

Jackpot Properties 32.7% 29.4% 32.4% 26.2%

Consolidated EBITDA margin 25.7% 22.7% 27.5% 9.9%

(1) Operating income (loss) margin is operating income (loss) as a

percentage of net revenues.

(2) EBITDA margin is EBITDA as a percentage of net revenues.

RECONCILIATION OF OPERATING INCOME (LOSS) TO EBITDA

(Dollars in Thousands)

(Unaudited)

The following table sets forth a reconciliation of operating income (loss),

a GAAP financial measure, to EBITDA, a non-GAAP financial measure.

Three Months Ended Nine Months Ended

September 30, September 30,

2009 2008 2009 2008

---------- ---------- ---------- ----------

Ameristar St. Charles:

Operating income $ 17,952 $ 14,816 $ 56,432 $ 45,694

Depreciation and

amortization 6,487 6,591 20,102 18,261

---------- ---------- ---------- ----------

EBITDA $ 24,439 $ 21,407 $ 76,534 $ 63,955

========== ========== ========== ==========

Ameristar East Chicago:

Operating income (loss) $ 6,330 $ 6,029 $ 29,897 $ (104,752)

Depreciation and

amortization 3,890 3,649 11,076 10,204

---------- ---------- ---------- ----------

EBITDA $ 10,220 $ 9,678 $ 40,973 $ (94,548)

========== ========== ========== ==========

Ameristar Kansas City:

Operating income $ 15,087 $ 12,224 $ 47,635 $ 37,731

Depreciation and

amortization 3,909 4,640 11,772 14,753

---------- ---------- ---------- ----------

EBITDA $ 18,996 $ 16,864 $ 59,407 $ 52,484

========== ========== ========== ==========

Ameristar Council Bluffs:

Operating income $ 12,375 $ 13,701 $ 36,436 $ 38,481

Depreciation and

amortization 2,703 2,481 8,402 8,744

---------- ---------- ---------- ----------

EBITDA $ 15,078 $ 16,182 $ 44,838 $ 47,225

========== ========== ========== ==========

Ameristar Vicksburg:

Operating income $ 6,139 $ 8,796 $ 25,429 $ 29,559

Depreciation and

amortization 3,953 4,404 12,213 11,615

---------- ---------- ---------- ----------

EBITDA $ 10,092 $ 13,200 $ 37,642 $ 41,174

========== ========== ========== ==========

Ameristar Black Hawk:

Operating income $ 4,567 $ 3,401 $ 10,437 $ 8,999

Depreciation and

amortization 2,889 2,715 8,434 8,435

---------- ---------- ---------- ----------

EBITDA $ 7,456 $ 6,116 $ 18,871 $ 17,434

========== ========== ========== ==========

Jackpot Properties:

Operating income $ 4,171 $ 3,908 $ 11,471 $ 9,624

Depreciation and

amortization 1,475 1,524 4,449 4,178

---------- ---------- ---------- ----------

EBITDA $ 5,646 $ 5,432 $ 15,920 $ 13,802

========== ========== ========== ==========

Corporate and other:

Operating loss $ (15,663) $ (16,632) $ (42,065) $ (48,144)

Depreciation and

amortization 800 769 2,359 2,711

---------- ---------- ---------- ----------

EBITDA $ (14,863) $ (15,863) $ (39,706) $ (45,433)

========== ========== ========== ==========

Consolidated:

Operating income $ 50,958 $ 46,243 $ 175,672 $ 17,192

Depreciation and

amortization 26,106 26,773 78,807 78,901

---------- ---------- ---------- ----------

EBITDA $ 77,064 $ 73,016 $ 254,479 $ 96,093

========== ========== ========== ==========

RECONCILIATION OF EBITDA TO ADJUSTED EBITDA

(Dollars in Thousands)

(Unaudited)

Three Months Ended Nine Months Ended

September 30, September 30,

2009 2008 2009 2008

--------- --------- --------- ---------

EBITDA $ 77,064 $ 73,016 $ 254,479 $ 96,093

Black Hawk hotel pre-opening

expenses 2,225 - 2,422 -

One-time non-cash adjustment to

Black Hawk property taxes - - 1,276 -

Impairment loss on East Chicago

intangible assets - - - 129,000

East Chicago transition and

rebranding costs - 2,231 - 4,988

St. Charles and Vicksburg

pre-opening expenses - 563 - 2,725

Missouri and Colorado ballot

initiative costs - 5,185 - 6,323

--------- --------- --------- ---------

Adjusted EBITDA $ 79,289 $ 80,995 $ 258,177 $ 239,129

========= ========= ========= =========

RECONCILIATION OF EPS TO ADJUSTED EPS

(Unaudited)

The following table sets forth a reconciliation of diluted earnings (loss)

per share (EPS), a GAAP financial measure, to adjusted diluted earnings per

share (Adjusted EPS), a non-GAAP financial measure.

Three Months Ended Nine Months Ended

September 30, September 30,

2009 2008 2009 2008

--------- --------- --------- --------

Diluted earnings (loss) per share

(EPS) $ 0.25 $ 0.25 $ 1.01 $ (0.52)

Black Hawk hotel pre-opening

expenses 0.02 - 0.03 -

Loss on early retirement of debt - - 0.06 -

One-time non-cash adjustment to

Black Hawk property taxes - - 0.01 -

Impairment loss on East Chicago

intangible assets - - - 1.34

East Chicago transition and

rebranding costs - 0.02 - 0.06

St. Charles and Vicksburg

pre-opening expenses - 0.01 - 0.03

Missouri and Colorado ballot

initiative costs - 0.06 - 0.07

--------- --------- --------- --------

Adjusted diluted earnings per

share (Adjusted EPS) $ 0.27 $ 0.34 $ 1.11 $ 0.98

========= ========= ========= ========

Use of Non-GAAP Financial Measures

Securities and Exchange Commission Regulation G, "Conditions for

Use of Non-GAAP Financial Measures," prescribes the conditions for

use of non-GAAP financial information in public disclosures. We

believe our presentations of the following non-GAAP financial

measures are important supplemental measures of operating

performance to investors: earnings before interest, taxes,

depreciation and amortization (EBITDA), Adjusted EBITDA and

adjusted diluted earnings per share (Adjusted EPS). The following

discussion defines these terms and explains why we believe they are

useful measures of our performance.

EBITDA and Adjusted EBITDA EBITDA is a commonly used measure of

performance in the gaming industry that we believe, when considered

with measures calculated in accordance with United States generally

accepted accounting principles, or GAAP, gives investors a more

complete understanding of operating results before the impact of

investing and financing transactions and income taxes and

facilitates comparisons between us and our competitors. In

forecasting and measuring our core operating results and in

comparing period-to-period results, management adjusts EBITDA, as

appropriate, to exclude certain non-recurring items.

The measure adjusting for such items, which we refer to as

Adjusted EBITDA, is a significant factor in management's internal

evaluation of total Company and individual property performance and

in the evaluation of incentive compensation for employees.

Therefore, we believe Adjusted EBITDA is useful to investors

because it allows greater transparency related to a significant

measure used by management in its financial and operational

decision-making and because it permits investors similarly to

perform more meaningful analyses of past, present and future

operating results and evaluations of the results of core ongoing

operations. Furthermore, we believe investors would, in the absence

of the Company's disclosure of Adjusted EBITDA, attempt to use

equivalent or similar measures in assessment of our operating

performance and the valuation of our Company. We have reported

Adjusted EBITDA to our investors in the past and believe its

inclusion at this time will provide consistency in our financial

reporting.

Adjusted EBITDA, as used in this press release, is EBITDA

adjusted for impairment charges related to intangible assets,

transition and rebranding costs, pre-opening expenses, ballot

initiative costs and a one-time Black Hawk property tax adjustment.

In future periods, the adjustments we make to EBITDA in order to

calculate Adjusted EBITDA may be different than or in addition to

those made in this release. The foregoing tables reconcile Adjusted

EBITDA to EBITDA and operating income (loss), based upon GAAP.

Adjusted EPS Adjusted EPS, as used in this press release, is

diluted earnings (loss) per share, excluding the after-tax

per-share impacts of impairment charges related to intangible

assets, transition and rebranding costs, pre-opening expenses,

ballot initiative costs, the one-time Black Hawk property tax

adjustment and the loss on early debt retirement. Management

adjusts EPS, when deemed appropriate, for the evaluation of

operating performance because we believe that the exclusion of

certain non-recurring items is necessary to provide the most

accurate measure of our core operating results and as a means to

compare period-to-period results. We have chosen to provide this

information to investors to enable them to perform more meaningful

analyses of past, present and future operating results and as a

means to evaluate the results of our core ongoing operations.

Adjusted EPS is a significant factor in the internal evaluation of

total Company performance and incentive compensation for senior

management. Management believes this measure is used by investors

in their assessment of our operating performance and the valuation

of our Company. In future periods, the adjustments we make to EPS

in order to calculate Adjusted EPS may be different than or in

addition to those made in this release. The foregoing table

reconciles EPS to Adjusted EPS.

Limitations on the Use of Non-GAAP Measures The use of EBITDA,

Adjusted EBITDA and Adjusted EPS has certain limitations. Our

presentation of EBITDA, Adjusted EBITDA and Adjusted EPS may be

different from the presentations used by other companies and

therefore comparability among companies may be limited.

Depreciation expense for various long-term assets, interest

expense, income taxes and other items have been and will be

incurred and are not reflected in the presentation of EBITDA or

Adjusted EBITDA. Each of these items should also be considered in

the overall evaluation of our results. Additionally, EBITDA and

Adjusted EBITDA do not consider capital expenditures and other

investing activities and should not be considered as a measure of

our liquidity. We compensate for these limitations by providing the

relevant disclosure of our depreciation, interest and income tax

expense, capital expenditures and other items both in our

reconciliations to the GAAP financial measures and in our

consolidated financial statements, all of which should be

considered when evaluating our performance.

EBITDA, Adjusted EBITDA and Adjusted EPS should be used in

addition to and in conjunction with results presented in accordance

with GAAP. EBITDA, Adjusted EBITDA and Adjusted EPS should not be

considered as an alternative to net income, operating income, EPS

or any other operating performance measure prescribed by GAAP, nor

should these measures be relied upon to the exclusion of GAAP

financial measures. EBITDA, Adjusted EBITDA and Adjusted EPS

reflect additional ways of viewing our operations that we believe,

when viewed with our GAAP results and the reconciliations to the

corresponding GAAP financial measures, provide a more complete

understanding of factors and trends affecting our business than

could be obtained absent this disclosure. Management strongly

encourages investors to review our financial information in its

entirety and not to rely on a single financial measure.

CONTACT: Tom Steinbauer Senior Vice President, Chief Financial

Officer Ameristar Casinos, Inc. (702) 567-7000

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From May 2024 to Jun 2024

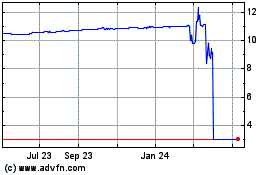

A SPAC I Acquisition (NASDAQ:ASCA)

Historical Stock Chart

From Jun 2023 to Jun 2024