Bitcoin Open Interest Surges To A 2-Year High, BTC Breaks Above $51,000

February 14 2024 - 3:30PM

NEWSBTC

Bitcoin’s open interest has surged past $11 billion for the first

time in over two years. This uptick comes when the world’s most

valuable coin surges, recently easing past $51,000, the highest

level since December 2021. Surging Open Interest And Order

Book Imbalance According to Kaiko, a leading crypto analytics

provider, this upswing in open interest comes at a critical time

for the coin. When prices zoomed past $48,000 on February 11, there

was an order book imbalance. Then, Kaiko observed there were $100

million more bids than asks. Technically, whenever there is

an order book imbalance with more bids than asks, it suggests that

buyers are more willing and enthusiastic to purchase at spot rates

than sellers are willing to liquidate. Following this imbalance,

prices shot higher the following days, breaking above the $50,000

psychological number to over $51,500 when writing on February

14. Related Reading: Avalanche Rumbles: AVAX Eyes To Reclaim

$50 As Upgrade Fuels Optimism On Testnet Surging open interest,

especially as the market trends higher, is bullish. It means that

more people are willing to participate in the market, hopeful of

riding the trend. Subsequently, their participation translates to a

more liquid market, charging the upside momentum. Bitcoin is racing

higher at the back of strong inflows into spot Bitcoin

exchange-traded funds (ETFs). Over the past few weeks, spot Bitcoin

ETF issuers have been rapidly accumulating the coin. The largest so

far is BlackRock’s IBIT, owning over 70,000 BTC. As a result,

prices are edging higher, reflecting the high demand pinned

directly to institutional participation. This positive sentiment

and expectations of even more price gains, translating to higher

open interest, is despite the continued liquidation of the

Grayscale Bitcoin Trust (GBTC). Following court approval, GBTC is

converted into an ETF, joining others like Fidelity, who also offer

a similar product. Genesis Looking To Sell GBTC; Will Bitcoin Rally

In March? Even with the high optimism, a potential cloud hangs over

the Bitcoin market. Genesis, a crypto lender under bankruptcy

protection, wants the court to allow them to sell over $1.4 billion

of GBTC. Related Reading: XRP Price Could Surge from New

Acquisition, Amid Community Skepticism If the court green-lights

this move, BTC could have more liquidation pressure, possibly

unwinding recent gains. So far, the FTX estate sold their GBTC,

estimated to be worth over $1 billion, coinciding with Bitcoin

dropping to as low as $39,500 in January. Besides these

Bitcoin-specific events, the market is closely watching how the

monetary policy scene in the United States will evolve in the next

few weeks. The United States Federal Reserve is expected to slash

rates in March, a potentially beneficial move for BTC. Feature

image from DALLE, chart from TradingView

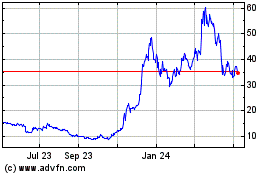

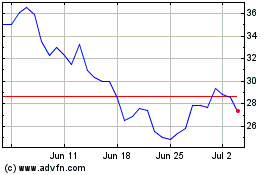

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Avalanche (COIN:AVAXUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024