Canadian Dollar Falls Against U.S., Australian Dollars

November 22 2023 - 6:05AM

RTTF2

The Canadian dollar declined against the U.S. and Australian

counterparts in the European session on Wednesday, as oil prices

dropped after the Organization of Petroleum Exporting Countries

postponed a meeting to decide on output cuts.

Crude for January delivery fell $3.41 to 74.36 per barrel.

The meeting has been delayed to November 30 amid Saudi's

dissatisfaction with the oil production levels of other member

countries of the group.

A stronger dollar also weighed on prices. The dollar rebounded

from 2-1/2-month low after the FOMC (Federal Open Market Committee)

meeting minutes largely reaffirmed the U.S. central bank's more

cautious stance on interest rates.

Minutes from the Fed's last rate-setting meeting showed

officials expect to keep interest rates at a restrictive level for

"sometime" and raise interest rates if progress in controlling

inflation faltered.

The loonie touched 1.3765 against the greenback, setting a 5-day

low. Next key support for the currency is possibly seen around the

1.40 level.

The loonie eased to 0.9012 against the aussie, from an early

2-day high of 0.8954. The loonie may locate support around the 0.92

mark.

In contrast, the loonie rose to a 2-day high of 108.82 against

the yen and a 5-day high of 1.4932 against the euro, off its early

lows of 108.04 and 1.4986, respectively. The next possible

resistance for the currency is seen around 113.00 against the yen

and 1.47 against the euro.

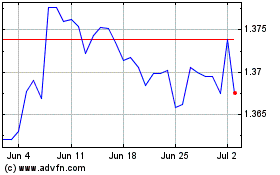

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Jun 2024 to Jul 2024

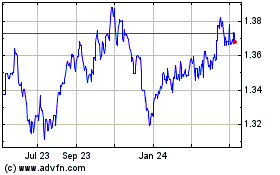

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Jul 2023 to Jul 2024