The Inverted Bitcoin Chart Bears Don’t Wanna See | BTCUSD Analysis October 27, 2022

October 27 2022 - 4:13PM

NEWSBTC

In this episode of NewsBTC’s daily technical analysis videos, we

flip the Bitcoin price chart upside down to get a unique

perspective on the market. Take a look at the video below: VIDEO:

Bitcoin Price Analysis (BTCUSD): October 27, 2022 We also examine a

weekly buy signal on BTCUSD using the Relative Strength Index, and

show several examples of the signal’s effectiveness using Bitcoin

and other assets. Related Reading: Bitcoin Bollinger Band Breakout

Starts To Squeeze Shorts | BTCUSD Analysis October 26, 2022

Inverted Bitcoin Price Chart Could Suggest Bear Market Is Over When

price action seems confusing, inverting the chart of any asset can

help to remove bias and provide a clearer picture. Looking at

BTCUSD from this perspective, it sure looks like a retest of

horizontal support turned resistance. There is also an ongoing

breakdown of an uptrend line. But remember, everything is upside

down. On higher timeframes, diagonal downtrend resistance remains

intact. We can also clearly see very similar price action across

the last major “top” which is actually the 2018 bear market

bottom. When you flip things right side up again, does Bitcoin

really look all that bearish? Bitcoin bulls can turn that frown

upside down | Source: BTCUSD on TradingView.com Related Reading:

Are Bitcoin Bulls Ready To Stampede? | BTCUSD Analysis October 25,

2022 BTCUSD Weekly RSI Buy Signal Days Away From Confirming Moving

along, we also have a potential buy signal on the weekly Relative

Strength Index. This one is particularly important, as this is how

the tool’s creator intended it to work. The buy signal happens

when a higher high is made on the RSI, after reaching oversold

conditions and holding above oversold territory on a subsequent

bounce. It does help that BTCUSD weekly is also working on

breaking out of downtrend RSI resistance also at the very same

time. Looking back at past Bitcoin bottoms, we can see that it

was this exact buy signal that put in each bottom on weekly

timeframes. We can also see there is a cyclical rhythm to when

each downtrend has come to its conclusion. Cyclical timing could

suggest crypto winter is over | Source: BTCUSD on TradingView.com

Related Reading: Can Bitcoin Bring An End To Crypto Winter? |

BTCUSD Analysis October 24, 2022 The End Of The Dollar Rally Could

Conclude Crypto Winter If that was a RSI buy signal on the BTCUSD

weekly, what we are about to see is a sell signal on the RSI via

the DXY weekly. The sell signal on the Dollar Currency Index

is beginning to break down from a diagonal RSI support line, and

break down from its ongoing parabola. Putting the DXY and

Bitcoin chart side to side, we can see that there are directly

opposing signals on each chart. Watch the full video for the

complete analysis and more comparisons. The dollar and BTC are

giving opposite signals | Source: BTCUSD on TradingView.com Learn

crypto technical analysis yourself with the NewsBTC Trading Course.

Click here to access the free educational program. Follow

@TonySpilotroBTC on Twitter or join the TonyTradesBTC Telegram

for exclusive daily market insights and technical analysis

education. Please note: Content is educational and should not

be considered investment advice. Featured image from

iStockPhoto, Charts from TradingView.com

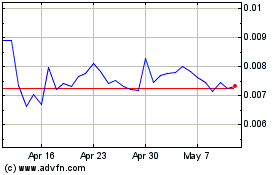

Amp (COIN:AMPUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Amp (COIN:AMPUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024

Real-Time news about Amp (Cryptocurrency): 0 recent articles

More Amp News Articles